Overview

This article highlights the significance of various predictive datasets that private equity teams can leverage to enhance their decision-making processes. By utilizing these datasets, teams can uncover lucrative funding opportunities, analyze critical market trends, and make informed strategic decisions. Ultimately, this approach leads to improved financial outcomes in an increasingly competitive investment landscape. The strategic use of predictive datasets is not just an advantage; it is essential for navigating the complexities of today's market.

Introduction

In an increasingly competitive financial landscape, private equity teams are continuously in pursuit of innovative tools to enhance their decision-making processes. The advent of predictive datasets has fundamentally transformed how these teams analyze market trends, uncover funding opportunities, and engage with stakeholders. Yet, the challenge persists: how can firms effectively leverage these datasets to secure a strategic advantage and navigate the complexities of investment decisions? This article delves into ten powerful predictive datasets that empower private equity teams to refine their strategies and optimize their financial outcomes.

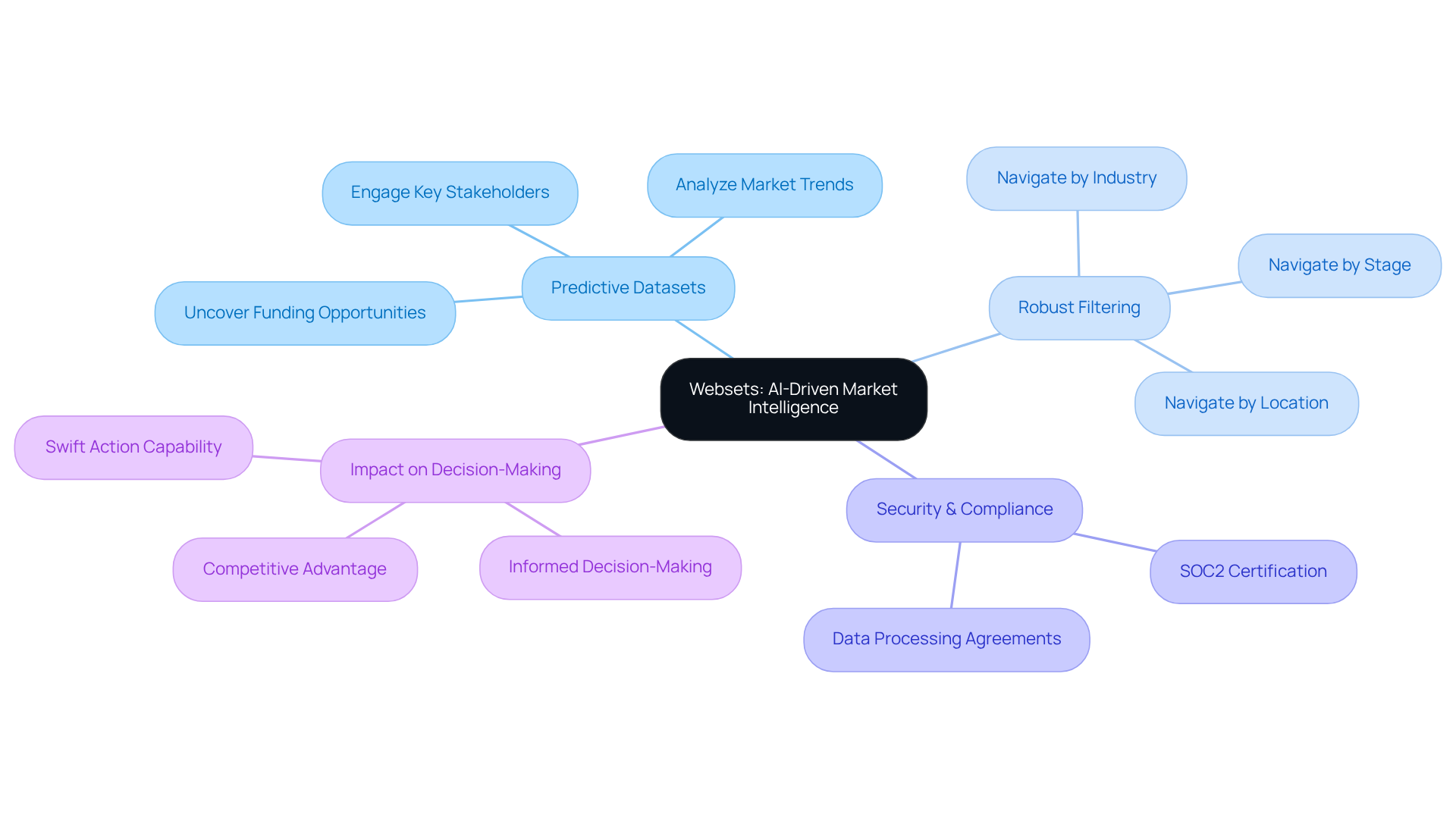

Websets: AI-Driven Market Intelligence for Enhanced Decision-Making

Websets transforms market intelligence by leveraging advanced AI algorithms to deliver precise and enriched datasets. Private capital groups can utilize predictive datasets for private equity teams to uncover potential funding opportunities, analyze market trends, and engage effectively with key stakeholders.

With robust filtering capabilities, users can by industry, stage, and location, ensuring they access the critical information necessary for informed decision-making. In the competitive landscape of venture capital, the ability to act swiftly and gather comprehensive information can significantly impact financial outcomes.

Moreover, Websets prioritizes security and compliance, offering SOC2 certification and comprehensive data processing agreements, allowing users to trust the integrity of their data.

