Overview

Tracking key regulatory hires is essential for startups. These roles are pivotal in navigating compliance and legal challenges that can significantly impact business success. Positions like Chief Compliance Officer and General Counsel are not just titles; they are critical to mitigating risks and enhancing investor confidence.

Consider this: effective regulatory hires can bolster operational integrity, making them indispensable for venture capitalists. Investors need to monitor these roles closely, as they directly influence the startup's ability to thrive in a complex regulatory landscape.

By detailing the responsibilities associated with these positions, we see how they contribute to a startup's resilience. For instance, a Chief Compliance Officer ensures adherence to laws and regulations, while a General Counsel provides legal guidance that can prevent costly missteps.

In conclusion, startups must prioritize these hires to not only safeguard their operations but also to instill confidence in their investors. The right regulatory team can be the difference between success and failure in today’s competitive market.

Introduction

Navigating the complex landscape of startup regulations is crucial for new businesses striving for success. As compliance requirements shift, the demand for strategic hires in regulatory roles has never been more critical. This article explores nine essential regulatory hires that venture capitalists should keep an eye on. These positions not only mitigate risks but also bolster investor confidence and operational integrity. With the stakes higher than ever, how can startups ensure they have the right talent to thrive in this dynamic environment?

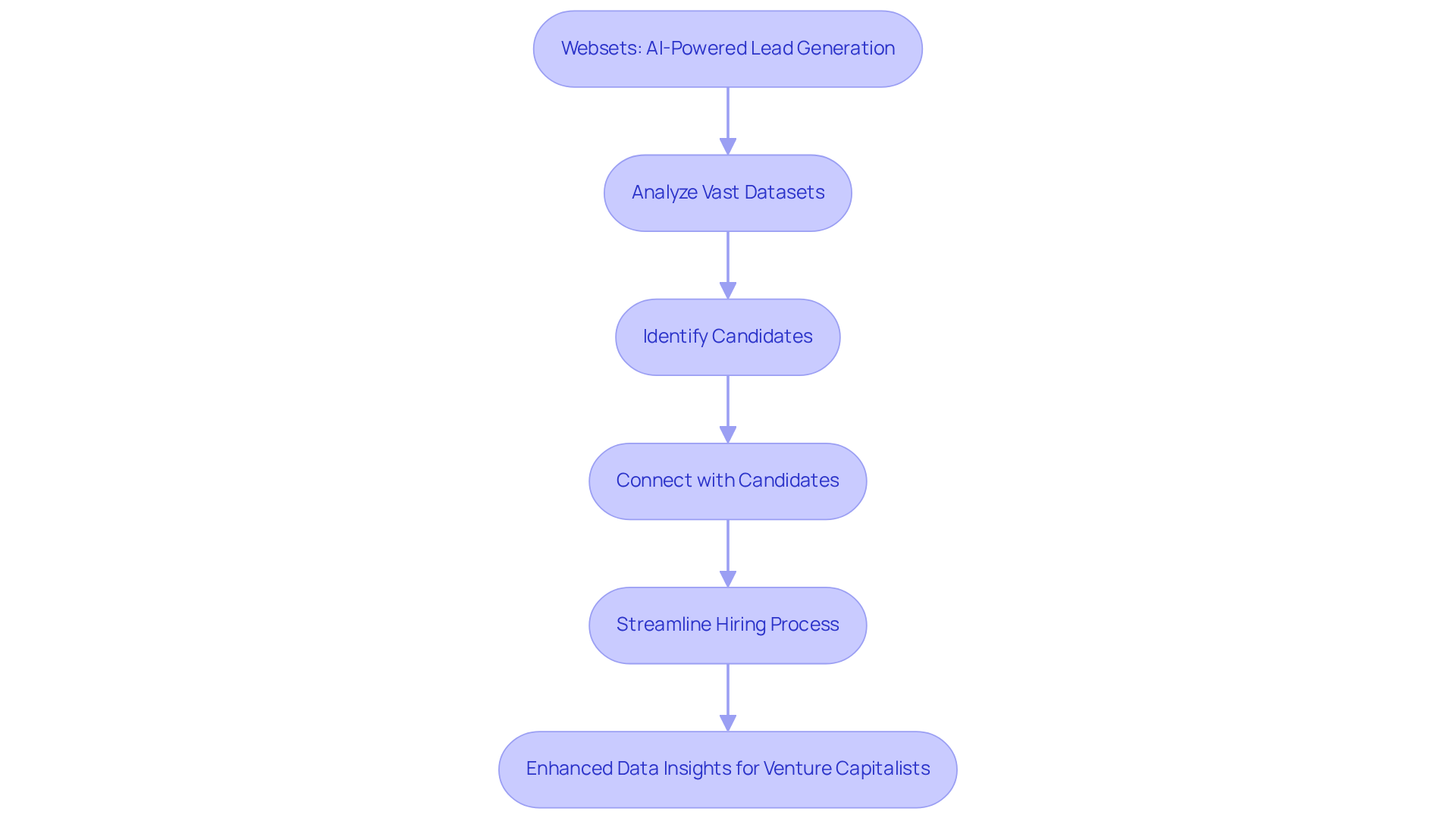

Websets: AI-Powered Lead Generation for Regulatory Talent Acquisition

Websets revolutionizes lead generation for compliance talent acquisition through advanced AI algorithms. By meticulously analyzing vast datasets, this platform empowers new businesses to swiftly identify and connect with candidates tailored to their specific compliance requirements. This not only streamlines the hiring process but also enables startups to remain agile amidst a constantly evolving legal landscape, particularly through startup regulatory hires tracked by vcs.

Moreover, Websets enhances data insights by delivering crucial information such as emails, company details, and prior work experience. This ensures that venture capitalists can cultivate compliant and successful ventures. With Websets, portfolio companies are equipped with the right talent to effectively navigate compliance challenges.

