Overview

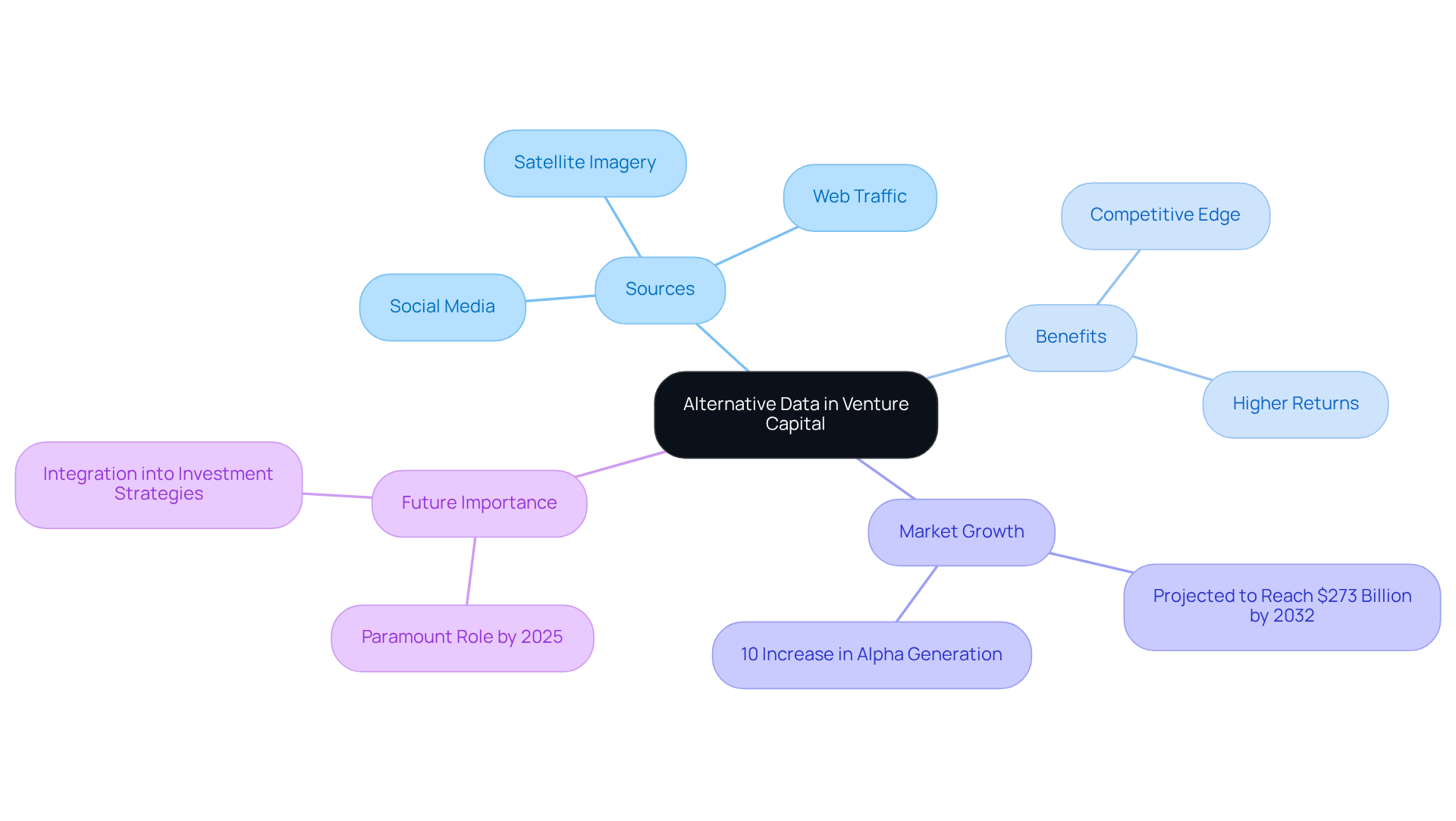

Mastering alternative data for venture capital sourcing is crucial for success in today’s competitive landscape. Understanding its significance allows investors to identify key data types that can be integrated into sourcing strategies. By leveraging diverse sources, such as social media metrics and web traffic, firms can enhance their investment decision-making. This innovative approach has led to higher returns compared to traditional methods, showcasing the transformative potential of alternative data. As the venture capital landscape evolves, embracing these insights is not just advantageous; it is essential for achieving superior outcomes.