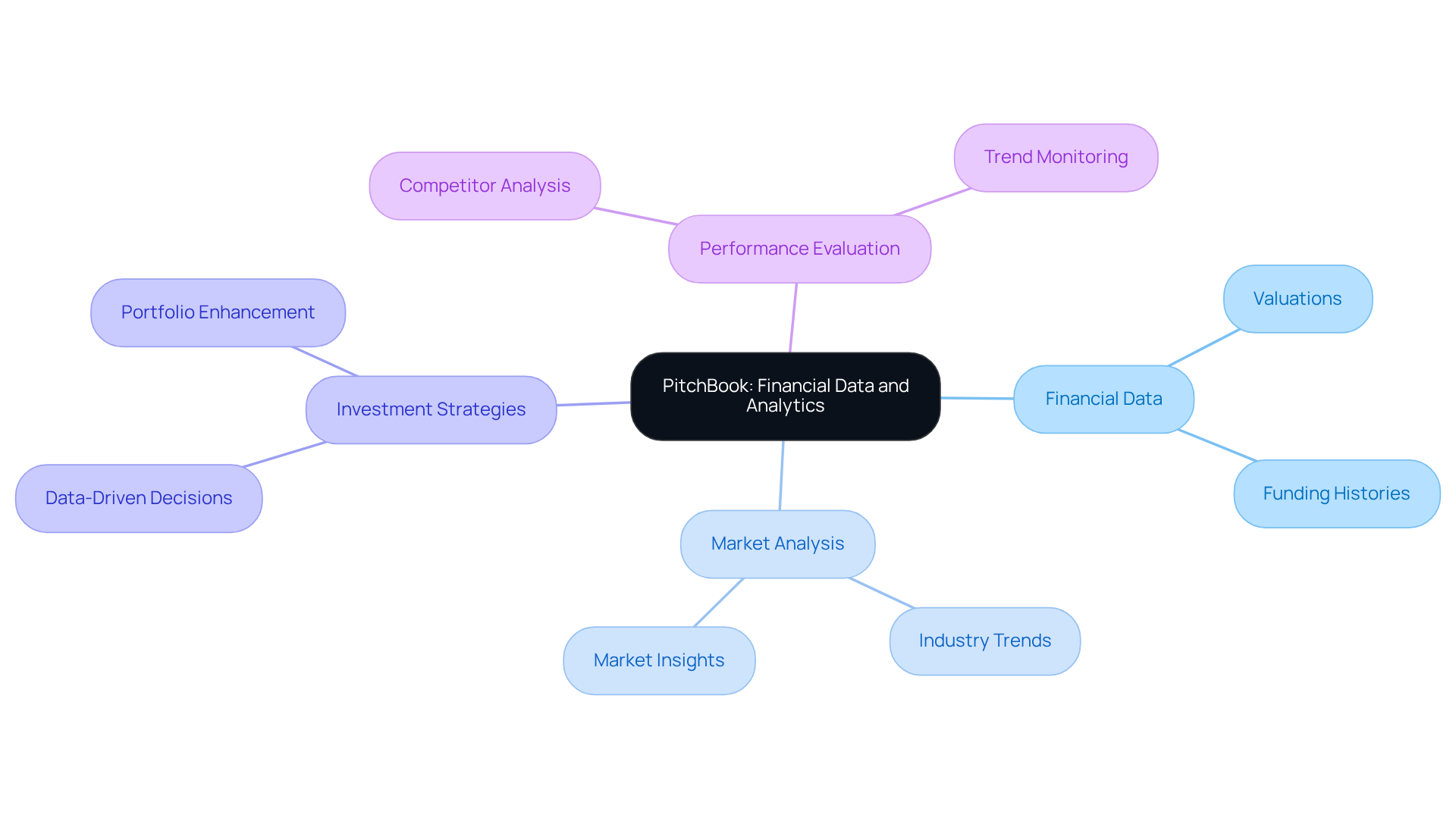

PitchBook: Comprehensive Financial Data and Analytics

PitchBook stands as an indispensable resource for private equity groups, delivering a wealth of financial data, including detailed valuations, funding histories, and comprehensive market analyses. This platform is crucial for , enabling groups to effectively monitor industry trends and evaluate their performance against competitors. The sophisticated analytics provided by PitchBook empower teams to make informed, data-driven decisions that align closely with their funding strategies.

Consider this: finance firms have successfully leveraged PitchBook's insights to uncover lucrative opportunities and enhance their portfolios. Financial analysts consistently emphasize the pivotal role of PitchBook in shaping robust investment strategies, highlighting that its analytics can significantly improve the accuracy of investment evaluations. By harnessing the capabilities of PitchBook, investment groups can navigate the complexities of the market with enhanced confidence and clarity.