In a world where compliance is paramount, can you afford to overlook such a vital tool? Embrace Websets and position your business for success.

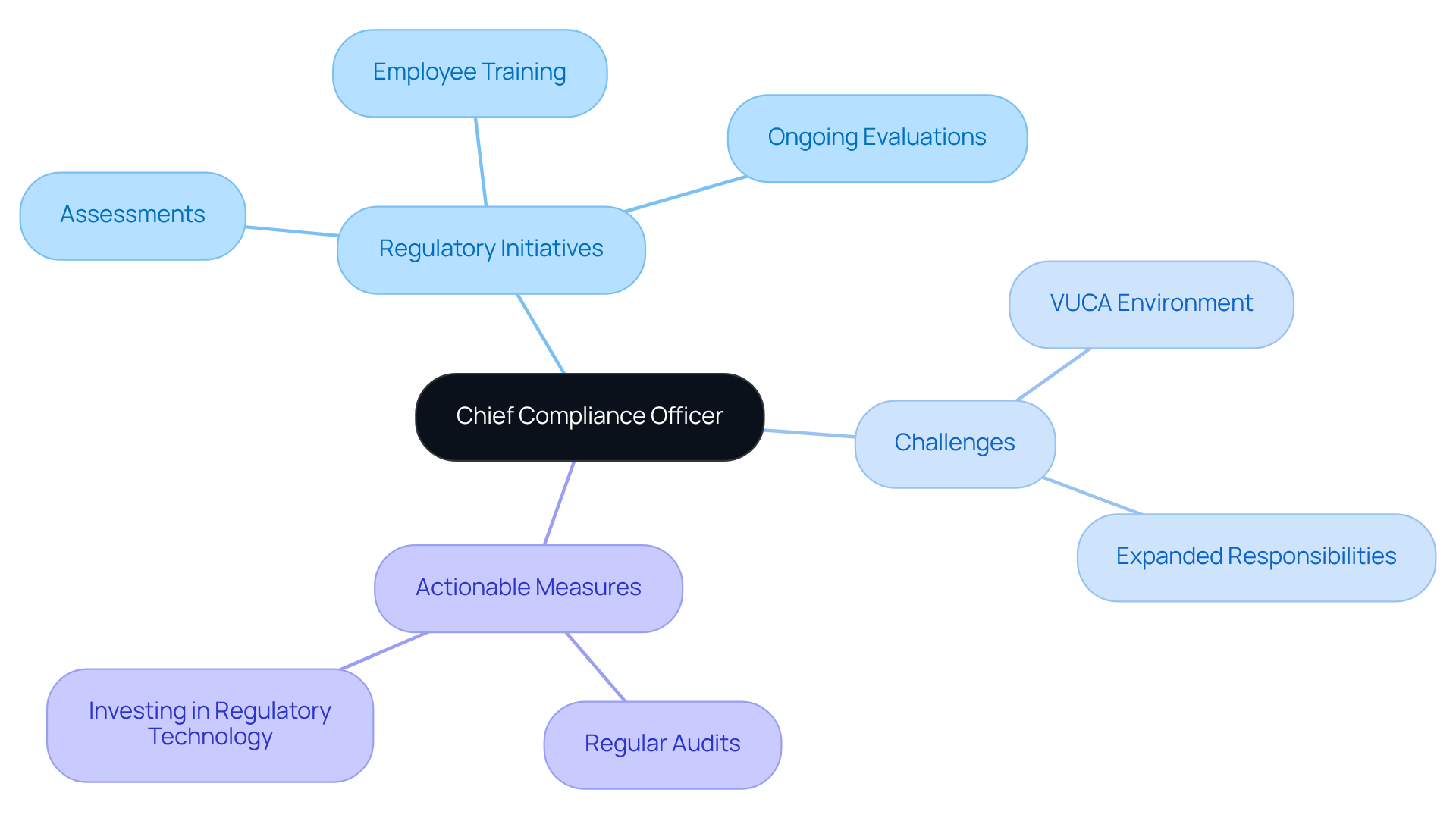

Chief Compliance Officer: Ensuring Regulatory Adherence in Startups

The Chief Compliance Officer (CCO) is pivotal in shaping and executing initiatives that align with legal and regulatory standards. This role encompasses detailed assessments, employee training on regulatory matters, and ongoing evaluations of adherence initiatives. For new enterprises, appointing a dedicated CCO is essential to mitigate legal risks and cultivate a robust adherence culture, particularly regarding startup regulatory hires tracked by vcs. This proactive strategy not only protects the organization but also significantly enhances investor confidence, showcasing a commitment to regulatory compliance and operational integrity.

As regulatory landscapes evolve, new ventures that prioritize effective adherence strategies are better positioned to navigate challenges and seize growth opportunities. In 2025, CCOs will encounter increasing complexity and challenges, characterized by greater volatility, uncertainty, complexity, and ambiguity (VUCA). Nearly 90% of CCOs report that their responsibilities have expanded over the past three years, highlighting the importance of startup regulatory hires tracked by vcs for adapting regulatory strategies.

Integrating technology and data into regulatory management is crucial for proactive risk oversight. Embracing a data-driven and collaborative approach can significantly enhance program effectiveness. Startups should consider actionable measures such as:

- Conducting regular audits

- Investing in regulatory technology

By taking these steps, organizations can not only comply with regulations but also thrive in a competitive environment.

