Overview

This article provides a compelling comparison of leading startup research platforms tailored for venture capitalists (VCs), emphasizing their essential features and benefits such as data enrichment, predictive analytics, and market reporting. By examining the distinctive offerings of platforms like Crunchbase, PitchBook, and CB Insights, it illustrates how these powerful tools significantly enhance decision-making, boost efficiency, and mitigate risks in a highly competitive investment landscape.

As VCs navigate the complexities of investment opportunities, the insights gleaned from these platforms become invaluable. For instance, data enrichment allows for a more comprehensive understanding of market trends, while predictive analytics empowers investors to forecast potential outcomes with greater accuracy. Furthermore, market reporting equips VCs with the necessary information to make informed decisions swiftly.

In conclusion, leveraging these startup research platforms not only streamlines the investment process but also positions VCs to capitalize on emerging opportunities effectively. By embracing these technologies, venture capitalists can enhance their strategic approach, ensuring they remain competitive in an ever-evolving market.

Introduction

In the dynamic realm of venture capital, swiftly identifying promising startups can distinguish a successful investment from a missed opportunity. With a multitude of startup research platforms at their disposal, venture capitalists are armed with powerful tools that provide deep insights and analytics, enabling informed decision-making. Yet, given the significant variation in features and benefits among these platforms, how can VCs ascertain which one aligns best with their investment strategies? This article embarks on a comparative analysis of leading startup research platforms, exploring their unique offerings, key functionalities, and the advantages they present to investors navigating this competitive landscape.

Overview of Leading Startup Research Platforms for VCs

In the competitive landscape of venture capital, several startup research platforms for VCs distinguish themselves with their unique offerings and capabilities. Key platforms include:

-

Crunchbase: Renowned for its vast database of startups, funding rounds, and investor profiles, Crunchbase serves as a vital resource for VCs seeking detailed company information. Its comprehensive data empowers investors to track funding trends and effectively identify potential opportunities.

-

PitchBook: This service excels in delivering financial data and analytics, proving particularly valuable for VCs focused on investment metrics and market trends. PitchBook's robust reporting tools enable users to analyze deal flow and assess market dynamics with precision.

-

CB Insights: Celebrated for its market intelligence, CB Insights offers predictive analytics and industry reports that aid VCs in recognizing emerging trends and potential investment opportunities. Its data-driven analysis is crucial for making informed decisions in a rapidly evolving market.

-

Tracxn: An AI-driven service that monitors emerging companies across various industries, Tracxn delivers real-time information and analytics, positioning itself as a crucial resource for proactive investment strategies. Its ability to sift through extensive datasets allows VCs to discover innovative companies before they capture widespread attention.

-

Dealroom: Focusing on European emerging companies, Dealroom provides comprehensive insights into funding rounds, valuations, and market dynamics, specifically catering to VCs interested in that region. Its localized data enhances the understanding of market trends and investment opportunities within Europe.

These startup research platforms for VCs serve as essential resources, enabling them to efficiently navigate the intricate entrepreneurial environment and make strategic investment choices.

