Overview

This article identifies crucial early indicators in venture capital that sales leaders must recognize to refine their investment strategies. It emphasizes key factors such as:

- Market trends

- Startup traction

- Founding team experience

- Market size

- Competitive landscape

- Product-market fit

- Financial health

- Customer feedback

- Regulatory compliance

Each of these elements serves as a vital metric for evaluating a venture's potential success and its appeal to investors. By understanding these indicators, sales leaders can make informed decisions that enhance their investment outcomes.

Introduction

In the fast-paced world of venture capital, sales leaders must adeptly identify emerging opportunities that promise significant investment returns. Recognizing the early indicators that signal a startup's potential is essential for making informed decisions in this competitive landscape. Yet, with a multitude of metrics and trends to analyze, how can sales leaders effectively navigate this complex terrain to pinpoint the most promising ventures? This article explores eight critical venture capital early indicators that every sales leader should know, providing valuable insights to enhance investment strategies and seize the next wave of innovation.

Websets: AI-Powered Lead Generation for Identifying Investment Opportunities

Websets transforms through advanced algorithms, enabling sales leaders to pinpoint profitable opportunities with remarkable precision. By leveraging AI-driven sales insights, users can navigate extensive datasets to identify professionals or organizations that align with their funding standards. This precision search solution not only enhances accuracy but also significantly reduces the time spent on lead qualification, allowing sales teams to focus on high-potential prospects. For instance, sales leaders can swiftly access enhanced data, including LinkedIn profiles, emails, and comprehensive work histories, which supports informed decision-making regarding potential opportunities.

