Overview

The article presents compelling strategies to enhance startup origination beyond Crunchbase, leveraging alternative databases, social media, and strategic partnerships. It underscores the critical need to diversify sources and implement effective lead generation techniques. Content marketing and AI-driven tools are highlighted as essential methods for uncovering unique investment opportunities that often elude mainstream platforms. By embracing these strategies, professionals can position themselves to discover and capitalize on untapped potential in the startup ecosystem.

Introduction

Exploring the landscape of startup origination unveils a plethora of opportunities that extend well beyond the familiar confines of Crunchbase. While this platform is widely recognized for tracking new ventures, numerous innovative companies, particularly within niche markets, remain undiscovered.

By tapping into alternative resources and leveraging strategic networking, investors can unveil unique opportunities that competitors might overlook.

What untapped strategies can lead to the discovery of these hidden gems in the startup ecosystem? The answers lie in a proactive approach to sourcing and evaluating potential investments.

Understanding Startup Origination Beyond Crunchbase

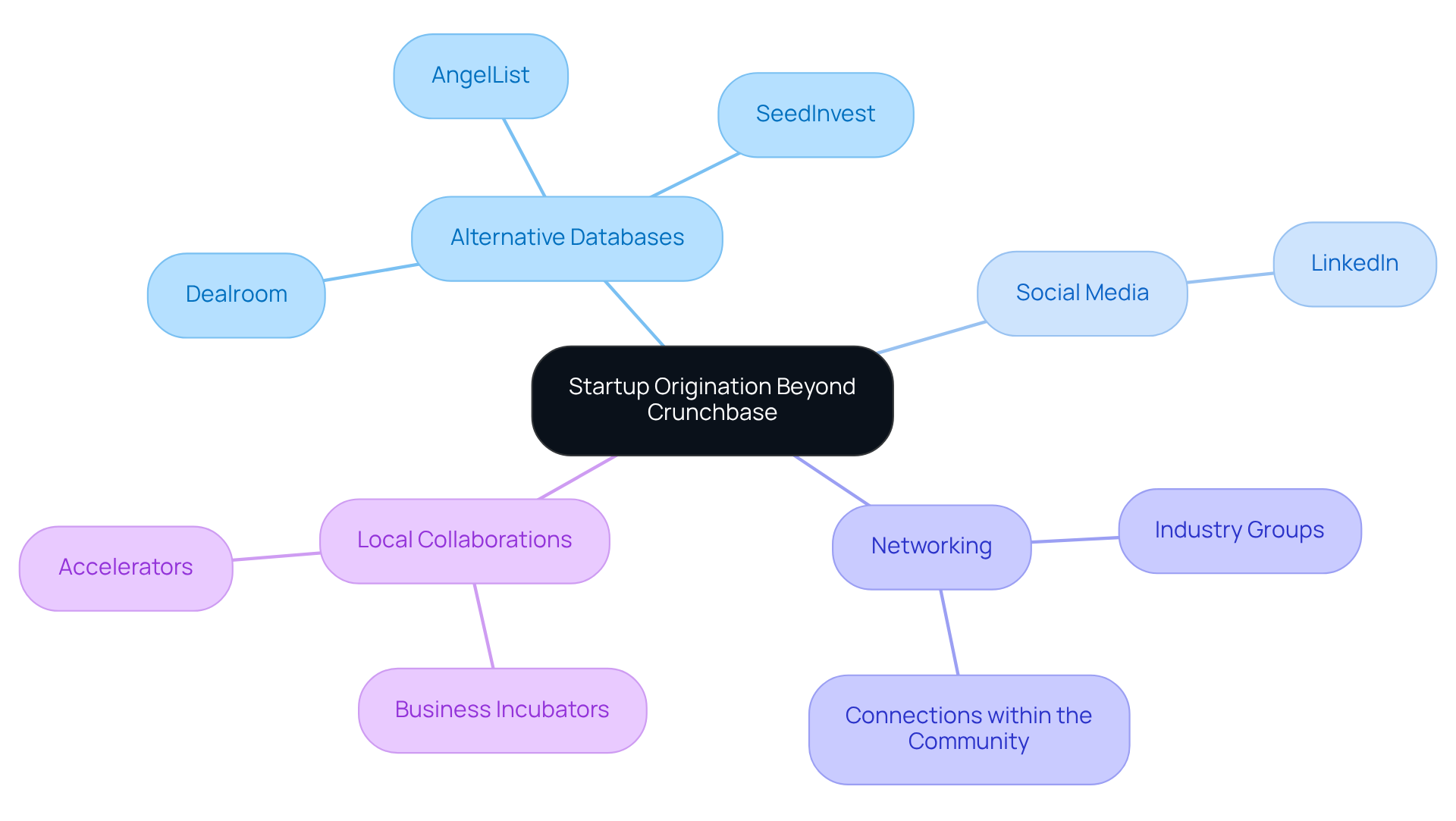

While Crunchbase is a prominent service for monitoring new businesses, it is critical to acknowledge that it is not the sole resource available. Many promising early-stage companies, particularly those in niche markets, may fall under startup origination outside Crunchbase. To effectively source new ventures, explore alternative databases such as:

- AngelList

- SeedInvest

- Dealroom

These services collectively accommodate numerous new ventures, providing a broader perspective on potential investment opportunities.

In addition to these databases, leveraging social media platforms like LinkedIn can be essential in identifying new businesses. Engaging in industry groups and networking can unveil insights into new ventures that may not yet be featured on mainstream platforms. Furthermore, collaborating with local business incubators and accelerators can yield valuable insights about innovative firms in their early stages.

By diversifying your sources and actively seeking startup origination outside Crunchbase, you can uncover unique opportunities that competitors may overlook. This approach aligns with insights from industry leaders who emphasize the importance of acquiring the right talent and fostering connections within the entrepreneurial community. As Marc Benioff observes, securing the right talent is vital for growth, and this principle extends to identifying suitable companies for investment.

Implementing Effective Lead Generation Strategies

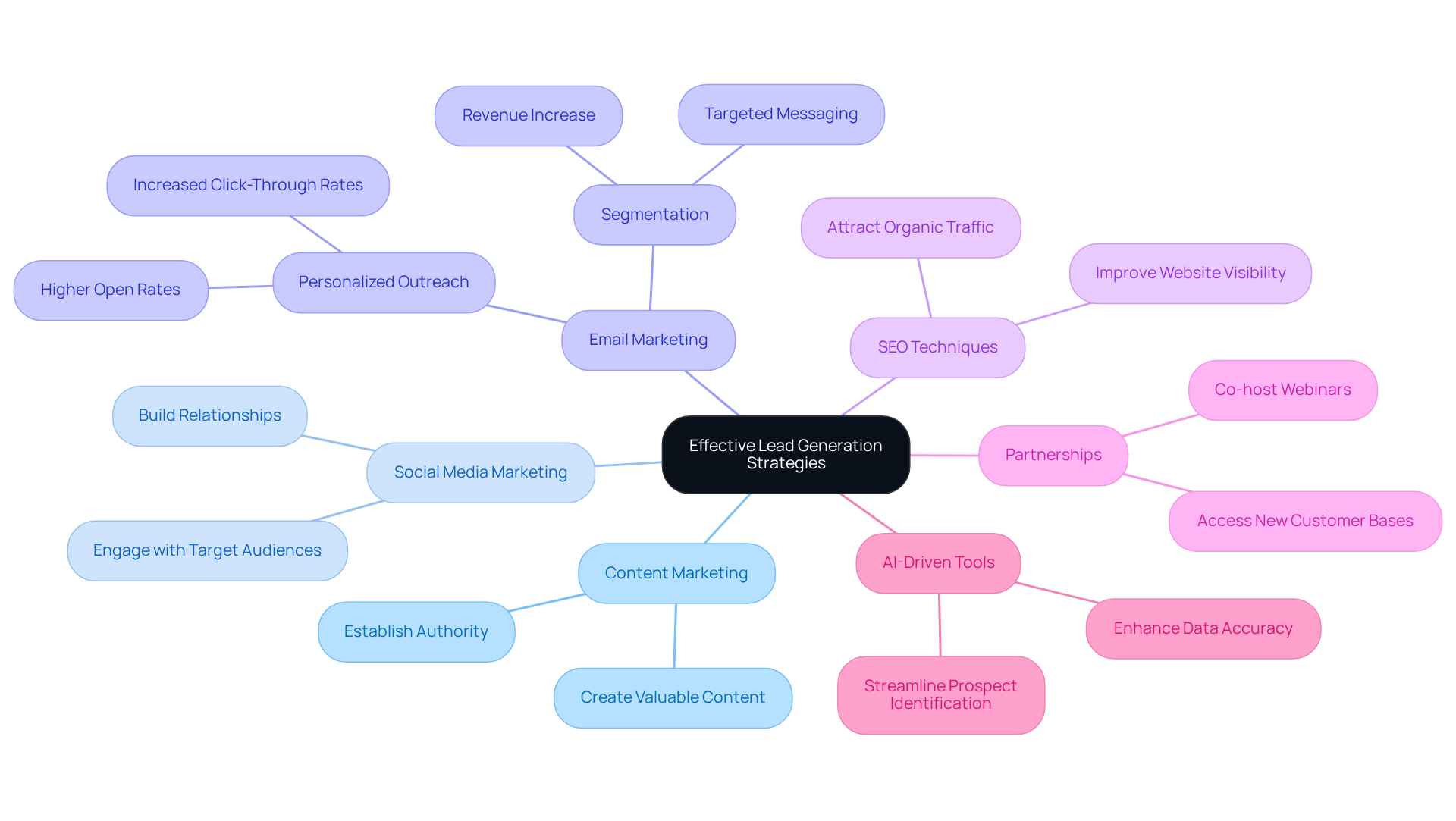

To implement effective lead generation strategies, startups must adopt a multi-channel approach that encompasses various marketing tactics.

-

Content Marketing: Start by creating valuable content that attracts potential leads and establishes authority within the industry.

-

Social Media Marketing: Engage directly with target audiences to build relationships and foster community.

-

Email Marketing: Leverage personalized outreach to significantly boost response rates; personalized emails can achieve open rates up to 29% higher than generic ones.

-

SEO Techniques: Focus on improving website visibility to attract organic traffic and enhance opportunity prospects.

Additionally, startups should explore partnerships with complementary businesses as a strategy for startup origination outside Crunchbase to access new customer bases. For instance, co-hosting webinars or events can yield mutual benefits and broaden reach.

Moreover, utilizing AI-driven tools like Websets for prospect generation can enhance data accuracy in sourcing candidates with distinctive attributes. Specifically, Exa Search allows new ventures to utilize advanced search capabilities and API integration, facilitating startup origination outside Crunchbase by streamlining the identification of notable companies and insights. By concentrating on hyper-specific criteria for sourcing applicants, teams can effectively target high-potential prospects.

By integrating these strategies, startups can significantly enhance their lead generation efforts and drive sustainable growth.