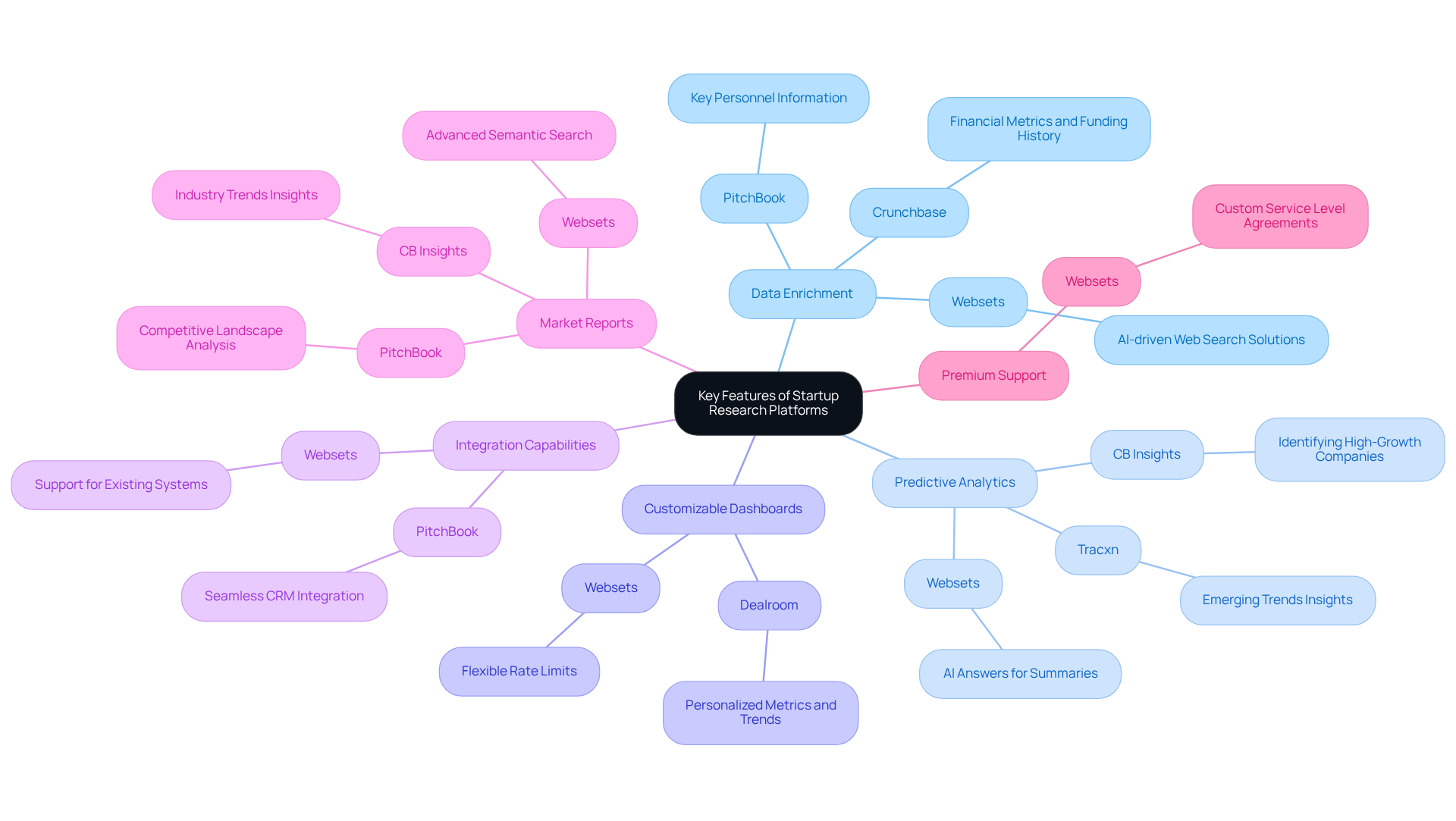

Key Features of Top Startup Research Platforms

The leading startup research platforms for VCs offer a suite of features tailored to the needs of venture capitalists. These key features are essential for making informed investment decisions:

-

Data Enrichment: Platforms such as Crunchbase and PitchBook deliver enriched data, encompassing financial metrics, funding history, and key personnel. This empowers VCs to make well-informed choices. Websets enhances this capability with enterprise-grade, AI-driven web search solutions that extract information from technical documents and niche sources, ensuring comprehensive data enrichment.

-

Predictive Analytics: CB Insights and Tracxn leverage AI to provide predictive insights, helping VCs identify potential high-growth companies before they reach mainstream recognition. Websets' AI Answers can generate well-cited summaries, equipping VCs with timely information on emerging trends and startups.

-

Customizable Dashboards: Numerous platforms, including Dealroom, allow users to create personalized dashboards that highlight relevant metrics and trends, thereby improving user experience and efficiency. Websets complements this with flexible, high-capacity rate limits designed to accommodate peak enterprise demands, ensuring VCs have access to essential data when needed.

-

Integration Capabilities: Platforms like PitchBook facilitate seamless integration with CRM systems, enabling VCs to streamline workflows and maintain organized records of interactions and investments. Websets also supports integration with existing systems, enhancing the overall efficiency of the research process.

-

Market Reports: Comprehensive market analysis reports from CB Insights and PitchBook provide VCs with insights into industry trends and competitive landscapes, which are crucial for strategic planning. With Websets' advanced semantic search technology, VCs can uncover niche insights and trends that conventional systems may overlook.

-

Premium Support: Websets offers tailored support solutions with custom Service Level Agreements, ensuring VCs receive the assistance necessary to maximize their research efforts.

Collectively, these features enhance the ability of VCs to use startup research platforms to conduct thorough research and make data-backed investment decisions. Furthermore, Websets' commitment to security and compliance guarantees that all data handling adheres to the highest industry standards.

Benefits of Utilizing Startup Research Platforms for VCs

Utilizing startup research platforms for VCs offers venture capitalists a multitude of advantages that are crucial for navigating the competitive landscape of investment.

-

Enhanced Decision-Making: Access to extensive data and analytics empowers VCs to make informed investment choices, significantly reducing the risks associated with funding startups. With AI-driven tools provided by Websets, VCs can analyze vast datasets to uncover patterns and predict the growth trajectories of new ventures with greater accuracy.

