Overview

The article emphasizes the critical role of talent flow analysis tools that venture capitalists (VCs) can leverage to boost their investment success. These tools, particularly those provided by platforms like Websets, offer invaluable insights into talent movement and recruitment trends. Such insights empower VCs to make informed funding decisions that are in sync with market dynamics, ultimately helping them identify high-growth opportunities. By utilizing these tools, VCs can navigate the complexities of investment landscapes with greater confidence and precision.

Introduction

In the fast-paced world of venture capital, successfully identifying and assessing high-potential startups relies heavily on the effective utilization of talent flow analysis tools. These innovative resources not only illuminate the dynamics of talent movement but also provide critical insights that can shape investment strategies and outcomes. Yet, with a multitude of tools at their disposal, how can venture capitalists discern which ones genuinely enhance their decision-making processes? This article explores ten essential talent flow analysis tools that promise to elevate success for VCs, offering a strategic roadmap for navigating the complexities of investment in today’s competitive landscape.

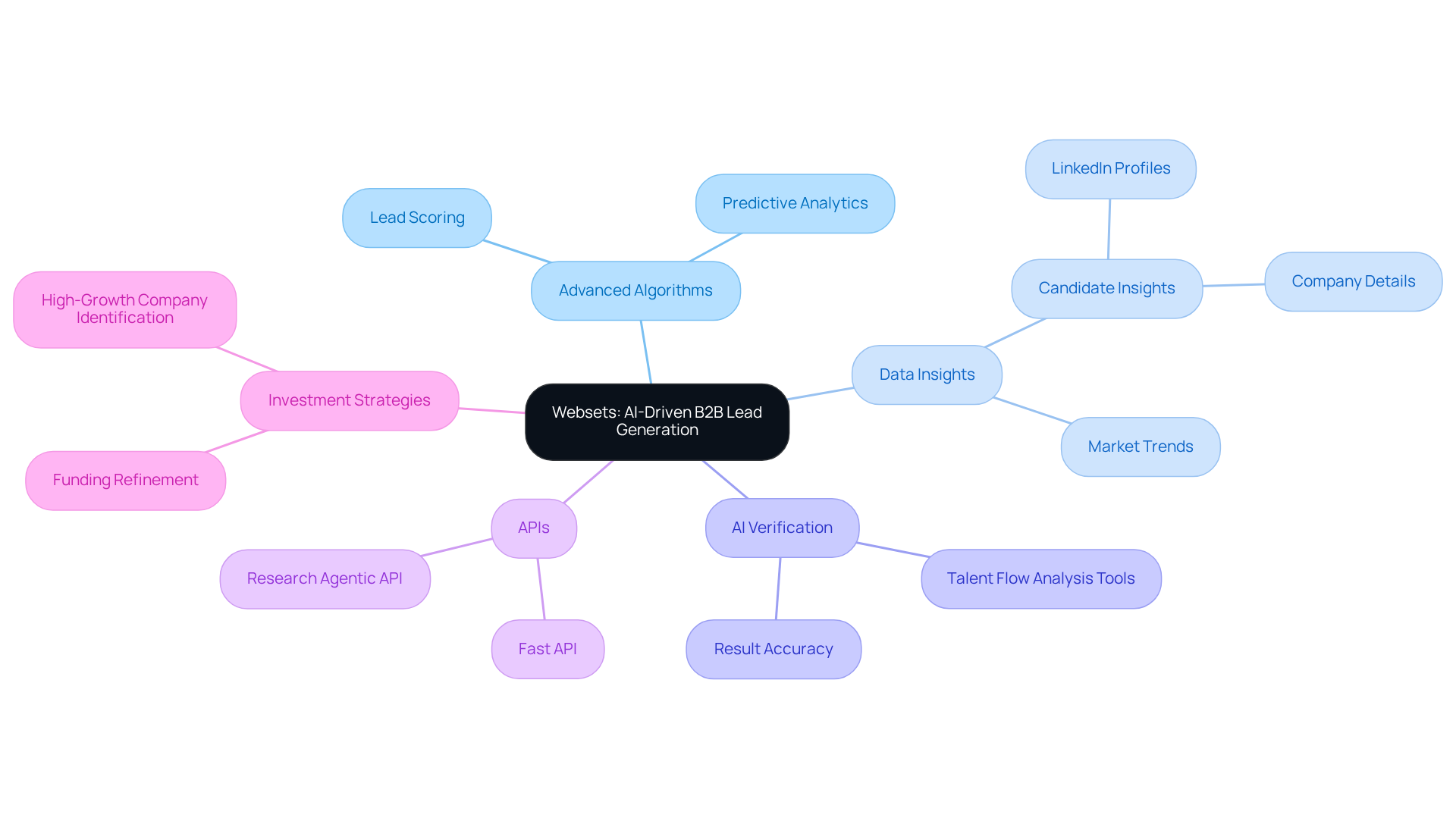

Websets: AI-Driven B2B Lead Generation for Talent Flow Analysis

Websets employs advanced algorithms to revolutionize B2B lead generation, positioning itself as a vital asset for capital investors interested in talent flow analysis tools for VCs. By providing comprehensive insights on candidates and emerging businesses—including LinkedIn profiles, emails, and company details—Websets empowers VCs to make swift, informed decisions. The platform's AI agents meticulously verify results with the help of talent flow analysis tools for VCs, ensuring both accuracy and relevance—critical factors in the ever-evolving venture capital landscape. This capability enables VCs to effectively pinpoint high-growth companies and the talent driving their success, ultimately refining their funding strategies with the help of talent flow analysis tools for VCs.

