Overview

Startups must prioritize essential compliance hires before a funding round. Why? Because these hires are crucial for adhering to legal and regulatory requirements. Not only do they mitigate risks, but they also enhance credibility with investors. This dual benefit can save costs and improve operational efficiency, ultimately positioning startups for long-term success.

Consider this: when startups invest in compliance, they signal to investors that they are serious about governance and risk management. This proactive approach not only builds trust but also sets the stage for smoother funding processes. In fact, companies that prioritize compliance often find themselves better equipped to navigate the complexities of the investment landscape.

So, what does this mean for your startup? It means that making these strategic hires isn’t just a checkbox on a to-do list; it’s a vital step toward securing your future. By ensuring that your team includes compliance experts, you’re not just protecting your business—you’re enhancing its value in the eyes of potential investors.

In conclusion, don’t overlook the importance of compliance hires. They are not merely an expense; they are an investment in your startup’s credibility and operational success. Take action now to position your startup for the growth and stability it deserves.

Introduction

In a landscape where startups are racing to secure funding and establish their foothold, the significance of compliance hiring stands out. As businesses navigate complex regulatory environments, the right compliance hires not only safeguard against legal pitfalls but also enhance credibility with investors and customers alike. Yet, many startups struggle to integrate these crucial roles into their pre-funding strategies.

How can emerging companies effectively prioritize compliance in a way that supports their growth and attracts investment? This question is vital, as the right approach to compliance can be a game-changer in securing the necessary backing and fostering trust in the market.

Understand the Importance of Compliance Hiring in Startups

For new businesses, compliance hires pre-funding round are essential to ensure they meet legal and regulatory requirements that can differ significantly across industries. In the fast-paced entrepreneurial landscape, the pressure to scale often leads to overlooking these critical regulatory matters. But ignoring regulations can result in severe consequences, such as hefty fines, legal challenges, and a substantial loss of investor confidence. For instance, businesses that fail to comply can face fines that accumulate quickly, severely impacting cash flow and profitability, with typical revenue declines estimated at $4,005,116.

By prioritizing compliance hires pre-funding round, startups can establish a solid foundation that not only protects them from potential challenges but also enhances their credibility with stakeholders. A dedicated regulatory officer can proactively manage risks and ensure that hiring practices align with current laws, fostering a culture of accountability and transparency. Moreover, appointing a C-level regulatory leader can save businesses an average of $1.25 million in regulatory expenses, showcasing the financial benefits of investing in regulatory roles.

This strategic investment in compliance hires pre-funding round not only mitigates risks but also enhances the positioning of new businesses in the eyes of potential investors, ultimately supporting their long-term success. Additionally, with 61% of organizations planning to increase their spending on Governance, Risk, and Compliance (GRC) technology in the next three years, the growing recognition of regulatory importance in the evolving business landscape is undeniable. Non-compliance can also inflict reputational damage, signaling mismanagement and unreliability to investors, customers, and talent.

