Overview

This article delves into the distinctive datasets that investors leverage to make informed decisions regarding startups. It underscores various platforms, including Websets, Crunchbase, and PitchBook, which furnish invaluable insights and analytical tools. These resources significantly enhance the investment process by providing comprehensive data on startup performance, funding history, and emerging trends. By utilizing these platforms, investors can navigate the complexities of the startup ecosystem with greater confidence and precision.

Introduction

In a world where innovation propels economic growth, astute investors are increasingly turning to unique startup datasets to make informed decisions. By leveraging advanced tools and platforms, stakeholders can uncover insights into emerging trends, funding opportunities, and competitive landscapes—crucial elements for navigating the complexities of the startup ecosystem. Yet, with a multitude of data sources at their disposal, how can investors determine which datasets will genuinely enhance their investment strategies and yield optimal returns?

Websets: AI-Driven B2B Lead Generation for Startup Insights

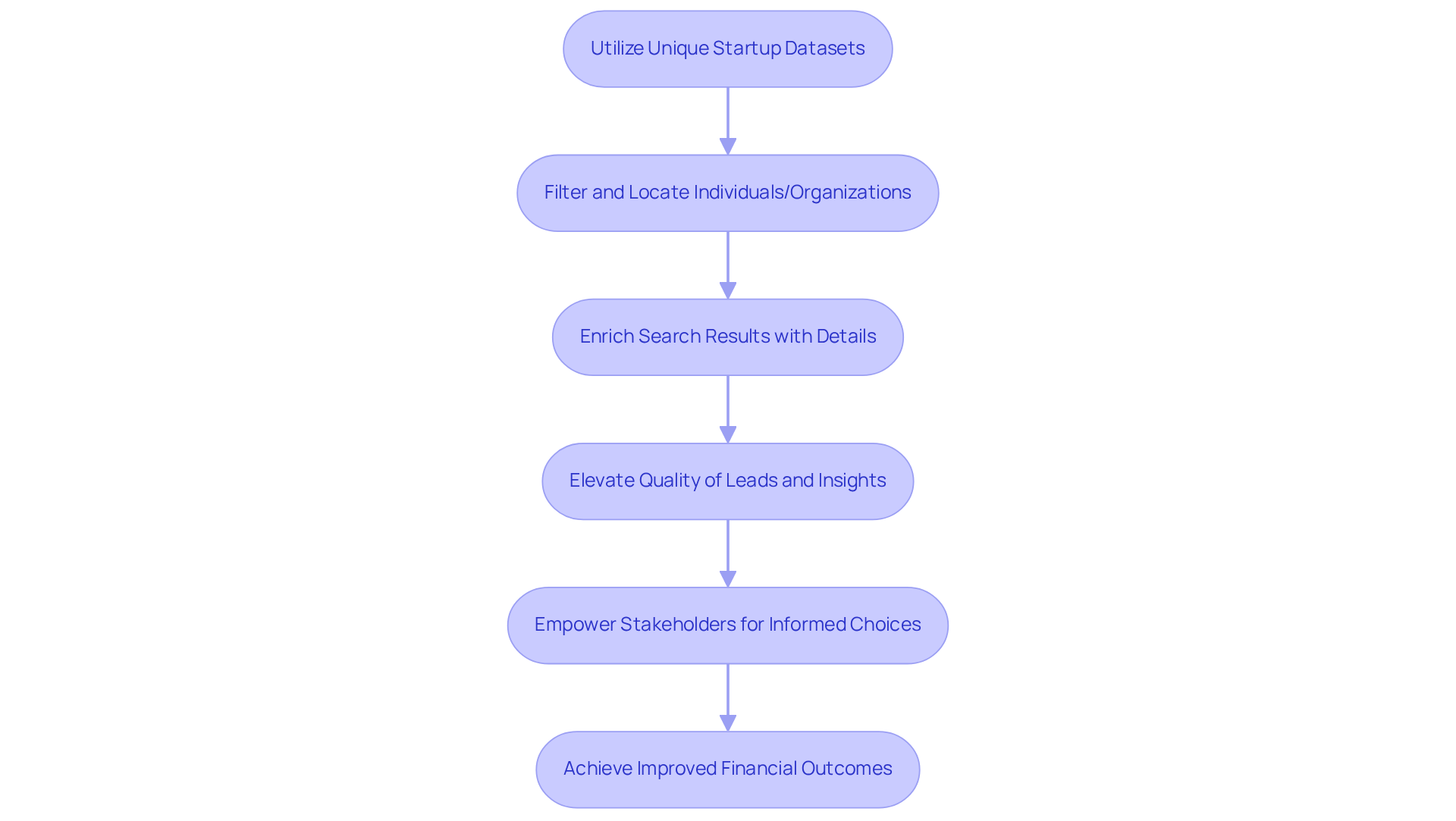

Websets leverages cutting-edge algorithms and advanced AI capabilities to revolutionize B2B lead generation, significantly aiding stakeholders in identifying promising startups by utilizing unique startup datasets investors use. With a robust internally developed search engine, the platform navigates extensive datasets, allowing users to filter and locate specific individuals or organizations that meet their funding criteria. This functionality is further enhanced by enriching search results with comprehensive details, such as LinkedIn profiles, emails, company information, and previous work experience. As a result, the quality of leads and insights available is elevated, empowering stakeholders to make more informed and strategic choices that lead to improved financial outcomes.

The integration of AI streamlines data discovery, ensuring investors have access to unique startup datasets investors use, which provide the most relevant and actionable information in a rapidly evolving market landscape. As industry leaders assert, "Businesses that don't utilize AI and data to innovate will be at a disadvantage," underscoring the essential role of AI in modern funding strategies. Additionally, the company's commitment to security and compliance, exemplified by SOC2 certification and enterprise-ready infrastructure, guarantees the ethical and effective use of its tools.

Case studies reveal that companies incorporating AI into their operations gain a competitive edge, reinforcing the critical importance of utilizing platforms like Websets for successful investment decisions. Are you ready to tap into the power of AI for your funding strategies?

