Overview

The article titled "10 Essential Tools for Early-Stage Startup Monitoring Datasets" serves as a critical resource for new businesses seeking to enhance their competitive analysis and data monitoring capabilities. It underscores the significance of platforms like Websets, CB Insights, and Crunchbase, which furnish essential data and insights. These tools empower startups to:

- Identify market trends

- Navigate funding landscapes

- Refine their strategies

Ultimately, achieving a competitive edge in their respective industries. By utilizing these resources, startups can position themselves for success in a rapidly evolving market.

Introduction

Navigating the startup landscape resembles traversing a labyrinth, filled with countless tools designed to assist early-stage ventures in monitoring their progress and gaining crucial insights. In an era where data-driven decisions reign supreme, it is vital for startups to discern which resources can provide a competitive edge. This article delves into ten essential tools that empower startups to analyze datasets effectively, uncover market trends, and refine their strategies. With an overwhelming number of options available, how can emerging businesses identify the tools that will genuinely impact their journey toward success?

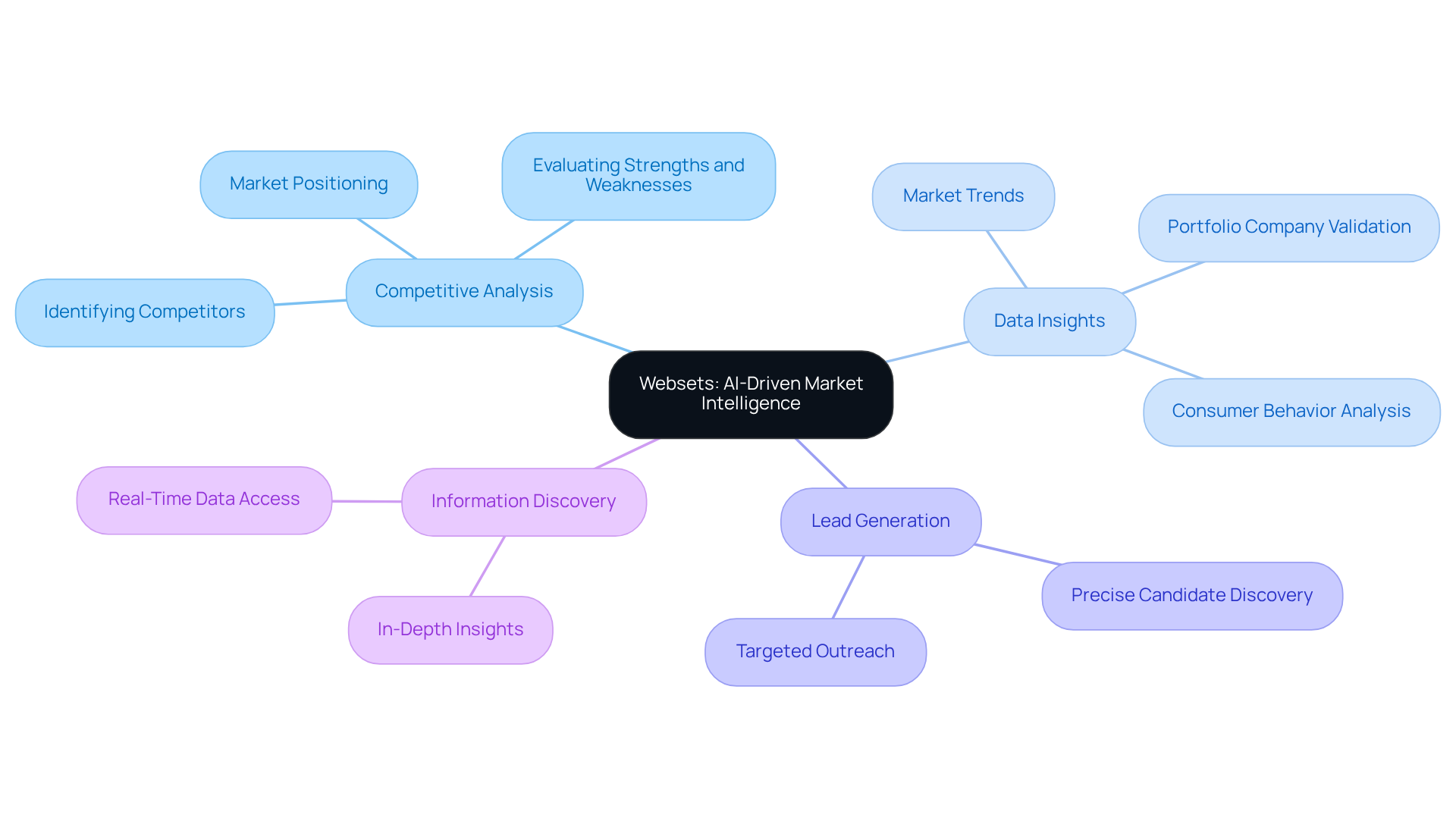

Websets: AI-Driven Market Intelligence for Competitive Analysis

Websets offers a powerful specifically designed for new businesses aiming to conduct comprehensive competitive analysis. By leveraging advanced algorithms, the platform enables users to navigate extensive datasets, identifying key competitors and analyzing their strategies to uncover essential market trends. This functionality is crucial for early-stage startups that are using monitoring datasets to establish a competitive advantage in their respective industries.

By enriching search results with in-depth insights, including LinkedIn profiles and company information, the platform ensures that users access accurate and relevant data. This capability empowers them to make informed decisions that drive their businesses forward. For instance, startups can utilize early-stage startup monitoring datasets to harness the platform's features for identifying validated portfolio companies and evaluating their competitors' strengths and weaknesses, thereby enhancing their strategic positioning within the market.

Moreover, with functionalities such as precise lead generation and AI-enhanced candidate discovery, Websets positions itself as an indispensable tool for advancing information discovery and technical insights across various sectors. This platform not only streamlines the competitive analysis process but also equips businesses with the knowledge necessary to thrive in a dynamic landscape.

