Overview

This article underscores the critical importance of mastering human capital signals during deal due diligence. Key indicators, such as employee turnover rates, leadership effectiveness, and cultural alignment, are essential for organizations aiming to mitigate risks. By thoroughly evaluating these signals, businesses can significantly enhance the likelihood of successful mergers and acquisitions.

Case studies illustrate that prioritizing cultural compatibility not only leads to smoother integrations but also results in improved organizational outcomes. Engaging with these insights enables organizations to navigate the complexities of mergers with greater confidence and effectiveness.

Introduction

Understanding the intricacies of human capital signals is essential for organizations navigating the complex landscape of mergers and acquisitions. These signals—encompassing employee turnover rates and cultural alignment—provide invaluable insights into the workforce's potential for successful integration post-deal. Yet, a pressing challenge persists: how can stakeholders effectively identify and analyze these signals to mitigate risks and seize opportunities? This guide explores the critical indicators and strategies for mastering human capital signals in due diligence, equipping organizations to make informed decisions that enhance their chances of success in M&A endeavors.

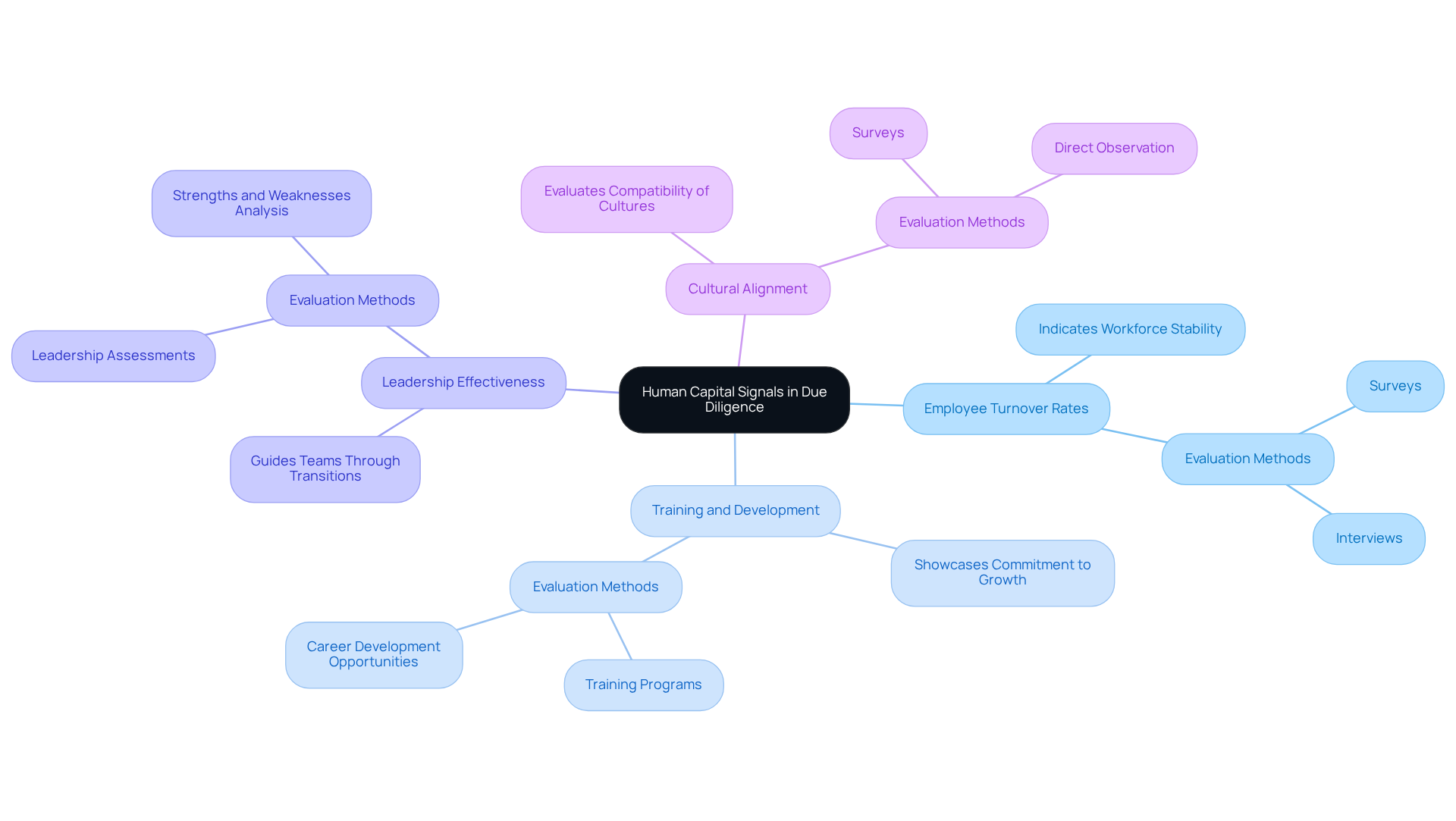

Define Human Capital Signals in the Context of Due Diligence

Human resources signals are critical indicators of the skills, experience, and overall value of a company's workforce, especially when considering human capital signals in deal due diligence during the mergers and acquisitions phase. Key signals include:

- Employee turnover rates, which indicate workforce stability.

- Training and development opportunities that showcase a company's commitment to employee growth.

- Leadership effectiveness, assessing leaders' capability to guide teams through transitions.

- Cultural alignment, evaluating how well the merging organizations' cultures can coexist.

Methods to gauge cultural fit encompass surveys, interviews, and direct observation, proactively addressing potential cultural clashes.

Understanding is essential for determining how effectively a target company's workforce can integrate with the acquiring company, which significantly influences the success of the merger or acquisition. Organizations that prioritize cultural compatibility often experience smoother integrations, as evidenced by case studies where thorough cultural assessments led to reduced misunderstandings and enhanced collaboration post-merger.

Statistics indicate that as much as 90% of an organization's worth is linked to intangible assets, including workforce, and that 60% of M&A activities do not enhance value. This underscores the importance of examining human capital signals in deal due diligence to recognize possible risks and opportunities that might influence the total value of the agreement. By focusing on these indicators, stakeholders can make informed decisions that enhance the likelihood of achieving desired outcomes in their M&A endeavors.

