Overview

The article titled "7 Hidden Gems in Private Markets for Sales Leaders to Explore" identifies underappreciated investment opportunities within private markets that sales leaders can leverage for a competitive advantage. It highlights various sectors, including:

- Distressed debt

- Secondary funds

- Emerging markets

By utilizing advanced data analytics and thorough due diligence, sales leaders can uncover significant returns from these overlooked areas in a rapidly evolving financial landscape. This exploration not only opens doors to new revenue streams but also positions sales leaders ahead of the competition.

Introduction

In a landscape where traditional investment strategies often overshadow emerging opportunities, sales leaders are uniquely positioned to uncover hidden gems within private markets. By exploring innovative avenues—such as AI-driven platforms, distressed debt, and overlooked investment sectors—they can gain a competitive edge that translates into substantial returns. Yet, the challenge lies in navigating these complex markets.

What strategies will truly unlock the potential of these underappreciated assets? This article delves into seven compelling opportunities that savvy sales leaders can leverage to enhance their investment portfolios and drive success in an evolving financial environment.

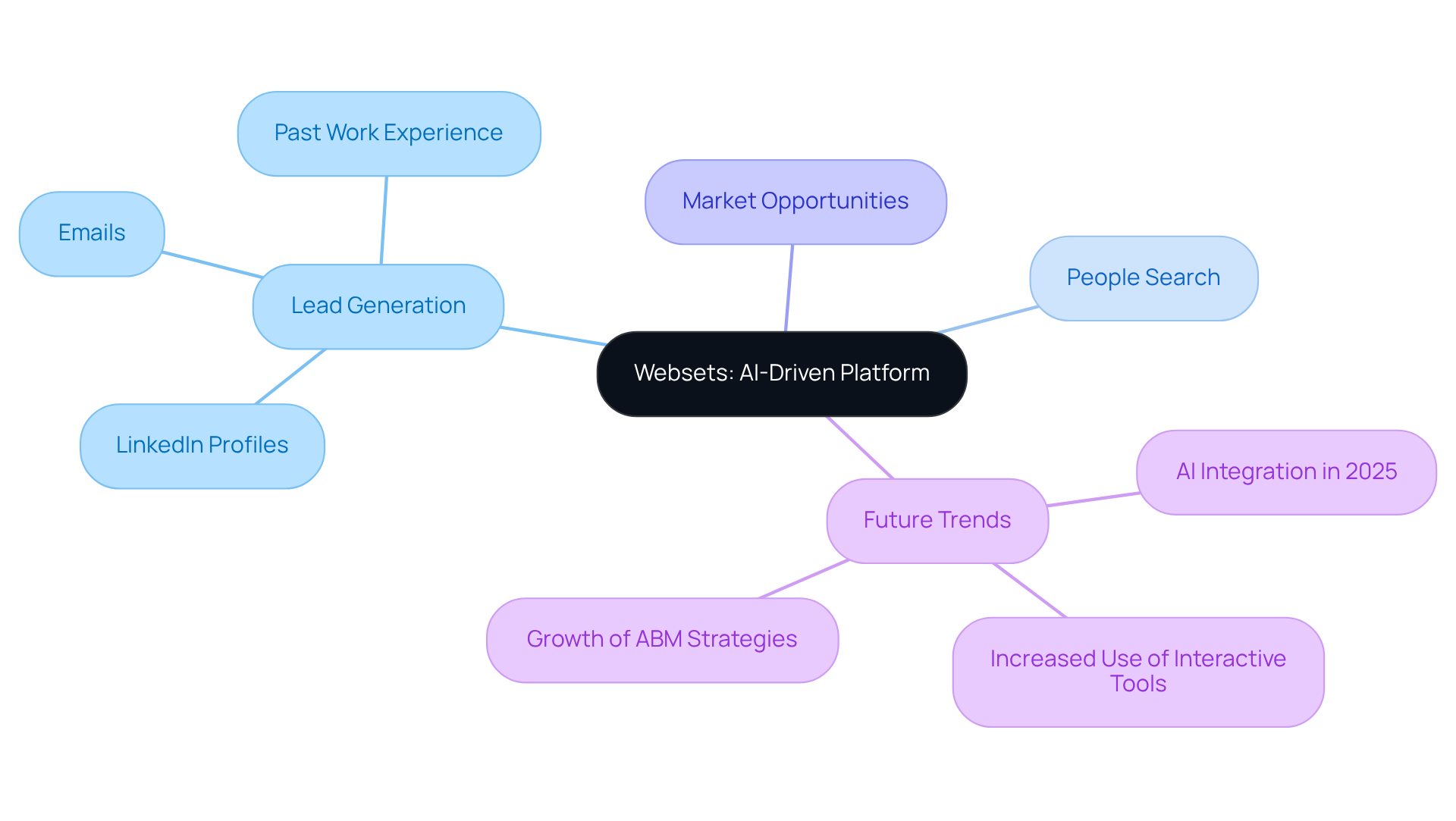

Websets: AI-Driven Platform for Discovering Private Market Opportunities

Websets stands out as a revolutionary AI-powered platform tailored for B2B lead generation and people search solutions, specifically designed to uncover exclusive opportunities with exceptional efficiency. By leveraging advanced algorithms and a custom-built search engine, sales leaders can navigate vast datasets to identify potential leads, significantly boosting their operational efficiency. The platform excels in refining search results with comprehensive information, including:

- LinkedIn profiles

- Emails

- Past work experience

These are essential elements for uncovering hidden gems in private markets. As the B2B lead generation landscape evolves, particularly in 2025, the integration of AI tools like Websets will be crucial for sales teams seeking to optimize their strategies and achieve higher conversion rates.

Distressed Debt: A Promising Frontier in Private Markets

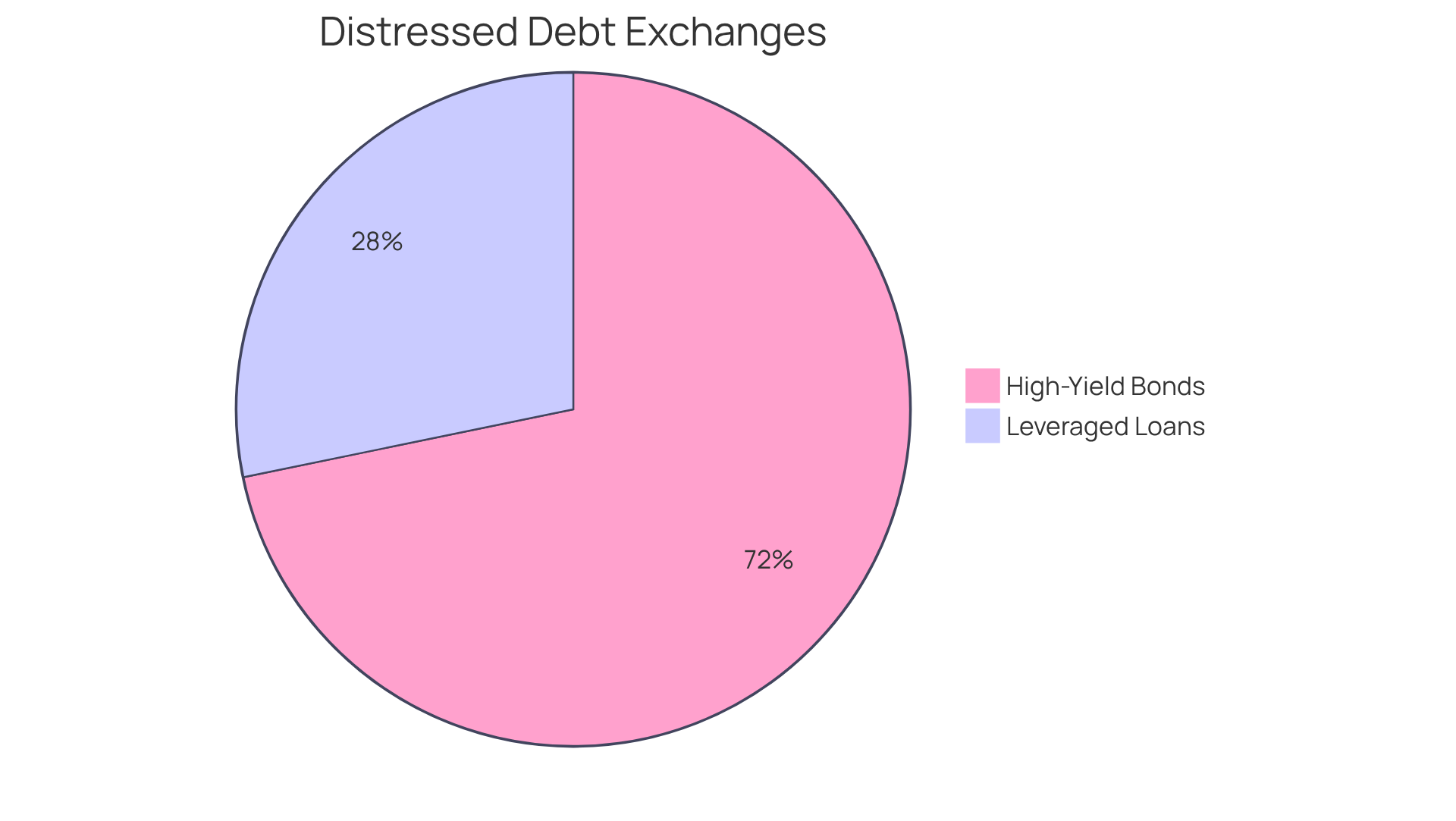

Distressed debt offers a compelling financial opportunity, especially in periods of economic uncertainty. Investors can acquire these assets at substantial discounts, potentially yielding significant returns if the underlying companies recover. Recent trends reveal a surge in distressed exchanges, with:

- $30 billion in high-yield bond distressed exchanges

- $11.8 billion in leveraged loan distressed exchanges reported in 2024

This reflects a growing interest in this asset class. Profitable allocations in troubled debt often employ tactics such as loan-to-own strategies and operational turnaround skills, enabling investors to navigate complexities effectively. Financial analysts highlight that leading distressed asset managers like Apollo, Oaktree, and Cerberus consistently achieve internal rates of return exceeding 15% across economic cycles, underscoring the potential of this investment avenue. For sales leaders, exploring distressed debt can serve as a strategic method to diversify portfolios and capitalize on economic inefficiencies. By actively pursuing these opportunities, they can position themselves advantageously during economic downturns.

Secondary Funds: Unlocking Value in Established Investments

Secondary funds present a compelling opportunity for investors seeking to acquire existing stakes in equity funds, often at attractive discounts. In 2025, the average discount across secondary assets has surged to approximately 26%, up from 17% the previous year, reflecting intensified liquidity pressures within private markets. This strategy not only facilitates swift diversification but also grants access to established assets that have demonstrated performance. For sales leaders, engaging with secondary funds can significantly unveil value in their portfolios while mitigating the risks typically associated with new ventures.

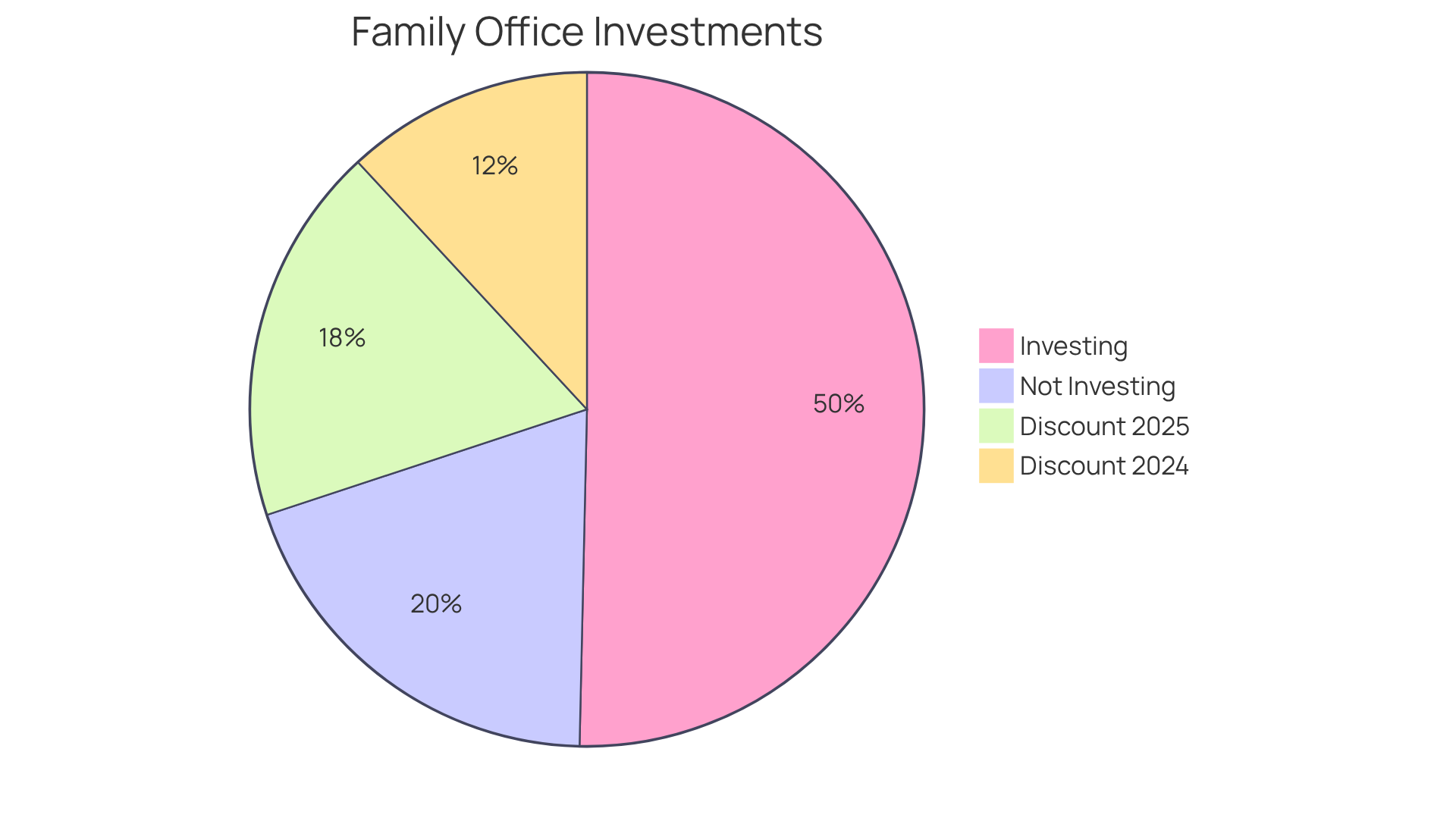

Investment professionals are increasingly acknowledging the potential of secondary markets. A recent Goldman Sachs survey indicates that 72% of family office members are now investing in secondaries, a notable increase from 60% the previous year. This trend highlights the growing recognition of secondaries as a viable investment strategy amidst liquidity challenges.