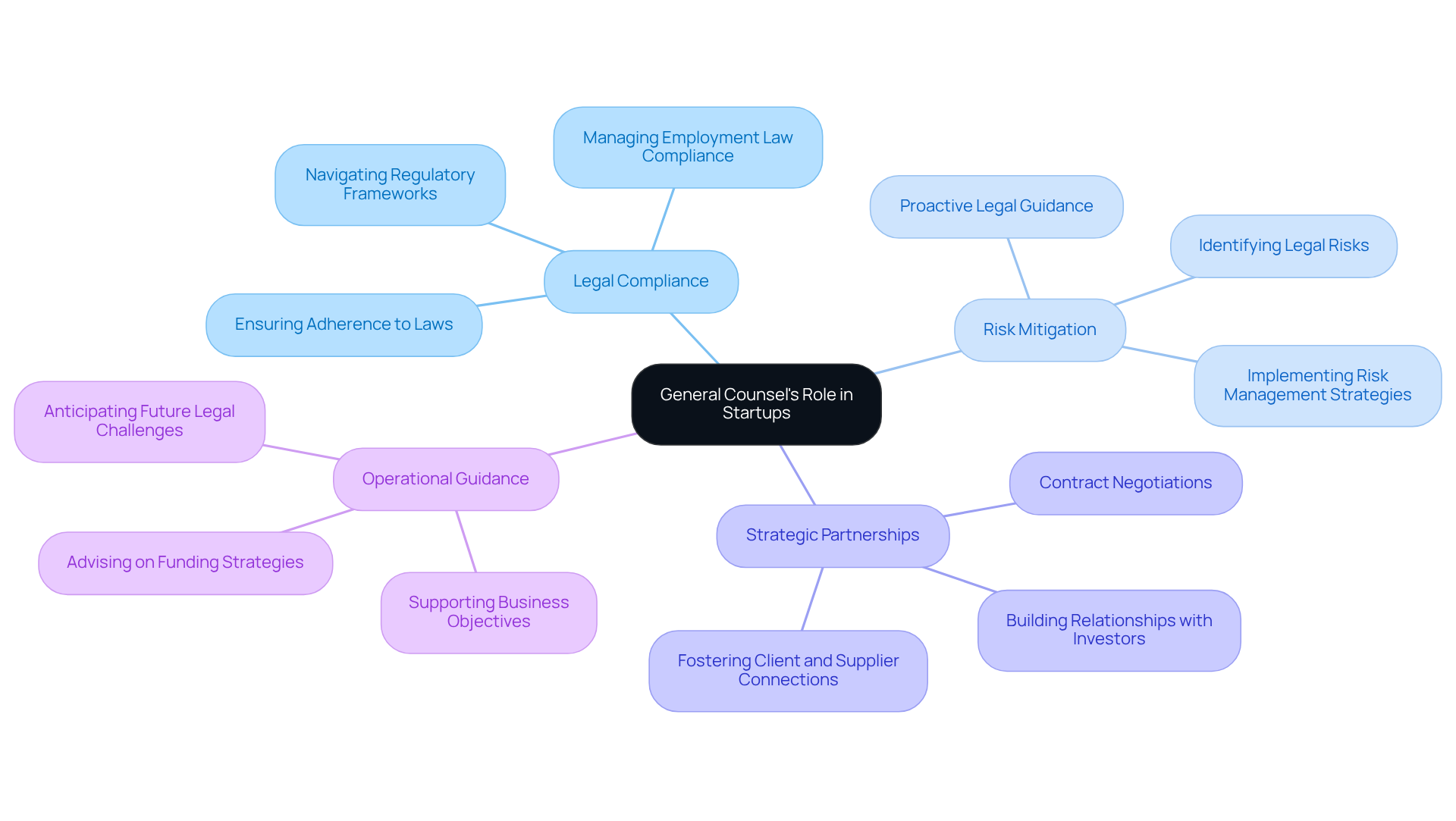

General Counsel: Navigating Legal Complexities for Startups

The General Counsel (GC) is the pivotal legal advisor for new ventures, expertly navigating complex legal landscapes that include intellectual property, contract negotiations, and regulatory compliance. This role is essential not only for ensuring adherence to legal standards but also for empowering businesses to achieve their strategic objectives. A well-informed General Counsel guarantees compliance with regulations, which is crucial for protecting new enterprises, including those with startup regulatory hires tracked by vcs, from potential penalties and legal disputes.

By proactively addressing legal challenges related to startup regulatory hires tracked by vcs, the GC safeguards the company's interests and fosters growth. This proactive stance is vital for risk mitigation, as the GC provides strategic insights that align with the startup regulatory hires tracked by vcs and the company's overarching goals. Moreover, the GC plays a key role in forging strong relationships with strategic partners, clients, suppliers, and investors during contract negotiations.

Anticipating potential legal hurdles and offering tailored guidance, the General Counsel becomes an indispensable asset, significantly influencing the company's growth trajectory and operational success. Founders should recognize the immense value these professionals bring to their teams from the outset. Investing in legal counsel early on can yield substantial long-term benefits.

Regulatory Affairs Manager: Managing Compliance and Risk

The Regulatory Affairs Manager is pivotal in ensuring products meet compliance standards, overseeing the preparation and submission of essential documentation to oversight organizations. This role requires a sharp awareness of evolving regulations and effective communication with various stakeholders to facilitate timely product approvals. For new ventures, a skilled Regulatory Affairs Manager, akin to the startup regulatory hires tracked by vcs, can significantly streamline the route to market, minimizing the risk of costly compliance issues.

Engaging early with authorities and achieving initial milestones—such as scientific advice or orphan drug designation—can enhance investor confidence and improve market entry outcomes. As compliance environments become increasingly complex by 2025, the success of new businesses will depend on the ability to navigate these challenges, particularly through startup regulatory hires tracked by vcs.

Moreover, integrating adherence into product management from the outset, supported by a clear regulatory roadmap, safeguards against potential pitfalls and aligns development efforts with regulatory expectations. This strategic approach not only drives value but also enhances operational efficiency.

In a landscape where regulatory demands are ever-changing, the expertise of a Regulatory Affairs Manager is not just beneficial; it’s essential. Are you ready to elevate your compliance strategy and ensure your products thrive in the market?

