Overview

This article delineates best practices for harnessing niche data sources in venture capital (VC), aimed at uncovering hidden investment opportunities and refining decision-making processes. By leveraging specialized databases, alternative datasets, and industry-specific insights, VCs can substantially enhance deal flow and risk management. This strategic approach positions VCs to secure a competitive advantage in identifying emerging trends and startups that larger investors may often overlook. In a landscape where precision and insight are paramount, the ability to tap into these resources is not just beneficial; it is essential for sustained success.

Introduction

In the competitive realm of venture capital, the capacity to pinpoint and capitalize on distinctive investment opportunities distinguishes success from stagnation. Niche data sources, frequently disregarded by mainstream providers, are pivotal in unlocking insights that can catalyze groundbreaking investments. As the venture capital landscape evolves, the pressing question arises: how can VCs effectively leverage these specialized resources to enhance their deal flow and adeptly navigate the complexities of investment decision-making?

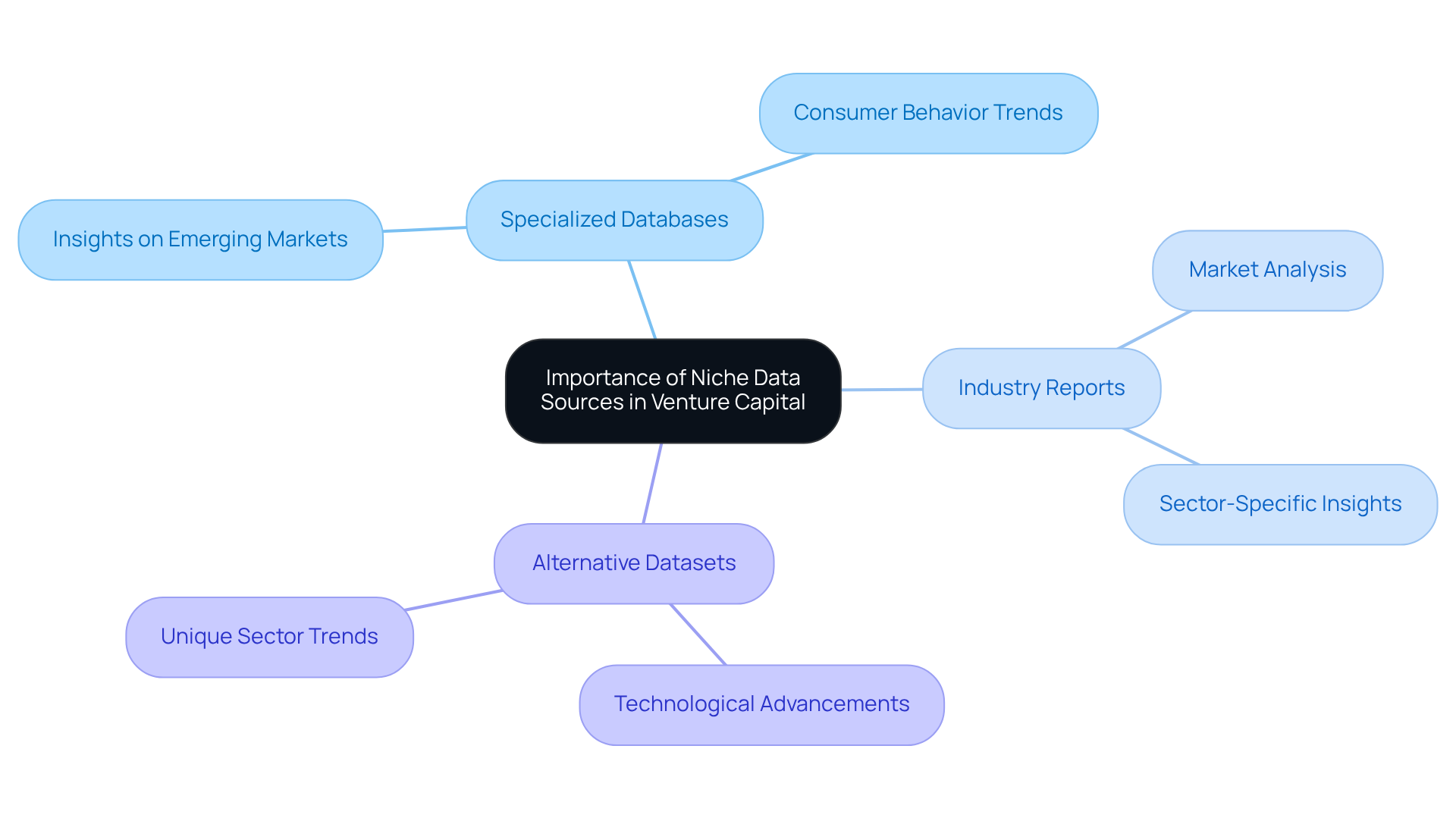

Understand the Importance of Niche Data Sources in Venture Capital

Niche data sources for VCs provide invaluable insights that are often overlooked by mainstream providers. These resources include:

- Specialized databases

- Industry reports

- Alternative datasets focused on emerging markets or specific sectors

By leveraging niche data sources for VCs, VCs can uncover hidden opportunities—startups that may not yet attract the attention of larger investors. For example, specialized information can reveal trends in consumer habits or technological advancements unique to certain sectors, empowering VCs to make informed decisions based on a thorough market evaluation.

This strategic approach not only enhances deal sourcing but also positions VCs to seize unique funding opportunities that competitors might miss. As the venture capital landscape evolves, the ability to analyze and utilize niche data sources for VCs effectively becomes increasingly vital for achieving exceptional financial outcomes.

