Overview

The title "10 Verified Datasets for M&A Deal Origination Success" raises a pivotal question: how can effective datasets enhance success in mergers and acquisitions (M&A) deal origination? This article delves into various platforms and their capabilities, underscoring the significance of verified datasets for M&A professionals. These datasets are essential for efficiently identifying potential acquisition targets, streamlining decision-making processes, and improving overall deal outcomes in a landscape that is increasingly competitive. By leveraging these resources, professionals can navigate challenges and position themselves for success.

Introduction

In the fast-paced world of mergers and acquisitions, accessing reliable data is not merely an advantage—it is an absolute necessity. M&A professionals are increasingly relying on verified datasets that deliver critical insights for deal origination. These resources empower them to identify lucrative opportunities and make informed decisions. Yet, with a multitude of platforms asserting they offer the best solutions, how can one discern which datasets genuinely drive success in this competitive landscape? This article delves into ten verified datasets that promise to enhance M&A deal origination, equipping professionals with the essential tools they need to thrive in an ever-evolving market.

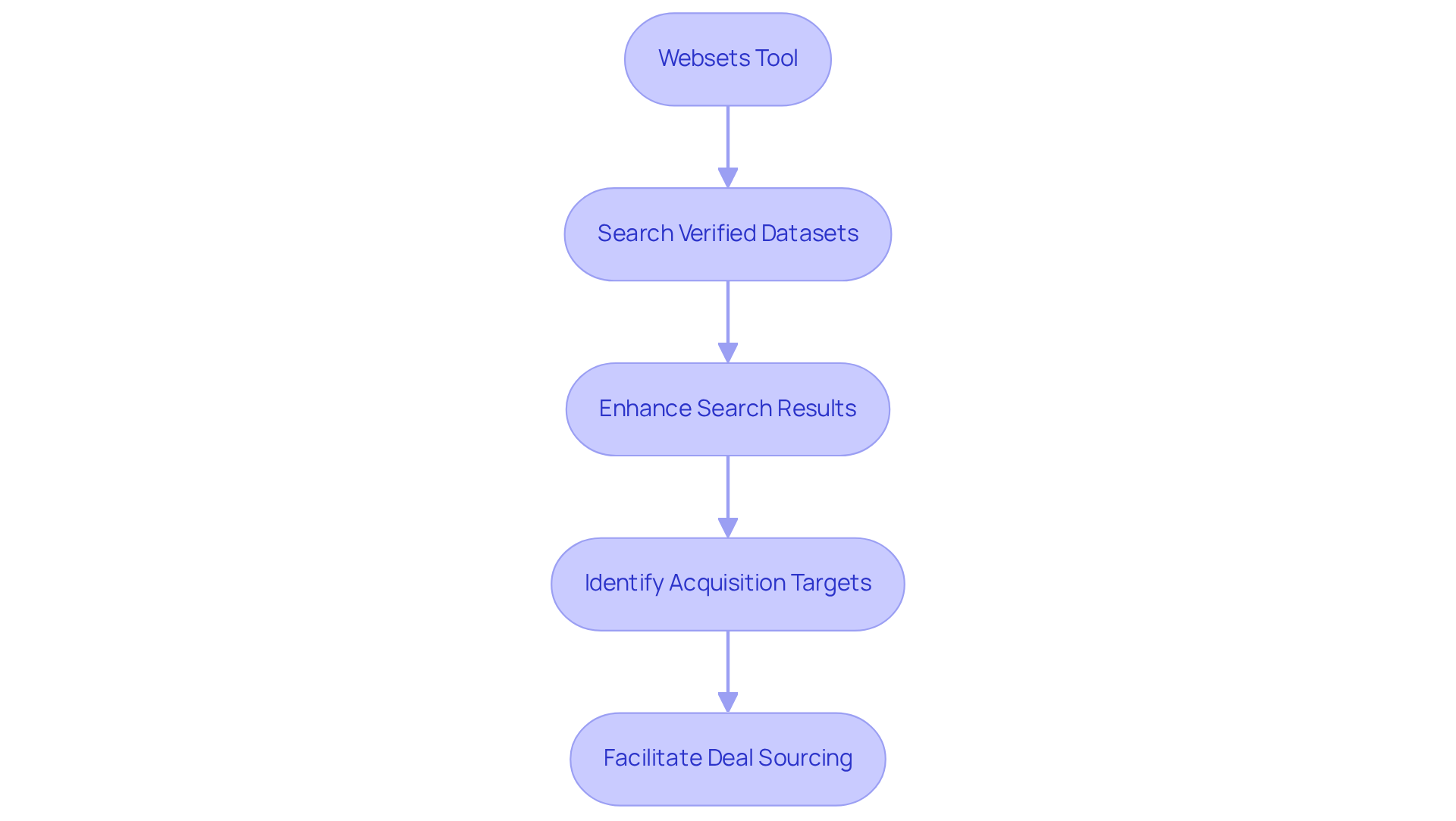

Websets: AI-Powered B2B Lead Generation for M&A Insights

Websets leverages to revolutionize , specifically using for . Its powerful search engine empowers users to navigate extensive verified datasets for m&a deal origination, allowing to efficiently identify potential acquisition targets or partners. By enhancing search results with detailed information, including LinkedIn profiles and company histories, Websets significantly elevates . This capability establishes it as an indispensable tool for in the dynamic M&A landscape, leveraging verified datasets for m&a deal origination, where is crucial. As AI continues to transform the industry, platforms like Websets lead the way, facilitating successful implementations that and enhance overall outcomes.