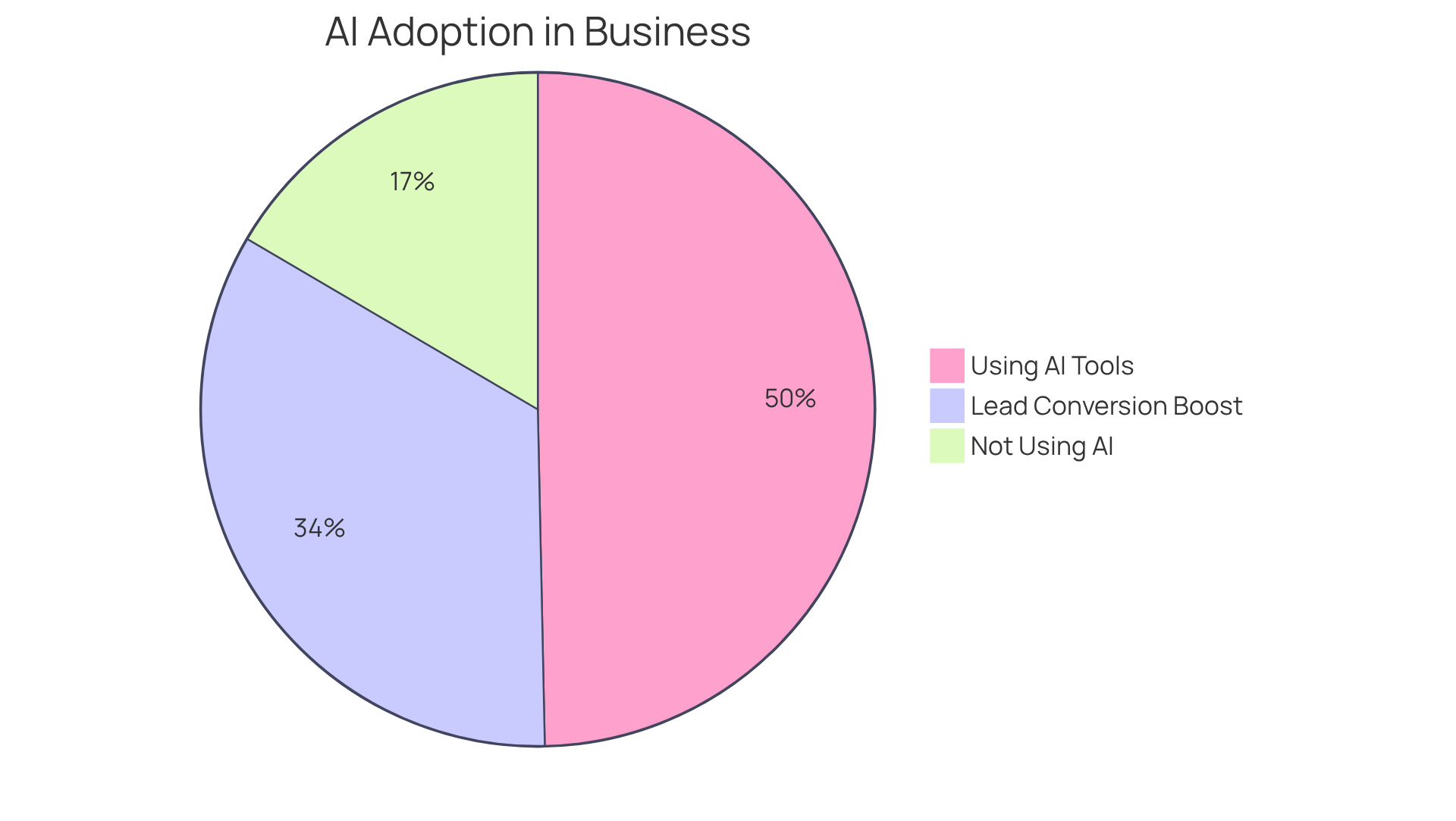

As businesses increasingly adopt AI tools—75% are already using or planning to use them—Websets distinguishes itself by providing a streamlined approach that aligns with the latest trends in lead generation for 2025. Furthermore, companies utilizing AI for lead scoring have experienced a 51% increase in lead-to-deal conversion rates, underscoring the effectiveness of AI in this domain. To maximize these benefits, sales leaders should assess their current lead generation processes and consider integrating Websets' AI-driven solutions to enhance their strategies.

Market Trends: Analyzing Shifts for Early Investment Indicators

Sales leaders must closely observe market trends to identify venture capital early indicators of financial opportunities. Shifts towards sustainable technologies or AI-driven solutions can act as venture capital early indicators of emerging sectors that are ripe for investment.

By leveraging Websets' AI-powered sales intelligence search, leaders can analyze detailed company profiles and market trends, discerning patterns that indicate where venture capital is flowing. This proactive approach enables sales teams to align their strategies with market demands, ensuring they as they arise, particularly those highlighted by venture capital early indicators.

Furthermore, utilizing insights from Websets News Monitor provides real-time updates on relevant sectors, thereby enhancing the ability to detect venture capital early indicators in the landscape.

