Overview

Detecting companies with alternative data is essential for achieving sales success. This approach allows organizations to assess potential risks and align with their corporate values, particularly in terms of ESG compliance. By leveraging alternative information—such as social media and news analytics—sales teams are empowered to make informed decisions. This ultimately enhances lead generation and market positioning. However, navigating challenges like privacy and compliance remains critical.

The integration of alternative data not only informs strategy but also positions companies to respond proactively to market dynamics. As organizations strive for competitive advantage, the ability to harness these insights becomes increasingly vital. Engaging with alternative data enables sales professionals to identify opportunities and mitigate risks effectively.

In conclusion, the strategic use of alternative data is not just a trend; it is a necessity for modern sales teams. By embracing these insights, organizations can enhance their market positioning while ensuring alignment with their core values. Are you ready to leverage alternative data for your sales strategy?

Introduction

Alternative data is transforming the landscape of risk assessment and opportunity identification for businesses, particularly in the crucial area of Environmental, Social, and Governance (ESG) compliance. By leveraging unconventional sources like social media and news articles, organizations can uncover vital insights into potential partners and competitors, thereby refining their sales strategies. Yet, as companies seek to harness this rich information, they confront a pivotal question: how can they effectively integrate alternative data into their decision-making processes while navigating the intricate challenges of privacy and compliance?