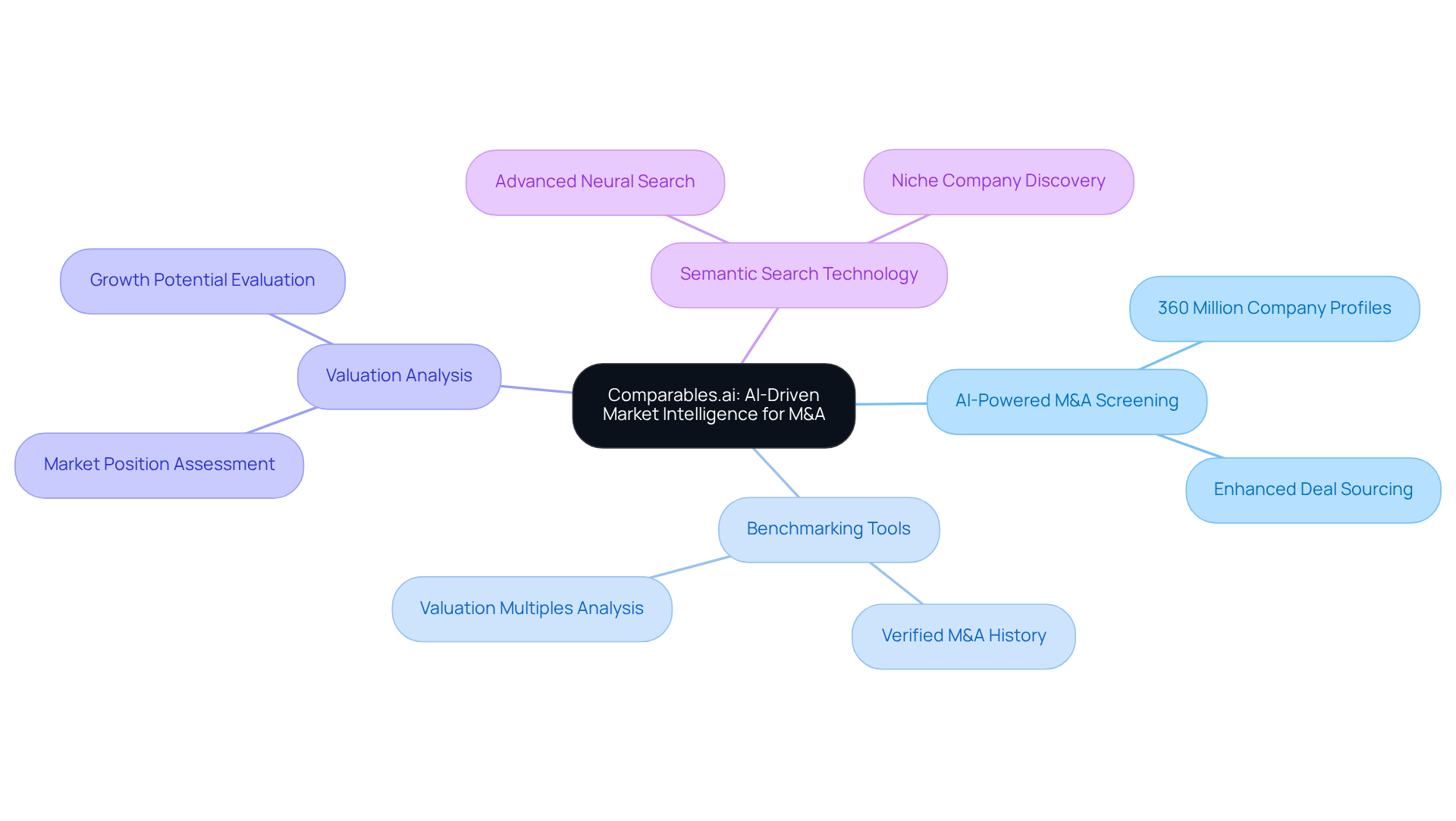

Comparables.ai: AI-Driven Market Intelligence for M&A

Comparables.ai stands out as an AI-powered platform tailored for M&A experts, delivering robust intelligence through verified datasets for that streamline the deal-making process. With features such as , benchmarking, and valuation analysis, it empowers users to swiftly pinpoint potential acquisition targets and assess their market positioning. The platform provides access to over 360 million company profiles, significantly enhancing the effectiveness of sourcing opportunities and facilitating .

In contrast to traditional search engines that depend heavily on keyword matching—often yielding irrelevant results—Comparables.ai harnesses advanced neural search technology. This AI-driven semantic search capability allows users to uncover niche companies more effectively, overcoming the limitations of conventional search methods. For example, when searching for companies akin to Thrifthouse, users can depend on the platform's sophisticated algorithms to generate relevant results that traditional searches frequently overlook.

The within Comparables.ai enable precise screening and benchmarking, allowing users to leverage verified M&A history and valuation multiples. This capability is vital in a landscape where M&A transactions surged by 21% year-over-year by Q1 2025, underscoring the necessity for advanced AI capabilities to maintain a competitive edge.

Successful instances of M&A screening utilizing AI demonstrate its transformative impact. Professionals leveraging Comparables.ai can swiftly validate assumptions and benchmark against deal origination, which fosters greater confidence in negotiations and enhances deal outcomes. The integration of AI not only shortens research duration but also refines strategic analysis, enabling analysts to focus on high-value tasks rather than information gathering.

The current market for in M&A is expanding rapidly, driven by the increasing complexity of transactions and the demand for accurate, timely information. Comparables.ai positions itself as a leader in this domain, offering tools that enhance sourcing and deliver critical insights precisely when needed.

Industry leaders acknowledge the efficacy of like Comparables.ai, emphasizing that the hybrid approach—melding AI's analytical prowess with human judgment—produces superior results. As one industry expert remarked, "AI won’t replace dealmakers—it will redefine them." This collaboration is essential as AI continues to reshape the role of dealmakers, allowing them to concentrate on negotiation and strategic connections while AI manages information processing and predictive analytics.

DealRoom: Purpose-Built M&A Platform for Efficient Deal Management

DealRoom stands out as an innovative platform meticulously crafted to streamline M&A . As the sole M&A platform offering a unified source of truth for comprehensive lifecycle management, it functions as a centralized hub for all deal-related data, empowering teams to collaborate effectively throughout the entire transaction process. Key functionalities—such as pipeline management, secure document sharing, automated workflows, alerts, and real-time updates—significantly diminish the time and effort required to finalize agreements. M&A professionals utilizing DealRoom can enhance , allowing them to focus on rather than becoming mired in administrative tasks.