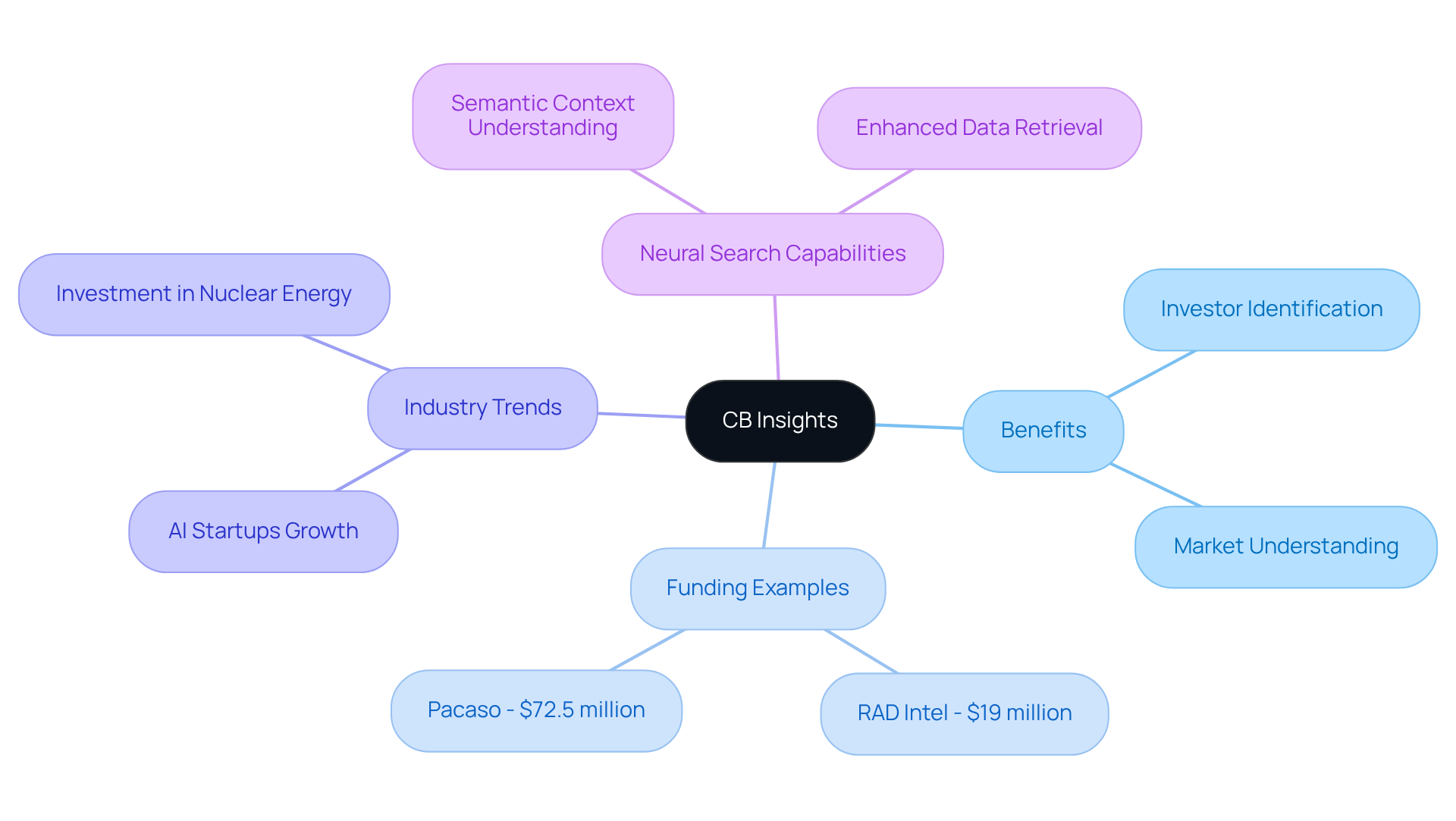

CB Insights: Comprehensive Data on Private Companies

CB Insights offers a powerful platform that consolidates extensive information on private companies, covering funding rounds, valuations, and industry trends. This resource is crucial for new businesses aiming to identify potential investors and understand the competitive landscape. With its , users can anticipate market shifts and make informed strategic decisions grounded in real-time data. This advantage is especially significant for early-stage startup monitoring datasets that are seeking funding and forming essential partnerships.

In 2025, the average funding amount for early-stage ventures has reached unprecedented heights, indicative of a thriving investment climate. Notably, successful funding rounds—such as RAD Intel's $19 million raise and Pacaso's $72.5 million retail funding—underscore the effectiveness of leveraging CB Insights information to attract investor interest. Venture capitalists emphasize the vital role of comprehensive information in navigating the funding landscape, positioning early-stage startup monitoring datasets from CB Insights as an indispensable resource for new businesses striving for success in a competitive market.

To further enhance their research and data analysis, emerging companies can tap into neural search capabilities, which refine data retrieval and analysis by grasping the semantic context of queries. By integrating neural search with CB Insights, these companies can more effectively identify and connect with potential investors, thereby maximizing their chances of securing funding.

