Overview

Unlocking hidden market intelligence is essential for investors aiming to enhance their strategies. This article serves as a comprehensive guide, detailing how to leverage advanced analytical tools and methodologies effectively.

By identifying key metrics, utilizing diverse information sources, and recognizing patterns, investors can significantly improve their decision-making processes. Continuous knowledge updates are crucial, particularly with the capabilities of AI-driven platforms like Websets, which facilitate comprehensive data analysis.

Embrace these insights to elevate your investment approach and stay ahead in the competitive market.

Introduction

Investors today encounter a rapidly evolving landscape where traditional research methods frequently fail to unveil the wealth of insights concealed beneath the surface. Unlocking this hidden market intelligence is crucial; it can provide a competitive edge, enabling investors to pinpoint emerging trends, consumer behaviors, and strategic opportunities that conventional approaches often overlook.

But how can investors effectively access these concealed insights to refine their strategies and enhance decision-making in an increasingly complex market? This guide explores the essential steps and tools that empower investors to harness hidden market intelligence, paving the way for informed and strategic investment choices.

Understand Hidden Market Intelligence

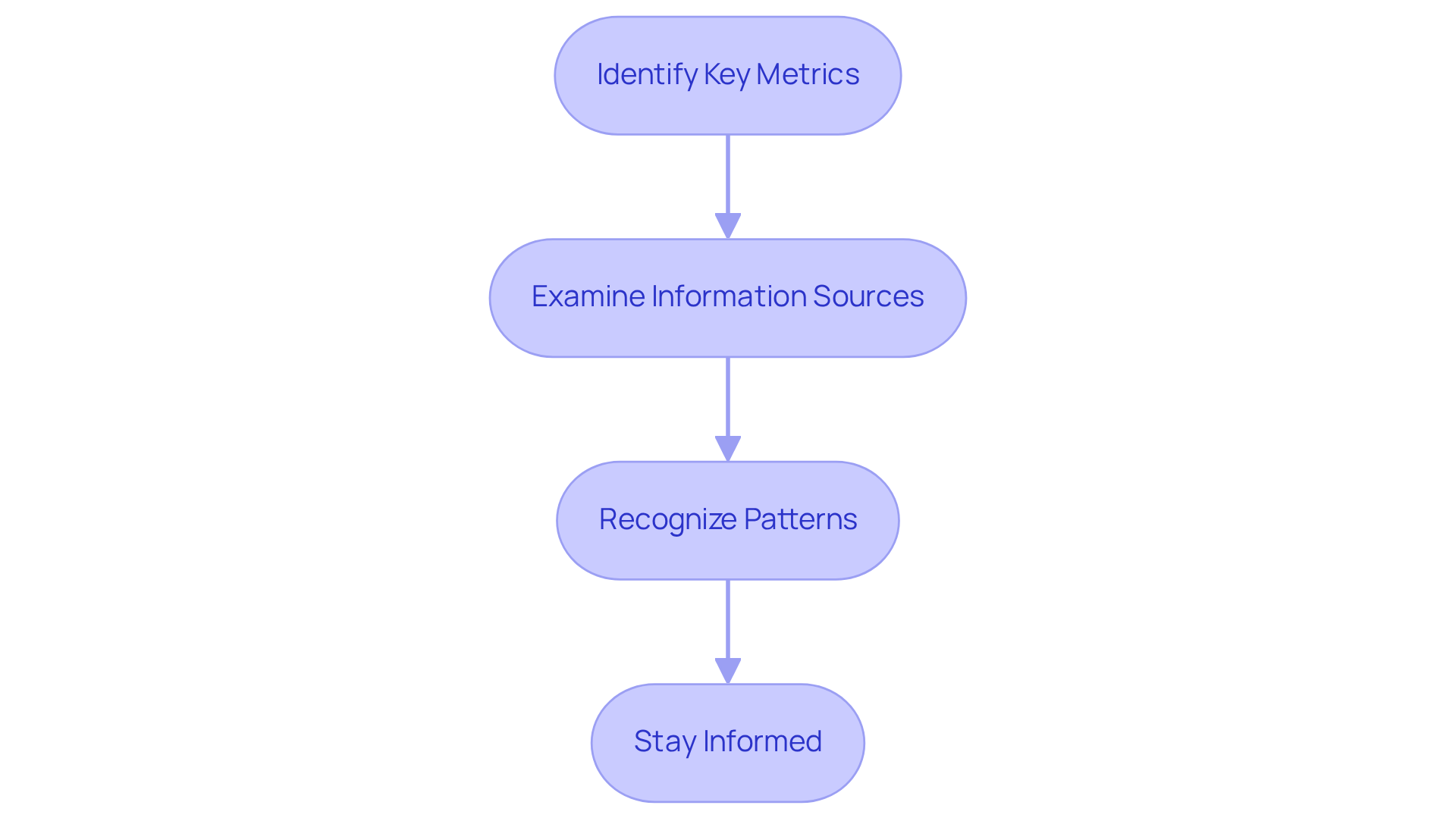

Concealed industry intelligence, which is a form of hidden market intelligence for investors, encompasses insights and information that are not readily apparent through conventional research techniques. This includes trends in consumer behavior, emerging opportunities, and competitor strategies derived from diverse data sources. To effectively harness hidden market intelligence, investors should consider the following steps:

- Identify Key Metrics: Focus on metrics that reveal market trends, such as consumer sentiment, purchasing patterns, and industry growth rates. For instance, recognizing that 64% of CMOs cite fragmented information as a barrier to enhancing intelligence value can direct focus areas. Leveraging Websets' enterprise-grade AI-driven web search solutions enhances this process by delivering extensive information critical for informed decision-making.

- Examine Information Sources: Utilize a variety of information sources, including social media, news articles, and industry reports, to gather comprehensive insights. Businesses that integrate financial data, social sentiment, and sales statistics often gain a clearer understanding of economic dynamics. Websets' AI-powered tools can aggregate insights from multiple platforms, ensuring that investors access hidden market intelligence for investors that traditional search engines may overlook.

- Recognize Patterns: Identify trends in the information that may signal shifts in industry dynamics or consumer preferences. For example, predictive analytics can help brands anticipate customer behavior based on historical data, thereby enhancing their ability to adjust strategies. Companies like Amazon and Netflix exemplify successful applications of predictive analytics to boost customer engagement. With Websets' advanced search capabilities, investors can uncover hidden market intelligence for investors that conventional methods might miss.

- Stay Informed: Continuously update your understanding of industry conditions and emerging trends to maintain a competitive edge. With projected to exceed $750 billion in 2025 and retail media networks expected to reach $200 billion in opportunity by 2026, remaining attuned to shifts in consumer behavior is imperative. Utilizing Websets' tools for real-time information monitoring can significantly enhance this aspect of business intelligence.

By mastering these concepts and leveraging Websets' AI-driven platform, investors can uncover hidden market intelligence for investors that significantly refines their investment strategies, positioning themselves ahead of competitors in a rapidly evolving business landscape.

