Overview

This article presents ten early-stage sourcing strategies that venture capital (VC) teams can implement to significantly enhance their deal sourcing efforts. By leveraging AI-driven tools and maintaining dynamic lists of potential startups, VC firms can stay ahead of the curve. Engaging with networks such as accelerators and regularly adapting strategies ensures alignment with evolving market trends. This proactive approach positions VC firms to capitalize on emerging investment opportunities, ultimately driving success in a competitive landscape.

Introduction

In the competitive realm of venture capital, the capacity to identify and secure promising startups is pivotal to an investment strategy's success. Firms are increasingly adopting innovative sourcing methods; thus, comprehending effective early-stage strategies is essential for achieving favorable outcomes. What if the key to unlocking a wealth of investment opportunities lies in mastering these techniques? This article explores ten actionable sourcing strategies that VC teams can implement today, leveraging technology and relationships to maintain a competitive edge in a rapidly evolving landscape.

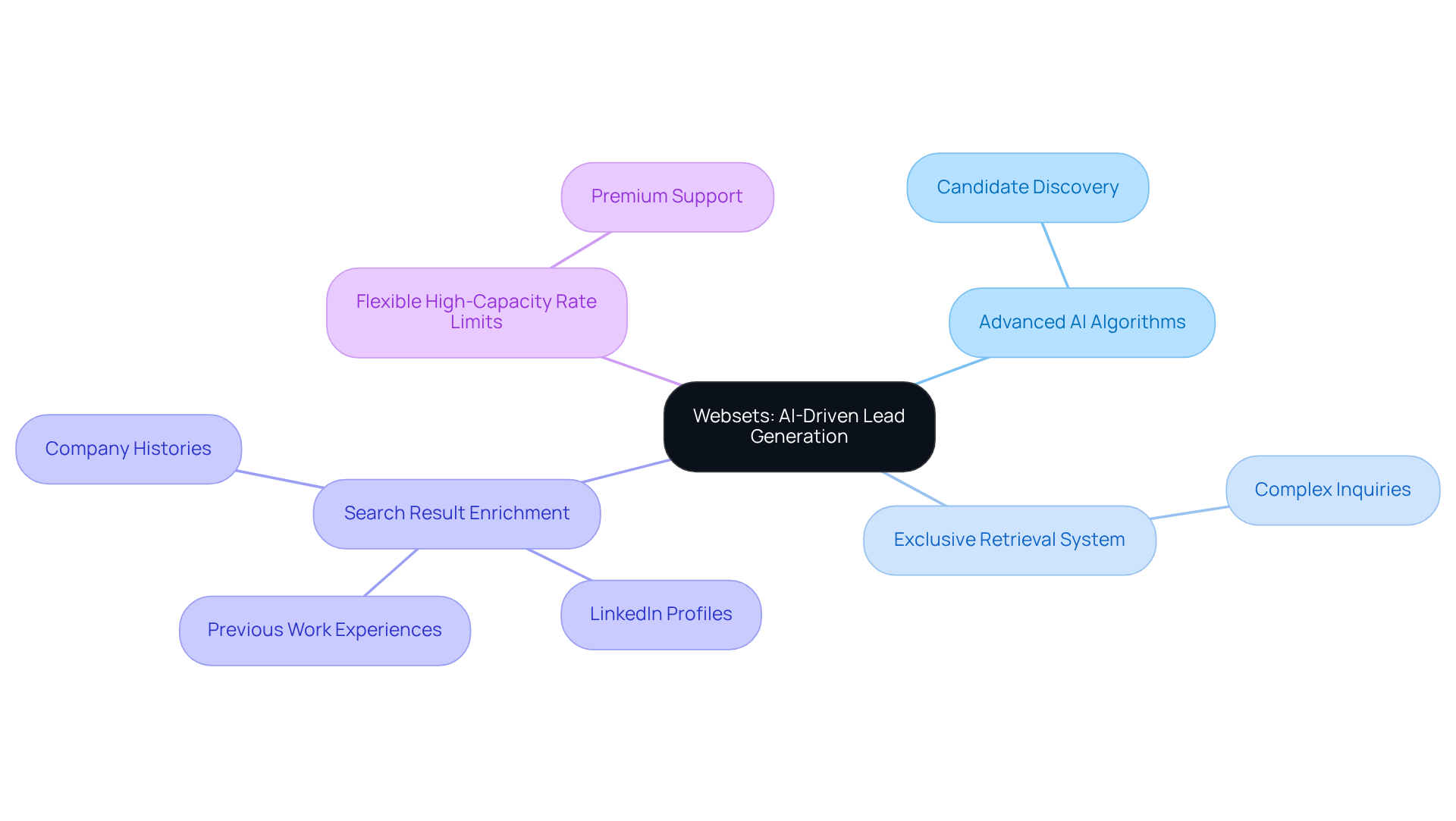

Websets: AI-Driven Lead Generation for Enhanced Deal Sourcing

The platform harnesses advanced AI algorithms to significantly enhance lead generation and candidate discovery, positioning itself as an indispensable resource for venture capital groups utilizing early-stage sourcing strategies VC teams use. Its exclusive retrieval system, meticulously tailored for complex inquiries, empowers VC experts to navigate vast datasets, utilizing early-stage sourcing strategies VC teams use to identify potential startups and funding opportunities that align with their strategic goals. Furthermore, Websets enriches search results with comprehensive information, including LinkedIn profiles, company histories, and previous work experiences, enabling teams to make swift, informed decisions. In the fast-paced realm of venture capital, the early-stage sourcing strategies VC teams use are paramount, as timely insights can unlock substantial investment opportunities.

Moreover, this platform offers flexible high-capacity rate limits and premium support, ensuring that enterprise-level demands are met without sacrificing performance. With these capabilities, venture capitalists can confidently navigate the competitive landscape, leveraging the platform’s strengths to capitalize on emerging opportunities.

