Overview

Investors looking to enhance their strategies must consider the Startup Signals API. This powerful tool is essential for identifying promising investment opportunities within the startup ecosystem. By tracking key growth indicators, it empowers investors to make informed decisions.

To effectively integrate the Startup Signals API into your investment approach, follow these essential steps:

- Conduct thorough research on suppliers to find the best fit for your needs.

- Evaluate pricing options to ensure you’re getting value for your investment.

- Don’t forget to sign up for trials, allowing you to test the API's capabilities firsthand.

- Be prepared to troubleshoot common issues that may arise during implementation.

By following these steps, you can seamlessly incorporate this tool into your investment strategies, positioning yourself for success in a competitive market. Are you ready to take your investment game to the next level?

Introduction

Investors are always seeking innovative tools that can give them a competitive edge in today’s fast-paced market. The Startup Signals API stands out as an essential resource, allowing investors to access critical indicators of startup growth and viability, including funding trends and hiring patterns. With the recent surge in venture funding underscoring the growing interest in startups, one pressing question arises: how can investors effectively navigate the purchasing process of this powerful API to enhance their investment strategies and seize emerging opportunities?

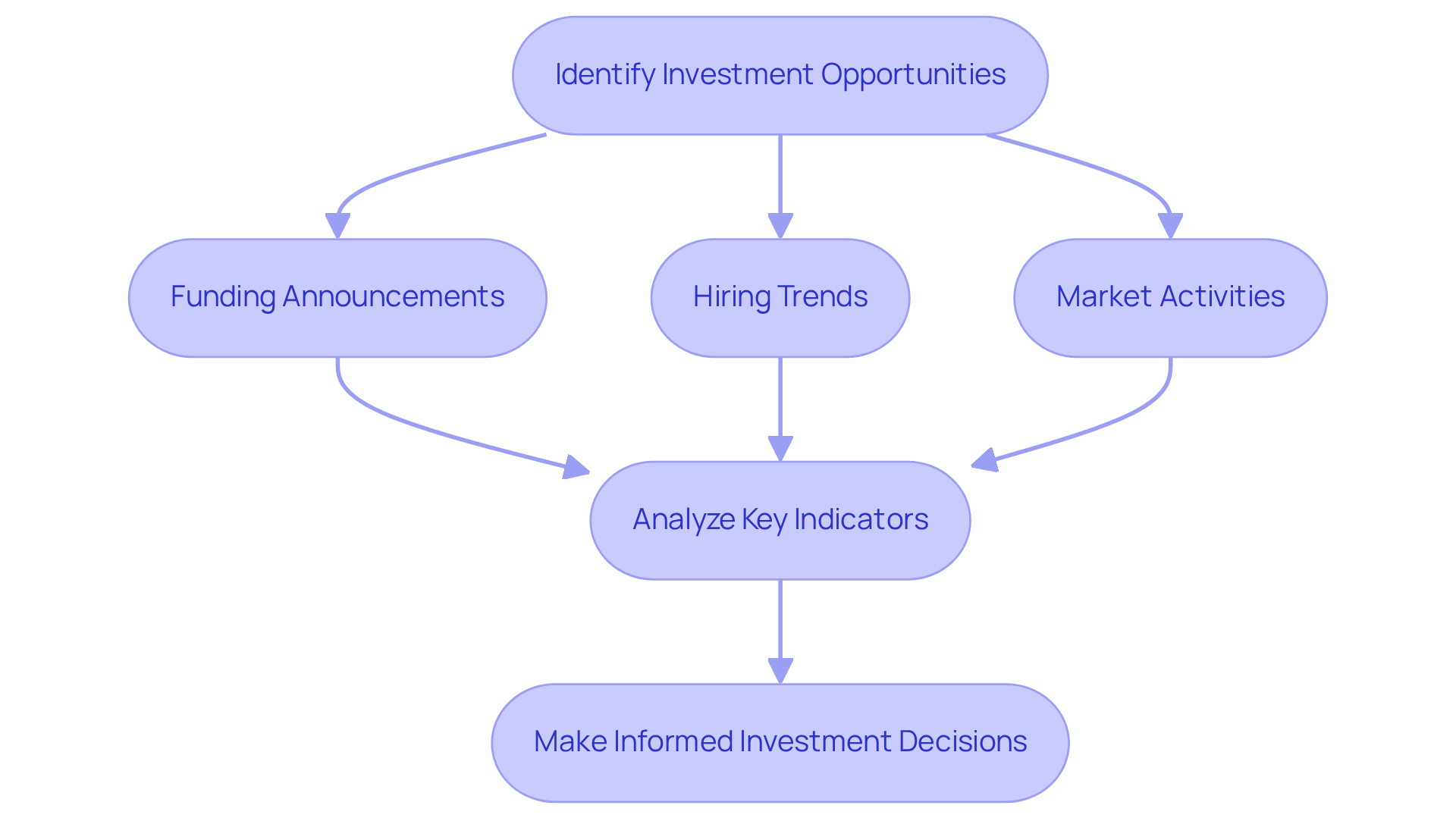

Understand Startup Signals API and Its Importance for Investors

The Signals API serves as an essential tool for investors eager to uncover promising investment opportunities by tracking key indicators of company growth and viability. These indicators include funding announcements, hiring trends, and market activities—critical elements for making informed investment decisions. By leveraging this API, powered by Websets' AI-driven market intelligence, investors gain access to valuable insights into startups that are gaining traction, allowing them to pinpoint those worthy of investment consideration.

This proactive approach not only boosts the chances of successful investments but also positions investors to stay ahead of market trends and competitive dynamics. In 2025, the importance of tracking these signals has surged, evidenced by a remarkable increase in venture funding, which hit $120 billion in Q3 alone. This figure reflects a strong interest in high-growth startups. Furthermore, European startups attracted $12.1 billion across 912 deals in the same quarter, showcasing the vibrant funding landscape.

For any investor aiming to enhance their portfolio and seize emerging opportunities within the dynamic startup ecosystem, it is vital to understand and utilize these signals by choosing to buy startup signals API for investors, leveraging Websets' advanced filtering and enriched data capabilities. As Camila Vieira from QED Investors notes, there’s a palpable sense of momentum returning, particularly in B2B infrastructure and AI-native fintech. This underscores the significance of the Signals API in today’s investment landscape. Are you ready to harness these insights and elevate your investment strategy?

