Overview

This article identifies critical hiring signals that reveal potential investment opportunities. By monitoring hiring trends, employee retention rates, company culture, leadership stability, diversity in hiring, skill development initiatives, market adaptability, technological integration, and employee feedback, investors can gain valuable insights into a company's growth potential and overall viability.

Understanding these signals is essential for making informed investment decisions. Investors who recognize the significance of these indicators will be better positioned to assess company performance and future success.

Introduction

In a rapidly evolving business landscape, recognizing the subtle signals of hiring trends can unlock lucrative investment opportunities. Companies are increasingly leveraging advanced technologies like AI to analyze recruitment patterns and employee dynamics, presenting investors with a unique chance to gain insights that significantly influence decision-making. Yet, with numerous variables at play, how can investors effectively discern which hiring signals truly indicate a company's potential for growth and profitability? This article delves into seven critical hiring signals that investors must recognize to navigate the complexities of investment opportunities in 2025 and beyond.

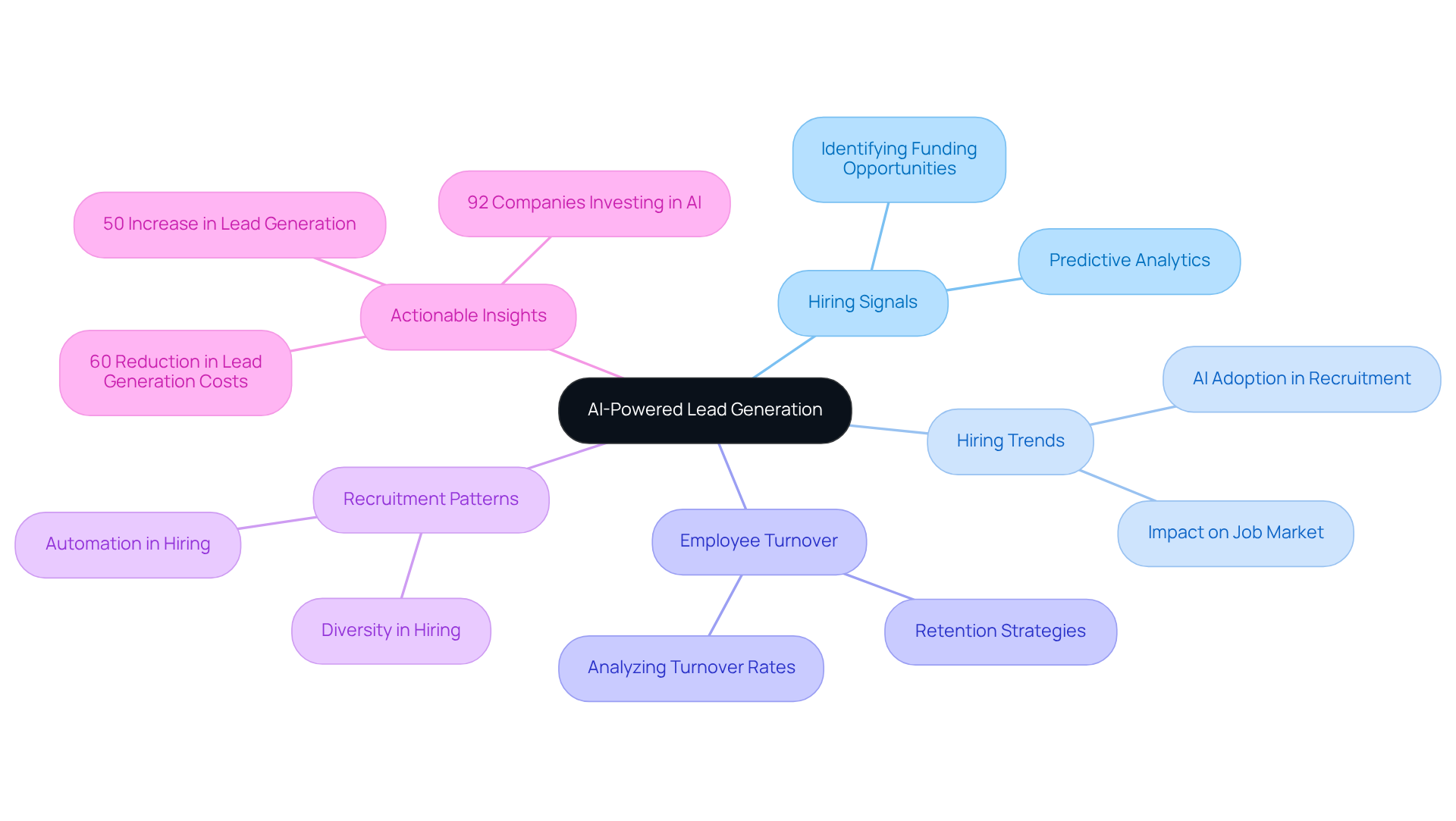

Websets: AI-Powered Lead Generation for Identifying Hiring Signals

Websets harnesses the power of advanced AI algorithms to analyze extensive datasets, enabling companies to identify hiring signals that may indicate potential funding opportunities. By scrutinizing hiring trends, employee turnover, and recruitment patterns, Websets provides actionable insights that empower investors to make informed decisions regarding resource allocation. This analytical capability is essential in today's competitive landscape, where timely and accurate information can offer a significant strategic advantage.

Notably, companies employing AI in their hiring processes have reported a 50% increase in lead generation, showcasing the transformative impact of AI on recruitment and funding strategies. Furthermore, with 92% of companies planning to invest in generative AI over the next three years, integrating AI tools into hiring practices is becoming vital for detecting profitable indicators.

Websets is at the forefront of this evolution, delivering insights that not only but also drive smarter investment decisions.