Utilize Tools for Market Insight Discovery

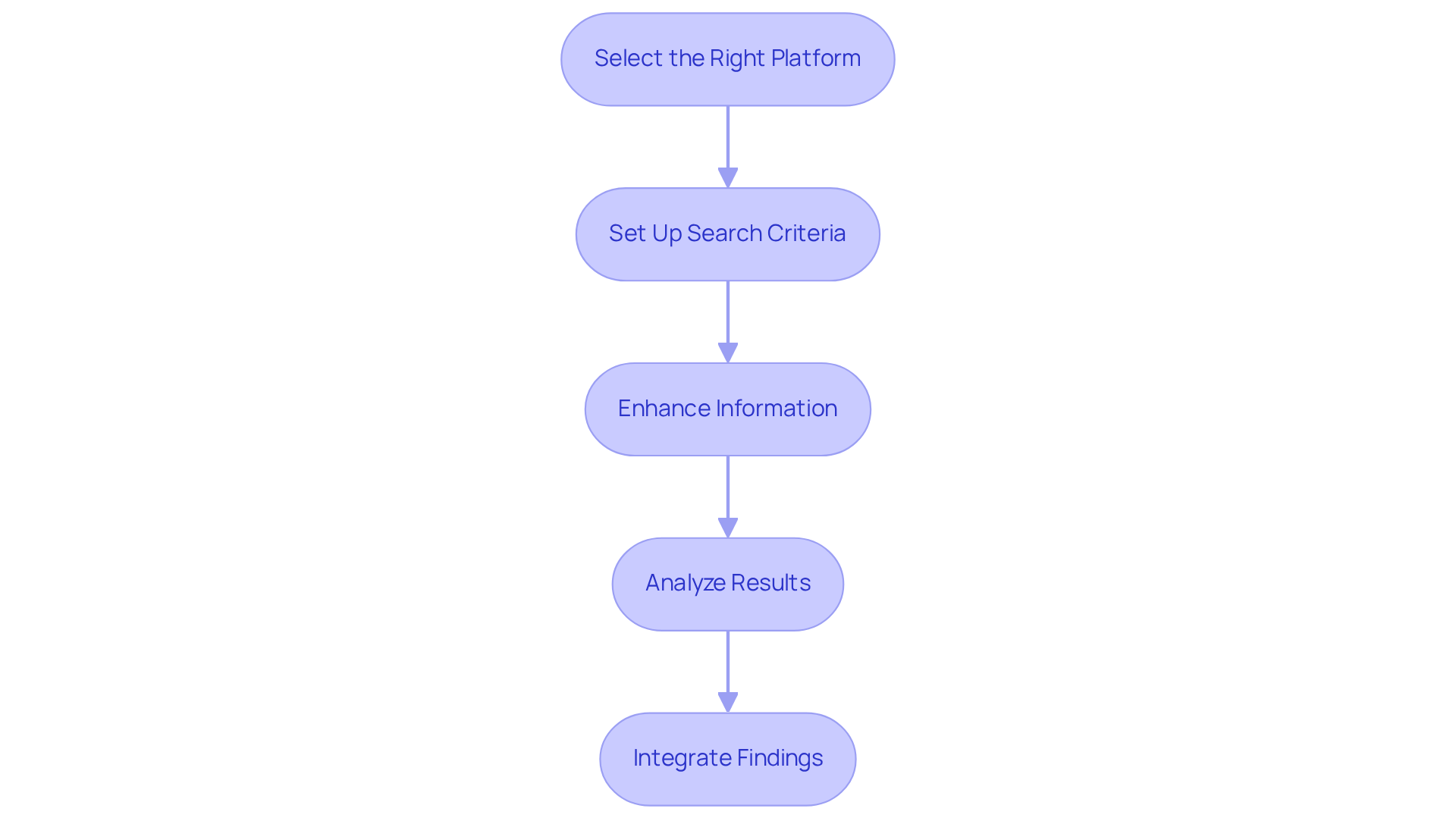

To uncover valuable insights within the industry, investors must leverage advanced analytical tools designed for analysis and lead generation. Here are essential steps to maximize the potential of these tools:

- Select the Right Platform: Choose an AI-driven platform like Websets, which excels in B2B lead generation and market research. This platform empowers users to navigate extensive datasets with rapid and accurate web information retrieval, ensuring access to relevant information tailored to specific needs.

- Set Up Search Criteria: Clearly define your search parameters, such as industry, company size, and geographic location, to refine results and enhance the relevance of the information retrieved. Websets facilitates complex queries, simplifying the process of finding precise leads.

- Enhance Information: Utilize features that allow for information enrichment, such as integrating LinkedIn profiles, emails, and company details. This additional context provides deeper insights into potential leads, significantly improving the quality of information available. Websets' AI-driven search functionalities enhance this process, ensuring that the information is thorough and actionable.

- Analyze Results: Diligently review the collected data to identify trends and opportunities that align with your investment objectives. Effective analysis can reveal practical information that drives strategic decisions. With Websets, you can gain a , examining industry trends and competitor environments.

- Integrate Findings: Seamlessly incorporate the insights gained into your financial strategy, ensuring that your decisions are grounded in robust data analysis. By leveraging Websets' advanced features, investors can enhance their operational efficiency and decision-making processes.

For further guidance on getting started with Websets, refer to the user manuals available on their platform.

By adhering to these steps, investors can effectively utilize tools to uncover hidden market intelligence for investors, which enhances their decision-making processes and ultimately drives improved results. A recent study indicates that 72% of leaders view enhancing the ROI of their IT asset portfolio by at least 25% as a crucial business goal, underscoring the importance of employing advanced AI-driven platforms. Furthermore, Guild Mortgage's experience illustrates the transformative power of AI; after integrating AI-powered lead generation tools, they doubled their lead response times, enabling more effective outreach and engagement.