Follow the Step-by-Step Process to Purchase the API

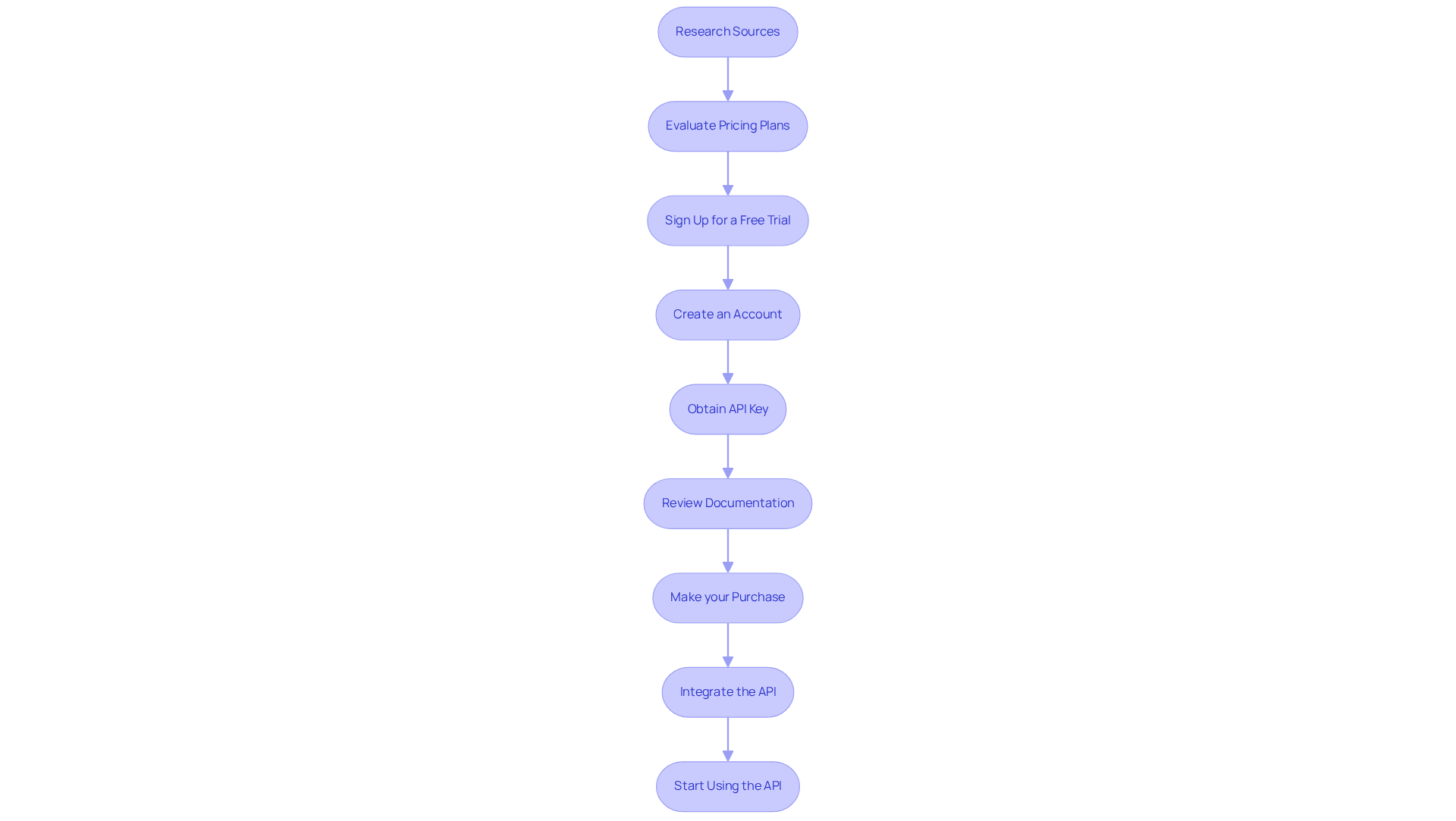

To purchase the Startup Signals API, follow these essential steps:

-

Research Sources: Start by identifying trustworthy API suppliers that offer the Signals API tailored for startups. Look for reviews, case studies, and comparisons to ensure reliability and make an informed choice.

-

Evaluate Pricing Plans: Next, compare pricing plans among potential suppliers. Consider factors such as the number of API calls allowed, data coverage, and any additional features included. For example, gathering information on average pricing plans to buy startup signals API for investors in 2025 can vary significantly, so this information is crucial during your evaluation.

-

Sign Up for a Free Trial: Many services provide a free trial period. Take advantage of this opportunity to test the API's functionality and confirm it meets your needs before making a commitment.

-

Create an Account: After selecting a service, create an account on their platform. This typically requires your email address and a password, setting the stage for your API journey.

-

Obtain API Key: Once your account is established, navigate to the API section of the service's dashboard to generate your unique API key. This key is essential for authenticating your requests and accessing the API's features.

-

Review Documentation: Familiarize yourself with the API documentation provided by the vendor. Understanding how to integrate the API into your existing systems will empower you to utilize its features effectively.

-

Make your purchase: If you're satisfied with the trial and documentation, you can buy the startup signals API for investors. Follow the service's checkout process, which may involve selecting a subscription plan and entering payment details.

-

Integrate the API: After purchasing, integrate the API into your systems according to the documentation. This may involve coding or using integration tools, depending on your technical expertise.

