Overview

Harnessing workforce dynamics as investment signals can significantly enhance sales success. This approach empowers investors to identify organizations that are strategically positioned for growth and adaptability in fluctuating market conditions. Notably, factors such as employee demographics, engagement levels, and organizational structure exert a direct influence on a company’s performance. These elements provide crucial insights for informed investment decisions, aligning with emerging workforce trends.

By analyzing these dynamics, investors can make data-driven choices that reflect the realities of the modern workforce. Consider how understanding employee engagement can lead to better investment outcomes. As organizations evolve, those that prioritize workforce dynamics are likely to thrive. This understanding not only informs investment strategies but also fosters a deeper connection with the evolving market landscape.

In conclusion, recognizing the significance of workforce dynamics is essential for investors aiming to navigate the complexities of today's economy. By leveraging these insights, investors can position themselves advantageously, ensuring their decisions are both timely and impactful.

Introduction

Understanding the intricate relationship between workforce dynamics and organizational performance is increasingly essential for investors. As companies navigate a rapidly changing economic landscape, leveraging insights from employee demographics, engagement, and adaptability emerges as a powerful indicator of future success.

However, the critical question is: how can investors effectively harness these workforce dynamics to make informed decisions that align with market trends and drive sales success?

This article delves into the critical factors influencing workforce dynamics and offers strategic approaches for utilizing these insights to enhance investment outcomes.

