Overview

Compliance jobs are vital signals of growth, ensuring organizations meet regulatory standards. This adherence not only mitigates legal risks but also opens doors to new markets and fosters innovation. As regulations grow increasingly complex, the strategic importance of compliance roles will only heighten. Professionals in this field are becoming essential to risk management and corporate governance, positioning businesses for long-term success.

Consider this: organizations that prioritize compliance are not just avoiding pitfalls; they are actively paving the way for expansion. With the right compliance strategies in place, companies can confidently explore new opportunities without the looming threat of legal repercussions. This proactive approach is not merely a safeguard; it’s a catalyst for growth.

As we look to the future, it’s clear that compliance professionals will play a pivotal role in shaping corporate strategies. Their expertise will be crucial in navigating the intricate landscape of regulations, ensuring that businesses not only survive but thrive. Are you ready to embrace the changing dynamics of compliance and leverage it for your organization’s success?

In conclusion, investing in compliance roles is not just a regulatory necessity; it’s a strategic imperative. By doing so, businesses can enhance their risk management frameworks and strengthen their governance practices, ultimately securing a competitive edge in the marketplace.

Introduction

The business landscape is in a state of constant evolution, with compliance jobs emerging as vital indicators of organizational growth. These roles not only ensure adherence to complex regulations but also empower companies to confidently explore new markets. As industries face heightened scrutiny and regulatory demands, a pressing question arises: how can organizations leverage compliance roles as strategic advantages for expansion?

This article delves into the transformative role of compliance jobs, examining their significance in fostering sustainable growth and navigating the challenges of an ever-changing regulatory environment. By understanding the impact of these positions, businesses can position themselves for success in a competitive marketplace.