Recognize Hiring Trends: Key Indicators of Investment Potential

Investors must closely monitor hiring signals for investment opportunities, especially sudden increases in job postings or shifts in recruitment strategies. The recent surge in job openings in the U.S. reached 7.769 million, surpassing the anticipated 7.3 million, indicating a robust labor market. This uptick often signals business expansion or the launch of new products, while a decrease in postings may suggest cost-cutting measures or restructuring efforts. By monitoring these trends, investors can better recognize hiring signals for investment opportunities and more accurately gauge a company's growth trajectory.

Recent funding by major corporations further underscores this connection. Apple's commitment to invest $500 billion in the U.S., including the establishment of a new factory in Texas, is anticipated to create numerous job opportunities, reflecting a strategic move to enhance manufacturing capabilities. Similarly, Eli Lilly's pledge of at least $27 billion in U.S. infrastructure aims to improve its manufacturing processes, indicating that there are hiring signals for investment opportunities linked to funding potential. Economics professor Jared Pincin noted, "It's positive from the perspective of increased funding in the U.S. More jobs available," while finance expert Tom Smith remarked, "There's going to be a little backlash from domestic companies but in the long run, this is much better for communities."

Additionally, the labor force participation rate fell to 62.2%, emphasizing the importance of monitoring job postings as a critical indicator of market dynamics. By analyzing these recruitment shifts, stakeholders can identify hiring signals for investment opportunities and make informed decisions that align with market trends. To capitalize on these insights, stakeholders should develop a systematic approach to and correlate them with corporate announcements and investment activities, focusing on hiring signals for investment opportunities to ensure they remain ahead in the investment landscape.

Evaluate Employee Retention Rates: A Signal for Investment Viability

Evaluating staff retention rates is crucial for investors analyzing a business's viability. High retention rates often reflect a positive workplace culture and effective management, driving sustained productivity and profitability. Organizations with effective retention strategies typically incur lower turnover expenses, which can range from half to double a worker's yearly salary. This financial impact underscores the importance of fostering an environment where staff members feel valued and engaged.

Conversely, high turnover rates may signal deeper organizational issues, potentially jeopardizing performance and investor appeal. Research indicates that annual turnover in the U.S. has surged to 19.3%, with voluntary departures comprising 13% of this figure. Furthermore, staff retention rates across U.S. firms have declined by 1.5% over the past year, highlighting a growing retention crisis. Such trends disrupt operations and diminish institutional knowledge, complicating efforts to maintain competitive advantages.

Statistics reveal a clear link between staff retention and organizational performance. Companies prioritizing retention often witness enhanced staff engagement, a critical area given that Gallup reports engagement has reached an 11-year low. Organizations investing in staff development and well-being initiatives generally experience higher retention rates, leading to improved overall performance and investment viability. Notably, 50% of staff seeking new positions do so due to their manager, emphasizing the pivotal role of leadership in retention.

Thus, understanding and is essential for investors to identify hiring signals for investment opportunities in the market. As Dick Finnegan aptly states, turnover isn't merely a percentage—it's a dollar drain. Therefore, investing in career development and strategic training opportunities is vital for fostering staff growth and retention.