CB Insights: Comprehensive Data Analytics for Startup Investment

The company offers an enterprise-grade, AI-driven web search solution that significantly enhances data discovery and technical insights, positioning itself as an invaluable resource for stakeholders within the startup ecosystem. This platform empowers users to search the web for technical documentation, Stack Overflow, and various other sources, enabling them to generate well-cited summaries for any query. In a market where informed decision-making is paramount, this capability is crucial.

Moreover, the platform's sophisticated data analytics tools provide investors with a competitive edge by uncovering unique startup datasets investors use that traditional keyword-based searches might miss. Its advanced neural search capabilities facilitate a deeper understanding of complex queries, ensuring users can adeptly navigate the intricacies of the startup landscape.

Additionally, the company upholds a robust security framework and adheres to industry standards, which is essential for enterprise customers. By leveraging Websets, individuals can ensure they are making informed decisions in a rapidly evolving market.

Crunchbase: Detailed Startup Profiles and Funding Information

Crunchbase stands out as an indispensable resource for financiers by offering unique startup datasets investors use, which include comprehensive company profiles, funding histories, key personnel, and market focuses. This platform empowers stakeholders to effectively evaluate a startup's growth trajectory, with the median Series A funding for U.S. startups currently positioned at $18 million. By scrutinizing this data, stakeholders can accurately identify funding requirements and assess the likelihood of future success.

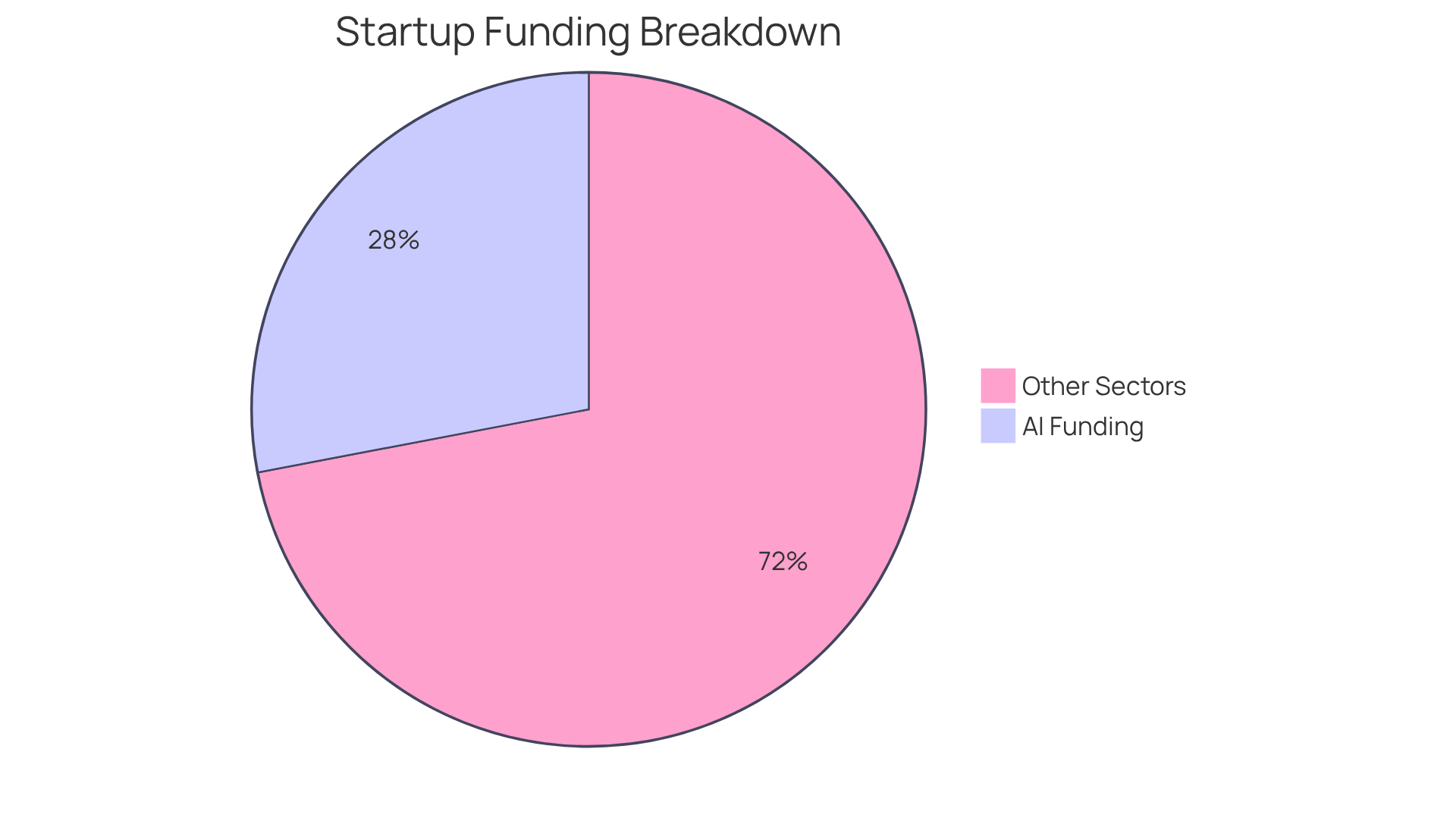

Furthermore, Crunchbase enables the tracking of industry trends and emerging companies, allowing investors to utilize unique startup datasets investors use to uncover lucrative opportunities at an early stage. For instance, in Q2 2025, global venture funding reached $91 billion, with AI companies attracting nearly $19 billion, which represents 28% of total funding. Such insights are essential for making informed financial decisions.

Investors can also utilize unique startup datasets investors use from Crunchbase to comprehend average funding amounts across various industries, a critical aspect for benchmarking and strategic planning. As the entrepreneurial landscape evolves, leveraging platforms like Crunchbase becomes increasingly vital for navigating the complexities of venture capital and optimizing financial returns.

