Overview

Investors can significantly enhance their early deal origination skills through the strategic use of an API. This tool is crucial for effectively identifying and securing funding opportunities. By leveraging this API, investors can boost their efficiency, thanks to comprehensive data aggregation, real-time alerts, and advanced filtering capabilities. These features ultimately lead to more informed investment decisions and improved financial outcomes.

Consider the impact of having immediate access to critical data. With real-time alerts, investors can act swiftly on emerging opportunities, ensuring they stay ahead of the competition. Advanced filtering allows for tailored searches, enabling investors to focus on the most relevant prospects. This not only saves time but also enhances the quality of investment choices.

In a landscape where every second counts, the ability to make informed decisions quickly is invaluable. By utilizing this API, investors can transform their approach to deal origination, leading to better financial results. Are you ready to take your investment strategy to the next level? Embrace the power of technology and watch your opportunities expand.

Introduction

Understanding the complexities of deal origination is crucial for any investor aiming for success in today’s competitive market. The early deal origination API presents a powerful method for identifying and securing funding opportunities, equipping investors with essential tools to enhance their decision-making processes. But as the landscape shifts, how can investors seamlessly integrate this technology into their workflows while addressing potential challenges?

This guide explores the key features, benefits, and strategies for mastering the early deal origination API. By doing so, it empowers investors to seize opportunities and refine their investment strategies. With the right approach, you can navigate this evolving terrain and position yourself for success.