-

Time Efficiency: Automated data collection and analysis streamline the research process, allowing VCs to save 5-10 hours weekly on routine tasks. This efficiency enables them to concentrate on strategic decision-making rather than manual data gathering, thereby enhancing overall productivity.

-

Competitive Advantage: By leveraging predictive analytics and market knowledge, VCs can recognize emerging trends and new ventures ahead of their rivals. Tools such as Exa's link similarity and keyword search enhance company research, allowing VCs to proactively discover high-growth sectors that can lead to significant returns.

-

Networking Opportunities: Numerous platforms facilitate connections between VCs and emerging companies, fostering relationships that can lead to successful investments and collaborations. This networking capability is essential for building a robust investment portfolio.

-

Risk Mitigation: Detailed insights into market dynamics and company performance enable VCs to assess risks more accurately, allowing for more strategic portfolio management. By utilizing sophisticated analytics from Websets, VCs can steer clear of low-return investments and concentrate on unique companies.

These advantages underscore the essential function of startup research platforms for VCs in maneuvering through the rapid environment of venture capital, ultimately leading to improved investment results.

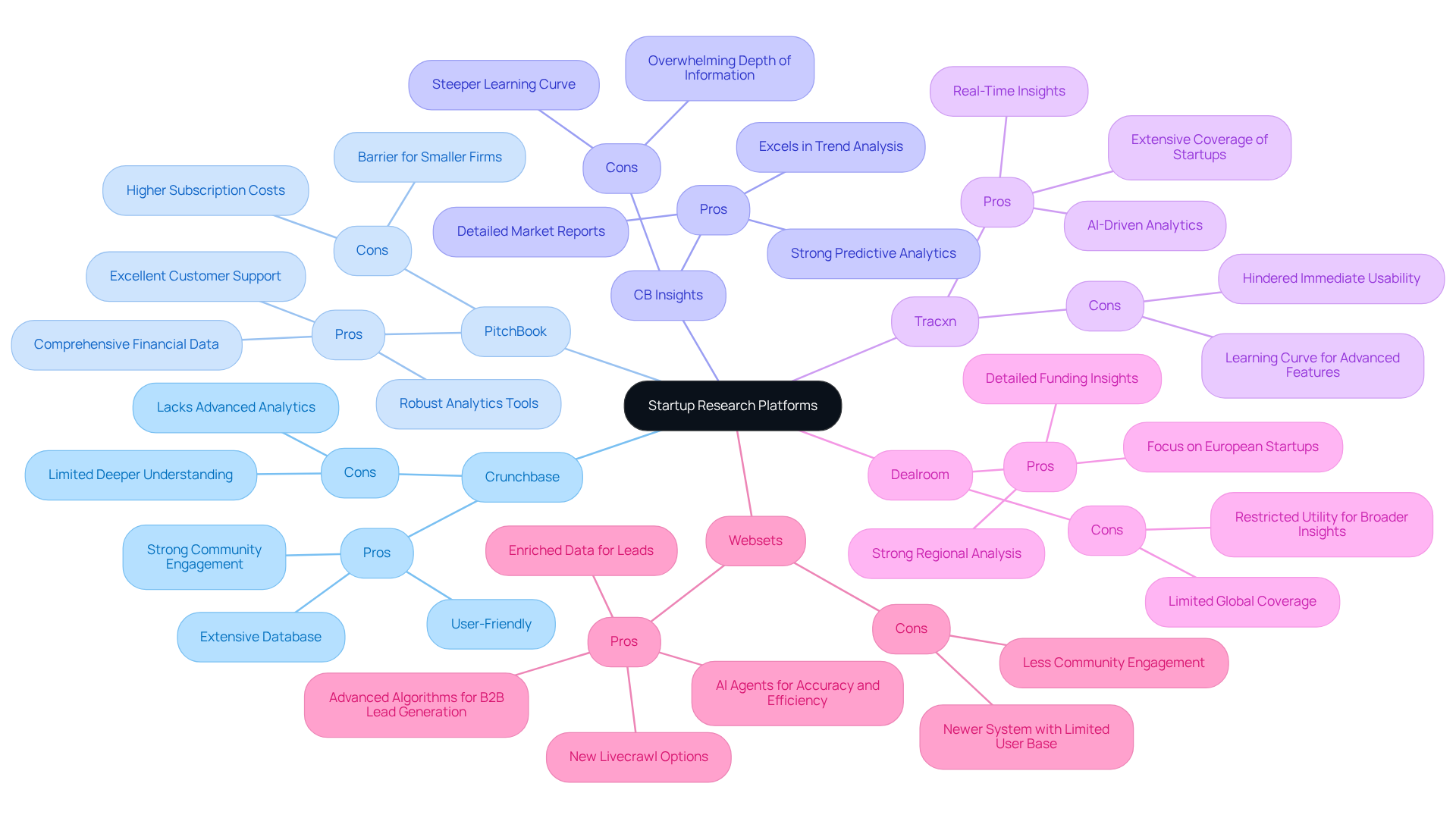

Comparative Analysis: Pros and Cons of Each Platform

A comparative analysis of the leading startup research platforms reveals distinct pros and cons that every venture capitalist should consider:

-

Crunchbase

- Pros: Offers an extensive database that is user-friendly, fostering strong community engagement and making it accessible for users at all levels.