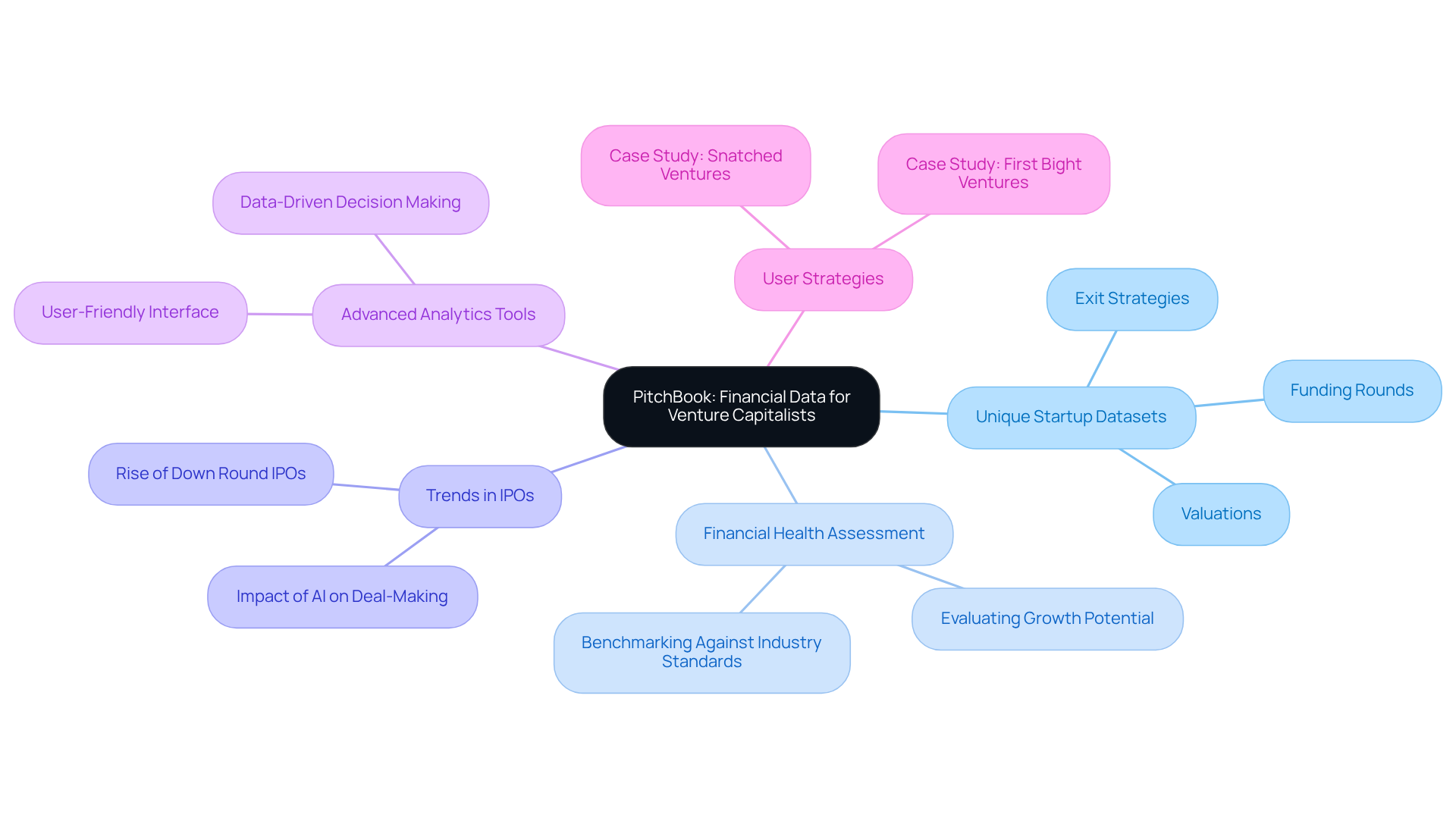

PitchBook: Financial Data and Insights for Venture Capitalists

PitchBook stands as an indispensable resource for venture capitalists, offering unique startup datasets investors use that deliver comprehensive financial data, including valuations, funding rounds, and exit strategies for emerging companies. This wealth of unique startup datasets investors use is essential for assessing the financial health and growth potential of assets. Furthermore, the platform's advanced analytics tools enable users to benchmark against unique startup datasets investors use and industry standards, facilitating informed financial decisions.

Recent trends reveal a rise in down round IPOs, a point underscored by Kevin Colas, Managing General Partner, who highlights the necessity for precise financial insights in today’s unpredictable market. As deal-making increasingly centers on artificial intelligence, understanding the financial landscape through PitchBook analytics can significantly influence funding strategies. Experts agree that thorough evaluations of financial health, including unique startup datasets investors use, are essential for identifying promising new ventures, especially as fundraising efforts anticipate a resurgence of substantial exits.

By harnessing PitchBook's insights, venture capitalists can adeptly navigate the intricacies of funding new businesses with enhanced confidence. This is exemplified by firms such as Snatched Ventures and First Bight Ventures, which effectively utilize these analytics to refine their funding strategies. In this dynamic environment, leveraging accurate data is not just advantageous—it is imperative for success.

