Overview

Today, the leading intelligence platforms for investors—AlphaSense, Magnifi, and Visualping—stand out by offering distinctive features tailored to various user needs and investment strategies. These platforms leverage advanced technologies, including AI and neural search, to enhance data analysis and decision-making processes. Such capabilities make them indispensable tools for navigating the intricate financial landscape. Investors must recognize the value these platforms bring to their strategic planning and operational efficiency.

Introduction

Investment intelligence platforms are revolutionizing financial decision-making, leveraging AI and machine learning to deliver critical insights to investors. As these tools continue to evolve, they present a variety of features tailored to meet diverse investor needs—ranging from real-time monitoring to comprehensive analytics. Yet, with an abundance of options at their disposal, how can investors identify the platform that aligns best with their unique strategies and objectives? This article explores the premier intelligence platforms for investors, emphasizing their key features, benefits, and suitability for various investor profiles. By doing so, we empower readers to make informed choices in an increasingly intricate market.

Overview of Intelligence Platforms for Investors

Investment intelligence systems have undergone a significant evolution, increasingly leveraging AI and machine learning to deliver actionable insights. Services such as Websets, AlphaSense, Magnifi, and Visualping cater to diverse user needs, offering features that enhance the thorough analysis of trends and customized financial strategies.

A pivotal advancement in this domain is the integration of neural search technology, exemplified by Exa—a fully neural search engine that elevates data discovery through its sophisticated embeddings model. This technology facilitates a deeper understanding of entity types, such as companies, blog posts, and GitHub repositories, along with descriptors like funny, scholastic, and authoritative, all while processing vast datasets with semantic precision. This empowers individuals to make informed decisions, monitor market trends, and effectively.

As the financial landscape grows increasingly complex, the importance of the best intelligence platforms for investors escalates, equipping them with essential tools to navigate uncertainties and seize emerging opportunities.

Looking ahead to 2025, the adoption of AI in trading systems is expected to surge significantly, mirroring a broader trend towards automation and data-driven decision-making within the financial sector. The practical applications of machine learning in financial intelligence are evident, with systems employing advanced algorithms to enhance predictive analytics and risk management, ultimately yielding improved financial outcomes.

