Overview

The article highlights the pivotal role of the Predictive Signals API in empowering venture capital (VC) firms to enhance their decision-making processes and improve deal flow. By effectively analyzing predictive signals, VC firms can prepare for seamless API integration and implement a structured approach to leverage data-driven insights. This collective effort enables them to identify high-potential startups and optimize their investment strategies, ultimately leading to more informed decisions and successful outcomes.

Introduction

The venture capital landscape is undergoing a remarkable transformation, with data-driven insights emerging as the foundation of effective investment strategies. The Predictive Signals API equips VC firms with a robust tool to pinpoint promising startups and refine funding decisions through essential metrics such as hiring trends and market activity. Yet, the real challenge lies in seamlessly integrating this API into existing systems and harnessing its data to bolster decision-making.

How can firms adeptly navigate this intricate process to maintain competitiveness and seize emerging opportunities?

Understand Predictive Signals and Their Importance for VC Firms

The predictive signals API for VC firms serves as crucial data-driven markers that empower venture capital firms to pinpoint promising funding opportunities and evaluate the viability of startups. These signals include a range of metrics, such as hiring trends, funding rounds, and overall market activity. Understanding the implications of these signals enables VC firms to make informed decisions, prioritize leads, and allocate resources effectively.

For instance, a significant uptick in hiring at a startup often indicates substantial growth potential. Similarly, an increase in funding activity within a particular sector may reveal emerging trends worthy of exploration. By examining these predictive indicators, firms can leverage the predictive signals API for VC firms to enhance deal flow and significantly boost their chances of successful funding.

Successful VC firms are increasingly leveraging the predictive signals API for VC firms to refine their funding strategies, ensuring they remain competitive in a rapidly evolving market. As the venture capital landscape matures, the use of a predictive signals API for VC firms in decision-making processes becomes essential for identifying high-potential startups and optimizing investment outcomes.