Define Deal Origination and Its Importance for Investors

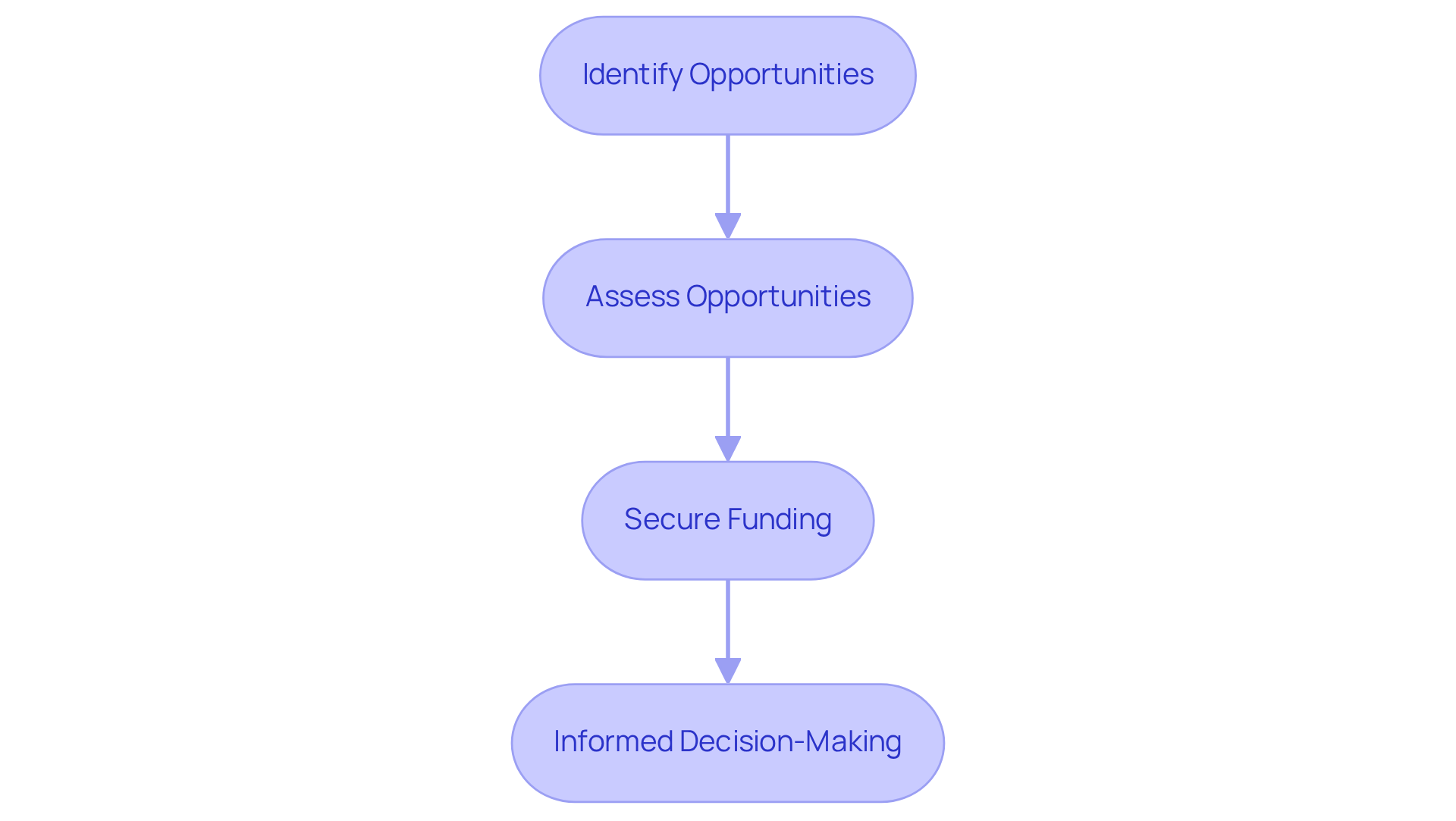

The early deal origination API for investors is a critical process through which they identify, assess, and secure potential funding opportunities. This structured method significantly influences the funding lifecycle, impacting both the quality and quantity of opportunities available to financiers. By mastering effective opportunity origination with the early deal origination API for investors, they can tap into a broader array of prospects, enabling informed decision-making based on comprehensive market insights.

With Websets' advanced AI-powered search engine, including features like the Research Agentic API and high-compute, agentic search, investors can elevate their data discovery and technical insights. This capability is particularly advantageous in navigating the competitive landscape of opportunity, where timing and precise information are paramount.

Imagine having the tools to enhance your portfolio performance and achieve greater returns. By utilizing the early deal origination API for investors, Websets allow investors to refine their approach to opportunity origination, ensuring they stay ahead in a fast-paced market. Don't miss out on the chance to transform your investment strategy—leverage the power of Websets today.