Tracxn: Curated Startup Data for Emerging Trends

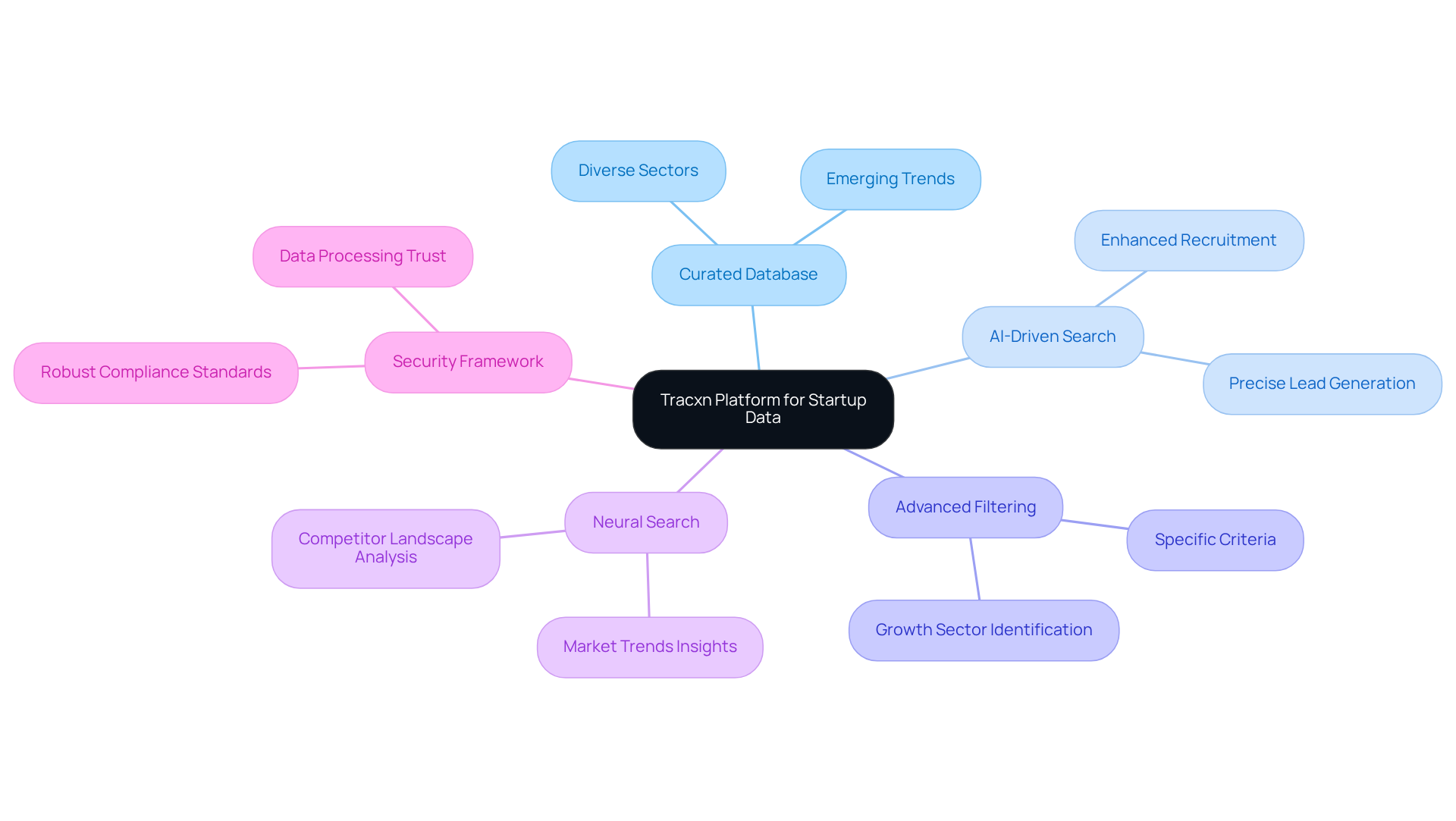

Tracxn offers a curated database of startups across diverse sectors, spotlighting emerging trends and innovations. In parallel, another platform elevates this experience with its enterprise-grade, AI-driven web search solutions. Investors can leverage this platform's capabilities for precise lead generation and recruitment, enriching their data with unique startup datasets investors use, which underscore potential funding opportunities. Its advanced search features empower users to filter by specific criteria, enabling them to pinpoint sectors primed for growth and adopt proactive investment strategies.

Moreover, the platform's neural search capabilities provide deeper insights into market trends and competitor landscapes, establishing it as an indispensable tool for informed decision-making in the venture capital arena. Case studies spanning various sectors demonstrate how effectively the platform has been utilized for lead generation and recruitment, underscoring its efficacy. Additionally, the company upholds a robust security framework and compliance standards, ensuring that enterprise customers can confidently trust their data processing needs.