Understand Alternative Data in ESG Risk Detection

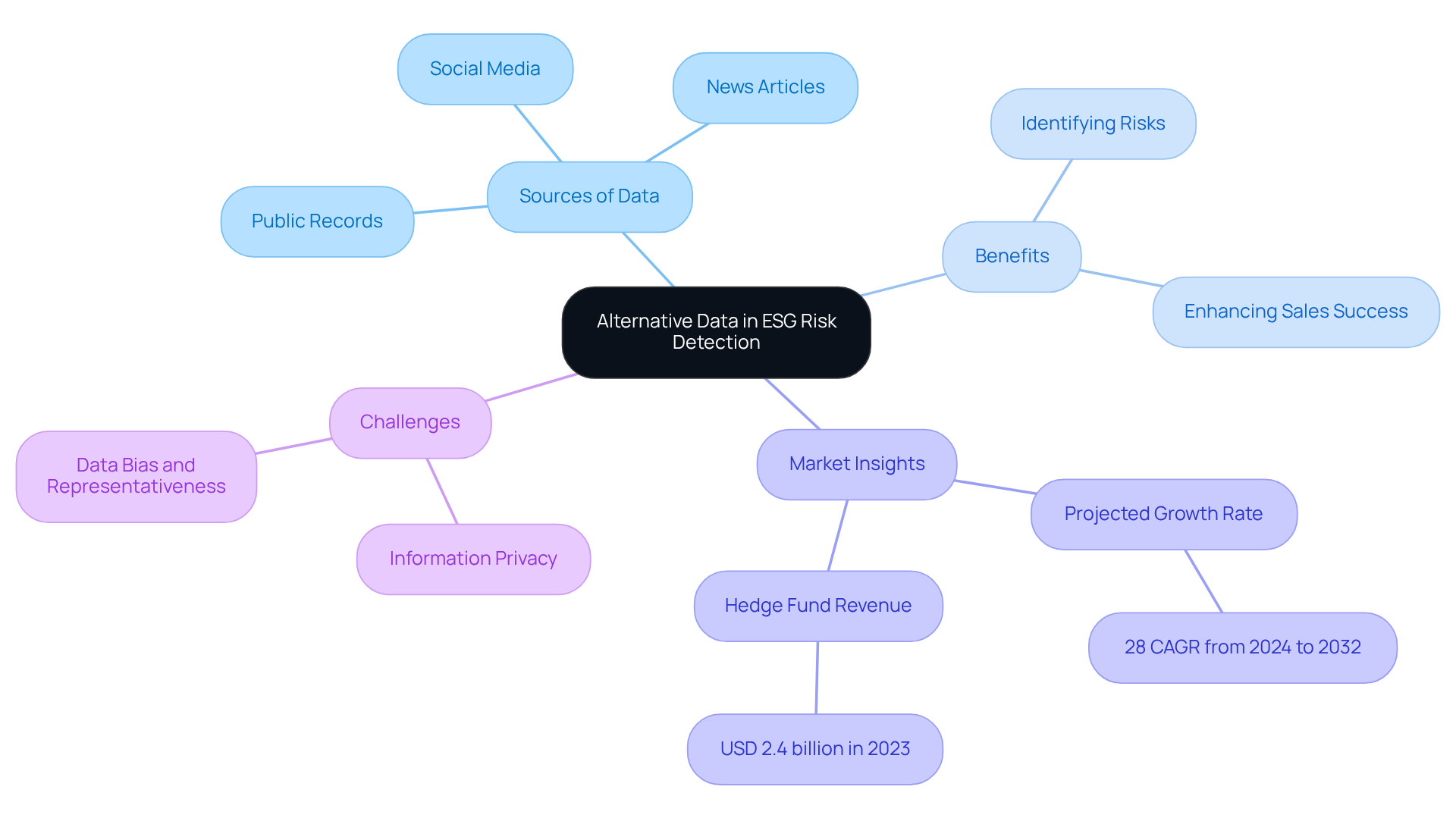

Alternative information encompasses non-traditional sources that yield valuable insights into a company's performance and risk profile, particularly regarding Environmental, Social, and Governance (ESG) compliance. This data includes information from social media, news articles, and public records, which collectively signify a company's adherence to ESG principles. By leveraging Websets' enterprise-grade AI-driven web search solutions, business teams can pinpoint organizations that may pose reputational risks or align with their corporate values. For instance, companies facing negative media scrutiny related to environmental practices may be flagged as potential risks, whereas those demonstrating positive community engagement are regarded as more favorable partners. This nuanced understanding empowers professionals in commerce to make informed decisions when targeting leads, ultimately enhancing their success in transactions.

The impact of diverse information on sales success is particularly pronounced in 2025, as organizations increasingly recognize the necessity of data-driven decision-making. Industry insights indicate that detecting companies with alternative data can significantly enable them to outpace their competitors, with an anticipated market growth rate of 28% from 2024 to 2032. Notably, hedge fund managers generated approximately USD 2.4 billion in market revenue in 2023 by employing non-traditional information for investment strategies.

Industry executives underscore the importance of alternative information for sales teams. One expert articulated that 'data is absolutely crucial to making smart business decisions,' emphasizing its role in identifying potential leads and evaluating risks. Numerous real-world examples abound, showcasing how detecting companies with alternative data allows companies to effectively integrate alternative information into their ESG compliance strategies to bolster their market positioning and sales outcomes. Specific case studies illustrate how Websets' AI-driven tools, including its comprehensive search for professionals and market research capabilities, have been successfully harnessed to enhance information for targeted results. However, organizations must also navigate challenges such as information privacy and compliance issues when utilizing alternative data. By understanding and employing diverse information, sales teams can adeptly maneuver through the complexities of the modern business landscape, ensuring they focus on the right leads while aligning with their organizational principles.