Explore the Features of Early Deal Origination APIs

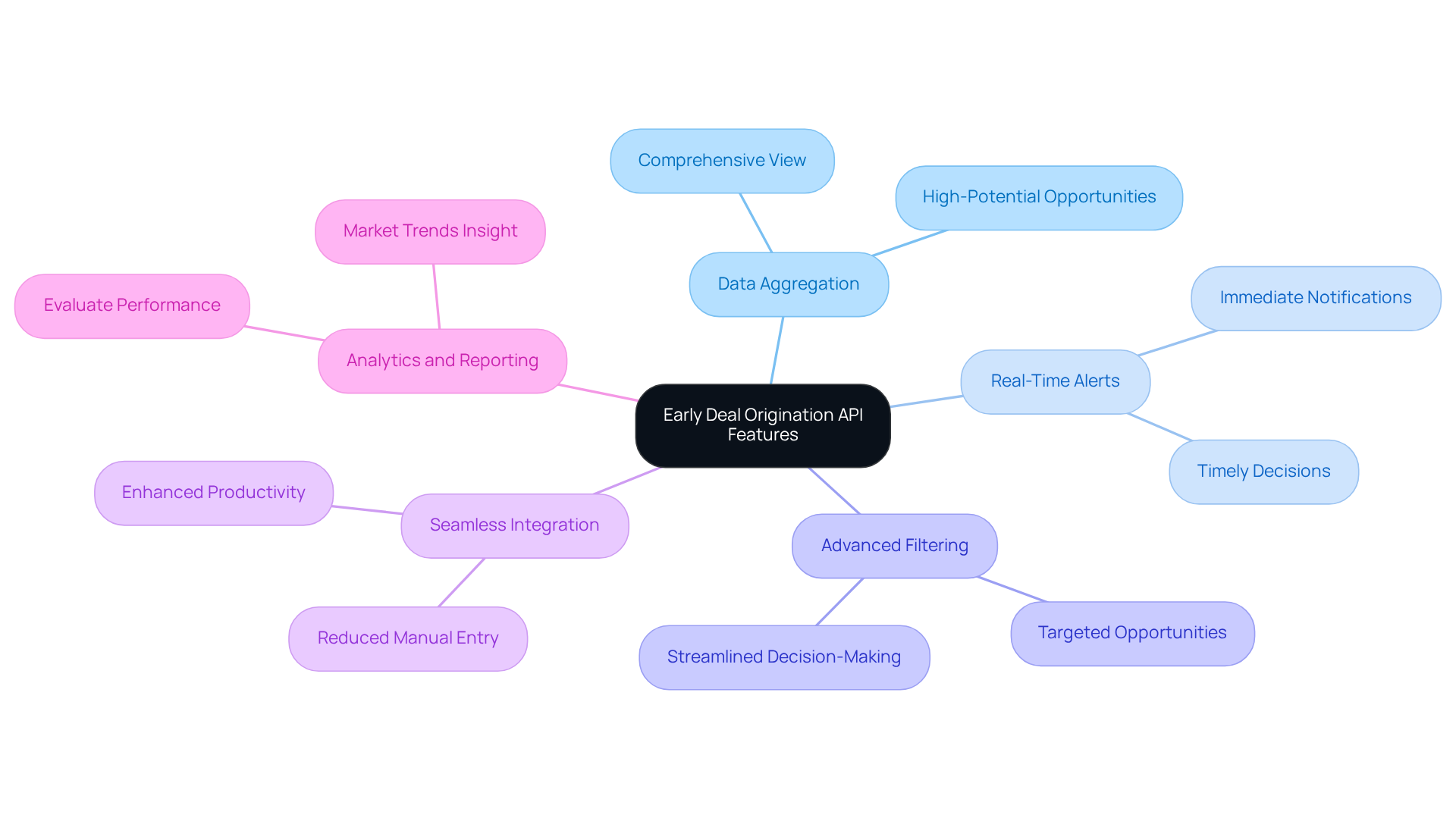

The early deal origination API for investors revolutionizes the funding process with a suite of powerful features. These capabilities not only enhance efficiency but also empower investors to make informed decisions that can significantly impact their financial outcomes.

-

Data Aggregation stands out as a key functionality. By consolidating information from various sources, the early deal origination API for investors provides a comprehensive view of potential deals. This holistic perspective is essential; firms leveraging aggregated data can pinpoint high-potential opportunities more effectively, utilizing over 50 data points to extract valuable investment signals.

-

Real-Time Alerts further enhance the investment landscape. With immediate notifications about new opportunities, investors can make timely decisions, gaining a competitive edge in fast-paced markets. How often do you miss out on a great deal simply because you weren’t informed in time?

-

Advanced Filtering capabilities allow users to sift through deals based on specific criteria such as industry, size, and geographical location. This targeted approach ensures that only the most relevant opportunities are presented, streamlining the decision-making process and saving valuable time.

-

Moreover, the early deal origination API for investors offers seamless integration with existing systems. By connecting effortlessly with current CRM and asset management platforms, they enhance productivity, streamline workflows, and reduce the burden of manual data entry. Imagine the efficiency gains when your systems work in harmony.

-

Finally, integrated Analytics and Reporting tools empower investors to evaluate transaction performance and market trends. This data-driven insight facilitates informed strategic decisions, allowing investors to navigate the complexities of the market with confidence.

By harnessing these features, investors can significantly enhance their transaction initiation methods using an early deal origination API for investors, leading to better financial outcomes and a more effective approach to discovering and seizing opportunities.

