Overview

This article emphasizes the critical importance of optimizing venture capital (VC) workflows to achieve early sourcing success within sales teams. By implementing systematic deal flow management, leveraging AI technologies, and enhancing collaboration, organizations can significantly transform their operations. Structured processes, AI-driven insights, and effective communication tools are not just enhancements—they are essential elements that can dramatically improve efficiency and decision-making.

Consider the impact: structured workflows lead to better investment outcomes and increased transaction assessments. The integration of AI technologies allows teams to harness data effectively, providing insights that drive smarter decisions. Furthermore, fostering collaboration within teams ensures that all members are aligned and working towards common goals, ultimately enhancing overall performance.

In conclusion, the strategic optimization of VC workflows is not merely an operational improvement; it is a pathway to achieving superior results in a competitive landscape. By embracing these methodologies, sales teams can position themselves for success and navigate the complexities of venture capital with confidence.

Introduction

In the fast-paced world of venture capital, the ability to efficiently source and manage deals is critical to a firm's success. Optimizing workflows allows VC teams to streamline processes, minimize time spent on routine tasks, and concentrate on high-impact activities that drive results. Yet, as the landscape evolves with the advent of AI technologies and collaboration tools, the challenge emerges: how can these innovations be integrated effectively to enhance sourcing efficiency? VC firms must leverage these advancements not just to keep pace but to excel in an increasingly competitive market.