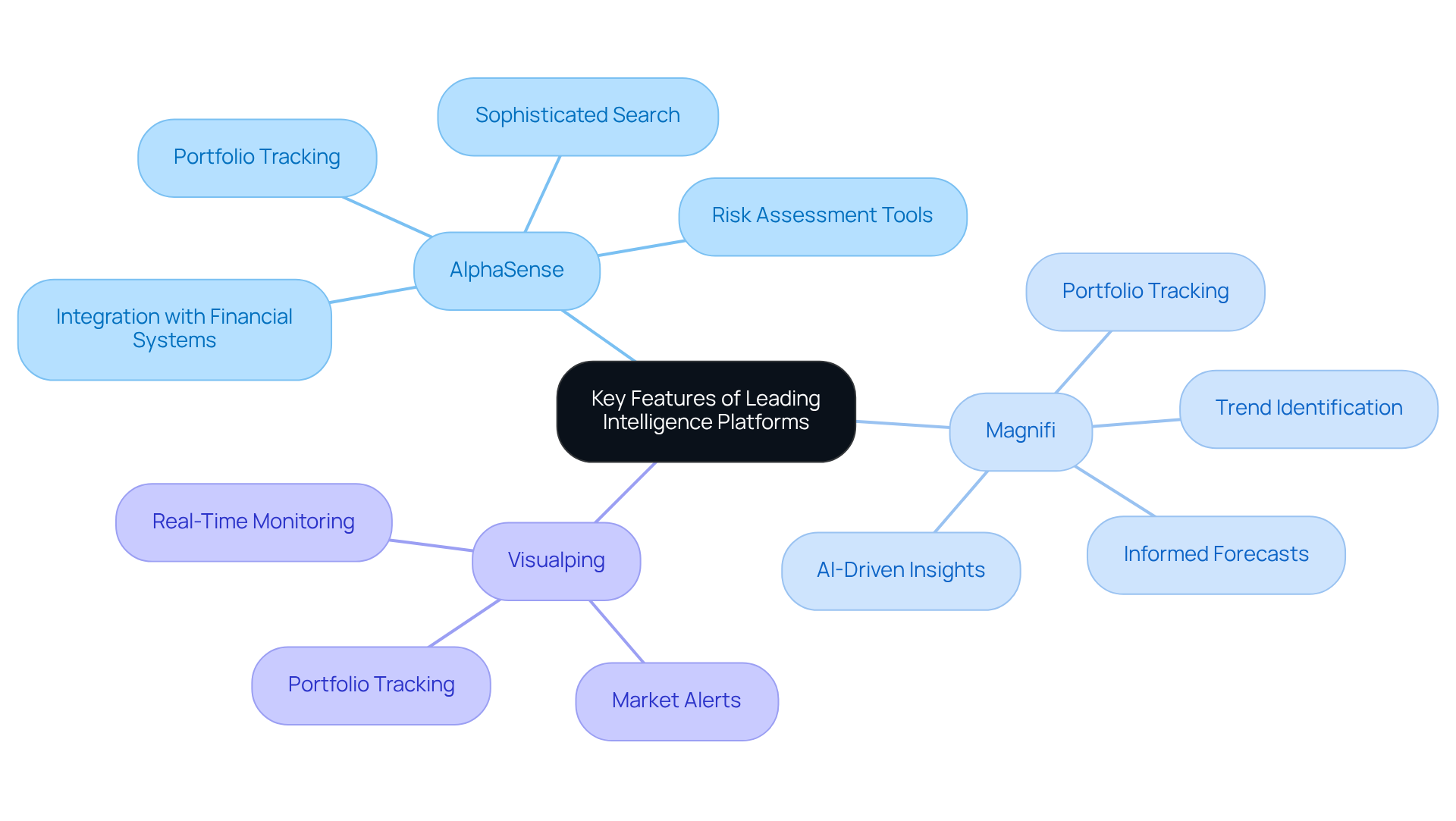

Key Features of Leading Intelligence Platforms

The best intelligence platforms for investors are revolutionizing the investment process with a range of powerful features. For instance, AlphaSense offers sophisticated search functionalities, empowering users to navigate vast datasets effortlessly. In contrast, Magnifi harnesses AI-driven insights, enabling individuals to identify trends and make informed forecasts. Meanwhile, Visualping excels in real-time market monitoring, alerting users to significant developments as they unfold. Common features also encompass:

- Portfolio tracking

- Risk assessment tools

- Seamless integration with existing financial systems

By comparing these offerings, investors can determine which of the best intelligence platforms for investors aligns best with their specific needs, whether they prioritize real-time data, comprehensive analytics, or user-friendly interfaces. The right choice can significantly and investment outcomes.