The impact of on M&A transaction management is profound. Industry specialists emphasize that having all relevant information in one easily accessible location fosters improved communication and collaboration among team members, ultimately leading to expedited transaction closures. One M&A expert articulated the challenges of using fragmented systems, stating, "It's hard to make any updates on Smartsheets to our transaction pipeline midway through the process... it's just not very intuitive." In stark contrast, DealRoom's integrated approach alleviates these frustrations, enabling teams to maintain focus and momentum.

Real-world examples underscore the effectiveness of DealRoom in during M&A transactions. The platform's features facilitate , essential for sustaining alignment across various stakeholders. As another expert noted, "Create scalable, repeatable strategies that maintain progress"—a testament to how DealRoom supports structured workflows and minimizes operational friction. Moreover, Ivan Golubic, CFO at FastLap, remarked, "Invest in the right tools, such as DealRoom, and your transactions will proceed much faster and much more smoothly." By embracing such , M&A teams can navigate the complexities of transactions with heightened confidence and agility. It is also crucial to acknowledge the risks associated with over-reliance on manual processes like Excel trackers, which can introduce human error and impede deal progress.

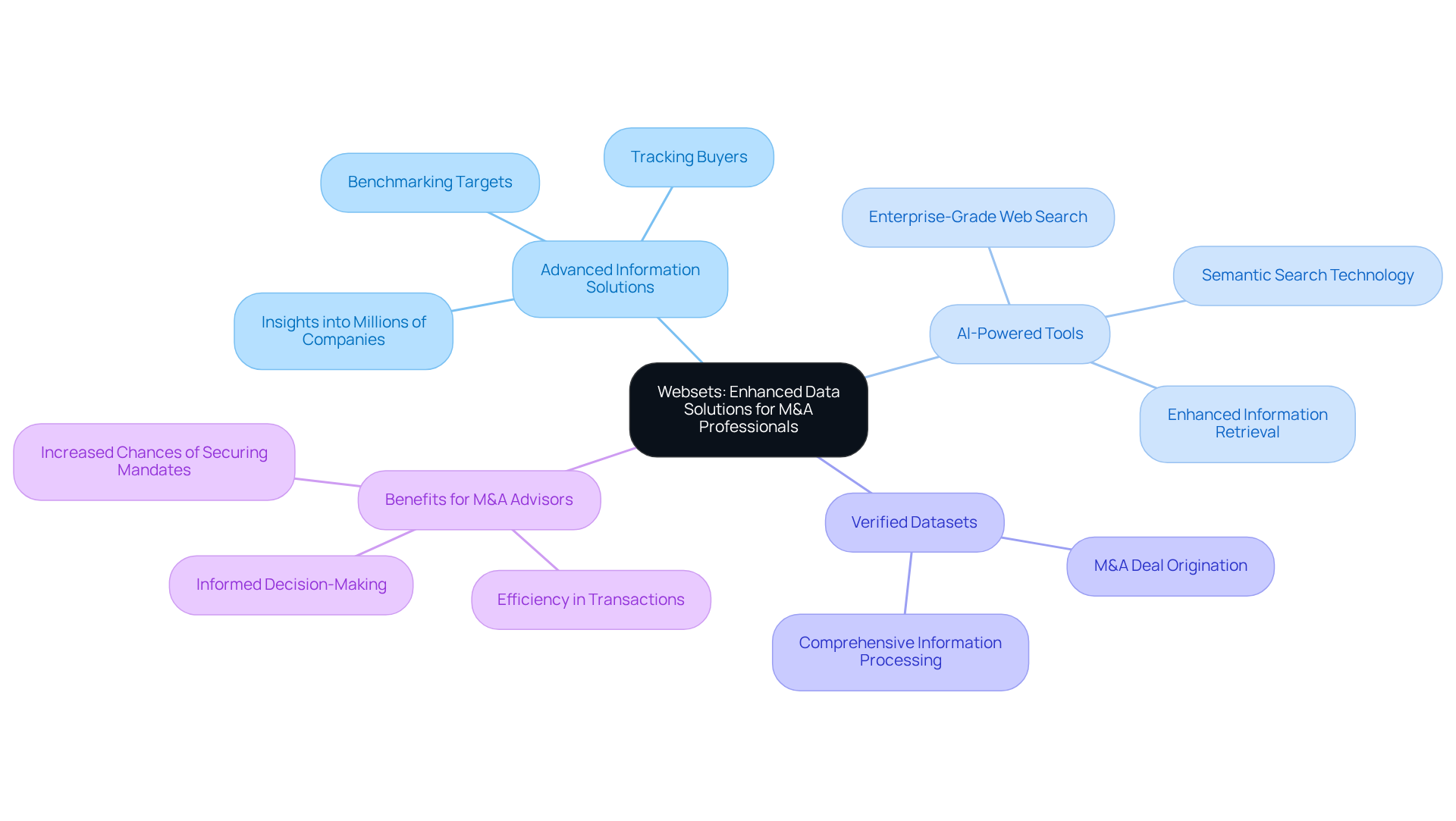

Gain.pro: Enhanced Data Solutions for M&A Professionals

Websets equips M&A experts with that significantly . This platform offers insights into millions of companies, enabling users to effectively track buyers and benchmark targets using verified datasets for . With enterprise-grade, , Websets harnesses Exa's semantic search technology to uncover , delivering enhanced information for targeted results. In a landscape where precise information is paramount for , this capability is vital.

By leveraging and , M&A advisors can make informed decisions, thus increasing their chances of securing mandates and driving success in transactions. As Nicola Ebmeyer, Co-Founder and Co-CEO, asserts, 'We do the work of analysts, but ten times faster and more efficiently.' This commitment is underscored by Websets' adherence to the highest industry standards, including tailored for enterprise clients. Such measures ensure that M&A advisors have access to , which empowers them to navigate complex transaction environments and identify lucrative opportunities.