Introduction

Alternative data is revolutionizing the venture capital landscape, providing investors with a distinctive perspective to analyze market trends and assess startup potential. By leveraging unconventional sources such as social media metrics, web traffic, and job postings, investors can uncover critical insights that traditional data often misses. As reliance on these innovative data sets increases, the pressing question arises: how can investors effectively integrate and utilize this information to refine their sourcing strategies and maintain a competitive edge?

Understand Alternative Data in Venture Capital

Alternative information encompasses non-traditional sources that yield valuable insights into market trends, consumer behavior, and company performance. In the venture capital arena, alternative data for venture capital sourcing encompasses data from social media activity, web traffic, satellite imagery, and beyond. By effectively leveraging these types of information, investors can secure a competitive edge, identifying promising startups and market shifts before they become evident through conventional sources. For instance, companies that utilize diverse datasets have reported a 10% increase in alpha generation over five years, underscoring the importance of these insights in refining investment strategies.

Understanding the significance of alternative data for venture capital sourcing is crucial for enhancing sourcing strategies. With the , its relevance is set to grow. Successful venture capital firms are increasingly adopting these innovative information sources to inform their decision-making processes. For example, hedge funds that integrate non-traditional data have achieved annual returns 3% higher than those relying solely on traditional sources, illustrating the tangible benefits of incorporating alternative insights into investment strategies.

By 2025, the role of alternative data for venture capital sourcing and decision-making will be paramount. Familiarizing yourself with these concepts can significantly enhance your ability to identify lucrative investment opportunities and adeptly navigate the evolving market landscape.