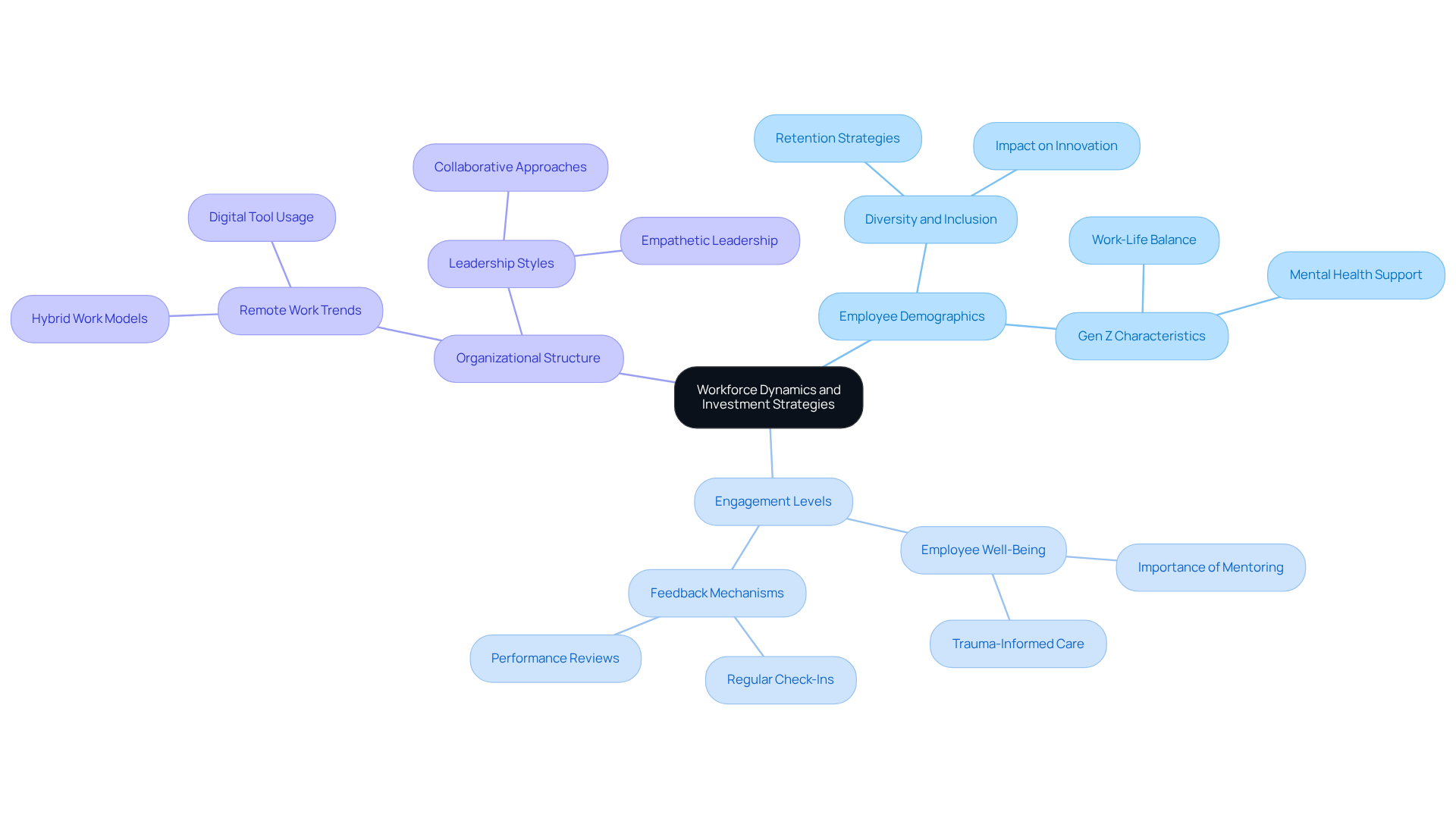

Define Workforce Dynamics and Their Importance in Investment Strategies

Workforce characteristics reflect the dynamic nature of an organization's personnel, encompassing elements such as employee demographics, engagement levels, and organizational structure. Understanding these interactions is crucial for investors, as they can act as a indicating potential shifts in an organization's performance. For example, organizations that effectively embrace remote work trends are often better positioned for growth in today's market. By monitoring labor trends, investors can use workforce dynamics as investment signal to identify companies poised for success amid changing economic conditions, enabling informed investment decisions that align with market fluctuations and consumer demands.

The impact of workforce demographics on investment performance is underscored by case studies demonstrating that organizations prioritizing diversity and inclusion experience heightened innovation and productivity. A notable instance is a global retail chain that implemented tailored development opportunities for its diverse workforce, leading to increased engagement and retention. This directly illustrates the connection between employee interactions and organizational success. Supporting this, a statistic reveals that 60% of Gen Z individuals cite employer concern for well-being as a pivotal factor in job satisfaction, emphasizing the importance of understanding workforce demographics.

As we approach 2025, understanding workforce dynamics as an investment signal will be essential for investment strategies. Companies that adapt to the preferences of emerging generations, such as Gen Z—which values flexibility and mental health support—are likely to attract and retain top talent. In fact, 77% of Gen Zers regard work-life balance as central to a successful career, highlighting the necessity for organizations to prioritize these elements. This adaptability not only enhances employee satisfaction but also bolsters overall organizational performance, making it a critical consideration for investors eager to capitalize on future growth opportunities. As David Satterwhite aptly stated, "Thriving employees help their organizations achieve critical goals, including financial performance and market leadership." It is also vital to recognize that cutting DEI initiatives during economic downturns can negatively impact employee interactions, potentially leading to disengagement and reduced productivity.

Identify Key Factors Influencing Workforce Dynamics

Several critical factors shape workforce dynamics, each playing a significant role in organizational success:

- Employee Demographics: The composition of the workforce—encompassing age, gender, and cultural diversity—significantly influences team dynamics and productivity. Diverse teams enhance problem-solving capabilities, with companies in the top quartile for ethnic diversity being 36% more likely to outperform their less diverse counterparts financially.

- Engagement Levels: High staff engagement correlates strongly with enhanced performance and decreased turnover rates. A staggering 94% of workers indicated they would remain with their employer if investments were made in their career development. This statistic underscores the importance of fostering an engaging work environment.

- Organizational Structure: The framework of an organization affects communication and decision-making processes, which in turn influences overall efficiency. Organizations prioritizing clear communication and collaboration are better positioned to adapt to changing market conditions. Moreover, with health insurance expenses expected to increase by 5.8% in 2025, companies must evaluate how their organizational framework supports staff wellness initiatives.

- Technological Adoption: Companies that actively embrace new technologies not only attract top talent but also enhance retention rates. The incorporation of AI tools in performance management signifies a shift in worker attitudes, with many perceiving these technologies as offering impartial feedback and assessment. This growing comfort with AI tools indicates a significant change in how employees perceive technology in the workplace.

- Market Trends: Economic shifts, such as the rise of remote work and the gig economy, significantly alter labor dynamics. Organizations that adjust to these trends can better fulfill the requirements of a varied employee base, enhancing operational flexibility and positioning themselves for success in a competitive environment. Understanding these trends is essential for investors seeking to pinpoint organizations that are successfully adapting to the as investment signal.