Assess Company Culture: A Reflection of Investment Attractiveness

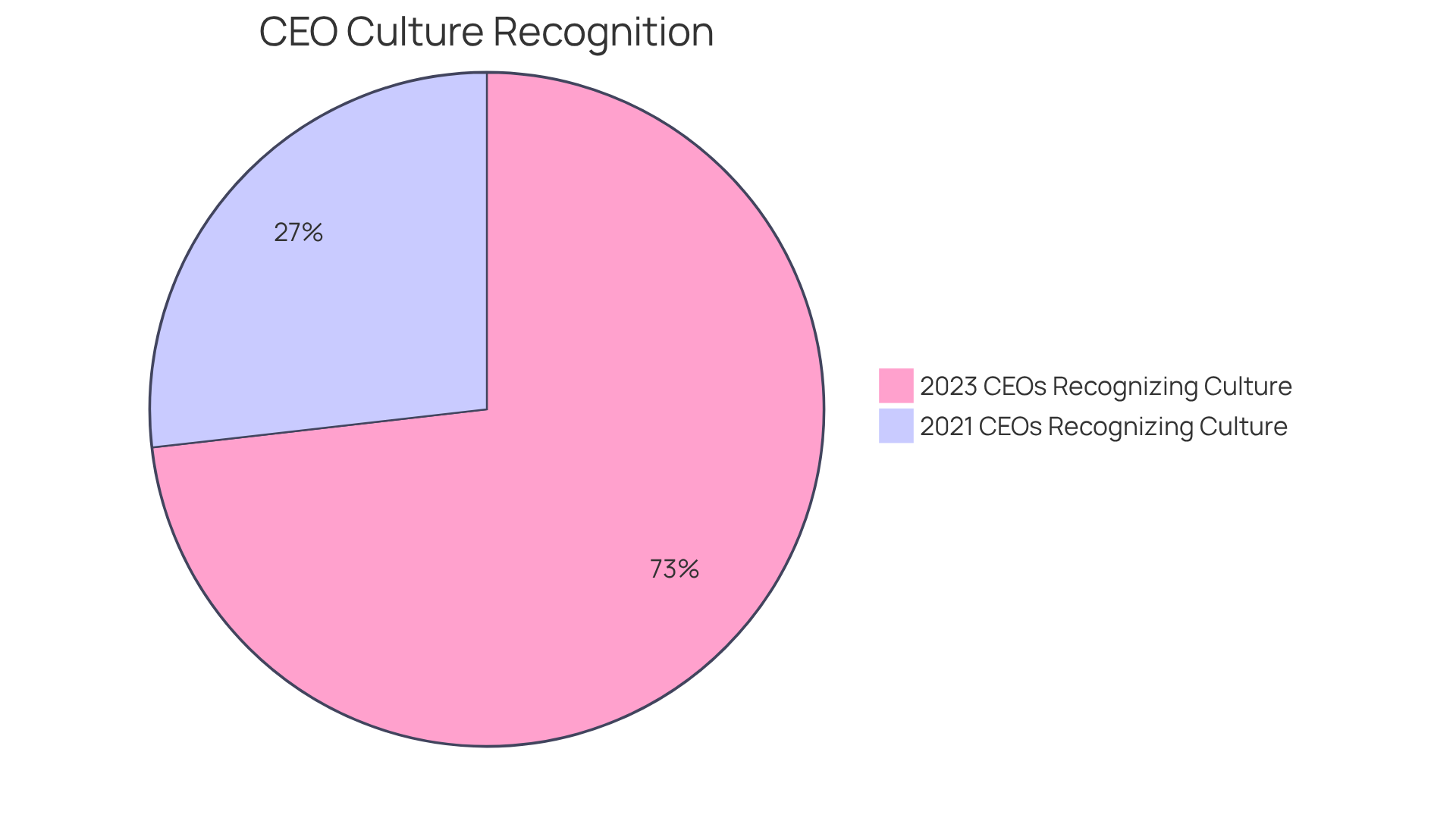

Investors must evaluate a company's culture, as it significantly influences long-term success and investment attractiveness. A strong culture not only boosts staff engagement but also drives innovation and fosters loyalty—key components that enhance performance and reduce turnover rates. Companies that prioritize their culture often see an improvement in brand reputation and customer satisfaction, making them more appealing to investors.

For instance, nearly 71% of CEOs recognize culture as a key factor positively impacting financial performance, a notable increase from 26% in 2021. Moreover, 46% of decision-makers indicate that a robust culture leads to improvements in essential growth areas such as staff productivity and retention. As the landscape evolves, organizations that align their culture with strategic goals will be better positioned to thrive.

Therefore, are essential for recognizing hiring signals for investment opportunities. Sales team leaders should consider conducting regular cultural assessments and employee engagement surveys to identify areas for improvement and ensure alignment with their strategic objectives.

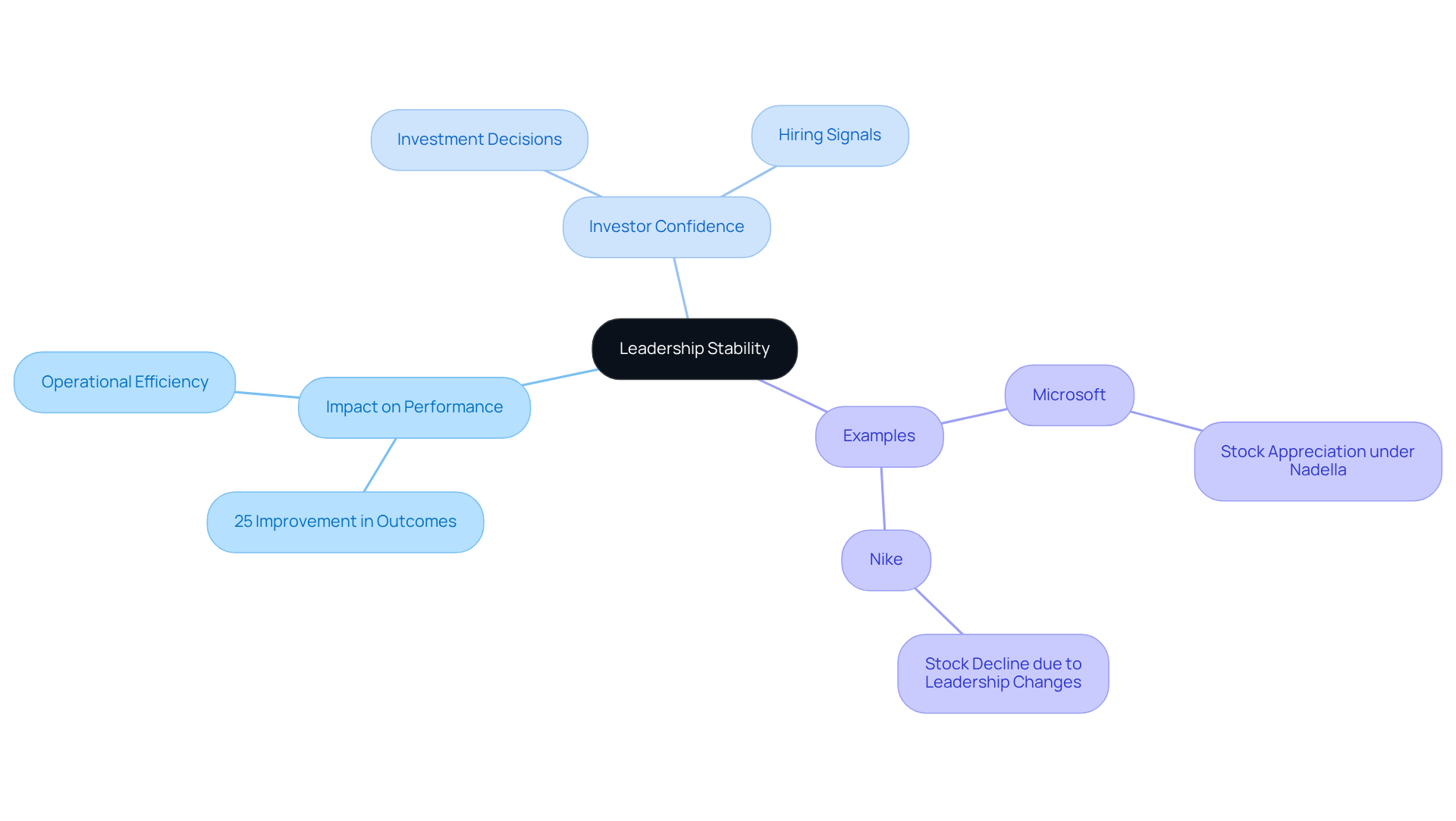

Monitor Leadership Stability: A Critical Indicator for Investors

Observing leadership stability is crucial for stakeholders, as it significantly impacts an organization's strategic direction and operational efficiency. Frequent leadership changes create uncertainty, disrupt ongoing initiatives, and ultimately harm performance. Organizations that maintain a consistent leadership team often demonstrate a clearer vision and more effective strategy execution, resulting in improved investment outcomes. Research indicates that organizations with stable leadership experience a 25% improvement in business outcomes, underscoring the value of continuity.