Define Compliance Jobs and Their Role in Business Expansion

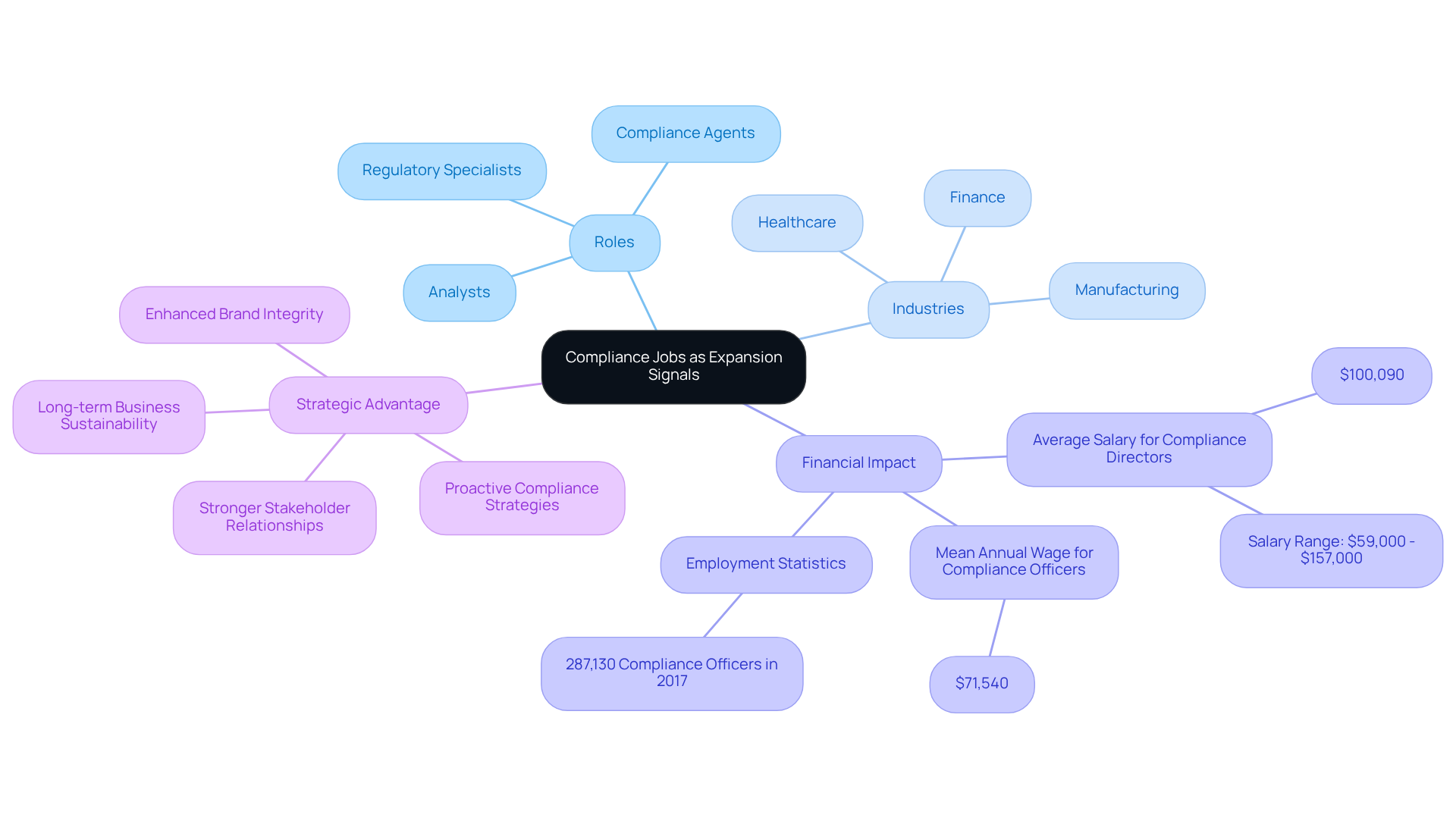

Compliance jobs as expansion signals are pivotal positions within organizations, ensuring adherence to laws, regulations, and internal policies. These roles are especially critical in sectors like finance, healthcare, and manufacturing, where regulatory frameworks are stringent. Regulatory specialists, including compliance agents and analysts, oversee and enforce standards, conduct audits, and provide training to staff. Their efforts not only mitigate legal risks but also cultivate a culture of integrity and accountability—essential for sustainable business growth.

Regulatory roles empower organizations to explore new markets and innovate without the fear of regulatory repercussions, demonstrating that compliance jobs as expansion signals are crucial for companies operating within legal boundaries. In 2017, the average yearly salary for regulatory specialists was $71,540, underscoring the financial implications of employing skilled professionals in this field. Notably, 287,130 individuals in the United States were employed as regulatory officers in 2017, emphasizing the significance of this profession, particularly in healthcare, where the demand for regulatory officers is rising due to increasingly complex regulations.

As Alan Carlisle aptly noted, "In 2025, adherence is no longer a checkbox exercise but a strategic advantage." Organizations that adopt proactive regulatory strategies often enjoy enhanced brand integrity and stronger stakeholder relationships, indicating that compliance jobs as expansion signals position them for long-term success in competitive landscapes. Conversely, failing audits or violations can lead to substantial financial penalties, highlighting the crucial role of professionals in safeguarding organizational interests.

Are you ready to embrace compliance as a strategic advantage? The time to act is now.