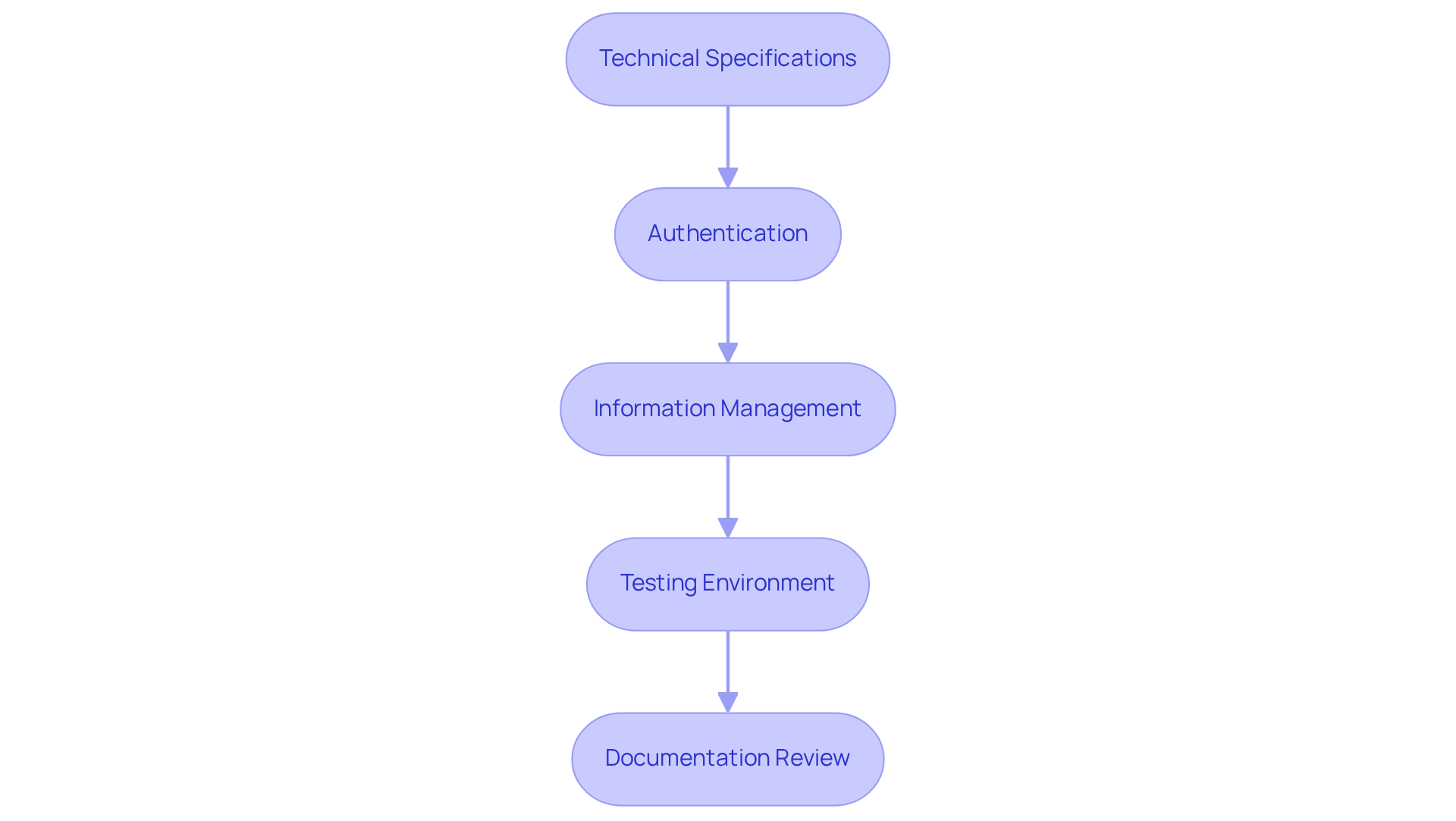

Prepare for API Integration: Requirements and Setup

To successfully integrate the predictive signals API for VC firms from Websets, your system must meet several essential requirements.

Technical Specifications: Ensure your infrastructure is compatible with RESTful APIs and can efficiently process JSON formats. This compatibility is crucial for seamless communication with the predictive signals API for VC firms.

Authentication: Protect your information by obtaining API keys from Websets and implementing robust authentication methods. This safeguards against unauthorized access.

Information Management: Prepare your database to effectively handle incoming information from the Websets API. It is vital that your system can accommodate both the volume and structure of the content without performance issues.

Testing Environment: Establish a staging environment to conduct thorough testing of the Websets API connection prior to going live. This proactive approach allows for troubleshooting and ensures that any potential issues do not disrupt production systems.

Documentation Review: Familiarize yourself with the Websets API documentation, which outlines endpoints, data formats, and error handling procedures. A solid understanding of these elements will facilitate a smoother incorporation process.

For instance, when making a POST request to the Websets API, ensure that your JSON payload is structured correctly to match the expected format. Here’s a sample code snippet for a basic integration:

{

"query": "search term",

"filters": {

"industry": "technology"

}

}

Statistics indicate that firms leveraging APIs can reduce time-to-insight from hours to seconds, underscoring the importance of a well-prepared integration strategy. By adhering to these best practices and utilizing a predictive signals API for VC firms, investment firms can enhance their operational efficiency and maintain a competitive edge in the rapidly evolving financial landscape.