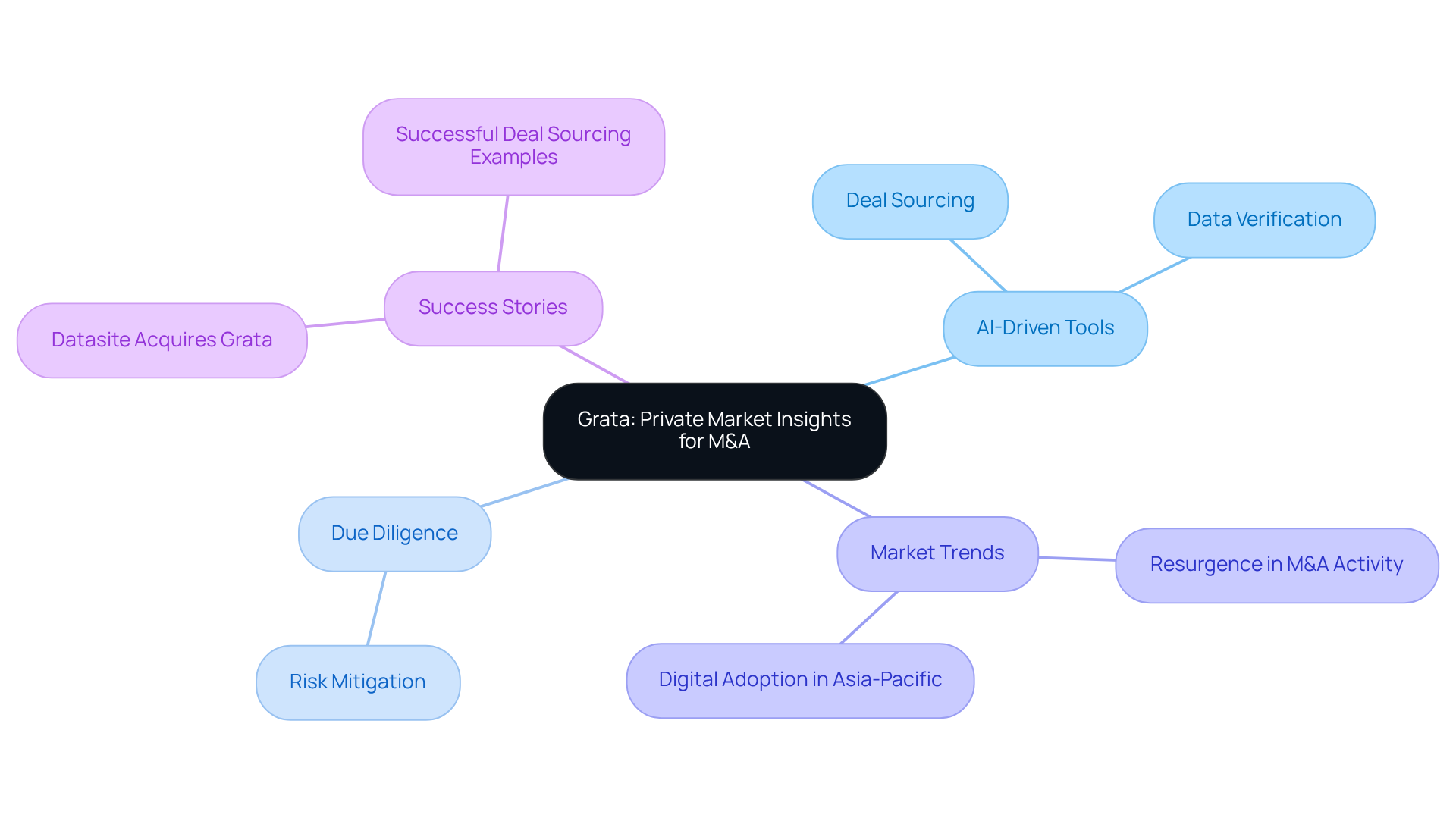

Grata: Key Insights into Private Market Data for M&A

Grata emerges as a premier platform delivering , which includes verified datasets for , indispensable for . By leveraging advanced , Grata empowers users to efficiently source deals, streamline , and foster connections with fellow dealmakers. This capability is vital in today's competitive landscape, where the swift identification and assessment of can significantly influence success rates.

Recent trends indicate a resurgence in M&A activity, particularly in the Asia-Pacific region, driven by rapid digital adoption. Grata’s platform enhances this momentum by providing , which include comprehensive, accurate, and searchable data on private companies that is crucial for . In fact, Grata records over 55,000 projects annually, offering users verified datasets for M&A deal origination to navigate the intricacies of private sectors.

The importance of due diligence in M&A transactions cannot be overstated. Industry experts emphasize that thorough due diligence is essential for mitigating risks and ensuring . Grata's tools facilitate this process, allowing users to efficiently conduct in-depth analyses of potential targets using verified datasets for M&A deal origination. Consider the recent acquisition of Grata by Datasite, which illustrates the growing acknowledgment of AI's role in enhancing intelligence and sourcing capabilities.

Successful examples of deal sourcing and due diligence abound, with increasingly relying on platforms like Grata to identify lucrative opportunities. As the industry evolves, the integration of AI tools into due diligence processes will remain a game-changer, enabling M&A experts to operate more intelligently and swiftly, ultimately leading to improved outcomes in their transactions.

MarktoMarket: M&A Research Platform for Target Identification

Websets stands as a pivotal , empowering experts to pinpoint with precision. By connecting M&A advisors and investors to , it facilitates thorough research and analysis. Users gain access to verified datasets for M&A deal origination, which include , company profiles, financial information, and insights, significantly enhancing the for .

In an era where understanding buyer motivations and industry dynamics is increasingly critical, this capability is indispensable. As the 2025 UK M&A landscape shifts towards , leveraging verified datasets for M&A deal origination becomes essential for uncovering and enabling successful transactions.