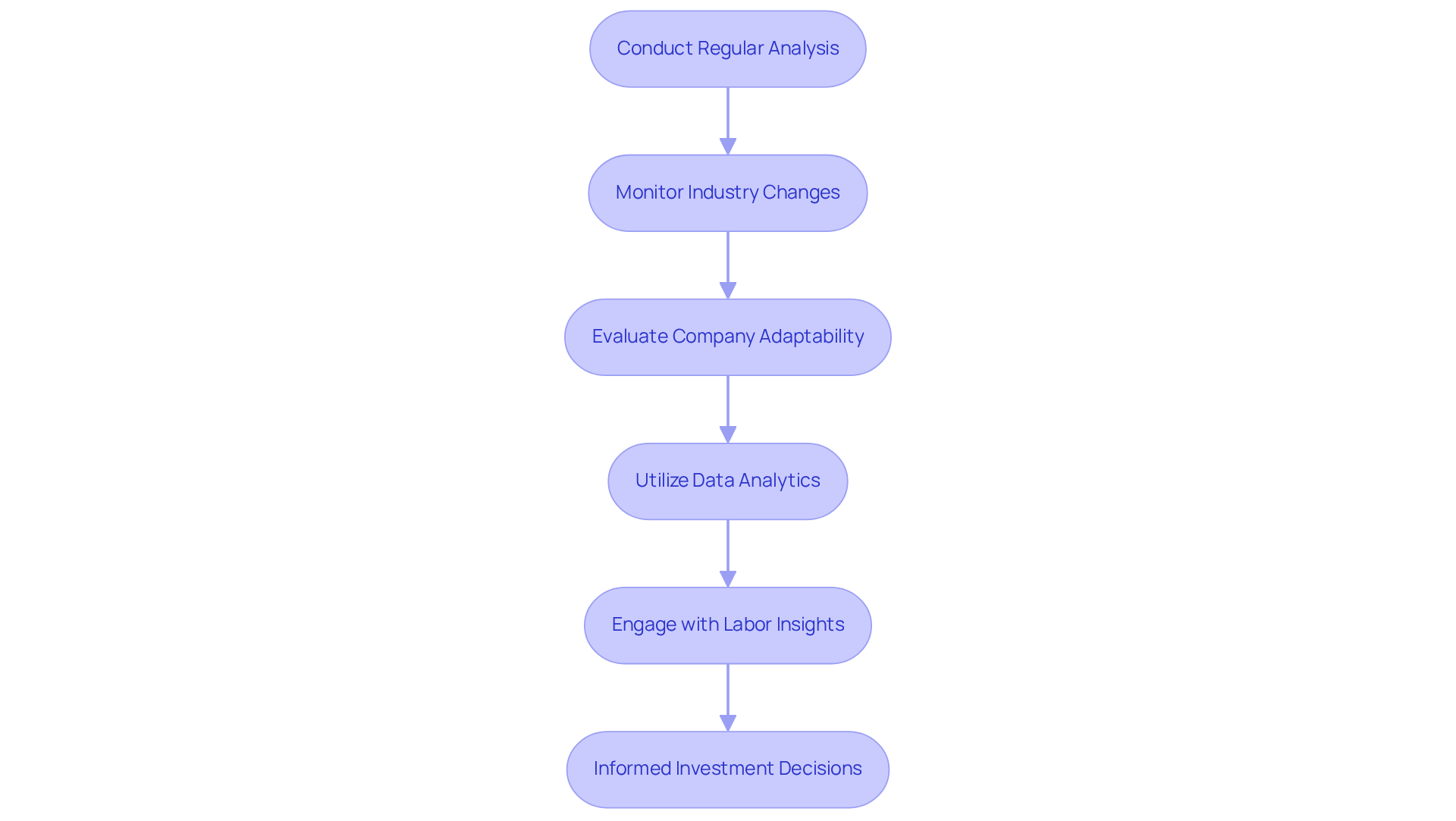

Leverage Workforce Dynamics for Informed Investment Decisions

Investors can strategically leverage workforce dynamics to enhance their investment decisions through several key approaches:

- Conduct Regular Analysis: Consistently examine personnel metrics, including turnover rates, employee satisfaction surveys, and demographic shifts, to uncover emerging trends that may impact organizational performance.

- Monitor Industry Changes: Stay informed about industry-specific employment trends, such as the rise of remote work and evolving skill requirements, to better anticipate shifts in organizational performance and market positioning.

- Evaluate Company Adaptability: Assess how effectively companies are adapting to changes in personnel. Organizations that prioritize employee development and flexible work arrangements tend to be more resilient and positioned for long-term success. For instance, Amazon's investment in its Technical Academy has resulted in an 80% transition rate to software developer roles, showcasing the advantages of employee development.

- Utilize Data Analytics: Employ to track employee dynamics and correlate these insights with financial performance indicators, enabling the identification of promising investment opportunities. For instance, Citizens Financial Group's dedication to staff development demonstrates a strategic method to improving skills and generating job opportunities.