Identify Key Types of Alternative Data

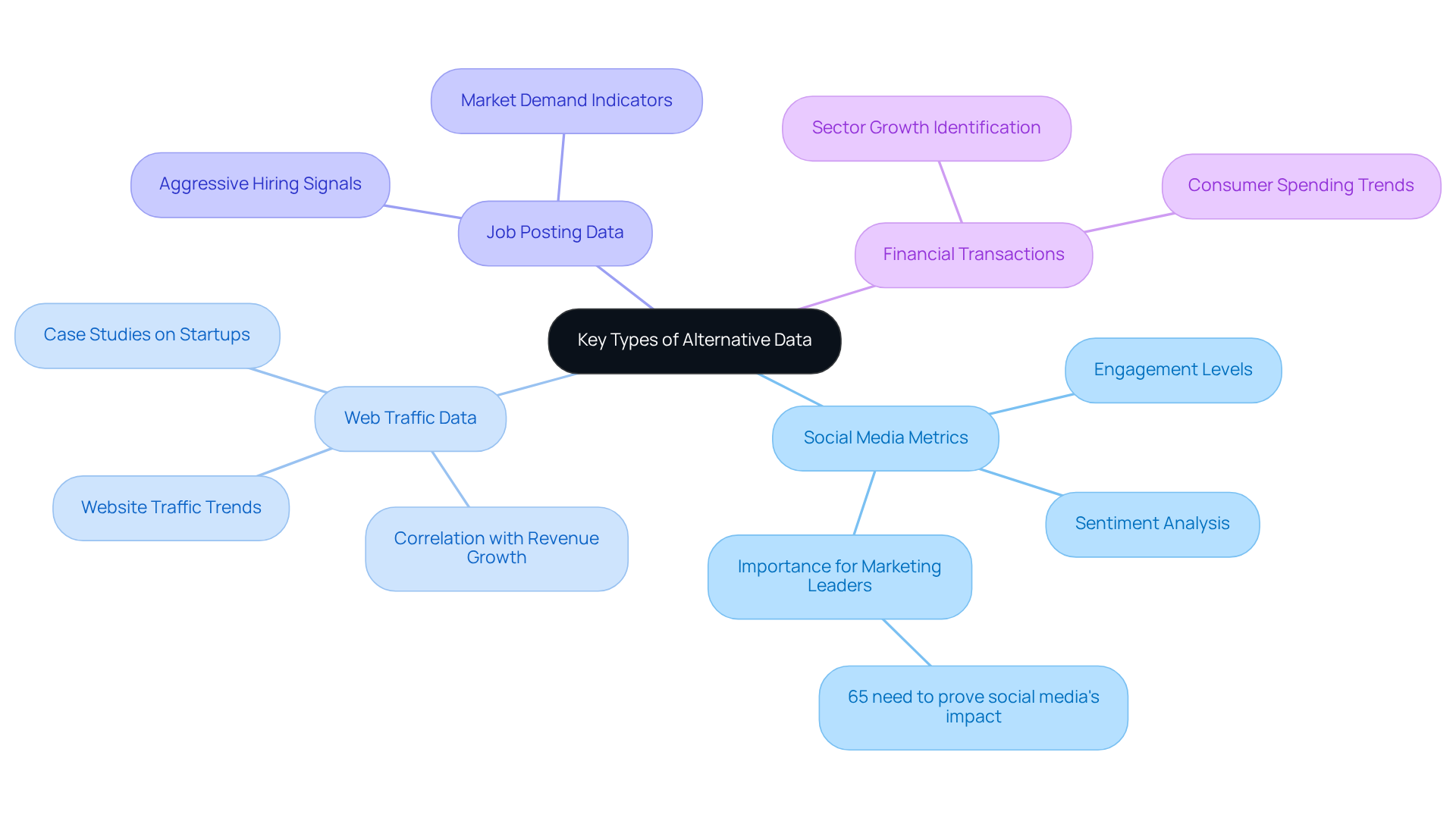

Key types of alternative data that can significantly enhance investment insights include:

- Social Media Metrics: Analyzing engagement levels and sentiment surrounding specific companies or industries enables investors to gauge public interest and potential growth trajectories. Metrics such as likes, shares, and comments provide valuable insights into consumer perceptions and brand health. Notably, research indicates that 65% of marketing leaders must demonstrate how social media supports business goals, underscoring the importance of these metrics in investment decision-making.

- Web Traffic Data: Utilizing tools like SimilarWeb or SEMrush facilitates the assessment of website traffic trends, serving as indicators of a company's market presence and consumer interest. An increase in web traffic often correlates with heightened consumer engagement and potential revenue growth. For instance, case studies reveal that startups experiencing a surge in web traffic frequently see a corresponding rise in investment interest.

- Job Posting Data: Monitoring job postings can unveil companies that are hiring aggressively, signaling potential growth or expansion. A surge in recruitment efforts typically indicates a company’s confidence in its future prospects and market demand. This aligns with trends showing that companies increasing their hiring are often those anticipating growth in their sectors.

- Financial Transactions: Examining credit card transactions or payment information provides insights into consumer spending trends across various sectors. This information can highlight and preferences, informing investment strategies. For example, understanding shifts in spending can help investors identify sectors poised for growth based on consumer interest.

By recognizing and utilizing alternative data for venture capital sourcing, investors can gather essential insights that will effectively guide their investment choices.