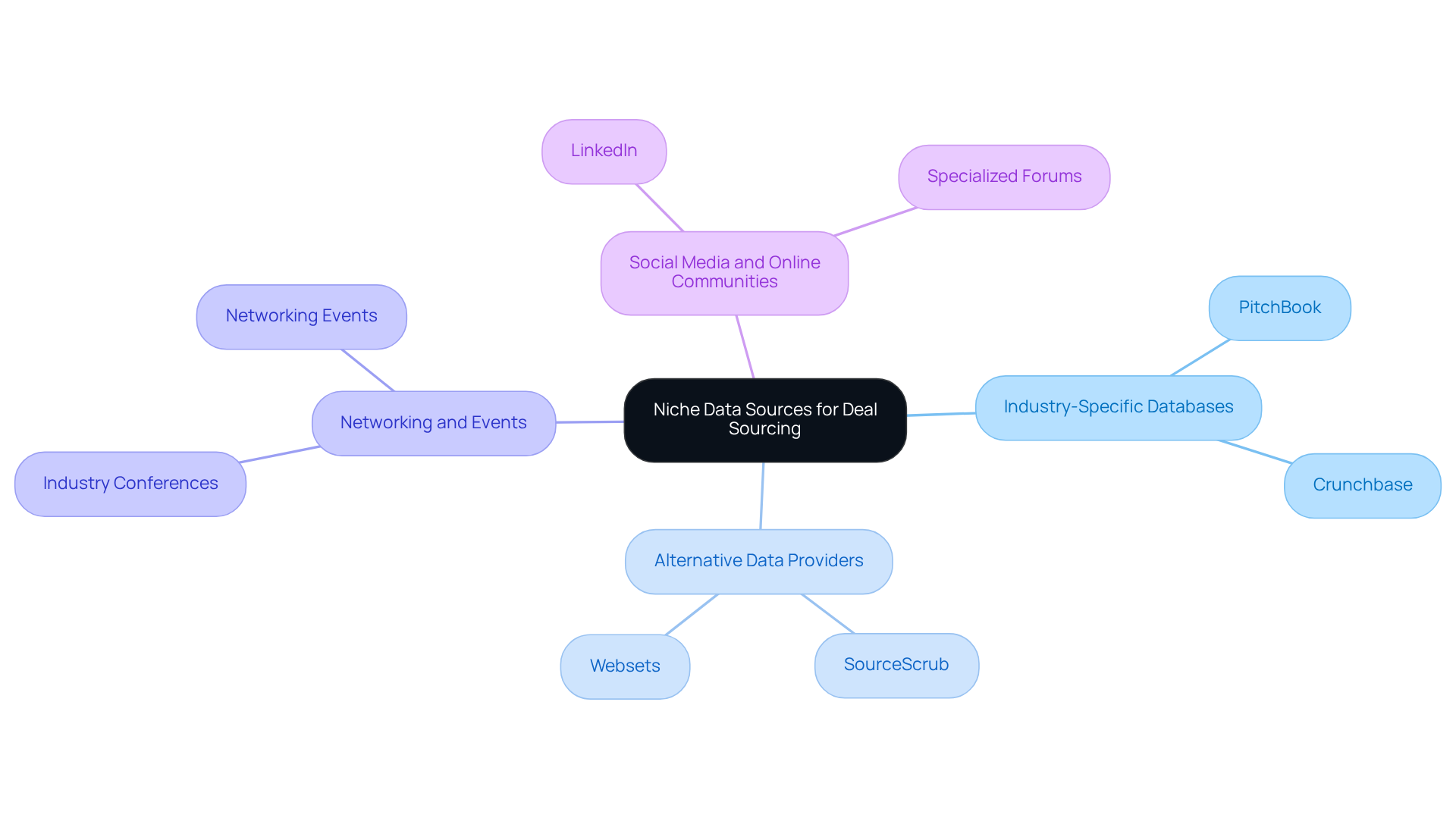

Identify and Utilize Effective Niche Data Sources for Deal Sourcing

To effectively source deals, venture capitalists (VCs) must leverage niche data sources for VCs, which can significantly enhance their funding strategies. Key categories include:

-

Industry-Specific Databases: Platforms such as PitchBook and Crunchbase deliver comprehensive insights into startups across various sectors. These databases empower VCs to sift through potential opportunities based on specific criteria, facilitating targeted decision-making.

-

Alternative Data Providers: Services like SourceScrub provide valuable information on private companies that may not be publicly listed. This access to emerging players in the market allows VCs to uncover hidden opportunities that traditional databases might miss. Furthermore, 'Websets' enterprise-grade AI-driven web search solutions can enhance this process by offering access to technical documents and specialized insights often overlooked by conventional sources.

-

Networking and Events: Engaging in industry-specific conferences and networking events can yield critical connections and insights into lesser-known startups. Interacting with thought leaders and peers in these settings frequently leads to the discovery of unique funding opportunities.

-

Social Media and Online Communities: Monitoring discussions on platforms such as LinkedIn and specialized forums enables VCs to stay ahead of trends and identify potential opportunities before they garner widespread attention. This proactive approach can result in early-stage funding for high-growth startups. However, it is imperative to maintain high-quality datasets, as the reliability of the information directly influences financial outcomes. 'Websets' advanced semantic search technology can assist in navigating extensive online information to uncover pertinent discussions and insights.

By strategically employing niche data sources for VCs, while remaining cognizant of the potential pitfalls of over-reliance, VCs can cultivate a robust pipeline of unique funding opportunities that align with their strategic goals. This ultimately enhances their chances of securing high-return ventures.

