Overview

This article examines how venture capital (VC) teams can significantly enhance their performance by leveraging benchmark talent datasets. It showcases various AI-driven platforms and strategies that leading VC firms utilize to identify promising startups and exceptional talent. The discussion emphasizes the critical importance of data accuracy and advanced analytics in refining talent acquisition and making informed investment decisions. By understanding these tools and methodologies, VC teams can position themselves to make smarter, data-driven choices that ultimately lead to greater success.

Introduction

In the fast-paced world of venture capital, identifying and leveraging the right talent datasets can be the decisive factor between a successful investment and a missed opportunity. As firms increasingly embrace innovative technologies and data-driven strategies, mastering the effective utilization of these resources becomes essential.

What challenges do VC teams encounter in navigating this evolving landscape? How can they harness the power of benchmark talent datasets to elevate their performance?

This article delves into ten vital datasets that promise to revolutionize talent acquisition and investment strategies for VC teams, paving the way for smarter, more informed decisions.

Websets: AI-Powered B2B Lead Generation for VC Talent Acquisition

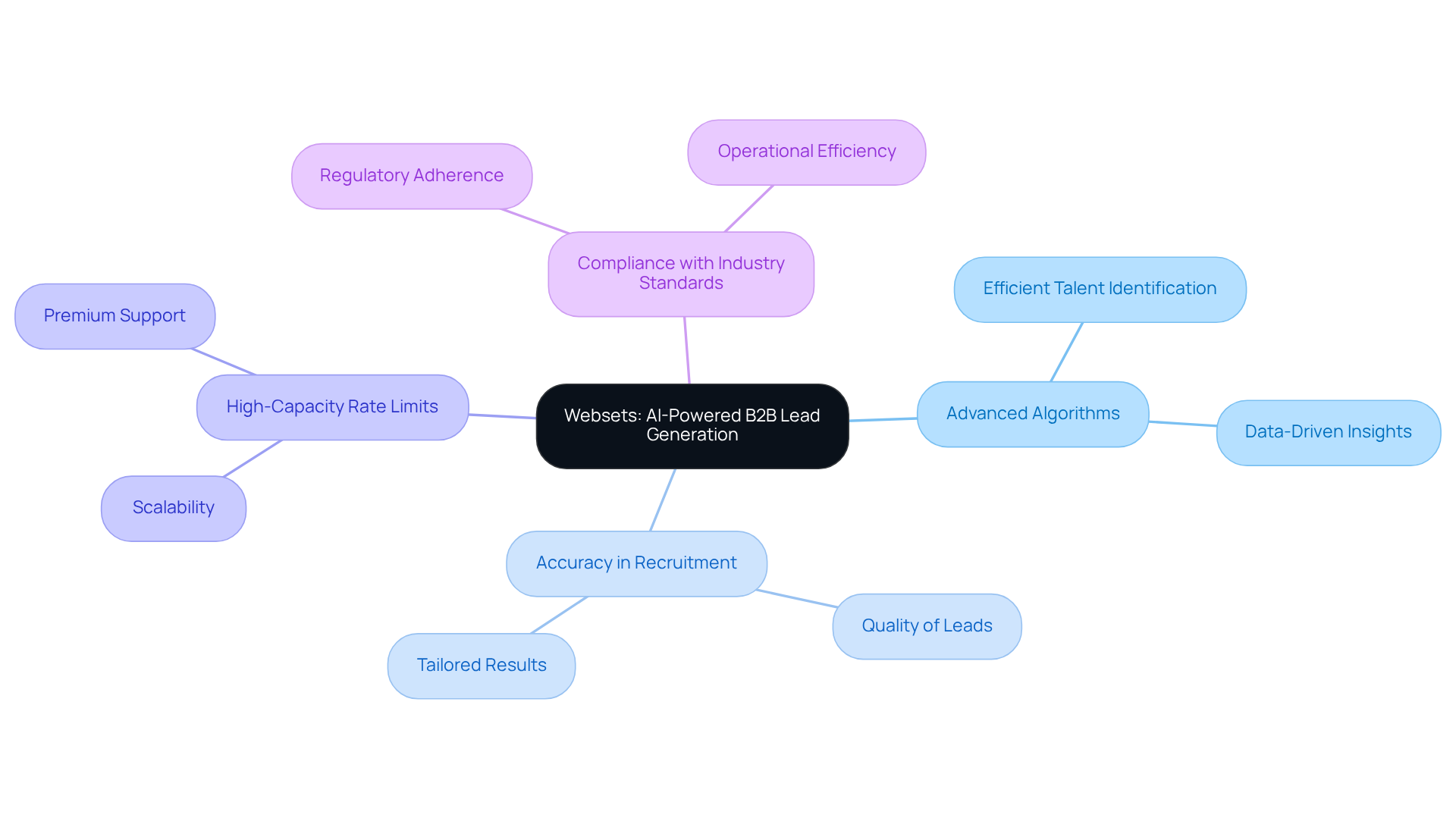

This innovative AI-driven platform stands at the forefront of B2B lead generation and candidate discovery, serving as an invaluable asset for venture capital teams looking to benchmark talent datasets for VC teams and refine their talent acquisition strategies. By harnessing advanced algorithms alongside a proprietary search engine developed in-house, the company empowers users to sift through extensive datasets, pinpointing specific individuals or organizations based on precise criteria. This capability enables VC teams to efficiently identify potential founders and key talent by leveraging benchmark talent datasets for VC teams, streamlining the recruitment process and bolstering overall operational efficiency.

The platform's unwavering commitment to accuracy guarantees that results are meticulously tailored to user specifications, significantly enhancing the quality of leads generated. As Marc Benioff aptly noted, "Data accuracy is crucial in recruitment, as it directly impacts the quality of hires and organizational success." With a striking 60% of leading tech companies planning to invest in , Websets positions itself as a pivotal player in this rapidly evolving landscape.

Furthermore, its flexible, high-capacity rate limits, coupled with premium support, enable VC teams to benchmark talent datasets for VC teams and effectively leverage the latest advancements in AI. This strategic approach not only keeps them competitive but also ensures compliance with industry standards, empowering them to navigate the complexities of recruitment with confidence.