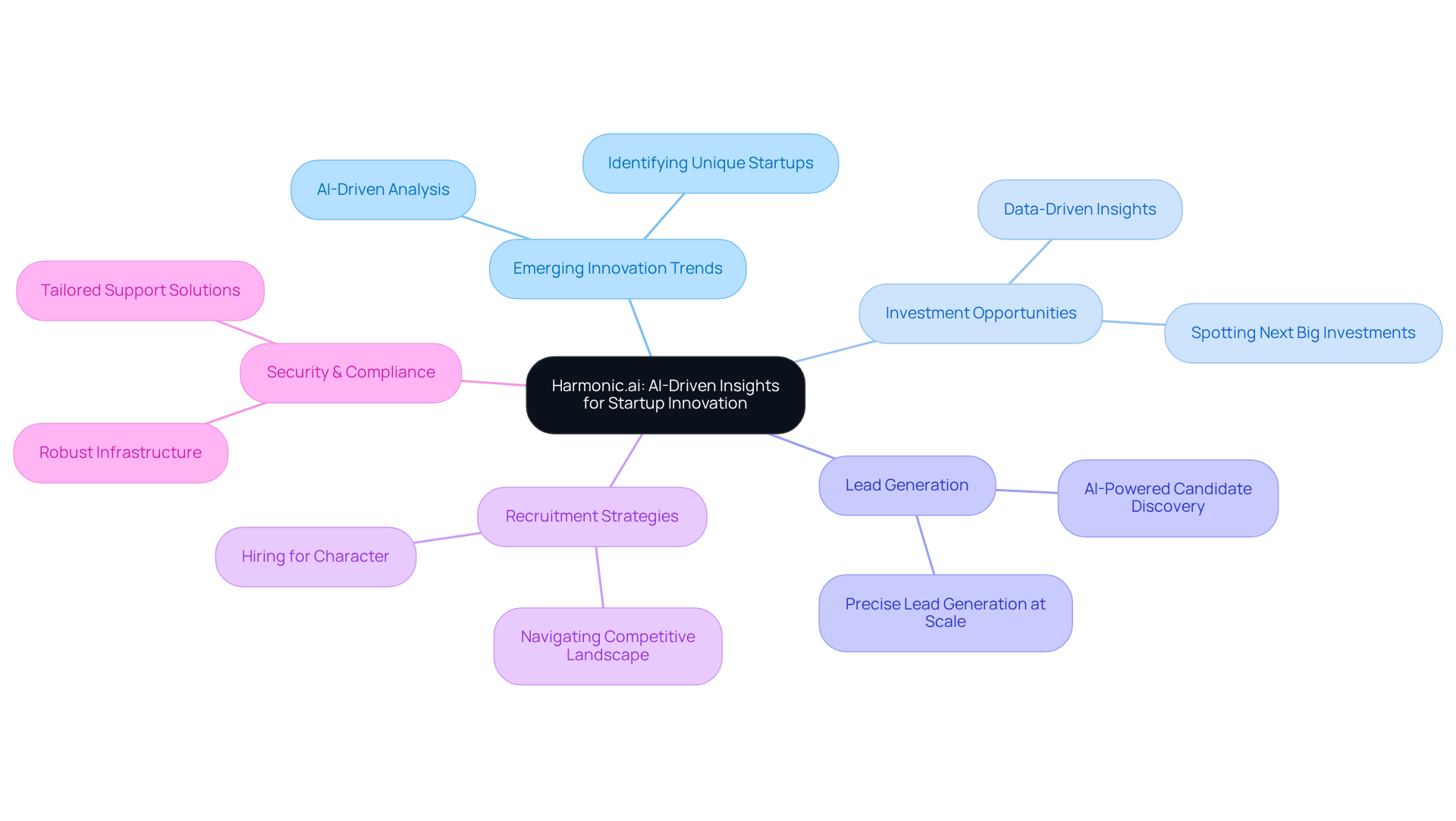

Harmonic.ai: AI-Driven Insights for Startup Innovation

Websets harnesses advanced artificial intelligence to meticulously analyze new business data, delivering essential insights into emerging innovation trends for stakeholders. This AI-driven analysis empowers investors to identify unique startup datasets investors use that are redefining technology and business models. Such an analytical approach not only enhances the decision-making process but also aligns with the increasing focus on technology's role in leveraging unique startup datasets investors use to uncover promising investment opportunities. Moreover, enterprise-grade AI-driven web search solutions significantly impact lead generation and recruitment strategies. With capabilities like precise lead generation at scale and AI-powered candidate discovery, Websets equips sales teams to navigate the competitive landscape of innovative companies with greater precision and confidence. The platform's commitment to security and compliance, coupled with tailored support solutions, ensures users can rely on robust infrastructure while leveraging advanced semantic retrieval for enhanced data discovery.

VentureRadar: Tracking Startup Performance and Market Positioning

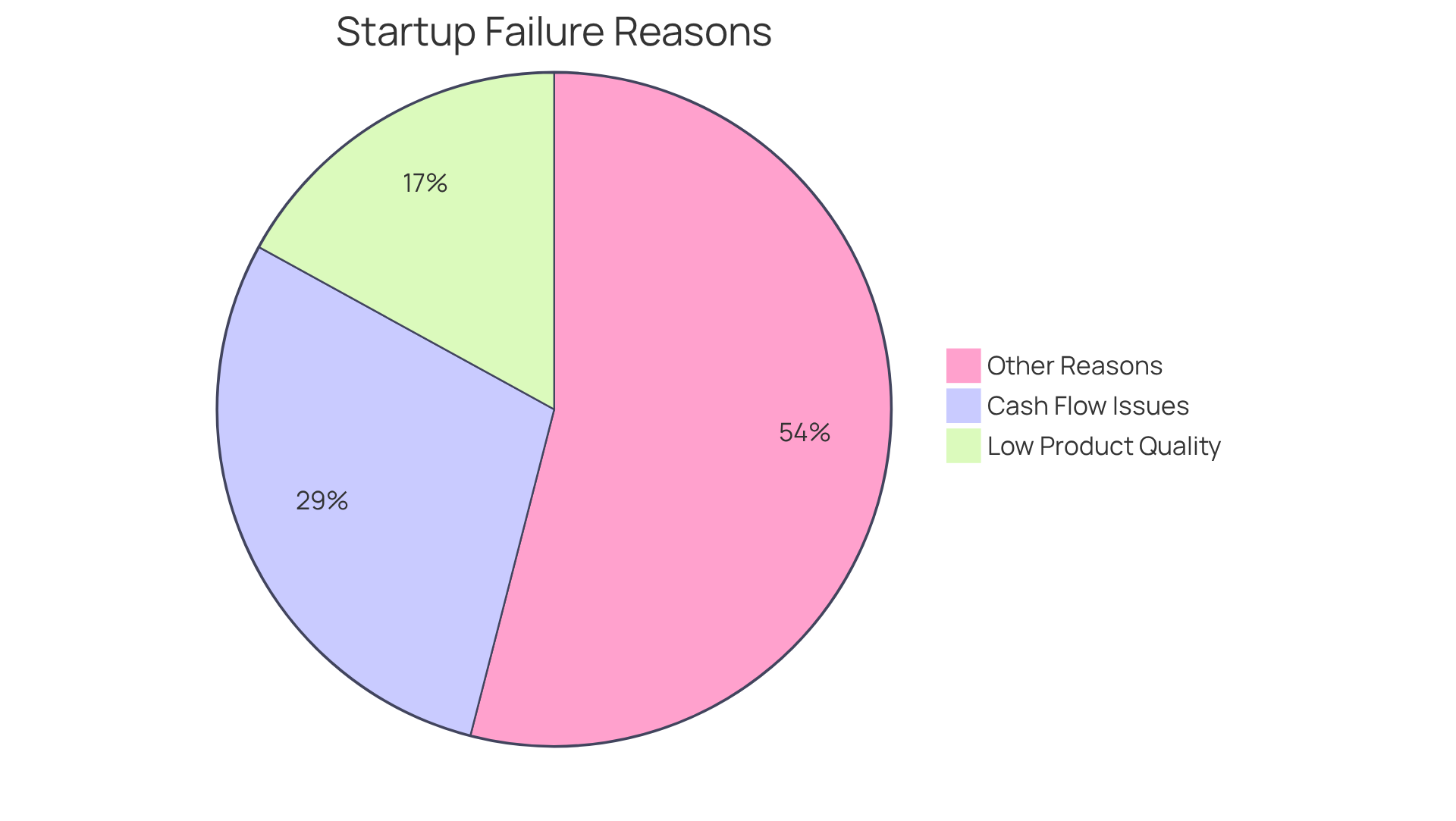

VentureRadar provides essential tools for tracking the performance and market positioning of emerging companies, offering investors access to unique startup datasets that reveal how new ventures stack up against their competitors. With a staggering 90% of new ventures failing, grasping these metrics is vital for making informed investment decisions. For example:

- 29% of new business failures stem from cash flow issues.