To effectively navigate this landscape, sales leaders should prioritize strategies that emphasize active portfolio management. Engaging in GP-led transactions, which reached $71 billion in 2024—a remarkable 40% year-over-year increase—provides sponsors the opportunity to retain exposure to valuable assets while delivering liquidity to investors. As the secondary exchange continues to evolve, understanding these dynamics will be crucial for uncovering hidden gems in private markets.

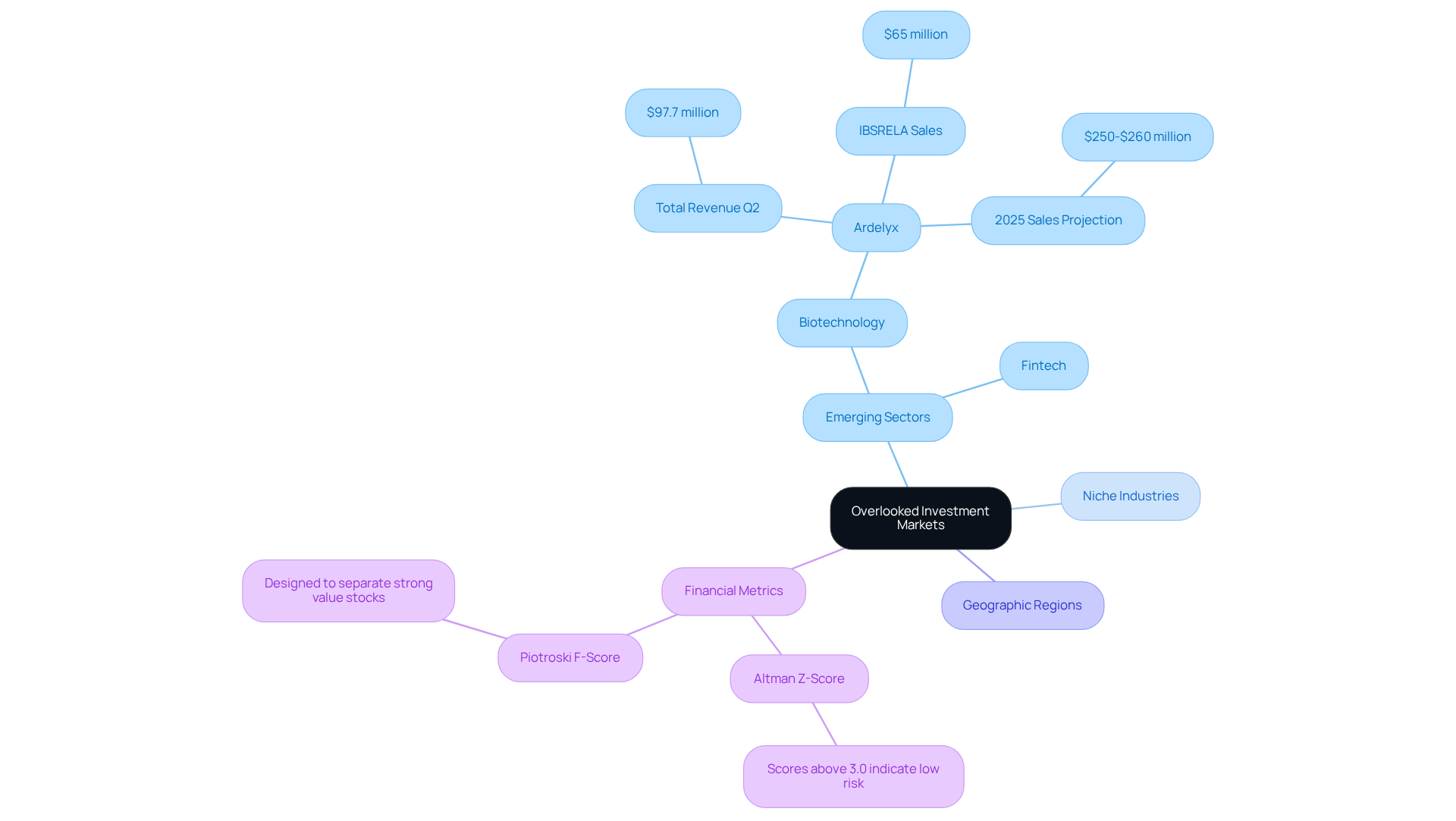

Overlooked Investment Markets: Hidden Gems Worth Exploring

Numerous investment sectors, regarded as hidden gems in private markets, remain underappreciated, yet they hold the promise of significant returns for those willing to delve deeper. Emerging sectors, niche industries, and specific geographic regions often harbor hidden gems in private markets that mainstream investors frequently overlook. For sales leaders, actively pursuing these hidden gems can yield a competitive edge in an increasingly crowded marketplace. By utilizing advanced data analytics and industry insights, they can identify and capitalize on these opportunities before they achieve broad recognition.