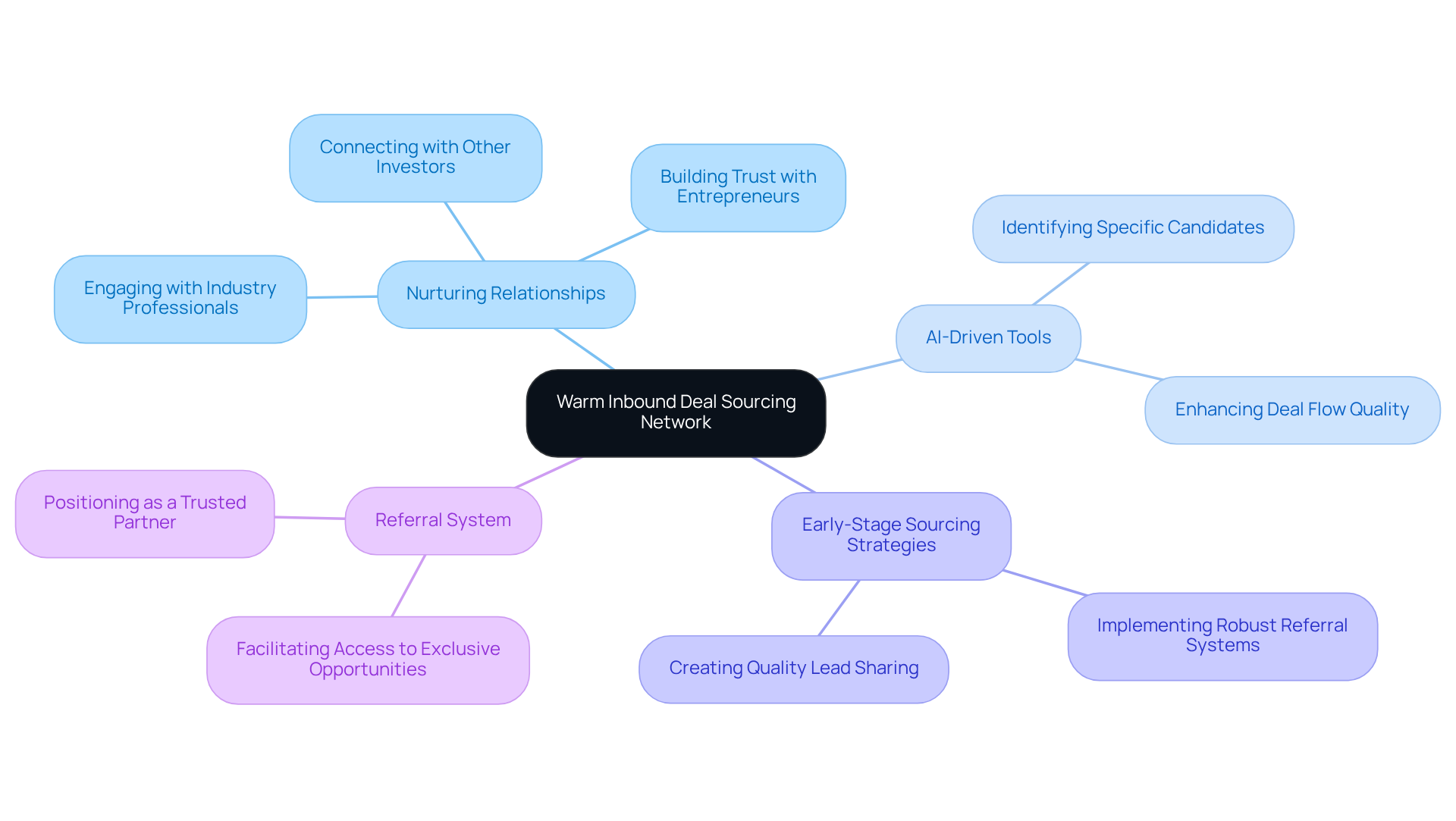

Establish a Warm Inbound Deal Sourcing Network

Establishing a warm inbound deal sourcing network is essential for nurturing relationships with industry professionals, entrepreneurs, and other investors, particularly in the context of early-stage sourcing strategies VC teams use. By engaging frequently with these contacts, VC groups can implement early-stage sourcing strategies VC teams use to create a robust referral system where quality leads are naturally shared.

Furthermore, by harnessing AI-driven tools, venture capital firms can enhance the early-stage sourcing strategies VC teams use to identify candidates and firms that meet highly specific criteria. This ensures a superior quality of deal flow.

This strategic approach not only elevates the quality of leads but also positions the VC firm as a trusted partner within the ecosystem. Consequently, it facilitates access to exclusive opportunities that may otherwise remain out of reach. In an increasingly competitive landscape, the ability to forge meaningful connections and leverage technology is paramount for success.

