Overview

The article highlights the critical importance of Jobs-to-Investment Correlation Analysis as an essential tool for businesses aiming to comprehend the intricate relationship between job market dynamics and investment performance. This understanding is vital for strategic decision-making. It elaborates on various methodologies for conducting the analysis, underscores the significant impact of job creation on financial returns, and offers a step-by-step guide for interpreting results. By applying these insights, businesses can develop informed financial strategies that drive success.

Introduction

Understanding the intricate relationship between job market dynamics and investment performance can be a game-changer for businesses navigating economic uncertainties. The Jobs-to-Investment Correlation Analysis is a vital tool, empowering companies to make informed decisions that align workforce planning with financial strategies. As job creation fluctuates and market conditions evolve, organizations must consider: how can they effectively leverage this analysis to enhance their strategic outcomes? This article delves into the methodologies and practical steps for mastering Jobs-to-Investment Correlation Analysis, equipping readers with the insights needed to thrive in a rapidly changing economic landscape.

Define Jobs-to-Investment Correlation Analysis

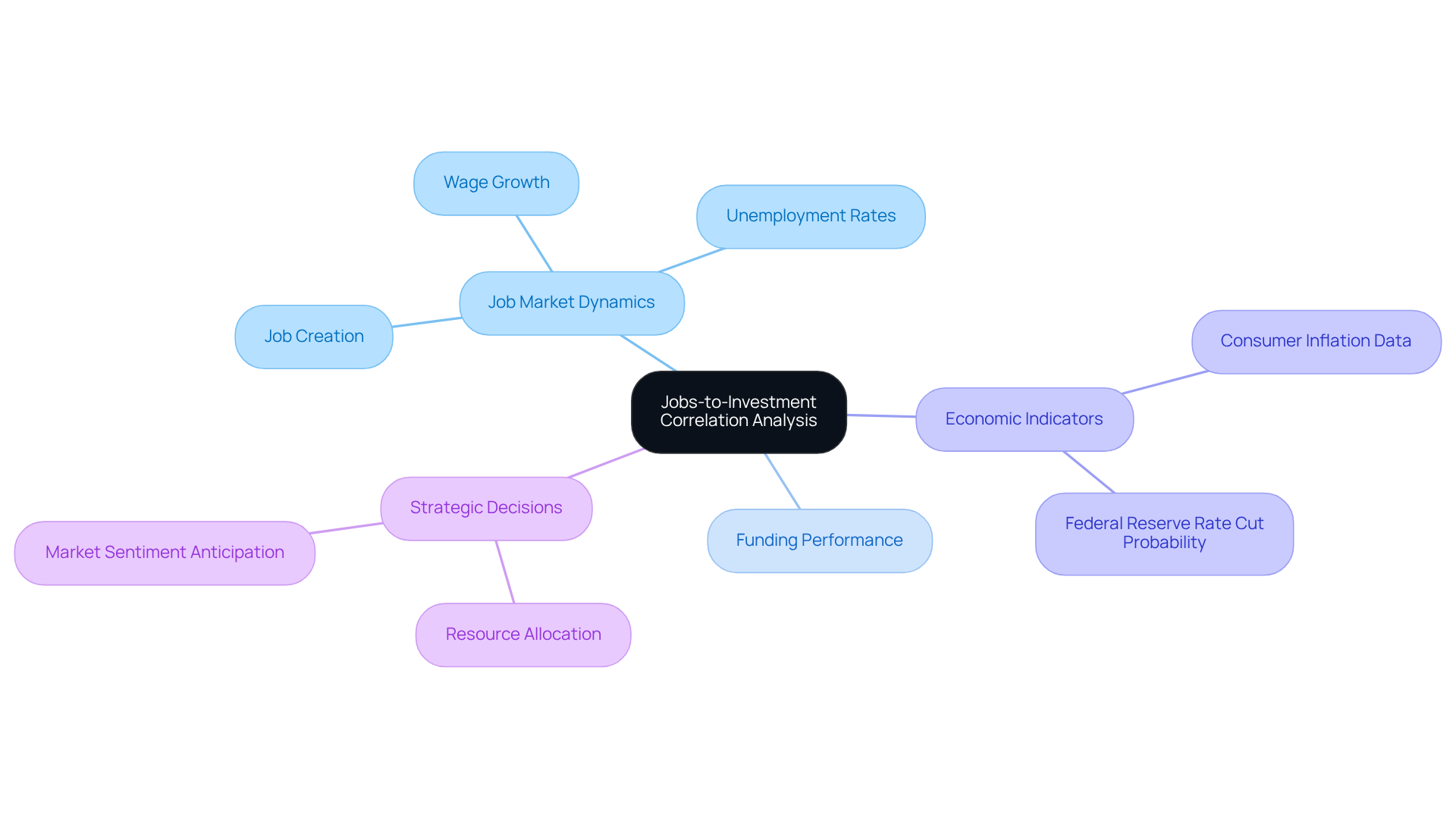

Jobs-to-Investment Correlation Analysis represents a critical statistical examination of the interplay between job market dynamics and funding performance. This analysis seeks to uncover how fluctuations in job creation, unemployment rates, and wage growth are connected to the jobs-to-investment correlation analysis and its impact on shifts in returns and broader market trends. By understanding the jobs-to-investment correlation analysis, businesses can make informed strategic decisions regarding resource allocation and anticipate market movements based on employment data. For example, a robust jobs report often signals economic growth, prompting investors to increase their funding in specific sectors. Conversely, a downturn in job listings may necessitate a more cautious approach to financial strategies. This jobs-to-investment correlation analysis is crucial for aligning workforce planning with funding strategies, ultimately enhancing financial outcomes.