In 2025, sectors such as biotechnology and fintech are expected to reveal substantial growth potential, driven by innovation and evolving consumer needs. For instance, small-cap biotech firms like Ardelyx have demonstrated remarkable revenue growth, with a 33% year-on-year increase attributed to their successful products. This trend underscores the potential for outsized returns in niche markets, which are often considered hidden gems in private markets, where smaller firms can expand earnings at a faster pace than their larger counterparts.

Market analysts emphasize the importance of disciplined research in uncovering these hidden opportunities. As Tim Melvin notes, smaller firms often strengthen their balance sheets and improve profitability, making them hidden gems in private markets before they attract Wall Street's attention. This proactive approach can lead to identifying undervalued stocks that are poised for growth.

Investors should view the Altman Z-Score and Piotroski F-Score as useful instruments for assessing the financial well-being of possible ventures. Companies with high scores indicate low risk and robust fundamentals, making them appealing options for funding. By concentrating on these metrics, sales executives can reveal concealed funding prospects in specialized sectors that offer strong profits in the upcoming years.

The Power of Storytelling in Private Equity Investments

Storytelling serves as a vital instrument in private equity funding, transforming complex ideas into relatable narratives. By crafting an engaging narrative around funding opportunities, sales executives can effectively attract prospective investors and cultivate trust. This approach not only underscores financial metrics but also forges an emotional connection, amplifying the venture's appeal.

Research reveals that presentations infused with storytelling can significantly boost investor engagement, with nearly 70% of investors indicating a greater likelihood of funding opportunities presented through narrative techniques. Noteworthy sales figures, such as Eric Scalzo, assert that impactful storytelling transcends mere numbers; it involves creating a vision that resonates with investors.

As David Marks aptly notes, "What does matter are larger demographic trends," underscoring the importance of contextual storytelling in today's evolving financial landscape. By harnessing storytelling's power, sales leaders can elevate their presentations, ultimately enhancing their prospects for securing investment.

Private Equity in the United States: A Resilient Force

In 2025, independent equity in the United States has emerged as a resilient force, adeptly navigating shifting market conditions while continuing to attract substantial capital. Despite facing economic challenges, equity firms have proven their capability to generate returns and add value for investors. Notably, U.S. investment equity fundraising reached a total of $223 billion by mid-2025, reflecting an anticipated 20% decrease compared to the previous year. This decline underscores the hurdles firms encounter, yet it also highlights their strategic adaptability in a competitive landscape.

Successful investment firms are increasingly focused on operational excellence and exit preparedness. Nearly two-thirds of surveyed investors anticipate an uptick in deployment activity over the next six months. This optimism is bolstered by the fact that private equity sponsors constituted 31% of the overall M&A sector in the first half of 2025, a significant rise from 25% in the same period the previous year.

Experts emphasize the importance of adapting to industry changes. As one industry expert noted, "Sponsors are navigating fewer exits and constrained IRRs by leaning harder on execution: turning portfolio strategy into the primary engine of value." This perspective reflects a broader trend where firms are not only addressing immediate challenges but are also positioning themselves for long-term success.

Sales leaders must remain vigilant to the evolving dynamics within the U.S. private equity sector. Understanding these trends can inform financial strategies and aid in identifying potential partners and opportunities, ultimately enhancing operational efficiency and strategic decision-making.

Emerging Markets: Tapping into New Investment Opportunities

Developing economies represent a treasure trove of investment opportunities, characterized by rapid growth and evolving consumer demands. These sectors frequently offer higher returns compared to their established counterparts. For sales leaders, diversifying portfolios to include emerging sectors can unlock distinct benefits and access to new customer bases. A keen understanding of local dynamics and trends is essential for navigating these environments effectively.

In 2025, growth in developing regions is projected to decelerate to approximately 3.7%, yet this rate still surpasses double that of advanced economies. Notably, equities in developing economies delivered strong returns in Q2 2025, driven by favorable policy shifts and region-specific initiatives. Economists highlight the structural growth potential in these regions, particularly in India, where rising urban consumption and government-backed manufacturing initiatives are expected to sustain expansion.

By strategically investing in these sectors, sales executives can position themselves to leverage the shifting landscape and generate substantial returns. The time to act is now—embrace the opportunities that developing economies present and secure your competitive advantage.