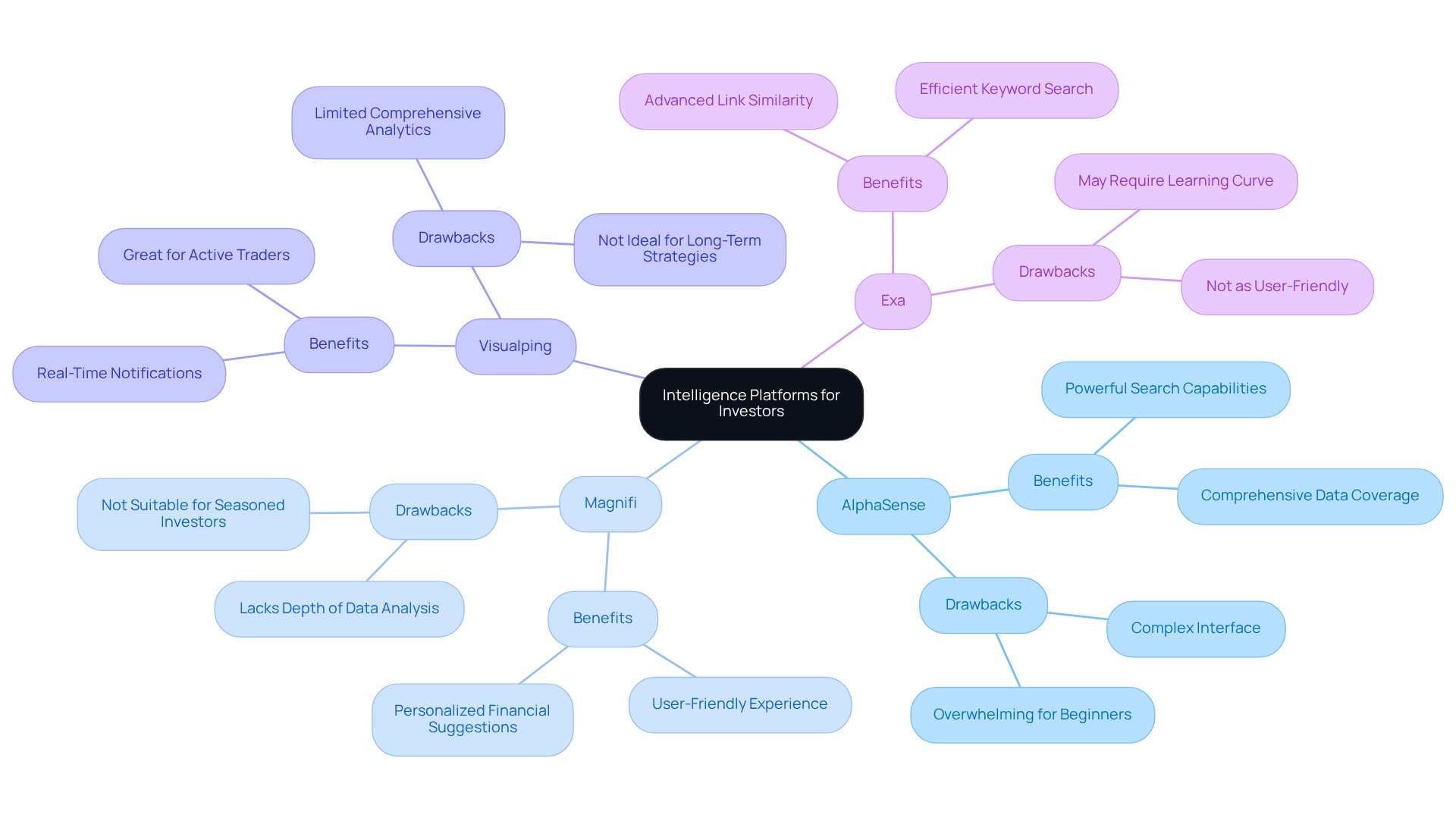

Benefits and Drawbacks of Each Platform

Choosing the best is crucial for effective market research. Each of the best intelligence platforms for investors offers its own set of benefits and drawbacks that can significantly impact your investment strategy.

For instance, AlphaSense stands out for its comprehensive data coverage and powerful search capabilities, making it particularly suitable for in-depth market analysis. However, some users may find its interface complex and overwhelming, posing a challenge for those seeking simplicity.

On the other hand, Magnifi offers a user-friendly experience and personalized financial suggestions, yet it may not provide the depth of data analysis that seasoned investors require. Meanwhile, Visualping excels in delivering real-time notifications, a game-changer for active traders. However, its emphasis on monitoring might not meet the comprehensive analytics demands necessary for long-term financial strategies.

Additionally, tools like Exa enhance corporate research through advanced link similarity and keyword search features, allowing users to efficiently uncover related companies and insights. By weighing these factors, you can select the best intelligence platforms for investors that align with your specific investment approach and goals, ensuring that your choice is both informed and strategic.