Consider Microsoft, which saw its stock appreciate significantly following Satya Nadella's appointment as CEO. This reflects increased in his strategic vision. In contrast, organizations like Nike faced a drop in stock value due to leadership changes, illustrating the potential dangers linked to instability. Furthermore, organizations investing in leadership development experience a 25% improvement in business outcomes, emphasizing the significance of cultivating effective leaders.

Investors should focus on firms that show strong hiring signals for investment opportunities related to leadership continuity. Such stability serves as a reliable indicator of hiring signals for investment opportunities and future financial performance. In an environment where change is constant, recognizing the value of stable leadership can lead to more informed investment decisions.

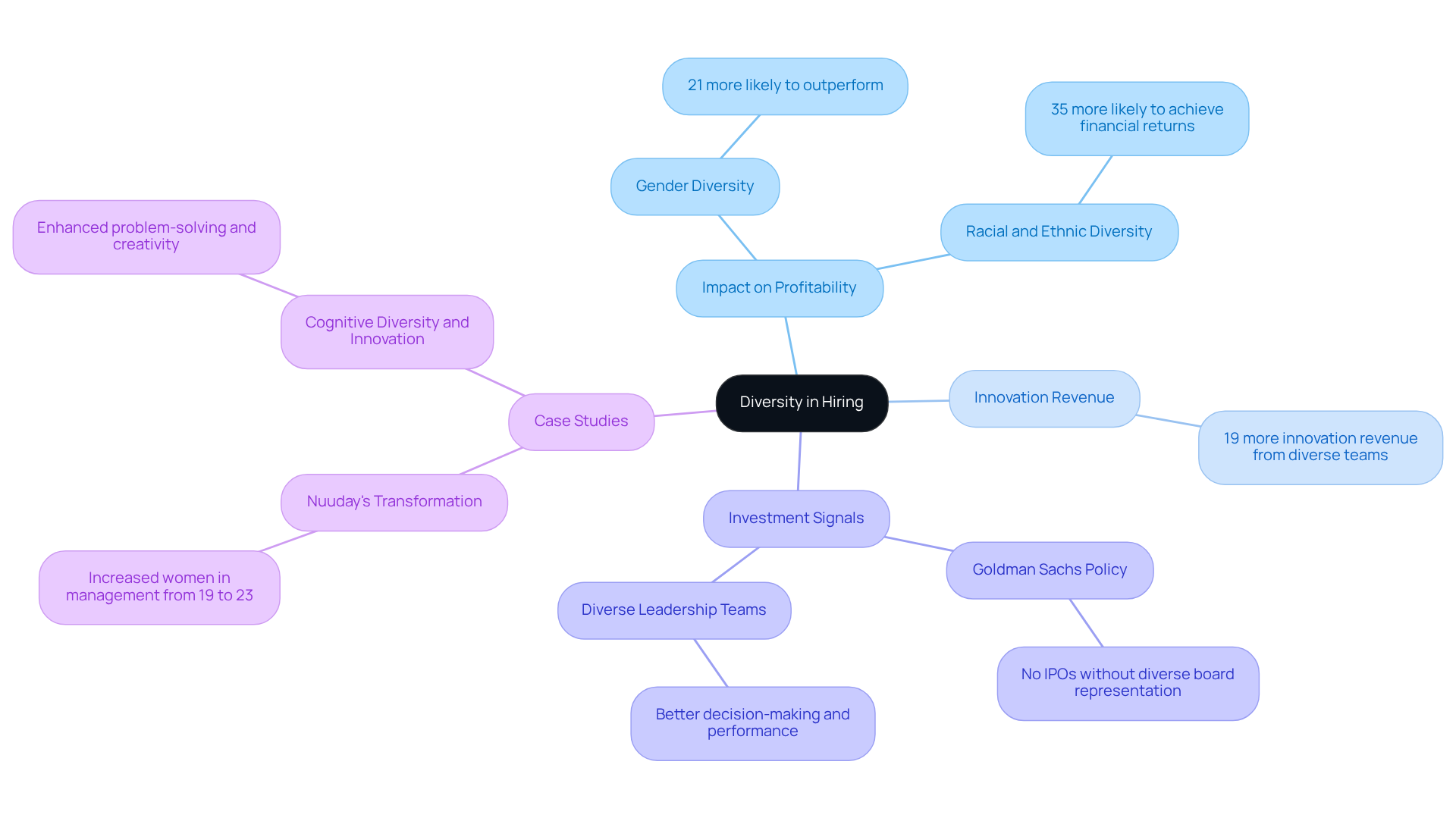

Analyze Diversity in Hiring: A Catalyst for Investment Growth

Evaluating diversity in recruitment methods is essential for investors seeking firms with a competitive edge. Diverse teams offer varied perspectives that can lead to innovative solutions and enhanced decision-making. Research shows that organizations with diverse teams frequently outperform their counterparts, underscoring diversity as a vital component in assessing financial potential.

Moreover, organizations in the top quartile for gender diversity on executive teams are 21% more likely to exceed in profitability, according to McKinsey's research. Additionally, those in the top quartile for racial and ethnic diversity are 35% more likely to achieve financial returns above their industry average. This correlation emphasizes the as a key factor in an organization's ability to foster growth and recognize hiring signals for investment opportunities.

For example, firms with above-average diversity in their leadership teams generate 19% more innovation revenue, illustrating that diverse teams are better positioned to understand and respond to the needs of a varied customer base. This adaptability is crucial in a globalized market where consumer preferences are increasingly diverse.