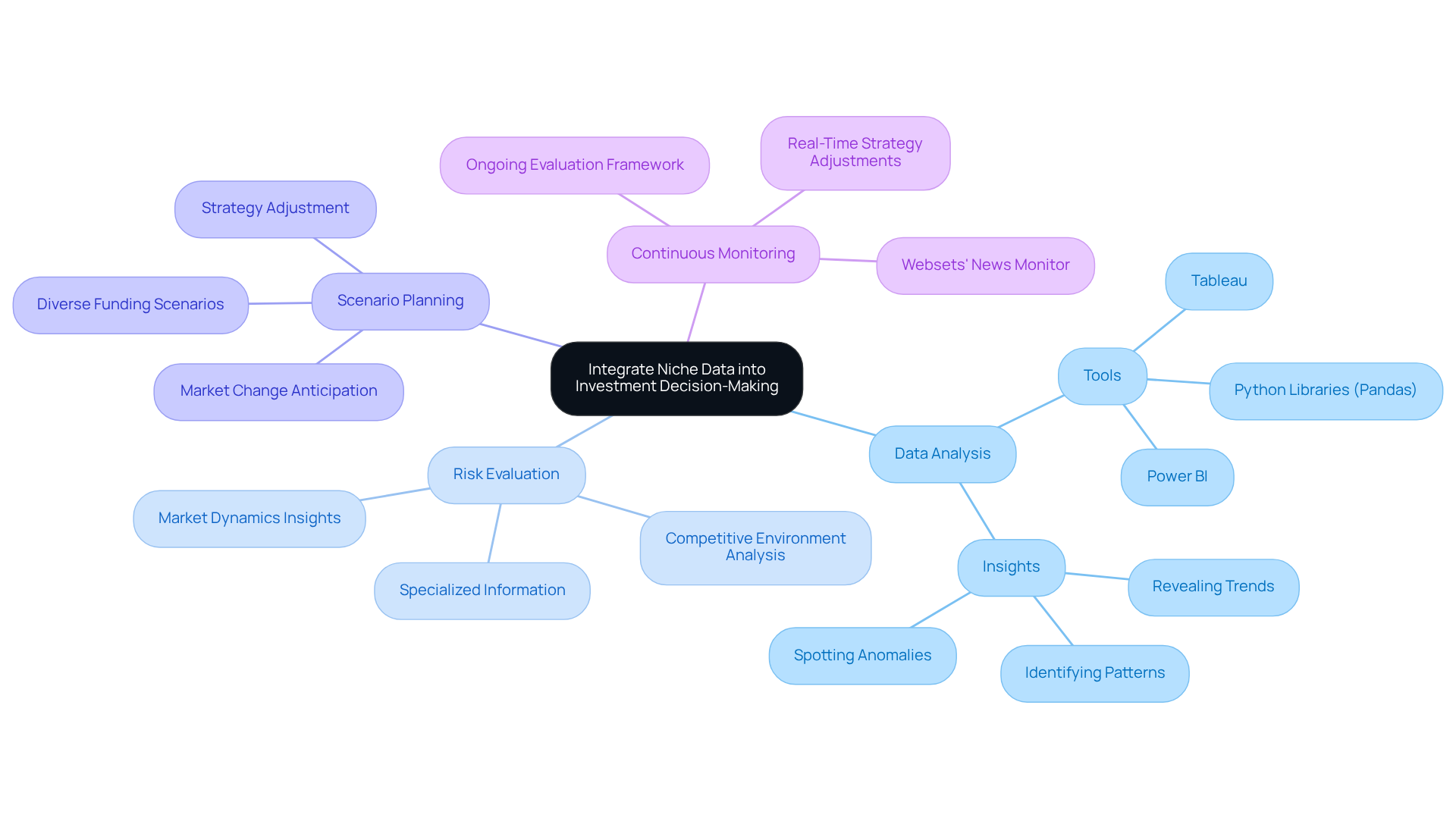

Integrate Niche Data into Investment Decision-Making Processes

Integrating niche data sources for VCs into the investment decision-making process is essential for venture capitalists aiming to stay ahead in a competitive landscape.

Data Analysis: Advanced analytical tools such as Tableau, Power BI, or Python libraries like Pandas are crucial for examining data from specialized sources. By leveraging Websets' enterprise-grade AI-driven web search solutions, VCs can access niche data sources for VCs that other tools may overlook. Identifying patterns, trends, and anomalies can reveal promising investment opportunities. Efficient information visualization emphasizes essential insights from niche data sources for VCs that could otherwise be missed.

Risk Evaluation: Niche data sources for VCs provide specialized information that enables thorough risk evaluations, offering deeper insights into market dynamics and competitive environments specific to certain sectors. As Mike Hinckley aptly states, 'venture capital is driven by information,' underscoring the importance of informed choices to minimize unexpected challenges. Websets' tools aggregate insights from niche data sources for VCs, which enhances analysis depth and facilitates a nuanced understanding of risks.

Scenario Planning: By analyzing niche data sources for VCs, VCs can develop diverse funding scenarios, which equips them to anticipate market changes and adjust strategies proactively. This foresight is particularly crucial in fast-evolving sectors like fintech and health tech, where rapid changes can significantly impact financial outcomes. Websets' AI-driven tools assist in generating well-cited summaries by utilizing niche data sources for VCs, aiding in scenario development and ensuring a comprehensive view of potential futures.

Continuous Monitoring: Establishing a robust framework for ongoing evaluation of niche data sources for VCs is vital for VCs to stay updated on market shifts and adjust funding strategies in real-time. Agility is essential for maintaining a competitive edge in the fast-paced venture capital landscape. Websets' News Monitor plays a pivotal role in aggregating insights across science, politics, finance, and startup funding, serving as niche data sources for VCs that provide the necessary information for timely decision-making and enabling swift responses to emerging trends.