Integrate the API into Your Investment Workflow

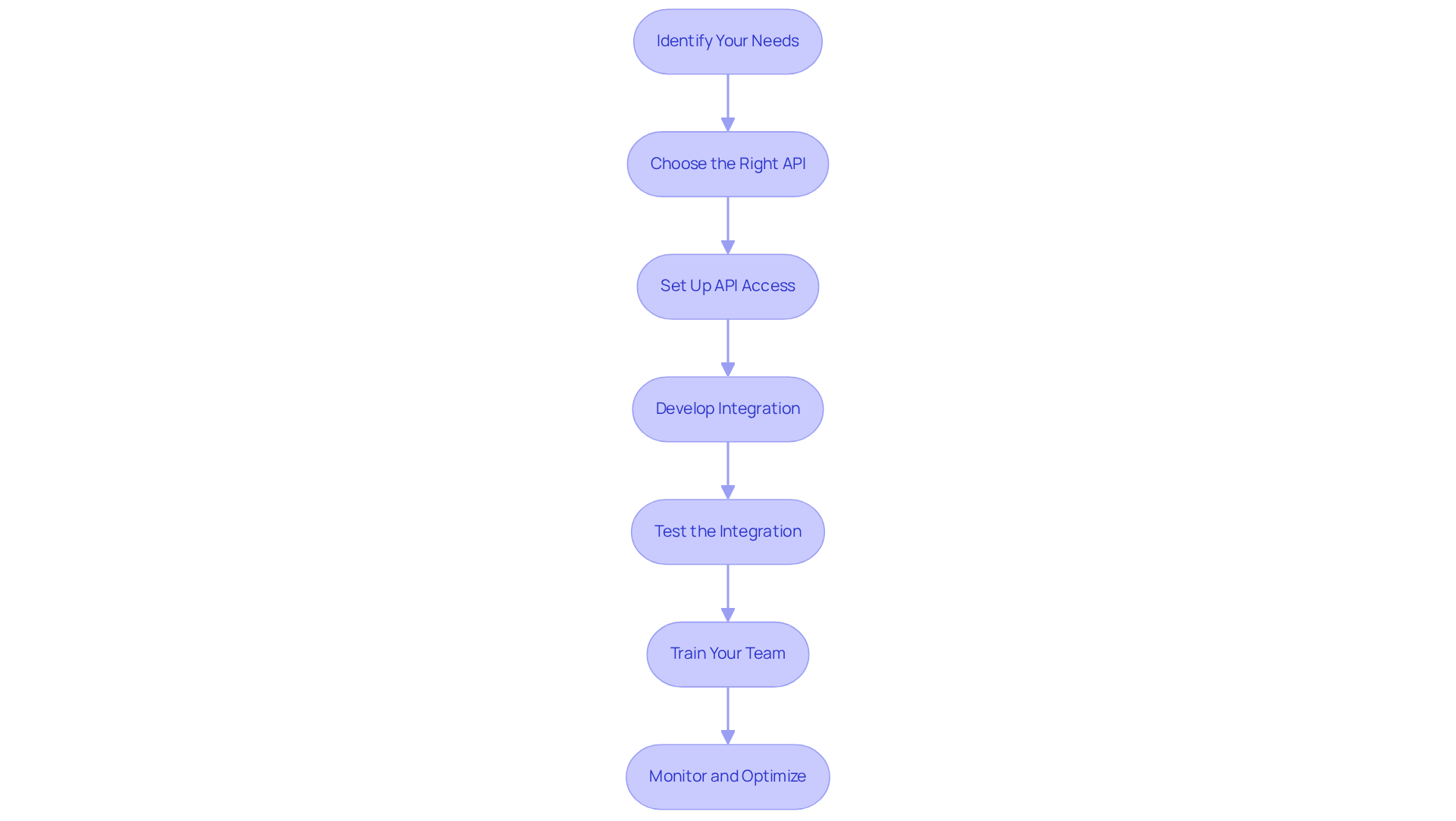

Incorporating an early deal origination API for investors into your investment workflow is not just a choice; it’s a strategic imperative for optimizing efficiency and effectiveness. Here’s how to do it:

- Identify Your Needs: Begin by evaluating your current deal sourcing methods. What specific areas could an API streamline? Where can it enhance data accuracy?

- Choose the Right API: Conduct thorough research to find an API that aligns with your unique requirements. Consider the quality of data sources, available features, and how easily it integrates with your existing systems.

- Set Up API Access: Obtain the necessary API keys and access credentials from the provider. Dive into the documentation to understand the integration process and capabilities.

- Develop Integration: Work closely with your IT team or a developer to integrate the API into your systems. This may involve coding and configuring the API to ensure it functions seamlessly within your workflow.

- Test the Integration: Conduct comprehensive testing to confirm that the API accurately pulls data and that all features work as intended. This step is crucial to avoid disruptions in your financial activities.