Numerous organizations have successfully leveraged diversity as hiring signals for investment opportunities. Goldman Sachs, for instance, has enacted a policy of not taking firms public without diverse board representation, reflecting a growing recognition of diversity's role in driving business success. Such initiatives not only enhance an organization's reputation but also position it favorably in the eyes of stakeholders seeking sustainable growth.

In conclusion, integrating diversity into hiring practices transcends mere social responsibility; it is a strategic imperative that can profoundly affect an organization's performance and act as hiring signals for investment opportunities.

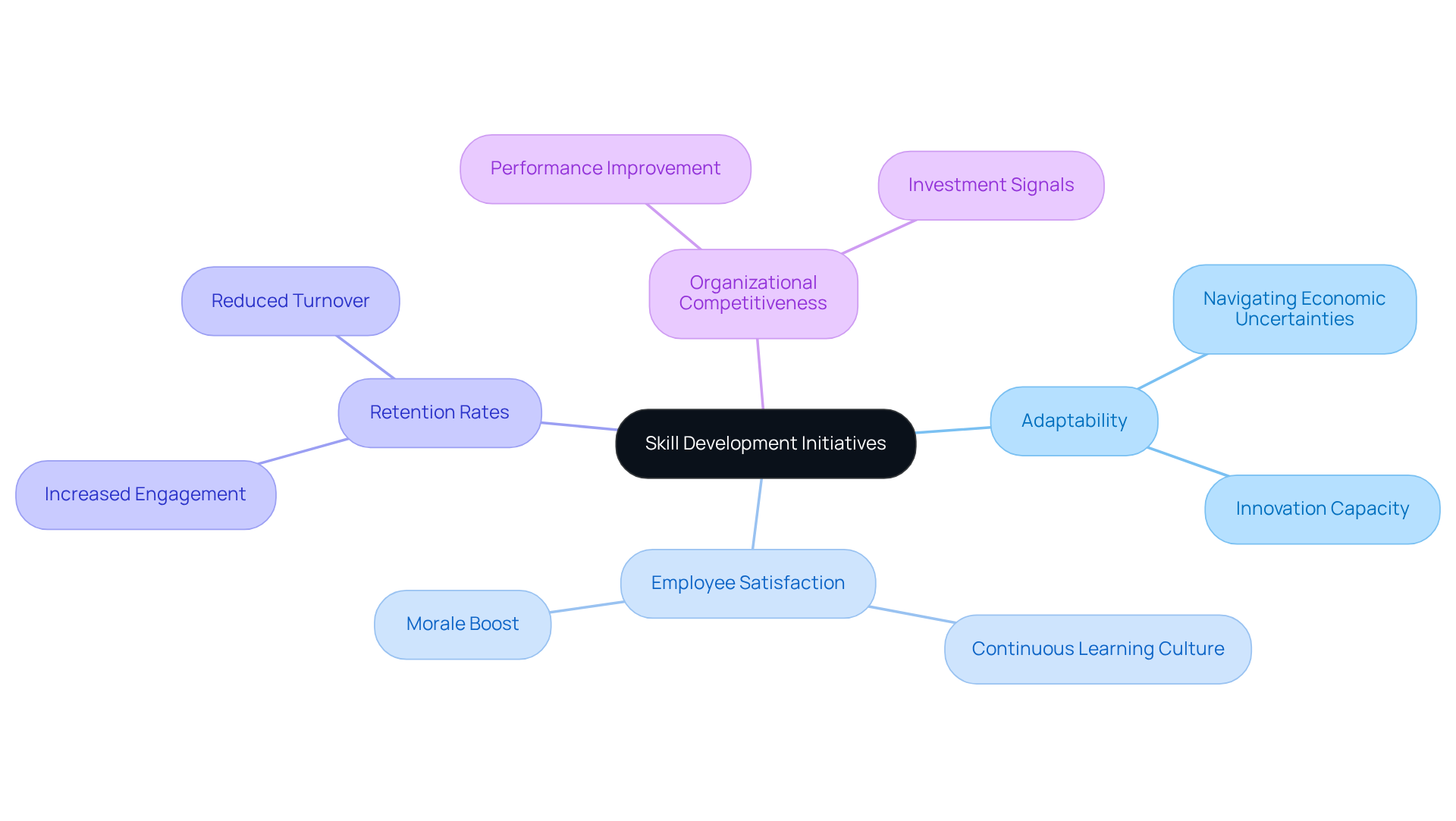

Evaluate Skill Development Initiatives: Indicators of Future Success

For investors, assessing a company's commitment to skill development initiatives is essential. Organizations that prioritize staff development not only enhance their adaptability to shifting market demands but also secure a competitive edge. A culture of continuous learning fosters greater staff satisfaction and retention, both of which are crucial for long-term success.

Notably, organizations with robust professional development initiatives report a marked increase in staff morale and engagement, leading to improved retention rates. Data reveals that businesses investing in staff training can outperform their competitors by as much as 24%, underscoring the direct link between workforce development and organizational competitiveness.

Furthermore, as organizations navigate economic uncertainties, those with a strong focus on employee development are better positioned to adapt and innovate, ensuring resilience in the face of challenges. This not only strengthens the workforce but also acts as hiring signals for investment opportunities, demonstrating a commitment to sustainable growth and flexibility to stakeholders.