For instance, a VC focused on health tech might analyze specific information related to regulatory changes, emerging technologies, and consumer health trends. This targeted approach not only enhances funding choices but also aligns with the increasing emphasis on data-driven strategies in venture capital. However, VCs must remain vigilant against common pitfalls, such as over-reliance on partial information or neglecting the broader market context, which can lead to misguided financial decisions.

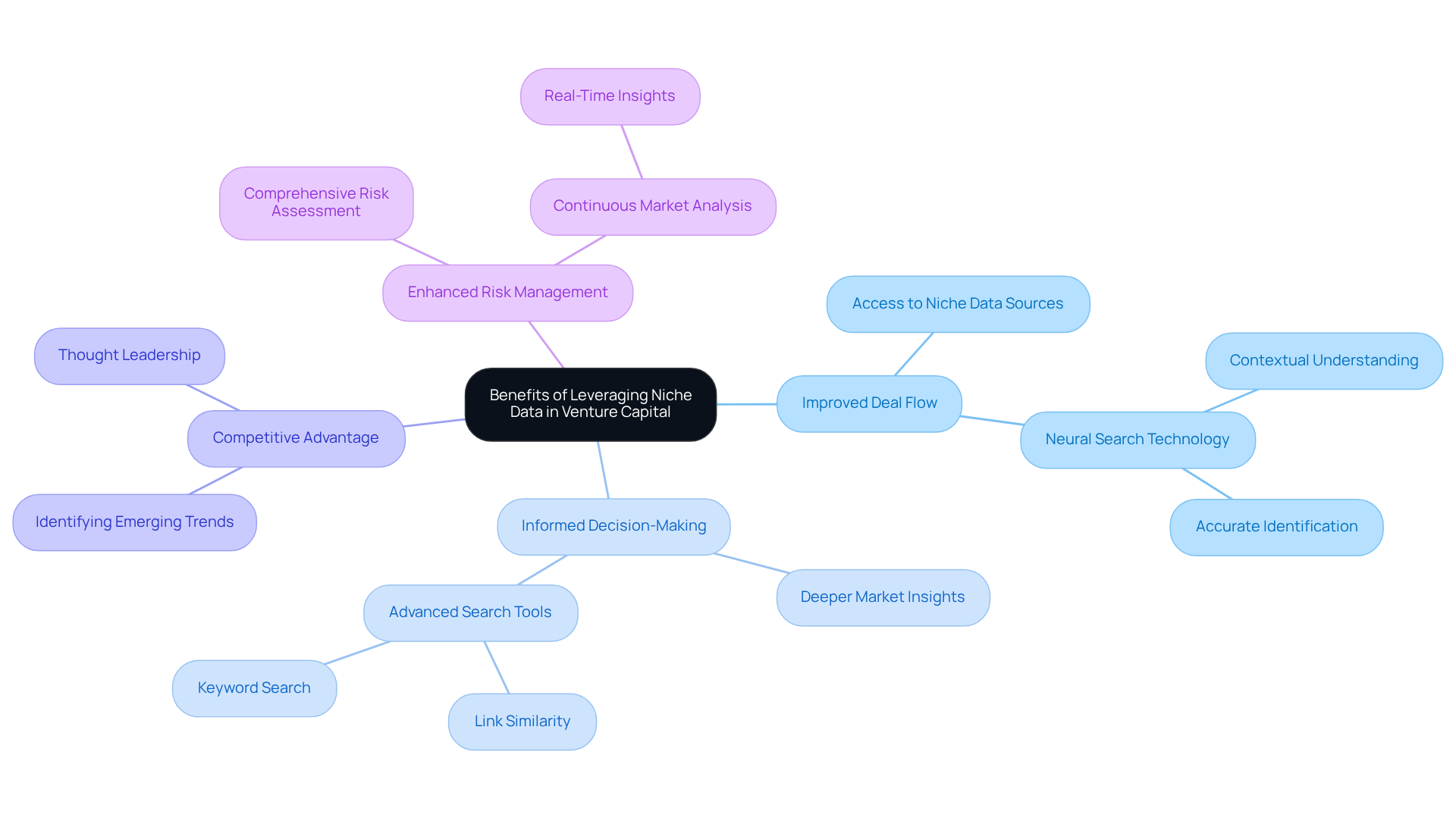

Evaluate the Benefits of Leveraging Niche Data in Venture Capital

Leveraging niche data in venture capital offers several compelling advantages:

-

Improved Deal Flow: Accessing niche data sources for VCs empowers them to uncover investment opportunities that conventional channels might overlook, resulting in a more diverse and robust portfolio. Traditional search engines often falter in identifying niche companies due to their reliance on keyword matching, which frequently leads to irrelevant results. Neural search technology effectively addresses this limitation by comprehending the context and semantics of queries, facilitating more accurate identification of pertinent companies.