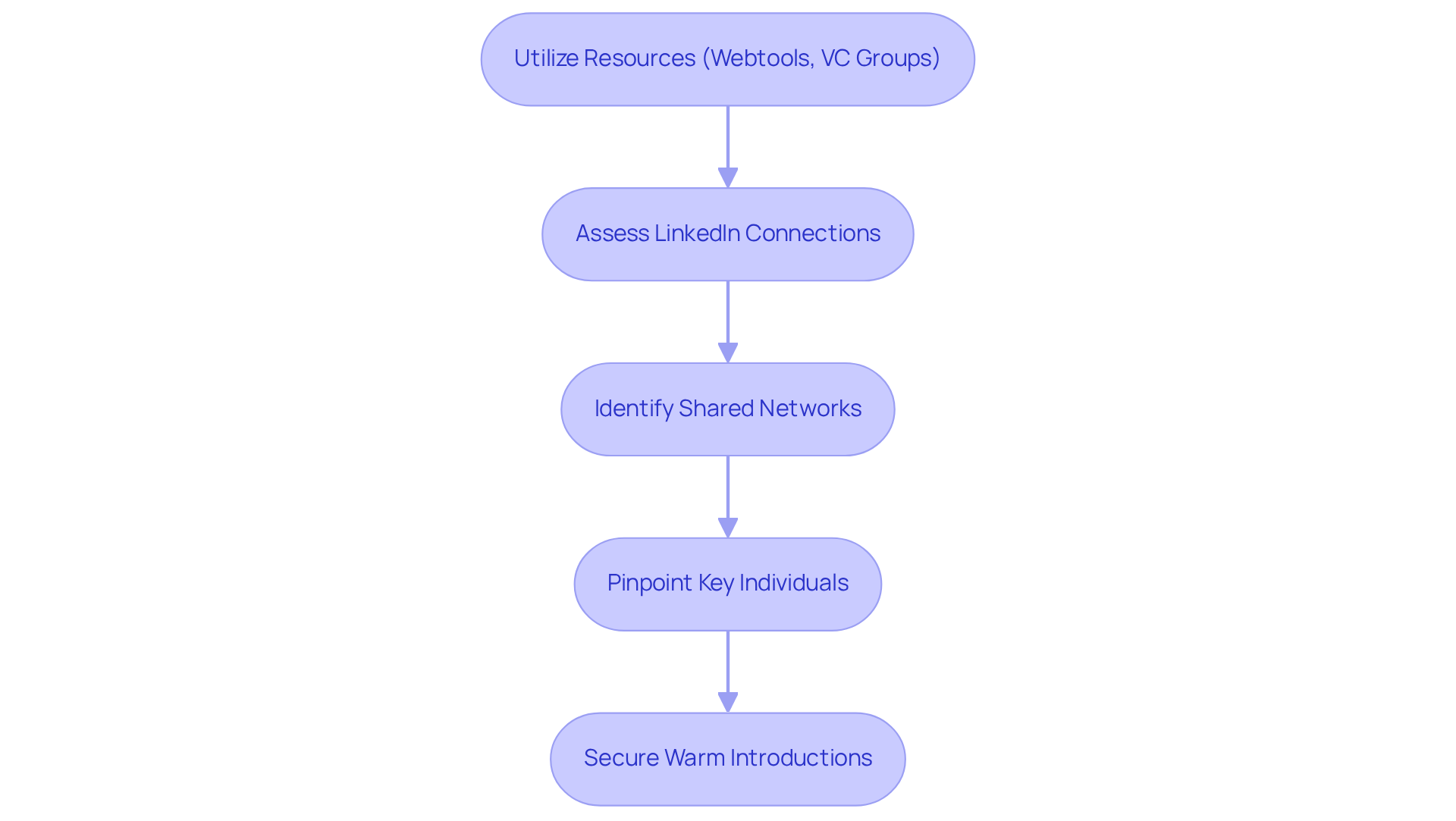

Identify Connections to Target Companies

Utilizing resources like Webtools, VC groups can effectively identify links to target companies through shared networks. By leveraging advanced AI-powered features, these groups can assess LinkedIn connections and past collaborations with greater efficiency. This strategic approach enables them to pinpoint individuals who can facilitate introductions, significantly enhancing their recruitment and sales intelligence.

Not only does this strategy save valuable time, but it also increases the likelihood of securing a warm introduction—often proving more effective than traditional cold outreach. In a competitive landscape, the ability to connect with the right individuals can be the key differentiator for success.

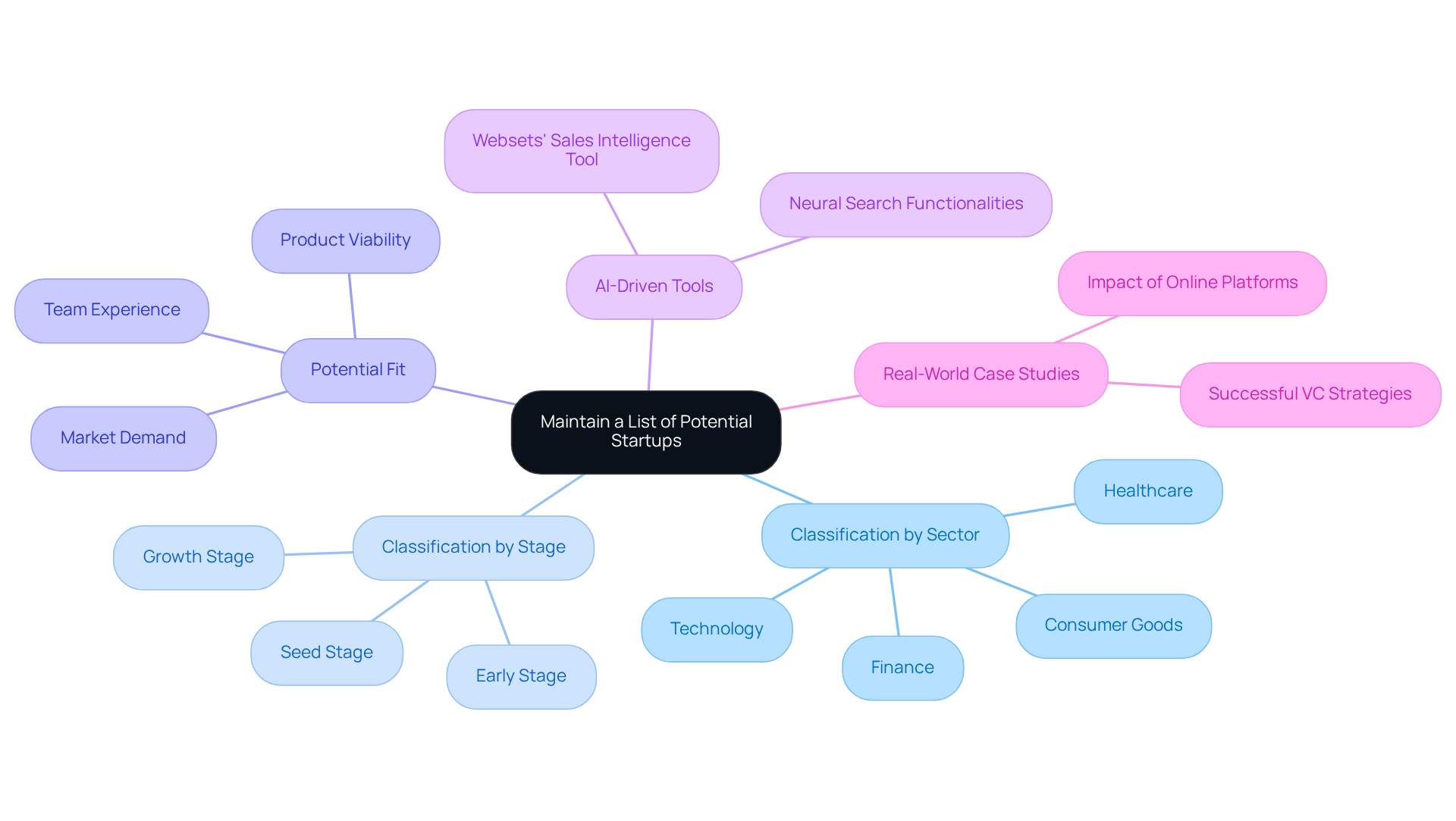

Maintain a List of Potential Startups

Venture capital groups must maintain a dynamic list of potential startups that align with the early-stage sourcing strategies VC teams use. This list should be regularly updated in response to market trends, emerging technologies, and industry shifts. By leveraging Websets' AI-driven sales intelligence tool, groups can effectively locate and enhance information on startups that meet highly specific criteria, including emails and company details.