Apply Insights to Enhance Investment Strategies

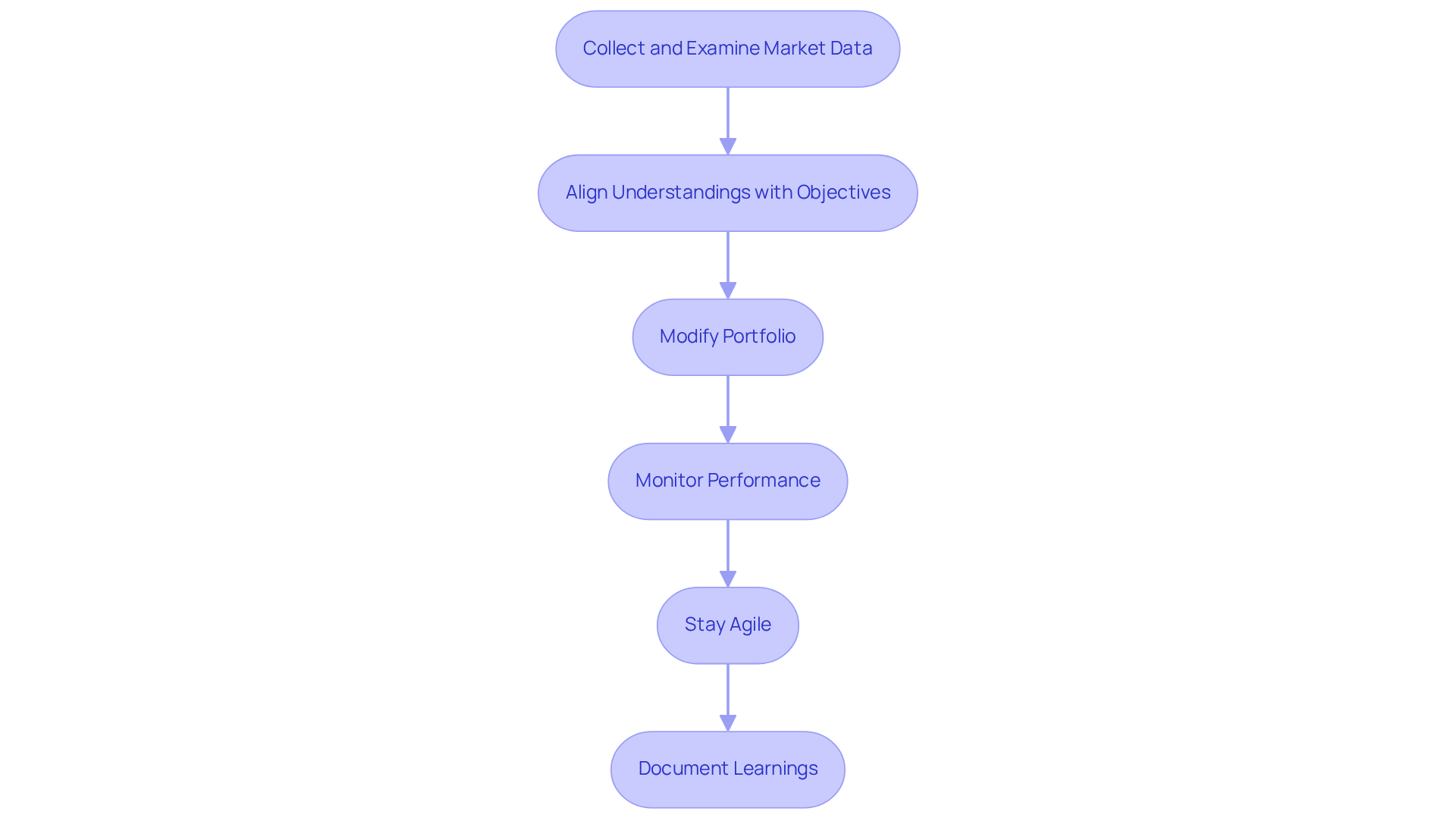

After collecting and examining market data, the next step is to leverage hidden market intelligence for investors to enhance your financial strategies. Here’s how to do it effectively:

- Align Understandings with Objectives: Ensure that the knowledge you’ve gathered aligns with your overall financial goals and risk tolerance. This alignment is crucial for maintaining a coherent financial strategy that reflects your aspirations. As noted by the BlackRock Investment Institute, adapting to structural changes is essential for achieving above-benchmark returns.

