Overview

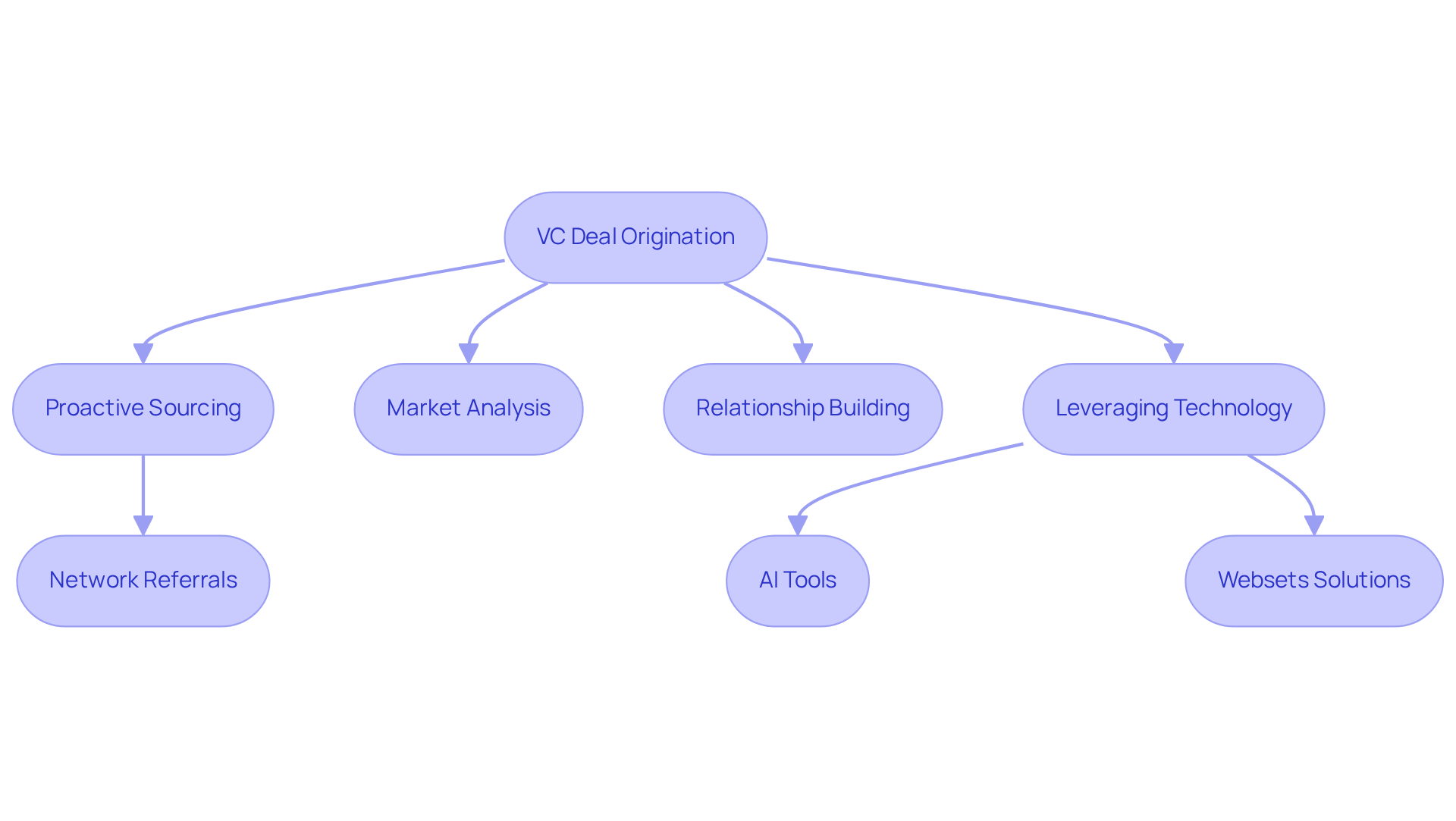

The article articulates strategies to maximize venture capital (VC) deal origination beyond traditional databases by emphasizing proactive sourcing, relationship intelligence, and network building. By actively seeking opportunities, leveraging data analytics for relationship management, and fostering a diverse network, it highlights a crucial approach to enhancing the identification and funding of high-potential startups in a competitive market.

In a landscape where competition is fierce, the ability to proactively source deals is paramount. This involves not just waiting for opportunities to arise but actively pursuing them. Data analytics plays a vital role here, enabling VC firms to manage relationships effectively and identify potential startups that align with their investment goals.