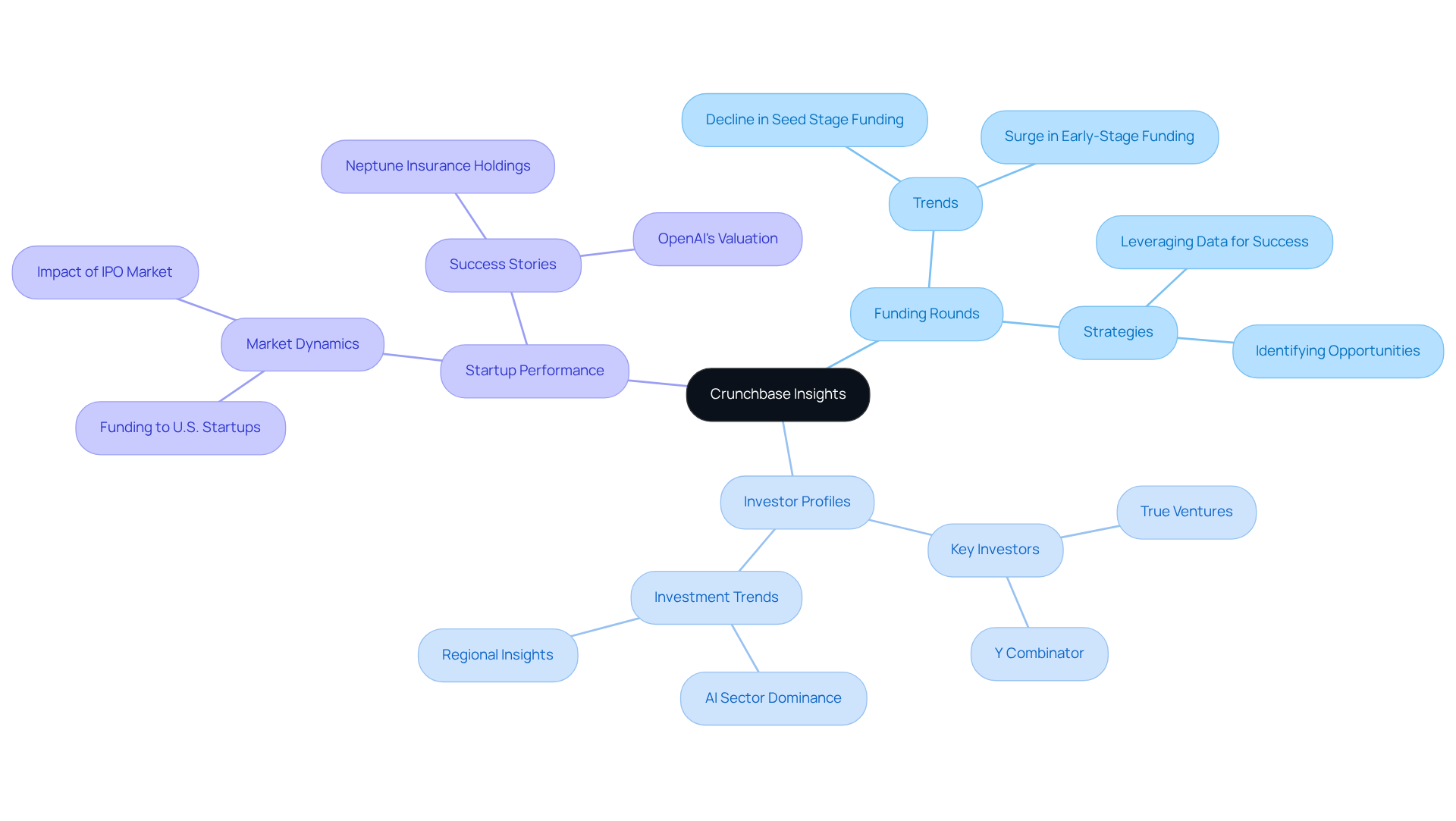

Crunchbase: Insights into Funding Rounds and Startup Performance

Crunchbase is an indispensable resource for new businesses, offering comprehensive information on funding rounds, investor profiles, and company performance metrics. By tracking their competitors' funding activities, users can analyze successful funding strategies that are vital for early-stage startup monitoring datasets, which help early-stage companies attract investors and refine their business models. Utilizing Crunchbase enables emerging companies to glean insights into market dynamics, empowering them to make that enhance their growth prospects.

In 2025, average investor involvement in early-stage funding rounds has surged, with U.S.-based ventures accounting for 68% of global venture capital. This statistic underscores a robust interest in new companies. Successful entrepreneurs consistently highlight the significance of leveraging funding round data and early-stage startup monitoring datasets to identify trends and opportunities, thus reinforcing the platform's pivotal role in shaping effective funding strategies.

As the entrepreneurial landscape evolves, the insights derived from Crunchbase become crucial for navigating the complexities of securing investment and utilizing early-stage startup monitoring datasets for achieving sustainable growth. Are you ready to harness the power of data to drive your company's success?