- Modify Portfolio: Based on your findings, consider adjusting your asset portfolio to capitalize on emerging trends or industries with promising growth potential. For instance, with U.S. equities showing strength due to superior earnings and profitability compared to other developed markets, reallocating funds towards these areas could yield significant returns.

- Monitor Performance: Continuously observe the performance of your assets in light of the new insights. Regular performance reviews are vital, allowing for timely adjustments that can optimize returns and mitigate risks. The tactical investment horizon has been extended to six to twelve months, underscoring the importance of ongoing monitoring.

- Stay Agile: Be ready to pivot your strategy based on ongoing industry intelligence, as market conditions can shift rapidly. The case study 'Navigating Market Volatility & Policy Uncertainty' illustrates how investors can effectively utilize hidden market intelligence for investors to adjust their strategies during unpredictable periods.

- Document Learnings: Maintain a record of what strategies worked and what didn’t. Utilizing tools such as financial journals or can serve as valuable resources for refining future financial decisions, enabling a more informed approach to portfolio management.

By effectively applying these insights, investors can enhance their strategies, leading to better decision-making and improved financial outcomes. As highlighted by industry experts, integrating emerging technologies and maintaining a disciplined investment approach can significantly impact performance, particularly in today’s dynamic market environment.

Conclusion

Unlocking hidden market intelligence is essential for investors seeking to refine their strategies and gain a competitive edge. By tapping into concealed insights that extend beyond traditional research methods, investors can make informed decisions that align with evolving market trends and consumer behaviors.

Key steps are outlined to help investors effectively harness hidden market intelligence. These include:

- Identifying critical metrics

- Utilizing diverse information sources

- Recognizing patterns

- Staying informed about industry dynamics

Additionally, leveraging advanced tools like Websets allows for enhanced data analysis and integration of insights into financial strategies, ultimately leading to improved investment outcomes.

In a rapidly changing market landscape, the ability to adapt based on real-time intelligence is crucial. Investors are encouraged to embrace these methodologies and tools, not only to enhance their decision-making processes but also to drive better financial performance. By committing to continuous learning and agile strategy adjustments, investors can navigate complexities and seize opportunities that arise within the market, ensuring their investments remain resilient and profitable.

Frequently Asked Questions

What is hidden market intelligence?

Hidden market intelligence refers to insights and information about the market that are not easily accessible through traditional research methods. It includes trends in consumer behavior, emerging opportunities, and competitor strategies derived from various data sources.

What steps should investors take to harness hidden market intelligence?

Investors should identify key metrics, examine diverse information sources, recognize patterns in data, and stay informed about industry conditions and emerging trends.

How can key metrics help in understanding market trends?

Key metrics reveal important market trends such as consumer sentiment, purchasing patterns, and industry growth rates. For example, understanding that 64% of CMOs see fragmented information as a barrier can help focus efforts on improving intelligence value.

What types of information sources should investors utilize?

Investors should use a variety of information sources, including social media, news articles, and industry reports, to gather comprehensive insights. Integrating financial data, social sentiment, and sales statistics can provide a clearer understanding of economic dynamics.

How can recognizing patterns in data benefit investors?

Recognizing patterns can signal shifts in industry dynamics or consumer preferences. Predictive analytics, for instance, can help brands anticipate customer behavior based on historical data, allowing them to adjust their strategies effectively.

Why is it important for investors to stay informed about industry conditions?

Staying informed allows investors to maintain a competitive edge by understanding shifts in consumer behavior and emerging trends. For example, with global digital ad spending projected to exceed $750 billion by 2025, being attuned to these changes is crucial.

How does Websets' AI-driven platform assist investors in uncovering hidden market intelligence?

Websets' AI-driven platform enhances the process of gathering hidden market intelligence by delivering extensive information from various sources and enabling real-time information monitoring, which helps refine investment strategies.