Trace the Evolution of Compliance Jobs in Response to Regulatory Changes

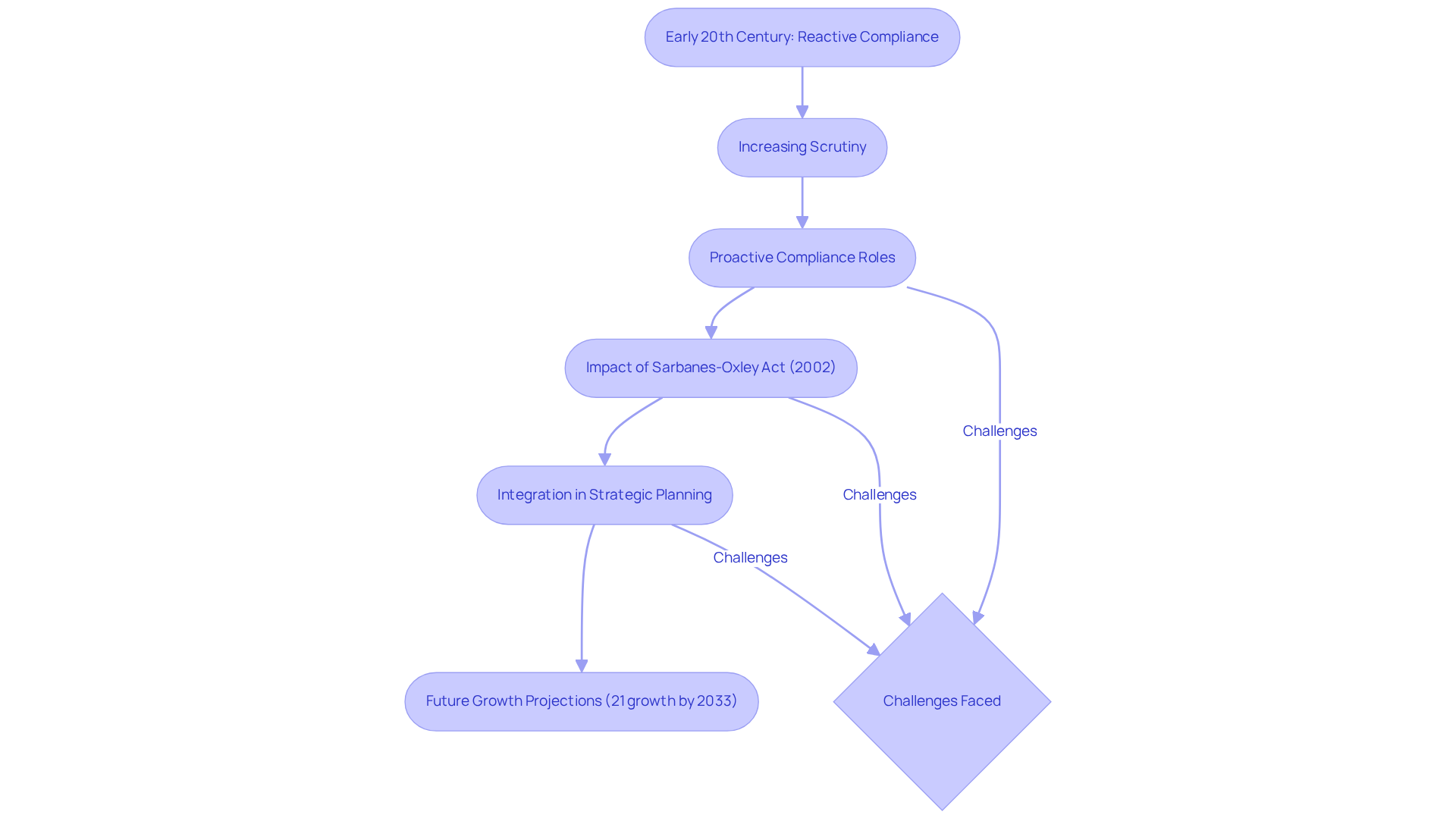

The evolution of regulatory roles dates back to the early 20th century, a time when businesses faced mounting scrutiny from regulatory bodies. Initially, these positions were reactive, focusing on ensuring compliance with existing laws. However, as regulations became more complex and industries experienced heightened oversight, the role of compliance jobs as expansion signals transformed into a proactive function.

Take, for instance, the Sarbanes-Oxley Act of 2002, which significantly impacted the finance sector, leading to the establishment of specialized oversight departments. Today, these roles are integral to strategic planning, with experts actively involved in risk management and corporate governance. They ensure that organizations not only comply with regulations but also recognize compliance jobs as expansion signals to leverage oversight as a competitive advantage.

Consider this: 92% of regulatory professionals report that their roles have become more challenging, highlighting the increasing complexity of regulatory landscapes. Moreover, the regulatory sector is projected to grow by 21% by 2033, indicating a sustained demand for skilled professionals adept at navigating these evolving environments. Chief Compliance Officers (CCOs) are now securing a seat at the executive table, which underscores their strategic importance in compliance jobs as expansion signals. Yet, 44% of regulatory officers struggle to keep pace with changes, emphasizing ongoing challenges in the field.

Case studies, such as CoStar’s VPPA victory and the CCPA Consumer Complaints Update, illustrate the real-world implications of these shifting regulatory environments. As the landscape continues to evolve, staying informed and adaptable is crucial for success.