Startup Traction: Measuring Growth Metrics as Investment Signals

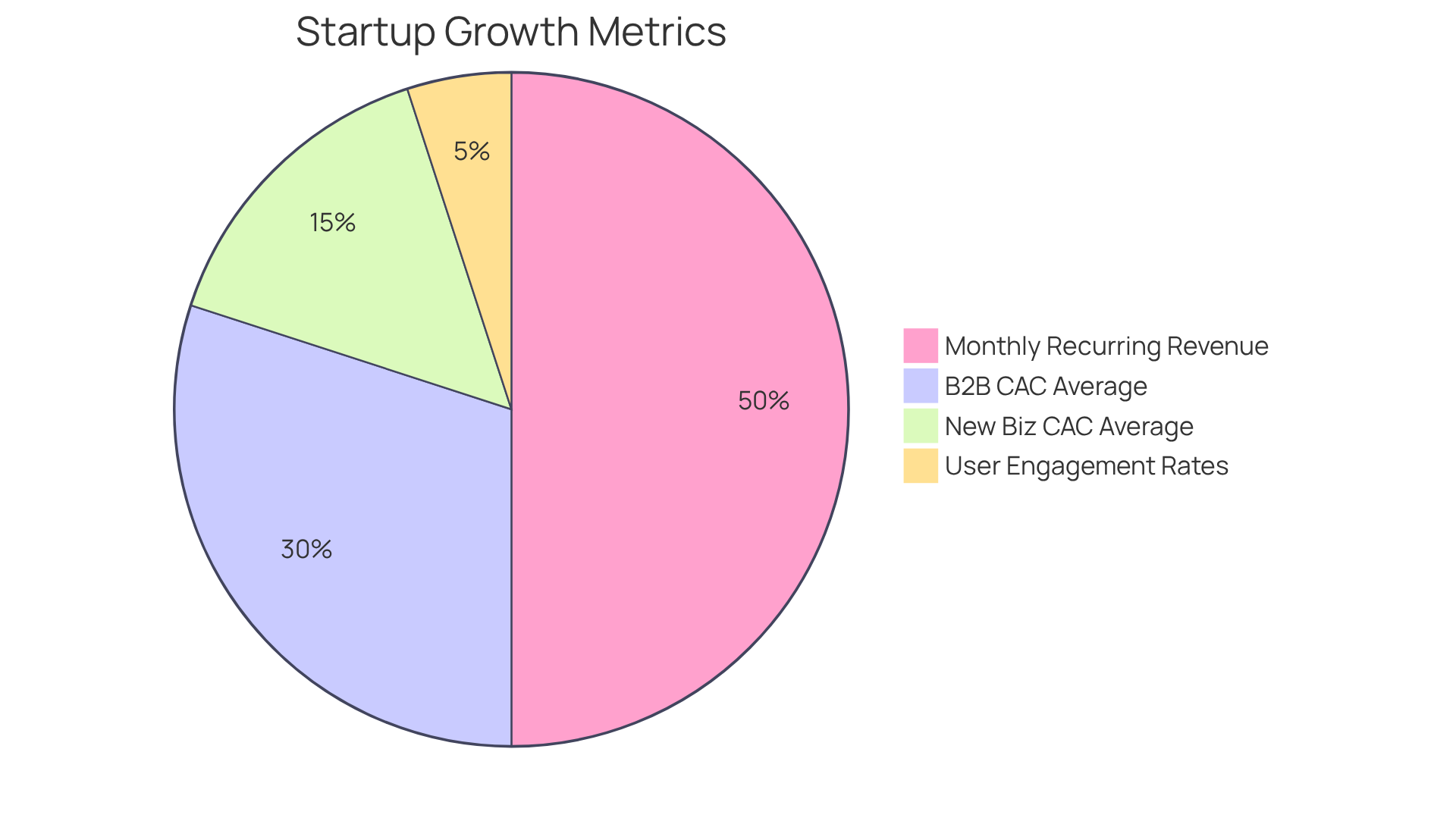

Assessing traction for new ventures requires a thorough evaluation of essential growth metrics, including Monthly Recurring Revenue (MRR), customer acquisition costs (CAC), and user engagement rates. Sales leaders must prioritize consistent growth patterns, as these are strong venture capital early indicators of a venture's potential success. For example, companies demonstrating a 20% month-over-month increase in MRR often attract more investor interest compared to those with stagnant revenue streams.

Understanding CAC benchmarks is crucial; the stands at approximately $656, while new businesses in 2025 average $225 per customer. By leveraging platforms like Websets, which provide AI-driven tools for B2B lead generation and data analysis, sales teams can access real-time data to evaluate these metrics effectively. This access enables informed decision-making and strategic planning, enhancing the analysis of customer acquisition costs and user engagement metrics.

As Murtuza Kutub aptly puts it, 'Think of metrics as your venture’s pulse; they show what’s thriving and what needs a jolt.' He further emphasizes, 'Ultimately, CAC is not just a marketing metric—it’s a business performance indicator that reflects your company’s ability to drive efficient, cost-effective customer growth.' This perspective highlights the significance of tracking venture capital early indicators to facilitate successful investment decisions.