With its , Websets delivers comprehensive insights into startups, allowing users to filter by industry, stage, and location, thereby further supporting M&A professionals in their strategic pursuits.

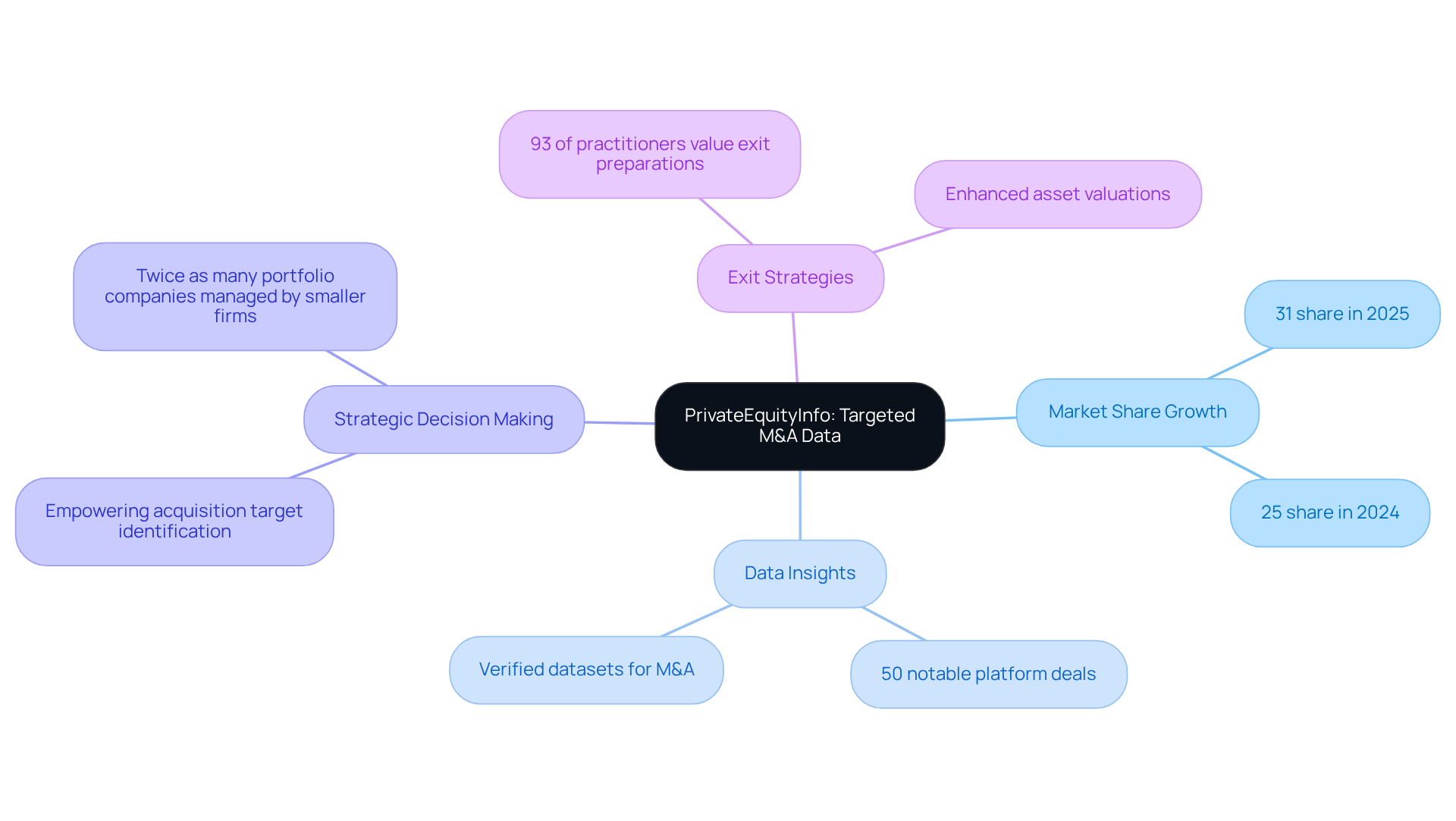

PrivateEquityInfo: Targeted M&A Data for Strategic Decisions

PrivateEquityInfo emerges as a premier M&A research platform, delivering precise data essential for within the private equity landscape. It provides into , their portfolio companies, and prevailing investment trends, empowering users to swiftly identify potential acquisition targets. This capability is particularly vital, given that of the total M&A sector in the first half of 2025, a notable increase from 25% during the same period in 2024.

The platform's extensive database, featuring verified datasets for , significantly enhances , enabling M&A professionals to make informed choices that greatly influence their success. Recent information highlighted 50 significant platform agreements accomplished by private equity firms, illustrating the vibrant quality of the market. As deal sizes and complexities grow, the demand for accurate and timely information becomes paramount.

PrivateEquityInfo not only grants access to but also bolsters strategic decision-making by offering insights into . Executives at smaller private equity firms manage twice as many portfolio companies per dealmaker compared to their larger counterparts, indicating a shift in operational strategies that can be leveraged for competitive advantage.

Moreover, industry specialists underscore the importance of efficient exit strategies, with 93% of private equity practitioners observing that such preparations lead to . This underscores the value of real-time insights and in navigating the complexities of M&A transactions. By utilizing PrivateEquityInfo, experts can refine their strategic approach, ensuring they remain at the forefront of the evolving private equity landscape.