Identify Key Skills and Characteristics of Successful Compliance Professionals

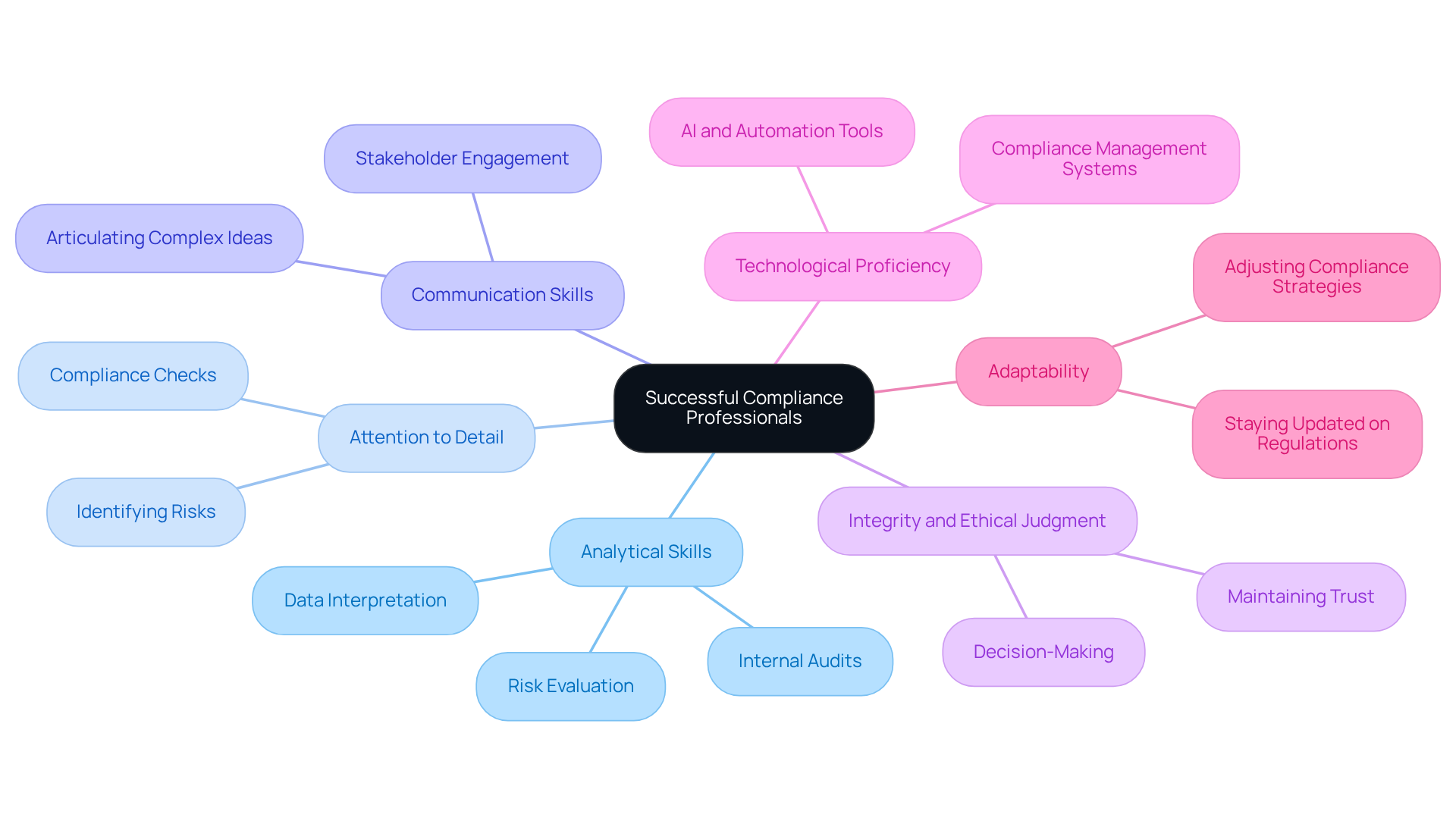

Successful regulatory professionals possess a unique blend of skills that enable them to navigate the complexities of regulatory environments with confidence. Robust analytical skills are essential; they empower these professionals to decode intricate regulations and translate them into actionable policies. Data indicates that candidates with strong analytical abilities are significantly better equipped to conduct internal inquiries and audits, linking various facts to uncover broader regulatory concerns.

Attention to detail is another critical trait. Minor oversights can lead to substantial risks, including legal penalties and reputational damage. Equally important are effective communication skills, which allow professionals to articulate complex ideas clearly to a range of stakeholders, from senior management to regulators.

Integrity and ethical judgment are vital qualities in this field. Regulatory officers often face challenging decisions that can impact their organization’s reputation. As technology and data analytics become increasingly crucial, regulatory professionals must leverage advanced software tools to monitor compliance and assess risks effectively. By 2025, expertise in AI and automation tools will likely become a necessity, as organizations strive to enhance their management processes.