Identify Key Indicators of Human Capital Signals

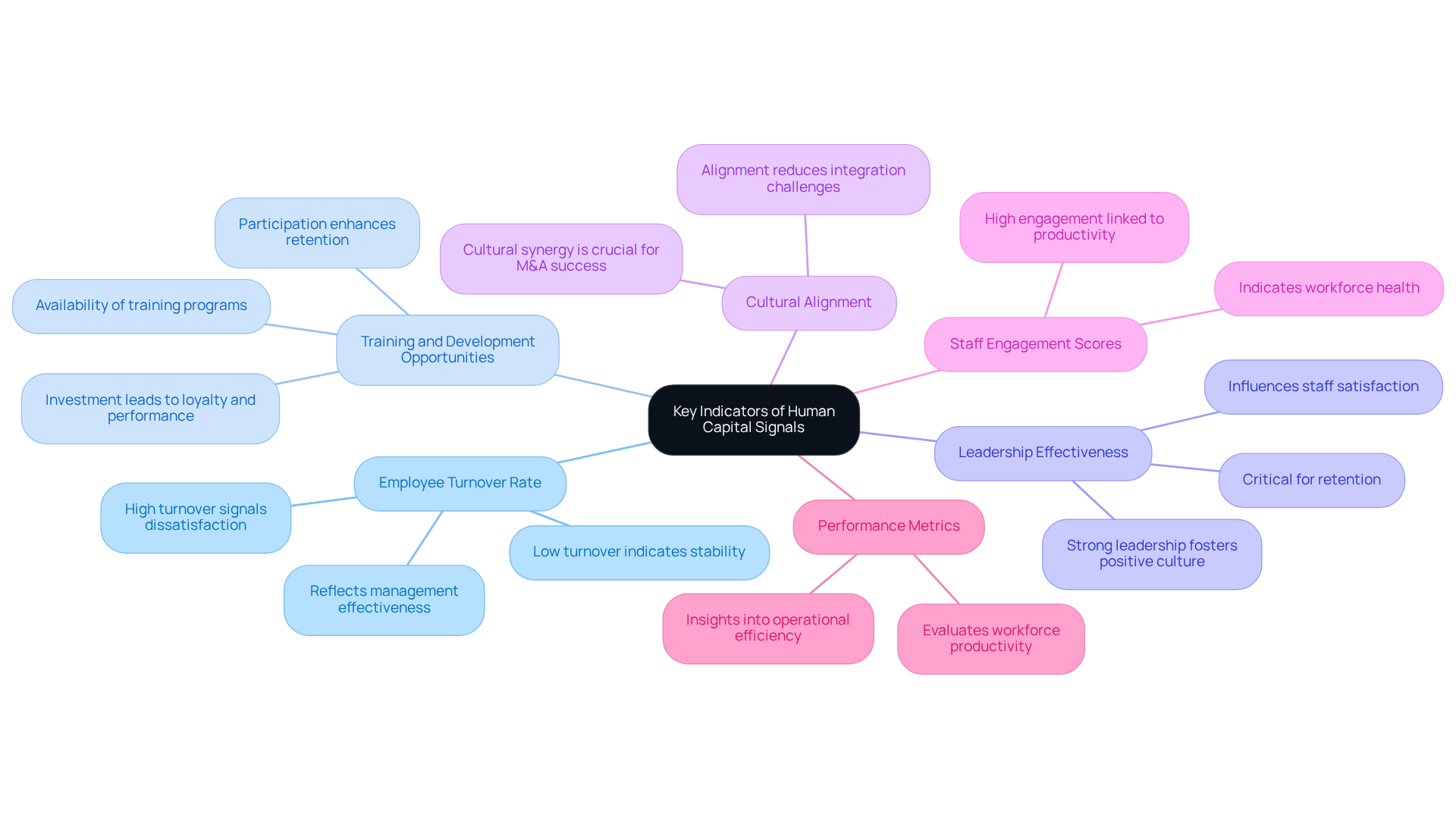

To effectively identify human capital signals, organizations must focus on the following key indicators:

- Employee Turnover Rate: A high turnover rate often signals dissatisfaction or ineffective management, whereas a low turnover rate typically indicates a stable and engaged workforce. Understanding these dynamics is essential, as can significantly impact business acquisitions and integration processes. As noted by Thomas P. Moliterno, effective managers are critical to a company’s success, and high turnover can reflect underlying issues in management effectiveness.

- [Training and Development Opportunities](https://docs.exa.ai/websets/api/overview): Evaluate the availability and participation in training programs. Organizations that prioritize workforce development demonstrate a commitment to growth, which can enhance retention rates. Statistics indicate that companies investing in training experience a significant enhancement in staff loyalty and performance. For instance, research shows that organizations with robust training programs experience lower turnover rates, a crucial factor for maintaining a competitive edge in the market.

- Leadership Effectiveness: Assess the leadership structure and management effectiveness in fostering a positive work environment. Strong leadership is vital for cultivating a culture that promotes staff involvement and retention, as these aspects serve as important human capital signals in deal due diligence for successful mergers and acquisitions. Research on managerial human capital emphasizes that effective leadership can significantly influence staff satisfaction and organizational performance.

- Cultural Alignment: Analyze the alignment between the target company's culture and your own. Cultural mismatches can lead to integration challenges, making it imperative to understand how well the two organizations can collaborate post-acquisition. Cultural synergy is crucial for the success of mergers and acquisitions, as emphasized by various experts in the field.

- Staff Engagement Scores: Elevated levels of staff involvement are frequently associated with enhanced productivity and retention. Monitoring these scores provides insight into the overall health of the workforce and can indicate potential challenges in the integration process. Engaged individuals are more inclined to contribute positively to the organization, making this a critical metric to evaluate.

- Performance Metrics: Review performance evaluation systems and their outcomes to assess workforce productivity and effectiveness. Understanding how employees are evaluated can reveal insights into the company's operational efficiency and its potential for future success. The signaling perspective on managerial talent indicates that performance metrics can offer valuable insights into a candidate's abilities and suitability within the organization.

By concentrating on human capital signals in deal due diligence, organizations can make informed decisions, ensuring that they are not only acquiring assets but also valuable personnel that will drive future growth.