As the job market evolves, particularly in 2025, the jobs-to-investment correlation analysis will highlight the increasingly significant impact of job creation on financial returns. This makes the analysis an indispensable resource for companies aiming to navigate economic fluctuations effectively. Recent data indicates a 96.6% probability that the Federal Reserve will lower its benchmark rate, which could further influence financial strategies. Moreover, insights from experts like Michael Kramer emphasize the necessity of monitoring labor market conditions, as variations in job growth can lead to considerable shifts in market sentiment and investment performance.

Explore Methodologies for Correlation Analysis

Correlation analysis encompasses a range of methodologies, each specifically designed for distinct data types and research objectives. Among the key approaches are:

-

Pearson Correlation Coefficient: A widely utilized technique, it measures the linear connection between two continuous variables, effectively identifying direct links. A Pearson coefficient approaching 1 indicates a strong positive association, whereas values near -1 suggest a strong negative association. As a statistician aptly noted, "The Pearson coefficient serves as a crucial measurement tool to evaluate linear interdependence connections between two random variables."

-

Spearman's Rank Correlation: This non-parametric alternative assesses the strength and direction of monotonic connections, making it ideal for ordinal data or non-linear associations. Particularly relevant in job market studies, where rankings and ordered categories are prevalent, Spearman's method effectively examines connections between education levels and salary expectations. Research has shown that a Spearman’s coefficient ranging from 0.4 to 0.6 signifies a moderate strength monotonic association, underscoring its importance in economic analysis.

-

Kendall's Tau: Another robust non-parametric method, Kendall's Tau measures the strength of dependence between two variables. Its resilience against outliers distinguishes it from Pearson's method, making it suitable for datasets where extreme values may skew results.

-

Regression Analysis: Going beyond mere association, this method models the relationship between a dependent variable and one or more independent variables. It provides insights into how changes in the job market can impact financial outcomes, facilitating refined strategic planning.

-

Time Series Analysis: This technique examines data points collected at specific intervals, proving invaluable for identifying trends over time. For instance, analysts can perform a jobs-to-investment correlation analysis to investigate the correlation between job growth and stock market performance, unveiling critical insights into economic dynamics.

By leveraging these methodologies, analysts can select the most appropriate strategy for their datasets and research questions, ultimately enhancing their ability to make informed financial decisions.