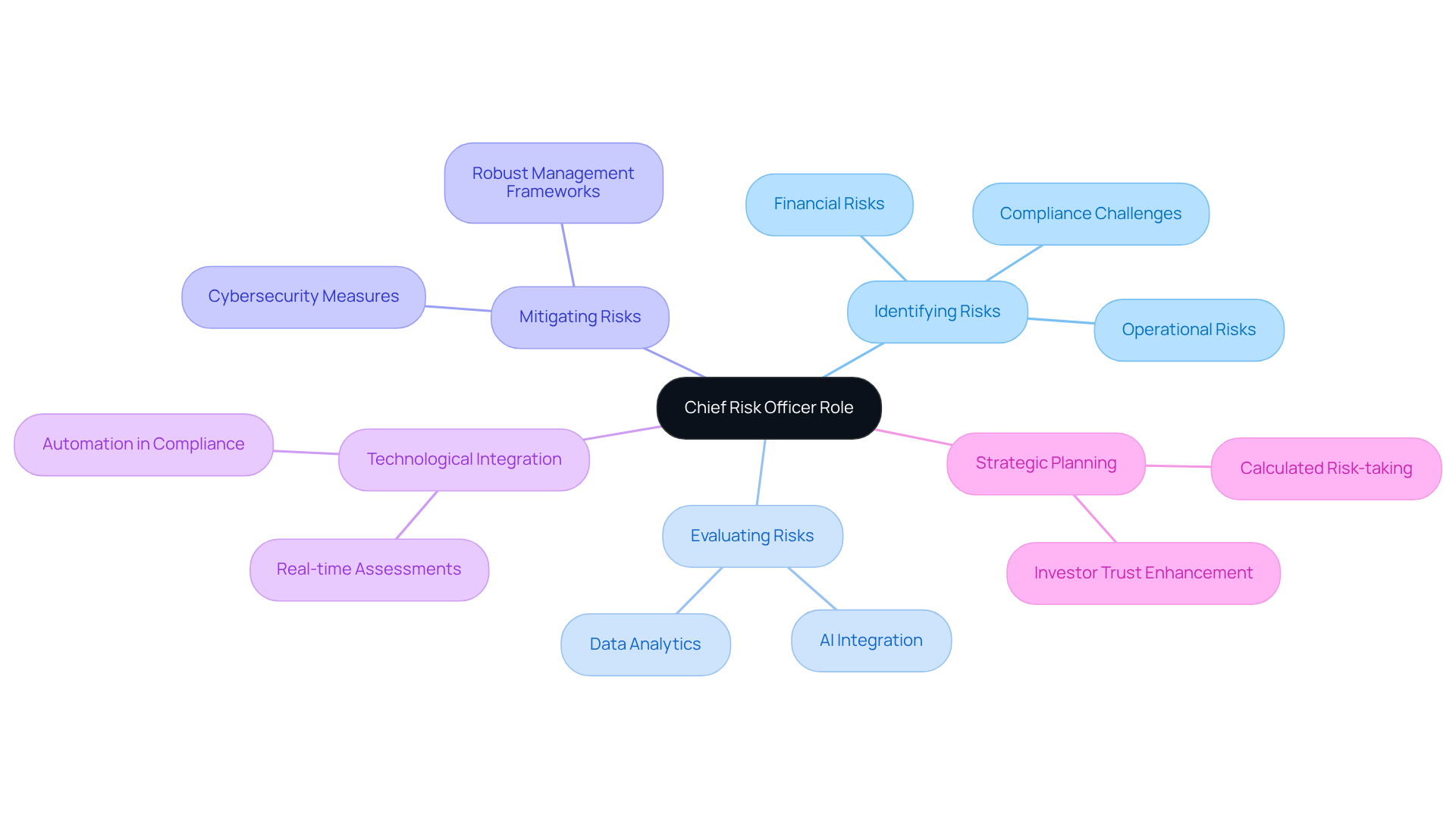

Chief Risk Officer: Identifying and Mitigating Startup Risks

The Chief Risk Officer (CRO) is pivotal in crafting management strategies that effectively identify, evaluate, and mitigate various threats in a new business. This encompasses financial, operational, and compliance challenges, all vital for maintaining organizational integrity. By establishing robust management frameworks, the CRO empowers new businesses to navigate uncertainties confidently, fostering informed decision-making that safeguards assets and enhances reputation. This proactive approach not only protects the organization but also significantly boosts investor trust, as stakeholders are more likely to invest in companies demonstrating a solid understanding of management practices.

Recent trends indicate that effective management frameworks in emerging business environments increasingly rely on advanced technologies like artificial intelligence and data analytics. These tools facilitate real-time assessments of potential issues and agile responses to emerging threats, ensuring startups remain resilient in a rapidly evolving landscape. Moreover, integrating calculated risk-taking into strategic planning is becoming essential, as it encourages innovation while managing potential downsides. As the fintech sector continues to grow, the CRO's role in shaping these strategies will be crucial for attracting investment and driving sustainable growth. Notably, 97% of Chief Risk Officers believe the sector must become more comfortable with embracing managed uncertainties to foster growth, highlighting the importance of accepting calculated challenges in today's business landscape.