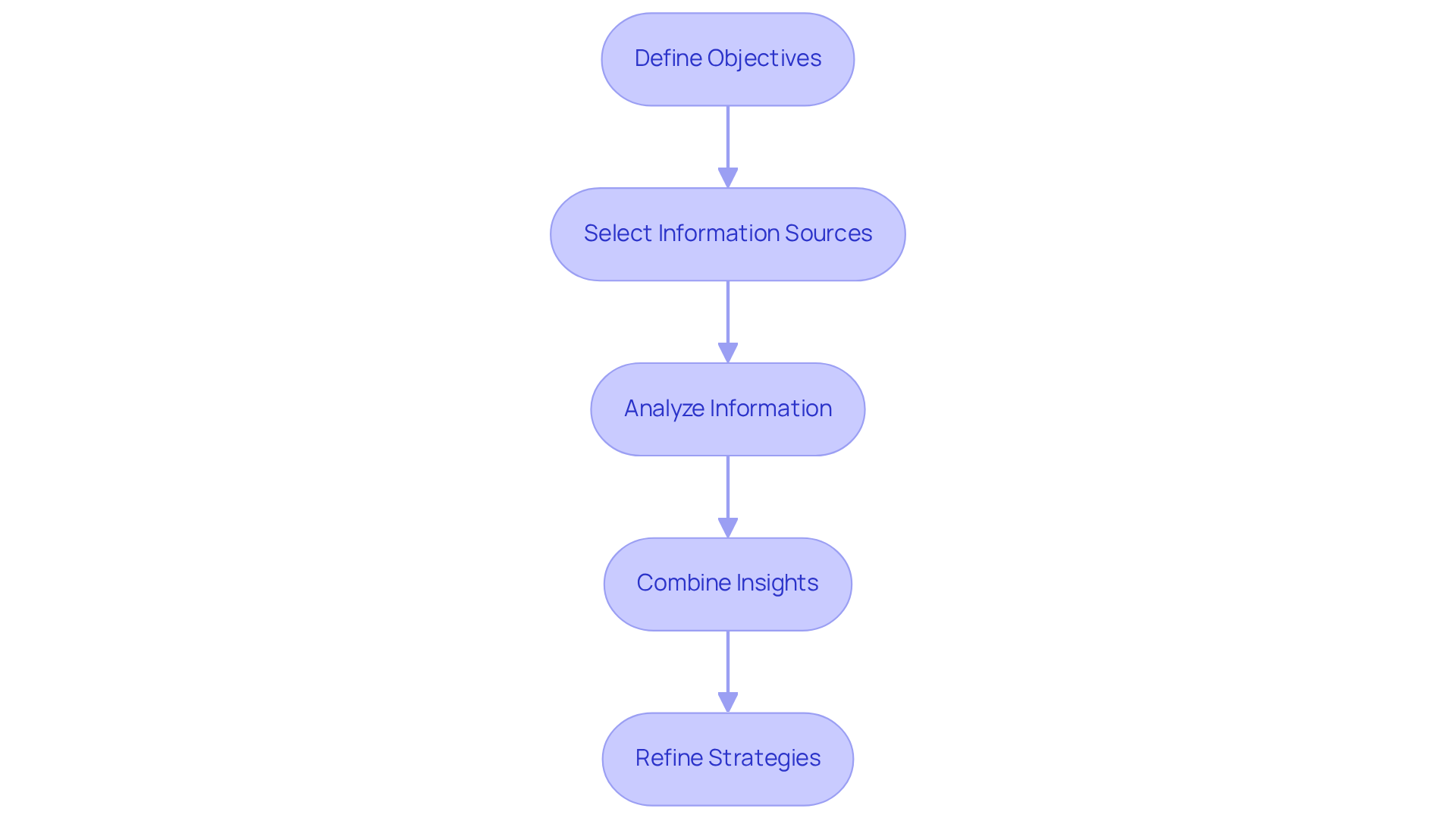

Integrate Alternative Data into Sourcing Strategies

To effectively integrate alternative data for venture capital sourcing into your sourcing strategies with Websets' advanced tools, begin by defining your objectives. What do you aim to achieve with this additional information? Whether it's identifying new investment opportunities or evaluating market trends, clarity on your goals is essential.

Next, select trustworthy information sources that align with your objectives. Websets' News Monitor can assist in gathering insights across various domains, including science, politics, finance, and startup funding, providing a substantial resource for your needs.

Once you have your sources, analyze the information using Websets' AI-driven analytical tools. Look for patterns and correlations that can inform your investment decisions. Employ Exa's link similarity and keyword search features to enhance your company research.

Combine these non-traditional insights with conventional financial metrics to develop a comprehensive view of potential investments through alternative data for venture capital sourcing. Websets' are instrumental in identifying significant firms and relevant technology information that can support your procurement strategies.