- Engage with Labor Insights: Utilize insights from analytics platforms to gain a nuanced understanding of how changes in employment may impact specific sectors or companies, guiding informed investment strategies. Statistics such as Amazon's reported 13% decline in recordable injury rates from 2019 to 2021 illustrate the positive impact of employee training on productivity and safety.

By concentrating on these sectors, investors can achieve a competitive advantage in recognizing possible growth opportunities and reducing risks related to labor trends.

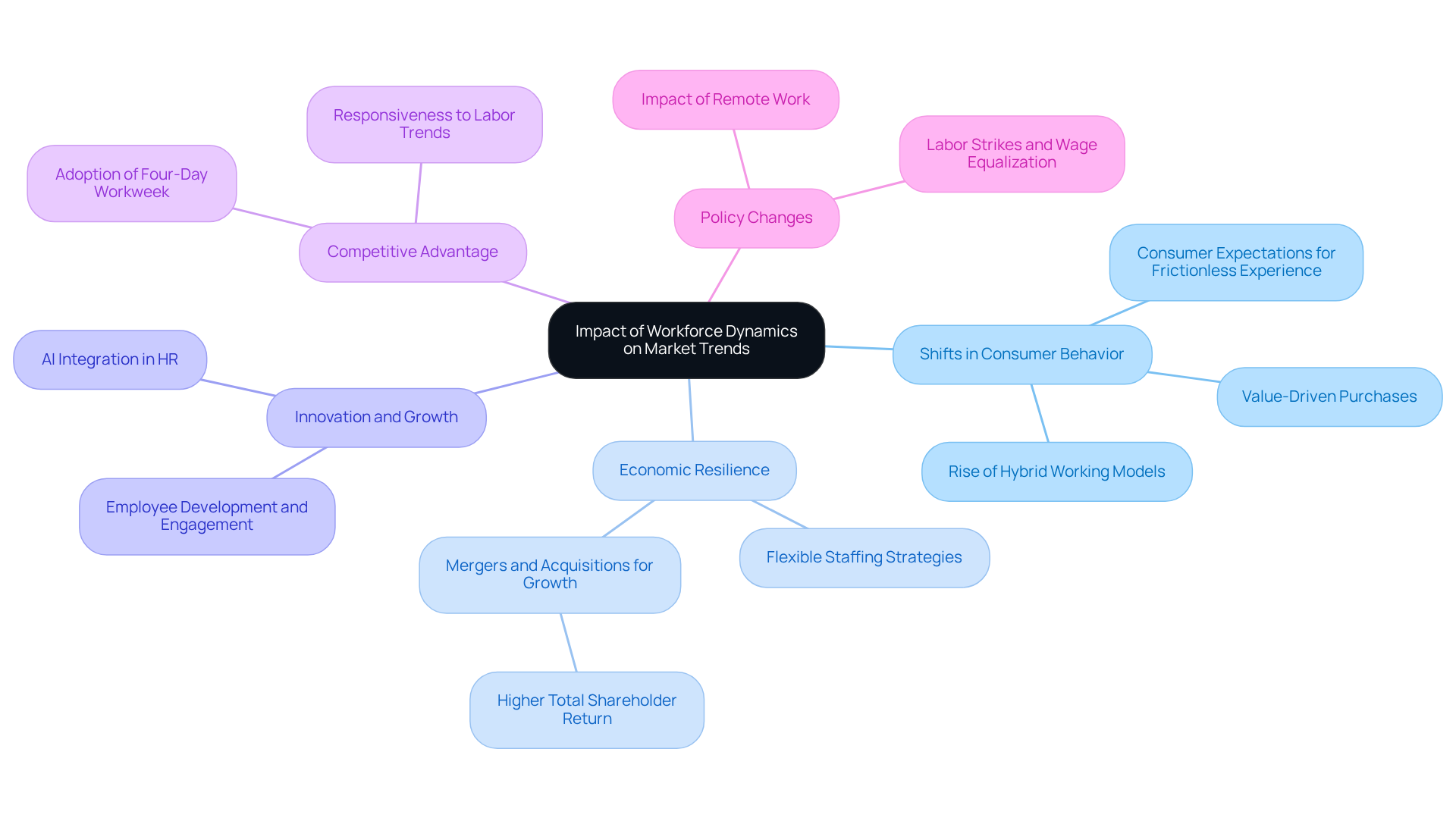

Analyze the Impact of Workforce Dynamics on Market Trends

Workforce dynamics significantly shape market trends in several critical ways:

- Shifts in Consumer Behavior: Employee demographics are evolving, with the rise of hybrid working models and the gig economy directly influencing consumer preferences. As more skilled professionals embrace flexible work arrangements, their purchasing decisions reflect a desire for products and services that align with their values and lifestyles. Furthermore, consumers now expect a frictionless buying experience, with information available instantly and effortlessly. This shift highlights the pressing need for businesses to adapt their offerings accordingly.