Classifying startups by sector, stage, and potential fit enables groups to prioritize their outreach efforts, ensuring they engage with the most promising opportunities. Furthermore, employing neural search functionalities enhances query accuracy, allowing VC groups to uncover valuable insights and connections that conventional keyword-driven searches may overlook.

Real-world case studies illustrate how venture capital groups have successfully utilized online platforms to refine the early-stage sourcing strategies VC teams use. This approach not only streamlines their efforts but also positions them to capitalize on the most relevant opportunities in a rapidly evolving landscape.

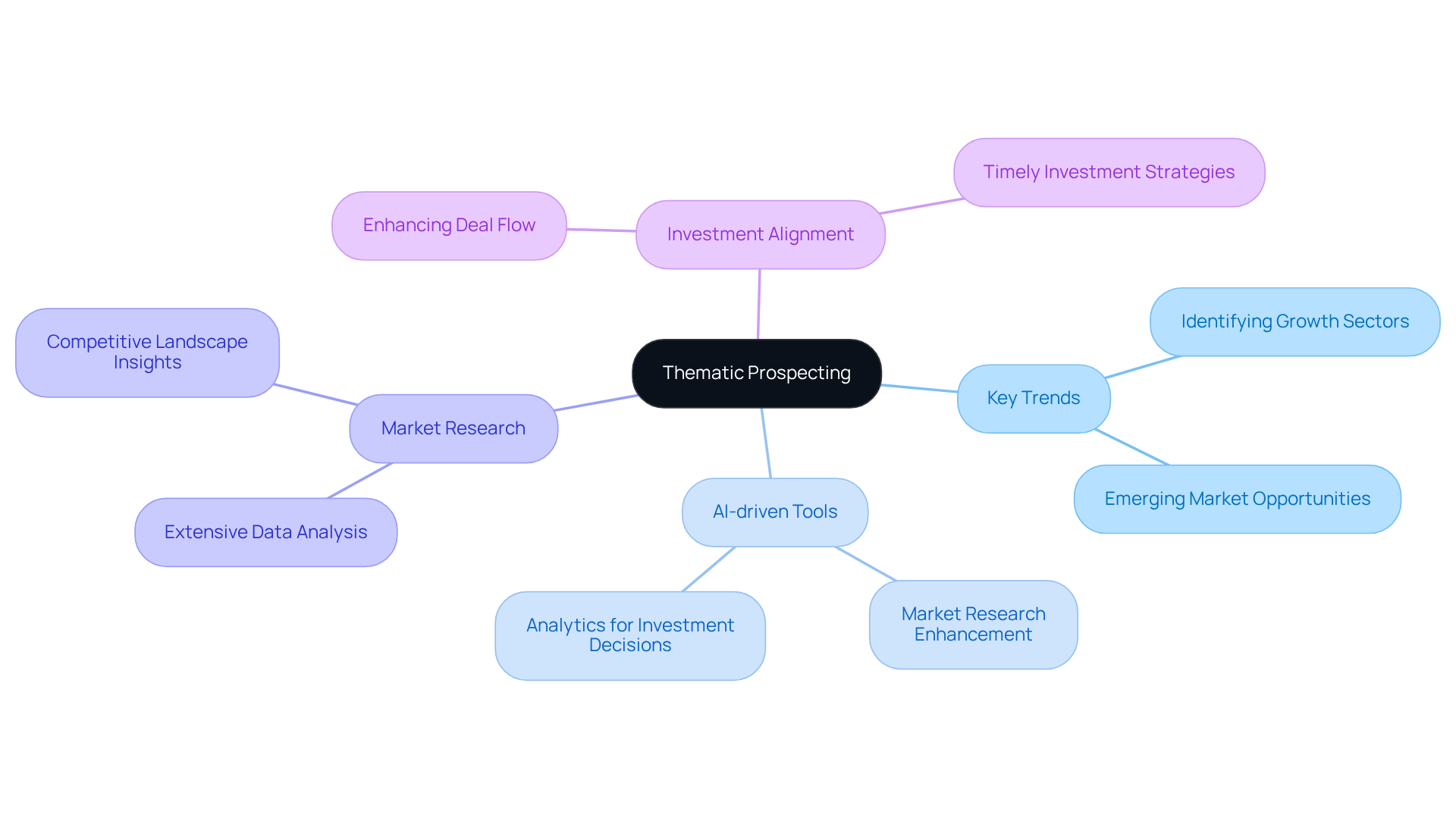

Conduct Thematic Prospecting for Targeted Deal Flow

Thematic prospecting is crucial for identifying key trends and sectors poised for growth. AI-driven tools significantly enhance this process, empowering venture capital groups to conduct extensive market research and analytics. By focusing their sourcing efforts on startups that align with these emerging themes, they can ensure that their investments remain relevant and timely.

Utilizing AI-driven sales intelligence tools enables groups to uncover new opportunities that may not yet be on the radar of other investors. This approach not only enriches their deal flow but also provides them with precise information about companies and sectors. In a competitive landscape, leveraging such technology is not just advantageous; it is essential for staying ahead.