Implement Effective Strategies for Utilizing Alternative Data

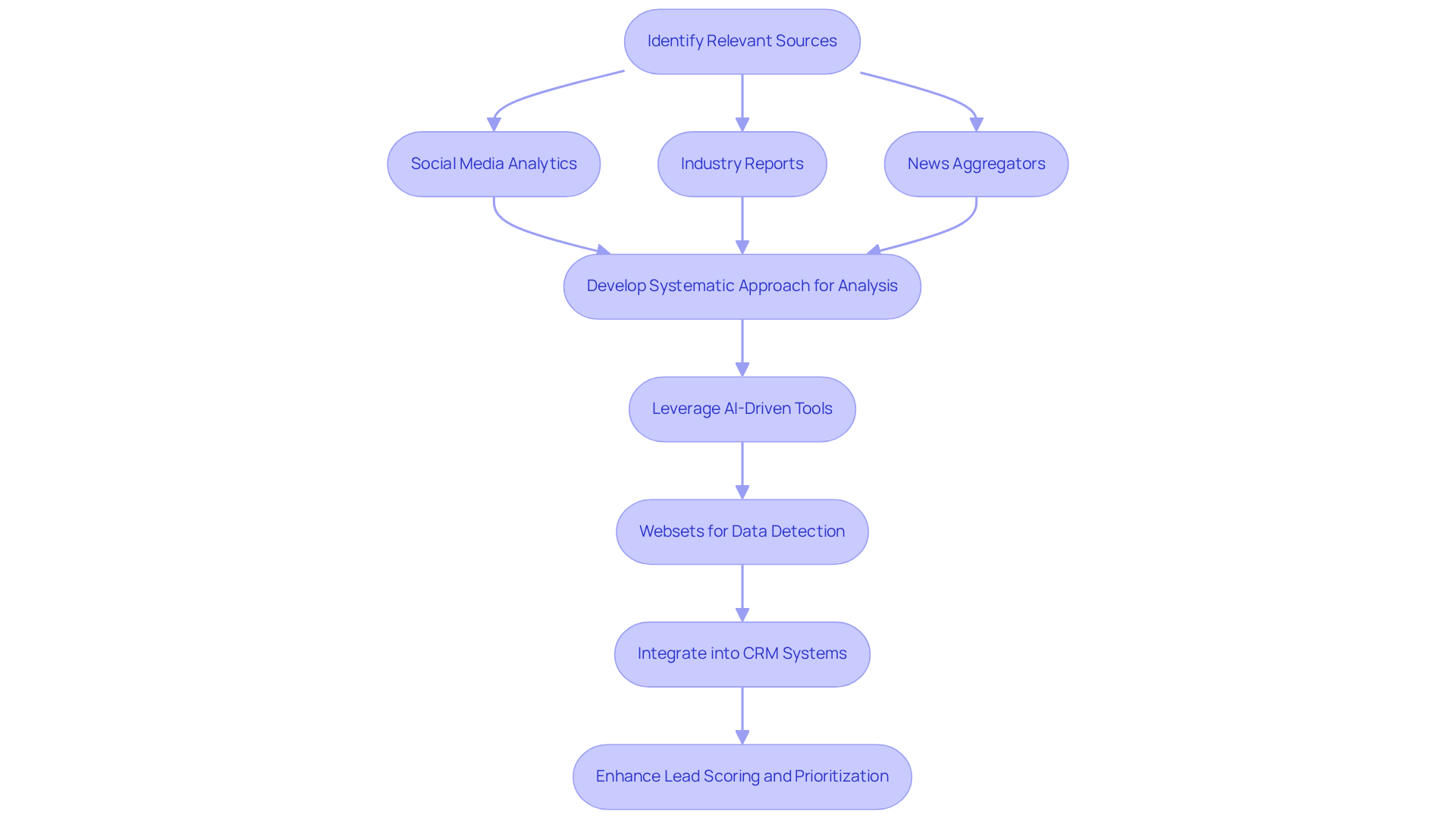

To effectively harness alternative information, sales teams must first identify relevant resource sources that align with their target market. This includes:

- Social media analytics

- Industry reports

- News aggregators

Once these sources are pinpointed, teams should develop a systematic approach for gathering and analyzing this information. For instance, leveraging AI-driven tools like Websets can significantly streamline the process of detecting companies with alternative data by sifting through extensive datasets to discover those that meet specific criteria, such as:

- Notable firms in Series A funding

- Companies exhibiting substantial growth potential

Moreover, integrating this information into CRM systems can enhance lead scoring and prioritization, allowing sales teams to focus their efforts on the most promising prospects. Regular practice in interpreting and analyzing information empowers teams to make informed decisions that refine their marketing strategies, utilizing Websets' advanced search features for comprehensive market research.