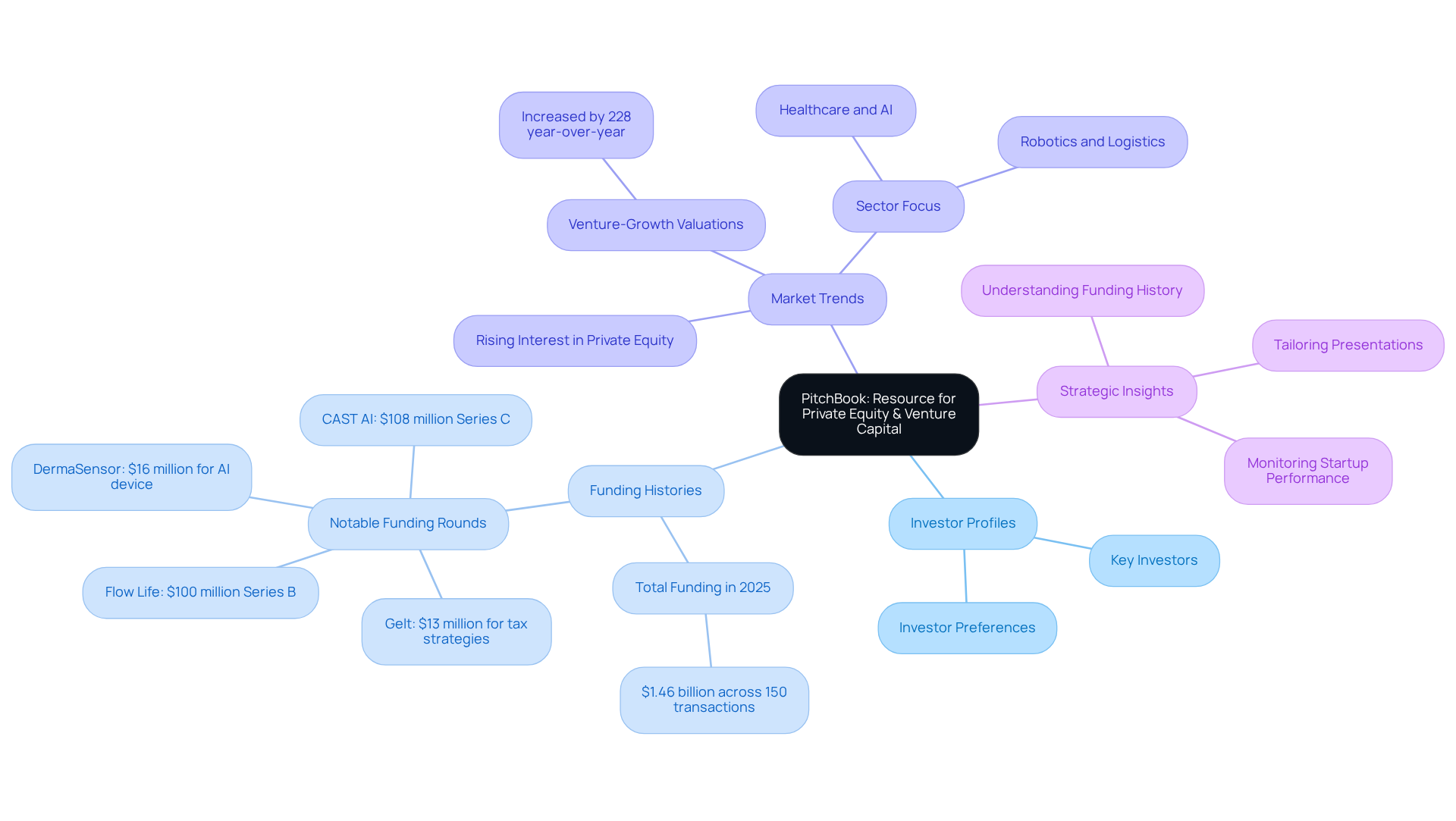

PitchBook: Detailed Information on Private Equity and Venture Capital

PitchBook stands as an indispensable resource for new businesses navigating the complex terrain of private equity and venture capital. It provides extensive data, featuring detailed profiles of investors, funding histories, and market trends. By leveraging this platform, emerging ventures can pinpoint potential investors whose interests align with their business objectives, significantly enhancing their likelihood of securing funding. Analyzing funding trends and investor preferences allows new ventures to tailor their presentations effectively, increasing their appeal to prospective supporters.

In 2025, successful new businesses have witnessed an average funding increase, with PitchBook reporting a remarkable total of $1.46 billion across 150 transactions in the first half of the year. Significant rounds, such as CAST AI's $108 million Series C and Flow Life's $100 million Series B, contribute to a . Insights from PitchBook underscore the importance of understanding funding history for early-stage startup monitoring datasets, as this knowledge informs strategic decisions and investment tactics. Recent trends reveal a rising interest in private equity for new ventures, highlighting the necessity of utilizing data-driven insights to stimulate growth and attract investment.