-

Informed decision-making is supported by niche data sources for VCs, which provide deeper insights into specific markets, allowing them to base their decisions on thorough analyses rather than intuition alone. Given that venture capital accounts for 21% of U.S. economic output, informed decision-making is paramount for maximizing impact in this significant sector. Advanced search tools like Exa's link similarity and keyword search further enhance the information available for analysis.

-

Competitive Advantage: By leveraging niche data sources for VCs, VCs can identify emerging trends and opportunities ahead of their competitors, establishing themselves as thought leaders in their sectors. The capacity to utilize neural search capabilities allows VCs to remain ahead of the curve by discovering innovative companies through niche data sources for VCs that may not be easily found via traditional search methods.

-

Enhanced Risk Management: A comprehensive understanding of niche data sources for VCs equips them to assess risks with greater precision and develop effective mitigation strategies. Continuous market analysis is essential for staying informed about new trends and growth sectors, ultimately improving potential returns. The integration of neural search technology can facilitate this ongoing analysis by providing real-time insights into market dynamics.

Consider a scenario where a firm searches for companies similar to Thrifthouse, a platform for selling secondhand goods on college campuses. Traditional search methods may yield irrelevant results. However, by employing specialized information and neural search technology, a venture capital firm focused on sustainable energy can leverage niche data sources for VCs to pinpoint innovative technologies and startups aligned with global sustainability trends. This approach not only capitalizes on a burgeoning market but also effectively manages investment risks, illustrating the strategic value of leveraging niche data in venture capital.

Conclusion

Leveraging niche data sources in venture capital is a critical strategy for VCs aiming to gain a competitive edge and uncover unique investment opportunities. These specialized resources—ranging from industry-specific databases to alternative datasets—empower venture capitalists to make informed decisions that can lead to exceptional financial outcomes. By understanding and utilizing these niche data sources, VCs can significantly enhance their deal sourcing, risk management, and overall investment strategies.

Several key practices underscore the importance of niche data:

- Identifying effective niche data sources, such as industry-specific databases and alternative data providers, is crucial.

- Integrating niche data into investment decision-making processes—including data analysis and continuous monitoring—is essential for adapting to market changes.

- The benefits of leveraging niche data, such as improved deal flow, informed decision-making, and enhanced risk management, illustrate the strategic value these resources offer to VCs.

The significance of niche data in venture capital cannot be overstated. As the landscape continues to evolve, embracing these specialized insights will not only help venture capitalists identify emerging trends and opportunities but also position them as leaders in their respective sectors. By actively seeking and utilizing niche data sources, VCs can enhance their investment strategies, ultimately leading to better outcomes and a more robust portfolio. The call to action is clear: venture capitalists must prioritize the integration of niche data into their practices to stay ahead in a competitive market and maximize their potential for success.

Frequently Asked Questions

What are niche data sources in venture capital?

Niche data sources in venture capital are specialized resources that provide unique insights often overlooked by mainstream providers. They include specialized databases, industry reports, and alternative datasets focused on emerging markets or specific sectors.

How do niche data sources benefit venture capitalists (VCs)?

Niche data sources help VCs uncover hidden opportunities, such as startups that may not yet attract larger investors. They provide insights into trends in consumer habits and technological advancements specific to certain sectors, enabling VCs to make informed decisions.

What advantages do VCs gain by using niche data sources?

By leveraging niche data sources, VCs enhance their deal sourcing capabilities and position themselves to seize unique funding opportunities that competitors might overlook, leading to better financial outcomes.

Why is it increasingly vital for VCs to utilize niche data sources?

As the venture capital landscape evolves, the ability to effectively analyze and utilize niche data sources becomes crucial for VCs to achieve exceptional financial results and stay competitive in the market.