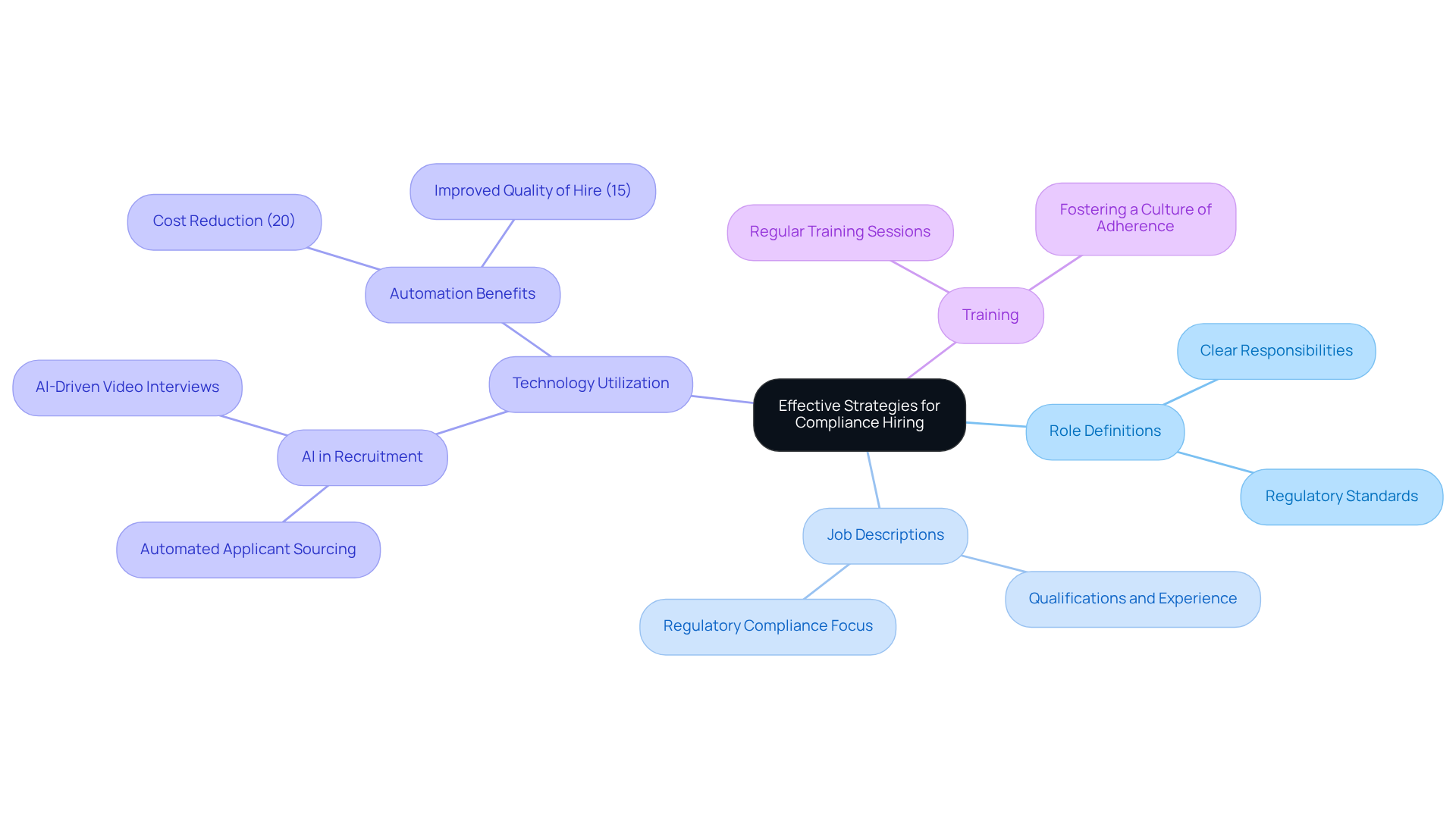

Implement Effective Strategies for Compliance Hiring

To establish effective adherence recruitment strategies, new businesses must begin by clearly outlining the roles and responsibilities tied to regulations. Crafting thorough job descriptions that specify the required qualifications and experience related to regulatory standards is essential. Moreover, startups should leverage technology to automate aspects of the recruitment process, such as background checks and training for regulations. Utilizing platforms like Websets can significantly enhance recruitment by providing access to a broader pool of qualified candidates with the necessary compliance expertise. Websets' advanced AI-powered search engine is specifically designed to sift through large volumes of applicants, ensuring organizations can efficiently find the right talent. In fact, statistics reveal that 67% of organizations employ AI to manage applicant volumes, underscoring the effectiveness of AI in streamlining recruitment processes.

Organizations that incorporate automation into their recruitment processes experience a 20% reduction in costs and a 15% improvement in quality-of-hire metrics. Notably, data-driven hiring practices have resulted in a 15% increase in quality-of-hire metrics aligned with business objectives, further emphasizing the effectiveness of these strategies. However, it’s important to recognize that 50% of respondents believe automation can reduce human interaction and negatively impact the candidate experience, highlighting a potential drawback of relying solely on technology.

In addition to technology, conducting regular training sessions on regulatory standards for all employees is crucial. This practice fosters a culture of adherence within the organization, ensuring every team member understands their role in upholding regulations. By merging clear role definitions, automation through Websets, and continuous training, new businesses can establish a robust regulatory framework that supports their growth and operational integrity.

