Overview

Mastering venture capital deal sourcing APIs is essential for investors looking to enhance their deal sourcing capabilities. This four-step process will empower you to efficiently leverage these tools for informed investment decisions.

- Obtain API access to unlock valuable data.

- Set up a development environment tailored for your needs.

- Make initial API calls to begin exploring the data.

- Incorporate this information into your investment analysis.

By following these steps, you can optimize your sourcing strategies and elevate your investment approach.

Introduction

Venture capital represents an ever-evolving landscape where timely access to critical information can decisively influence investment decisions. The emergence of deal sourcing APIs has transformed how investors identify and evaluate potential funding opportunities, providing a wealth of insights at their fingertips. Yet, many investors find themselves struggling to fully leverage these powerful tools, often overlooking lucrative prospects.

How can one effectively master the intricacies of venture capital deal sourcing APIs to enhance their investment strategy and maintain a competitive edge in this field?

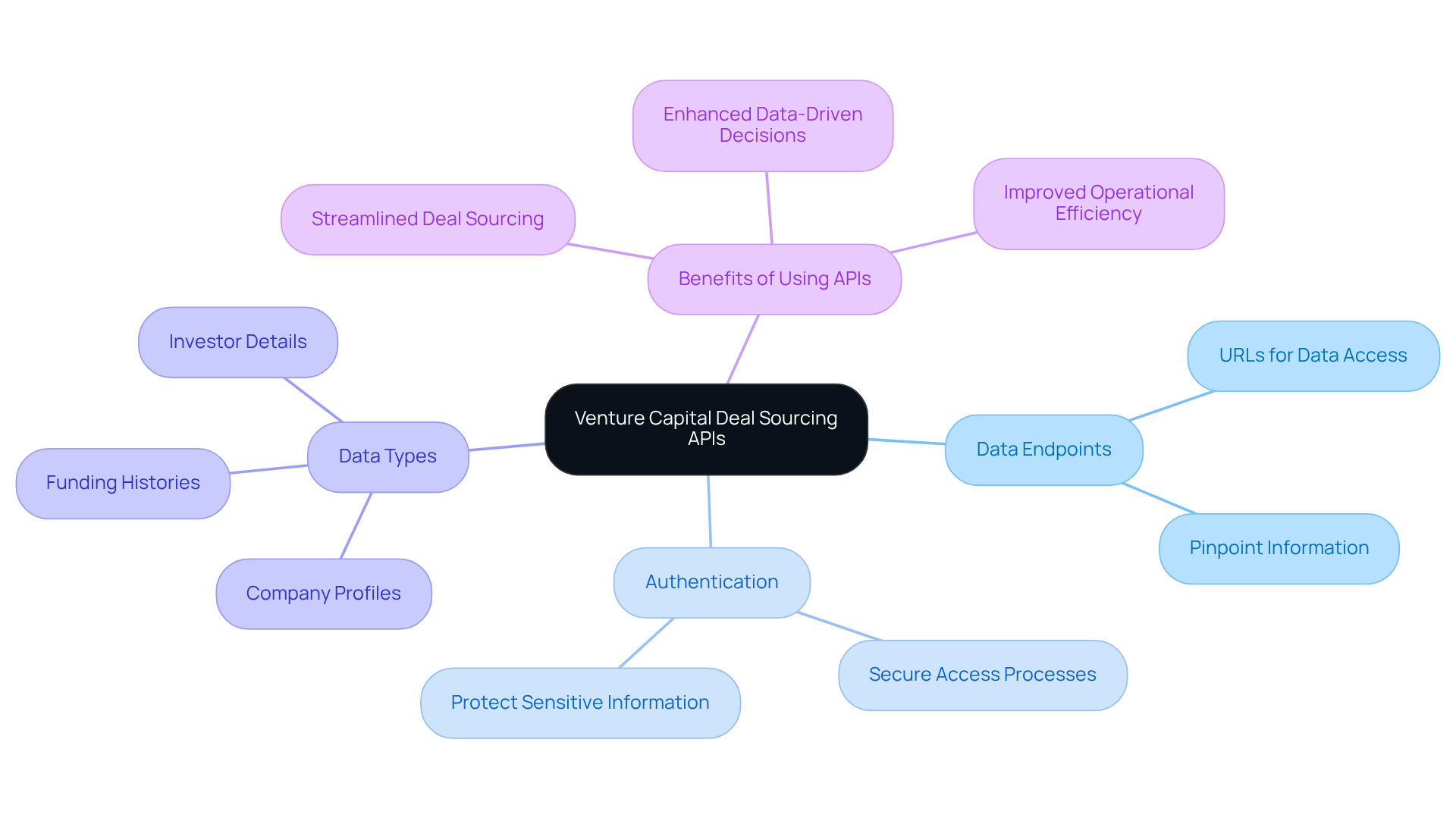

Understand Venture Capital Deal Sourcing APIs

Venture capital are essential tools for investors, providing access to a wide range of information about potential funding opportunities. These APIs empower users to filter and retrieve critical insights about startups, funding rounds, and market trends—elements that are crucial for informed investment decisions. To harness the full potential of these APIs, understanding several key concepts is vital:

- Data Endpoints: These specific URLs provide access to various data types within the API, enabling investors to pinpoint the information they require.

- Authentication: Most APIs implement an authentication process to ensure secure access to sensitive information, safeguarding both the investor and the information provider.

- Data Types: Familiarity with the diverse data types available—such as company profiles, funding histories, and investor details—allows investors to maximize the utility of the API.

By mastering these concepts, investors can seamlessly integrate and utilize the venture capital deal sourcing API in their strategies, enhancing their ability to source deals efficiently and make data-driven decisions. Firms like Affinity exemplify how leveraging APIs can improve operations, refine deal sourcing, and ultimately yield better financial outcomes.