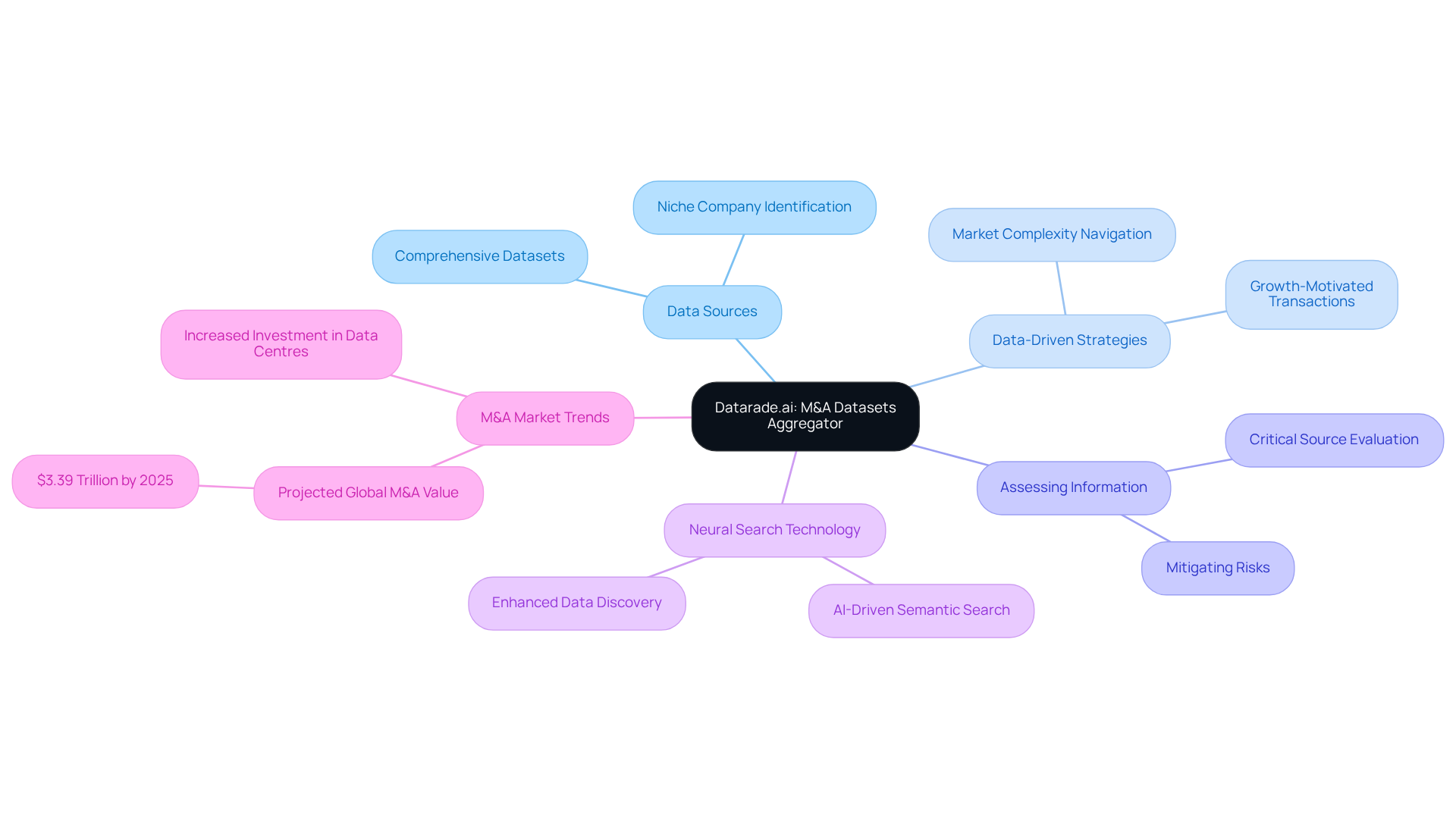

Datarade.ai: Comprehensive Aggregator of M&A Datasets

Datarade.ai serves as an essential aggregator of , granting M&A specialists access to a wide range of data sources. This platform empowers users to , ensuring they have the most relevant and accurate information for their needs. By utilizing Datarade.ai, experts can significantly enhance their , leading to that drives successful M&A transactions.

Current trends highlight a growing focus on in M&A, with professionals increasingly depending on to navigate market complexities. Insights from industry specialists emphasize that critically assessing information sources is vital for uncovering valuable opportunities and mitigating risks. Datarade.ai streamlines this process by providing tools that facilitate comparison, allowing users to efficiently evaluate the strengths and weaknesses of different datasets.

Moreover, traditional search methods often fall short in identifying niche companies, as illustrated by searching for platforms like Thrifthouse. This is where neural search technology becomes instrumental, enhancing through . By leveraging advanced semantic retrieval, Datarade.ai enables M&A professionals to uncover that conventional search methods might overlook. This capability is crucial in a landscape where have surged, with global M&A value projected to reach $3.39 trillion by 2025. By utilizing Datarade.ai, users can ensure they are equipped with the insights necessary to capitalize on these industry dynamics, ultimately improving their chances of success in opportunity origination.