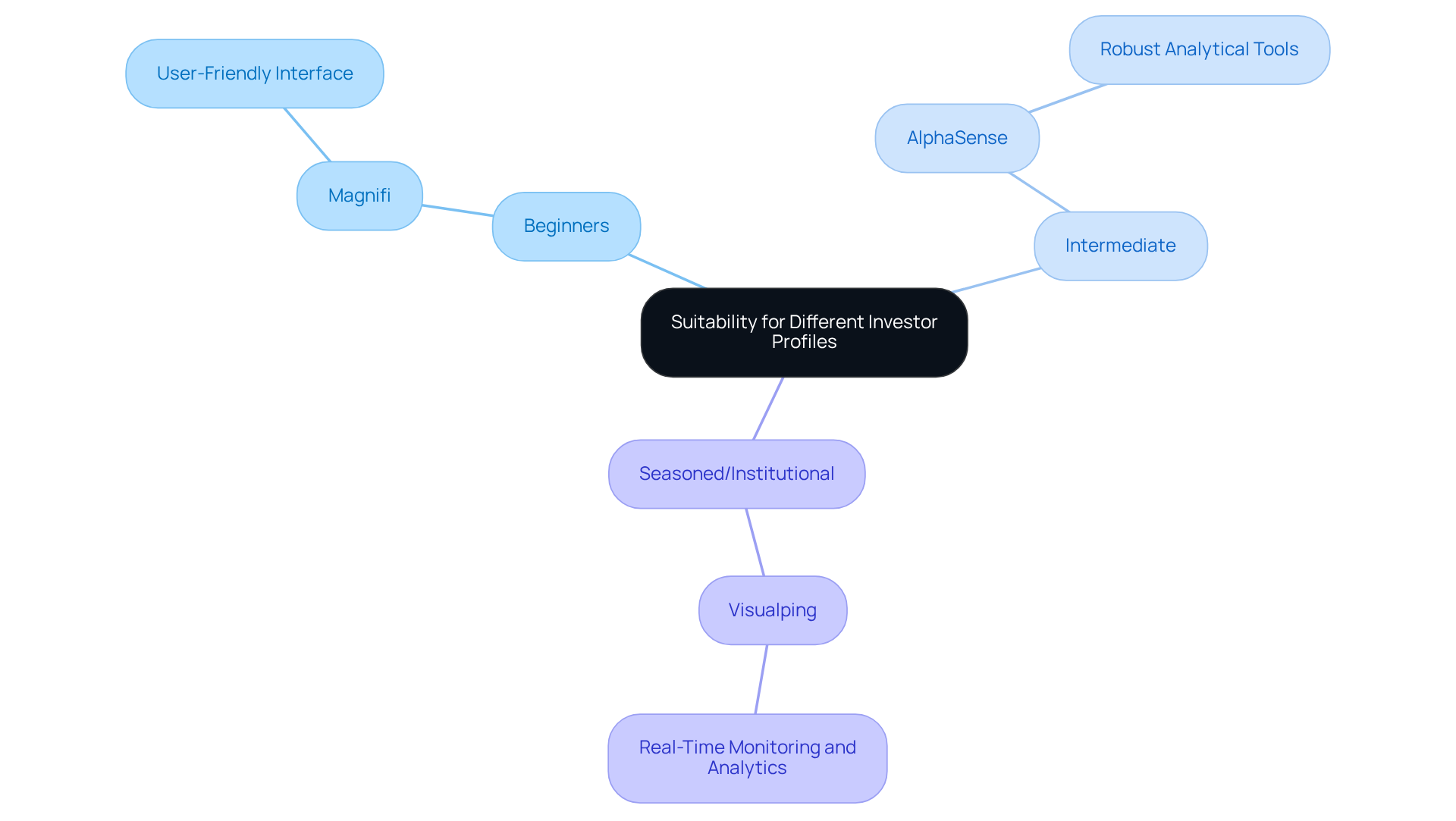

Suitability for Different Investor Profiles

The appropriateness of the best varies significantly across different types of investors. For beginners, platforms like Magnifi, with their user-friendly interfaces and tailored support, are ideal for building confidence and understanding financial dynamics. Intermediate investors may find value in AlphaSense, which offers robust analytical tools that enhance research capabilities. For seasoned individuals and institutional clients, Visualping's real-time monitoring and comprehensive data analytics provide essential insights for making swift, informed decisions in fast-paced markets. By aligning the best intelligence platforms for investors with investor profiles, individuals can select tools that not only address their current needs but also foster their growth as investors.

Conclusion

The exploration of intelligence platforms for investors underscores their transformative role in modern investment strategies. By leveraging advanced technologies such as AI and machine learning, these platforms empower investors to make data-driven decisions, navigate market complexities, and optimize their portfolios. The importance of selecting the right platform cannot be overstated, as it directly influences investment success and strategic planning.

Throughout this analysis, platforms like AlphaSense, Magnifi, and Visualping have been scrutinized for their unique features and suitability for diverse investor profiles. From comprehensive data analysis and real-time monitoring to user-friendly interfaces, each platform presents distinct advantages and potential drawbacks. Grasping these nuances enables investors to align their choices with personal goals, whether they are novices seeking guidance or seasoned professionals in need of in-depth insights.

Ultimately, the journey into the realm of investment intelligence platforms highlights the necessity of informed decision-making in an increasingly automated financial landscape. As the adoption of these tools continues to rise, investors are urged to evaluate their options meticulously and select platforms that not only meet their current needs but also adapt to their evolving investment strategies. Embracing these advanced tools can lead to more informed decisions, enhanced risk management, and, ultimately, improved financial outcomes in the dynamic world of investing.

Frequently Asked Questions

What are intelligence platforms for investors?

Intelligence platforms for investors are systems that leverage AI and machine learning to provide actionable insights, helping users analyze trends and develop customized financial strategies.

What are some examples of investment intelligence services?

Examples of investment intelligence services include Websets, AlphaSense, Magnifi, and Visualping, each catering to diverse user needs.

What is neural search technology and how does it benefit investors?

Neural search technology, like that used by Exa, enhances data discovery by processing vast datasets with semantic precision, allowing investors to understand various entity types and descriptors, which aids in informed decision-making and market trend monitoring.

Why is the use of intelligence platforms becoming more important for investors?

As the financial landscape becomes more complex, intelligence platforms provide essential tools that help investors navigate uncertainties and capitalize on emerging opportunities.

What is expected regarding the adoption of AI in trading systems by 2025?

By 2025, the adoption of AI in trading systems is expected to increase significantly, reflecting a broader trend towards automation and data-driven decision-making in the financial sector.

How does machine learning enhance financial intelligence?

Machine learning enhances financial intelligence by employing advanced algorithms to improve predictive analytics and risk management, leading to better financial outcomes.