Basis Set Ventures: Leveraging Non-Obvious Datasets for Startup Discovery

Basis Set Ventures stands out in the venture capital arena by expertly identifying early-stage companies through the utilization of non-obvious datasets that many traditional investors frequently overlook. By focusing on the cognitive and behavioral traits of founders, they gain invaluable insights that significantly enhance their financial decision-making. This strategic approach not only enables them to uncover promising startups that often fly under the radar but also positions them favorably within the competitive landscape of venture capital.

Data-driven VCs notably invest in a third more women founders, underscoring the inclusivity inherent in their methodology. While information is undeniably essential, the is equally critical in early-stage funding, ensuring a holistic strategy. The incorporation of advanced neural search technology, such as Exa's capabilities, can further refine their research processes, facilitating more effective data discovery and lead generation.

By leveraging AI-driven semantic query functionalities, Basis Set Ventures can transcend the limitations of traditional search methods, allowing for a more efficient identification of niche companies like Thrifthouse. This emphasis on cognitive characteristics, coupled with sophisticated search techniques, has been shown to correlate with higher success rates for new ventures, making this approach a vital component of their funding strategy.

EQT Ventures: Utilizing Motherbrain for Data-Driven Investment Insights

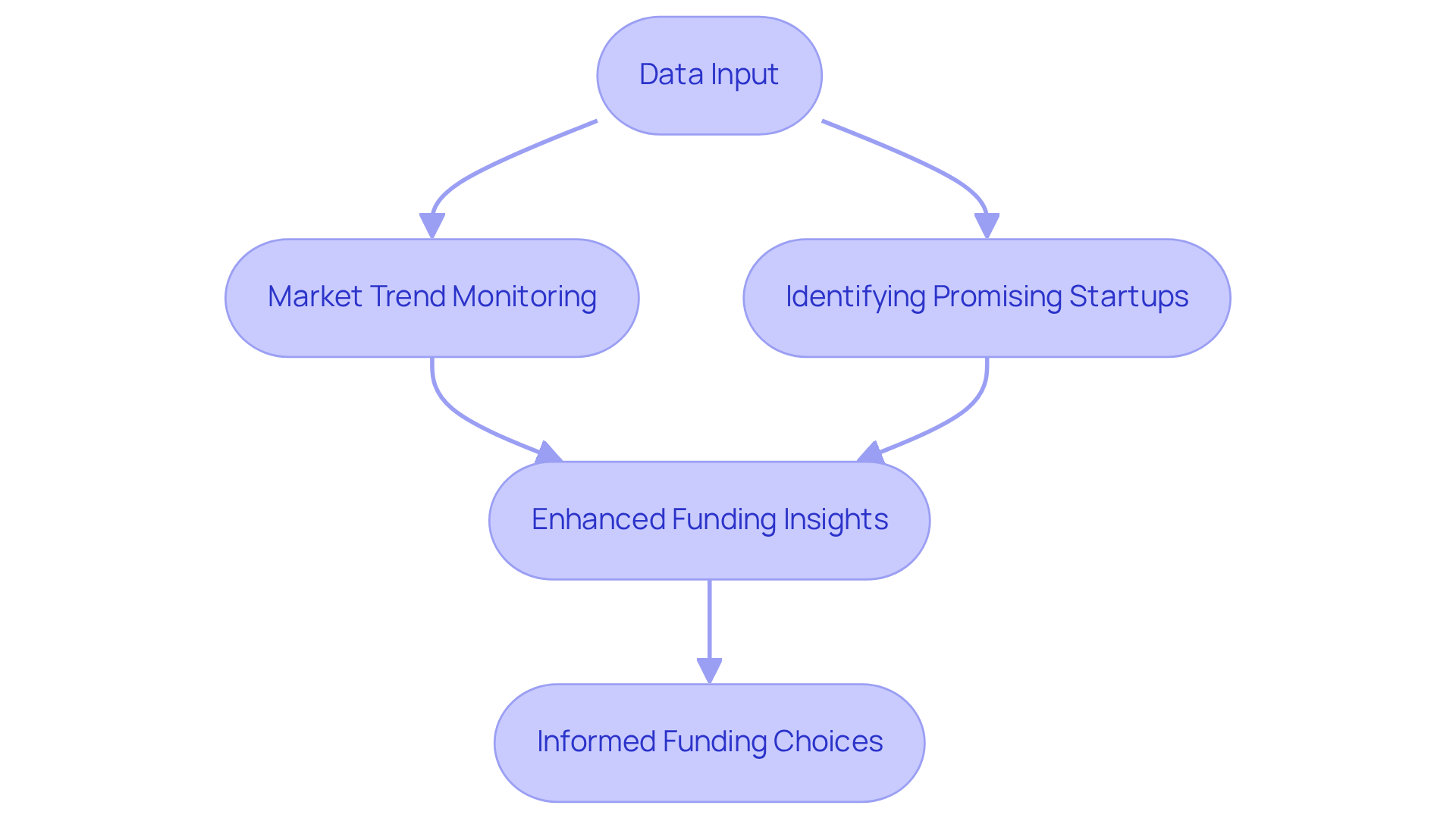

EQT Ventures harnesses its proprietary AI platform, Motherbrain, to enhance funding insights significantly. This advanced tool processes extensive datasets, effectively pinpointing promising startups and monitoring market trends. By merging institutional knowledge with sophisticated analytics, EQT Ventures accelerates informed funding choices with remarkable precision. This data-driven approach not only streamlines the sourcing process but also elevates the overall quality of their asset portfolio.

In 2023, the venture capital landscape experienced a notable shift towards data-centric strategies, as firms increasingly rely on analytics and benchmark talent datasets for vc teams to navigate market complexities. Consequently, EQT Ventures exemplifies how integrating AI into investment practices can yield superior outcomes. This reflects a broader industry trend where is essential for success. Are you ready to embrace this transformation in your investment strategy?