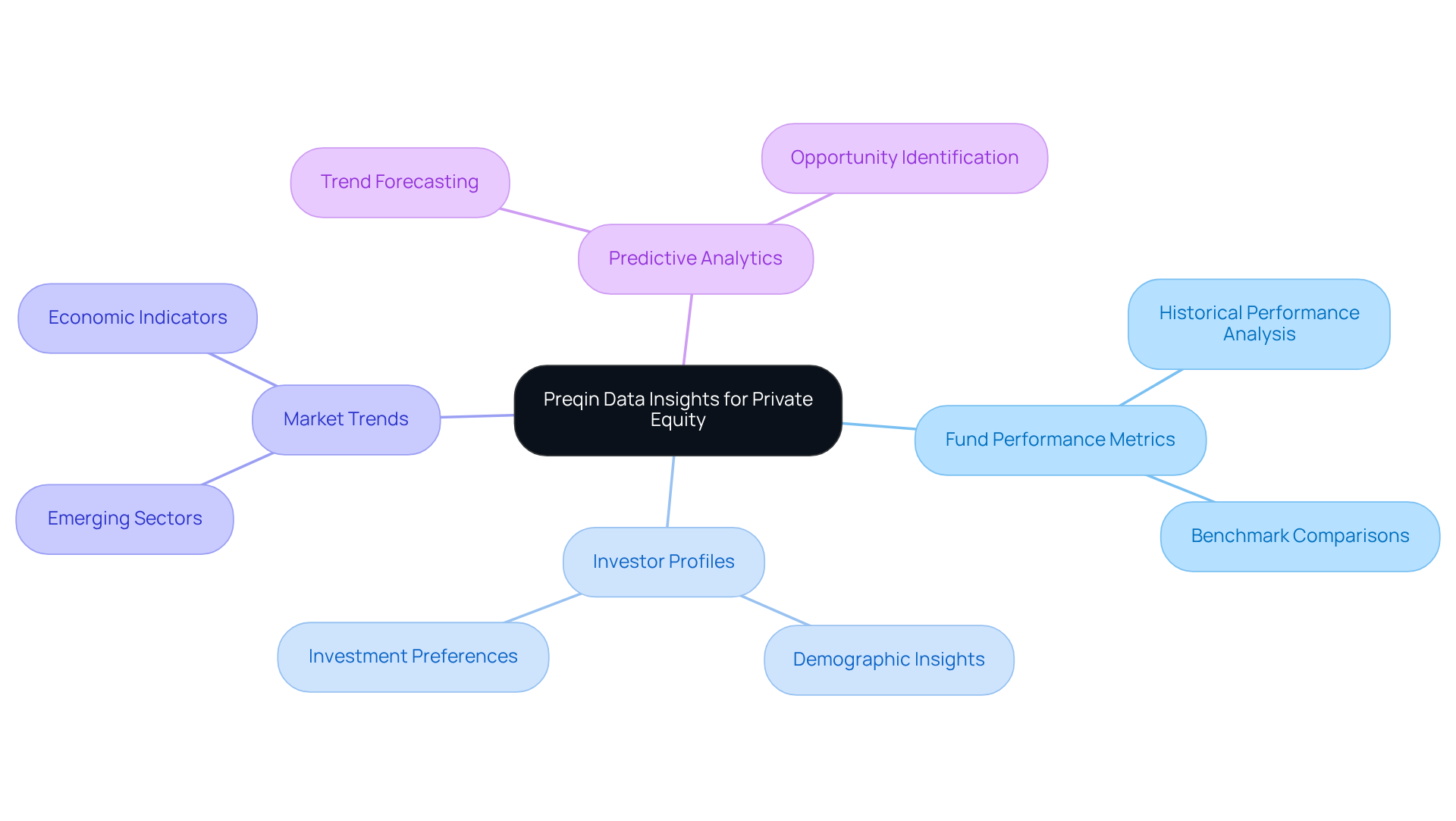

Preqin: Extensive Datasets on Private Equity Performance

Preqin offers a wealth of information on alternative investment performance, encompassing fund performance metrics, investor profiles, and market trends. This data is vital for private equity groups, as it enables them to evaluate past performance and leverage predictive datasets for private equity teams to predict future trends. Consequently, this insight assists in identifying high-potential opportunities. By leveraging predictive datasets for private equity teams, groups can refine their financial strategies and enhance overall portfolio performance.

Utilizing such comprehensive data not only supports informed decision-making but also fosters a competitive edge in the market. With the ability to , private equity firms can better position themselves for success. Are you ready to elevate your investment strategies? Embrace the insights that Preqin provides and transform your approach to alternative investments.