With 81% of marketers acknowledging the in decision-making, leveraging Websets can substantially enhance the precision of talent assessments and investment outcomes. Furthermore, features such as the Fast API and Research Agentic API bolster the platform's capacity to deliver high-quality insights tailored to specific needs.

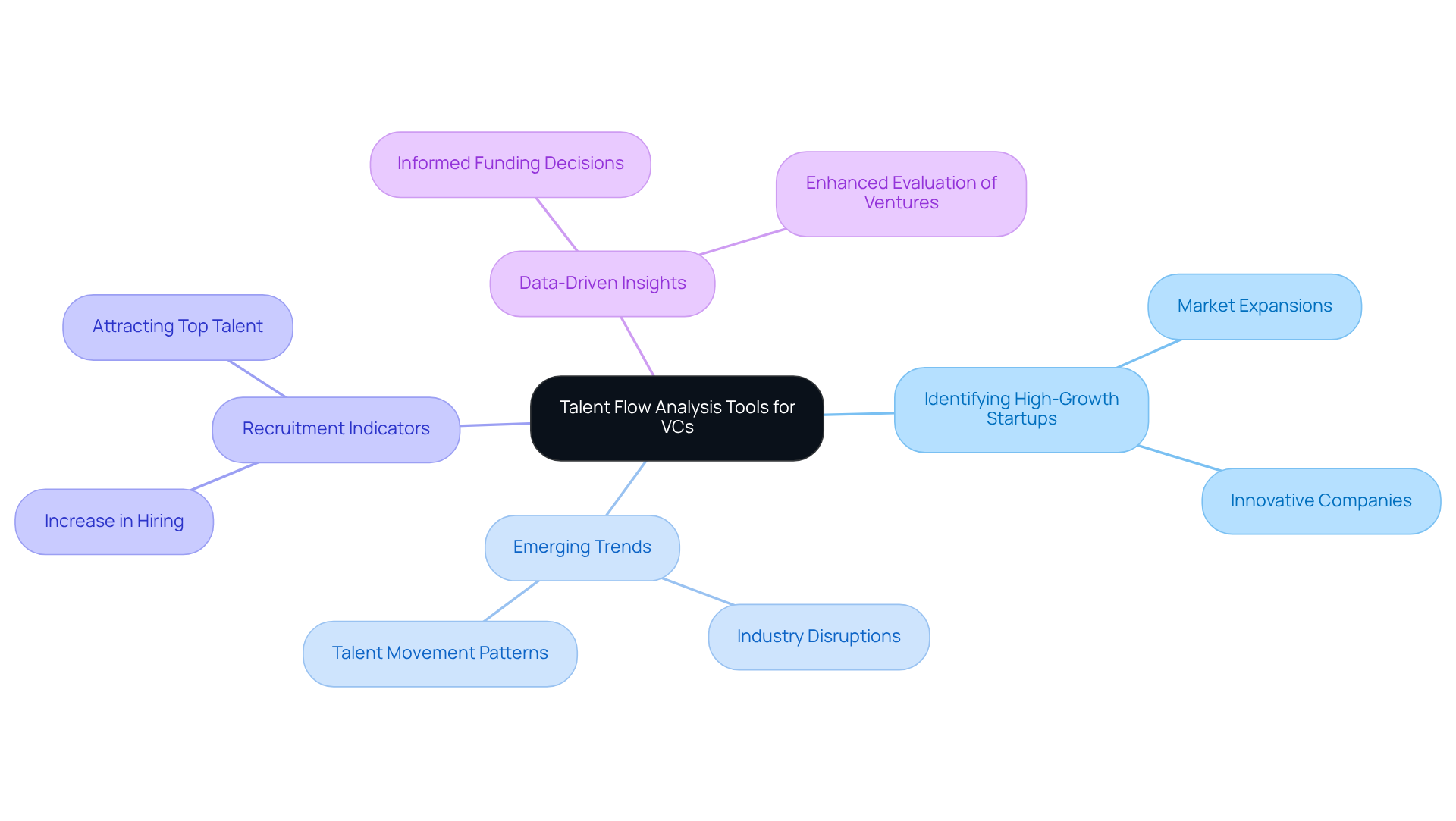

Talent Flow Data: A Key Resource for Identifying High-Growth Startups

Talent flow analysis tools for VCs serve as a crucial asset for venture capitalists (VCs) seeking to identify high-growth companies. By utilizing talent flow analysis tools for VCs to analyze the movement of talent across industries, VCs can uncover emerging trends and potential disruptions. A notable increase in recruitment at a technology company often indicates forthcoming innovations or market expansions, suggesting a robust growth trajectory. This analysis utilizes , which not only aids VCs in evaluating the stability of new ventures but also enhances their ability to make informed funding decisions.

Furthermore, leveraging Websets' AI-driven platform provides VCs with deeper insights into hiring trends and utilizes talent flow analysis tools for VCs. The platform's precise lead generation and candidate discovery features empower VCs to pinpoint startups that attract top talent, using talent flow analysis tools for VCs as an essential indicator of sustainable growth. Startups that effectively recruit skilled professionals are more likely to foster innovation and operational efficiency. By utilizing the talent flow analysis tools for VCs provided by Websets, VCs can strategically position themselves to capitalize on these opportunities, leading to more informed allocations. As one prominent capital provider noted, "If we lost Harmonic it would be a 9/10 bad day," underscoring the vital role of data-driven insights in making astute financial decisions.