Data Protection Officer: Safeguarding Privacy and Compliance

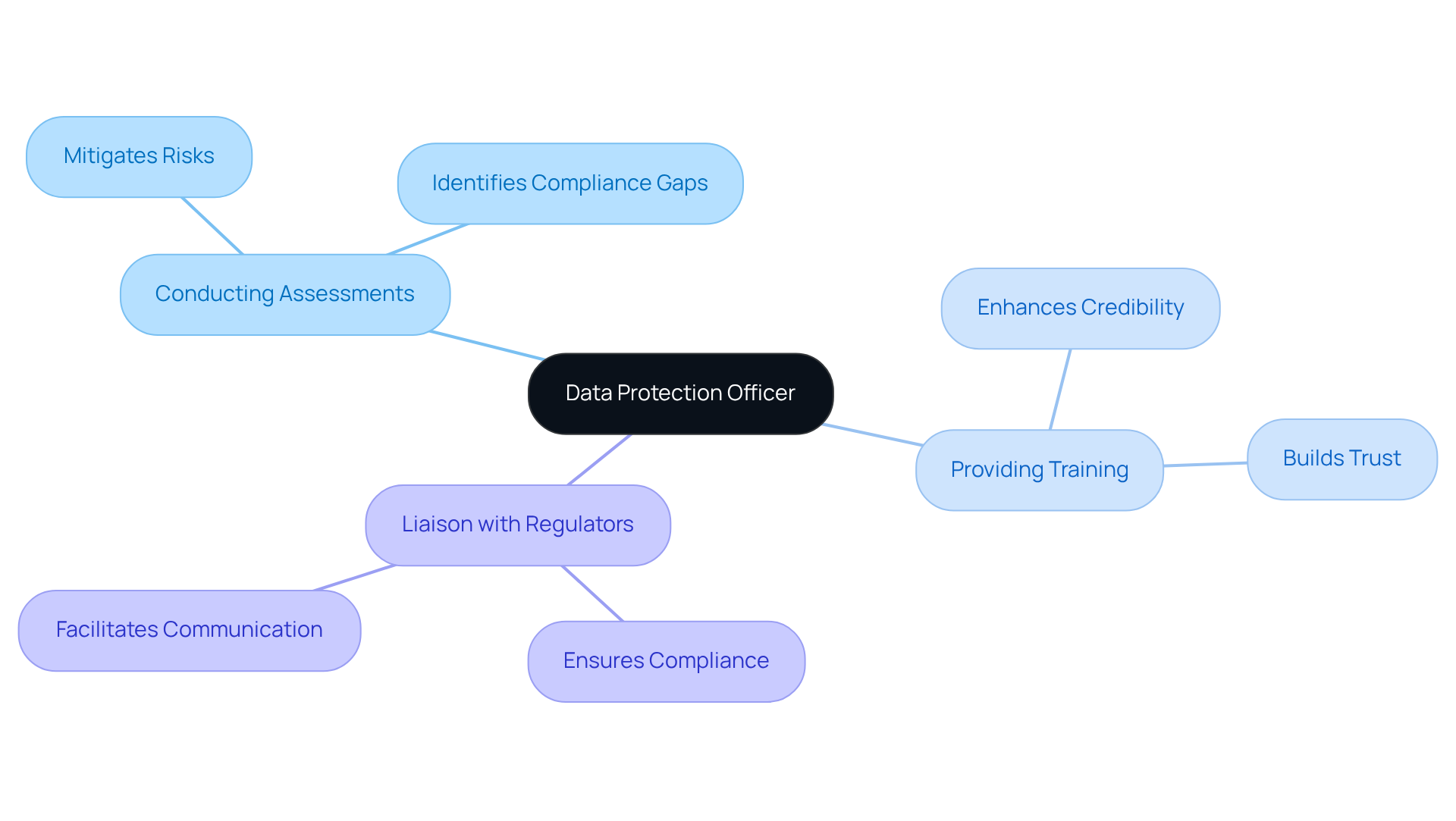

The Data Protection Officer (DPO) is crucial in shaping an organization's data protection strategy and ensuring compliance with vital regulations like the General Data Protection Regulation (GDPR). This role involves:

- Conducting data protection impact assessments

- Providing training on data privacy

- Acting as a liaison with regulatory bodies

For new businesses, appointing a DPO isn't merely a compliance measure; it's a strategic necessity that mitigates risks associated with data breaches and fosters trust among clients and partners.

With 92% of Americans concerned about their online privacy, prioritizing data protection is essential for new businesses aiming to enhance credibility and attract investment. The surge in data protection complaints—Lower Saxony recorded 1,689 complaints in the first half of 2025, a staggering 42% increase from the previous year—underscores the urgent need for effective data protection strategies. As industry experts assert, "Investing in strong data protection practices not only safeguards sensitive information but also builds lasting trust with customers and investors."

In this landscape, businesses must recognize that robust data protection is not just about compliance; it's about establishing a foundation of trust and reliability. Are you ready to take the necessary steps to protect your organization and its stakeholders?