- 17% arise from low product quality.

By leveraging VentureRadar's insights, funders can pinpoint emerging companies that exhibit significant competitive strengths and evaluate their performance using unique startup datasets. Success stories abound, as financiers utilize these datasets to adeptly navigate the competitive landscape, ensuring they back new ventures with the potential for substantial returns. To optimize the impact of these insights, individuals should routinely review performance metrics and adapt their strategies accordingly, thereby enhancing their chances of success in a demanding investment environment.

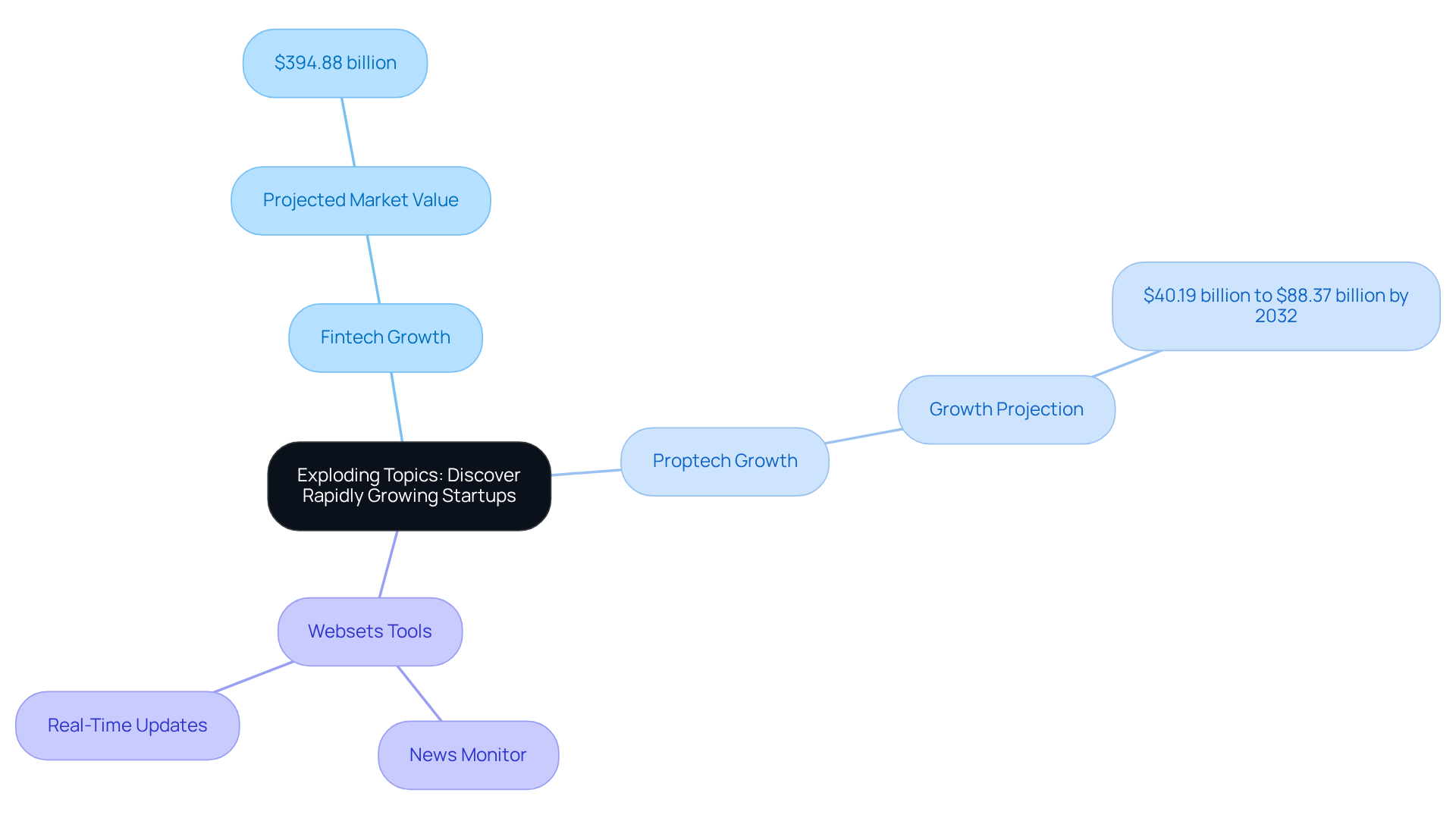

Exploding Topics: Discover Rapidly Growing Startups

Exploding Topics serves as an essential tool for discovering swiftly expanding companies across diverse sectors. Utilizing enterprise-grade AI-driven web search solutions, including custom semantic search and premium support, stakeholders can identify emerging companies gaining significant traction. This positions them advantageously before these new ventures reach their full potential.

In 2025, the entrepreneurial landscape is projected to witness remarkable growth, with many sectors experiencing substantial increases in activity. For instance, the global fintech market is expected to be valued at approximately $394.88 billion, while the proptech industry is set to grow from $40.19 billion to $88.37 billion by 2032.

By leveraging Websets' tools, such as the News Monitor for real-time updates on science, politics, finance, and new business funding, individuals can access data that highlights these trends. This empowers them to make informed decisions and capitalize on early-stage investment opportunities. Such a proactive strategy not only enhances their portfolio but also aligns with the latest findings of new companies, ensuring they remain at the forefront of innovation.

As Josh Howarth emphasizes, "The entrepreneurial landscape is evolving rapidly," underscoring the urgency for investors to identify successful ventures early.