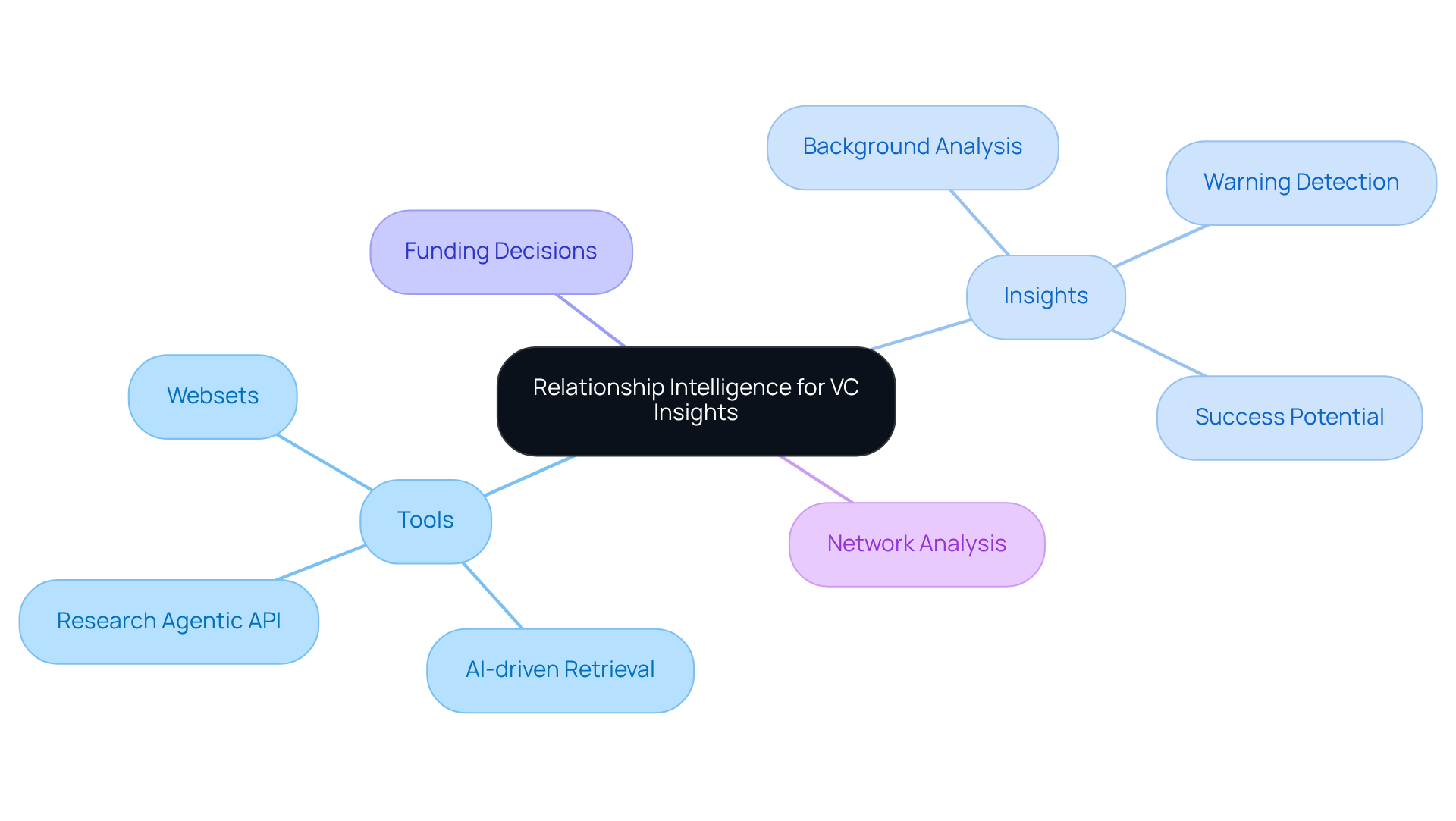

Leverage Relationship Intelligence for Better Insights

By leveraging relationship intelligence tools powered by alternative platforms, VC groups gain critical insights into the backgrounds and networks of startup founders. This advanced AI-driven retrieval tool, which integrates the Research Agentic API, empowers groups to detect potential warning signs or advantages that could influence their funding decisions. With Websets' highest-compute, agentic search capabilities, these groups can analyze the dynamics of a founder's network with greater precision. This enhanced analysis not only facilitates a more thorough assessment of a startup's potential for success but also ensures alignment with their funding strategy.