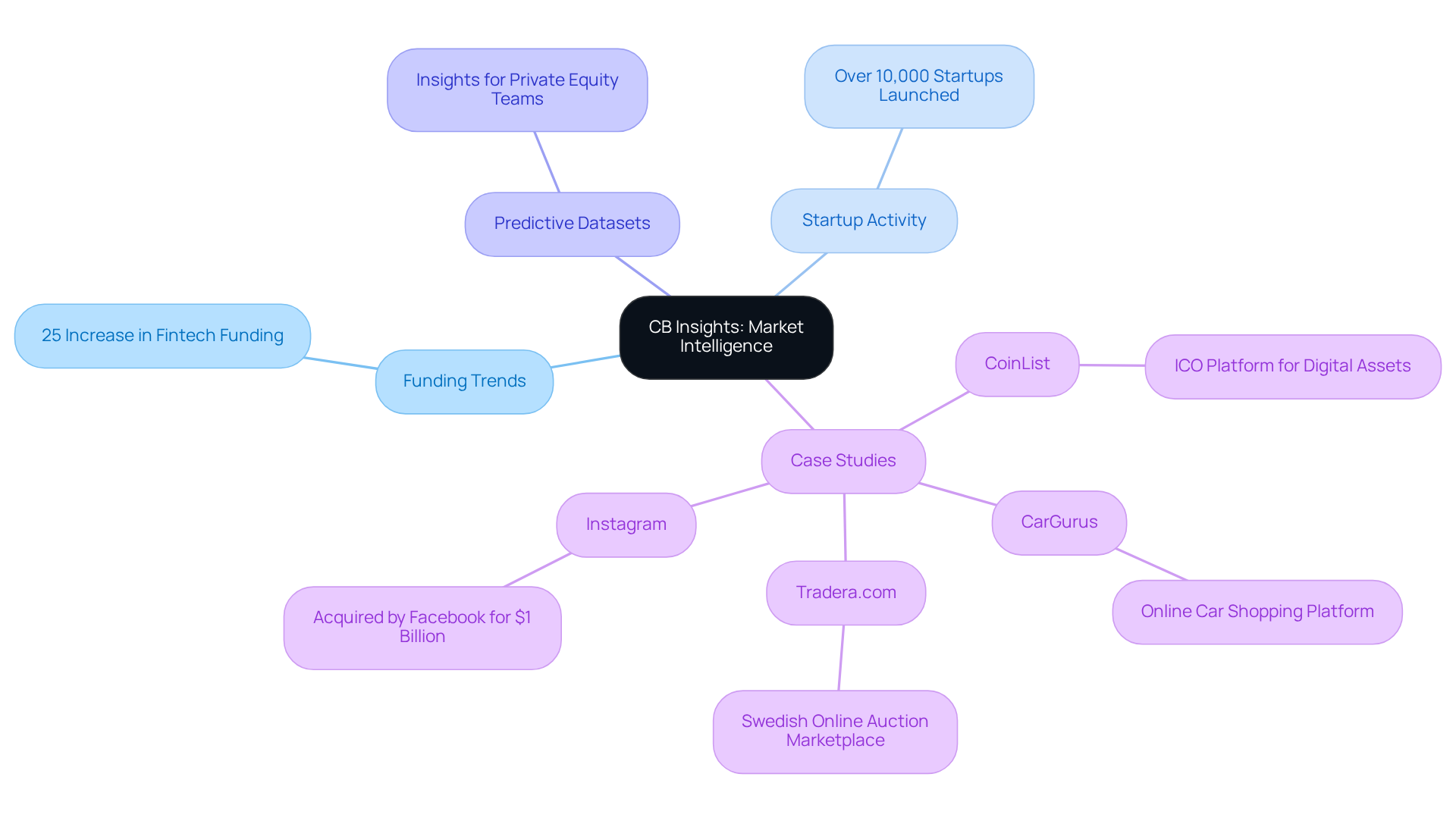

CB Insights: Market Intelligence and Analytics for Investment Trends

CB Insights stands at the forefront of market intelligence, delivering critical analytics on funding trends, startup activity, and industry developments. This platform provides alternative capital groups with essential insights from for private equity teams to identify emerging sectors and potential funding opportunities. By leveraging data from CB Insights, teams are empowered to make informed decisions that resonate with market trends and investor interests. Notably, the platform's focus on financial strategies, including predictive datasets for private equity teams, enables firms to navigate the dynamic landscape with agility.

Recent analytics reveal a remarkable 25% increase in funding within the fintech sector, underscoring its potential as a pivotal area for future financial support. Furthermore, the surge in startup activity, with over 10,000 new startups launched in the past year, presents abundant opportunities for investors. This data not only shapes strategic planning but also offers predictive datasets for private equity teams to anticipate shifts in the investment landscape.

Case studies such as CarGurus and CoinList exemplify how investment groups have adeptly utilized CB Insights to enhance their decision-making processes. By harnessing these insights, investment groups can maintain a competitive edge in a rapidly evolving market, ultimately achieving superior results.