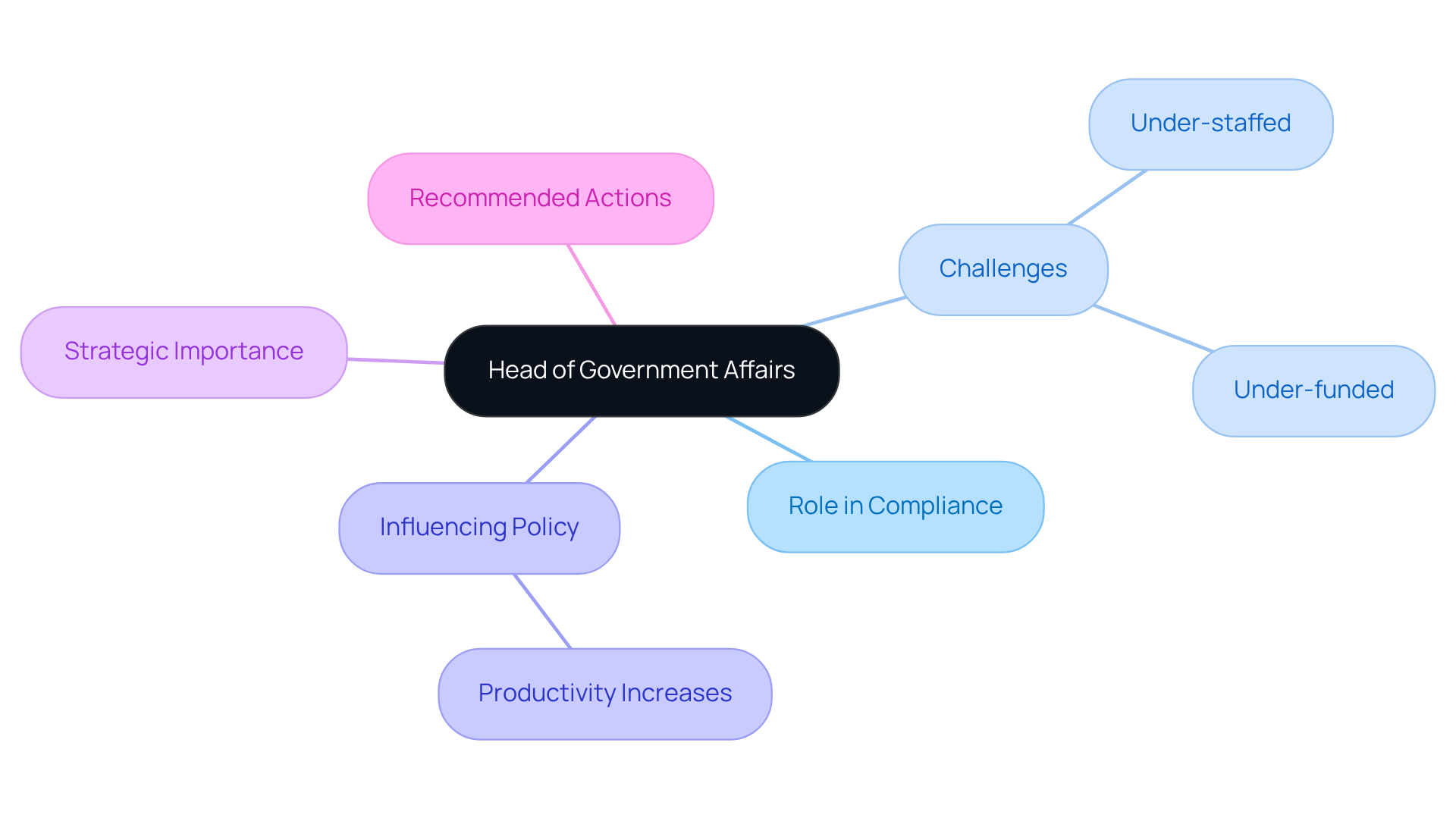

Head of Government Affairs: Engaging with Regulatory Bodies

The Head of Government Affairs plays a pivotal role in fostering relationships with government officials and regulatory bodies. This position goes beyond mere compliance; it actively promotes the company's interests and closely monitors legislative changes that could impact operations. With 37 percent of leaders reporting being under-staffed and 25 percent under-funded, the significance of this role in addressing these challenges is undeniable.

By effectively engaging with government stakeholders, startups can influence policy decisions and gain valuable insights that inform their business strategies. As John Bersentes notes, effective government relations can lead to productivity increases of up to 70% in public-policy roles. This proactive approach to government relations is essential for navigating the legal landscape, ensuring compliance, and ultimately driving long-term success.

Startups should prioritize building relationships with regulatory bodies to facilitate startup regulatory hires tracked by vcs. This not only allows them to adapt swiftly to changes but also enables them to leverage opportunities for growth. Are you ready to take action and enhance your government relations strategy?