Technology-Driven Innovations in Private Markets

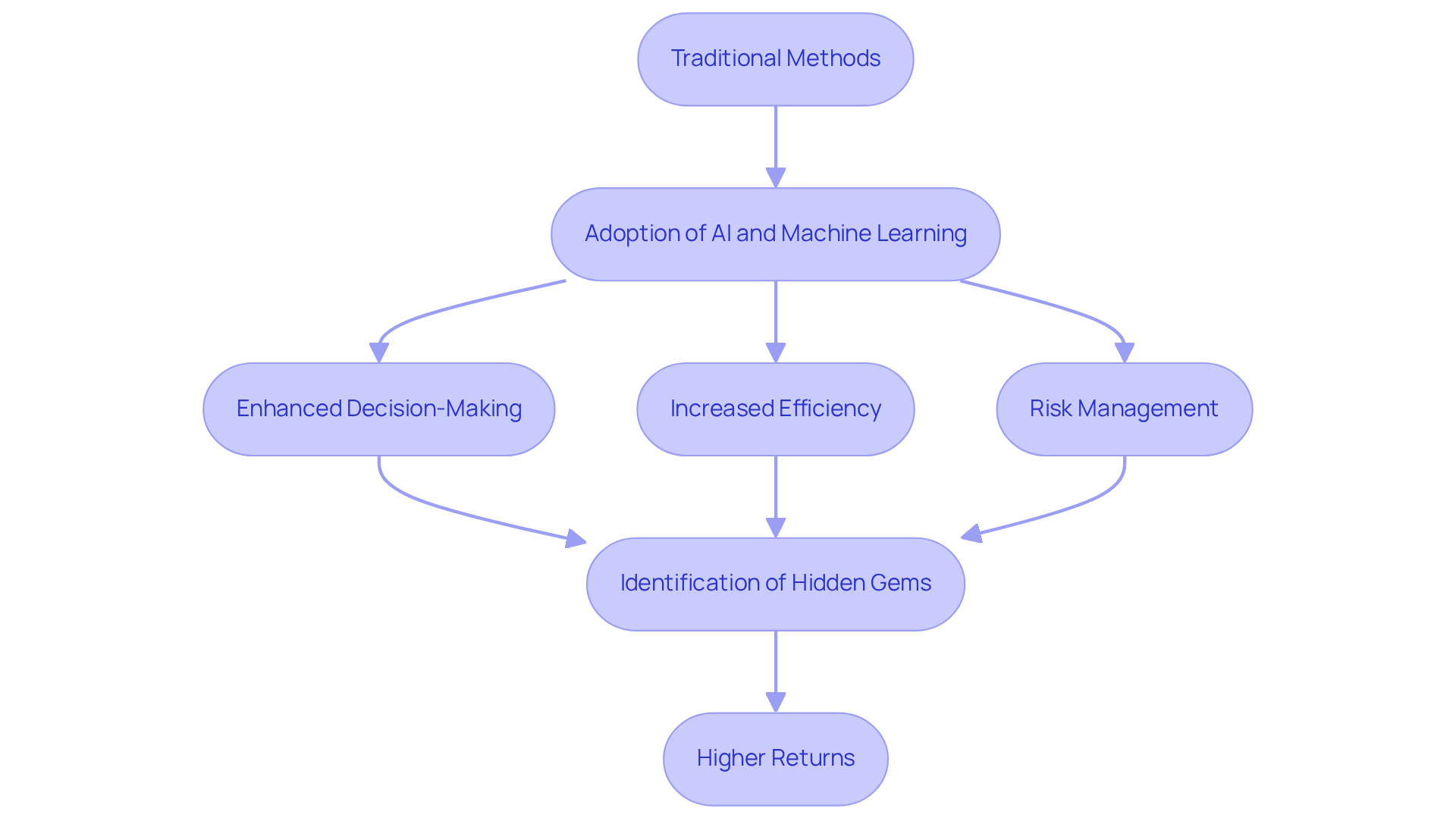

Technology is fundamentally transforming private markets and uncovering hidden gems in private markets, enhancing efficiency, transparency, and decision-making capabilities. By 2025, innovations such as AI, machine learning, and advanced data analytics will empower investors to identify hidden gems in private markets with unprecedented precision while effectively managing risks.

For instance, Websets employs AI to analyze extensive datasets, enabling sales executives to pinpoint relevant opportunities significantly faster than traditional methods. This capability allows firms to capitalize on emerging trends and identify hidden gems in private markets while enhancing operational efficiency.

Through Websets' enterprise-grade web search solutions, sales teams gain access to hidden gems in private markets that other tools may overlook, enriching their data for targeted outcomes. Sales leaders must embrace these technological innovations to elevate their operations and refine funding strategies.

By leveraging these tools, they can extract valuable insights that facilitate informed decision-making, ultimately driving higher returns. As industry specialists emphasize, the integration of AI and machine learning into financial strategies is not merely a trend; it is an essential factor for remaining competitive in a rapidly evolving market landscape.