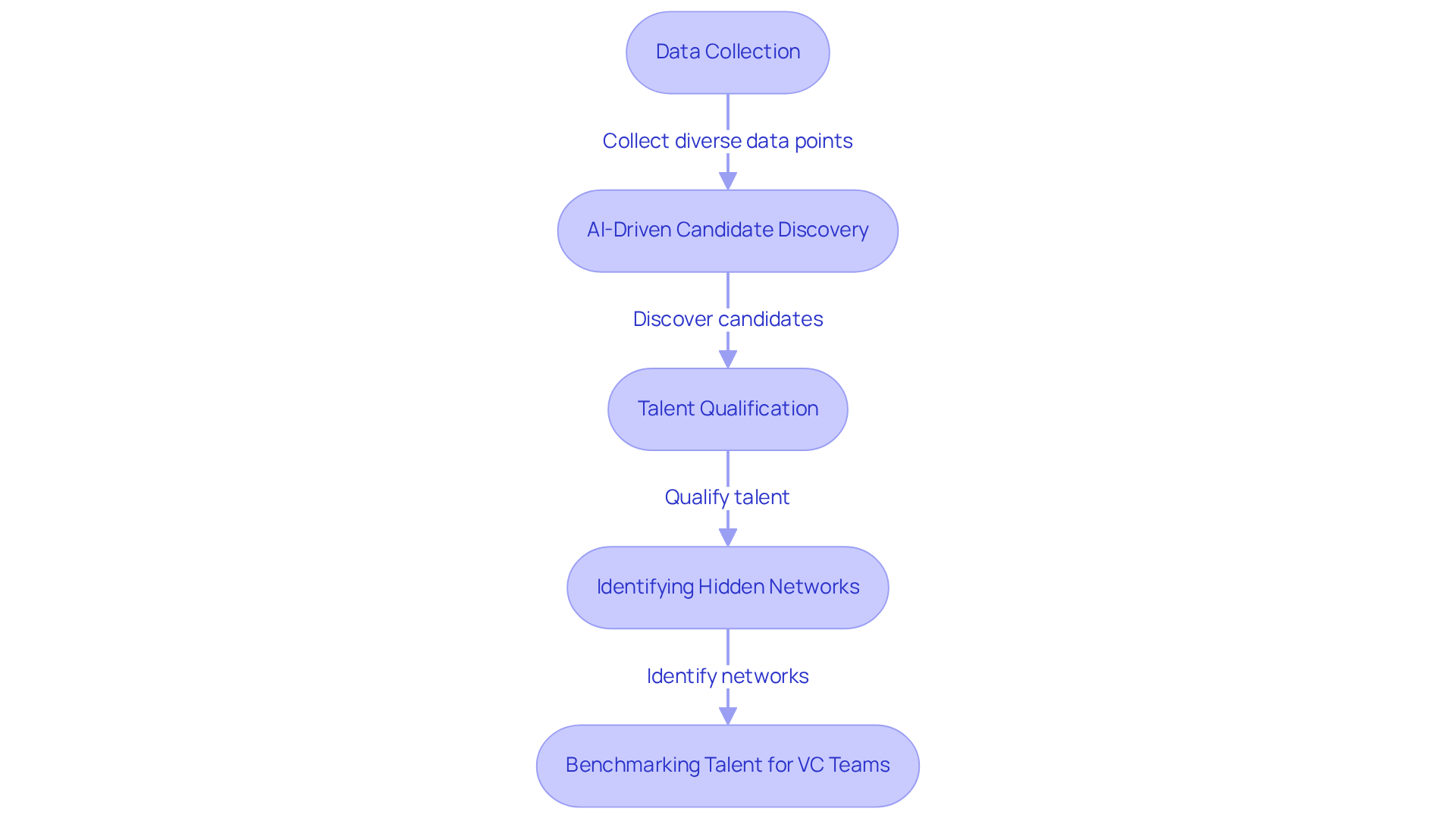

Level: Data Science for Identifying Hidden Talent Networks

Websets employs advanced analytical techniques to reveal that traditional methods often overlook. By meticulously examining diverse data points—such as AI-driven candidate discovery and qualification—they can identify individuals primed to lead successful startups. This capability is crucial for venture capitalists who need to benchmark talent datasets for VC teams that are looking to invest in innovative companies propelled by exceptional talent. Engaging with these concealed networks not only enhances the ability to recognize high-potential opportunities but also allows VC teams to benchmark talent datasets for VC teams, thus providing a significant competitive advantage in the ever-evolving financial landscape. Experts at Websets emphasize that uncovering these talent networks through customizable search solutions is fundamental to benchmark talent datasets for VC teams, empowering firms to make informed decisions aligned with their strategic objectives.