Crunchbase: Detailed Information on Startups and Funding Rounds

Websets offers a comprehensive platform for gaining insights into startups, featuring in-depth profiles that include information on founding teams, competitors, and recent news. This data is crucial for investment groups that are looking to use predictive datasets for private equity teams to fund innovative companies. By leveraging predictive datasets for private equity teams, these groups can filter startups by sector, phase, and region, identify promising opportunities, and assess growth potential through advanced filtering techniques. This enables them to make strategic funding decisions that align with their portfolio objectives.

Moreover, Websets delivers essential financial data and strategic insights, which include predictive datasets for private equity teams, enhancing competitive analysis and providing a deeper understanding of market trends and industry developments. This sets it apart from other platforms such as Crunchbase. With Websets, investment groups can , ensuring they are well-equipped to make informed decisions in a rapidly evolving market.

S&P Capital IQ: Financial Data and Analytics for Market Evaluation

S&P Capital IQ stands as a pivotal resource, providing comprehensive financial information and analytics that empower financial groups to efficiently assess market conditions and opportunities. This platform delivers critical insights into company performance, industry benchmarks, and economic indicators, utilizing for private equity teams to enable informed decisions grounded in thorough market evaluations. Leveraging S&P Capital IQ can significantly enhance the strategic planning process for personal financial ventures.

Recent studies reveal that traditional metrics like PME and GPME often present excessive noise at the individual fund level, resulting in inaccurate assessments. In contrast, the new metric α boasts a standard deviation that is 20% lower across venture capital funds than PME and GPME, underscoring its effectiveness in refining accuracy in capital allocation evaluations. Furthermore, the case study titled 'Performance Evaluation of Private Equity Funds' elucidates the limitations of conventional metrics, reinforcing the urgent need for predictive datasets for private equity teams to adopt this innovative benchmarking method.

Dr. Elisabetta Basilico, a recognized expert in the field, asserts that this new approach markedly enhances the predictability of future fund performance, thus aiding investors in making better-informed allocation decisions. By utilizing S&P Capital IQ, investment groups can align their strategies with prevailing market dynamics, culminating in more effective resource allocation and improved overall performance.