Conduct a Step-by-Step Jobs-to-Investment Analysis

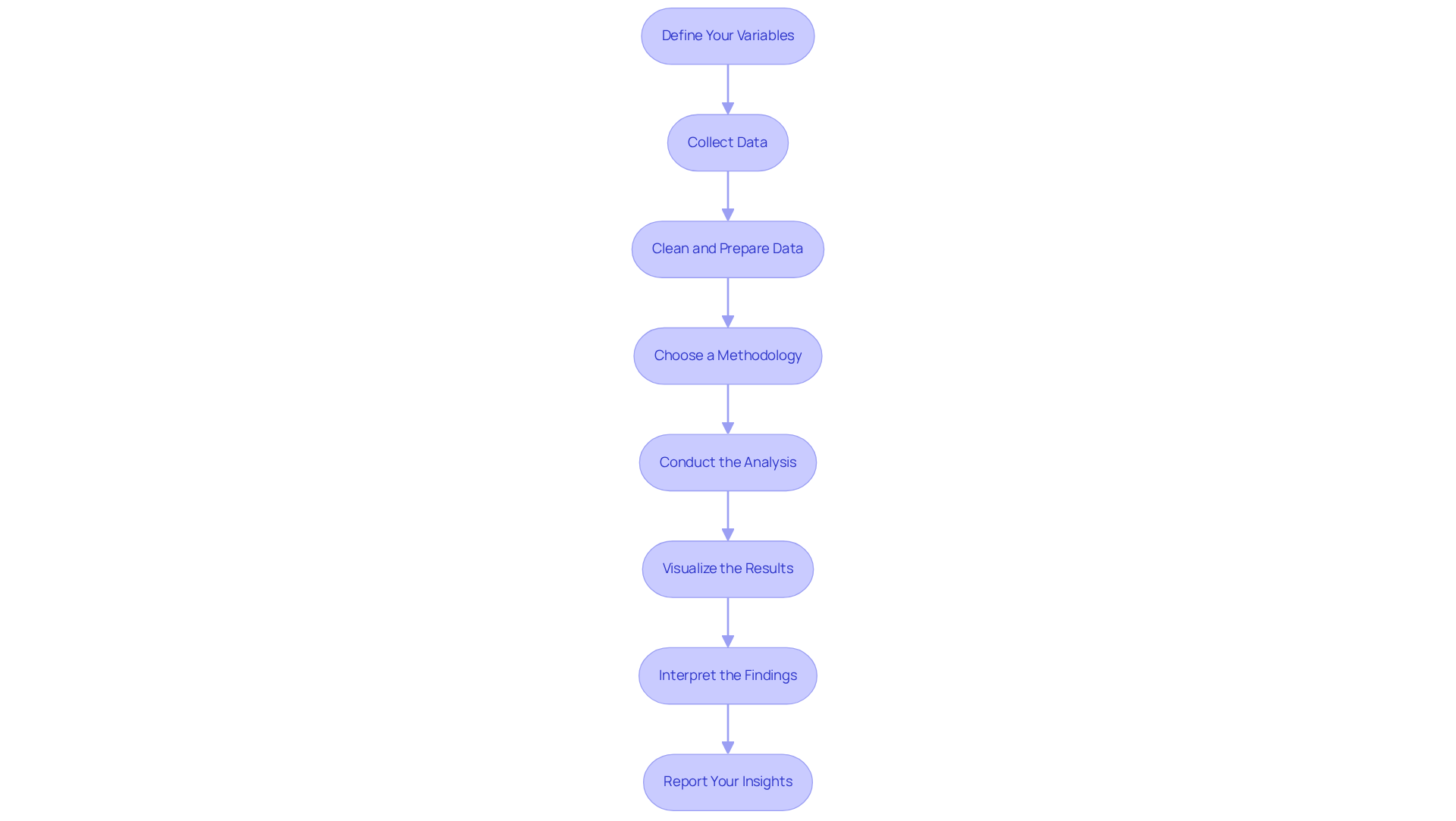

To conduct a Jobs-to-Investment Correlation Analysis, follow these essential steps:

-

Define Your Variables: Clearly identify the job market indicators to analyze, such as job postings and unemployment rates, alongside investment performance metrics like stock returns and sector performance.

-

Collect Data: Gather historical data for both sets of variables. Reliable sources include government labor statistics, financial market databases, and comprehensive economic reports. Utilizing data aggregators can enhance the breadth of your data collection, as highlighted by the importance of diverse data sources in job market analysis.

-

Clean and Prepare Data: Ensure your data is clean and formatted correctly. This involves removing outliers or anomalies that could skew results. Best practices suggest using standardized formats and consistent units to facilitate analysis.

-

Choose a Methodology: Select the suitable analysis technique based on your data type and research question. For example, apply Pearson's method for linear connections and Spearman's rank measure for ordinal data.

-

Conduct the Analysis: Utilize statistical software or tools such as Excel, R, or Python to compute the relationship coefficient between your variables. This quantifies the strength and direction of the association, providing a clear metric for analysis.

-

Visualize the Results: Create graphs or charts to illustrate the relationship effectively. Scatter plots are especially beneficial for demonstrating connections between variables, facilitating data interpretation.