Understand Deal Flow Management in VC Workflows

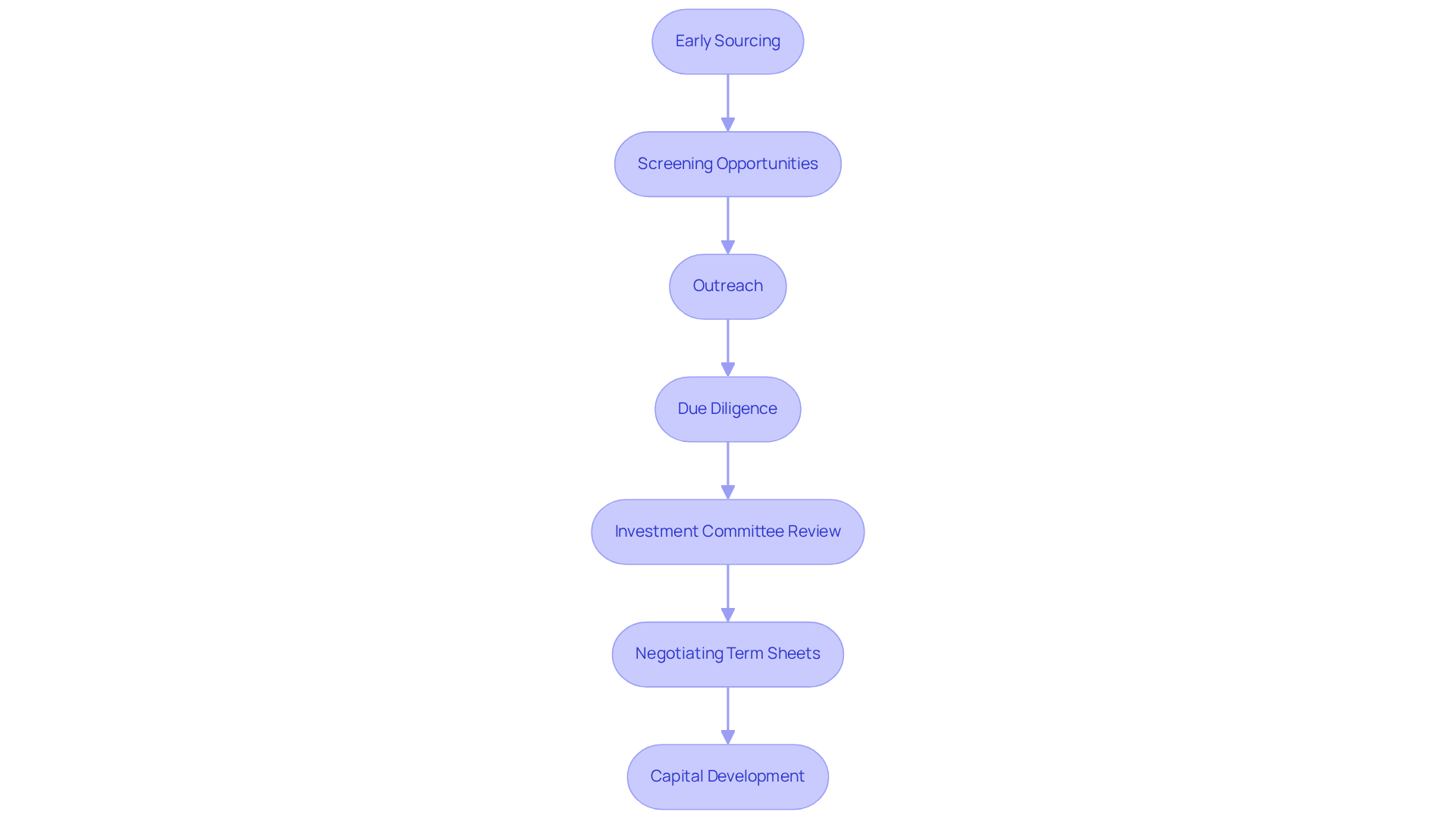

Deal flow management stands as a systematic method for acquiring, assessing, and monitoring funding opportunities, playing a crucial role in enhancing workflows within venture capital. VC groups must outline distinct phases in their investment flow process, incorporating VC workflows for:

- Early sourcing

- Screening opportunities

- Outreach

- Due diligence

- Investment committee review

- Negotiating term sheets

- Capital development

By leveraging a centralized platform for these stages, groups can significantly reduce time spent on repetitive tasks, allowing them to concentrate on high-value activities that drive results.

Implementing deal management software markedly enhances the ability to track critical metrics such as deal volume and conversion rates. This data empowers groups to identify bottlenecks in their processes and refine workflows accordingly. Regular pipeline gatherings are essential to ensure that all team members remain aligned and updated on the status of potential opportunities, fostering a collaborative atmosphere that enhances decision-making. Centralizing communication also mitigates confusion and prevents missed opportunities in deal-related discussions.

Consider a leading VC firm that adopted Affinity, a structured transaction flow management system. They witnessed an impressive 30% increase in the number of transactions assessed each quarter, culminating in notably improved investment outcomes. Moreover, relationship intelligence data from their platform facilitated closing transactions 25% faster, underscoring the transformative impact of efficient flow management on a firm's overall success. Regular reviews of deal flow strategies every 3 to 6 months are also vital for adapting to changing market conditions and ensuring sustained effectiveness.