Exploding Topics: Identifying Emerging Trends and Startups

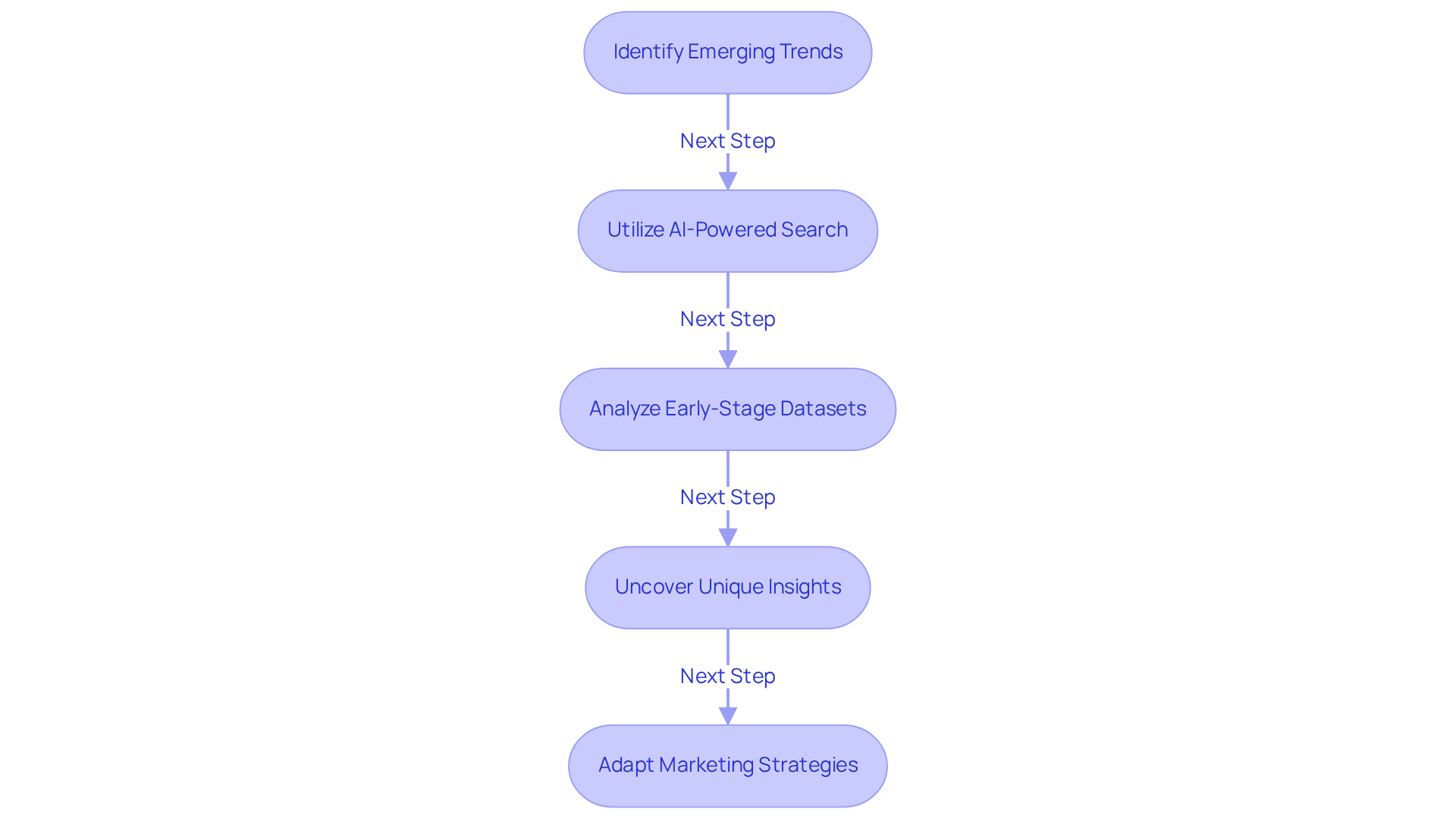

This platform serves as a powerful trend detection tool, enabling early-stage startup monitoring datasets to identify emerging subjects and trends before they gain mainstream recognition. By harnessing enterprise-level AI-powered web search capabilities, Websets meticulously analyzes early-stage startup monitoring datasets from diverse sources, revealing insights into industry dynamics and consumer interests. With features such as , the ability to uncover unique and niche results, and AI-generated summaries, early-stage startup monitoring datasets allow new companies to tap into a wealth of information that fuels innovation in their products or services. This ensures their marketing strategies are in sync with upcoming trends, enhancing their competitive edge in rapidly evolving markets.

Statistics reveal that new ventures embracing emerging trends are significantly more likely to succeed; nearly 94% of those attracting investment on platforms like Shark Tank flourish. As market analysts note, "Understanding market shifts can profoundly influence a new business's trajectory and overall success." Furthermore, new ventures can explore online platforms through a free trial, allowing them to assess the service's value without immediate financial commitment.

To fully leverage trend analysis, new businesses should consistently monitor early-stage startup monitoring datasets for updates on niche topics and emerging trends. This proactive approach ensures they remain ahead in the competitive landscape.

Tracxn: Tracking Startup Ecosystems and Investment Trends

Tracxn stands as a formidable platform for tracking and investment trends, offering access to information on thousands of ventures across diverse sectors. This extensive database allows users to identify potential competitors and partners, fostering strategic collaborations. In 2025, Tracxn monitored over 10,000 new ventures, underscoring the dynamic nature of the entrepreneurial landscape. The platform's advanced analytics tools empower early-stage companies to utilize early-stage startup monitoring datasets to decode market dynamics and investment patterns—essential elements for informed decision-making.

Industry leaders have noted that leveraging Tracxn's insights can significantly enhance a new venture's positioning within its field, enabling them to seize emerging opportunities effectively. The successful partnerships forged through Tracxn insights exemplify its value, as companies utilize the platform to uncover synergies and drive growth. As investment trends evolve, Tracxn remains an indispensable resource for new ventures navigating the complexities of the funding landscape. Moreover, integrating the AI-driven platform can further bolster lead generation and industry research efforts, providing users with enriched data insights and a comprehensive understanding of the competitive environment.