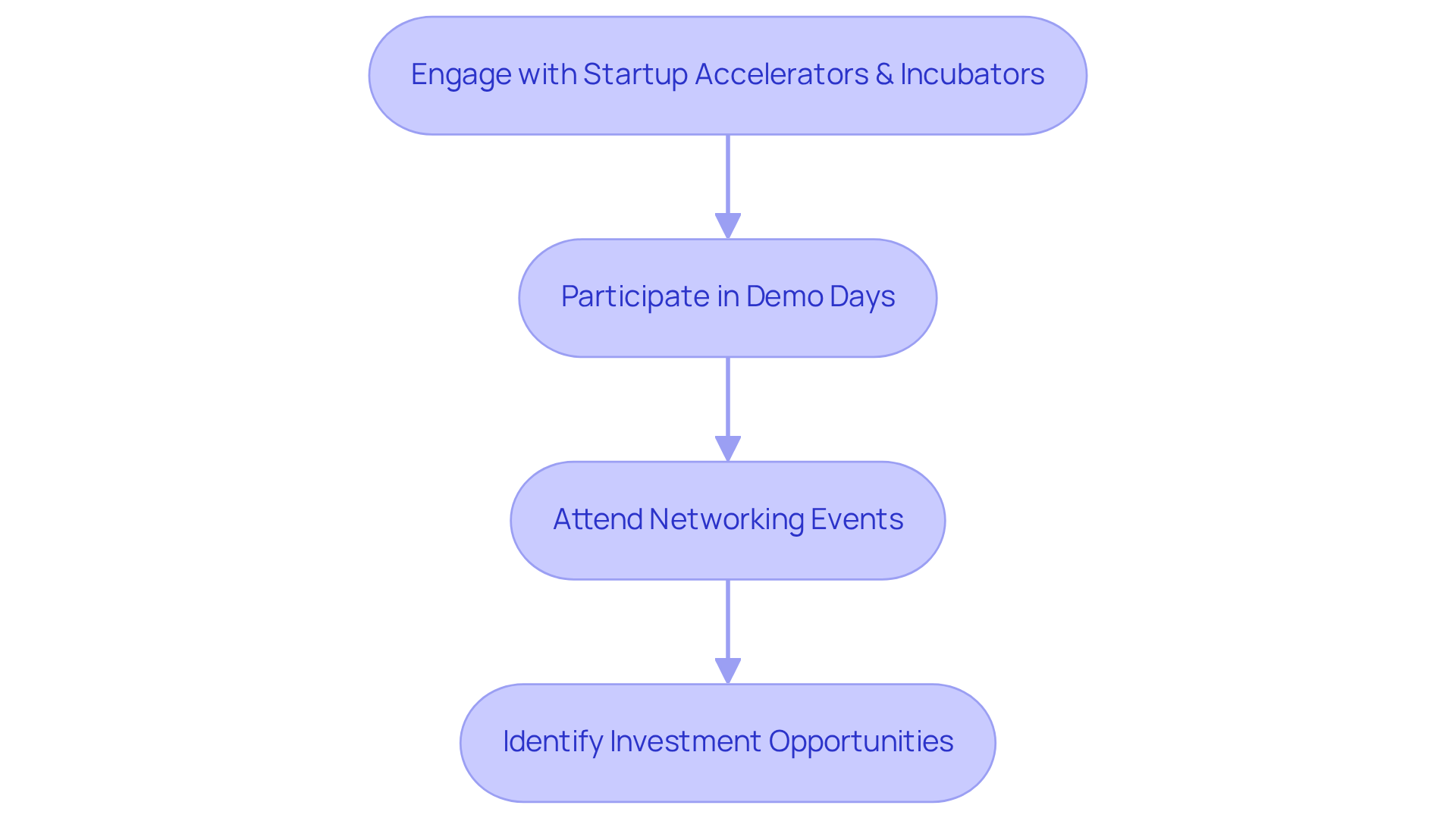

Engage with Startup Accelerators and Incubators

Engaging with startup accelerators and incubators provides venture capital (VC) groups with access to early-stage sourcing strategies VC teams use for a pipeline of vetted startups. These programs not only offer guidance but also equip developing businesses with essential resources, making them invaluable allies in the funding landscape.

By actively participating in demo days and networking events, VC groups can uncover innovative concepts and connect with founders who are primed for investment. This strategic engagement is crucial for identifying opportunities that align with the early-stage sourcing strategies VC teams use to achieve their investment goals.

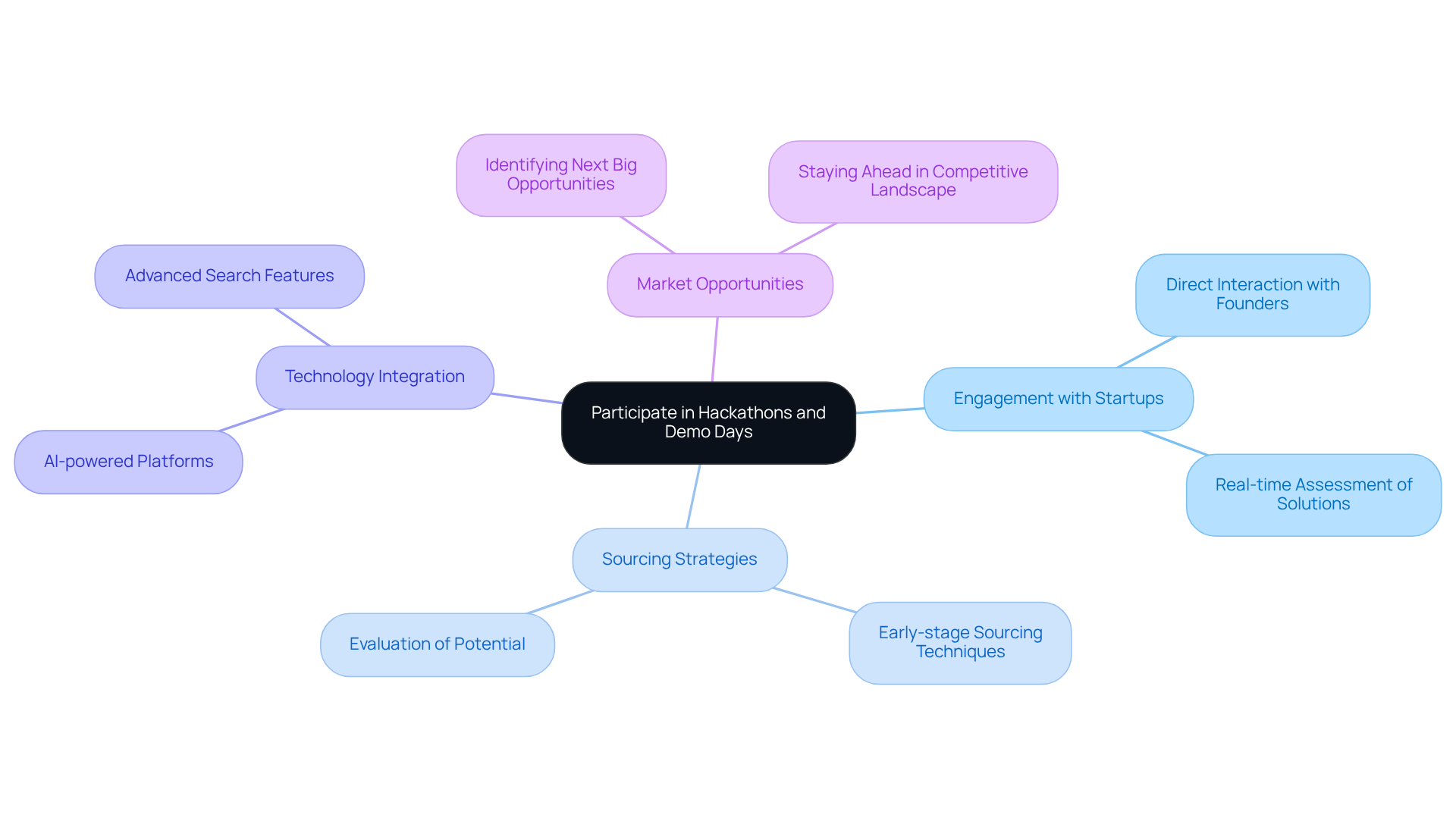

Participate in Hackathons and Demo Days

Participating in hackathons and demo days allows venture capital groups to engage with early-stage sourcing strategies VC teams use and witness firsthand the creativity and innovation of emerging startups. These events serve as a dynamic platform for startups to present their solutions, enabling investors to assess the early-stage sourcing strategies VC teams use to evaluate their potential in real-time. Engaging directly with founders at these gatherings can yield invaluable insights into the early-stage sourcing strategies VC teams use and potential funding opportunities.