Analyze and Interpret Human Capital Signals Effectively

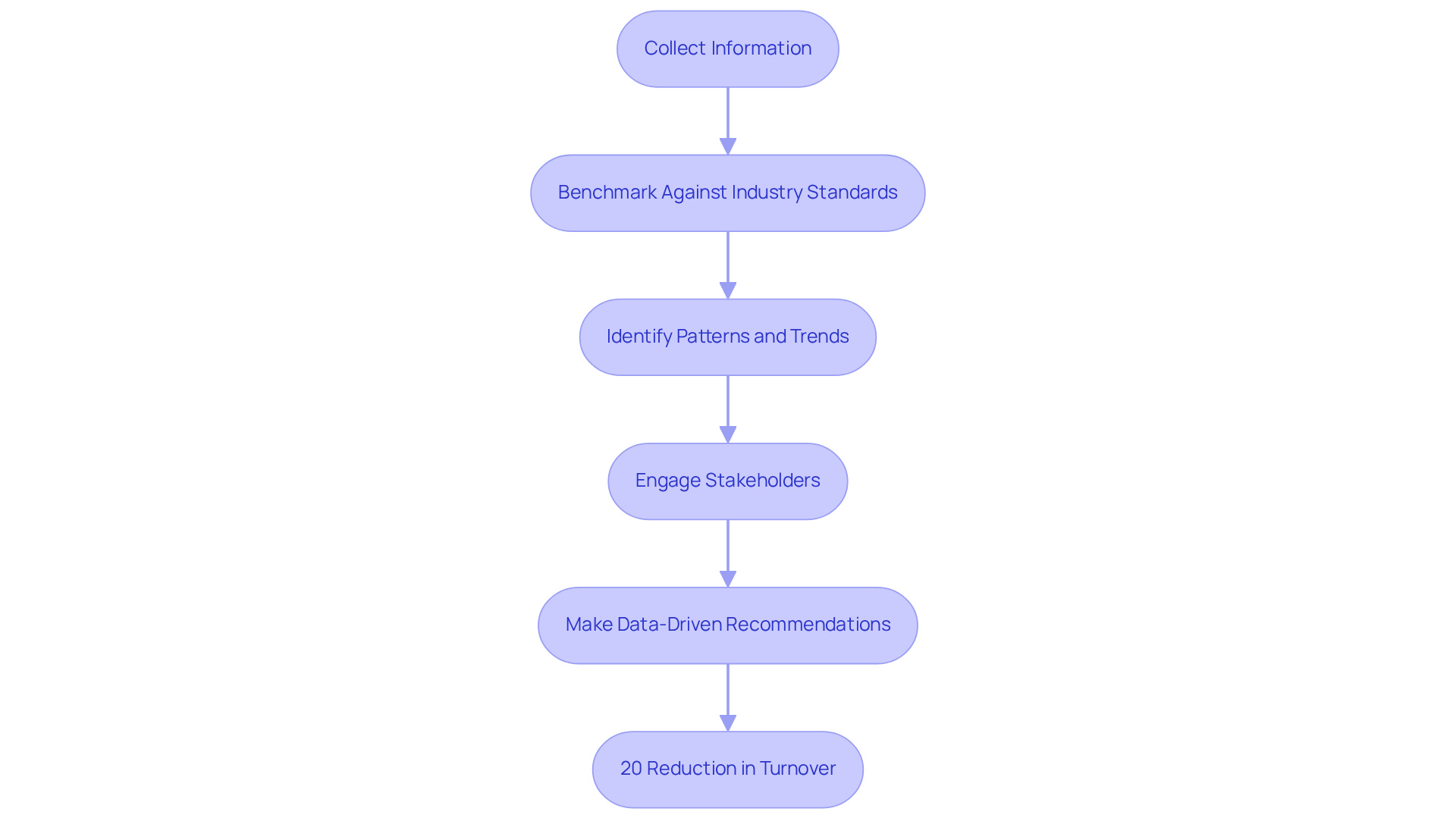

To effectively analyze and interpret human capital signals, follow this structured approach:

- Collect Information: Begin by gathering both quantitative and qualitative details on key human capital indicators. Utilize a combination of surveys, interviews, and existing HR metrics to ensure a comprehensive dataset.

- Benchmark Against Industry Standards: Compare your gathered information with established industry benchmarks. Be cautious of frequent traps in benchmarking, such as utilizing obsolete information or making misaligned comparisons, as these can distort your analysis and result in poor decision-making.