Ongoing education and adaptability are essential in this rapidly evolving landscape. Effective professionals not only stay informed about legal changes but also assess their institution's regulatory risks, aligning their priorities with management to ensure successful compliance strategies. They set achievable goals and focus on a prioritized list of regulatory objectives, which is vital for managing their responsibilities efficiently.

Moreover, effective delegation and outsourcing of non-core competencies can significantly enhance management efficiency. The growing demand for skilled regulatory professionals underscores the importance of cultivating these skills and traits, highlighting compliance jobs as expansion signals in the competitive landscape of regulatory roles.

Analyze the Strategic Importance of Compliance Jobs in 2025

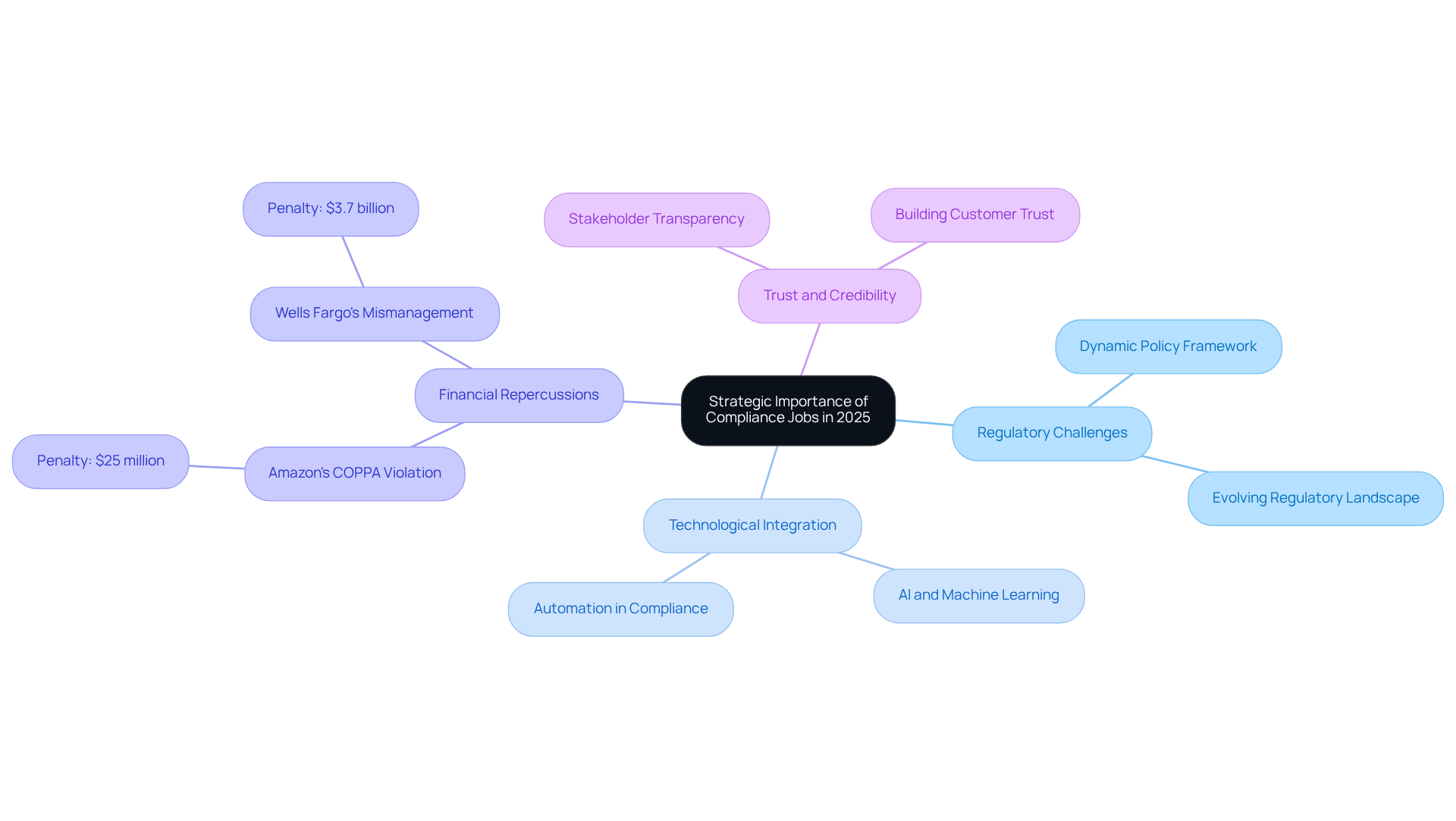

As we approach 2025, the strategic importance of compliance jobs as expansion signals is expected to escalate dramatically. The surge in digital transformation and globalization presents businesses with new regulatory challenges that demand robust adherence frameworks. Compliance professionals will be crucial in guiding organizations through these complexities, ensuring they remain compliant while viewing compliance jobs as expansion signals.