Integrate the API into Your Investment Strategy

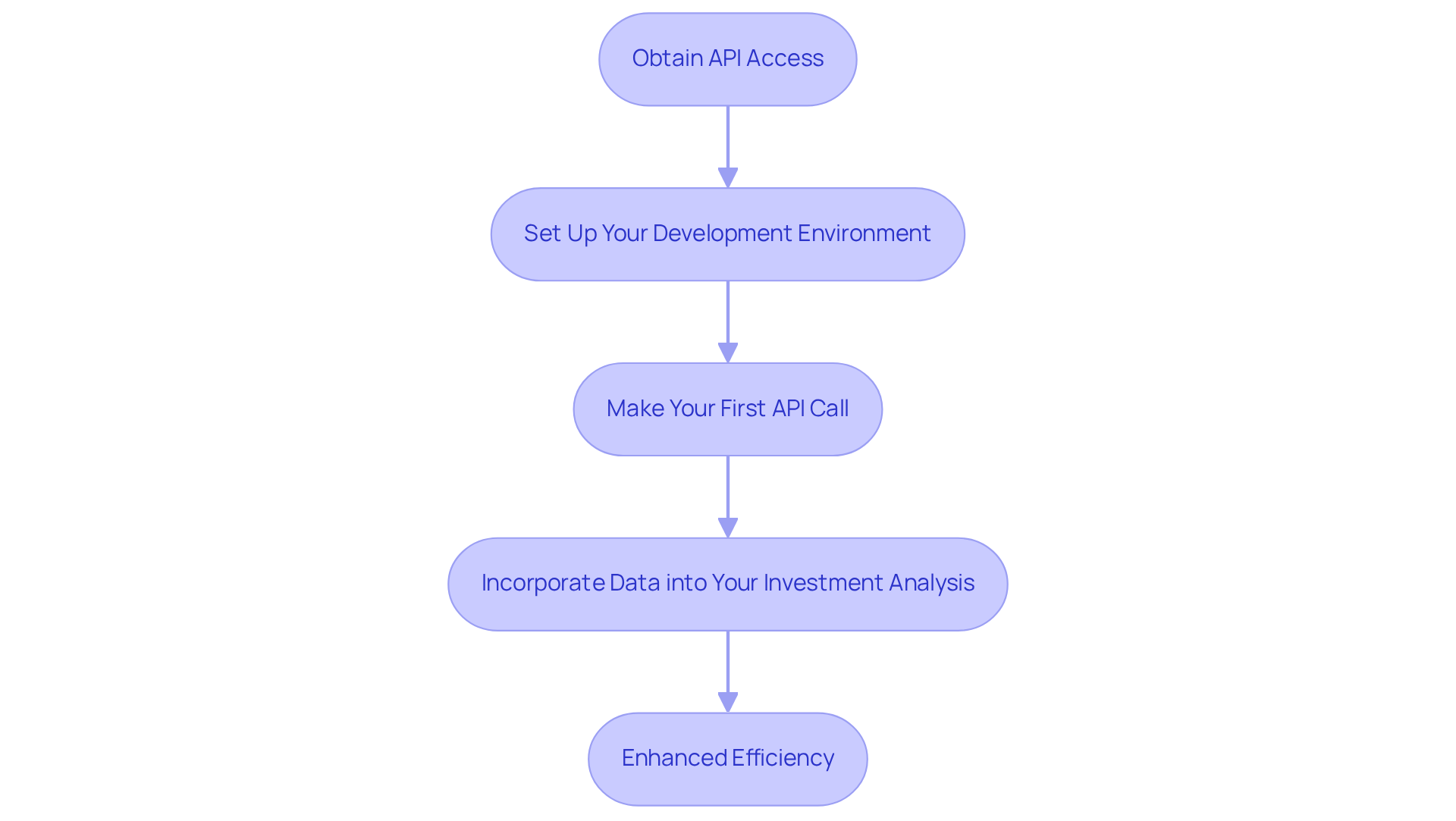

Incorporating the venture capital deal sourcing API into your funding strategy can significantly enhance your efficiency and decision-making capabilities. Here’s a streamlined approach to get started:

- Obtain API Access

Begin by signing up for the API service on the provider's website. Familiarize yourself with the pricing structure and any usage limitations. Upon registration, you will receive an API key, which is crucial for authentication in your requests. - Set Up Your Development Environment

Select a programming language that aligns with your expertise, such as Python or JavaScript. Install any required libraries or SDKs that will facilitate your API interactions, ensuring a smooth development process. - Make Your First API Call

Utilize your API key to authenticate and execute a basic request, such as retrieving a list of recent funding rounds. Review the response to confirm that the information is in the expected format, which is essential for further analysis. - Incorporate Data into Your Investment Analysis

Leverage the data obtained from the API to enhance your investment decisions. This may involve analyzing market trends, identifying promising leads, or assessing potential funding opportunities.

By following these steps, you can seamlessly integrate the venture capital deal sourcing API into your financial strategy, which will ultimately enhance your deal sourcing capabilities and operational efficiency. The typical time saved by using can be significant, enabling faster access to essential information and insights.