FactSet: Integrated Financial Data and Analytics

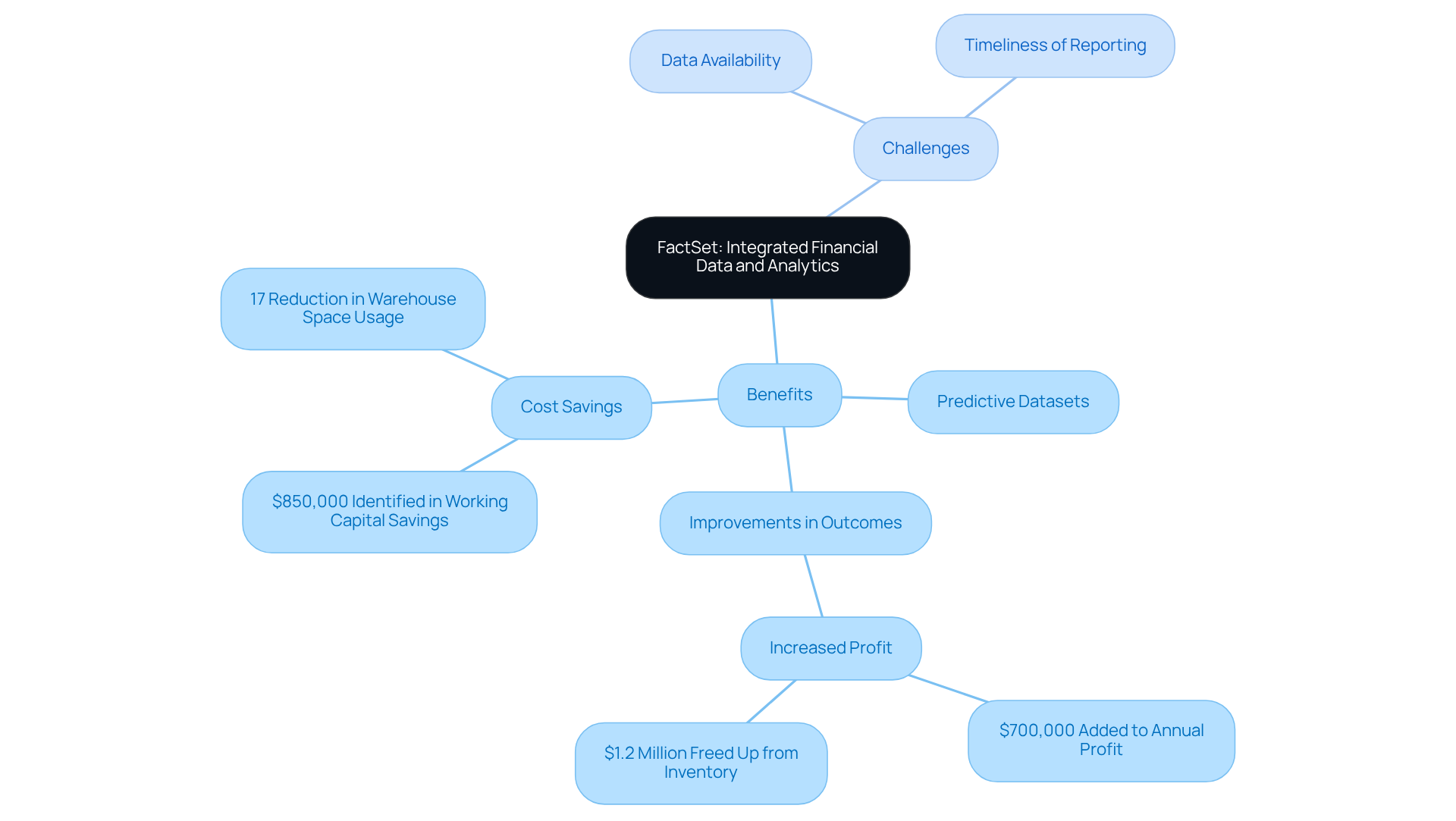

FactSet delivers a comprehensive suite of integrated financial information and analytics, empowering private equity teams with predictive datasets for private equity teams to gain a profound understanding of potential opportunities. By aggregating predictive datasets for private equity teams from diverse sources, FactSet enables teams to conduct in-depth analyses of financial performance, market trends, and competitive positioning. This holistic approach not only enhances financial strategies but also facilitates through predictive datasets for private equity teams.

For instance, financial groups utilizing predictive datasets for private equity teams have reported significant improvements in their outcomes, with analytics fostering a more strategic approach to market analysis. Remarkably, firms have identified $850,000 in working capital savings within the first hour of data analysis and added $700,000 to annual profit through improved sales velocity.

Nevertheless, challenges such as data availability and the timeliness of reporting continue to hinder effective data analytics. As one expert aptly noted, 'Data analytics can provide investors with information needed to help improve operations while still giving management sufficient freedom to run their business.'

The platform's ability to provide predictive datasets for private equity teams, along with real-time insights and comprehensive market summaries, positions it as an indispensable resource for finance professionals aiming to refine their strategies and capitalize on emerging opportunities.

Thomson Reuters Eikon: Real-Time Market Data and Analytics

Thomson Reuters Eikon delivers , empowering independent finance groups to remain agile amidst market fluctuations and funding opportunities. The platform's timely insights facilitate swift decision-making, enabling teams to rapidly adapt to evolving market conditions. This agility is crucial for capitalizing on emerging trends and opportunities, ultimately enhancing the responsiveness of financial teams in their strategic endeavors. Analysts assert that leveraging Eikon analytics significantly boosts financial firms' ability to react efficiently to market shifts, thereby refining their strategies and outcomes.

As Pete Witte, EY Global Private Investment Lead Analyst, articulates, "Exits remain a primary focus for alternative investment, and despite the unstable environment, firms capitalized on the available opportunities in the first half of the year to transform strategic value creation into realized returns, driving mid-year proceeds to their peak level in three years." Furthermore, with personal capital withdrawals reaching their highest point in three years and companies announcing 215 notable exit deals valued at a total of US$308 billion, the importance of tools like Eikon in enhancing financial responsiveness cannot be overstated.