-

Start Using the API: With the API integrated, you can begin leveraging its features to track startup signals and enhance your investment strategies. Are you ready to take your investment approach to the next level?

Troubleshoot Common Issues When Buying the API

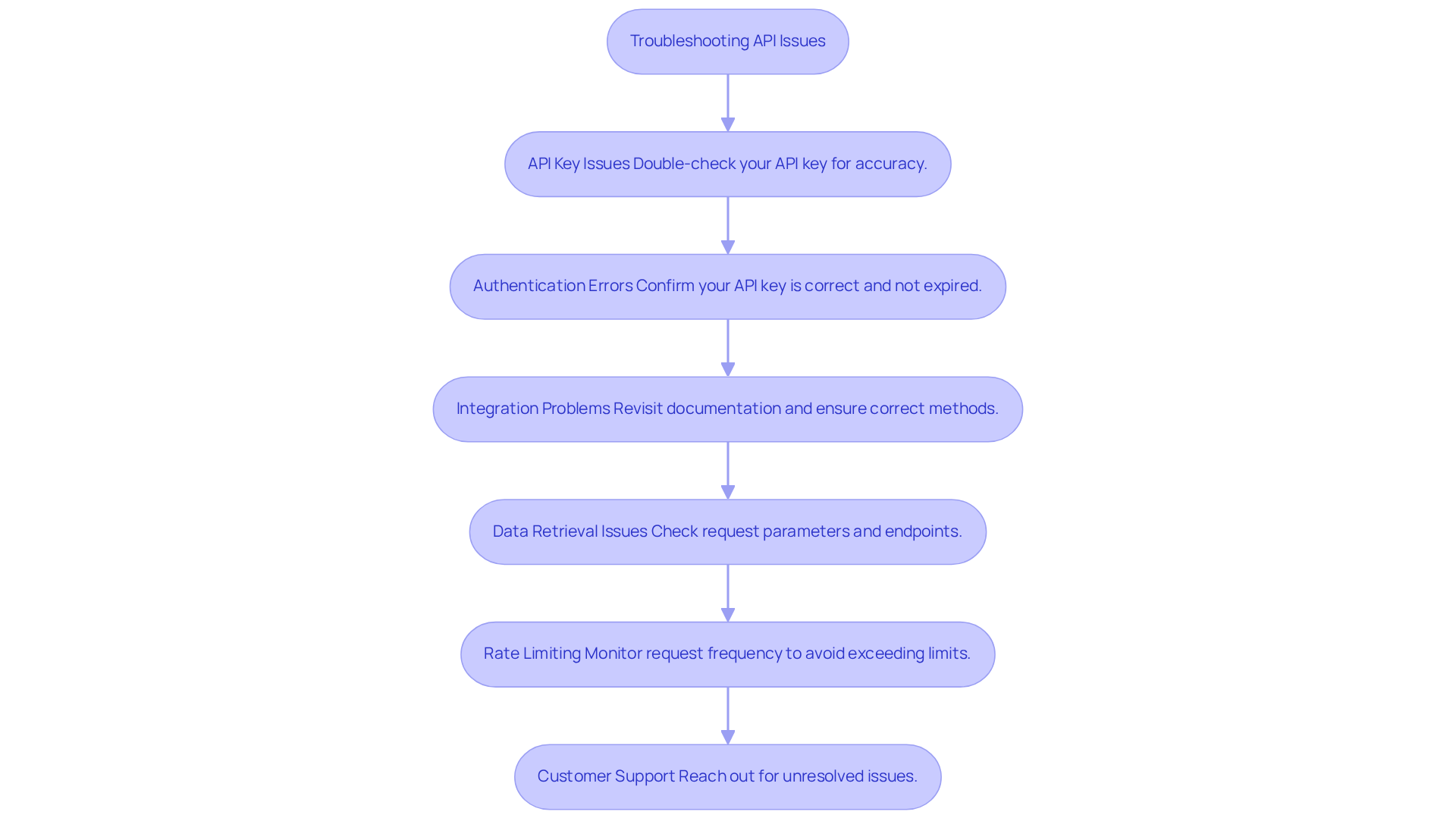

When you buy startup signals API for investors, you might run into a few common issues. Here’s how to troubleshoot them effectively:

-

API Key Issues: Encountering an error related to your API key? Double-check that you’ve copied it accurately from your service's dashboard. Look out for any extra spaces or characters that may have slipped in. A significant percentage of users face authentication failures due to incorrect API key entries, underscoring the need for meticulous handling.