By leveraging Websets' AI-powered platform, VC groups can significantly enhance the early-stage sourcing strategies VC teams use in their evaluation process. The platform's advanced search features are essential for implementing early-stage sourcing strategies VC teams use to identify startups that align with their funding criteria effectively. This technological integration not only streamlines lead generation but also supports the early-stage sourcing strategies VC teams use to enrich the data available for informed decision-making.

In a rapidly evolving market, the early-stage sourcing strategies VC teams use are paramount for making swift, data-driven decisions. How can your venture capital group capitalize on these innovative events to discover the next big opportunity? Embrace the potential of technology to refine your investment strategies and stay ahead in the competitive landscape.

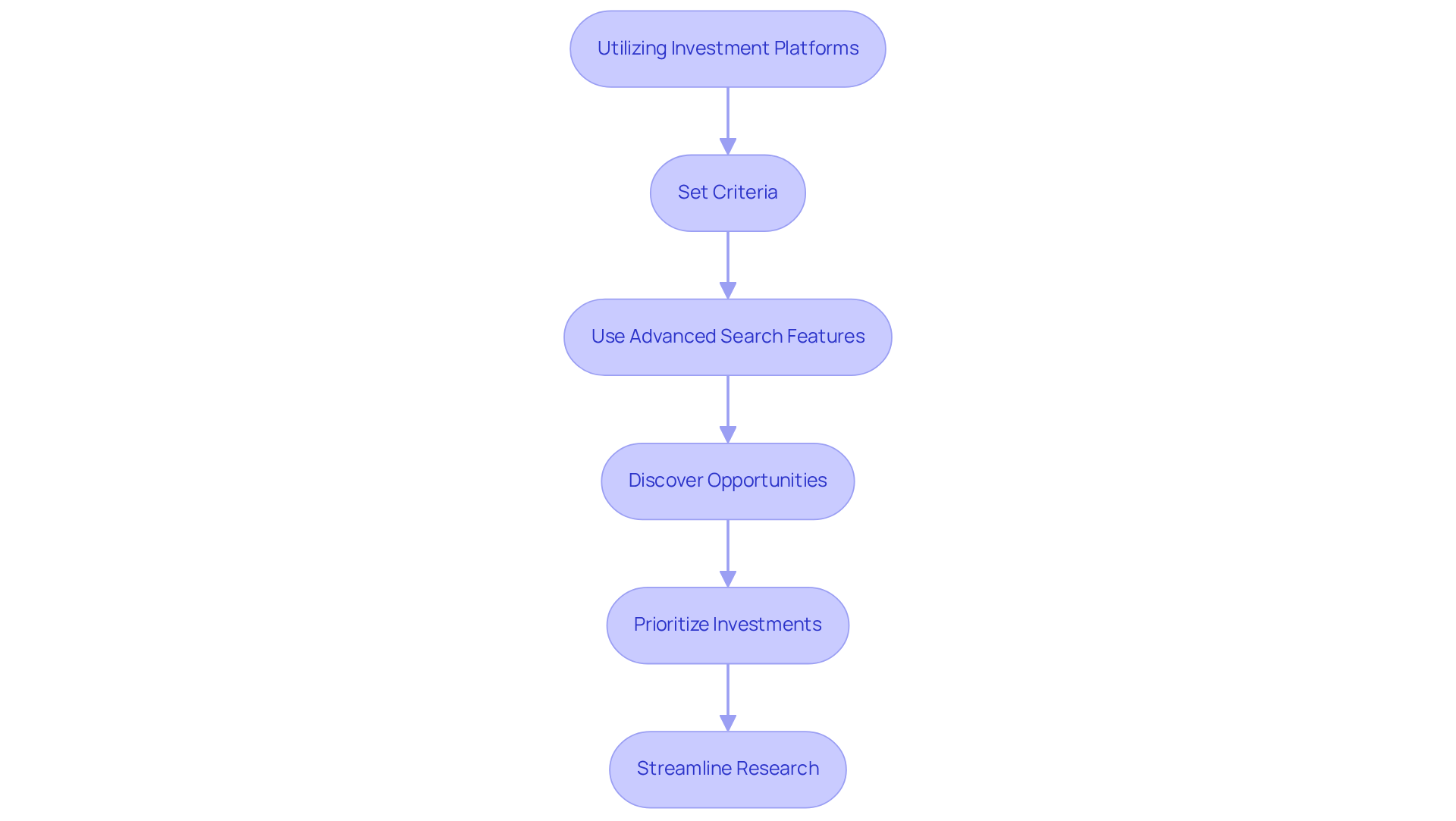

Utilize Investment Platforms for Efficient Deal Sourcing

Funding platforms serve as centralized hubs for deal sourcing, empowering VC groups to tap into a wide array of funding opportunities. By leveraging these platforms—especially with Exa's AI-powered capabilities—groups can efficiently filter deals according to their specific criteria. This not only enhances operational efficiency but also allows for a more focused approach to high-potential investments.

Exa's advanced search functionalities, such as link similarity search and the ability to crawl subpages, enable groups to discover promising opportunities with greater effectiveness. This strategic approach allows teams to prioritize high-value investments while minimizing the burden of administrative tasks. To fully capitalize on Exa's offerings, it is crucial to establish and manage your group effectively, thereby streamlining your research and lead generation efforts.