- Cons: Lacks advanced analytics features, which may restrict deeper understanding compared to its competitors.

-

PitchBook

- Pros: Provides comprehensive financial data and robust analytics tools, complemented by excellent customer support, making it a favorite among seasoned investors.

- Cons: Higher subscription costs can be a barrier for smaller firms, potentially limiting its user base.

-

CB Insights

- Pros: Known for its strong predictive analytics and detailed market reports, it excels in trend analysis, offering valuable insights for strategic decision-making.

- Cons: The depth of information can be overwhelming for new users, requiring a steeper learning curve.

-

Tracxn

- Pros: Delivers real-time insights and AI-driven analytics with extensive coverage of startups, making it a powerful tool for proactive investors.

- Cons: Users may face a learning curve to fully leverage its advanced features, which can hinder immediate usability.

-

Dealroom

- Pros: Focuses on European startups, providing detailed funding insights and strong regional analysis, beneficial for investors targeting this market.

- Cons: Its global coverage is limited compared to other services, which may restrict its utility for those seeking broader insights.

-

Websets

- Pros: Utilizes advanced algorithms for B2B lead generation, offering enriched data that enhances the value of leads and candidates. Its AI agents ensure accuracy and efficiency, addressing significant pain points in sales and recruiting. Additionally, Websets features new Livecrawl options and default settings that improve lead generation and data discovery, making it a compelling choice for sales intelligence.

- Cons: As a newer system, it may not yet have the extensive user base or community engagement observed in more established networks.

This analysis provides venture capitalists with essential information to evaluate their options and choose the startup research platforms for vcs that best align with their investment strategies and operational requirements.

Conclusion

In the realm of venture capital, selecting the right startup research platform is crucial for making informed investment decisions. A comparative analysis of leading platforms such as Crunchbase, PitchBook, CB Insights, Tracxn, Dealroom, and Websets reveals their unique features and benefits. Each platform provides specific tools and insights tailored to the diverse needs of venture capitalists, ranging from extensive databases to advanced predictive analytics. This ultimately empowers investors to navigate the dynamic startup landscape with greater precision.

Key arguments throughout this discussion underscore the importance of:

- Data enrichment

- Predictive analytics

- Customizable dashboards

These elements enhance decision-making processes. The benefits of utilizing these platforms extend beyond mere data access; they encompass:

- Time efficiency

- Competitive advantages

- Improved risk mitigation strategies

By leveraging these tools, VCs can streamline their research efforts while fostering valuable networking opportunities that can lead to successful investments.

As the venture capital landscape continues to evolve, embracing the capabilities of these startup research platforms becomes increasingly significant. The insights gained from using these tools can shape investment strategies and drive better outcomes. Venture capitalists are encouraged to explore these platforms further, ensuring they are equipped with the right resources to identify and capitalize on emerging opportunities in the startup ecosystem.

Frequently Asked Questions

What are some leading startup research platforms for venture capitalists (VCs)?

Key platforms include Crunchbase, PitchBook, CB Insights, Tracxn, and Dealroom.

What is Crunchbase known for?

Crunchbase is renowned for its vast database of startups, funding rounds, and investor profiles, serving as a vital resource for VCs seeking detailed company information.

How does PitchBook assist VCs?

PitchBook excels in delivering financial data and analytics, helping VCs focus on investment metrics and market trends with robust reporting tools to analyze deal flow and assess market dynamics.

What unique offerings does CB Insights provide?

CB Insights offers market intelligence, predictive analytics, and industry reports that help VCs recognize emerging trends and potential investment opportunities through data-driven analysis.

What makes Tracxn a valuable resource for VCs?

Tracxn is an AI-driven service that monitors emerging companies across various industries, providing real-time information and analytics to help VCs discover innovative companies early.

What is the focus of Dealroom?

Dealroom focuses on European emerging companies, providing insights into funding rounds, valuations, and market dynamics, catering specifically to VCs interested in that region.

Why are these startup research platforms important for VCs?

These platforms enable VCs to efficiently navigate the entrepreneurial environment and make strategic investment choices by providing essential data and insights.