Implement the Predictive Signals API: A Step-by-Step Process

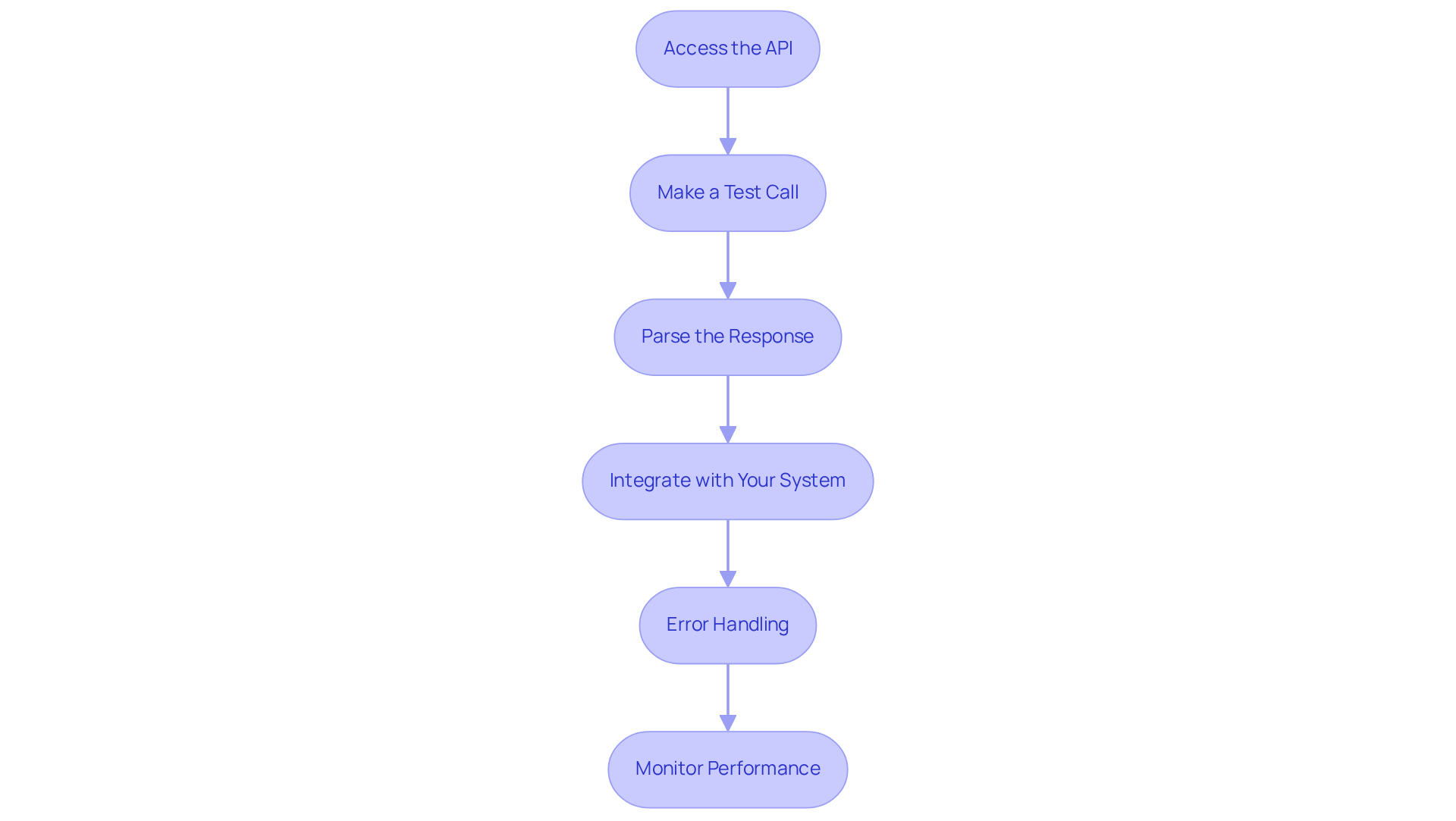

To implement the Predictive Signals API, follow these essential steps:

- Access the API: Begin by utilizing your API key to authenticate and access the Predictive Signals API. This foundational step is crucial for secure and effective interaction with the predictive signals API for VC firms.

- Make a Test Call: Initiate your journey with a straightforward GET request to one of the API endpoints. This ensures your connection is established correctly and sets the stage for further integration.

- Parse the Response: Carefully analyze the JSON response from the API. Understanding the structure of the information you will be working with is vital for effective data manipulation.

- Integrate with Your System: Develop code to seamlessly incorporate the API information into your existing systems. Focus on managing storage and retrieval efficiently to enhance operational effectiveness.

- Error Handling: Implement robust error handling to address any issues that may arise during API calls, such as rate limits or format errors. Monitoring error rates is essential for maintaining API quality and performance.

- Monitor Performance: After integration, consistently observe the API's performance and information accuracy. This vigilance ensures it meets your operational requirements. Employing predictive monitoring strategies can help identify potential issues before they impact users.