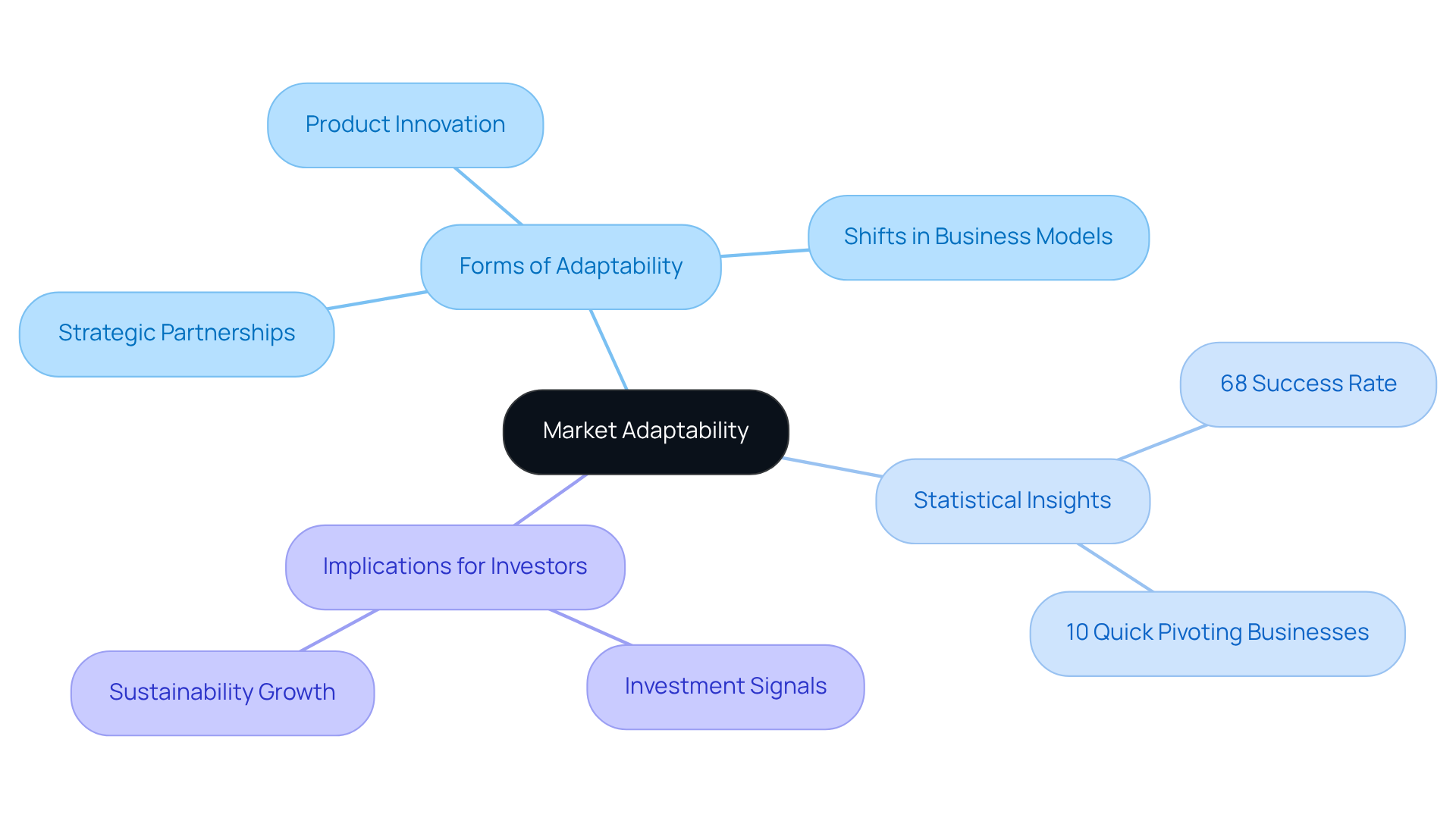

Assess Market Adaptability: A Signal of Investment Resilience

Assessing a firm's market adaptability is crucial for investors seeking robust investment opportunities. Organizations that can swiftly not only survive but thrive in volatile environments. This adaptability manifests in various forms—product innovation, strategic partnerships, and shifts in business models—all indicative of an organization's potential for sustained growth. For instance, those embracing an 'Always-On Strategy' demonstrate a commitment to continuous learning and adaptation, essential in today's fast-paced market landscape.

Data reveals that organizations adjusting their strategies based on real-time insights achieve a 68% success rate in meeting their strategic goals. However, it’s noteworthy that only 10% of businesses can pivot quickly and effectively, underscoring the challenges many face in this area. Furthermore, the green economy, generating over $5 trillion in annual revenues, illustrates how businesses pivoting towards sustainability can unlock significant growth opportunities.

As market conditions evolve, businesses that emphasize adaptability not only handle challenges better but also send hiring signals for investment opportunities, making them appealing options for backers. As Carmine Visconti, CEO of Quantive, asserts, 'Our research confirms a critical disconnect in current strategy approaches that stifle adaptability and, ultimately, business performance.