Furthermore, building a diverse network is essential. A varied network not only broadens the scope of opportunities but also enriches the insights gained from different perspectives. This diversity can lead to discovering innovative startups that might otherwise go unnoticed.

Ultimately, the article underscores the importance of these strategies in navigating the complexities of the VC landscape. By adopting a proactive approach, utilizing data-driven insights, and cultivating a diverse network, VC firms can significantly enhance their deal origination efforts.

Introduction

Venture capital thrives on the ability to identify and secure promising funding opportunities. Yet, many firms still rely heavily on traditional databases for deal origination. This reliance can limit their potential. Innovative strategies that transcend conventional methods are essential. Proactive sourcing and relationship intelligence play a pivotal role in enhancing deal flow in an increasingly competitive landscape.

As competition escalates, the challenge remains: how can VCs effectively cultivate networks and leverage technology to uncover high-potential startups that others may overlook? To address this, firms must adopt a more dynamic approach to sourcing deals. By integrating technology with relationship-building efforts, they can tap into a wealth of opportunities that traditional methods might miss.

Ultimately, the key lies in fostering connections and utilizing data-driven insights to enhance decision-making. This proactive stance not only improves deal flow but also positions firms to stay ahead in a fast-evolving market.

Understand the Importance of Deal Origination in Venture Capital

VC deal origination beyond databases is the lifeblood of venture capital (VC) firms, serving as the foundational step in identifying and securing funding opportunities. A well-designed approach to VC deal origination beyond databases not only improves the quality of transactions but also increases the volume of potential funding. VCs must acknowledge that the effectiveness of their deal sourcing, especially regarding VC deal origination beyond databases, directly influences their overall success. By proactively seeking opportunities for VC deal origination beyond databases rather than passively waiting for them to arise, firms can secure a competitive edge in the market. This proactive method frequently reveals high-potential ventures, facilitating VC deal origination beyond databases, that may not yet be on the radar of other backers, creating unique funding opportunities.

Furthermore, remaining aware of market trends and the changing startup environment allows VCs to enhance their funding strategies, particularly in VC deal origination beyond databases, to align them with emerging sectors. A significant case study shows that 88% of transactions at Robles Ventures are obtained through network referrals, highlighting the significance of relationship-driven sourcing in discovering promising ventures. As competition intensifies, it is becoming essential to shift from predominantly inbound to outbound sourcing, particularly focusing on VC deal origination beyond databases. This shift necessitates that investors engage in VC deal origination beyond databases by conducting thorough research and actively connecting with founders, ensuring they do not miss out on lucrative opportunities.

To enhance their market research capabilities, VCs can leverage Websets' enterprise-grade web search solutions. These tools provide detailed company profiles and strategic insights, enabling firms to conduct comprehensive analyses of potential investments. With 76% of companies utilizing AI to automate routine tasks and 94% of negotiators intending to integrate AI in some capacity, adjusting to technological advancements is vital for improving transaction origination strategies. Websets' AI-powered candidate discovery and qualification tools can significantly aid VCs in uncovering startups with enriched data insights, filtering by industry, stage, and location to find the most promising ventures.

Ultimately, a strategic emphasis on opportunity creation, supported by Websets' advanced AI-driven platform and enterprise-grade web search solutions, not only drives better returns on investment but also enhances VC deal origination beyond databases for VC firms in a rapidly changing market landscape.

Leverage Relationship Intelligence for Effective Deal Sourcing

In the competitive realm of venture capital, effective vc deal origination beyond databases requires leveraging relationship intelligence. This approach centers on utilizing data analytics to understand and manage industry connections. By meticulously mapping their networks, VCs can pinpoint key influencers, potential partners, and promising startups. Advanced tools that assess relationship strength and communication patterns empower VCs to prioritize their outreach efforts with precision.

Consider platforms like Websets, which can uncover niche results that other tools may overlook, thereby enhancing data discovery and offering comprehensive insights into potential leads. With Websets' AI-driven functionalities, VCs can enrich their data with detailed profiles, encompassing company information and communication history, ensuring that outreach is both targeted and impactful. Moreover, maintaining consistent communication with these individuals fosters trust and keeps VCs top-of-mind when new opportunities arise.

By integrating relationship intelligence into their sourcing strategies, VCs can significantly improve their vc deal origination beyond databases and enhance their chances of identifying high-quality investment opportunities. As Jen Stamulis, Director of Business Development & Brand Management at Elasticity, asserts, "A powerful CRM can help you keep track of your network, identify warm introductions, and manage your pipeline efficiently." Embracing these strategies not only enhances the effectiveness of outreach but also builds a robust foundation for future success.