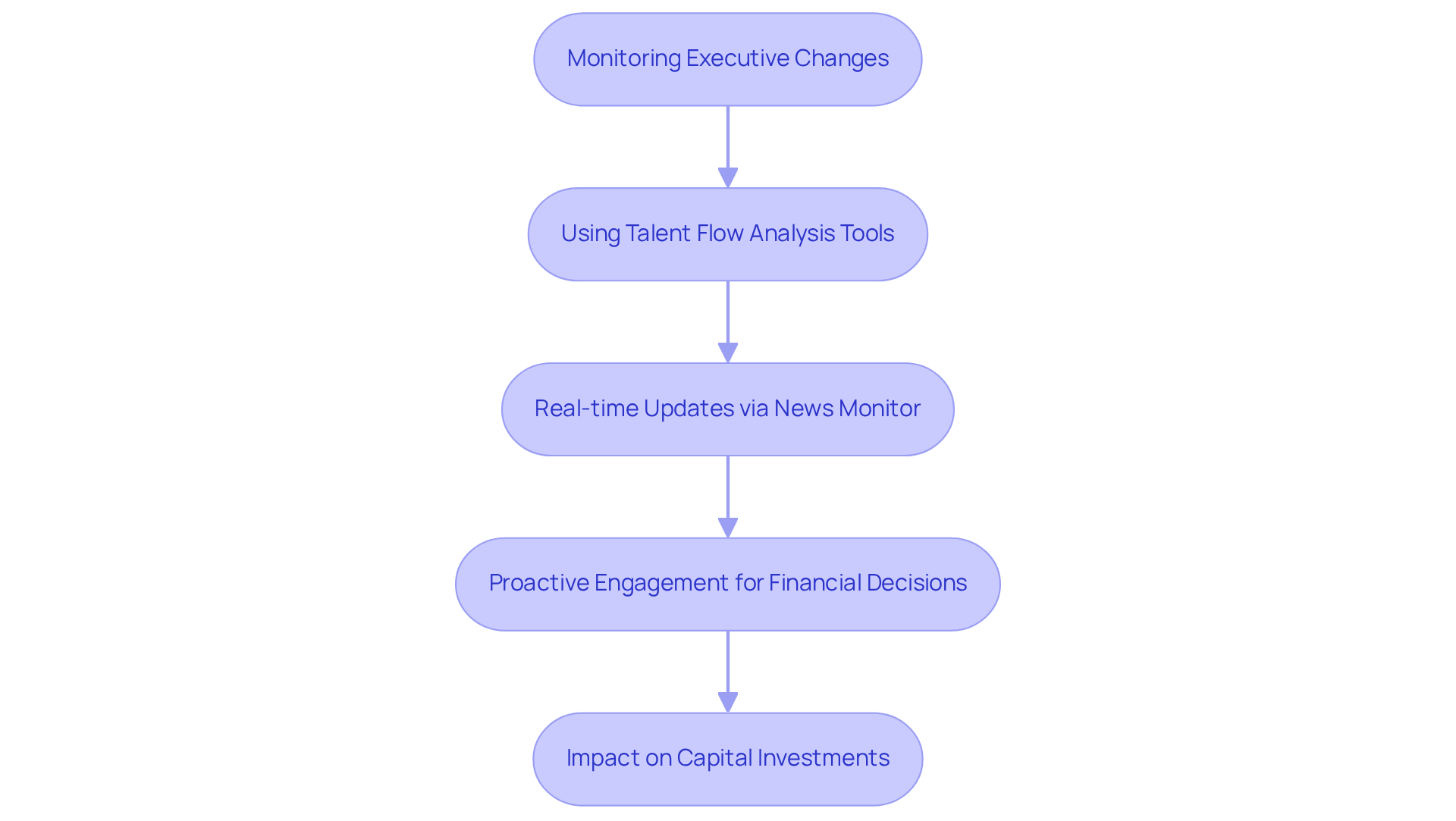

Workforce Intelligence Tools: Tracking Executive Changes for Market Insights

Talent flow analysis tools for VCs are indispensable for monitoring executive changes across various industries. These tools provide critical insights into market dynamics. For instance, the exit of a CEO from a new venture may indicate potential instability or a strategic shift, compelling VCs to reassess their funding positions.

By leveraging the talent flow analysis tools for VCs provided by Websets, including the News Monitor for real-time updates on science, politics, finance, and funding for new ventures, VCs can stay attuned to leadership trends. This proactive engagement enables them to make informed financial decisions that align with the evolving landscape.

Moreover, Websets offers 'Live Demos' and 'User Manuals' to empower VCs in effectively utilizing these tools for lead generation and recruitment. This strategic awareness is crucial, as the ramifications of can significantly influence the effectiveness of talent flow analysis tools for VCs, ultimately affecting capital investments and business outcomes.

In a rapidly shifting market, understanding these dynamics is essential for maintaining a competitive edge.