Integrate AI to Enhance Sourcing Efficiency

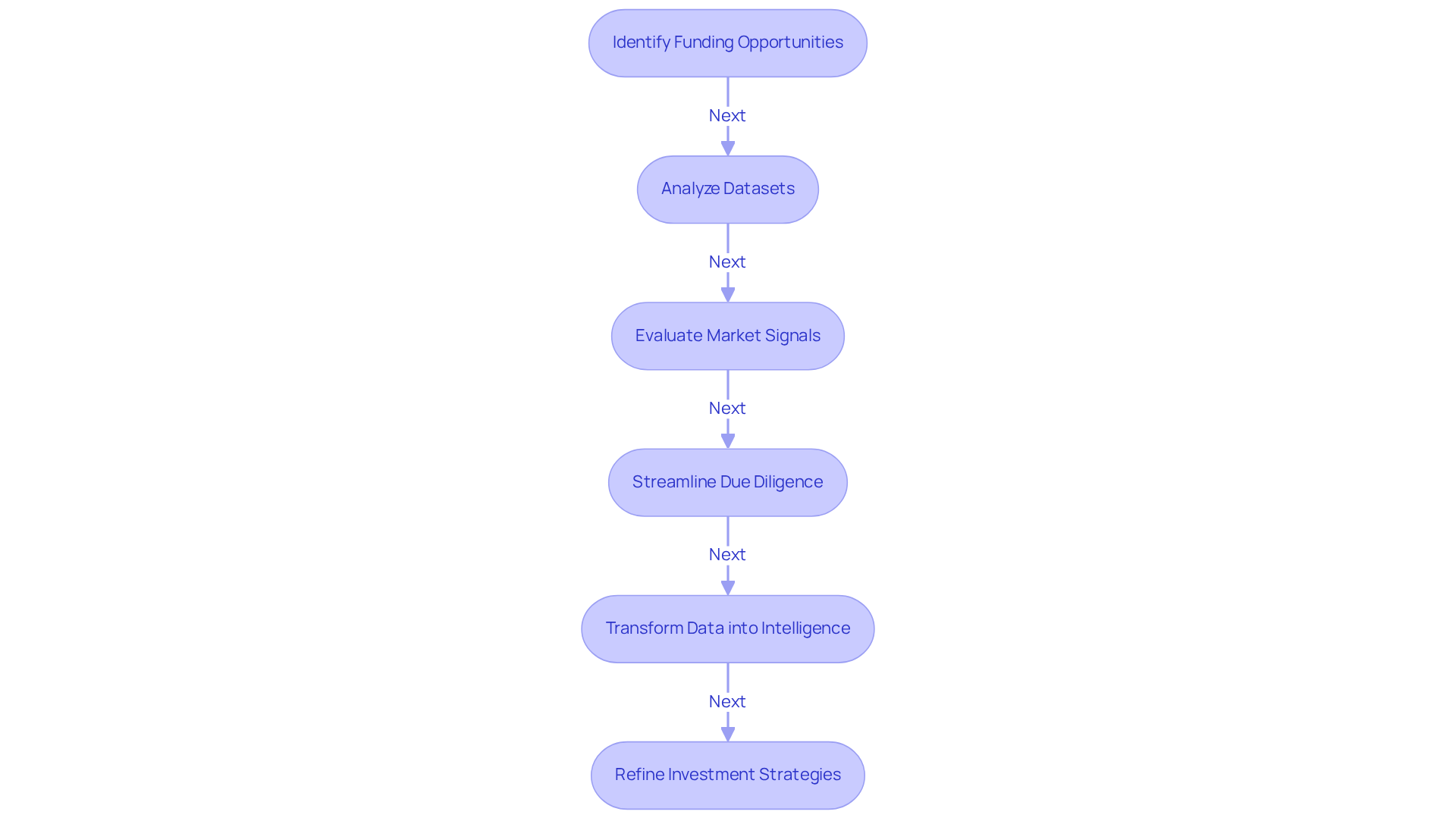

AI technologies are revolutionizing the venture capital landscape by automating VC workflows for early sourcing of potential funding opportunities. Platforms like Websets empower groups to analyze extensive datasets, uncovering patterns and trends that might otherwise remain hidden. For instance, Websets' enterprise-grade AI-driven web search identifies startups that align with a firm's funding strategy by evaluating market signals and social media engagement, thereby enhancing the accuracy of VC workflows for early sourcing. Furthermore, Websets' robust security framework and adherence to industry standards ensure that sensitive data is managed securely, establishing it as a reliable choice for enterprise customers.

Moreover, AI tools streamline the due diligence process, drastically reducing the time spent on manual research. This enables teams to focus on strategic evaluations rather than being mired in data collection. Websets' capability to sift through unstructured data transforms it into actionable intelligence, effectively guiding investment strategies.

To successfully implement these technologies, VC firms should adopt AI tools that integrate seamlessly with their VC workflows for early sourcing. Relationship intelligence platforms can provide valuable insights into startup traction and founder backgrounds, leading to a more effective acquisition process. Specific case studies illustrate how Websets has been effectively utilized in VC sourcing, showcasing its role in enhancing lead generation and recruitment.

By leveraging Websets' AI-driven platform, groups can evaluate a greater number of opportunities in less time, ultimately refining their investment strategies and boosting overall performance. As Ivan Nikkhoo, Managing Partner at Navigate Ventures, asserts, "In this next chapter of venture capital, those who strike the right balance between machine intelligence and human insight will shape the future of innovation.