Monitor and Adapt Alternative Data Practices for Ongoing Success

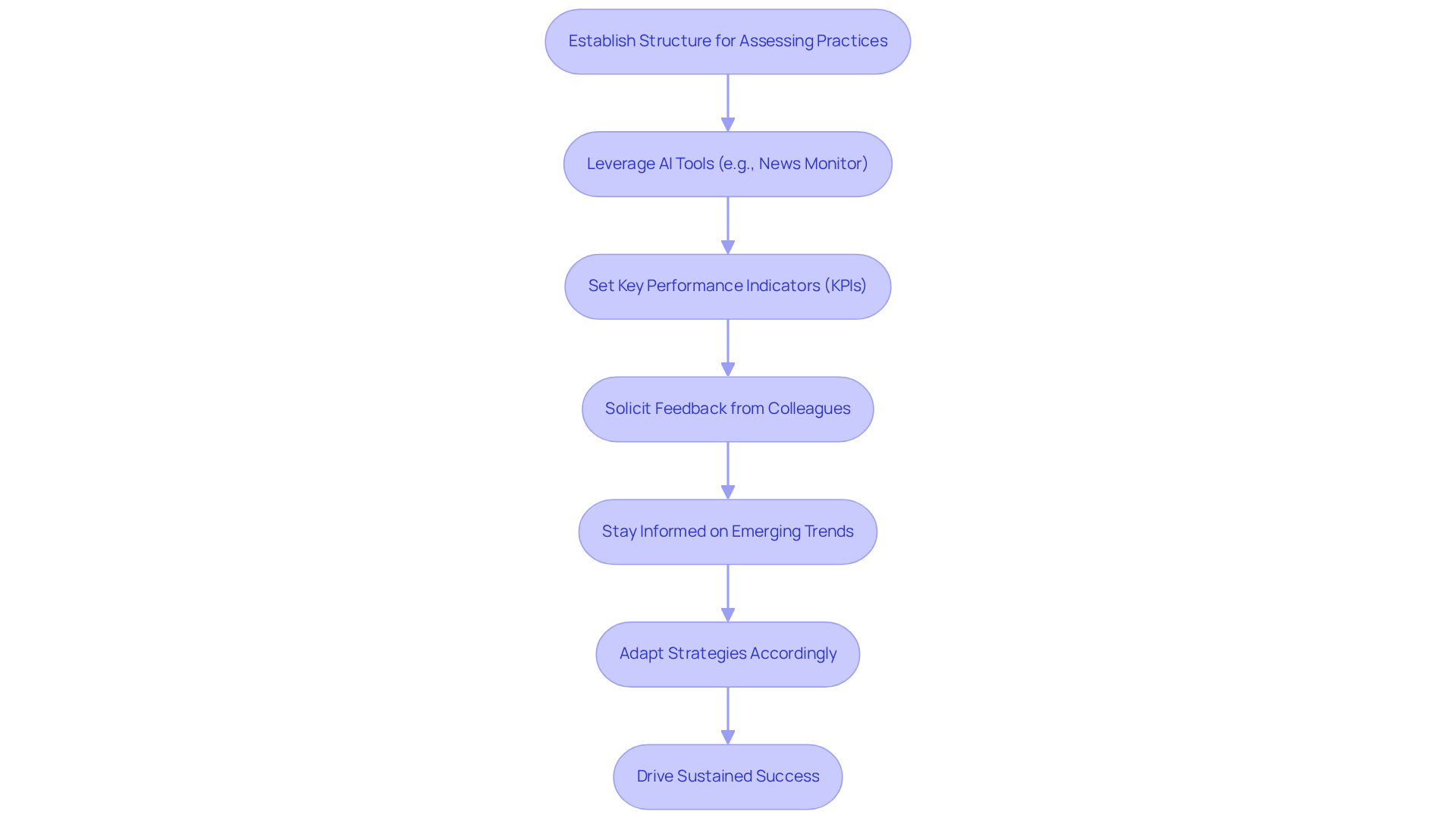

Sales groups must establish a robust structure for routinely assessing their information practices to maintain effectiveness. By leveraging Websets' AI-driven tools, such as the News Monitor for real-time updates on science, politics, finance, and startup funding, teams can significantly enhance lead generation and market insights.