Leverage Compliance Hires to Enhance Credibility and Efficiency

Compliance hires pre-funding round are crucial for enhancing a new business's credibility and operational efficiency. By bringing in compliance hires pre-funding round with regulatory knowledge, startups signal to investors and customers their commitment to ethical practices and legal standards. This commitment can significantly boost investor confidence, particularly in compliance hires pre-funding round, making it easier to secure funding.

Bill Harrison, CEO of ComplianceBridge, emphasizes that viewing adherence to regulations as a cost-saving measure rather than a financial burden is essential. The costs associated with a regulatory breach can far exceed those of managing compliance. Furthermore, regulatory professionals excel at streamlining operations by pinpointing inefficiencies and implementing best practices that meet regulatory requirements.

For instance, when a new business recruits a regulatory manager, it gains standardized processes that not only ensure compliance but also enhance overall operational efficiency. This leads to quicker decision-making and improved performance, ultimately positioning the company for greater success.

As the regulatory landscape evolves in 2024, the demand for compliance hires pre-funding round in this field becomes increasingly critical. Startups must remain competitive and compliant in a complex environment. Are you ready to invest in compliance expertise to secure your business's future?

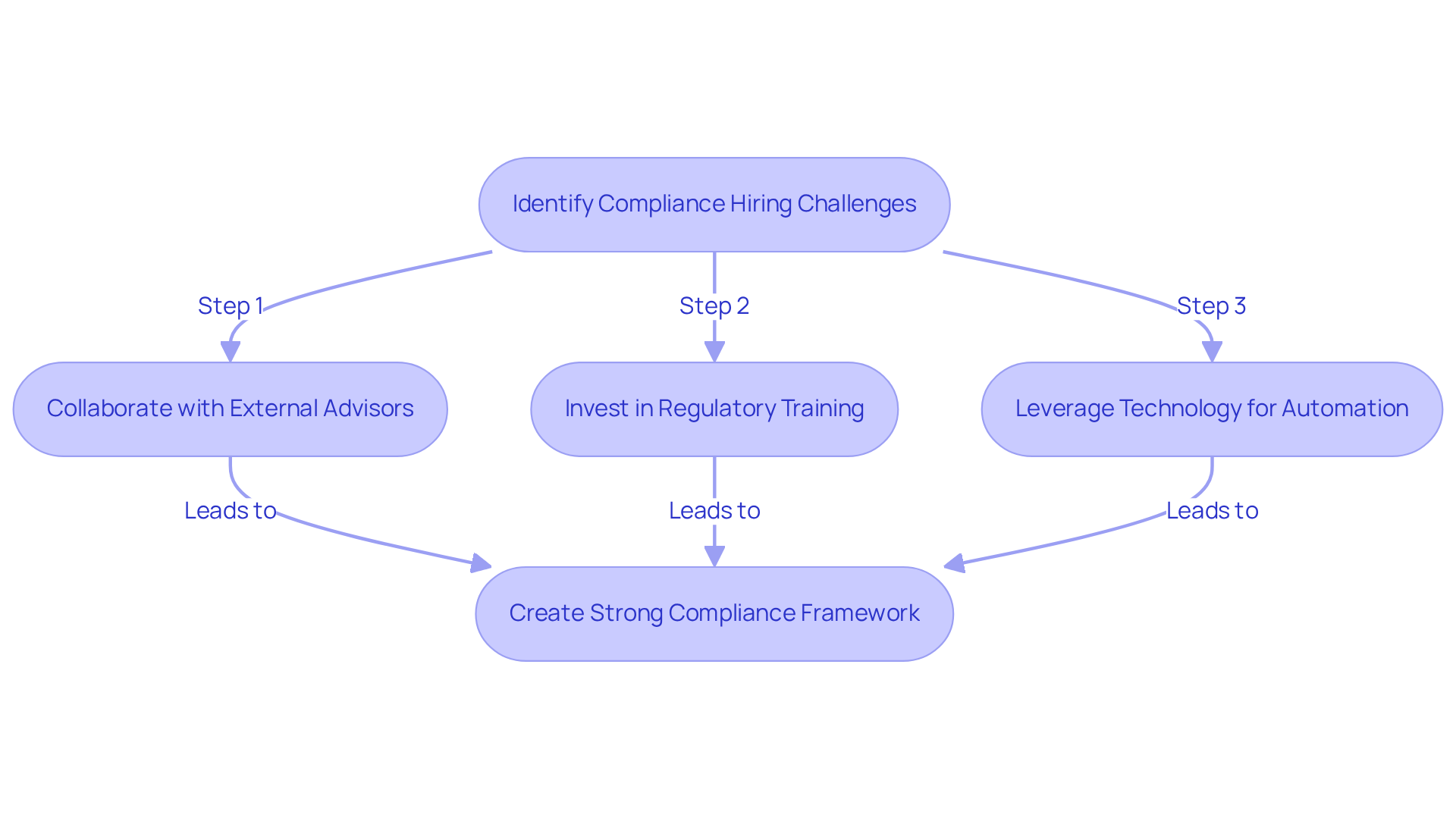

Address Challenges in Compliance Hiring for Startups

Startups face significant hiring challenges due to regulations, particularly in making compliance hires pre-funding round, along with limited resources and a lack of understanding of requirements. The fast-paced nature of their operations only adds to the complexity. To tackle these issues effectively, collaborating with external regulatory advisors can provide essential expertise without the need for a full-time hire.

Investing in regulatory training for existing staff is crucial. This not only bridges knowledge gaps but also ensures that every team member understands their responsibilities. Furthermore, leveraging technology to automate verification checks can streamline the hiring process, significantly reducing the burdens associated with regulatory compliance.

By proactively addressing these challenges, startups can create a strong compliance framework that supports their growth and aligns with their operational goals, particularly through compliance hires pre-funding round. Are you ready to take the necessary steps to enhance your hiring process and ensure compliance?

Conclusion

Investing in compliance hires before a funding round is not just a strategy; it’s a critical necessity for startups navigating today’s complex regulatory landscape. By prioritizing these roles, businesses can safeguard against potential legal pitfalls while simultaneously enhancing their appeal to investors. This commitment to ethical practices and operational integrity speaks volumes.