Hustle Fund: Efficient Screening of Startups for Investment Opportunities

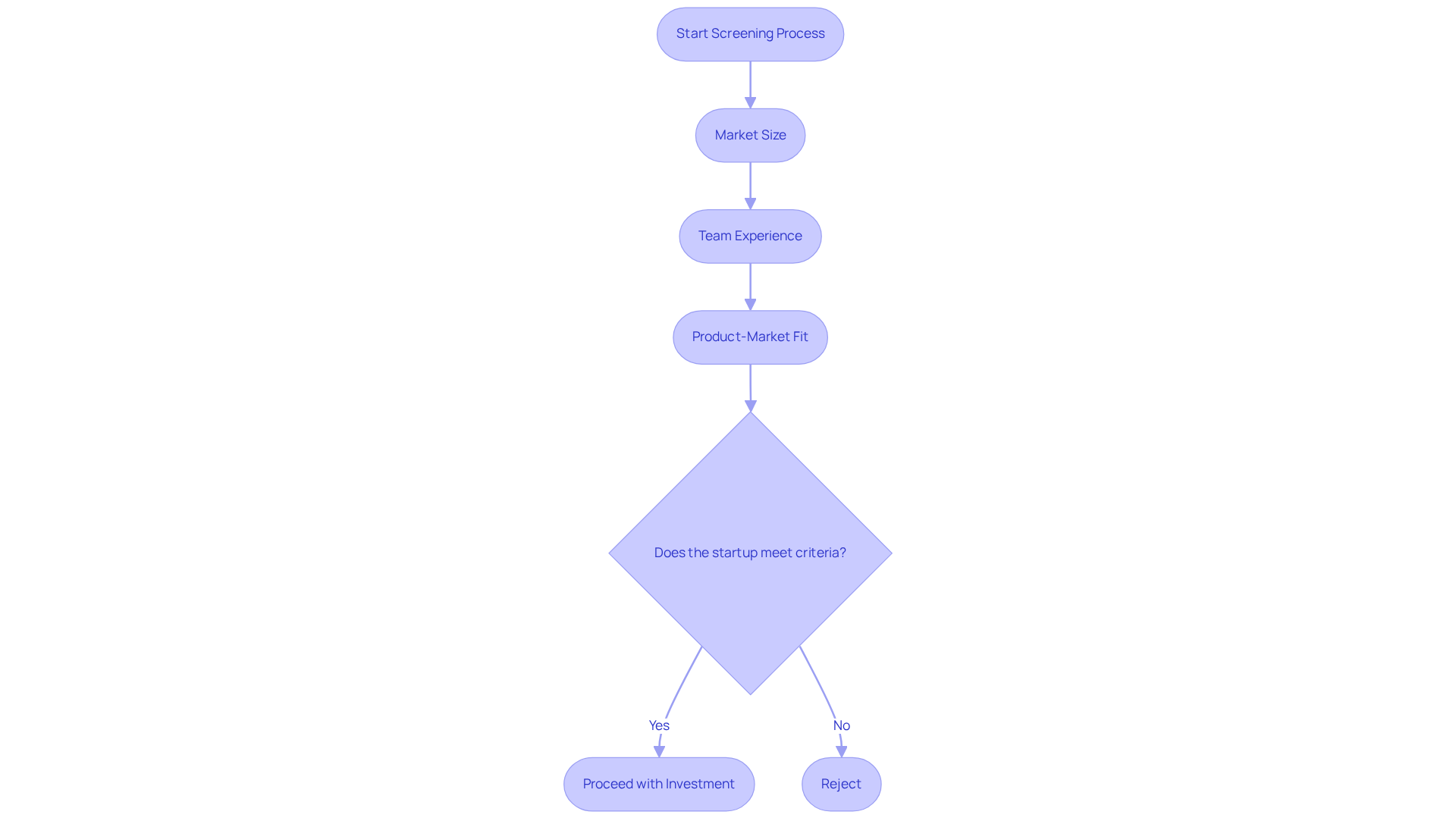

Hustle Fund employs a systematic approach to evaluating new ventures, emphasizing essential metrics alongside qualitative analyses to identify promising funding opportunities. By establishing precise evaluation criteria, they efficiently sift through numerous new ventures, focusing on those with the highest potential for success. This streamlined process not only conserves valuable time but also significantly enhances the likelihood of making well-informed financial choices. Metrics such as market size, team experience, and product-market fit play a crucial role in their evaluations, allowing them to pinpoint startups that align with their funding strategy.

Moreover, integrating Websets' AI-driven tools can further enhance this evaluation process by providing deeper insights into market trends and team capabilities, ultimately leading to more informed decisions. Case studies illustrate how this method has resulted in successful funding, underscoring the importance of a structured evaluation framework in the competitive venture capital landscape. As Michael Carmen, Co-Head of Private Investments, notes, "Comprehending the metrics that influence new business success is essential for making informed financial choices." This insight is invaluable for sales team leaders, highlighting the necessity of leveraging in their own lead generation and recruitment efforts.