Morningstar Direct: Investment Research and Portfolio Analytics

Morningstar Direct stands as a pivotal tool for extensive financial research and portfolio analysis, empowering alternative asset groups to evaluate their asset portfolios with remarkable efficiency. This platform delivers , risk evaluation, and market trends, enabling groups to refine their financial strategies. By leveraging the capabilities of Morningstar Direct, alternative asset groups can significantly enhance their portfolio management procedures, ultimately leading to improved overall financial performance. Are you ready to elevate your asset management approach?

Dealogic: Data and Analytics on Capital Markets

Dealogic delivers critical information and analysis on capital markets, empowering investment groups with insights into market trends, deal activity, and competitive positioning. This intelligence is indispensable for those aiming to make informed financial decisions grounded in current market dynamics. By leveraging Dealogic, investment groups can deepen their understanding of capital markets, thereby refining their investment strategies.

Moreover, the integration of neural search capabilities significantly enhances the data retrieval process, enabling teams to navigate complex queries with greater efficacy. This powerful synergy between Dealogic's analytics and neural search not only facilitates more informed decision-making but also boosts by leveraging predictive datasets for private equity teams. In an environment where precision and insight are paramount, utilizing these tools is essential for staying ahead in the competitive landscape.

Conclusion

The exploration of predictive datasets for private equity teams highlights their crucial role in enhancing decision-making processes within the investment landscape. By leveraging advanced analytical tools and comprehensive data sources, private equity groups can markedly improve their strategic initiatives and financial outcomes.

Various platforms such as Websets, PitchBook, Preqin, and others are instrumental in providing unique contributions to market intelligence and investment analysis. These tools equip teams with essential insights to identify funding opportunities, assess market trends, and refine their investment strategies. The emphasis on data-driven decision-making illustrates how these resources empower firms to navigate complexities and effectively capitalize on emerging trends.

In an environment where data is paramount, embracing predictive datasets is not merely advantageous but essential for achieving a competitive edge. The insights derived from these tools can transform investment strategies, optimize portfolio management, and ultimately lead to superior returns. Private equity teams must integrate these datasets into their operations to remain agile and informed as they pursue new opportunities in a rapidly evolving market.

Frequently Asked Questions

What is Websets and how does it enhance market intelligence?

Websets is an AI-driven platform that transforms market intelligence by utilizing advanced algorithms to provide precise and enriched datasets. It helps private capital groups uncover funding opportunities, analyze market trends, and engage with key stakeholders effectively.

What features does Websets offer to users?

Websets offers robust filtering capabilities that allow users to navigate extensive datasets by industry, stage, and location, ensuring they access critical information for informed decision-making.

How does Websets prioritize data security?

Websets prioritizes security and compliance by offering SOC2 certification and comprehensive data processing agreements, ensuring users can trust the integrity of their data.

What is PitchBook and what resources does it provide?

PitchBook is a comprehensive resource for private equity groups, delivering financial data including detailed valuations, funding histories, and market analyses. It is essential for assessing financial opportunities and monitoring industry trends.

How does PitchBook assist in making investment decisions?

PitchBook provides sophisticated analytics that empower teams to make informed, data-driven decisions aligned with their funding strategies, enhancing the accuracy of investment evaluations.

What role does Preqin play in private equity performance analysis?

Preqin offers extensive datasets on alternative investment performance, including fund performance metrics and market trends, which are vital for private equity groups to evaluate past performance and predict future trends.

How can private equity groups benefit from using Preqin?

By leveraging Preqin's predictive datasets and comprehensive data, private equity groups can refine their financial strategies, identify high-potential opportunities, and enhance overall portfolio performance.

What advantage does having access to comprehensive data offer private equity firms?

Access to comprehensive data supports informed decision-making and fosters a competitive edge in the market, allowing private equity firms to better position themselves for success.