- Train Your Team: Empower your team with the knowledge to use the new API effectively. Offer training sessions that cover its features, benefits, and best practices for maximizing its potential.

- Monitor and Optimize: After integration, keep a close eye on the API’s performance. Regularly assess its impact on your financial workflow and make adjustments as needed to enhance its effectiveness.

By following these steps, investors can seamlessly incorporate the early deal origination API for investors into their processes, significantly boosting their ability to identify and seize financial opportunities. Firms that have embraced API-driven solutions report up to 15 times more actionable insights, highlighting the transformative potential of these technologies in investment workflows.

Troubleshoot Common Issues with API Integration

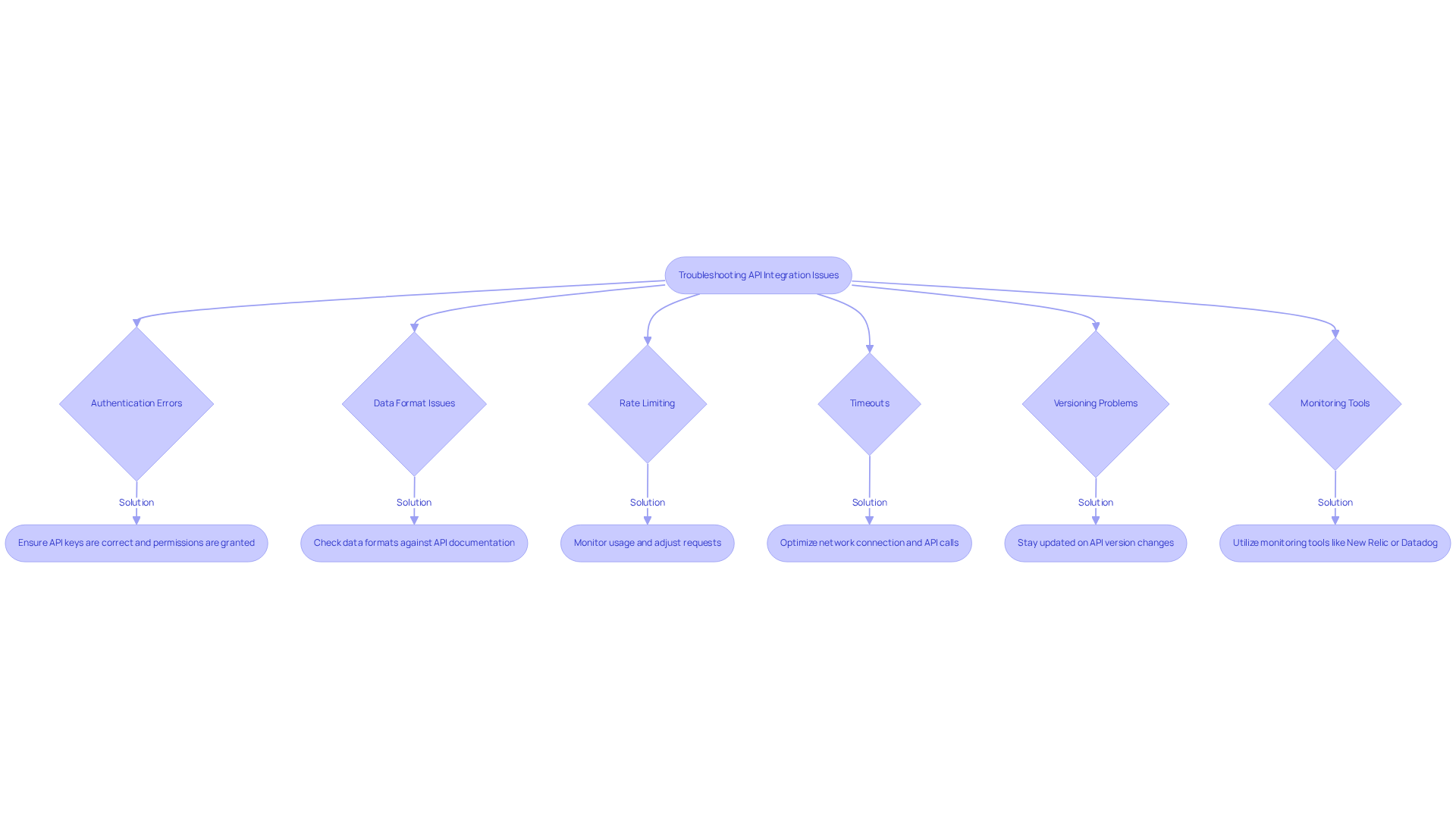

Integrating an early deal origination API for investors can pose significant challenges. However, with the right strategies, these hurdles can be effectively navigated. Here are essential troubleshooting tips to help you tackle common issues:

- Authentication Errors: Ensure your API keys are entered correctly and that you have the necessary permissions for access. Authentication failures are a frequent issue, often stemming from expired tokens or incorrect configurations. In fact, 401 Unauthorized errors typically cluster around token expiration times or after security policy updates.

- Data Format Issues: Confirm that the data being sent and received adheres to the expected formats. Refer to the API documentation for specific details on required formats to avoid common pitfalls.

- Rate Limiting: Many APIs enforce limits on the number of requests within a specified timeframe. Monitoring your usage is crucial; adjust your requests to prevent exceeding these limits. Notably, 59% of organizations report that effective integrations improve their close rates.

- Timeouts: If requests are timing out, investigate your network connection and consider optimizing your API calls. Implementing asynchronous processing can help mitigate delays and enhance responsiveness.

- Versioning Problems: APIs frequently undergo updates that may alter their functionality. Stay informed about version changes and update your integration accordingly to ensure compatibility and prevent disruptions.

- Monitoring Tools: Utilize monitoring tools like New Relic or Datadog to keep track of your API integration health. These tools can help identify issues before they escalate, ensuring smoother operations.

By proactively addressing these common issues and leveraging expert insights—'Many API hiccups can be resolved pretty quickly with the right approach'—investors can facilitate a smoother integration process and fully leverage the advantages of the early deal origination API for investors.

Conclusion

Mastering the early deal origination API for investors is crucial for navigating the complexities of today’s investment landscape. Leveraging such APIs can significantly transform the deal sourcing process, equipping investors with the necessary tools to efficiently identify and capitalize on lucrative opportunities. By adopting these technologies, financiers can enhance their decision-making capabilities, ensuring they remain competitive in a rapidly evolving market.

This guide has explored the invaluable features of the early deal origination API, including:

- Data aggregation

- Real-time alerts

- Advanced filtering

- Seamless integration with existing systems

Each of these functionalities empowers investors to streamline their workflows and make informed decisions based on comprehensive market insights. Moreover, the step-by-step approach to integrating the API into investment processes illustrates the practicality of adopting this technology, while troubleshooting tips ensure that common challenges can be effectively managed.

Ultimately, embracing the early deal origination API is not just about keeping pace; it’s about seizing opportunities that can lead to substantial financial growth. Investors are encouraged to take action, explore these powerful tools, and integrate them into their strategies to unlock a wealth of potential in their investment journeys. By doing so, they can position themselves for success in an increasingly competitive environment, ultimately achieving better outcomes and maximizing returns.

Frequently Asked Questions

What is deal origination?

Deal origination is a critical process through which investors identify, assess, and secure potential funding opportunities. It significantly influences the funding lifecycle and impacts the quality and quantity of opportunities available to financiers.

Why is deal origination important for investors?

Deal origination is important because it enables investors to tap into a broader array of prospects, allowing for informed decision-making based on comprehensive market insights.

How can the early deal origination API benefit investors?

The early deal origination API helps investors refine their approach to opportunity origination, enhancing their ability to discover and secure funding opportunities in a competitive landscape.

What tools does Websets provide for deal origination?

Websets provides an advanced AI-powered search engine, including features like the Research Agentic API and high-compute, agentic search, which elevate data discovery and technical insights for investors.

How does Websets' technology impact portfolio performance?

By using Websets' early deal origination API, investors can enhance their portfolio performance and achieve greater returns by accessing timely and precise information about funding opportunities.

What should investors do to improve their investment strategy?

Investors should leverage the power of Websets to transform their investment strategy by mastering effective opportunity origination and staying ahead in a fast-paced market.