The financial advantages of compliance hires are compelling. Startups can realize significant cost savings and improved operational efficiency. Establishing clear recruitment strategies is essential, as is leveraging technology to streamline hiring processes. Moreover, fostering a culture of compliance through regular training is vital. The potential reputational damage from non-compliance underscores the urgent need for startups to proactively build their compliance teams.

The call to action is unmistakable: startups must recognize compliance hires as an investment in their future. By embracing effective compliance strategies, businesses can mitigate risks and position themselves for sustainable growth in an increasingly competitive environment. Taking these steps now will lay a strong foundation for long-term stability and bolster investor confidence.

Frequently Asked Questions

Why are compliance hires important for startups before a funding round?

Compliance hires are essential for startups to meet legal and regulatory requirements that can vary across industries. They help avoid severe consequences such as fines, legal challenges, and loss of investor confidence.

What are the potential consequences of ignoring compliance regulations?

Ignoring compliance regulations can lead to hefty fines that accumulate quickly, impacting cash flow and profitability, with revenue declines estimated at around $4,005,116.

How can compliance hires enhance a startup's credibility?

By prioritizing compliance hires, startups can establish a solid foundation that protects them from challenges and enhances their credibility with stakeholders, including investors.

What role does a dedicated regulatory officer play in a startup?

A dedicated regulatory officer proactively manages risks and ensures hiring practices align with current laws, fostering a culture of accountability and transparency within the organization.

What financial benefits can come from appointing a C-level regulatory leader?

Appointing a C-level regulatory leader can save businesses an average of $1.25 million in regulatory expenses, highlighting the financial advantages of investing in compliance roles.

How does investing in compliance hires support long-term success for startups?

Strategic investment in compliance hires mitigates risks and enhances the positioning of new businesses in the eyes of potential investors, supporting their long-term success.

What trend is emerging regarding spending on Governance, Risk, and Compliance (GRC) technology?

There is a growing trend, with 61% of organizations planning to increase their spending on GRC technology in the next three years, indicating the rising recognition of regulatory importance.

What reputational risks do startups face due to non-compliance?

Non-compliance can lead to reputational damage, signaling mismanagement and unreliability to investors, customers, and talent.