-

Interpret the Findings: Analyze the results to determine the importance of the relationship. Consider the implications for financial strategies based on the strength and direction of the relationship, which can guide decision-making. For instance, with 40% of worldwide jobs vulnerable to AI, comprehending these relationships can be essential for strategic allocations.

-

Report Your Insights: Document your findings and insights, providing actionable recommendations for stakeholders. This may include recommendations for financial adjustments based on observed job market trends, supported by relevant statistics such as the projected +56% job growth in the technology sector.

By following these steps, analysts can conduct a thorough jobs-to-investment correlation analysis, leading to more informed and strategic financial choices.

Interpret Results and Apply Insights for Strategic Decisions

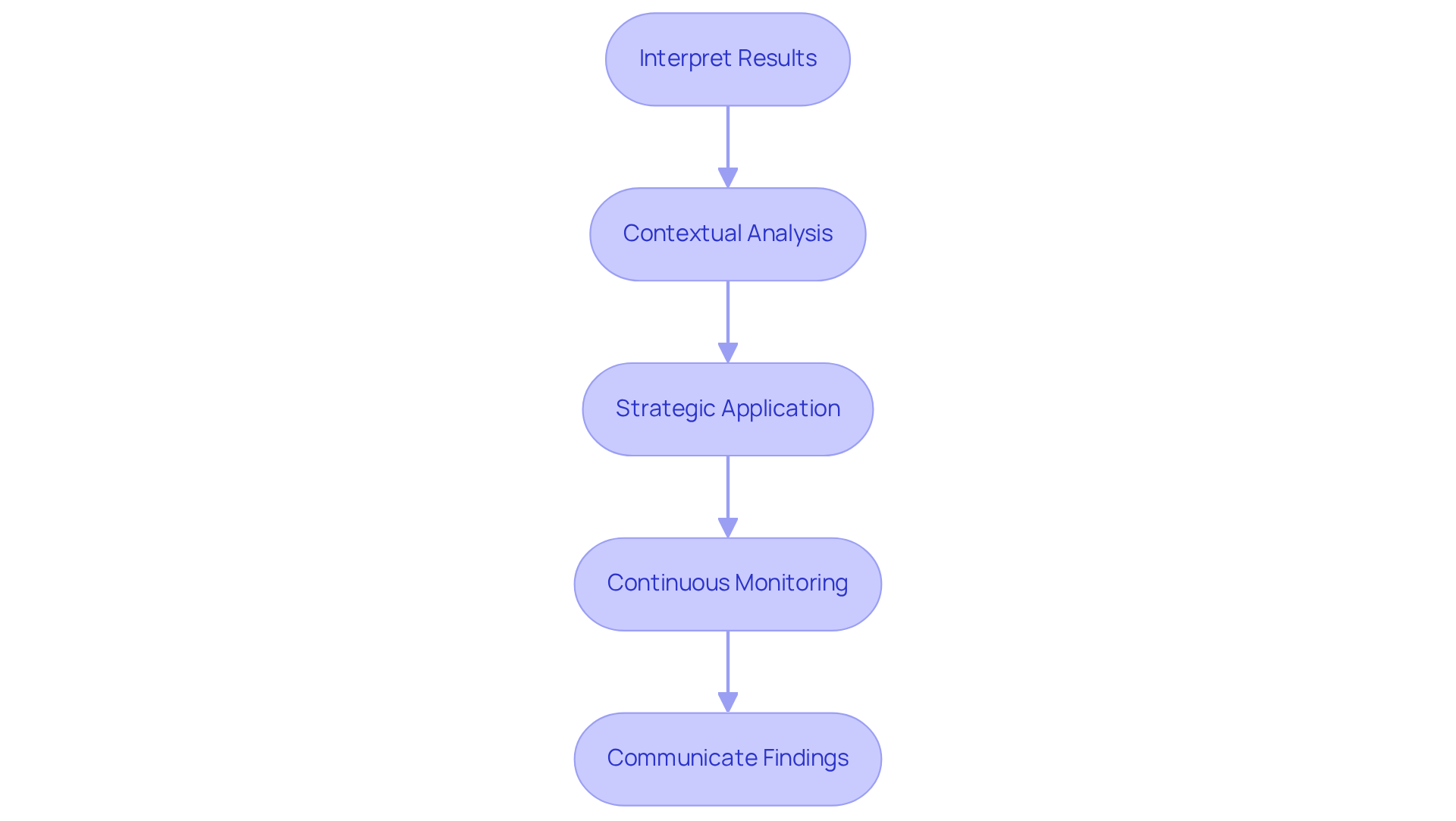

Interpreting the results of a jobs-to-investment correlation analysis necessitates a nuanced understanding of the correlation coefficient and its implications.