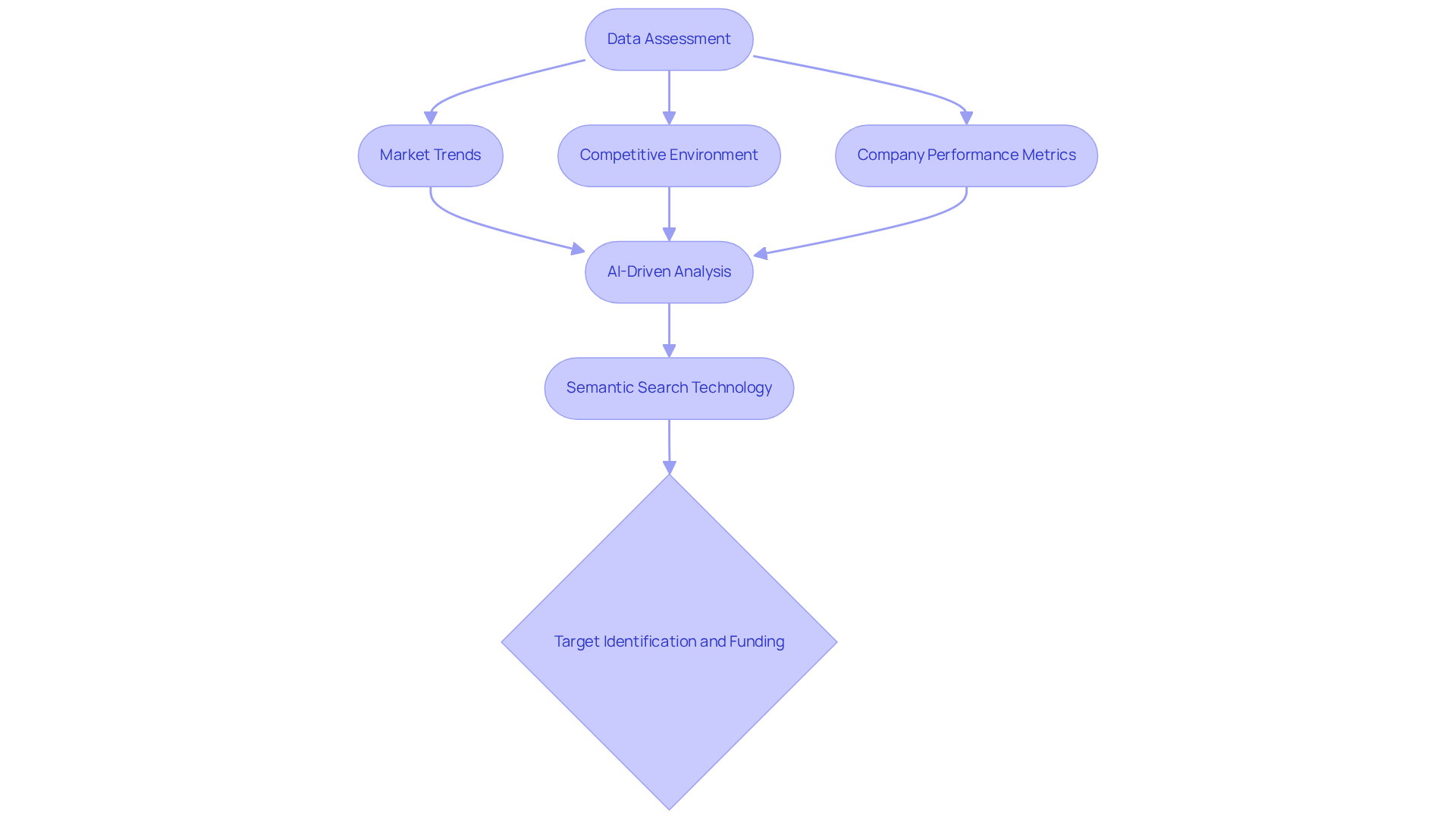

Greycroft: Data-Driven Target Identification for Startups

Greycroft employs a data-oriented strategy to precisely identify target companies for funding. Utilizing , they assess market trends, competitive environments, and company performance metrics. By leveraging advanced semantic search technology, Greycroft can effectively pinpoint companies that align with their investment thesis. This method not only enhances their ability to identify high-potential startups but also empowers them to make informed decisions grounded in thorough analysis, enriched by insights from the benchmark talent datasets for vc teams provided by Websets' extensive database.

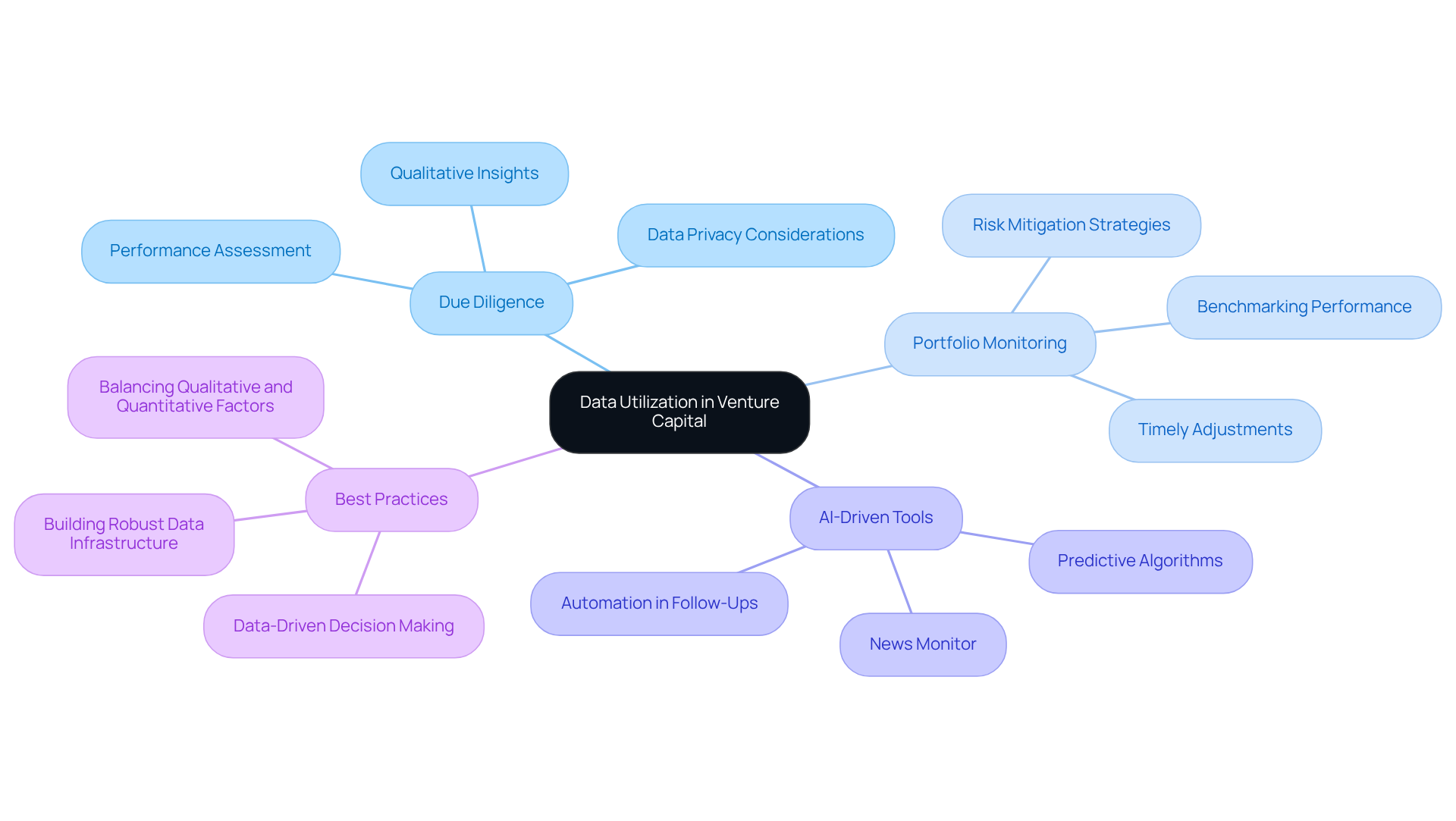

Tribe Capital: Data Utilization for Diligence and Portfolio Monitoring

Tribe Capital highlights the essential role of in due diligence and ongoing portfolio monitoring. By employing advanced analytics, they assess performance effectively and proactively identify potential risks. This strategic approach enables timely adjustments to their portfolio, optimizing returns while mitigating risks associated with their assets.