Due Diligence: Essential for Uncovering Hidden Investment Gems

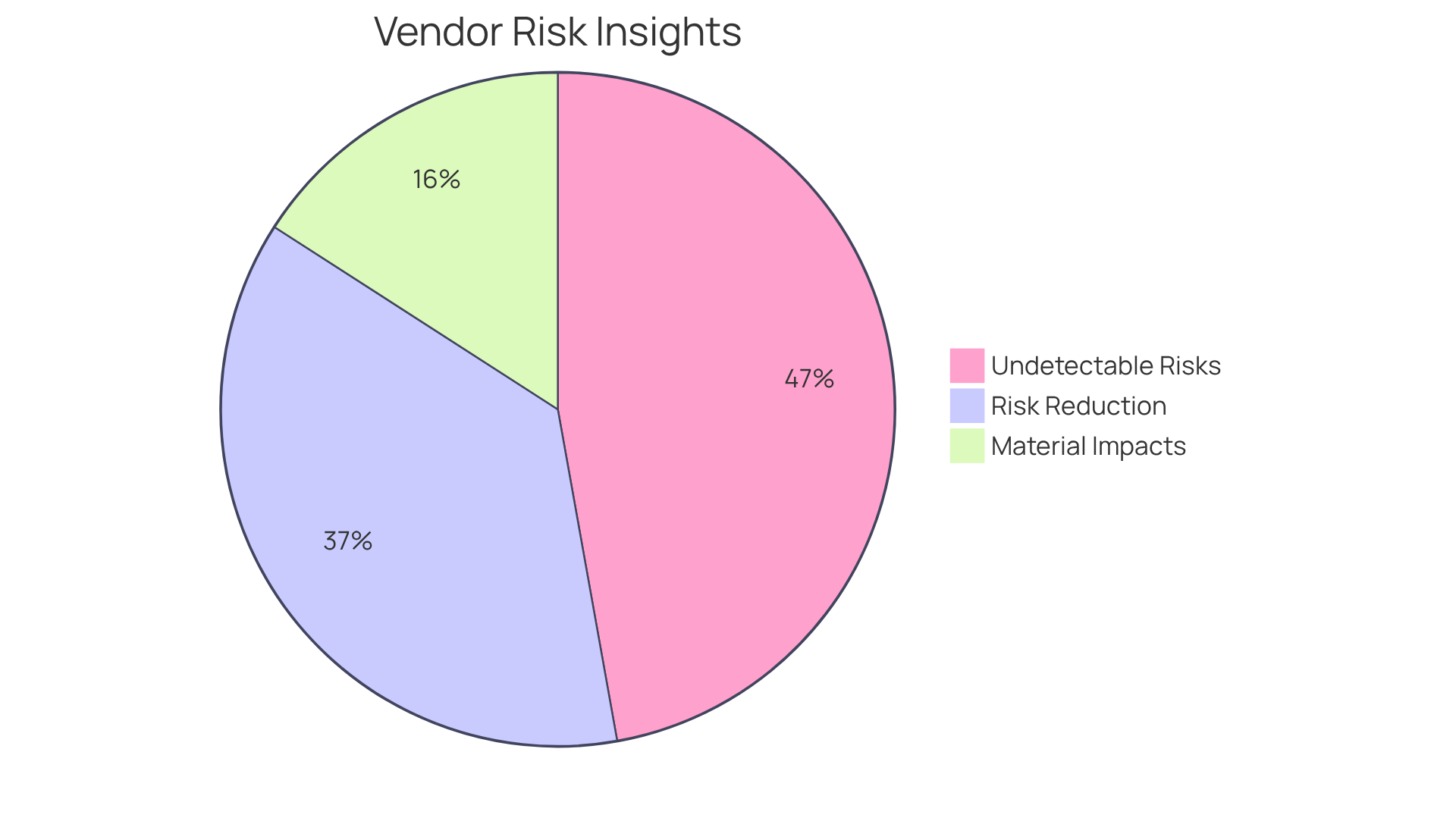

Due diligence stands as a pivotal element in the funding process, empowering investors to evaluate the viability and potential of diverse opportunities. A meticulous due diligence process not only uncovers hidden risks but also ensures that allocations align with overarching strategic objectives. For sales leaders, the implementation of comprehensive due diligence practices is essential for making informed decisions and avoiding costly missteps. Prioritizing due diligence can significantly bolster financial strategies, thereby increasing the likelihood of success within the competitive realm of private equity.

Statistics indicate that:

- 31% of identified vendor risks have led to material impacts.

- 92% of these risks remain undetectable through standard due diligence alone.

This highlights the urgent need for a robust approach to risk management. Furthermore, organizations that adopt comprehensive due diligence practices report a remarkable 72% reduction in legal, financial, and reputational risks, exemplifying the tangible benefits of thorough asset evaluations.

Financial consultants emphasize that successful investing hinges on understanding the fundamentals of prospective assets rather than relying solely on industry trends. As Warren Buffett aptly states, 'Risk comes from not knowing what you're doing.' This underscores the vital importance of informed decision-making in navigating the complexities of equity investment. By embracing best practices in due diligence, sales leaders can uncover hidden gems in private markets, ultimately enhancing their financial outcomes.