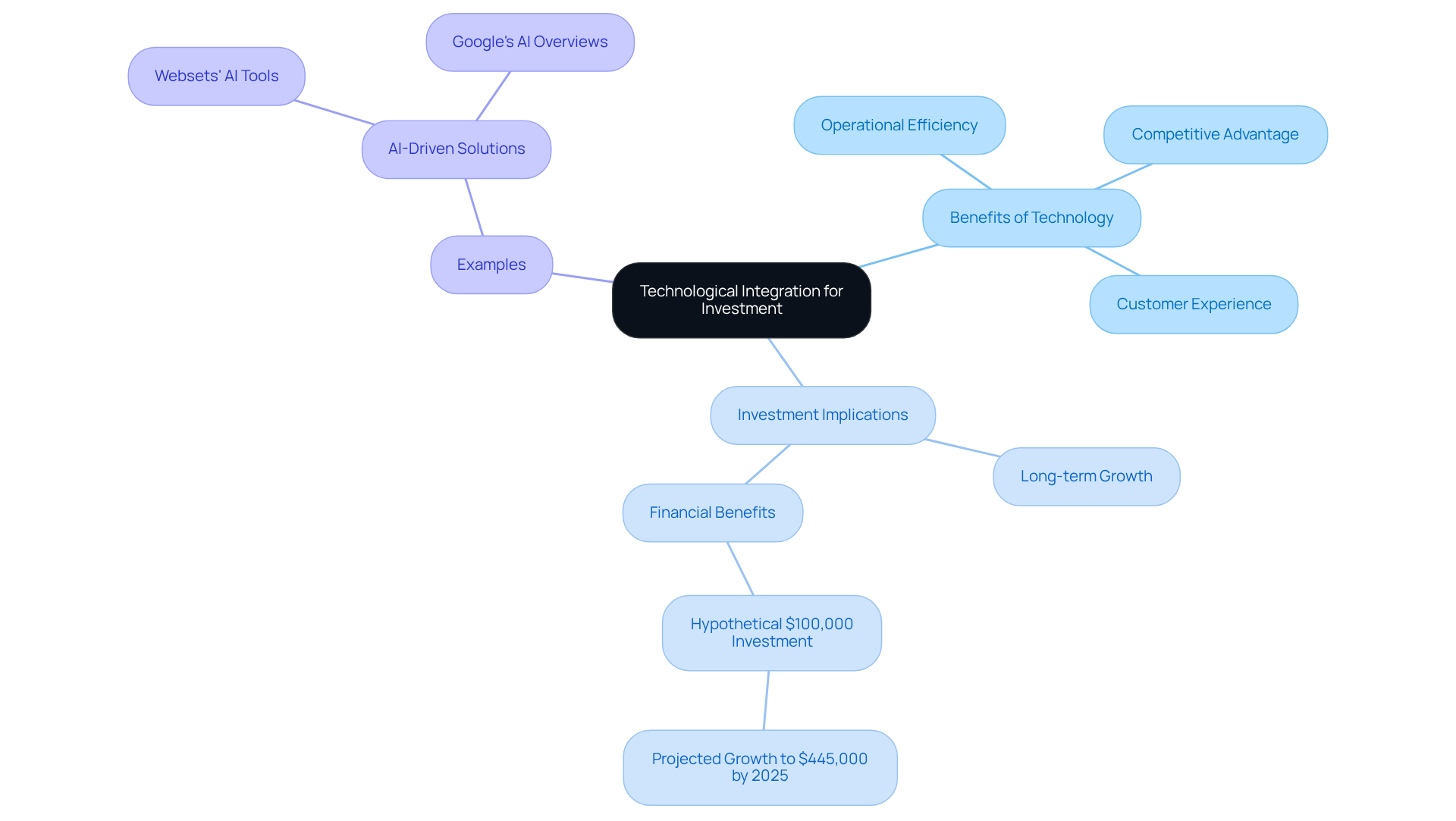

Examine Technological Integration: A Driver of Investment Opportunities

Evaluating an organization's technological integration is crucial for investors aiming to uncover growth opportunities. Organizations that skillfully harness technology—like enterprise-grade AI-driven web search solutions from Websets—optimize operations, enhance customer experiences, and innovate their product lines, positioning themselves for greater success. For instance, major tech firms have reported that AI significantly boosts their earnings, with Google noting that its AI Overviews reached 2 billion monthly users, illustrating the transformative impact of technology on revenue generation.

Investors should focus on firms that embed technology as a core element of their business strategy. This approach not only improves operational efficiency but also cultivates competitive advantages in the marketplace. Websets' , featuring advanced semantic search capabilities and the ability to uncover results that Google cannot, enrich data discovery and lead generation, making them essential for targeted outcomes. Furthermore, Websets' robust security framework ensures compliance with industry standards, enhancing its appeal to enterprise customers. As highlighted by industry specialists, businesses investing in data-driven technologies are better positioned for long-term growth, with sectors such as chip design and data analytics showcasing strong potential for returns. A hypothetical allocation of $100,000 in the S&P 500 Communications Services and Information Technology index could grow to nearly $445,000 by 2025, underscoring the financial benefits of technology adoption.

Ultimately, the integration of advanced technologies, such as those provided by Websets, is not merely a trend but a critical factor that can dictate a company's trajectory in today's fast-paced market. Investors who recognize and act on hiring signals for investment opportunities are likely to uncover valuable investment opportunities.