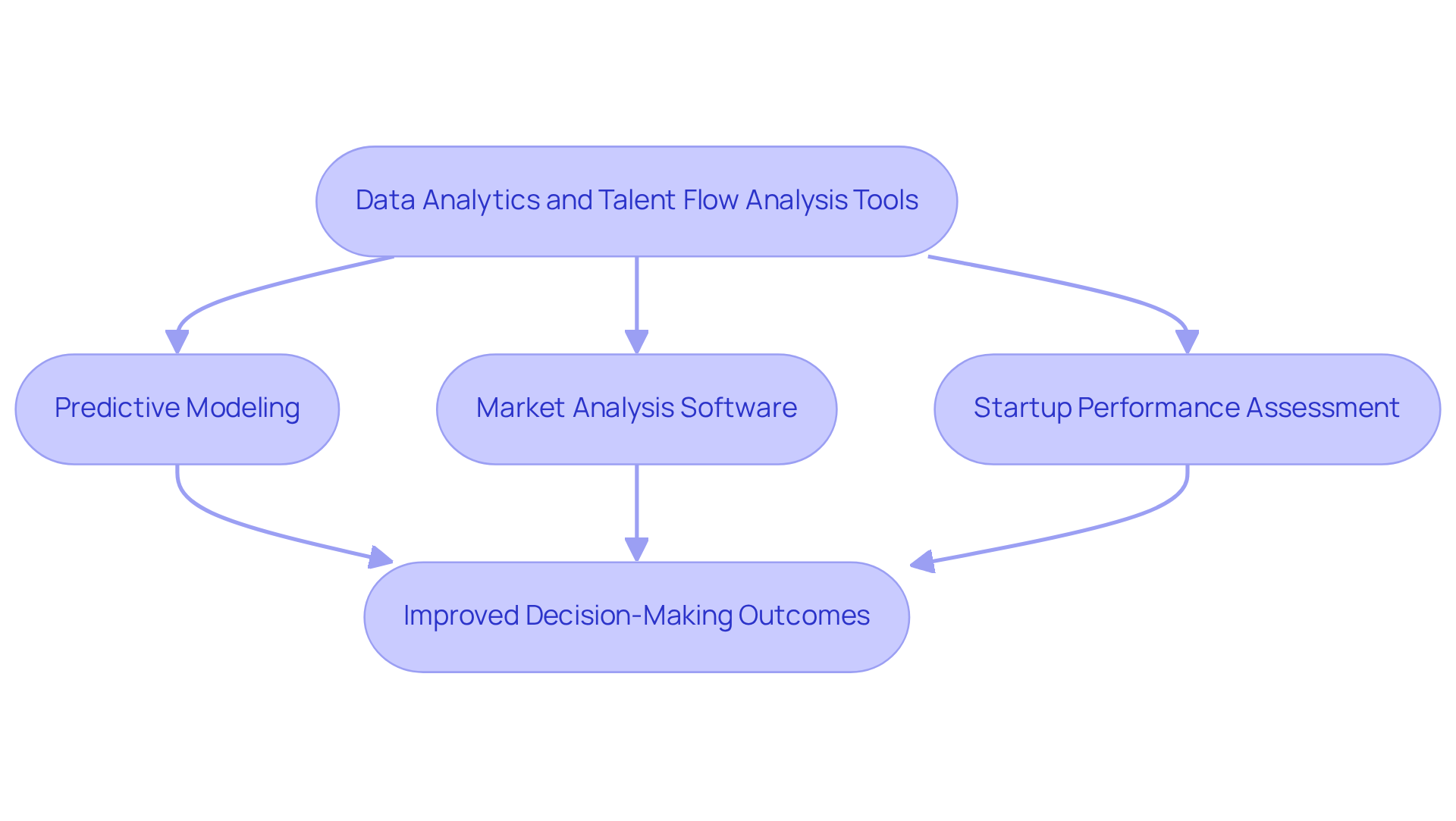

Data Analytics: Enhancing Decision-Making in Venture Capital

Enhancing decision-making processes among capital investors relies on data analytics and talent flow analysis tools for VCs. By leveraging talent flow analysis tools for VCs, along with sophisticated analytics such as predictive modeling and market analysis software, venture capitalists can effectively evaluate market trends, assess startup performance, and forecast future growth trajectories. This not only improves risk evaluation precision but also guides funding strategies, leading to superior outcomes in the highly competitive capital arena, where only 1% of proposals are financed and the average acceptance rate is a mere 0.7%.

As we approach 2025, the integration of advanced analytics alongside talent flow analysis tools for VCs is poised to further revolutionize investment decision-making, enabling VCs to navigate complexities with greater precision and agility.

As noted by Gompers et al., "VCs not only assume important microlevel functions in entrepreneurship but also serve as catalysts for innovation, job creation, and renewal in the broader economy.