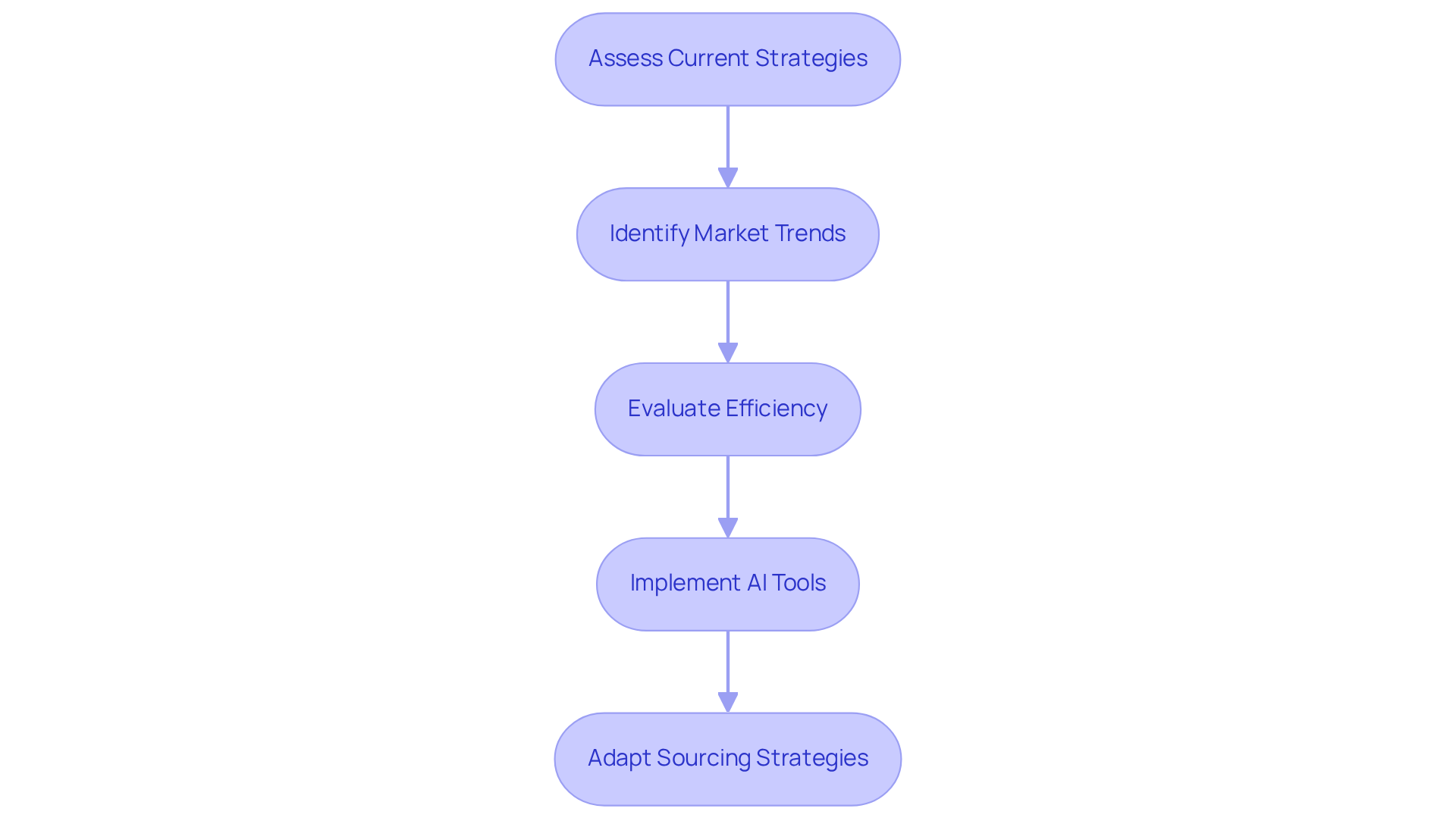

Review and Adapt Sourcing Strategies Regularly

VC groups must regularly assess and modify the early-stage sourcing strategies VC teams use to ensure they align with evolving market conditions and emerging trends. By leveraging Websets' AI-driven platform, these groups can significantly enhance their lead generation, recruitment, and market research capabilities. Evaluating the efficiency of existing strategies and implementing necessary changes through AI tools ensures that sourcing efforts remain in line with the firm's overall financial objectives.

This proactive approach not only improves deal flow but also aligns with the early-stage sourcing strategies VC teams use to increase investment success. It empowers teams to discover niche companies and qualified candidates more efficiently. Are you ready to elevate your sourcing strategies and achieve greater results?

Conclusion

The early-stage sourcing strategies employed by venture capital teams are essential for identifying promising investment opportunities and navigating a competitive landscape. By integrating advanced AI tools and fostering strong industry relationships, VC groups can enhance their lead generation and decision-making processes, ensuring they remain at the forefront of innovation.

Key strategies include:

- Leveraging AI-driven platforms like Websets for efficient lead generation

- Establishing warm inbound networks for referrals

- Maintaining organized lists of potential startups

- Engaging with startup accelerators

- Participating in hackathons

- Utilizing investment platforms

These approaches streamline operations and empower VC teams to make informed, timely decisions that align with evolving market conditions.

Ultimately, embracing these innovative strategies is crucial for venture capitalists aiming to maximize their investment potential. By continuously reviewing and adapting their sourcing methods, VC groups can stay ahead of industry trends and capitalize on the most relevant opportunities. The future of venture capital hinges on the ability to effectively integrate technology and relationships, paving the way for successful investments in the dynamic startup ecosystem.

Frequently Asked Questions

What is Websets and how does it enhance lead generation?

Websets is a platform that uses advanced AI algorithms to improve lead generation and candidate discovery for venture capital groups. It features an exclusive retrieval system designed for complex inquiries, allowing VC experts to navigate extensive datasets to identify potential startups and funding opportunities that align with their strategic goals.

What kind of information does Websets provide to users?

Websets enriches search results with comprehensive information, including LinkedIn profiles, company histories, and previous work experiences, which helps teams make swift and informed decisions.

Why are early-stage sourcing strategies important for venture capital teams?

Early-stage sourcing strategies are crucial for VC teams because timely insights can unlock substantial investment opportunities in the fast-paced realm of venture capital.

What additional features does Websets offer to meet enterprise-level demands?

Websets offers flexible high-capacity rate limits and premium support, ensuring that the performance meets the needs of enterprise-level demands without compromise.

How can VC firms establish a warm inbound deal sourcing network?

VC firms can establish a warm inbound deal sourcing network by nurturing relationships with industry professionals, entrepreneurs, and other investors. Frequent engagement with these contacts helps create a robust referral system for quality leads.

How can AI-driven tools enhance the deal sourcing strategies of VC firms?

AI-driven tools can help VC firms identify candidates and firms that meet specific criteria, thereby improving the quality of deal flow and positioning the firm as a trusted partner within the ecosystem.

What is the benefit of identifying connections to target companies?

Identifying connections to target companies allows VC groups to leverage shared networks and assess LinkedIn connections, which enhances recruitment and sales intelligence. This strategy increases the likelihood of securing warm introductions, making it more effective than traditional cold outreach.

Why is connecting with the right individuals important in venture capital?

In a competitive landscape, connecting with the right individuals can be a key differentiator for success, as it opens doors to exclusive opportunities and enhances the chances of successful investments.