Future Trends in Private Markets: What Investors Should Watch

The development of private sectors is marked by several key trends that investors must observe closely. A notable transformation is the increasing integration of technology into financial strategies, fundamentally changing decision-making processes. Notably, the rapid advancement of generative AI is compelling industry leaders to cultivate new capabilities to unlock value, reflecting a broader trend towards technology-driven funding strategies. As Fredrik Dahlqvist aptly notes, "Innovation in technology, especially the swift progress of generative AI, has driven leaders in non-public markets to develop new skills in their pursuit of greater value."

Moreover, there is a significant shift in investor preferences towards sustainable opportunities. Statistics reveal that a growing number of investors prioritize sustainability, with:

- 54% of limited partners viewing equity investment as a diversifier in their portfolios.

- 84% of limited partners expecting to sustain or increase their equity allocations in 2025, reinforcing the momentum towards sustainable investments.

This trend is anticipated to accelerate as more investors seek opportunities that resonate with their values and positively impact societal needs.

Additionally, data analytics is becoming increasingly crucial in decision-making processes. Investors are harnessing advanced analytics to evaluate market conditions and pinpoint hidden gems in private markets, thereby enhancing their ability to navigate the complexities of these markets. However, it is vital to recognize the challenges, such as liquidity constraints that may hinder limited partners' capacity to commit to new funds. By remaining informed about these trends and challenges, sales leaders can effectively adapt their strategies and seize emerging opportunities in this dynamic environment.

Conclusion

Exploring the hidden gems within private markets presents a wealth of opportunities for sales leaders seeking to enhance their investment strategies. Leveraging innovative tools and insights, such as AI-driven platforms like Websets, allows professionals to efficiently navigate complex datasets to uncover valuable leads and investment prospects. The ability to identify and capitalize on unique opportunities—including distressed debt, secondary funds, and emerging markets—is crucial for maintaining competitiveness in an evolving financial landscape.

Throughout this discussion, key insights have been shared regarding various investment avenues and strategies. From the potential of distressed debt in uncertain economic climates to the rising interest in secondary funds and overlooked markets, each section has underscored the importance of proactive engagement and informed decision-making. Moreover, the role of storytelling in private equity has been highlighted as a powerful tool for attracting investors and building trust. As technology continues to transform the investment landscape, understanding these dynamics is essential for achieving long-term success.

In conclusion, the call to action for sales leaders is clear: embrace the opportunities that lie within private markets by leveraging technology, conducting thorough due diligence, and adopting innovative investment strategies. By remaining vigilant and adaptable, professionals can uncover hidden gems that not only enhance their portfolios but also contribute to sustained growth and success in the competitive world of private equity. The future is ripe with potential—seize it.

Frequently Asked Questions

What is Websets and how does it function?

Websets is an AI-driven platform designed for B2B lead generation and people search solutions. It utilizes advanced algorithms and a custom-built search engine to help sales leaders navigate extensive datasets, identifying potential leads efficiently.

What types of information can Websets provide to enhance lead generation?

Websets refines search results by providing comprehensive information, including LinkedIn profiles, emails, and past work experience, which are crucial for uncovering valuable opportunities in private markets.

Why is distressed debt considered a promising investment opportunity?

Distressed debt offers financial opportunities during economic uncertainty, allowing investors to acquire assets at significant discounts with the potential for high returns if the underlying companies recover.

What recent trends have been observed in distressed debt exchanges?

In 2024, there were $30 billion in high-yield bond distressed exchanges and $11.8 billion in leveraged loan distressed exchanges, indicating a growing interest in distressed debt as an asset class.

What strategies do successful investors use when dealing with distressed debt?

Profitable allocations in distressed debt often involve tactics such as loan-to-own strategies and operational turnaround skills, which help investors navigate complexities and maximize returns.

How do secondary funds work and what benefits do they offer?

Secondary funds allow investors to acquire existing stakes in equity funds, often at attractive discounts. This strategy facilitates diversification and provides access to established assets that have demonstrated performance.

What is the current trend in discounts for secondary assets?

In 2025, the average discount for secondary assets has increased to approximately 26%, up from 17% the previous year, reflecting heightened liquidity pressures in private markets.

What percentage of family office members are investing in secondary funds according to recent surveys?

A Goldman Sachs survey indicates that 72% of family office members are now investing in secondaries, an increase from 60% the previous year.

What role do GP-led transactions play in the secondary market?

GP-led transactions, which reached $71 billion in 2024, allow sponsors to retain exposure to valuable assets while providing liquidity to investors, highlighting the dynamic nature of the secondary market.

How can sales leaders effectively navigate the secondary market?

Sales leaders should focus on active portfolio management strategies and understand the evolving dynamics of the secondary exchange to uncover value and mitigate risks associated with new ventures.