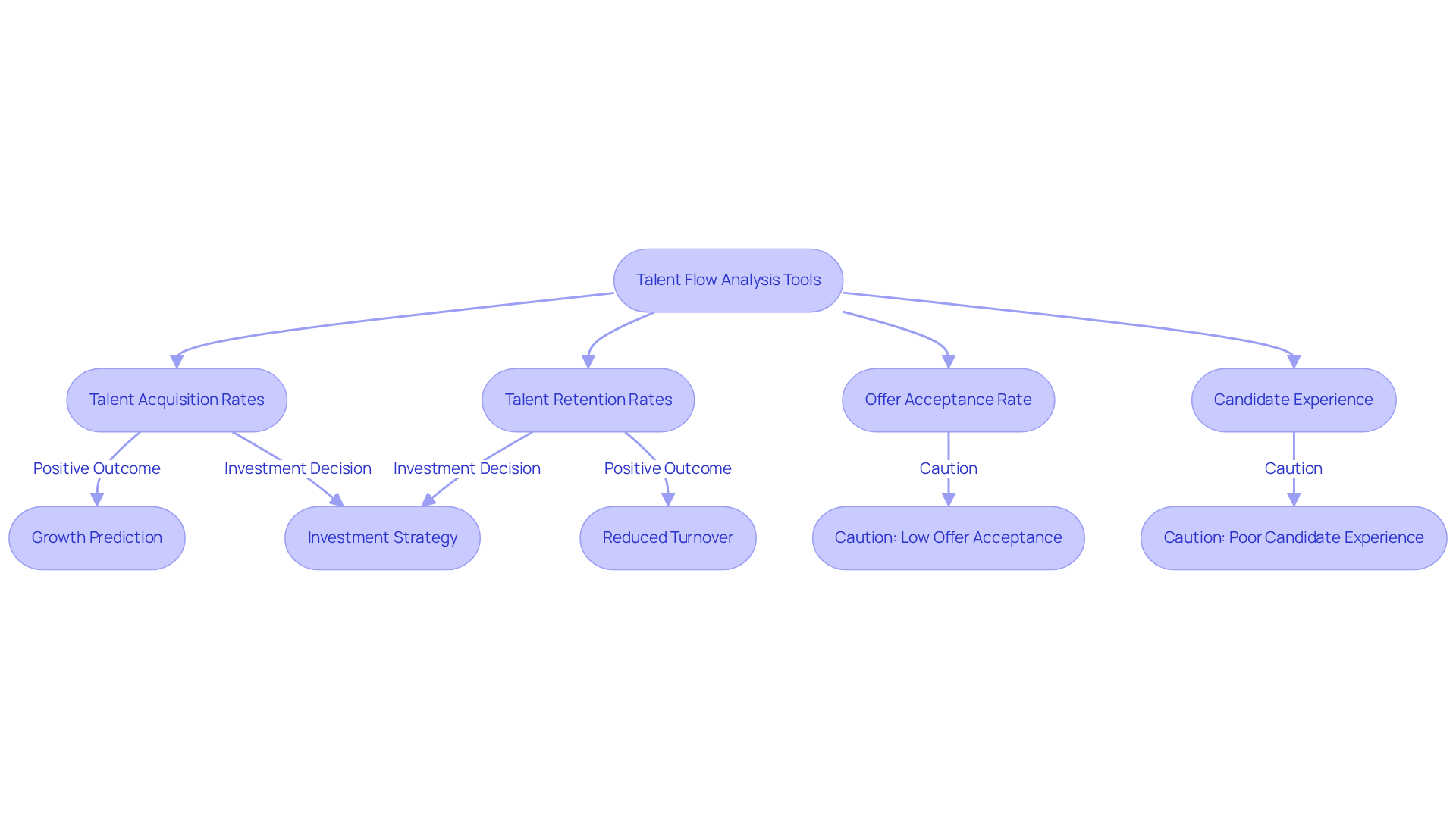

Talent Movement Benchmarking: Validating Market Position for Investments

Talent flow analysis tools for VCs serve as a crucial instrument to benchmark talent movement, allowing venture capitalists to assess a new company's market position by comparing its talent acquisition and retention rates against industry standards. This analysis not only reveals whether a new venture is effectively attracting top talent but also acts as a robust predictor of future success. Companies that prioritize effective talent acquisition strategies frequently witness accelerated growth rates and enhanced operational efficiency. Notably, firms with strong talent retention practices can achieve a 28% reduction in employee turnover, significantly bolstering their stability and growth potential. Furthermore, organizations that invest in employer branding can substantially lower hiring costs, further propelling their growth trajectory.

Moreover, VCs are increasingly leveraging talent flow analysis tools for VCs to guide their investment decisions. By scrutinizing metrics such as the offer acceptance rate and candidate experience, investors can assess a new venture's appeal to prospective hires. A low offer acceptance rate may signal potential compensation challenges, underscoring the necessity for VCs to incorporate these metrics into their evaluations. This data-driven approach empowers VCs to utilize talent flow analysis tools for VCs to pinpoint startups that are not only primed for growth but also capable of sustaining that growth through effective talent management. Understanding these dynamics enables VCs to , ultimately yielding more successful funding outcomes.