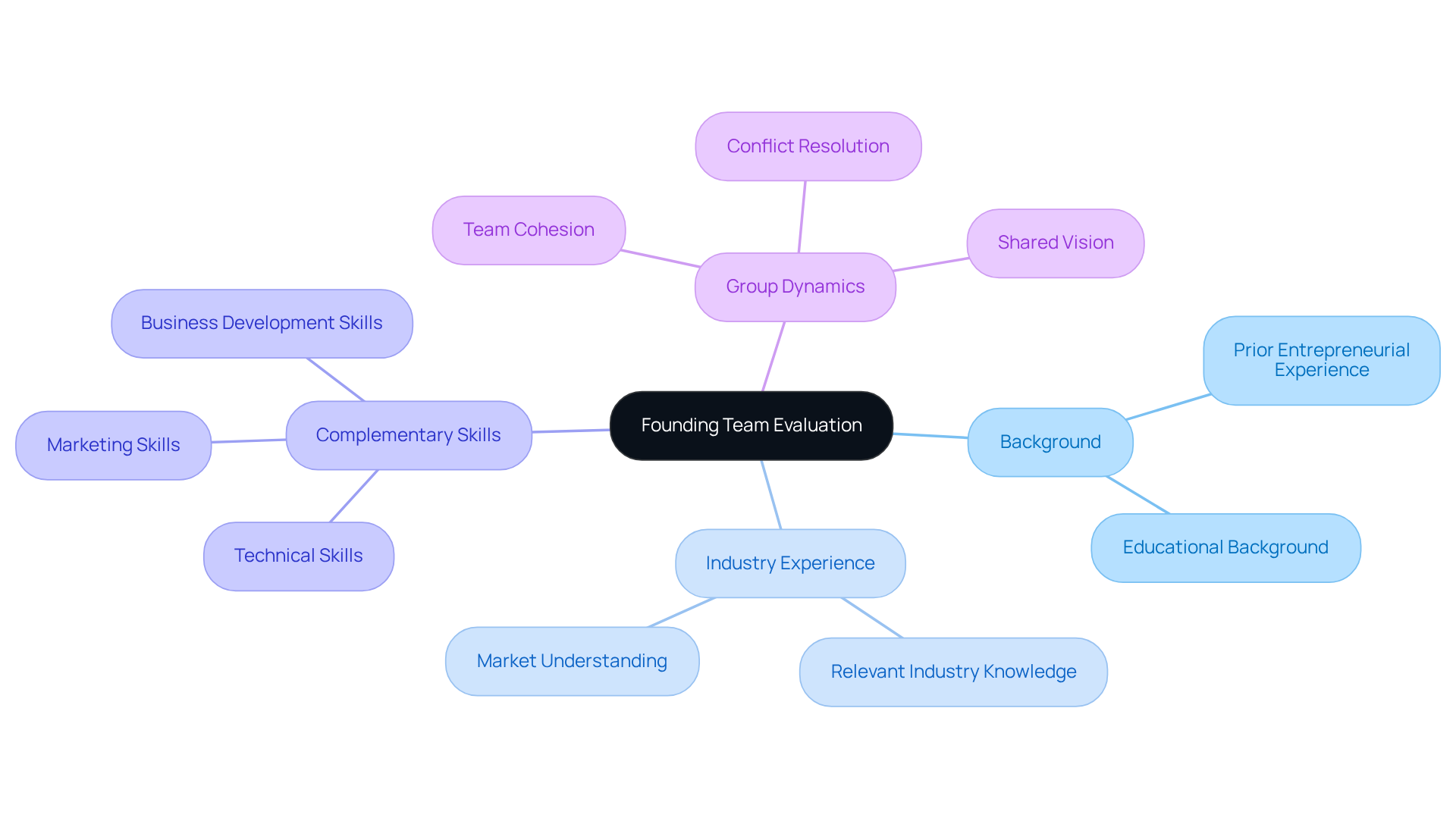

Founding Team: Evaluating Experience and Skills as Key Indicators

Assessing a new venture's founding group is crucial for determining its potential for success. This process requires a thorough examination of the group's backgrounds, industry experience, and complementary skills. A strong founding group—especially one with a proven track record—can significantly enhance a startup's chances of attracting investment and achieving venture capital early indicators. Sales leaders should prioritize factors such as prior entrepreneurial experience and industry knowledge, as these elements indicate the group's ability to execute their vision effectively. For instance, groups that combine varied skills in technology and marketing are often better equipped to tackle challenges and seize opportunities in a competitive environment.

Studies indicate that new ventures with diverse groups are more likely to secure financing, as venture capital early indicators suggest that investors increasingly recognize the importance of group dynamics and complementary skill sets in fostering success. Moreover, a methodical approach to assessing founding groups can help identify strengths and weaknesses, ensuring that the right talent is in place to meet market demands. As Thomas Mensink asserts, 'The caliber of a founding group can determine a venture’s future opportunities.' To enhance your evaluation process, consider implementing that assess both technical skills and team dynamics.