Consider the case of Amazon, which faced a staggering $25 million penalty for violating the Children's Online Privacy Protection Act (COPPA). This incident underscores the financial repercussions of inadequate adherence strategies. Similarly, Wells Fargo incurred $3.7 billion in penalties due to mismanagement of customer accounts, reinforcing the necessity of embedding regulatory compliance into the organizational culture.

The integration of artificial intelligence and machine learning into regulatory processes promises to enhance efficiency and accuracy. This shift allows teams to focus on strategic initiatives rather than merely reactive tasks. Moreover, the average time to identify and mitigate a data breach is 258 days, emphasizing the urgency and critical nature of responsibilities in mitigating data breach risks.

As stakeholders increasingly demand transparency and ethical practices, regulatory positions will be vital in fostering trust and credibility with customers and investors. This positions regulations as compliance jobs as expansion signals for business success. Furthermore, proactive strategies in compliance jobs as expansion signals, exemplified by companies like Microsoft that adopted GDPR regulations ahead of enforcement, can offer a competitive edge, further underscoring the strategic significance of compliance roles.

Conclusion

Compliance roles are not just functional positions within organizations; they serve as essential catalysts for growth and strategic advantage. By ensuring adherence to regulations and fostering a culture of accountability, compliance professionals empower businesses to navigate complex regulatory landscapes with confidence. As industries evolve and regulatory demands increase, the proactive approach of compliance jobs becomes a pivotal factor in positioning companies for sustainable success.

Key arguments throughout the article highlight:

- The evolution of compliance roles from reactive to proactive functions

- The critical skills required for success

- The strategic importance these positions will hold as we approach 2025

The financial implications of compliance failures, illustrated by high-profile penalties faced by major corporations, underscore the necessity of embedding compliance into the organizational fabric. Moreover, the integration of advanced technologies like AI in compliance processes signals a future where these roles will be even more integral to business strategy.

In light of these insights, organizations must recognize the strategic value of compliance jobs as expansion signals. By investing in skilled professionals and adopting proactive compliance strategies, businesses can not only mitigate risks but also enhance their reputation and stakeholder trust. Embracing compliance as a core element of business strategy is not merely a regulatory requirement; it is a pathway to growth and competitive advantage in an increasingly complex marketplace.

Frequently Asked Questions

What are compliance jobs and their significance in business expansion?

Compliance jobs are pivotal positions within organizations that ensure adherence to laws, regulations, and internal policies. They are especially critical in sectors like finance, healthcare, and manufacturing, where regulatory frameworks are stringent. These roles help mitigate legal risks and cultivate a culture of integrity and accountability, essential for sustainable business growth.

What specific roles do compliance professionals play?

Compliance professionals, such as regulatory specialists, compliance agents, and analysts, oversee and enforce standards, conduct audits, and provide training to staff. Their efforts ensure that organizations can explore new markets and innovate while remaining within legal boundaries.

What was the average salary for regulatory specialists in 2017?

In 2017, the average yearly salary for regulatory specialists was $71,540.

How many individuals were employed as regulatory officers in the United States in 2017?

In 2017, there were 287,130 individuals employed as regulatory officers in the United States.

Why is there a rising demand for regulatory officers, particularly in healthcare?

The demand for regulatory officers is rising in healthcare due to increasingly complex regulations that require skilled professionals to navigate and ensure compliance.

What did Alan Carlisle mean by stating that adherence will be a strategic advantage by 2025?

Alan Carlisle suggested that by 2025, adherence to regulations will not just be a compliance requirement but will serve as a strategic advantage for organizations, enhancing brand integrity and strengthening stakeholder relationships.

What are the consequences of failing audits or regulatory violations?

Failing audits or regulatory violations can lead to substantial financial penalties, highlighting the crucial role of compliance professionals in safeguarding organizational interests.