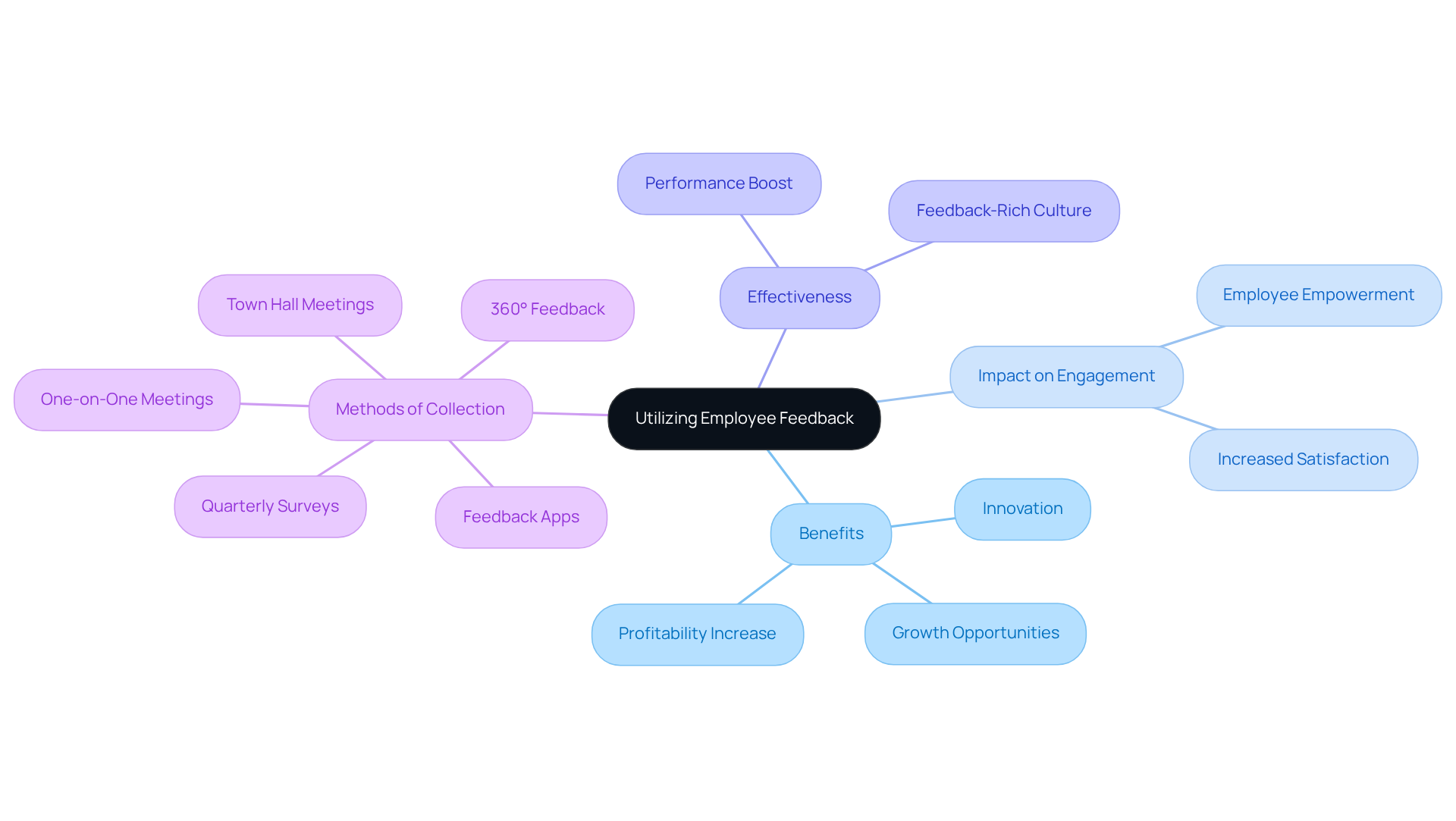

Utilize Employee Feedback: A Signal for Continuous Improvement and Investment

Utilizing staff input is essential for fostering a culture of ongoing enhancement. Organizations that proactively seek and act on staff insights are more adept at pinpointing growth opportunities and fostering innovation. This approach not only boosts staff engagement and satisfaction but also enhances overall organizational effectiveness. Research shows that companies with a experience a significant boost in performance; individuals who feel acknowledged are 4.6 times more likely to feel empowered to excel in their roles. Furthermore, effective feedback mechanisms can lead to an 8.9% increase in profitability, as noted by Gallup.

As Ethan Burris, a Professor of Management, emphasizes, "To manage the workforce experience, leaders must deeply understand perceptions, feelings, and desires of their staff and respond thoughtfully." Consequently, businesses that prioritize employee feedback send strong hiring signals for investment opportunities, becoming increasingly appealing to investors and demonstrating a commitment to operational excellence and adaptability in a competitive landscape. Implementing regular feedback collection methods, such as:

- Quarterly surveys

- One-on-one meetings

can further enhance this process.

Conclusion

Recognizing hiring signals is essential for investors seeking lucrative opportunities. Understanding indicators such as hiring trends, employee retention rates, company culture, and technological integration empowers investors to make informed decisions that resonate with market dynamics. The integration of AI tools, like those offered by Websets, significantly enhances the ability to identify these signals, ultimately leading to smarter investment strategies.

Key insights underscore the importance of:

- Monitoring hiring trends

- Evaluating employee retention

- Assessing company culture

- Recognizing leadership stability

Moreover, the role of diversity in hiring and the commitment to skill development emerge as critical factors influencing a company's growth potential. Each of these elements serves as a vital signal for investment viability, illuminating the broader market landscape.

In today's rapidly evolving economic environment, the ability to adapt and respond to hiring signals is more crucial than ever. Investors are urged to adopt a proactive approach, utilizing advanced tools and methodologies to track these indicators. By doing so, they position themselves to capitalize on emerging opportunities and contribute to sustainable growth within their investment portfolios.

Frequently Asked Questions

What is Websets and how does it assist in lead generation?

Websets is an AI-powered tool that analyzes extensive datasets to identify hiring signals indicating potential funding opportunities. It provides actionable insights on hiring trends, employee turnover, and recruitment patterns, helping investors make informed decisions regarding resource allocation.

How effective is AI in enhancing lead generation in hiring processes?

Companies using AI in their hiring processes have reported a 50% increase in lead generation, demonstrating the significant impact of AI on recruitment and funding strategies.

What trends should investors monitor to identify investment opportunities?

Investors should monitor hiring signals such as sudden increases in job postings or shifts in recruitment strategies. A surge in job openings often indicates business expansion, while a decrease may suggest cost-cutting measures or restructuring.

Can you provide examples of companies making significant investments that reflect hiring signals?

Apple plans to invest $500 billion in the U.S., including a new factory in Texas, which is expected to create numerous job opportunities. Similarly, Eli Lilly is pledging at least $27 billion in U.S. infrastructure to improve its manufacturing processes, indicating potential hiring signals.

Why is evaluating employee retention rates important for investors?

Evaluating employee retention rates is crucial as high retention often reflects a positive workplace culture and effective management, leading to sustained productivity and profitability. Conversely, high turnover rates may indicate deeper organizational issues that can jeopardize performance.

What are the current trends in employee turnover in the U.S.?

The annual turnover rate in the U.S. has surged to 19.3%, with voluntary departures accounting for 13%. Additionally, staff retention rates have declined by 1.5% over the past year, highlighting a growing retention crisis.

How does staff engagement relate to retention rates and organizational performance?

Companies that prioritize employee retention typically see enhanced staff engagement, which is critical as engagement levels have reached an 11-year low. Organizations investing in staff development and well-being initiatives generally experience higher retention rates, improving overall performance.

What should investors focus on to remain competitive in the investment landscape?

Investors should develop a systematic approach to track job postings and correlate them with corporate announcements and investment activities, focusing on hiring signals to identify potential investment opportunities.