Compliance Analyst: Supporting Regulatory Frameworks

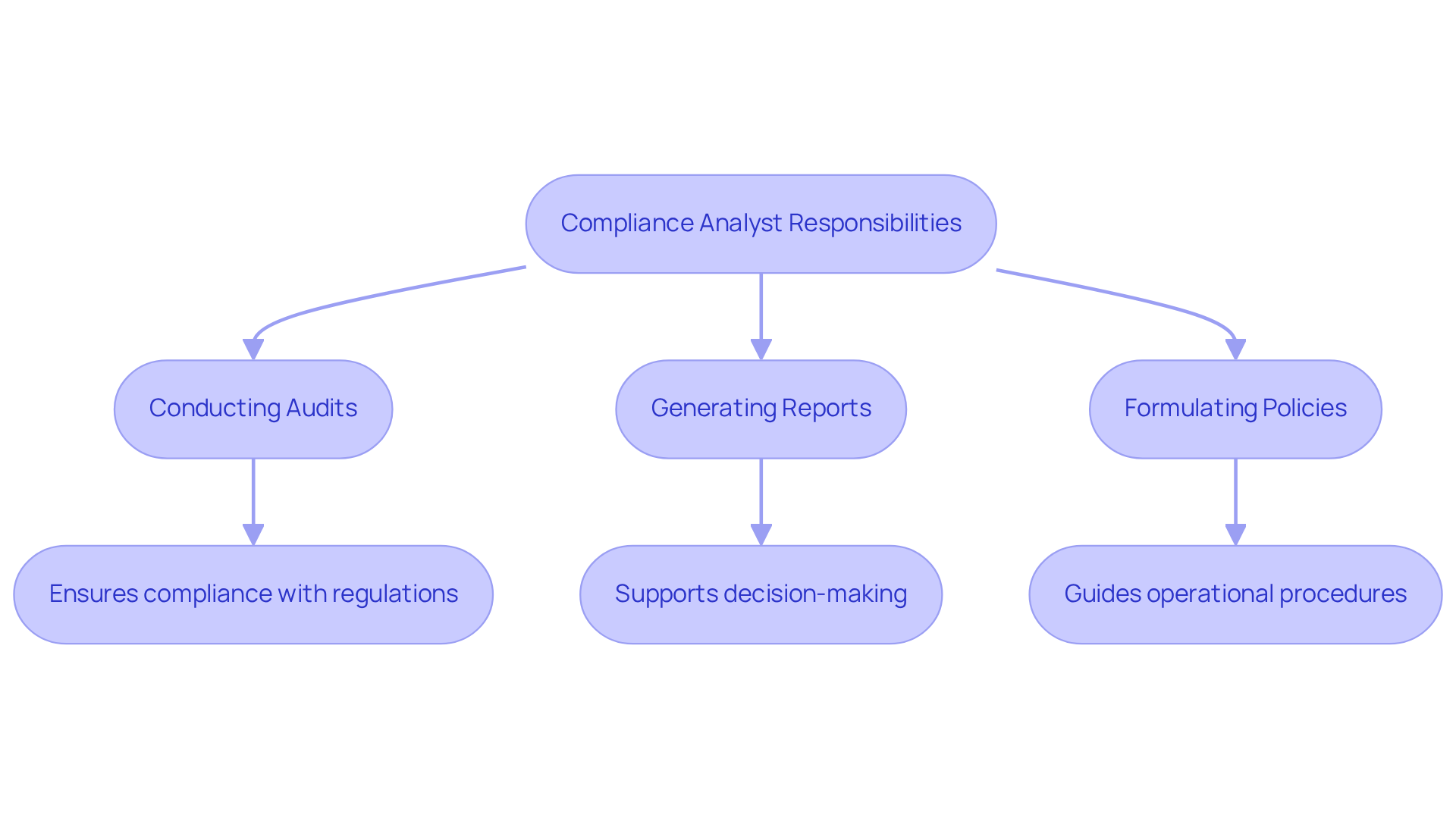

Compliance Analysts, considered among the startup regulatory hires tracked by vcs, play a vital role in executing effective regulatory programs within new enterprises by focusing on monitoring and analyzing adherence data. Their responsibilities include:

- Conducting audits

- Generating detailed reports

- Assisting in the formulation of regulatory policies and procedures

By making startup regulatory hires tracked by vcs, such as a dedicated Compliance Analyst, new ventures can significantly enhance their compliance with legal requirements, thus mitigating the risk of penalties that can exceed $250,000 annually for over 60% of fintech firms.

This proactive approach not only safeguards the organization but also bolsters operational integrity, ensuring that compliance is woven into the fabric of the business from the outset. As regulatory landscapes evolve—such as the recent changes to the H-1B visa program—the insights provided by Compliance Analysts become indispensable for understanding startup regulatory hires tracked by vcs. They empower new businesses to navigate complexities and maintain a competitive edge.

Moreover, adopting a modular regulatory framework allows new ventures to adapt effectively to diverse legal obligations. This reinforces the idea that efficient oversight not only minimizes risks but also promotes business growth and enhances reputation. Are you ready to integrate compliance into your core strategy and secure your business's future?

Chief Financial Officer: Ensuring Financial Compliance and Reporting

The Chief Financial Officer (CFO) is pivotal in steering the financial operations of a new business, ensuring strict adherence to financial regulations and reporting standards. This role involves the meticulous preparation of financial statements, adept budget management, and precise tax filings. A CFO's deep understanding of financial regulations is essential for new ventures, especially those involving startup regulatory hires tracked by VCs, aiming to build investor trust and secure funding, showcasing a firm commitment to transparency and accountability.

Moreover, effective financial reporting significantly influences a new venture's funding success. Investors often scrutinize these reports to assess the business's viability and growth potential. Beyond compliance, CFOs are increasingly embracing strategic roles, crafting comprehensive financial roadmaps that challenge market growth assumptions and competitive dynamics. This strategic engagement is vital for aligning financial strategies with overarching business goals and sustaining competitiveness.

CFOs also grapple with the emotional challenge of balancing fiscal discipline with a growth-oriented culture, a balance crucial for nurturing a favorable funding environment. By implementing robust financial reporting techniques, new businesses can not only meet regulatory requirements but also improve their appeal to potential investors, which is crucial for startup regulatory hires tracked by VCs. Are you ready to elevate your financial strategy and secure the funding your business deserves?