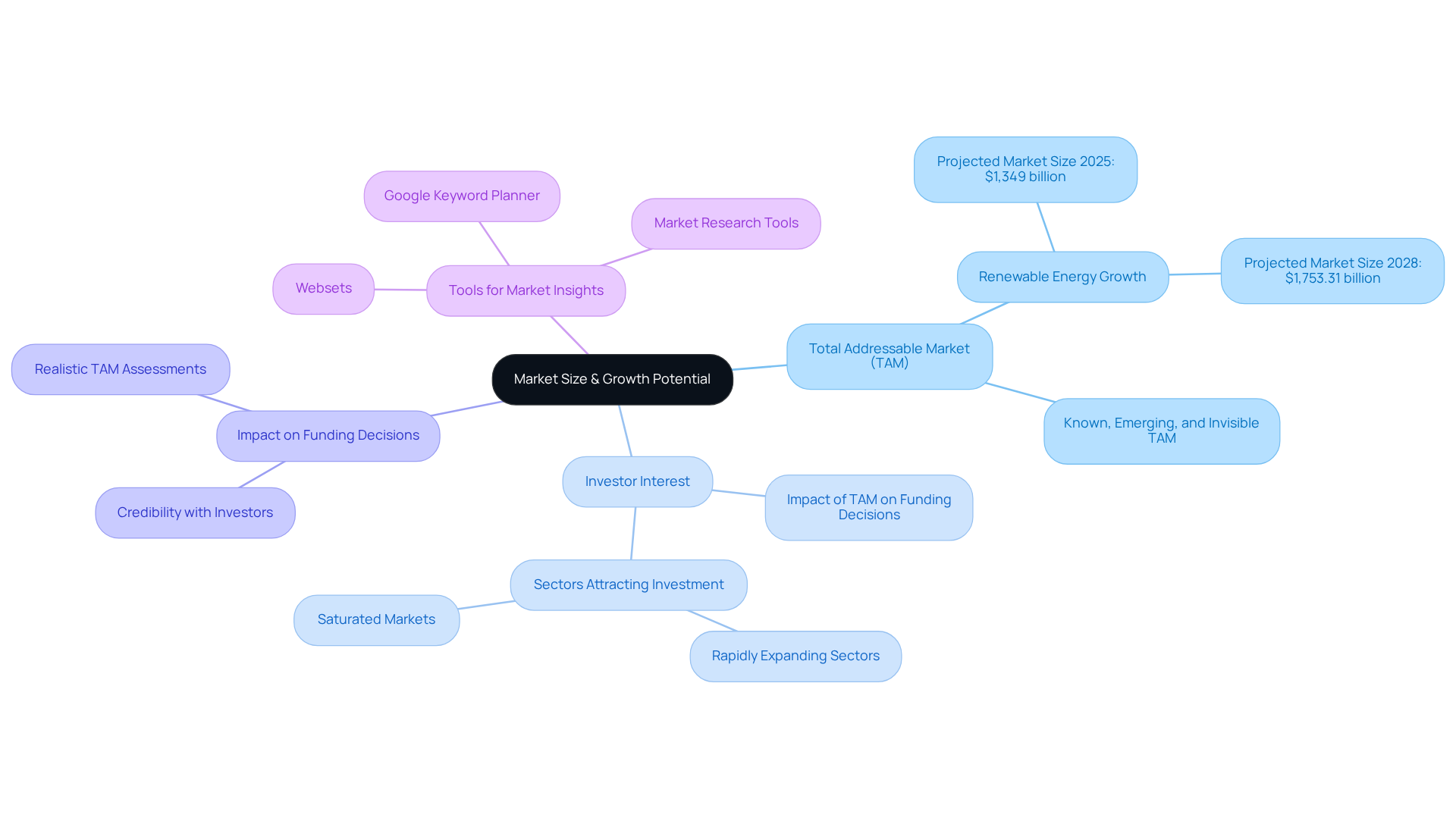

Market Size: Assessing Potential for Growth and Investment Returns

Assessing market size is crucial for understanding the Total Addressable Market (TAM) of a new venture's product or service. Sales leaders must investigate market reports and forecasts to evaluate growth potential effectively. Startups in rapidly expanding sectors, such as renewable energy, often attract more investor interest than those in saturated markets. Analysts emphasize that realistic TAM assessments significantly influence funding decisions, serving as venture capital early indicators and reflecting a founder's understanding of their business landscape.

Tools like Websets empower sales teams by granting access to extensive market data, facilitating informed investment strategies. With the by 2025, leveraging accurate market insights is essential for identifying lucrative opportunities in emerging industries.