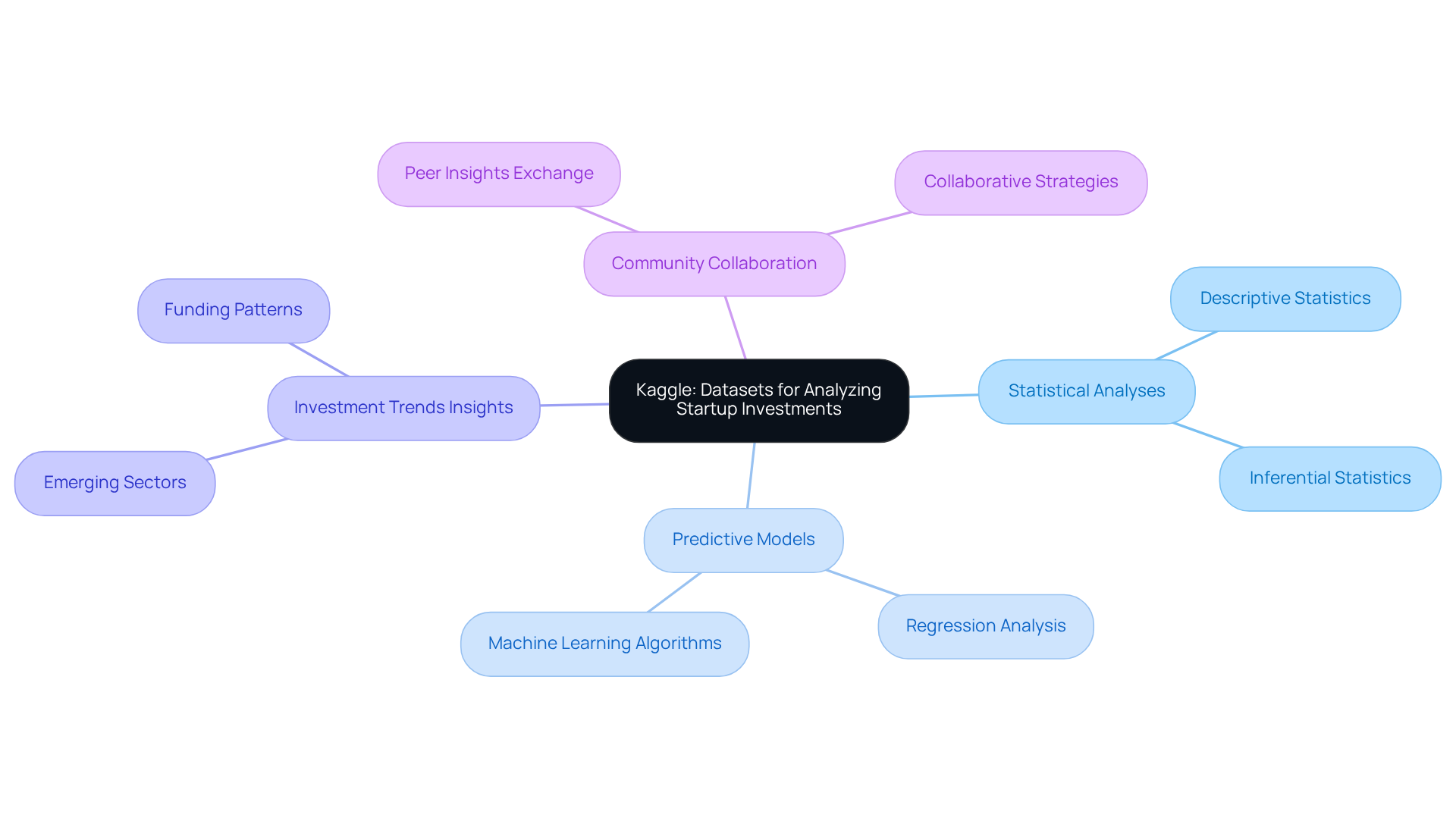

Kaggle: Datasets for Analyzing Startup Investments

Kaggle offers unique startup datasets investors use that are invaluable for analyzing startup funding. Investors can harness the unique startup datasets investors use to perform statistical analyses, construct predictive models, and uncover insights into emerging investment trends. Moreover, the platform's community-driven approach fosters collaboration, allowing participants to exchange insights and strategies with peers in the industry. This collective intelligence not only enhances individual understanding but also drives innovation in investment practices.