Leverage Collaboration Tools for Team Efficiency

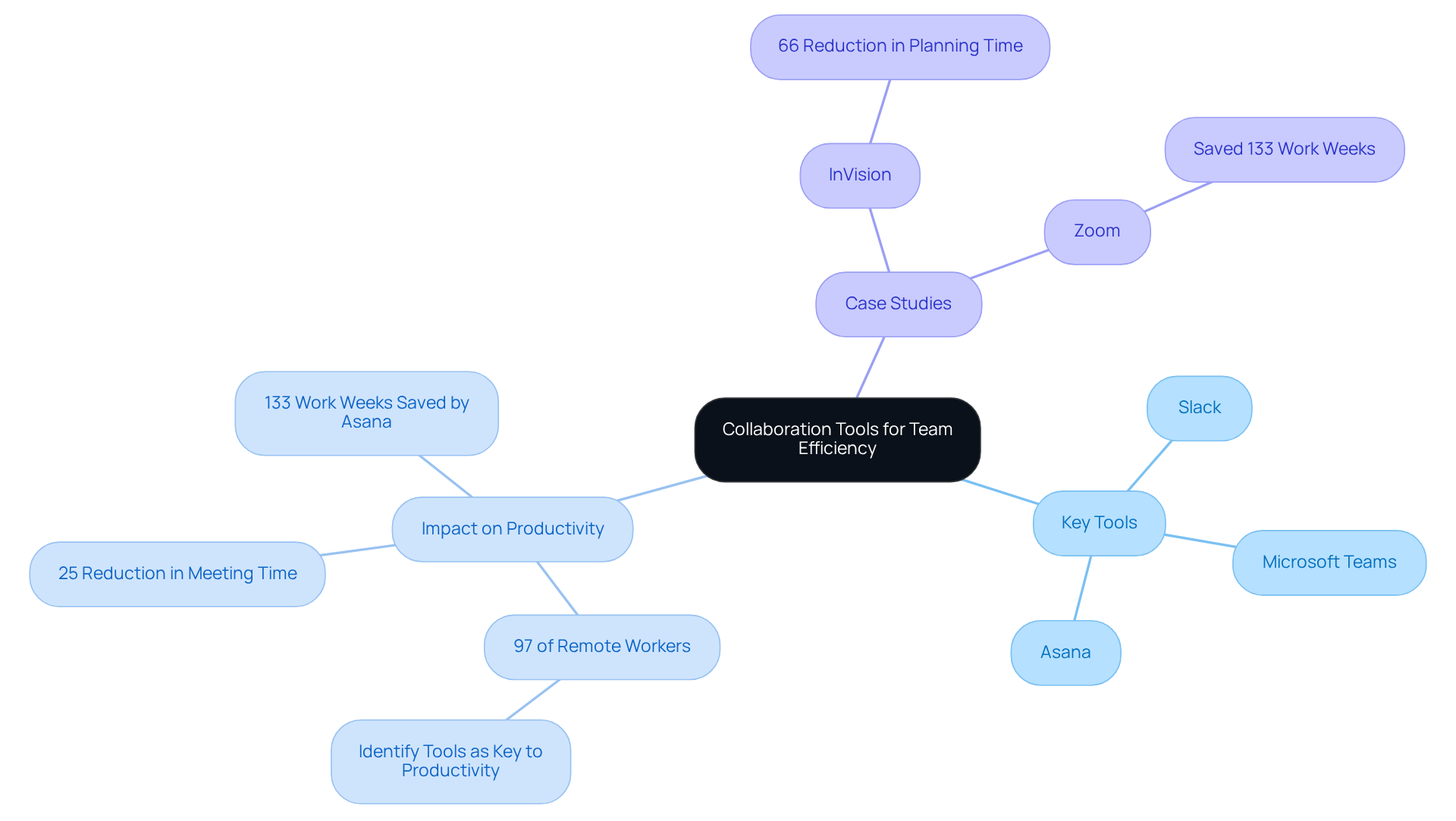

Enhancing group efficiency in vc workflows for early sourcing depends on effective collaboration. Tools such as Slack, Microsoft Teams, and Asana facilitate real-time communication and project management, ensuring alignment among group members. Notably, Slack reports that "97% of remote workers identify communication and collaboration tools as key to their productivity," highlighting the critical role of these platforms. They streamline information sharing, provide updates on transaction statuses, and solicit feedback on potential investments, thereby significantly boosting operational efficiency.