Quality Assurance Manager: Maintaining Standards and Compliance

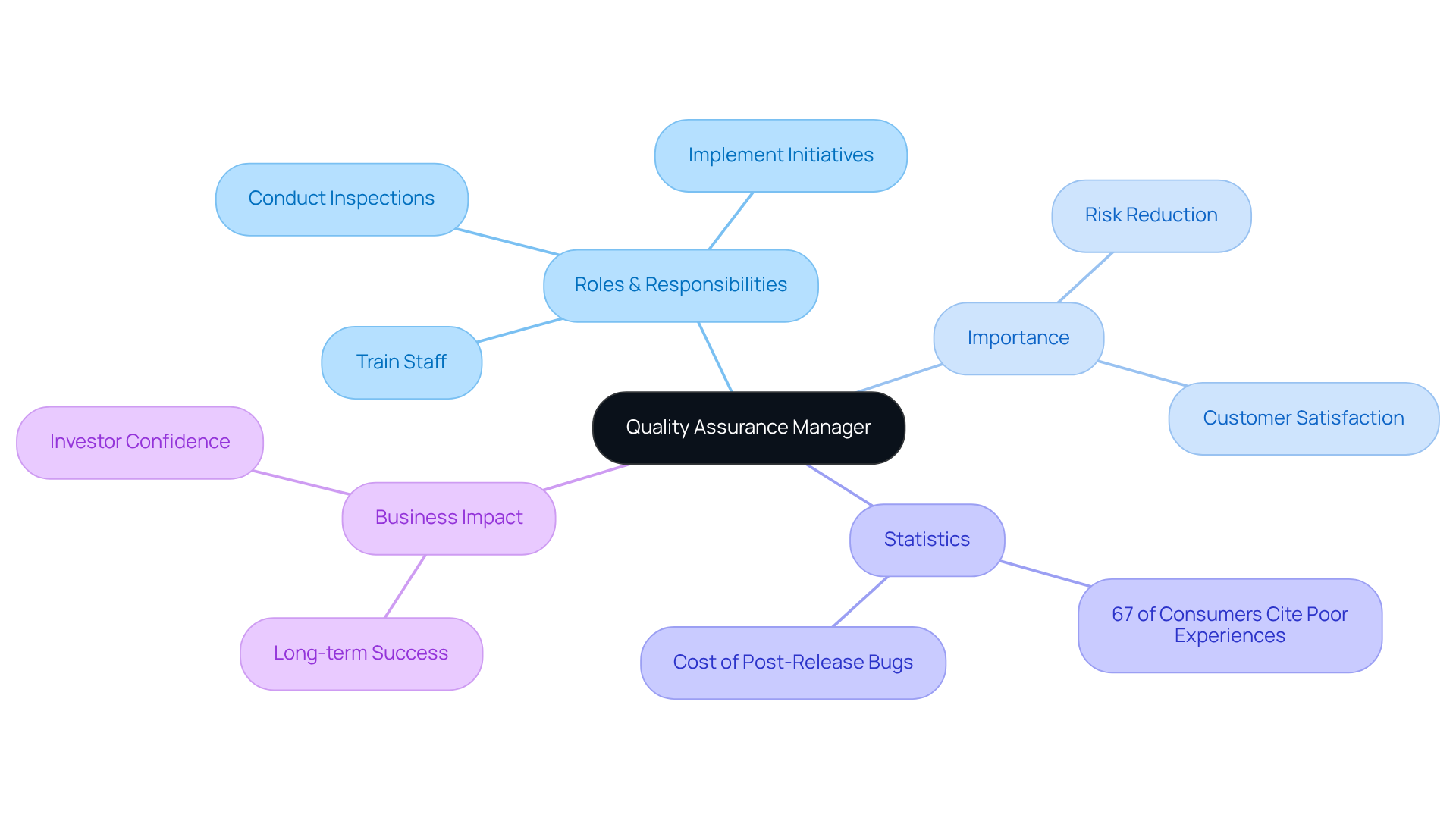

The role of a Quality Assurance Manager is pivotal in establishing and overseeing quality control processes that ensure products meet compliance standards and customer expectations. This position involves conducting thorough inspections, implementing quality enhancement initiatives, and training staff on established quality standards. For new businesses, appointing a Quality Assurance Manager is not just beneficial—it's essential. It significantly reduces the risks associated with product recalls and compliance failures, which can severely damage a company's reputation and financial stability.

Effective quality control safeguards against regulatory penalties and enhances customer satisfaction, ultimately contributing to long-term success. Consider this: 67% of consumers cite poor experiences as a reason for churn. This statistic underscores the critical role of effective quality control in retaining customers. Moreover, post-release bugs can be up to 100 times more expensive to fix than if identified during the design phase, highlighting the financial implications of inadequate QA.

Startups that prioritize robust QA practices and are among the startup regulatory hires tracked by VCs are better equipped to respond swiftly to market changes and customer needs, fostering trust with both investors and customers. Aligning QA goals with overall business objectives is crucial for effective quality assurance, ensuring that quality initiatives support the startup's strategic vision, particularly in relation to startup regulatory hires tracked by VCs. Are you ready to elevate your quality assurance practices and secure your company's future?

Conclusion

Navigating the regulatory landscape is not just a task; it’s a critical endeavor for startups aiming for success in today’s competitive market. The essential roles of regulatory hires—such as the Chief Compliance Officer, General Counsel, and Data Protection Officer—cannot be overstated. Each position plays a unique role in fostering compliance, mitigating risks, and ensuring that startups not only meet legal standards but also thrive in an ever-evolving environment.

Investing in regulatory talent is more than a compliance measure; it’s a strategic necessity for startups. Consider the proactive management strategies of a Chief Risk Officer alongside the meticulous oversight of a Quality Assurance Manager. Together, these roles enhance investor confidence and operational integrity. By integrating technology and data-driven approaches, startups can streamline their compliance processes, positioning themselves for growth and sustainability.

As regulatory requirements continue to shift, startups must prioritize their regulatory hires to build a solid foundation for success. Embracing these roles and their responsibilities safeguards the organization against potential pitfalls while empowering startups to seize opportunities in a complex business environment. Founders and investors must recognize the significance of these strategic hires, ensuring their ventures are equipped to navigate challenges and achieve long-term goals.

Frequently Asked Questions

What is Websets and how does it assist in talent acquisition?

Websets is an AI-powered platform that revolutionizes lead generation for compliance talent acquisition by analyzing vast datasets. It helps businesses quickly identify and connect with candidates that meet their specific compliance requirements, streamlining the hiring process.

How does Websets enhance data insights for venture capitalists?

Websets provides crucial information such as emails, company details, and prior work experience, enabling venture capitalists to cultivate compliant and successful ventures by ensuring portfolio companies have the right talent to navigate compliance challenges.

Why is appointing a Chief Compliance Officer (CCO) important for startups?

A Chief Compliance Officer is essential for startups to shape and execute initiatives that align with legal and regulatory standards, mitigate legal risks, and cultivate a robust adherence culture, which enhances investor confidence.

What challenges will Chief Compliance Officers face in 2025?

In 2025, CCOs will encounter increasing complexity and challenges characterized by greater volatility, uncertainty, complexity, and ambiguity (VUCA). Nearly 90% of CCOs report that their responsibilities have expanded over the past three years.

What actionable measures should startups take to improve regulatory compliance?

Startups should conduct regular audits and invest in regulatory technology to enhance program effectiveness and ensure compliance with regulations.

What role does the General Counsel (GC) play in a startup?

The General Counsel serves as the pivotal legal advisor, navigating complex legal landscapes, ensuring regulatory compliance, and protecting the company from potential penalties and legal disputes.

How can a General Counsel contribute to a startup's growth?

By proactively addressing legal challenges and providing strategic insights, the General Counsel safeguards the company's interests and fosters growth, significantly influencing the company's operational success.

Why should founders invest in legal counsel early on?

Investing in legal counsel early on can yield substantial long-term benefits by ensuring compliance with regulations and helping to navigate potential legal hurdles effectively.