Harmonic.ai: AI Insights for Market Dynamics and Competitor Analysis

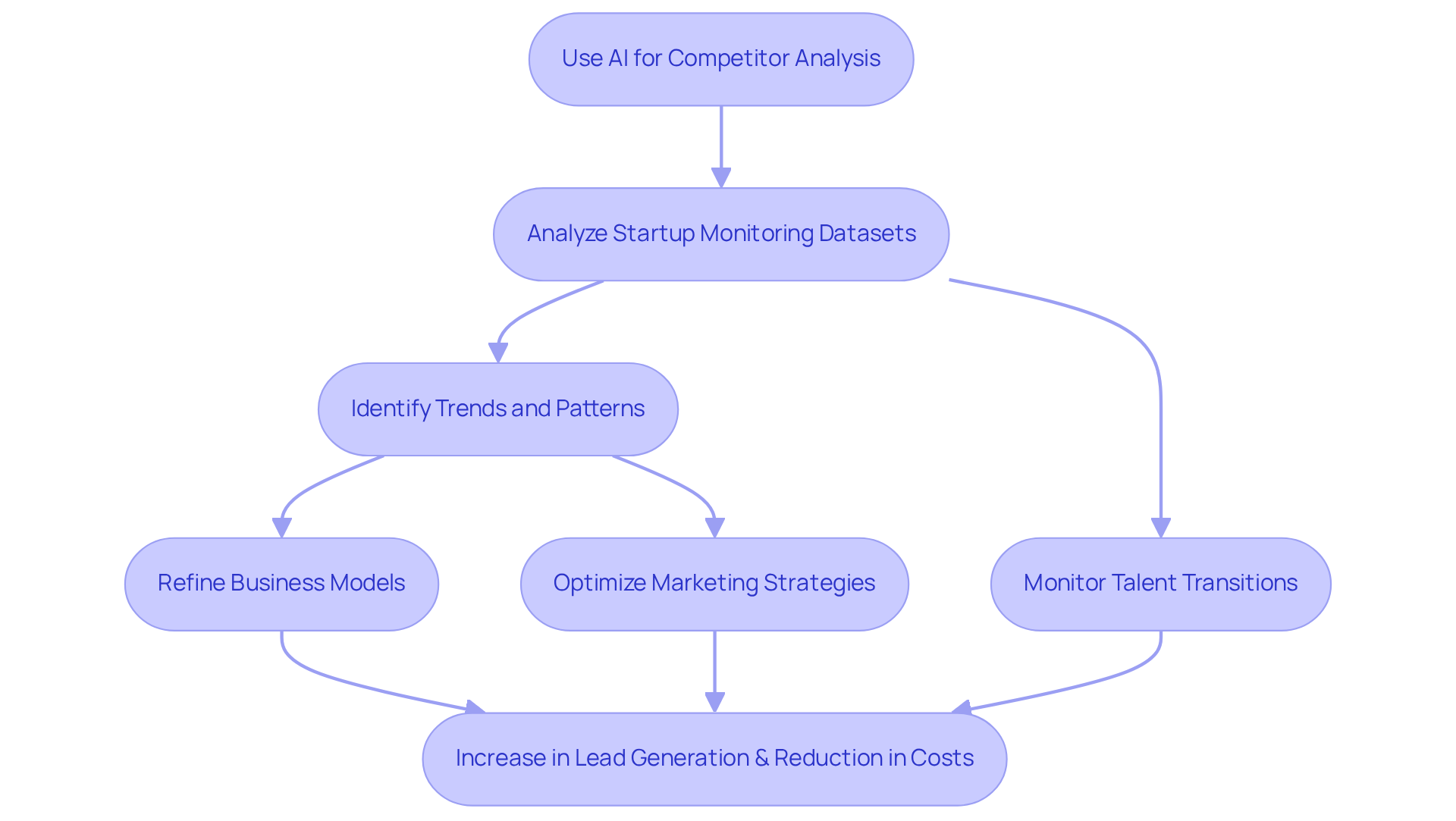

Websets harnesses the power of to deliver critical insights into industry dynamics and competitor evaluation for emerging businesses. By analyzing early-stage startup monitoring datasets, the platform reveals trends and patterns that inform strategic decision-making. Startups can capitalize on these insights to refine their business models, optimize marketing strategies, and maintain a competitive edge. Notably, reports indicate that businesses employing AI for competitor analysis experience a remarkable increase in lead generation—by as much as 50%—and a reduction in operational costs by 60%.

Furthermore, effective competitor analysis strategies often entail continuous monitoring of early-stage startup monitoring datasets and tracking communications. Users receive timely notifications regarding talent transitions or when companies become actionable, enabling new ventures to adapt swiftly to changes. By integrating AI-driven insights into their operations, companies can utilize early-stage startup monitoring datasets to significantly boost their agility and responsiveness, ensuring they remain ahead in a rapidly evolving landscape.

As Zain Rizavi, Principal at Ridge Ventures, aptly states, "Websets uncovers the earliest-stage companies from a variety of data sources well before other providers do," underscoring the importance of robust competitor analysis for new businesses striving to carve out their niche in competitive markets.