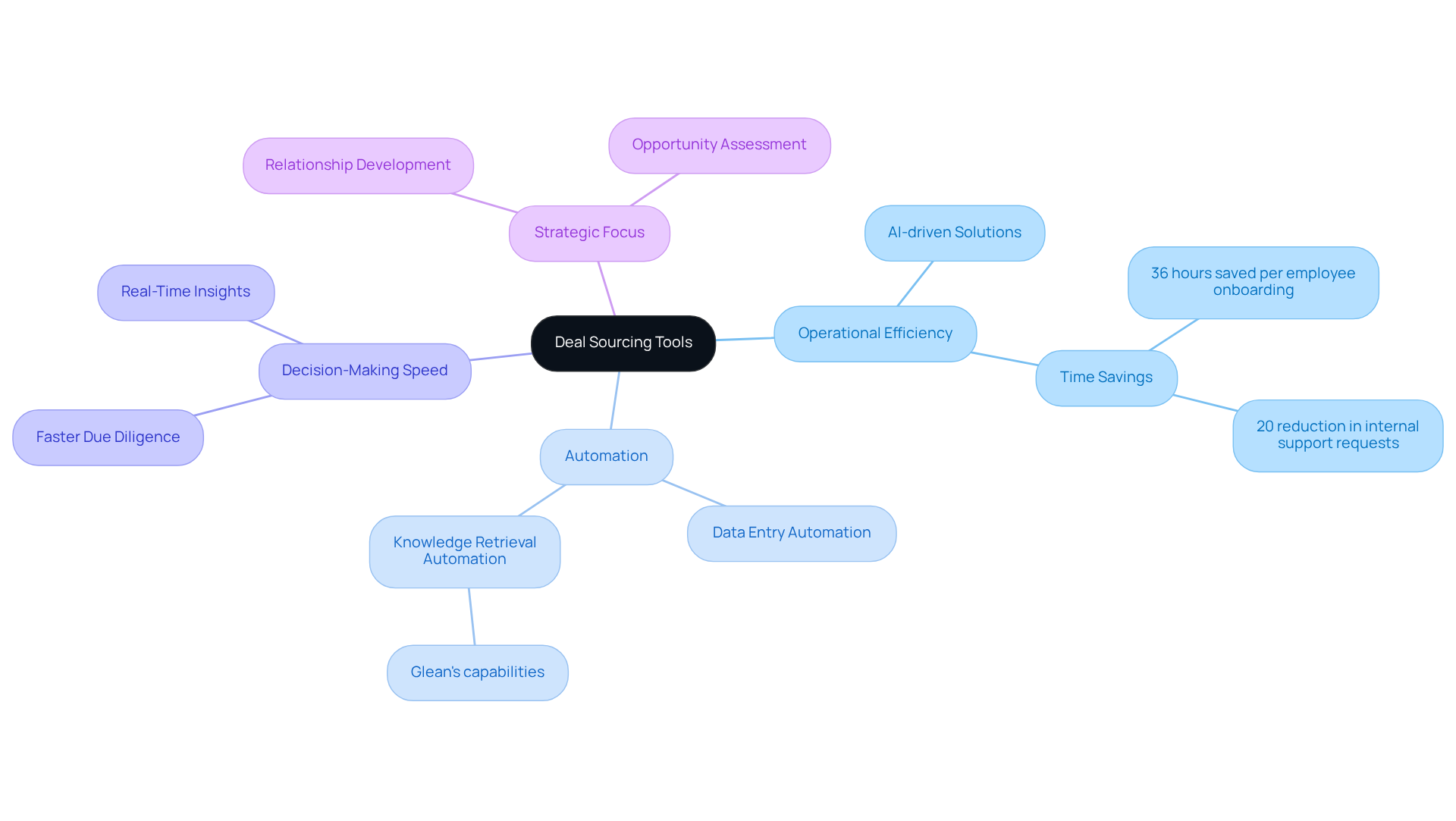

Deal Sourcing Tools: Streamlining the Investment Process for VCs

Deal sourcing tools are indispensable for venture capitalists aiming to elevate their funding processes. These streamline the identification and evaluation of potential ventures, enabling VCs to concentrate on high-potential opportunities. By automating data collection and analysis, these tools significantly boost operational efficiency, facilitating quicker and more informed decision-making.

For example, firms utilizing AI-driven solutions have reported marked enhancements in deal flow and decision-making speed. Automation not only reduces the time spent on manual tasks but also empowers VCs to focus on strategic relationship development and opportunity assessment.

As the capital landscape evolves, adopting these technologies is crucial for maintaining a competitive edge and achieving superior financial outcomes.