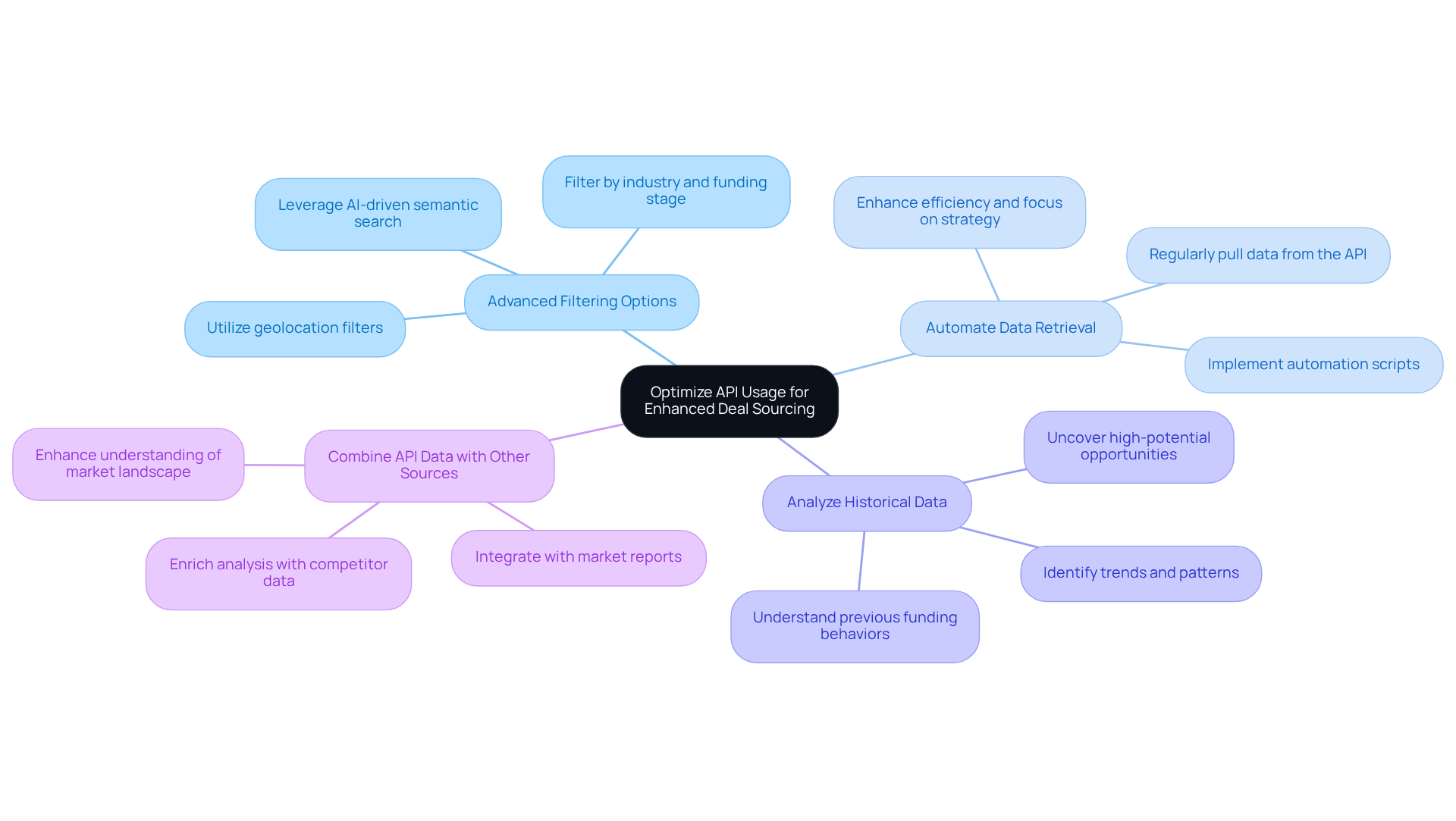

Optimize API Usage for Enhanced Deal Sourcing

To optimize your usage of the Venture Capital Deal Sourcing API, consider the following strategies:

- Utilize Advanced Filtering Options

Leverage the API's robust filtering capabilities, including geolocation filters and fast search types, to refine your search results. Filter by industry, funding stage, or geographical location to pinpoint the most relevant investment opportunities. Furthermore, the AI-driven semantic search technology can enhance your ability to discover unique leads. - Automate Data Retrieval

Implement automation scripts that regularly pull data from the API. This approach ensures you remain updated with the latest information without manual intervention, significantly enhancing efficiency. Industry insights suggest that automating information entry can save venture capitalists hundreds of hours each year, enabling them to focus on strategic decision-making. The Research Agentic API can assist in continuously researching until the correct information is obtained. - Analyze Historical Data

Access historical funding data through the API to identify trends and patterns. Understanding previous funding behaviors can uncover which sectors are gaining traction and emphasize potential future opportunities. Recognizing historical deal patterns can help identify high-potential opportunities. - Combine API Data with Other Sources

Enrich your analysis by integrating API data with additional datasets, such as market reports or competitor analyses. This comprehensive approach encourages more informed financial choices, allowing for a deeper understanding of the market landscape. Information and analytics enhance the quality and quantity of opportunities in the pipeline, assisting dealmakers in making more informed choices.