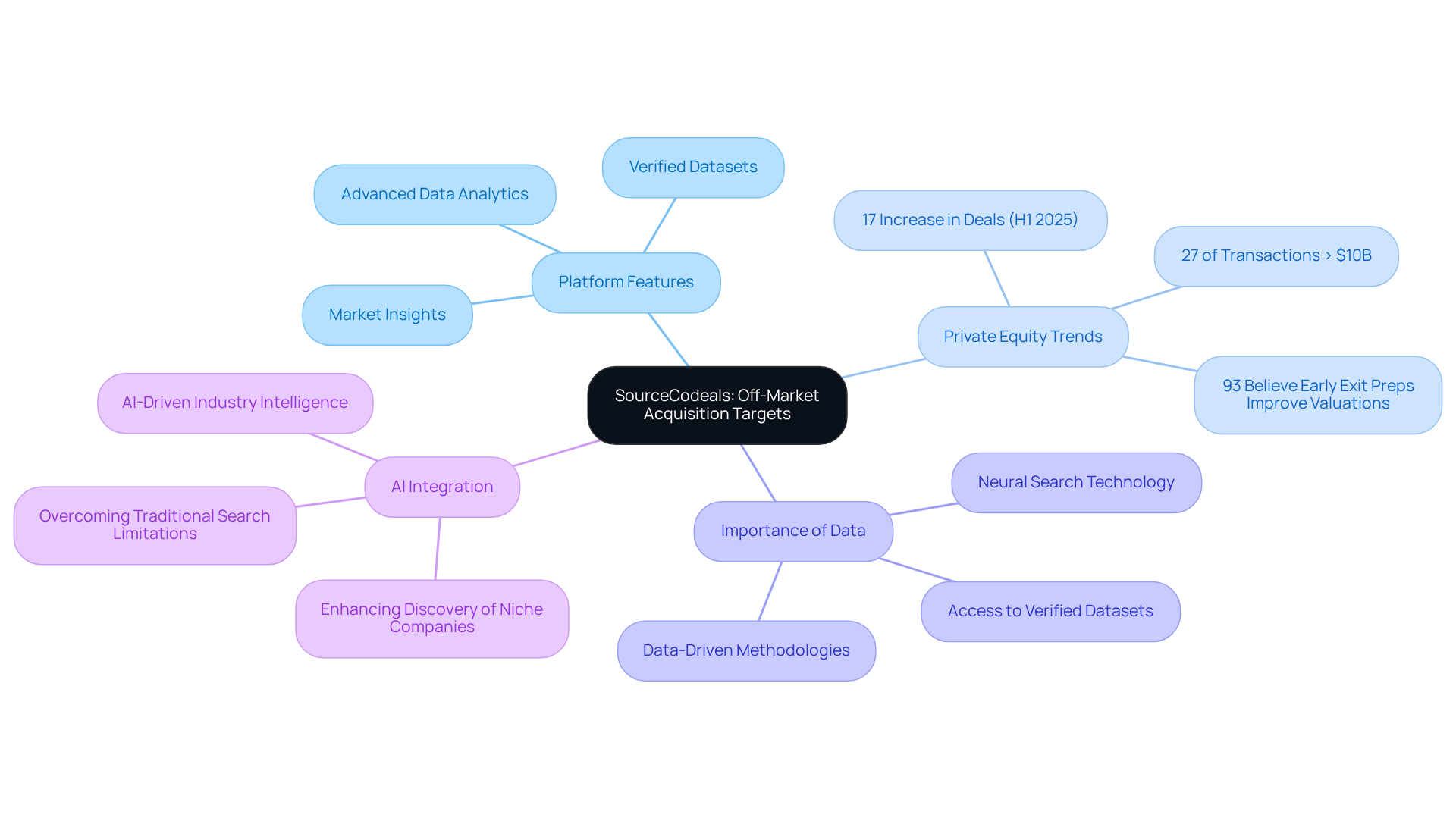

SourceCodeals: Discover Off-Market Acquisition Targets in Private Equity

SourceCodeals stands as a pioneering platform, expertly crafted to unveil off-market acquisition targets, thereby granting private equity firms access to unique opportunities often overlooked. By harnessing advanced data analytics alongside comprehensive market insights, SourceCodeals empowers users to identify potential targets that align with their distinct investment criteria using . This capability is indispensable for aiming to and seize exceptional opportunities within a competitive landscape.

In 2025, private equity activity witnessed a remarkable surge, with 27% of transactions exceeding $10 billion, highlighting a significant trend towards larger operations. As companies adapt to shifting economic conditions, the ability to discern distinctive investment opportunities becomes essential. Notably, 93% of private equity professionals assert that early exit preparations substantially elevate asset valuations, emphasizing the critical nature of .

Furthermore, the increase in private equity deals—up 17% in the first half of 2025 compared to the previous year—underscores the effectiveness of platforms like SourceCodeals in facilitating access to verified datasets for m&a deal origination and invaluable insights. Through the integration of , SourceCodeals enhances the discovery of niche companies and off-site opportunities, effectively overcoming traditional search limitations. Websets provides an extensive catalog of leading startups and , enabling private equity firms to efficiently assess industry trends and competitor landscapes. As the industry evolves, private equity firms increasingly depend on verified datasets for m&a deal origination and , including neural search technology, to navigate complexities and refine their acquisition strategies, ensuring they remain competitive in a dynamic environment.