Moreover, by leveraging AI-driven tools from web platforms, Tribe Capital enhances their data analysis capabilities, utilizing the News Monitor for real-time updates on market trends and startup funding. This integration not only improves their financial results but also exemplifies best practices in the venture capital landscape. It showcases how data-driven strategies can be further refined through innovative technology.

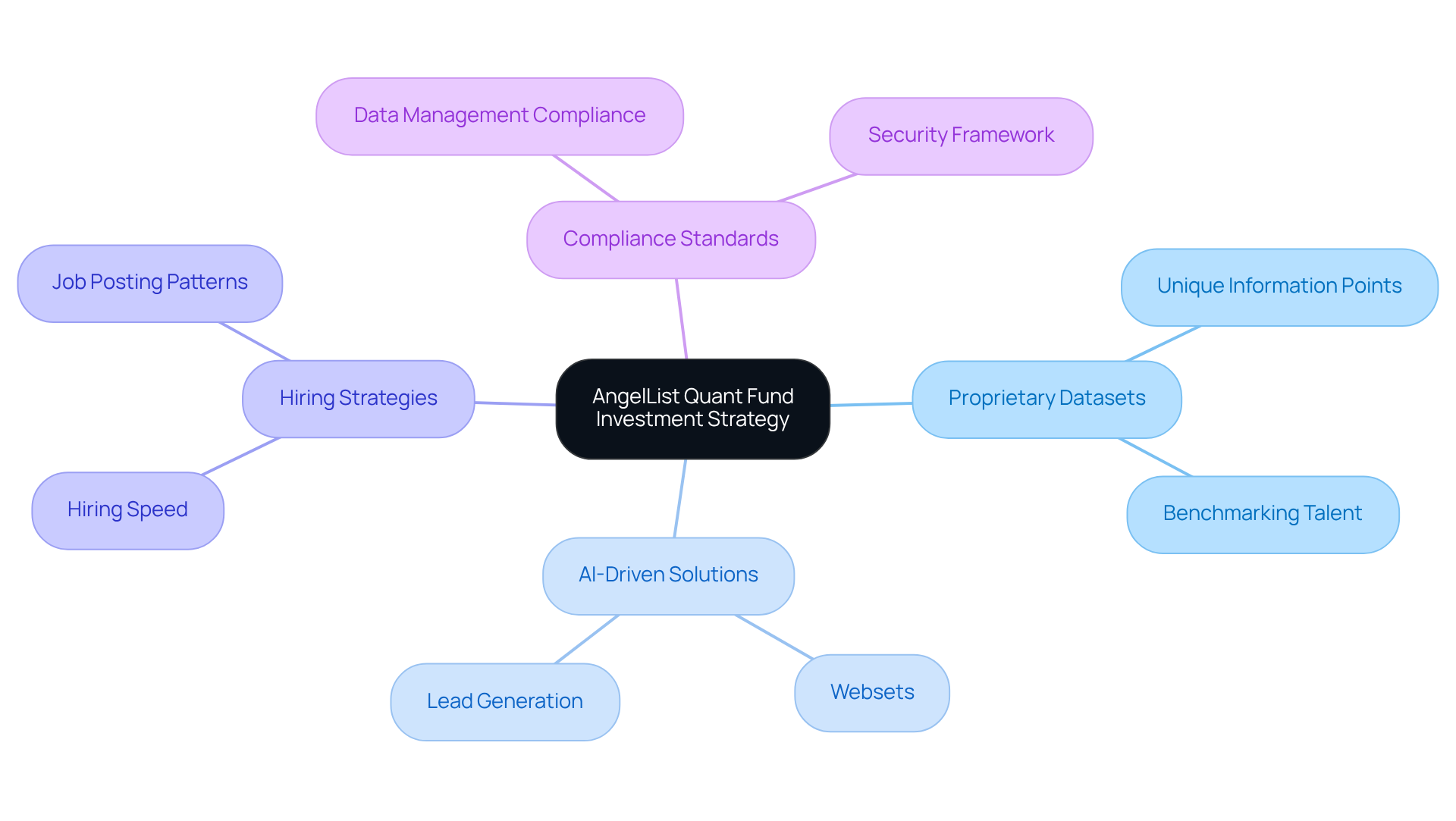

AngelList Quant Fund: Proprietary Datasets for Sourcing Investments

The AngelList Quant Fund leverages proprietary datasets alongside enterprise-level, AI-driven web search solutions to enhance its sourcing capabilities significantly. By utilizing unique information points unavailable to the broader market, the fund identifies promising new companies and financial opportunities that rivals may overlook. The 'Websets' AI-driven sales intelligence search further enhances the fund's information with precise lead generation, filtering businesses and individuals by hyper-specific criteria. This data-centric strategy empowers the fund to for vc teams, which helps in making informed decisions and ensures it remains at the forefront of the rapidly evolving venture capital landscape.

For instance, the fund's focus on hiring speed and job posting patterns, complemented by insights from various sources, enables efficient assessment of startup growth potential. This approach allows vc teams to benchmark talent datasets for recognizing high-value opportunities, providing a competitive edge. Moreover, Websets' robust security framework and compliance standards ensure all data management adheres to the highest industry criteria. This adherence enhances the transformative impact of proprietary data and advanced AI search solutions in refining venture capital sourcing processes, ultimately leading to improved financial outcomes.