Correlation Coefficient Interpretation: A correlation coefficient approaching +1 signifies a strong positive connection, indicating that as job metrics improve, asset performance typically rises. In contrast, a coefficient nearing -1 reveals a strong negative connection, suggesting that enhancements in job metrics may correlate with declines in investment performance. A coefficient around 0 denotes no significant relationship.

Contextual Analysis: It is critical to consider external factors that influence this relationship, including economic conditions, industry trends, and government policies. For instance, the recent drop in anticipated job growth from 180,000 to approximately 35,000 positions highlights current economic conditions impacting the job-investment relationship. A comprehensive grasp of the broader context is essential for accurate interpretation and effective decision-making.

Strategic Application: Utilize insights from the analysis to inform strategic decisions. If a strong positive relationship is identified between job growth in a specific sector and stock performance, investors may opt to increase their funding in that sector, capitalizing on the anticipated growth.

Continuous Monitoring: Acknowledge that correlation is dynamic and can evolve over time. Regularly updating your analysis with fresh data ensures that financial strategies remain aligned with current job market trends, facilitating timely adjustments.

Communicate Findings: Effectively convey insights to relevant stakeholders, such as financial teams or company leadership. Clear communication of the analysis and its implications fosters informed decision-making throughout the organization, enhancing overall strategic alignment.

By skillfully interpreting results and leveraging insights, businesses can harness jobs-to-investment correlation analysis to refine their strategic decision-making processes, ultimately driving improved investment outcomes.

Conclusion

Understanding the intricate relationship between job market dynamics and investment performance is crucial for businesses seeking strategic success. The jobs-to-investment correlation analysis serves as a vital tool to decipher how shifts in employment metrics, such as job creation and unemployment rates, influence financial outcomes. By mastering this analysis, organizations can make informed decisions that align workforce planning with investment strategies, ultimately enhancing their financial resilience in an ever-changing economic landscape.

This article delves into various methodologies for conducting a jobs-to-investment correlation analysis, including:

- The Pearson correlation coefficient

- Spearman's rank correlation

- Kendall's Tau

- Regression analysis

- Time series analysis

Each method provides unique insights into the relationship between job market indicators and investment performance, enabling analysts to tailor their approach based on specific research objectives. A step-by-step guide outlines the essential phases of conducting this analysis, from defining variables to reporting insights, ensuring that businesses can effectively interpret and apply their findings.

Reflecting on the significance of jobs-to-investment correlation analysis, it becomes clear that continuous monitoring and adaptation to labor market conditions are essential for strategic decision-making. As economic fluctuations persist, leveraging insights from this analysis can empower organizations to navigate uncertainties and capitalize on growth opportunities. Embracing this analytical approach not only fosters better investment outcomes but also positions businesses to thrive amid evolving market dynamics.

Frequently Asked Questions

What is Jobs-to-Investment Correlation Analysis?

Jobs-to-Investment Correlation Analysis is a statistical examination that explores the relationship between job market dynamics—such as job creation, unemployment rates, and wage growth—and funding performance, helping businesses make informed decisions regarding resource allocation and anticipate market movements.

How does Jobs-to-Investment Correlation Analysis affect investment strategies?

A strong jobs report can indicate economic growth, leading investors to increase funding in certain sectors. Conversely, a decline in job listings may require a more cautious financial strategy.

Why is Jobs-to-Investment Correlation Analysis important for businesses?

It helps align workforce planning with funding strategies, enabling companies to navigate economic fluctuations effectively and enhance financial outcomes.

What trends are expected in the job market by 2025?

The analysis will show a growing impact of job creation on financial returns, making it a vital resource for companies adapting to economic changes.

What recent data is relevant to financial strategies in the context of job market analysis?

There is a 96.6% probability that the Federal Reserve will lower its benchmark rate, which could influence financial strategies related to job market conditions.

Who emphasizes the importance of monitoring labor market conditions?

Experts like Michael Kramer highlight that variations in job growth can lead to significant shifts in market sentiment and investment performance.