Lucid: NLP Tools for Enhanced Investor Reporting

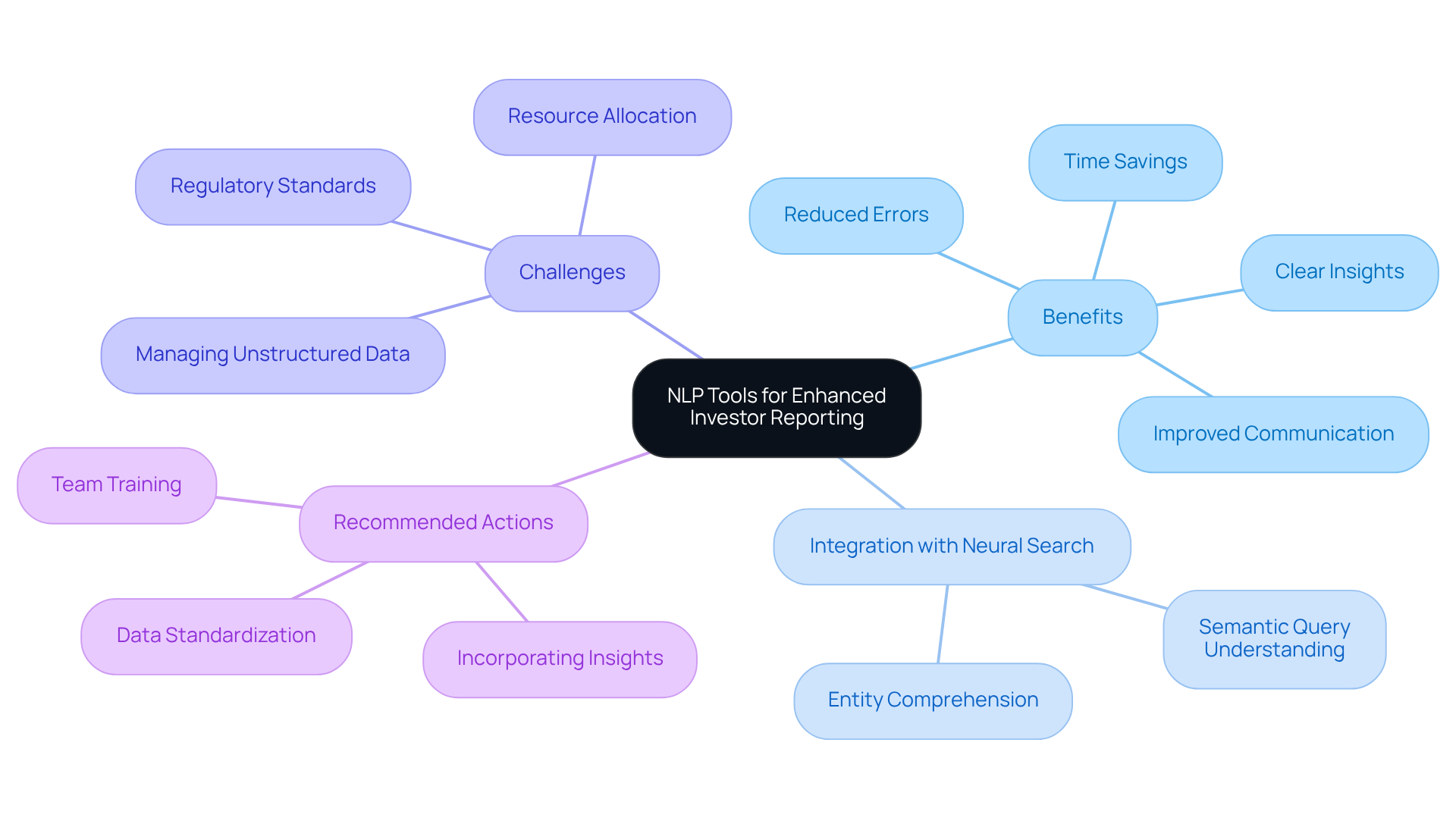

Natural language processing (NLP) tools are transforming the landscape of report creation, turning complex data into clear, concise insights. These advanced tools analyze vast amounts of information, enabling users to present their findings in formats that stakeholders can easily grasp. Enhanced reporting capabilities streamline communication, playing a crucial role in maintaining transparency and fostering trust in investment decisions. By leveraging NLP, stakeholders can ensure their reports are not only accurate but also tailored to the expectations of their audience, ultimately elevating the quality of communication with investors.

Moreover, the integration of neural search capabilities significantly enhances these processes. Neural search comprehends entity types—such as companies and blog posts—and the semantic qualities within queries, facilitating more sophisticated data retrieval and deeper insights into complex inquiries. This synergy between NLP and neural search enriches reports, making them more relevant and insightful for stakeholders.

However, startups face challenges in managing unstructured data and adhering to regulatory standards when implementing these technologies. To effectively harness these tools, investors should prioritize:

- Training their teams on the specific functionalities of neural search

- Developing strategies to incorporate these insights into their reporting processes

By doing so, they not only improve their reporting quality but also position themselves for success in an increasingly data-driven environment.

Conclusion

In the startup ecosystem, investors are increasingly recognizing the value of unique datasets that provide critical insights for informed decision-making. This article underscores various platforms—such as Websets, CB Insights, and Crunchbase—that harness advanced technologies and AI to deliver invaluable data. By leveraging these resources, stakeholders can deepen their understanding of market dynamics, pinpoint promising startups, and refine their investment strategies.

The article emphasizes the significance of data-driven decision-making in a rapidly evolving landscape. With detailed company profiles available on Crunchbase and the comprehensive financial analytics offered by PitchBook, each platform equips investors with unique tools to navigate the complexities of startup funding. Moreover, the integration of AI and advanced analytics across these platforms is highlighted as a vital factor in securing a competitive edge.

In a landscape where the success of startups can depend on timely and informed investments, utilizing these unique startup datasets is not merely advantageous but essential. Investors are urged to explore these innovative tools and platforms to remain ahead of emerging trends and seize early-stage opportunities. By incorporating these insights into their investment strategies, they can significantly enhance their prospects for success in an increasingly competitive environment.

Frequently Asked Questions

What is Websets and how does it assist in B2B lead generation?

Websets is an AI-driven platform that revolutionizes B2B lead generation by utilizing unique startup datasets to help stakeholders identify promising startups. It features a robust search engine that allows users to filter and locate individuals or organizations that meet specific funding criteria, enriching search results with detailed information such as LinkedIn profiles and previous work experience.

How does AI enhance the functionality of Websets?

AI streamlines data discovery within Websets, providing investors with access to relevant and actionable information from unique startup datasets. This capability allows stakeholders to make informed and strategic choices, ultimately leading to improved financial outcomes.

What security measures does Websets implement?

Websets is committed to security and compliance, as demonstrated by its SOC2 certification and enterprise-ready infrastructure, ensuring ethical and effective use of its tools.

What advantages do companies gain by incorporating AI into their operations, as highlighted in the article?

Companies that incorporate AI into their operations gain a competitive edge, which is critical for making successful investment decisions in the rapidly evolving market landscape.

What is CB Insights and how does it benefit startup investors?

CB Insights is an enterprise-grade, AI-driven web search solution that enhances data discovery and technical insights for stakeholders in the startup ecosystem. It allows users to search for technical documentation and other sources, generating well-cited summaries that aid in informed decision-making.

How does CB Insights provide a competitive edge to investors?

CB Insights offers sophisticated data analytics tools that uncover unique startup datasets that traditional searches might miss, along with advanced neural search capabilities for understanding complex queries, helping investors navigate the startup landscape effectively.

What role does Crunchbase play for investors in the startup ecosystem?

Crunchbase provides detailed startup profiles, funding histories, and market focuses, enabling stakeholders to evaluate a startup's growth trajectory and funding requirements. It helps investors identify lucrative opportunities and track industry trends.

What insights can investors gain from Crunchbase regarding funding trends?

Crunchbase allows investors to understand average funding amounts across various industries and provides insights into global venture funding trends, such as the significant funding attracted by AI companies, which is crucial for strategic planning and benchmarking.

Why is leveraging platforms like Crunchbase increasingly vital for investors?

As the entrepreneurial landscape evolves, platforms like Crunchbase become essential for navigating the complexities of venture capital and optimizing financial returns by providing comprehensive data and insights.