- Economic Resilience: Companies that adopt flexible staffing strategies exhibit greater resilience during economic downturns. Research indicates that organizations leveraging mergers and acquisitions for growth outperform those relying solely on organic growth, generating 2.5 percentage points more total shareholder return. This adaptability not only enhances their market position but also makes them attractive investment options, particularly in uncertain economic climates.

- Innovation and Growth: Organizations that prioritize employee development and engagement are better positioned to innovate. By fostering a culture of ongoing education and skill enhancement, these organizations can respond effectively to market demands, driving growth and broadening their market presence. The shift towards AI integration in HR functions further enhances this capability, allowing businesses to focus on strategic initiatives rather than routine tasks. As Bernard Marr notes, AI integration in HR is revolutionizing human capital management, enabling organizations to enhance their responsiveness and effectiveness.

- Competitive Advantage: Understanding and reacting to workforce dynamics as investment signal provides organizations with a . For instance, businesses that implement the four-day workweek not only enhance staff well-being but also boost productivity, positioning themselves advantageously in the market. This responsiveness to labor trends serves as a workforce dynamics as investment signal, which can significantly influence a company's market position and appeal to investors. The case study titled "The Four-Day Week: Redefining Productivity And Work-Life Balance" illustrates the positive impacts of this model on both productivity and employee satisfaction.

- Policy Changes: Government policies regarding labor and employment play a crucial role in shaping workforce dynamics. Recent trends indicate that remote work and labor strikes are contributing to wage equalization globally, creating more equitable opportunities for workers. Investors must remain vigilant regarding these policy changes to adjust their strategies accordingly, ensuring alignment with evolving market conditions.

Conclusion

Understanding workforce dynamics is essential for investors navigating today’s complex market landscape. Recognizing how employee characteristics, engagement levels, and organizational structures influence performance enables informed decisions that capitalize on emerging trends. Interpreting these dynamics signals potential growth opportunities and underscores the necessity of adaptability in a rapidly changing economic environment.

Key insights emphasize that diverse workforce demographics enhance innovation, while high engagement levels correlate with lower turnover and increased productivity. Companies embracing technological advancements and flexible work arrangements are better positioned to thrive. By consistently analyzing personnel metrics and staying attuned to industry shifts, investors can identify organizations likely to succeed amid evolving consumer preferences and economic challenges.

Ultimately, leveraging workforce dynamics as an investment signal is not merely a strategic advantage; it is a necessity for those looking to stay ahead in a competitive market. As the landscape continues to evolve, investors should prioritize companies that foster inclusive environments, invest in employee development, and adapt to market trends. By doing so, they can enhance their investment strategies and contribute to a more resilient and innovative economic future.

Frequently Asked Questions

What are workforce dynamics and why are they important for investment strategies?

Workforce dynamics refer to the characteristics of an organization’s personnel, including employee demographics, engagement levels, and organizational structure. They are important for investment strategies because they can signal potential shifts in an organization’s performance, helping investors identify companies that are well-positioned for growth.

How can remote work trends influence investment decisions?

Organizations that effectively embrace remote work trends are often better positioned for growth. By monitoring these trends, investors can use workforce dynamics as signals to identify companies that may succeed amid changing economic conditions.

What role do workforce demographics play in investment performance?

Workforce demographics significantly impact investment performance, as organizations that prioritize diversity and inclusion tend to experience increased innovation and productivity. Case studies show that tailored development opportunities for diverse workforces lead to higher engagement and retention.

Why is understanding Gen Z preferences important for investors?

Understanding Gen Z preferences is crucial because this generation values flexibility and mental health support in the workplace. Companies that adapt to these preferences are likely to attract and retain top talent, which can enhance overall organizational performance and present growth opportunities for investors.

What is the significance of work-life balance for Gen Z?

Work-life balance is central to a successful career for 77% of Gen Z individuals. This emphasizes the necessity for organizations to prioritize work-life balance to enhance employee satisfaction and overall performance.

How can cutting DEI initiatives affect an organization?

Cutting Diversity, Equity, and Inclusion (DEI) initiatives during economic downturns can negatively impact employee interactions, potentially leading to disengagement and reduced productivity, which is detrimental to organizational success.

What is the relationship between employee satisfaction and organizational goals?

Thriving employees contribute to achieving critical organizational goals, including financial performance and market leadership, making employee satisfaction a vital consideration for investors.