Finally, continuously evaluate and refine your acquisition strategies based on insights gleaned from diverse information sources. This iterative process ensures that you maintain a competitive edge in your market.

Evaluate the Impact of Alternative Data on Sourcing Outcomes

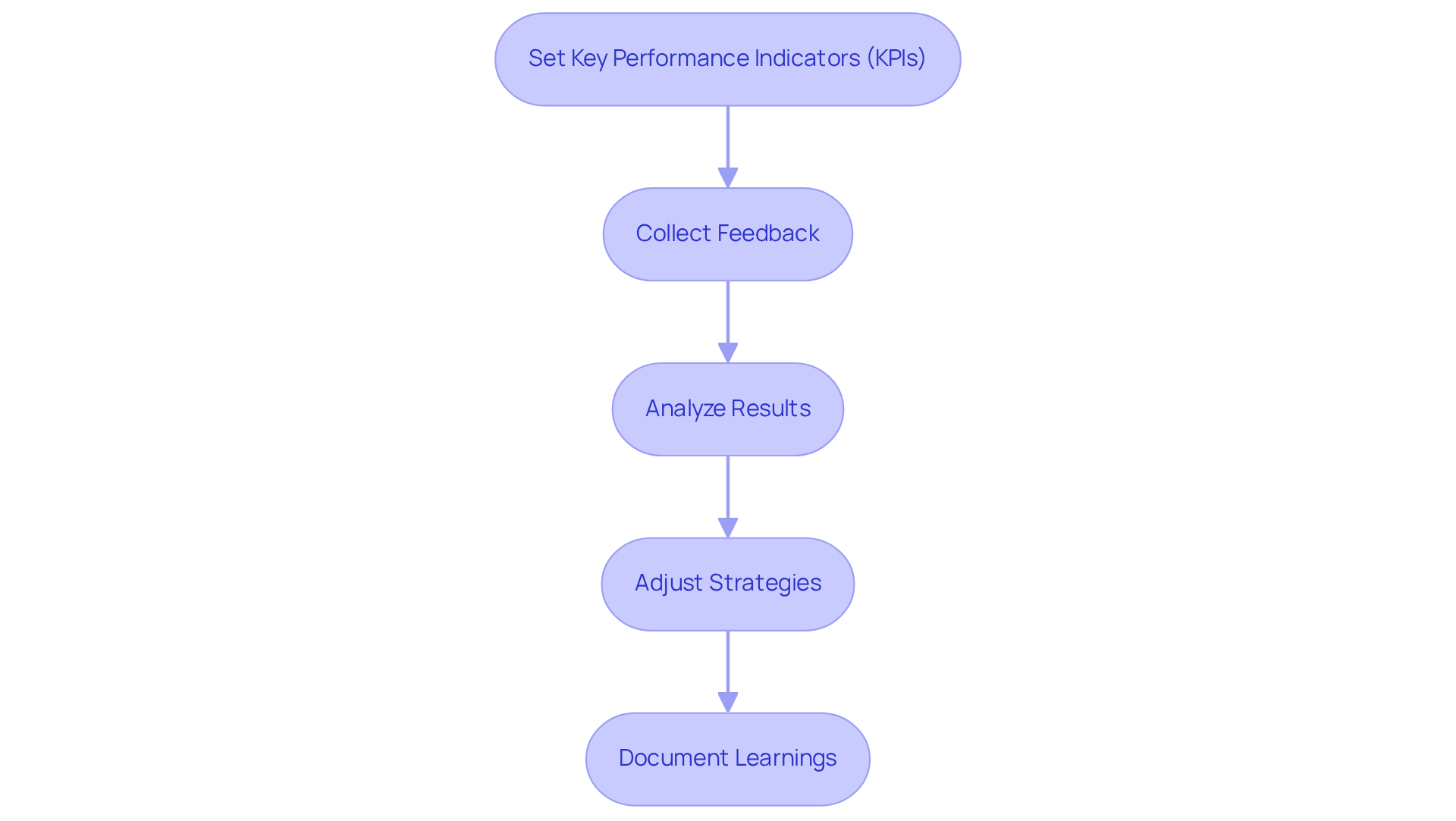

To evaluate the impact of alternative data on your sourcing outcomes, follow these essential steps:

- Set Key Performance Indicators (KPIs): Clearly define what success entails for your procurement strategies. This may include the number of leads generated, the quality of investments, or the pace of acquisition. Utilizing Websets' AI-driven sales intelligence can significantly aid in establishing precise KPIs by providing comprehensive insights into lead quality and acquisition efficiency.