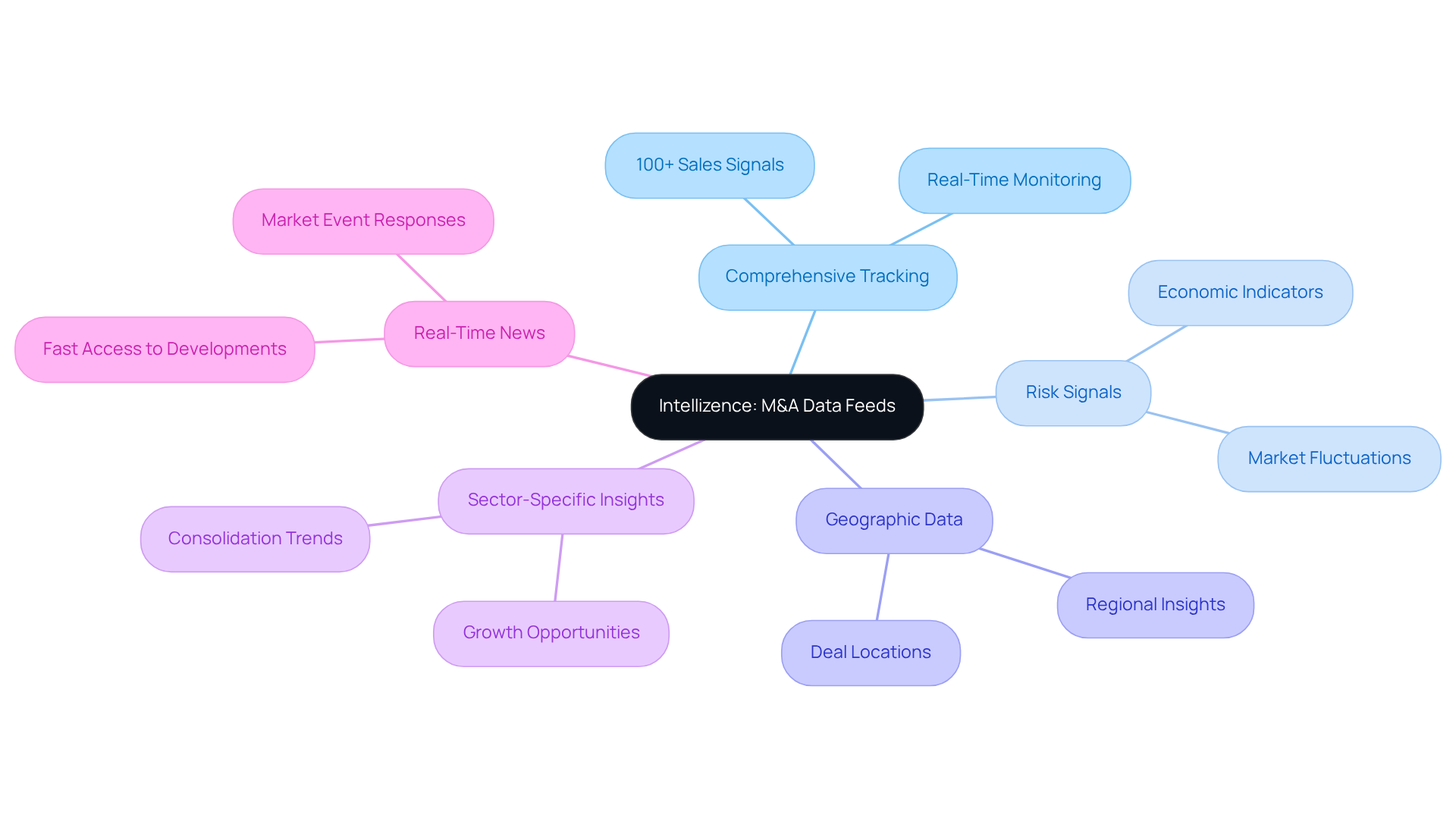

Intellizence: Detailed M&A Data Feeds for Market Tracking

Intellizence delivers , empowering experts to monitor trends and changes in real-time. By tracking over 100 sales and risk signals, Intellizence provides users with crucial insights to adeptly navigate the ever-evolving . This capability is vital for M&A professionals who must swiftly adapt their strategies in response to fluctuating economic conditions.

For instance, as the M&A landscape transforms, understanding geographic and sector-specific data can reveal where significant deals are occurring, allowing firms to concentrate on promising opportunities. Furthermore, accessing reliable , enabling companies to respond swiftly to market events such as asset sales or buyouts. This not only mitigates risks but also within a competitive environment.

Conclusion

The exploration of verified datasets for M&A deal origination unveils a transformative landscape where data-driven insights are crucial for success. Various platforms, including Websets, Comparables.ai, and DealRoom, empower M&A professionals with advanced tools and analytics, enabling them to identify potential targets and streamline their decision-making processes. These platforms not only enhance lead quality but also facilitate efficient transaction management and strategic planning.

Key arguments highlight the necessity of leveraging AI and comprehensive datasets to navigate the complexities of the M&A environment. Grata’s insights into private market data and Datarade.ai’s aggregation of diverse datasets each contribute uniquely to informed decision-making. The emphasis on real-time data, effective due diligence, and the integration of AI tools reflects the evolving nature of M&A practices, ensuring that professionals remain competitive in a rapidly changing market.

Ultimately, the significance of utilizing verified datasets for M&A deal origination cannot be overstated. As the industry continues to evolve, embracing these advanced tools will be essential for professionals aiming to capitalize on emerging opportunities and enhance their strategic initiatives. By prioritizing data-driven methodologies, M&A experts can improve transaction outcomes and redefine their roles in this dynamic landscape, ensuring they are well-prepared for future challenges and successes.

Frequently Asked Questions

What is Websets and how does it assist in B2B lead generation for M&A?

Websets is an AI-powered platform that leverages advanced algorithms and verified datasets to enhance B2B lead generation specifically for M&A deal origination. It allows M&A professionals to efficiently identify potential acquisition targets or partners by providing detailed search results that include LinkedIn profiles and company histories.

How does Comparables.ai improve the M&A deal-making process?

Comparables.ai is an AI-driven platform that offers robust market intelligence through verified datasets for M&A deal origination. It features M&A screening, benchmarking, and valuation analysis, enabling users to quickly identify potential acquisition targets and assess their market positioning. The platform uses advanced neural search technology to deliver more relevant results than traditional keyword-based searches.

What unique features does Comparables.ai offer compared to traditional search engines?

Comparables.ai utilizes AI-driven semantic search technology, allowing users to uncover niche companies more effectively than traditional search engines, which often rely on keyword matching. This advanced capability helps users find relevant results that may be overlooked by conventional methods.

How does AI integration in M&A screening benefit professionals?

The AI tools within Comparables.ai enable precise screening and benchmarking against verified datasets, which fosters greater confidence in negotiations and enhances deal outcomes. AI integration shortens research duration and refines strategic analysis, allowing analysts to focus on high-value tasks instead of information gathering.

What role does DealRoom play in M&A transaction management?

DealRoom is an innovative platform designed to streamline M&A transaction management by serving as a centralized hub for all deal-related data. It facilitates effective collaboration throughout the transaction process with features like pipeline management, secure document sharing, automated workflows, and real-time updates.

How does centralized data management in DealRoom improve M&A transactions?

Centralized data management in DealRoom fosters improved communication and collaboration among team members, leading to expedited transaction closures. It alleviates the challenges associated with fragmented systems, allowing teams to maintain focus and momentum throughout the transaction process.

What advantages does DealRoom provide over manual processes?

DealRoom minimizes operational friction by providing structured workflows and reducing reliance on manual processes like Excel trackers, which can introduce human error and impede deal progress. This efficiency enables M&A teams to navigate complex transactions with greater confidence and agility.