- Identify Patterns and Trends: Analyze the data for patterns over time, such as rising turnover rates or decreasing . Recognizing these trends is essential for uncovering underlying issues that may require attention.

- Engage Stakeholders: Involve key stakeholders in discussions regarding your findings. Their diverse perspectives can enrich the analysis and lead to more informed decision-making. As noted by HR Acuity, involving different leaders can assist in assessing the effect of particular strategies on staff groups.

- Make Data-Driven Recommendations: Based on your analysis, formulate actionable recommendations aimed at addressing identified issues or capitalizing on strengths. This may include strategies to enhance employee engagement or improve training programs, ensuring that your organization remains competitive and responsive to its workforce dynamics. For instance, a mid-sized technology company successfully reduced turnover by 20% within a year by implementing effective HR benchmarking practices.

Troubleshoot Common Challenges in Identifying Human Capital Signals

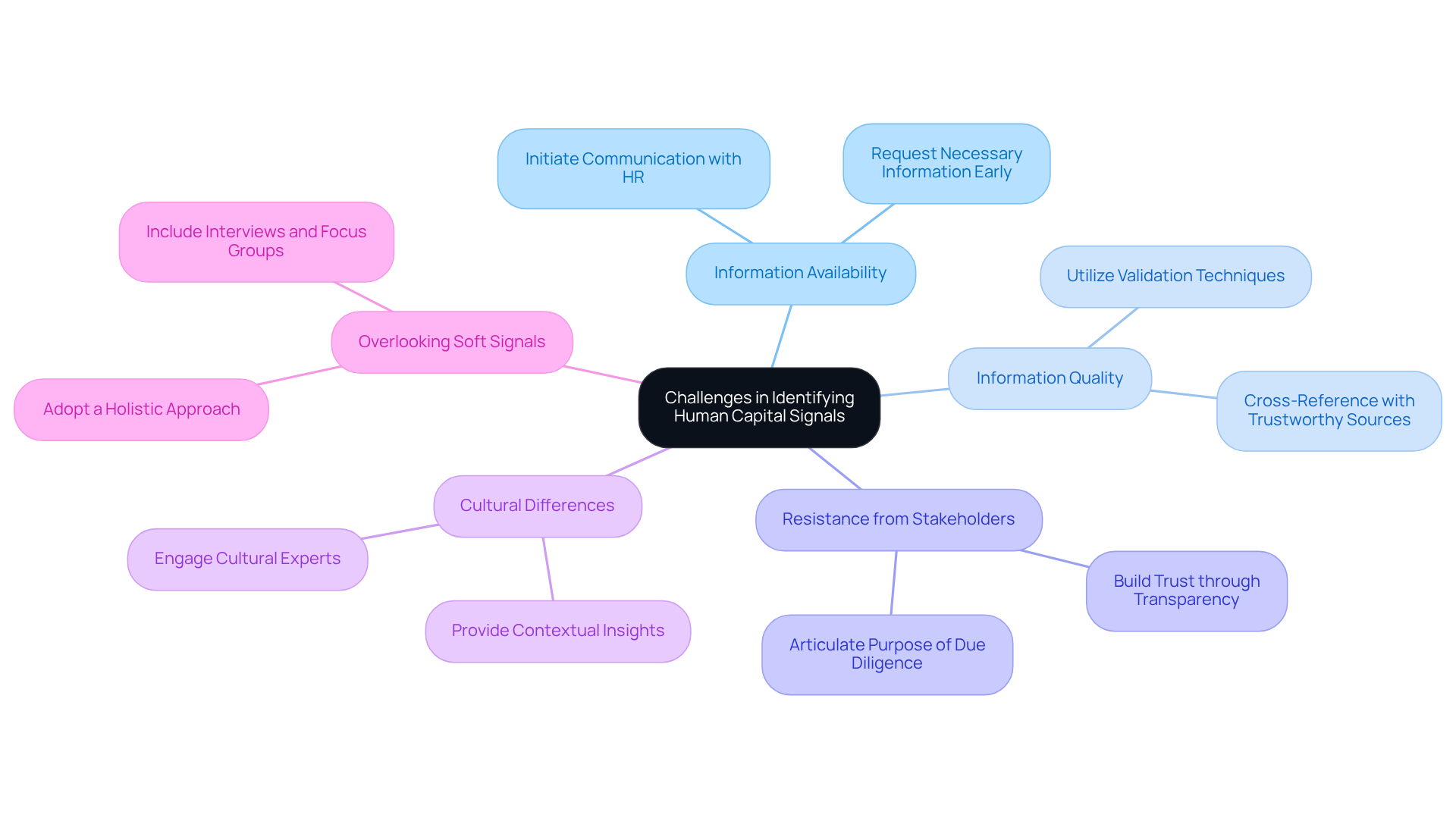

Identifying human capital signals in deal due diligence can present several challenges that require strategic approaches. Common issues include:

- Information Availability: Essential information may not always be reachable. To mitigate this, initiate clear communication with the target company's HR department early in the due diligence process to request the necessary information. This proactive method significantly improves the information-gathering process.

- Information Quality: Incorrect or obsolete information can skew analysis. Utilize , such as cross-referencing with several trustworthy sources, to ensure the precision of the information. Inadequate information management can result in significant revenue losses—estimated at $5.2 million for many companies—making quality a top priority.

- Resistance from Stakeholders: Stakeholders may be reluctant to share sensitive information. To build trust, clearly articulate the purpose of the due diligence process and how it benefits all parties involved. Establishing a transparent dialogue alleviates concerns and fosters cooperation.

- Cultural Differences: Variations in organizational cultures can affect information interpretation. Engaging cultural experts or consultants provides valuable insights and context, helping navigate these differences effectively and ensuring findings are accurately understood.

- Overlooking Soft Signals: A narrow focus on quantitative data can result in missing critical qualitative insights. To capture the complete range of workforce signals, include interviews and focus groups in the analysis. This holistic approach allows for a richer understanding of workforce dynamics.

By addressing these challenges with targeted strategies, organizations can enhance their due diligence processes and make more informed decisions using human capital signals in deal due diligence.

Conclusion