-

Authentication Errors: If authentication errors arise when you try to buy startup signals API for investors, confirm that you’re using the correct API key and that it hasn’t expired. Some providers may require you to regenerate your key periodically. As David Oppenheim points out, organizations often overlook the necessity of regular key updates, which can lead to access issues.

-

Integration Problems: Struggling to integrate the API into your system? Revisit the documentation. Ensure you’re following the correct steps and using the right programming language or tools. A case study involving a grocery company shows how adjusting integration methods can effectively resolve common API issues.

-

Data Retrieval Issues: If the API isn’t returning the expected data, check your request parameters. Are you using the correct endpoints? Are your queries formatted properly? Monitoring API logs can help pinpoint misconfigurations that lead to data retrieval problems.

-

Rate Limiting: Many APIs impose rate limits on the number of requests you can make within a certain timeframe. Exceeding this limit can result in errors. It’s crucial to monitor your usage and adjust your request frequency accordingly. Statistics indicate that exceeding rate limits is a frequent cause of API errors, highlighting the importance of careful request management.

-

Customer Support: If you encounter issues that remain unresolved, don’t hesitate to reach out to the provider's customer support. They can assist you and help troubleshoot specific problems related to their API. Engaging with support often leads to quicker resolutions, as they’re familiar with the common issues users face.

Conclusion

Investors looking to navigate the ever-evolving startup landscape must leverage the Startup Signals API. This powerful tool provides essential insights that help identify high-potential investment opportunities by tracking key indicators like funding rounds, hiring trends, and market activities. By embracing this technology, investors can make informed decisions, stay ahead of the competition, and enhance their investment strategies.

This article outlines a clear step-by-step process for purchasing the Startup Signals API. It emphasizes the importance of thorough research, evaluating pricing plans, and understanding the integration process. Additionally, it addresses common troubleshooting issues that may arise during the purchase and implementation phases, ensuring investors are well-prepared to tackle any challenges they may encounter.

In a rapidly changing investment environment, leveraging the Startup Signals API is not just a strategic advantage; it’s a necessity for those aiming to capitalize on emerging opportunities. By adopting this proactive approach, investors can enhance their portfolios and contribute to the growth of innovative startups that drive economic progress. Taking the first step towards acquiring the API could unlock a wealth of investment potential in 2025 and beyond.

Frequently Asked Questions

What is the Signals API and its purpose for investors?

The Signals API is a tool designed for investors to identify promising investment opportunities by tracking key indicators of company growth and viability, such as funding announcements, hiring trends, and market activities.

How does the Signals API help investors make informed decisions?

By leveraging the Signals API, investors gain access to valuable insights into startups that are gaining traction, which helps them pinpoint companies worthy of investment consideration.

Why is tracking startup signals important in 2025?

In 2025, the importance of tracking startup signals has surged due to a significant increase in venture funding, which reached $120 billion in Q3, indicating strong interest in high-growth startups.

What funding trends were observed in European startups?

In Q3 2025, European startups attracted $12.1 billion across 912 deals, highlighting a vibrant funding landscape in that region.

How can investors enhance their portfolios using the Signals API?

Investors can enhance their portfolios by understanding and utilizing the Signals API, which provides advanced filtering and enriched data capabilities to seize emerging opportunities in the startup ecosystem.

What sectors are showing momentum according to industry experts?

According to Camila Vieira from QED Investors, there is a notable momentum returning in B2B infrastructure and AI-native fintech, emphasizing the relevance of the Signals API in today's investment landscape.