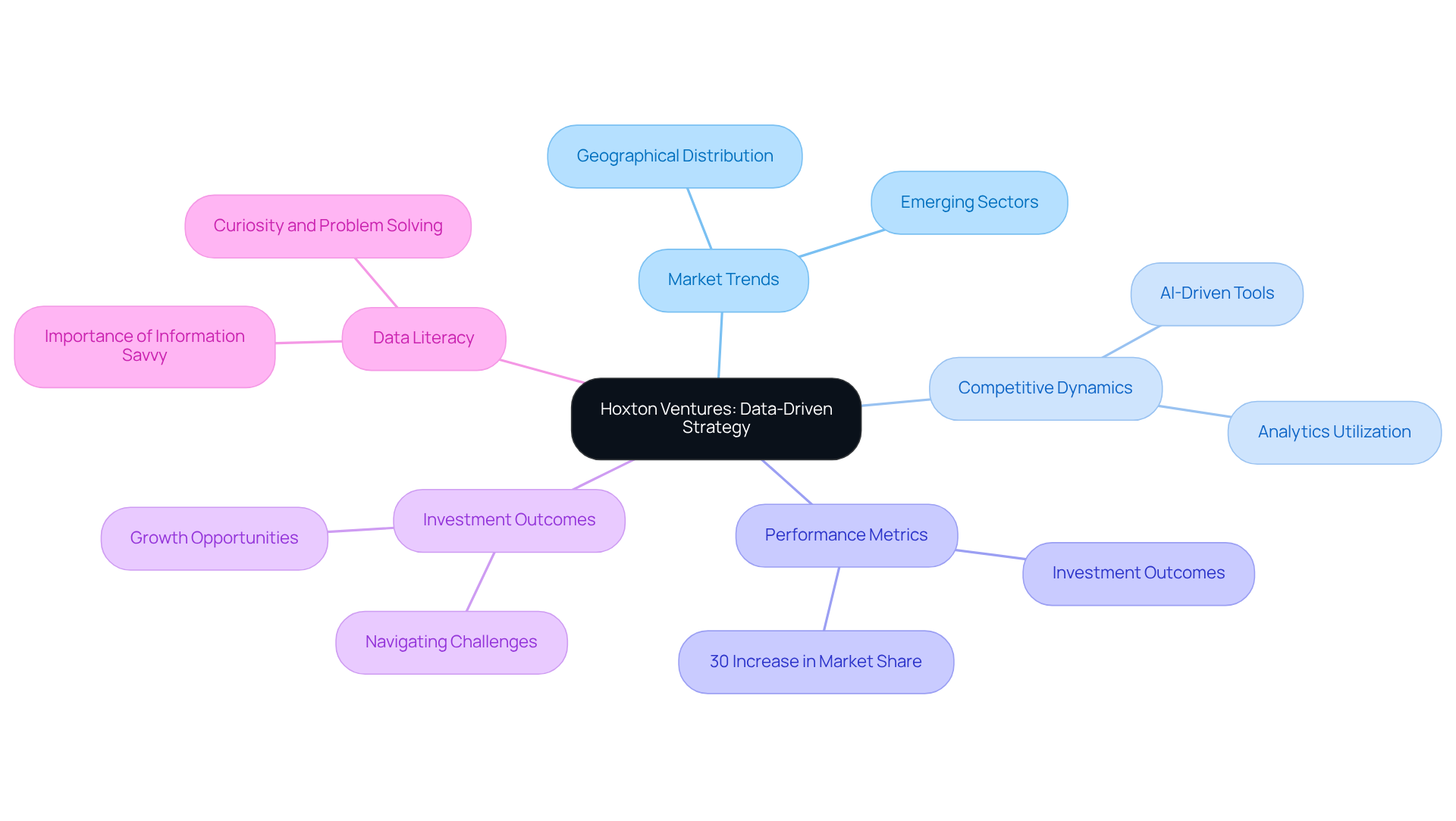

Hoxton Ventures: Strategic Data Application for Value Addition

Hoxton Ventures employs a strategic, data-driven approach to enhance the value of their assets. By meticulously analyzing market trends, competitive dynamics, and new venture performance metrics, they provide critical insights to their portfolio companies. As a representative from Hoxton Ventures asserts, "Data is the backbone of our funding strategy; it enables us to recognize not only opportunities but also possible challenges that new businesses may encounter." This methodology not only uncovers growth opportunities but also equips startups to effectively navigate challenges, ultimately improving investment outcomes.

For instance, leveraging analytics and AI-driven tools akin to those offered by Websets, Hoxton Ventures adeptly guided a portfolio company through a competitive landscape, resulting in a 30% increase in market share within a year. The focus on information analysis, particularly through advanced neural search capabilities, empowers Hoxton Ventures to assist their portfolio companies in making informed decisions, fostering an environment conducive to sustainable growth and success.

Furthermore, as Miro Kazakoff emphasizes, "In a world of increased information, the firms with more information-savvy individuals are the ones that are going to succeed." This underscores the importance of among emerging teams in maximizing the benefits of insight-driven analytics.

General Catalyst: Early Founder Identification through Data Analytics

General Catalyst effectively identifies early-stage founders with high potential for success through analytics. By analyzing a variety of data points—including founder backgrounds, market trends, and venture performance metrics—they pinpoint individuals likely to lead successful enterprises. This proactive approach not only enhances their investment strategy but also allows them to focus on new ventures that exhibit strong leadership potential.