Mastering human capital signals during deal due diligence is essential for organizations aiming to navigate the complexities of mergers and acquisitions effectively. By understanding and analyzing these signals, stakeholders gain valuable insights into the workforce dynamics of a target company, ultimately influencing the success of the integration process.

Critical indicators of human capital signals include:

- Employee turnover rates

- Training opportunities

- Leadership effectiveness

- Cultural alignment

- Staff engagement scores

- Performance metrics

Each element plays a vital role in assessing the potential risks and opportunities associated with a merger or acquisition. Additionally, overcoming common challenges—such as information availability and quality, stakeholder resistance, and cultural differences—is crucial for ensuring a thorough and insightful analysis.

In a landscape where up to 90% of an organization's worth is tied to intangible assets, recognizing the significance of human capital signals is paramount. Organizations are encouraged to adopt a proactive and holistic approach to due diligence, incorporating both quantitative and qualitative data to foster informed decision-making. By prioritizing human capital in their due diligence processes, companies can enhance their chances of achieving successful mergers and acquisitions, ultimately driving long-term growth and stability.

Frequently Asked Questions

What are human capital signals in the context of due diligence?

Human capital signals are critical indicators of the skills, experience, and overall value of a company's workforce, particularly during the mergers and acquisitions phase.

What key signals should be considered during due diligence?

Key signals include employee turnover rates, training and development opportunities, leadership effectiveness, and cultural alignment between merging organizations.

How can cultural fit be gauged during due diligence?

Cultural fit can be assessed through surveys, interviews, and direct observation to proactively address potential cultural clashes.

Why is understanding human capital signals important in deal due diligence?

Understanding these signals is essential for determining how effectively a target company's workforce can integrate with the acquiring company, which significantly influences the success of the merger or acquisition.

What is the impact of cultural compatibility on mergers and acquisitions?

Organizations that prioritize cultural compatibility tend to experience smoother integrations, reducing misunderstandings and enhancing collaboration post-merger.

What statistics highlight the importance of examining human capital signals?

Statistics indicate that up to 90% of an organization's worth is linked to intangible assets, including the workforce, and that 60% of M&A activities do not enhance value.

How can stakeholders benefit from focusing on human capital signals?

By focusing on these indicators, stakeholders can make informed decisions that enhance the likelihood of achieving desired outcomes in their mergers and acquisitions.