Consider a venture capital firm that adopted a collaboration tool, resulting in a remarkable 25% reduction in time spent on internal meetings. This transformation allowed the group to dedicate more time to strategic discussions and critical decision-making. Furthermore, Zoom noted that Asana implementation saved "133 work weeks per year," exemplifying the substantial productivity gains achievable through effective collaboration tools. Additionally, integrating these tools with deal management software improves vc workflows for early sourcing by providing a comprehensive view of the deal pipeline, fostering transparency and accountability within the group. Such integrations not only enhance communication but also empower teams to act swiftly and effectively in a competitive landscape. The case study of InVision reinforces this point, as they achieved a 66% reduction in planning time after transitioning to Asana, showcasing the tangible benefits of collaboration tools.

Establish Continuous Improvement Mechanisms

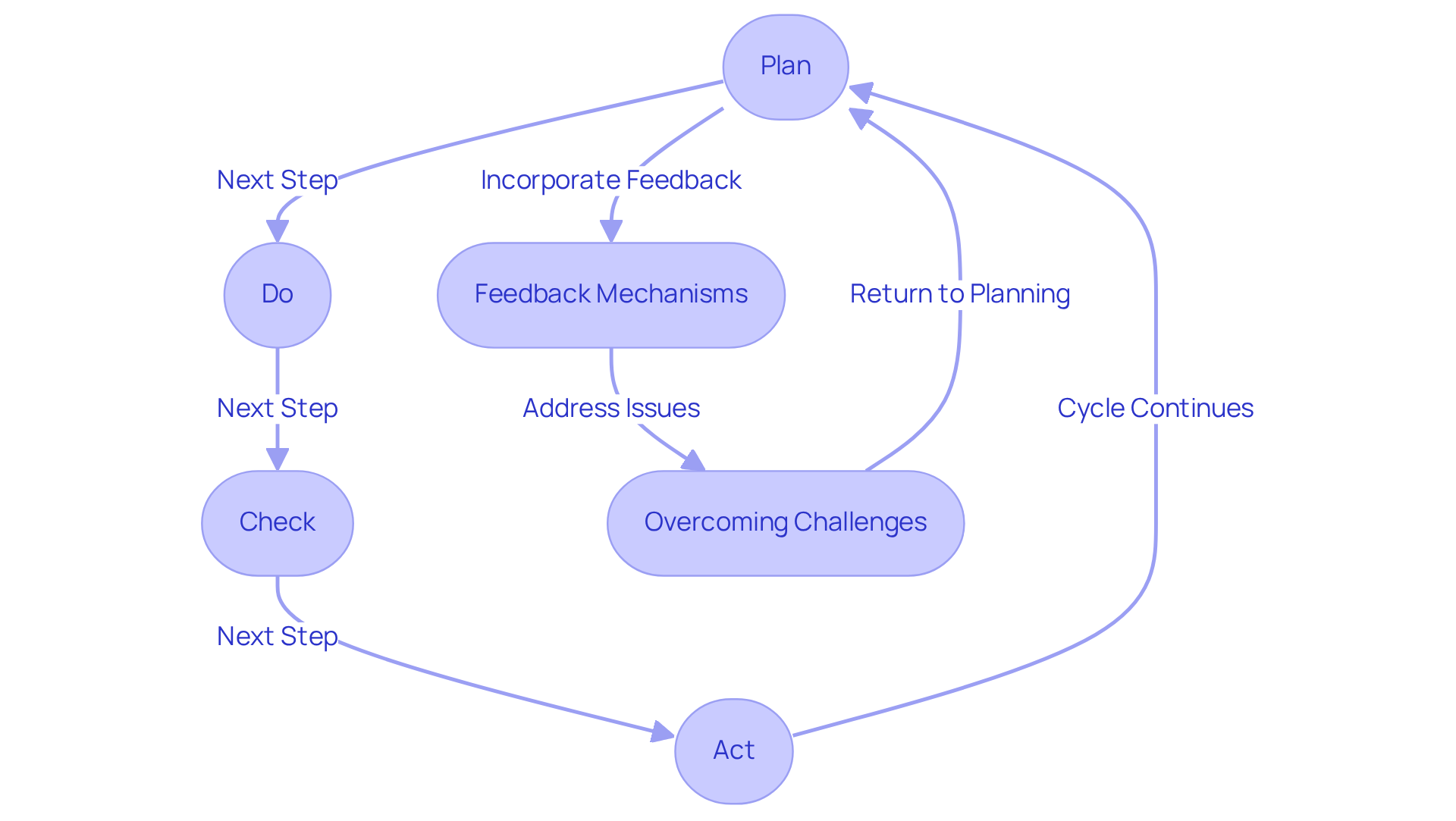

Fostering a culture of ongoing enhancement within venture capital (VC) groups is crucial for significantly improving sourcing and evaluation processes. Regular reviews of VC workflows for early sourcing, along with the identification of inefficiencies and implementation of changes based on performance metrics and feedback, are essential practices. The Plan-Do-Check-Act (PDCA) cycle serves as an effective framework for nurturing this culture.

Consider a VC firm that adopted continuous improvement practices, which reported a remarkable 40% increase in the speed of their deal evaluation process. By consistently evaluating their performance metrics and seeking input from colleagues, they pinpointed inefficiencies and applied targeted enhancements, ultimately resulting in improved financial outcomes.

Moreover, companies that prioritize enhancing their people’s performance achieve an average 30% higher revenue growth, underscoring the tangible benefits of continuous improvement. As noted by the Forbes Business Council, "When continuous improvement is embedded into culture, systems, and leadership, it drives performance and fuels engagement, innovation, and long-term resilience that benefits the whole organization."

However, implementing continuous improvement practices can present challenges. Common pitfalls include:

- Resistance to change

- Insufficient feedback mechanisms

To mitigate these issues, it is crucial to establish structured feedback loops that encourage open communication and regular performance evaluations. This iterative approach not only streamlines operations but also empowers teams to adapt swiftly to the dynamic investment landscape.

Conclusion

Optimizing VC workflows for early sourcing success is not just beneficial; it is essential for venture capital firms looking to enhance their investment strategies and outcomes. By implementing structured deal flow management, integrating AI technologies, leveraging collaboration tools, and fostering a culture of continuous improvement, VC teams can significantly streamline their processes and focus on high-value activities.