By employing these optimization strategies, you can significantly enhance your deal sourcing capabilities, making your investment strategy more robust and data-driven.

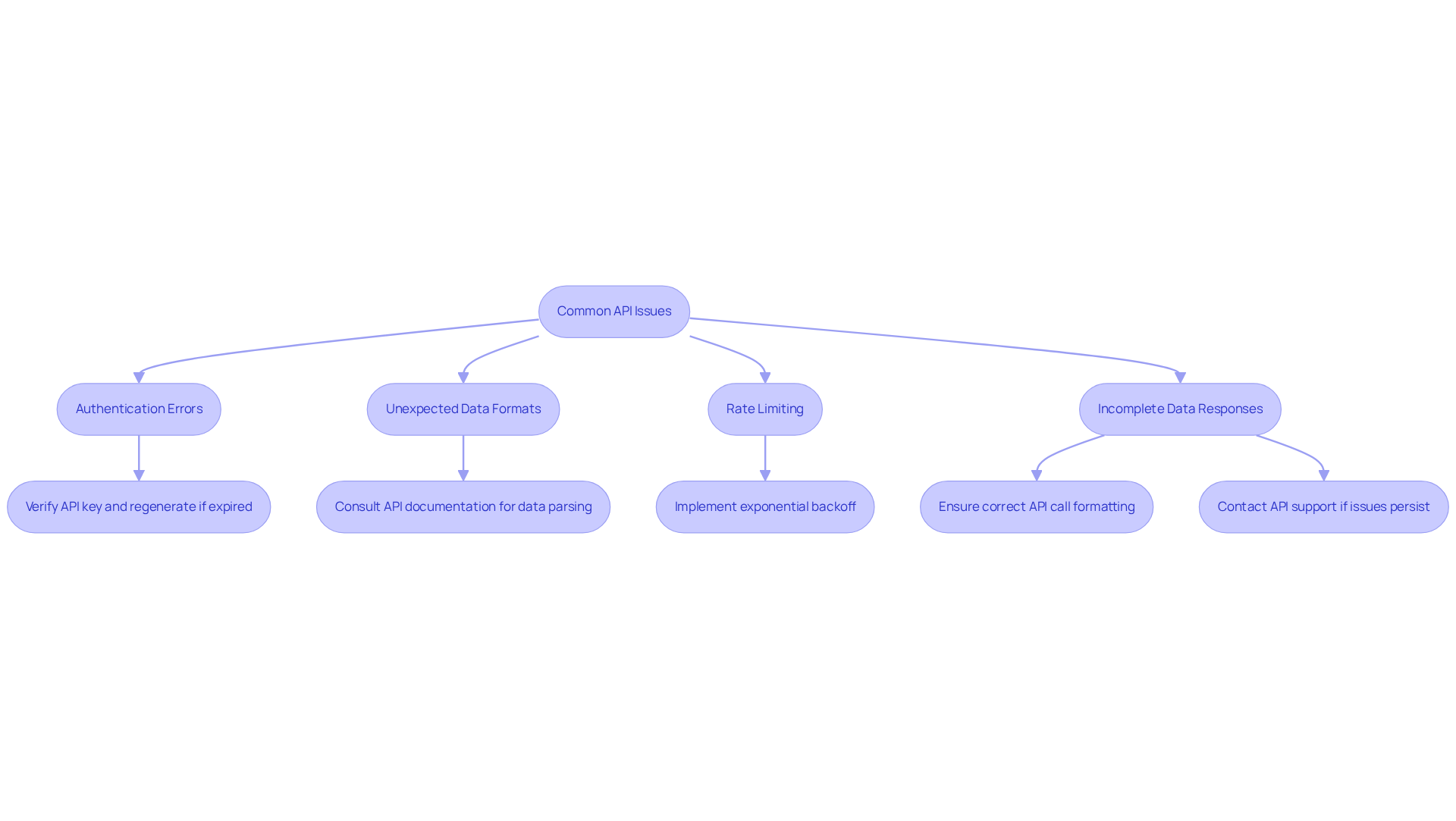

Troubleshoot Common Issues with the API

When utilizing the , you may encounter several common challenges. Here’s how to troubleshoot them effectively:

Issue 1: Authentication Errors

Verify that your API key is included in your requests. If it has expired, generate a new one via the provider's dashboard. Statistics indicate that over 80% of organizations experience authentication issues due to expired or improperly configured tokens. This highlights the importance of regular checks in API management.

Issue 2: Unexpected Data Formats

Consult the API documentation to ensure proper data parsing. Changes in the API response structure can lead to unexpected formats. For instance, a grocery firm addressed similar challenges by applying a formatting check to tidy up address information prior to sending, which greatly minimized errors. This example underscores the significance of ensuring that your information handling aligns with the API's requirements.

Issue 3: Rate Limiting

If you encounter a rate limit error, implement exponential backoff in your requests. This strategy involves gradually increasing the wait time between requests to avoid exceeding the limit. Such practices can enhance overall API performance.

Issue 4: Incomplete Data Responses

Ensure your API calls are correctly formatted and that you are targeting the appropriate data endpoints. If problems persist, reach out to the API support team for assistance. In 2021, less than 50% of organizations conducted API-specific security testing, which can lead to incomplete data responses if not addressed. This statistic underscores the necessity of proactive measures in troubleshooting.

By proactively addressing these common issues, you can enhance your experience with the venture capital deal sourcing API and focus on sourcing valuable investment opportunities.

Conclusion

Mastering the venture capital deal sourcing API is a game-changer in the investment landscape, offering critical insights that enhance decision-making capabilities. By grasping the core components—such as data endpoints, authentication, and various data types—investors can effectively streamline their deal sourcing processes.

This article outlines a clear path for integrating the API into an investment strategy. It emphasizes essential steps, including:

- Obtaining access

- Setting up a development environment

- Executing initial API calls

- Leveraging the data for deeper analysis

Moreover, it suggests optimization strategies like:

- Advanced filtering

- Automation

- Combining data sources to refine investment choices

Addressing common troubleshooting issues ensures a seamless experience, allowing investors to concentrate on identifying promising opportunities.

Ultimately, embracing the venture capital deal sourcing API not only enhances operational efficiency but also empowers investors to make informed, data-driven decisions. By adopting these practices, investors can position themselves at the forefront of the market, unlocking potential that may have previously been overlooked. The time to harness the power of APIs is now; the future of venture capital awaits those who are ready to innovate and adapt.

Frequently Asked Questions

What are venture capital deal sourcing APIs?

Venture capital deal sourcing APIs are tools that provide investors with access to information about potential funding opportunities, including insights about startups, funding rounds, and market trends.

Why are venture capital deal sourcing APIs important for investors?

They are important because they empower investors to filter and retrieve critical insights necessary for making informed investment decisions.

What are data endpoints in the context of venture capital deal sourcing APIs?

Data endpoints are specific URLs that provide access to various types of data within the API, allowing investors to pinpoint the information they need.

How does authentication work with these APIs?

Most APIs implement an authentication process to ensure secure access to sensitive information, protecting both the investor and the information provider.

What types of data can investors access through venture capital deal sourcing APIs?

Investors can access various data types, including company profiles, funding histories, and investor details.

How can mastering these concepts help investors?

By understanding these concepts, investors can effectively integrate and utilize the APIs in their strategies, enhancing their ability to source deals efficiently and make data-driven decisions.

Can you provide an example of a firm that successfully uses venture capital deal sourcing APIs?

Affinity is an example of a firm that leverages APIs to improve operations, refine deal sourcing, and achieve better financial outcomes.