Leveraging Technology for Enhanced Sales Insights

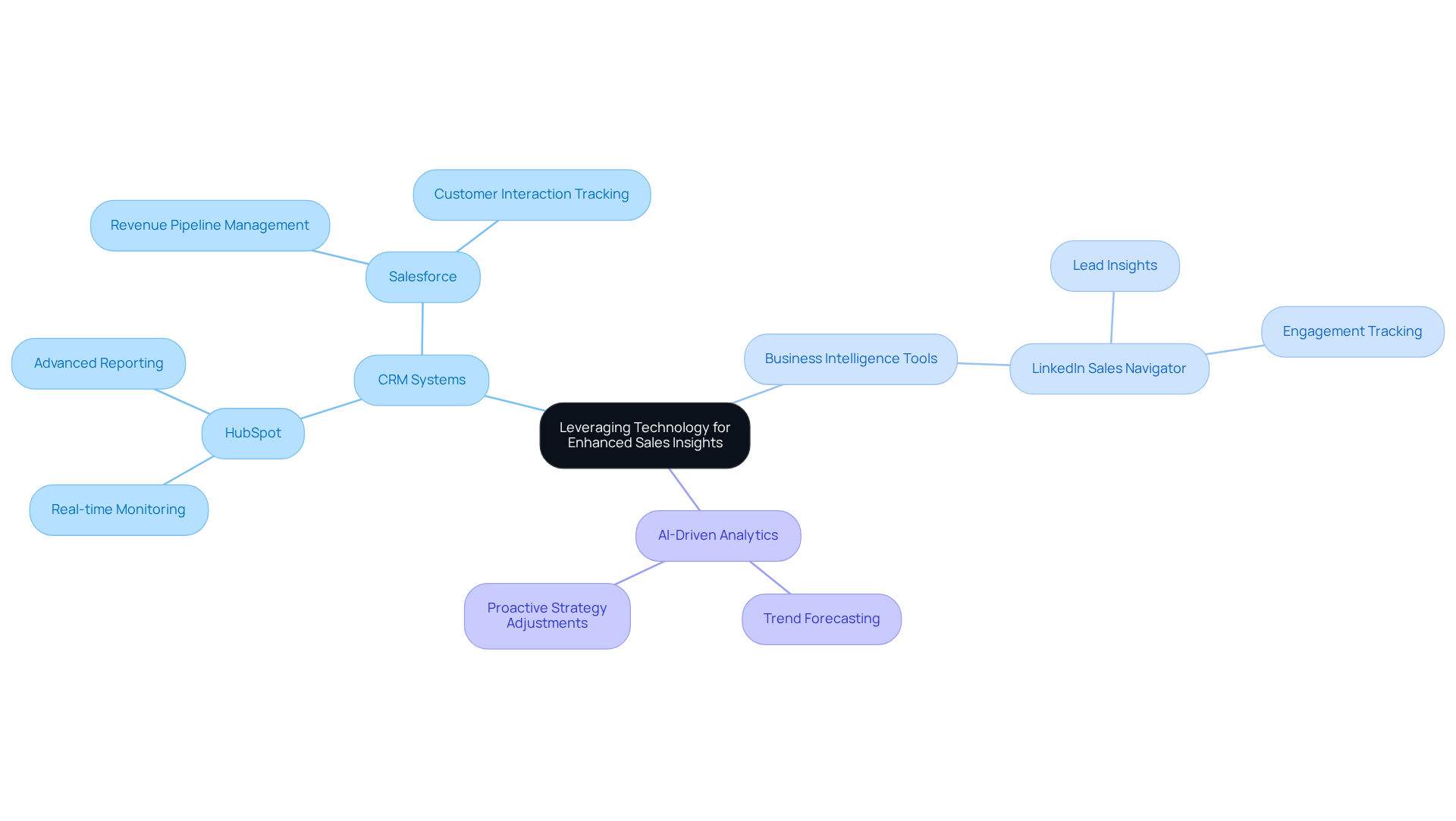

In today's digital landscape, technology is pivotal for understanding revenue performance and customer behavior. Startups must prioritize investments in CRM systems equipped with advanced analytics and reporting capabilities. These tools facilitate real-time monitoring of business activities and customer interactions, proving essential for growth. Noteworthy platforms like HubSpot and Salesforce provide comprehensive features that empower startups to manage their revenue pipelines effectively.

Moreover, leveraging business intelligence tools such as LinkedIn Sales Navigator yields critical insights into potential leads and their engagement levels. This enhances the effectiveness of outreach efforts, driving better results. Additionally, the implementation of AI-driven analytics is vital; it uncovers trends and forecasts sales, enabling proactive adjustments to strategies.

By adopting these technologies, startups can markedly enhance operational efficiency and propel significant revenue growth. The time to act is now—embrace these tools and transform your business trajectory.

Conclusion

Exploring startup origination beyond Crunchbase unveils a myriad of opportunities for both investors and entrepreneurs. By broadening the scope of resources and strategies utilized, innovative ventures that may otherwise remain hidden come to light. It is essential to emphasize diverse platforms such as AngelList, SeedInvest, and Dealroom, alongside leveraging social media and local incubators for effective startup sourcing. Insights shared by industry leaders further reinforce that connecting with the right talent is crucial for identifying promising companies.

Key strategies for lead generation—content marketing, social media engagement, and advanced SEO techniques—significantly enhance visibility and attract potential customers. Moreover, partnerships and the integration of AI-driven tools streamline the identification of high-potential startups. Implementing these multifaceted approaches not only boosts lead generation efforts but also lays the groundwork for sustainable growth.