Key insights from the article underscore the importance of a systematic approach to deal flow management. This strategy not only reduces repetitive tasks but also enables teams to track critical metrics effectively. The integration of AI tools like Websets has proven transformative, allowing firms to analyze vast datasets and enhance sourcing efficiency. Furthermore, collaboration tools facilitate real-time communication and project management, driving team alignment and minimizing inefficiencies.

Ultimately, the significance of optimizing workflows in venture capital cannot be overstated. As the landscape evolves, embracing these best practices will empower firms to make informed decisions, adapt to market changes, and foster innovation. By prioritizing these strategies, VC teams can enhance their current performance and position themselves for sustained success in a competitive environment.

Frequently Asked Questions

What is deal flow management in venture capital (VC)?

Deal flow management is a systematic method for acquiring, assessing, and monitoring funding opportunities, which enhances workflows within venture capital.

What are the distinct phases in the investment flow process for VC groups?

The distinct phases include early sourcing, screening opportunities, outreach, due diligence, investment committee review, negotiating term sheets, and capital development.

How can VC groups improve their workflows with deal flow management?

By leveraging a centralized platform for deal flow management, VC groups can significantly reduce time spent on repetitive tasks and focus on high-value activities that drive results.

What benefits does deal management software provide?

Deal management software enhances the ability to track critical metrics such as deal volume and conversion rates, helping groups identify bottlenecks and refine their workflows.

Why are regular pipeline gatherings important in VC workflows?

Regular pipeline gatherings ensure that all team members remain aligned and updated on the status of potential opportunities, fostering collaboration and enhancing decision-making.

How does centralizing communication impact deal flow management?

Centralizing communication mitigates confusion and prevents missed opportunities in deal-related discussions, leading to more effective management of the deal flow.

Can you provide an example of a VC firm benefiting from deal flow management?

A leading VC firm that adopted Affinity, a structured transaction flow management system, saw a 30% increase in the number of transactions assessed each quarter and closed transactions 25% faster.

How often should VC groups review their deal flow strategies?

VC groups should conduct regular reviews of their deal flow strategies every 3 to 6 months to adapt to changing market conditions and ensure sustained effectiveness.