In the venture capital landscape, challenges in API coordination often revolve around ensuring data consistency across platforms and managing the varying response times of different APIs. Real-world instances, such as First Bank's successful implementation of the Account Balance Activity API, underscore the importance of thorough testing and monitoring for achieving operational efficiency. On average, API connections in financial services can take several weeks, influenced by the complexity of the systems involved and the level of customization required. Aligning API metrics with business KPIs is not just beneficial; it is essential to ensure that the integration effectively supports your organizational goals.

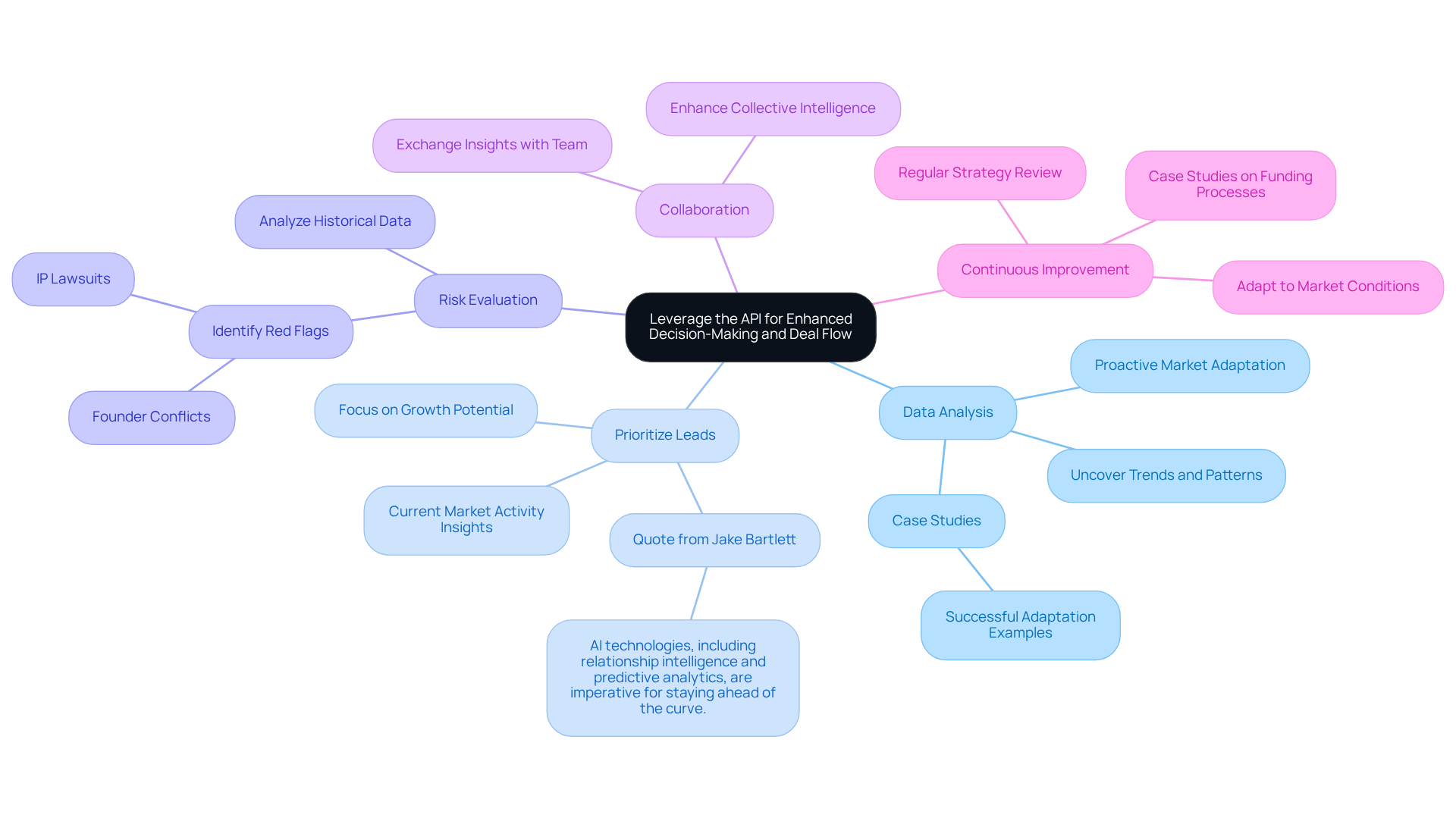

Leverage the API for Enhanced Decision-Making and Deal Flow

Integrating the Predictive Signals API significantly enhances decision-making and improves deal flow through several key strategies:

-

Data Analysis: Regular analyses of predictive signals uncover trends and patterns that shape financial strategies. This proactive approach keeps you ahead of market shifts, as illustrated by case studies showing how firms have successfully adapted their strategies with Websets' AI-powered market research tools.

-

Prioritize Leads: Insights from the predictive signals API for VC firms enable you to prioritize leads based on growth potential and current market activity, ensuring your focus remains on the most promising opportunities. As Jake Bartlett states, "AI technologies, including relationship intelligence and predictive analytics, are imperative for staying ahead of the curve."

-

Risk Evaluation: Evaluating the risks associated with potential ventures involves analyzing historical data alongside predictive indicators, facilitating more informed decision-making. Enhanced information from Websets provides context regarding portfolio companies, including insights about founding teams and competitors, which helps identify red flags such as founder conflicts and IP lawsuits in startups.

-

Collaboration: Cultivating a cooperative atmosphere by exchanging insights with your team ensures alignment on financial strategies and enhances collective intelligence. Websets' customizable search solutions facilitate better communication and understanding among team members.

-

Continuous Improvement: Regularly reviewing and refining your financial strategy based on data from the predictive signals API for VC firms allows for adaptation to evolving market conditions and emerging trends, thus maintaining a competitive edge. For instance, predictive analytics has significantly enhanced funding processes, as demonstrated by successful case studies in venture capital.

By leveraging these strategies, VC firms can enhance their deal flow and make more informed investment decisions, ultimately leading to better outcomes.

Conclusion

Harnessing the power of the Predictive Signals API is essential for venture capital firms aiming to excel in a competitive landscape. By comprehensively understanding and implementing this API, firms can leverage critical data-driven insights to identify high-potential startups and optimize their investment strategies effectively.

Predictive signals serve as key indicators that empower VC firms to make informed decisions regarding funding opportunities. The necessity of proper API integration cannot be overstated; it involves understanding technical requirements, following implementation steps, and developing strategies that enhance decision-making and deal flow. By focusing on data analysis, risk evaluation, and continuous improvement, firms can refine their approaches and adapt to market changes, ultimately leading to superior investment outcomes.

In an environment where timely and accurate information is paramount, embracing the Predictive Signals API can significantly enhance operational efficiency and investment success. Venture capital firms are urged to adopt these insights and strategies, ensuring they not only keep pace with industry developments but also thrive by making smarter, data-driven decisions.

Frequently Asked Questions

What is the predictive signals API for VC firms?

The predictive signals API for VC firms is a data-driven tool that helps venture capital firms identify promising funding opportunities and assess the viability of startups through various metrics.

What types of metrics are included in the predictive signals?

The predictive signals include metrics such as hiring trends, funding rounds, and overall market activity.

Why are predictive signals important for VC firms?

Predictive signals are important because they enable VC firms to make informed decisions, prioritize leads, and allocate resources effectively, ultimately enhancing deal flow and increasing the chances of successful funding.

How can hiring trends indicate a startup's potential?

A significant increase in hiring at a startup often suggests substantial growth potential, making it a key indicator for VC firms to consider.

What does an increase in funding activity within a sector signify?

An increase in funding activity within a particular sector may reveal emerging trends that are worth exploring for potential investment opportunities.

How are successful VC firms using the predictive signals API?

Successful VC firms are leveraging the predictive signals API to refine their funding strategies and remain competitive in a rapidly evolving market.

What role does the predictive signals API play in decision-making for VC firms?

The predictive signals API plays a crucial role in decision-making by helping VC firms identify high-potential startups and optimize their investment outcomes as the venture capital landscape matures.