Ultimately, the integration of technology through robust CRM systems and business intelligence tools is vital for startups aiming to improve sales insights and operational efficiency. Embracing these innovations transcends mere recommendation; it is a necessary step for startups to thrive in a competitive landscape. By actively seeking new methods of startup origination and leveraging technology effectively, the potential for success is significantly amplified.

Frequently Asked Questions

What is Crunchbase and its role in startup origination?

Crunchbase is a prominent service for monitoring new businesses, but it is not the only resource available for sourcing startups.

What are some alternative databases to Crunchbase for finding new ventures?

Alternative databases include AngelList, SeedInvest, and Dealroom, which collectively provide a broader perspective on potential investment opportunities.

How can social media platforms assist in identifying new businesses?

Social media platforms like LinkedIn can be essential for identifying new businesses, especially through engaging in industry groups and networking.

Why is collaboration with local business incubators and accelerators important?

Collaborating with local business incubators and accelerators can yield valuable insights about innovative firms in their early stages.

What is the benefit of diversifying sources for startup origination?

Diversifying sources allows individuals to uncover unique opportunities that competitors may overlook, enhancing the chances of identifying promising ventures.

What insights do industry leaders provide regarding talent acquisition and startup identification?

Industry leaders emphasize the importance of acquiring the right talent for growth, which also applies to identifying suitable companies for investment.