VentureRadar: Discovering Partners and Competitors

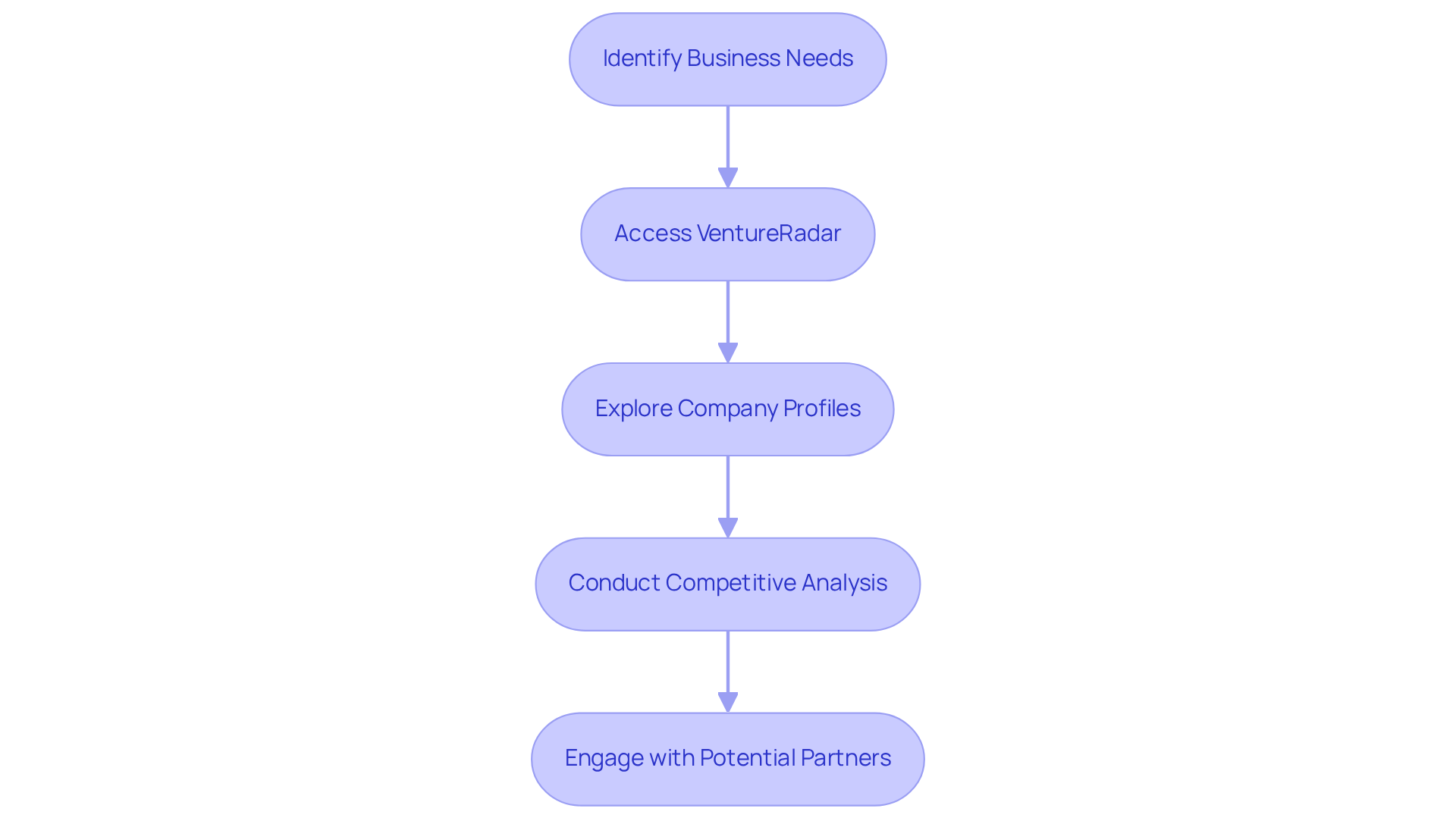

VentureRadar serves as a vital discovery platform for emerging businesses looking to identify potential partners and competitors. By providing comprehensive profiles of companies across various sectors, it enables users to conduct thorough analyses of their competitive landscape and uncover collaboration opportunities. This capability is especially beneficial for early-stage startup monitoring datasets, as it helps companies aiming to expand their networks and leverage synergies within their industry.

In 2025, effective competitor analysis becomes paramount; new businesses that utilize early-stage startup monitoring datasets from platforms like VentureRadar can strategically position themselves for growth. Remarkably, 92% of business owners recognize that having the right digital tools is essential for business success, underscoring the importance of data-driven insights in fostering meaningful partnerships and enhancing market presence.

As Andrew Thomson, the creator of VentureRadar, notes, traditional methods of finding business partners are increasingly ineffective in today’s fast-paced environment, making innovative tools indispensable for new enterprises striving for success. By integrating Websets' advanced AI-driven search solutions, including the Research Agentic API and high-compute, agentic search, new businesses can significantly enhance their information discovery capabilities.

These enterprise-level tools are designed for B2B lead generation and recruitment, empowering users to locate and refine information with precision. With features such as and industry research insights, emerging businesses can effectively identify and engage with potential partners and competitors, ultimately bolstering their growth and strategic initiatives.