Build and Maintain a Robust Network of Potential Startups

Creating and fostering a diverse network of emerging businesses is essential for venture capitalists looking to excel in vc deal origination beyond databases. This network should encompass not only new ventures but also industry specialists, other investors, and accelerators. Actively engaging with these groups through industry events, conferences, and online platforms can yield valuable connections. For instance, attending pitch events and demo days allows VCs to meet founders and evaluate their potential firsthand.

Moreover, maintaining these relationships is crucial. Regular check-ins and providing assistance can foster trust, motivating new ventures to approach VCs when they seek funding. Research indicates that startups backed by well-connected lead investors—defined as those in the 90th percentile or above based on PitchBook's PageRank algorithm—experience significantly lower failure rates. Specifically, well-connected investors have a failure rate of only 4% for Series D funding, compared to 15% for those with peripheral connections.

Social interactions play a vital role in these relationships, with studies showing that 30 to 40% of partnership meetings focus on building friendships and trust. By cultivating a dynamic and engaged network, VCs can improve vc deal origination beyond databases to secure a steady stream of funding prospects and stay aware of market trends. Additionally, pre-event preparation, such as defining success metrics and identifying key contacts, is crucial for maximizing networking effectiveness. Industry events not only facilitate these connections but also provide a platform for VCs to showcase their value to startups, ultimately leading to more successful partnerships and investments. The global market for B2B events is projected to grow significantly, highlighting the increasing importance of these gatherings in the business landscape.

Conclusion

Maximizing VC deal origination beyond traditional databases is essential for venture capital firms aiming to thrive in a competitive landscape. By adopting proactive strategies and leveraging relationship intelligence, VCs can enhance their sourcing capabilities, discover high-potential startups, and ultimately secure better funding opportunities. This shift from passive to active engagement in deal origination not only improves the quality of transactions but also positions firms to capitalize on emerging market trends.

Key insights from the discussion highlight the critical importance of building and maintaining a robust network of industry connections. The use of advanced tools like Websets significantly enhances data discovery and analysis, empowering VCs to make informed decisions. Furthermore, fostering relationships through consistent communication and engagement at industry events can yield valuable partnerships and insights. The evidence presented, such as the success rates of well-connected investors, underscores the tangible benefits of a strong network in achieving successful deal origination.

In conclusion, the significance of innovative strategies for VC deal origination cannot be overstated. As the venture capital landscape evolves, embracing relationship intelligence and proactive networking will be essential for firms striving to identify and invest in the next wave of groundbreaking startups. By prioritizing these practices, VCs can position themselves not only for immediate success but also for sustained growth in an ever-changing market.

Frequently Asked Questions

What is the significance of deal origination in venture capital?

Deal origination is crucial in venture capital as it serves as the foundational step in identifying and securing funding opportunities, directly influencing the effectiveness and success of VC firms.

How can VC firms improve their deal origination strategies?

VC firms can improve their deal origination strategies by proactively seeking opportunities rather than waiting for them to arise, which helps in discovering high-potential ventures that may not be on the radar of other investors.

What role do market trends play in VC deal origination?

Staying aware of market trends and the changing startup environment allows VCs to enhance their funding strategies and align them with emerging sectors, improving their deal origination efforts.

What is the importance of relationship-driven sourcing in venture capital?

Relationship-driven sourcing is significant as demonstrated by Robles Ventures, where 88% of transactions are obtained through network referrals, highlighting the effectiveness of personal connections in discovering promising ventures.

Why is there a shift from inbound to outbound sourcing in VC deal origination?

As competition intensifies, it is essential for VCs to shift from predominantly inbound to outbound sourcing to actively engage with founders and conduct thorough research, ensuring they do not miss lucrative investment opportunities.

How can technology assist VC firms in deal origination?

Technology, such as Websets' enterprise-grade web search solutions, can provide detailed company profiles and strategic insights, enhancing market research capabilities and aiding in the identification of promising startups.

What percentage of companies are utilizing AI in their operations?

76% of companies are utilizing AI to automate routine tasks, and 94% of negotiators intend to integrate AI in some capacity, indicating the growing importance of technology in improving transaction origination strategies.

How does Websets' AI-powered platform benefit VC firms?

Websets' AI-powered platform aids VCs in uncovering startups with enriched data insights, allowing them to filter by industry, stage, and location to find the most promising ventures, ultimately driving better returns on investment.