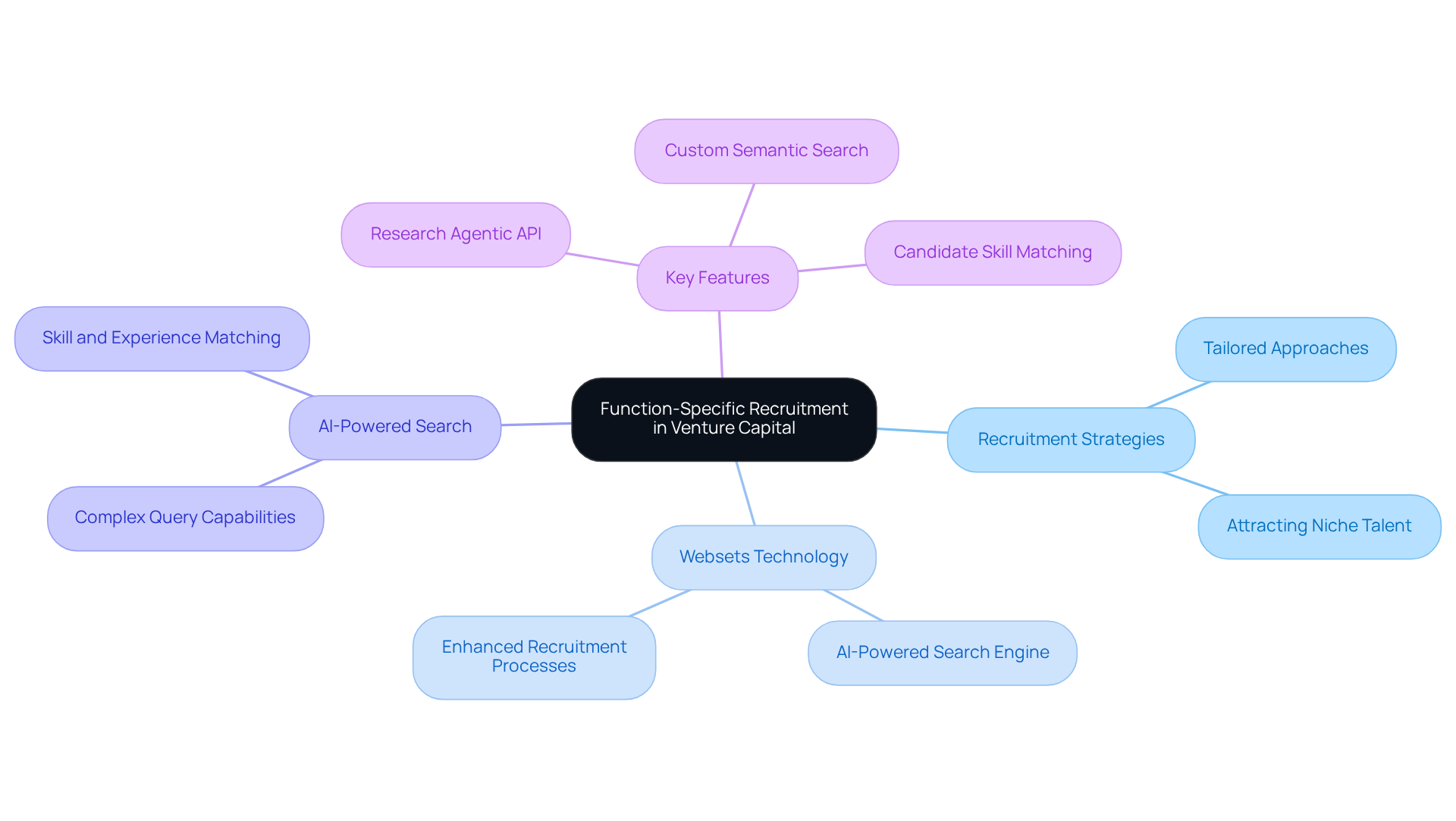

Function-Specific Support: Tailoring Recruitment Strategies in Venture Capital

Function-specific assistance in recruitment empowers capital firms to tailor their strategies, attracting the right talent for their specific focus areas. Leveraging Websets' advanced AI-powered search engine, venture capitalists can unlock unique capabilities for complex queries, refining their recruitment processes significantly. This innovative technology enables firms to pinpoint candidates with the precise skills and experiences necessary for various sectors, ensuring they assemble teams capable of executing their investment strategies effectively. With features such as the Research Agentic API and , Websets enhances the ability to produce well-cited summaries and discover niche talent that other tools may overlook.

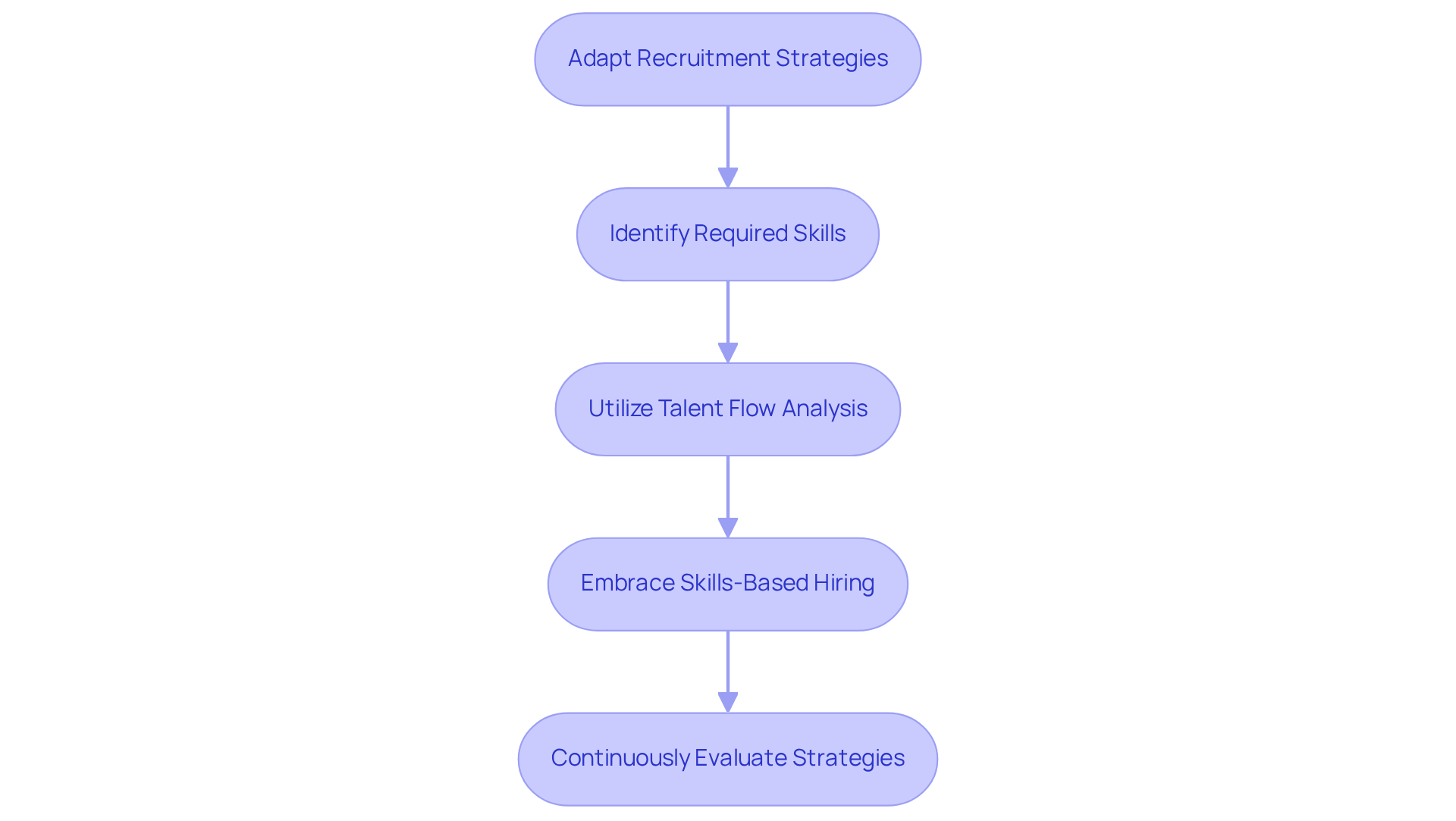

Future Role of VCs in Recruitment: Adapting to Market Demands

The evolving landscape of investment capital necessitates a strategic overhaul of recruitment methods to align with market demands. As industries experience rapid transformation, venture capitalists must proactively pinpoint the skills and expertise that will underpin future success. This strategy not only bolsters their capacity to support portfolio companies but also ensures they remain competitive in a fluid environment.

Notably, statistics indicate that:

- 76% of workers seek portable, employer-verified skills data, highlighting an increasing focus on skills-based hiring.

- 90% of business executives concur that transitioning to a skills-based organization is vital for adapting to market fluctuations.