Establishing key performance indicators (KPIs) to evaluate the impact of these diverse information sources on sales outcomes is crucial. Regularly soliciting feedback from colleagues on the usability and effectiveness of these sources can yield valuable insights for improvement.

Furthermore, staying informed about emerging trends is essential for detecting companies with alternative data and ESG factors. As new data sources emerge or as regulations regarding ESG reporting evolve, teams must adapt their strategies accordingly.

By fostering a culture of continuous learning and adaptation, and utilizing Websets' advanced tools, sales teams can enhance their effectiveness and drive sustained success.

Conclusion

The integration of alternative data into sales strategies transcends mere trend; it represents a transformative approach that can significantly enhance decision-making and competitive advantage. By understanding and utilizing non-traditional data sources, companies can better assess Environmental, Social, and Governance (ESG) risks while identifying promising leads. This strategic use of diverse information empowers sales teams to align their efforts with corporate values, ultimately driving success in a rapidly evolving marketplace.

Key insights from the article underscore the importance of leveraging AI-driven tools, such as Websets, to sift through vast datasets. This capability enables sales professionals to pinpoint high-potential companies and assess their ESG compliance effectively. The discussion emphasizes the necessity of establishing effective practices for data collection and analysis, as well as the importance of continuously monitoring and adapting these strategies to maintain relevance and effectiveness. Real-world examples illustrate how organizations have successfully harnessed alternative data to improve lead generation and market positioning.

Embracing alternative data offers a powerful avenue for businesses to navigate the complexities of modern sales landscapes. Sales teams are encouraged to adopt a culture of continuous learning and adaptation, utilizing advanced tools to refine their strategies and enhance their effectiveness. By doing so, organizations not only improve their sales outcomes but also align their practices with broader societal values, ensuring they remain resilient and competitive in the face of ongoing change.

Frequently Asked Questions

What is alternative data in the context of ESG risk detection?

Alternative data refers to non-traditional sources of information that provide insights into a company's performance and risk profile, particularly concerning Environmental, Social, and Governance (ESG) compliance. This includes data from social media, news articles, and public records.

How can businesses utilize alternative data for decision-making?

Businesses can leverage enterprise-grade AI-driven web search solutions, like those offered by Websets, to identify organizations that may pose reputational risks or align with their corporate values, aiding in informed decision-making when targeting leads.

What are some examples of how alternative data can affect a company's reputation?

Companies facing negative media scrutiny related to their environmental practices may be flagged as potential risks, while those showing positive community engagement are viewed as more favorable partners.

What is the expected market growth rate for alternative data from 2024 to 2032?

The anticipated market growth rate for alternative data is 28% from 2024 to 2032.

How did hedge fund managers benefit from alternative data in 2023?

Hedge fund managers generated approximately USD 2.4 billion in market revenue in 2023 by using non-traditional information for their investment strategies.

Why is alternative information considered crucial for sales teams?

Alternative information is crucial for sales teams as it helps in identifying potential leads and evaluating risks, ultimately leading to smarter business decisions.

What challenges do organizations face when using alternative data?

Organizations must navigate challenges such as information privacy and compliance issues when utilizing alternative data.

How can Websets' AI-driven tools assist companies in integrating alternative data?

Websets' AI-driven tools, including comprehensive professional searches and market research capabilities, can enhance information for targeted results, helping companies integrate alternative data into their ESG compliance strategies.