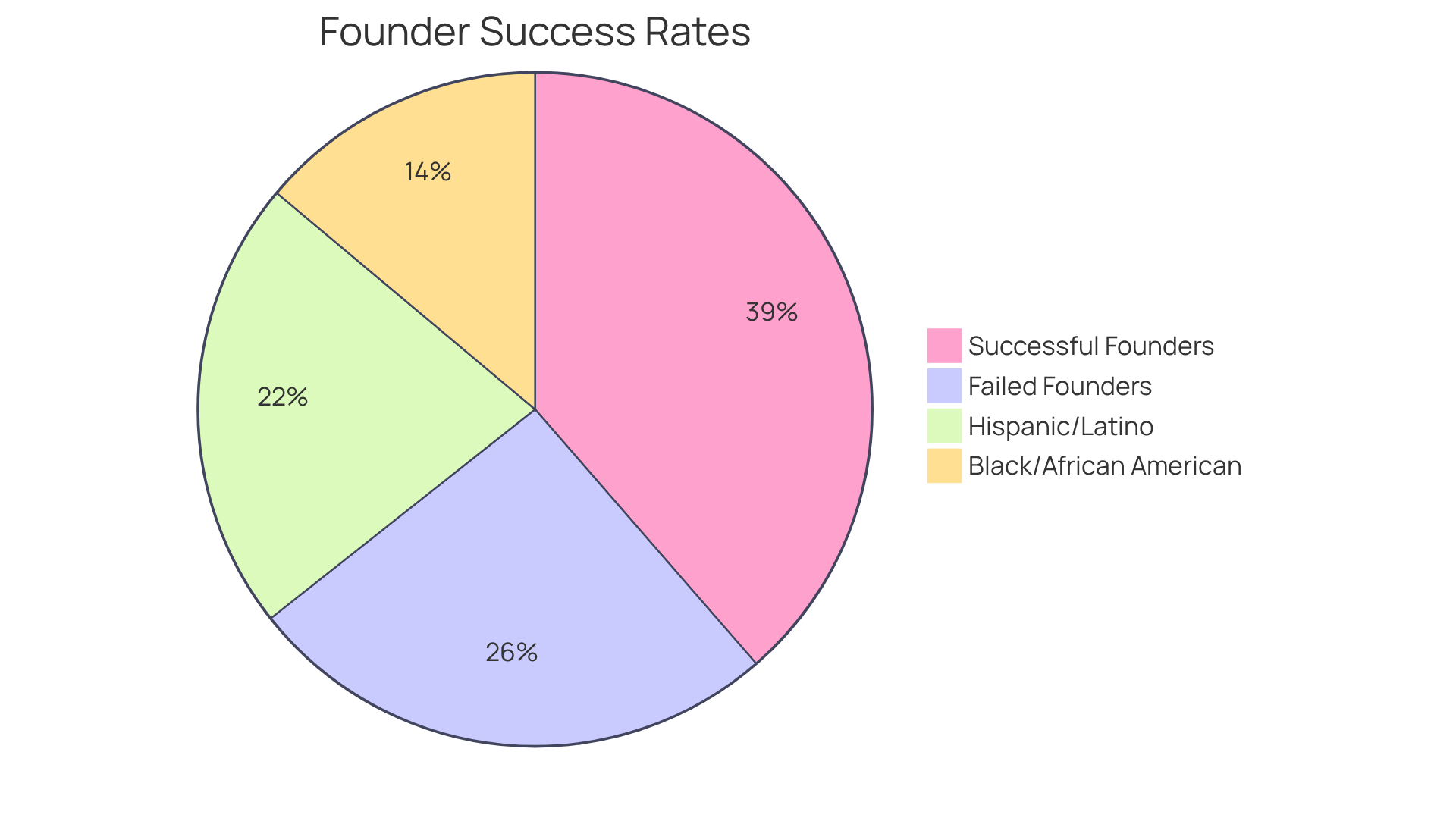

Research reveals that founders with previous successful ventures boast a significantly , compared to the average. Conversely, business owners with past failures experience a success rate of only 20% in new ventures. Additionally, an analysis of founder demographics shows that diverse backgrounds foster innovative thinking and problem-solving, with 16.9% of startup founders identifying as Hispanic or Latino and 10.8% as Black or African American.

General Catalyst's commitment to data-driven decision-making underscores how analytics can lead to more informed choices, ultimately resulting in greater success rates for their portfolio companies. As General Catalyst emphasizes, "analyzing founder backgrounds is crucial for identifying investment opportunities that align with our strategic goals.

Conclusion

Harnessing the power of benchmark talent datasets is essential for venture capital teams seeking to enhance performance and refine investment strategies. This article has explored ten innovative approaches that VC firms are employing to optimize their talent acquisition processes, leveraging advanced technologies and unique datasets to identify promising startups and founders.

From AI-driven platforms like Websets, which streamline lead generation, to Basis Set Ventures' focus on non-obvious datasets that reveal hidden opportunities, the insights shared underscore the critical role of data in making informed investment decisions. Firms such as EQT Ventures and Hustle Fund exemplify how data analytics can optimize funding choices and improve the evaluation of startups, ensuring that VCs remain competitive in a rapidly evolving landscape.

The significance of adopting data-driven strategies cannot be overstated. As the venture capital industry continues to evolve, embracing these methodologies will not only enhance operational efficiency but also empower teams to make decisions that align with their long-term strategic goals. For VC teams looking to thrive in 2025 and beyond, investing in advanced data analytics and leveraging unique datasets will be paramount to uncovering the next wave of entrepreneurial talent and ensuring sustained success in the market.

Frequently Asked Questions

What is Websets and how does it assist VC teams?

Websets is an AI-powered platform for B2B lead generation and candidate discovery that helps venture capital teams benchmark talent datasets and refine their talent acquisition strategies by using advanced algorithms and a proprietary search engine.

How does Websets ensure data accuracy in recruitment?

Websets guarantees data accuracy by meticulously tailoring results to user specifications, which significantly enhances the quality of leads generated, as emphasized by industry leaders like Marc Benioff.

What is the significance of AI in recruiting according to the article?

The article notes that 60% of leading tech companies plan to invest in AI-powered recruiting software, highlighting the growing importance of AI in improving recruitment processes and outcomes.

What unique approach does Basis Set Ventures take in identifying startups?

Basis Set Ventures utilizes non-obvious datasets and focuses on the cognitive and behavioral traits of founders to identify early-stage companies that traditional investors may overlook.

How does Basis Set Ventures promote inclusivity in its investment strategy?

Data-driven VCs, like Basis Set Ventures, notably invest in a third more women founders, reflecting the inclusivity inherent in their data-driven approach.

What technology does Basis Set Ventures incorporate to enhance its research processes?

Basis Set Ventures incorporates advanced neural search technology, such as Exa's capabilities, to refine research processes and facilitate more effective data discovery and lead generation.

How does EQT Ventures utilize its AI platform, Motherbrain?

EQT Ventures uses Motherbrain to process extensive datasets, pinpoint promising startups, and monitor market trends, thereby enhancing funding insights and decision-making.

What trend is observed in the venture capital landscape regarding data strategies?

The venture capital landscape is shifting towards data-centric strategies, with firms increasingly relying on analytics and benchmark talent datasets to navigate market complexities and improve investment outcomes.