By embracing these insights, VCs can utilize talent flow analysis tools for VCs to refine their recruitment strategies, ensuring they attract top talent that meets the evolving needs of their portfolios. Successful VCs are already adapting by utilizing talent flow analysis tools for VCs, leveraging data-driven insights from platforms like Websets to inform their hiring processes.

For example, teams across various sectors have utilized Websets' AI-powered candidate discovery and qualification tools to filter candidates based on skills, experience, and location, enriching their searches with comprehensive profiles and prior work experience. This data-centric approach significantly enhances their portfolio's potential for growth and innovation.

To implement these insights effectively, VCs should continuously evaluate their recruitment strategies against current market trends, leveraging talent flow analysis tools for VCs to maintain a .

Effective Board Membership: Strategic Guidance for Portfolio Companies

Effective board membership is essential for providing strategic guidance to portfolio companies. Venture capitalists (VCs) who actively engage with their portfolio companies can offer invaluable insights and support, enabling them to navigate challenges and seize opportunities. Research indicates that each additional initial public offering (IPO) among a VC firm's first ten contributions predicts an 8% higher IPO rate on subsequent ventures, underscoring the significant impact of strategic guidance. By fostering strong connections and providing direction, board members can enhance the overall success of their ventures.

As Lior Ronen, founder of Finro, states, "Active engagement with portfolio companies is essential for driving growth and achieving successful outcomes."

Furthermore, firms like Sequoia Capital effectively utilize their Company Design philosophy to guide startups, aligning their strategic goals with the expertise and resources of the VCs. Sales team leaders can leverage these insights by encouraging their teams to cultivate strong relationships with VCs, ensuring they are well-positioned to receive the necessary for success.

Comprehensive Research Methods: Gaining Insights for Better Investment Outcomes

Thorough research techniques are crucial for venture capitalists aiming to enhance financial results. By leveraging diverse research methods such as:

VCs can uncover valuable insights into prospective opportunities. This comprehensive understanding not only facilitates but also mitigates risks and boosts returns. Notably, 77% of B2B companies employ market research to navigate market dynamics and consumer trends, underscoring its importance in pinpointing high-return opportunities. Furthermore, firms engaging in market research report an impressive ROI exceeding four times their investment, highlighting the tangible benefits of these practices. As industry leaders assert, market analysis is a cornerstone of strategic investment planning, equipping investors with the essential knowledge to optimize their financial objectives. By integrating these robust research methods, VCs can refine their strategies, ensuring they remain competitive in an ever-evolving landscape.

Conclusion

The exploration of talent flow analysis tools underscores their essential role in boosting the success of venture capitalists (VCs) within a rapidly evolving investment landscape. By harnessing these tools, VCs can make data-driven decisions that not only pinpoint high-growth startups but also enhance their recruitment strategies and optimize funding allocations. The integration of advanced analytics and AI technologies—such as those provided by platforms like Websets—equips VCs to navigate complexities and seize opportunities with heightened precision.

Key insights presented throughout this article illuminate the significance of monitoring talent movement, leveraging workforce intelligence, and employing effective deal sourcing tools. These strategies empower VCs to stay ahead of market trends, evaluate the stability of potential investments, and ensure alignment with the industry's shifting demands. Moreover, the focus on function-specific recruitment and comprehensive research methods further emphasizes the necessity for VCs to adapt their approaches to sustain a competitive advantage.

Ultimately, the adoption of talent flow analysis tools transcends mere tactical advantage; it emerges as a strategic imperative for VCs aspiring to drive innovation and growth. By consistently assessing and refining their investment strategies in response to market dynamics, venture capitalists can enhance their portfolio's potential and contribute meaningfully to the broader economic landscape. Embracing these insights fosters more informed decisions, ultimately cultivating a thriving environment for both investors and startups.

Frequently Asked Questions

What is Websets and how does it assist VCs in lead generation?

Websets is an AI-driven platform that revolutionizes B2B lead generation by providing comprehensive insights on candidates and emerging businesses, which include LinkedIn profiles, emails, and company details. It empowers venture capitalists (VCs) to make swift, informed decisions regarding talent flow analysis tools.

How does Websets ensure the accuracy and relevance of its data?

Websets employs advanced algorithms and AI agents that meticulously verify results using talent flow analysis tools for VCs. This verification process is crucial for ensuring both accuracy and relevance, which are critical factors in the venture capital landscape.

Why is talent flow analysis important for identifying high-growth startups?

Talent flow analysis helps VCs identify high-growth companies by analyzing the movement of talent across industries. Notable increases in recruitment at technology companies can indicate forthcoming innovations or market expansions, suggesting a robust growth trajectory.

What features does Websets offer to enhance its lead generation capabilities?

Websets offers features such as the Fast API and Research Agentic API, which enhance the platform's ability to deliver high-quality insights tailored to specific needs, thereby improving the precision of talent assessments and investment outcomes.

How does monitoring executive changes benefit VCs?

Monitoring executive changes using talent flow analysis tools helps VCs gain critical insights into market dynamics. For example, the exit of a CEO may indicate potential instability or a strategic shift, prompting VCs to reassess their funding positions.

What resources does Websets provide to help VCs utilize its tools effectively?

Websets offers 'Live Demos' and 'User Manuals' to empower VCs in effectively utilizing its talent flow analysis tools for lead generation and recruitment, ensuring they can make informed financial decisions in a rapidly shifting market.

What role does data play in the decision-making process for marketers and VCs?

Data plays an essential role in decision-making, with 81% of marketers acknowledging its importance. Leveraging platforms like Websets can significantly enhance the precision of talent assessments and investment outcomes for VCs.