- Collect Feedback: Actively gather input from your team regarding the effectiveness of alternative information in their procurement efforts. This qualitative data can offer valuable insights into its impact. With Websets, teams can with detailed profiles, thereby improving the feedback on lead quality and candidate suitability.

- Analyze Results: Conduct a comparative analysis of the performance of investments obtained through various information sources against those sourced via traditional methods. Identify trends in success rates, returns, and overall satisfaction. Websets facilitates in-depth analysis of market trends and competitor landscapes, empowering you to make informed comparisons and strategic adjustments.

- Adjust Strategies: Based on your assessment, implement necessary modifications to your procurement strategies. This may involve refining your data sources, altering your analytical approach, or concentrating on different types of alternative data. Leveraging Websets' customizable search solutions can enhance your ability to adapt strategies to target specific industries or candidate profiles more effectively.

- Document Learnings: Maintain a comprehensive record of what proves effective and what does not, fostering continuous improvement in your procurement strategies. By utilizing insights gained from Websets, you can establish a robust documentation process that informs future sourcing efforts.

Conclusion

Mastering alternative data for venture capital sourcing is not just beneficial; it is essential in today's rapidly evolving investment landscape. By harnessing non-traditional information sources, investors gain critical insights that enhance their decision-making processes and provide a competitive edge. The effective use of alternative data identifies promising startups and anticipates market shifts, proving invaluable for successful venture capital strategies.

This article underscores the significance of various types of alternative data, including:

- social media metrics

- web traffic data

- job postings

- financial transactions

Each type offers unique insights that inform investment decisions, guiding investors toward lucrative opportunities. Moreover, integrating these data sources into sourcing strategies through defined objectives and advanced analytical tools can significantly enhance investment effectiveness. Continuous evaluation and refinement of these strategies ensure sustained success in a dynamic market.

Ultimately, embracing alternative data represents a necessary evolution in venture capital sourcing, not merely a trend. Investors must actively seek out and integrate these insights into their practices, as doing so can lead to superior investment outcomes and a deeper understanding of market dynamics. By adopting these strategies, venture capitalists can position themselves at the forefront of innovation and opportunity, ready to capitalize on the next wave of growth in the industry.

Frequently Asked Questions

What is alternative data in the context of venture capital?

Alternative data refers to non-traditional sources of information that provide valuable insights into market trends, consumer behavior, and company performance. In venture capital, this includes data from social media activity, web traffic, satellite imagery, and more.

How can alternative data benefit venture capital investors?

By leveraging alternative data, investors can gain a competitive edge by identifying promising startups and market shifts before they are apparent through conventional sources. This has been shown to lead to better investment strategies and increased alpha generation.

What evidence supports the effectiveness of alternative data in venture capital?

Companies that utilize diverse datasets have reported a 10% increase in alpha generation over five years. Additionally, hedge funds that integrate non-traditional data have achieved annual returns 3% higher than those relying solely on traditional sources.

What is the projected growth of the alternative information market?

The alternative information market is projected to reach $273 billion by 2032, indicating its increasing relevance in the venture capital sector.

Why is it important to understand alternative data for venture capital sourcing?

Understanding alternative data is crucial for enhancing sourcing strategies, allowing investors to identify lucrative investment opportunities and navigate the evolving market landscape effectively.

What is the expected role of alternative data in venture capital by 2025?

By 2025, the role of alternative data for venture capital sourcing and decision-making is expected to be paramount, significantly influencing how investment opportunities are identified and evaluated.