Zigpoll: Real-Time Data Insights and Market Trends

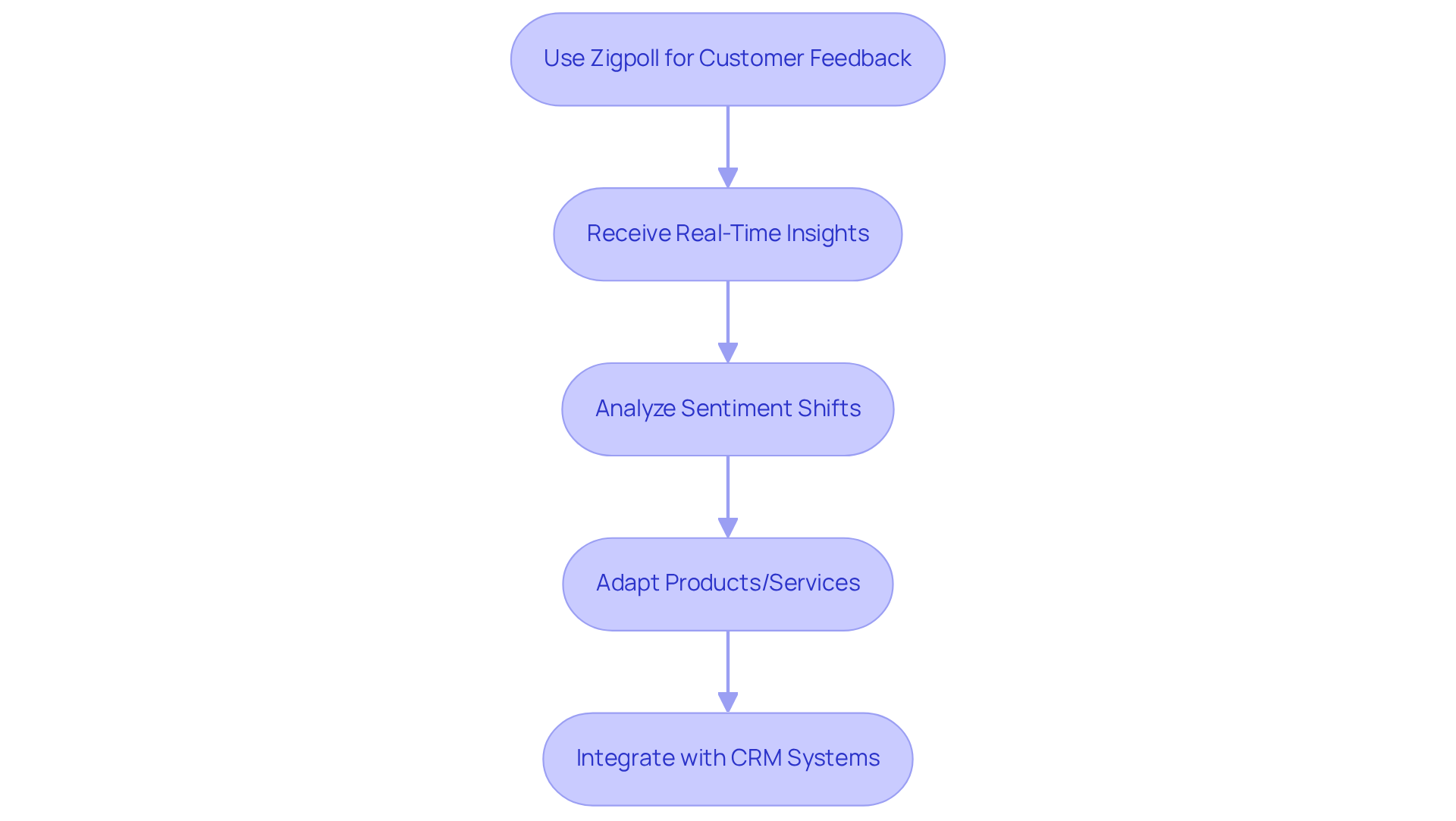

Zigpoll stands out as a powerful , delivering real-time insights and sentiment analysis that are essential for new businesses navigating today’s fast-paced landscape. By leveraging Zigpoll, early-stage startup monitoring datasets enable early-stage companies to obtain immediate feedback from their target audience, allowing for quick adaptations to products or services based on genuine consumer sentiment. The platform’s robust analytics capabilities empower users to track trends and sentiment shifts, which are vital for maintaining a competitive edge.

As we look to 2025, startups are increasingly relying on early-stage startup monitoring datasets for real-time data. Utilizing Zigpoll can significantly enhance their responsiveness to customer needs and evolving market dynamics. This proactive strategy not only aids in refining product offerings but also cultivates a culture of continuous improvement, driven by validated consumer insights. Furthermore, integrating Zigpoll with CRM systems can optimize information utilization, thereby elevating the overall effectiveness of customer engagement strategies.

Mitzu.io: Analytics Tools for Building Data-Driven Cultures

The company provides innovative AI-driven tools designed to enhance B2B lead generation and recruitment initiatives for Sales Team Leaders. By focusing on data analysis, this platform equips teams to effectively gather and interpret critical data from early-stage startup monitoring datasets, allowing them to monitor key performance indicators and track user engagement. Utilizing the company's solutions enables Sales Team Leaders to make informed decisions based on , thereby fostering a culture of continuous improvement and strategic growth.

As the importance of data-driven decision-making becomes increasingly recognized, tools similar to those offered by certain platforms are essential for achieving success in competitive markets. For example, companies leveraging analytics capabilities can refine their sales strategies and enhance customer interactions, demonstrating the tangible benefits of incorporating advanced data solutions into their operations.

By adopting Websets' tools, Sales Team Leaders can address common challenges in lead generation and recruitment, ultimately improving their performance metrics and achieving their strategic objectives.

Conclusion

Navigating the startup landscape presents significant challenges, particularly for early-stage companies aiming to establish their presence and secure funding. The tools discussed in this article are indispensable resources for startups, providing valuable insights and data that empower informed decision-making. By leveraging platforms such as Websets, CB Insights, and Crunchbase, emerging businesses can conduct comprehensive competitive analyses, track investment trends, and identify potential partners, thus positioning themselves for success in a competitive market.

The key arguments emphasize the necessity of AI-driven market intelligence tools to gain a thorough understanding of industry dynamics and competitor strategies. Each platform boasts unique features—from predictive analytics to real-time sentiment analysis—that equip startups with the essential knowledge to adapt and thrive. Analyzing funding rounds, market trends, and consumer feedback not only enhances a startup's strategic planning but also cultivates a culture of continuous improvement.

In conclusion, embracing these essential tools for startup monitoring can profoundly influence a company's trajectory, making it imperative for new ventures to proactively engage with the available data. By integrating these insights into their operations, startups can develop a competitive edge, drive innovation, and ultimately achieve their growth objectives. The future of entrepreneurship hinges on the ability to harness data effectively—are you prepared to take the leap and empower your startup with the insights necessary for success?

Frequently Asked Questions

What is Websets and how does it assist new businesses?

Websets is an AI-driven platform designed for new businesses to conduct comprehensive competitive analysis. It helps users navigate extensive datasets to identify key competitors and analyze their strategies, which is essential for early-stage startups to establish a competitive advantage.

What features does Websets offer to enhance competitive analysis?

Websets enriches search results with in-depth insights, including LinkedIn profiles and company information. It provides functionalities such as precise lead generation and AI-enhanced candidate discovery, streamlining the competitive analysis process and equipping businesses with necessary knowledge.

How does CB Insights support new businesses?

CB Insights consolidates extensive information on private companies, including funding rounds, valuations, and industry trends, helping new businesses identify potential investors and understand the competitive landscape. Its predictive analytics capabilities allow users to anticipate market shifts and make informed strategic decisions.

What significance do funding rounds have for early-stage ventures according to CB Insights?

In 2025, the average funding amount for early-stage ventures has reached unprecedented heights, highlighting a thriving investment climate. Successful funding rounds, such as RAD Intel's $19 million raise, demonstrate the effectiveness of using CB Insights to attract investor interest.

How can emerging companies enhance their research using CB Insights?

Emerging companies can utilize neural search capabilities integrated with CB Insights to refine data retrieval and analysis by understanding the semantic context of queries, which helps them effectively identify and connect with potential investors.

What role does Crunchbase play for new businesses?

Crunchbase provides comprehensive information on funding rounds, investor profiles, and company performance metrics, allowing new businesses to analyze competitors' funding activities and successful strategies, which is vital for attracting investors and refining business models.

What trends are evident in early-stage funding rounds as of 2025?

In 2025, U.S.-based ventures account for 68% of global venture capital, indicating a robust interest in new companies. This trend emphasizes the importance of leveraging funding round data for identifying opportunities and shaping effective funding strategies.

How does Crunchbase empower startups to make data-driven decisions?

By tracking competitors' funding activities and analyzing market dynamics, Crunchbase enables emerging companies to glean insights that empower them to make informed decisions, enhancing their growth prospects and navigating the complexities of securing investment.