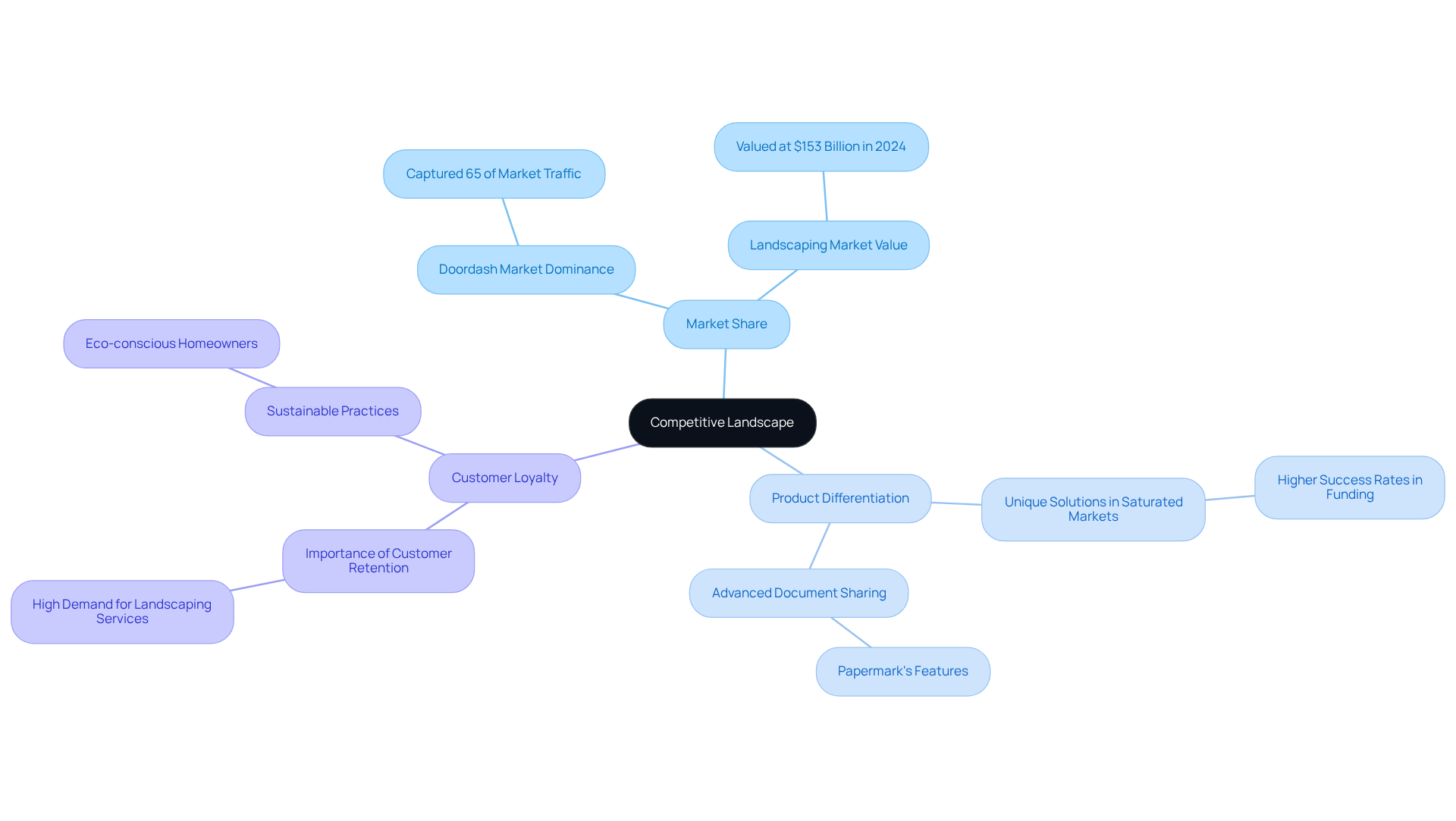

Competitive Landscape: Analyzing Market Positioning for Investment Decisions

Analyzing the competitive landscape is essential for identifying key players and comprehending their strengths and weaknesses. Sales leaders must assess factors such as:

- Market share

- Product differentiation

- Customer loyalty

to evaluate a new venture's potential. Startups that introduce unique solutions in saturated markets frequently gain a competitive edge, rendering them more attractive to investors. Industry insights reveal that companies with distinct product offerings can achieve higher success rates in securing funding and gaining market traction. By leveraging Websets' advanced data enrichment capabilities, sales teams can access detailed insights into competitors' performance and market positioning, enabling informed investment decisions. This strategic approach not only enhances but also aids in identifying new ventures poised for growth and success, which are considered venture capital early indicators.

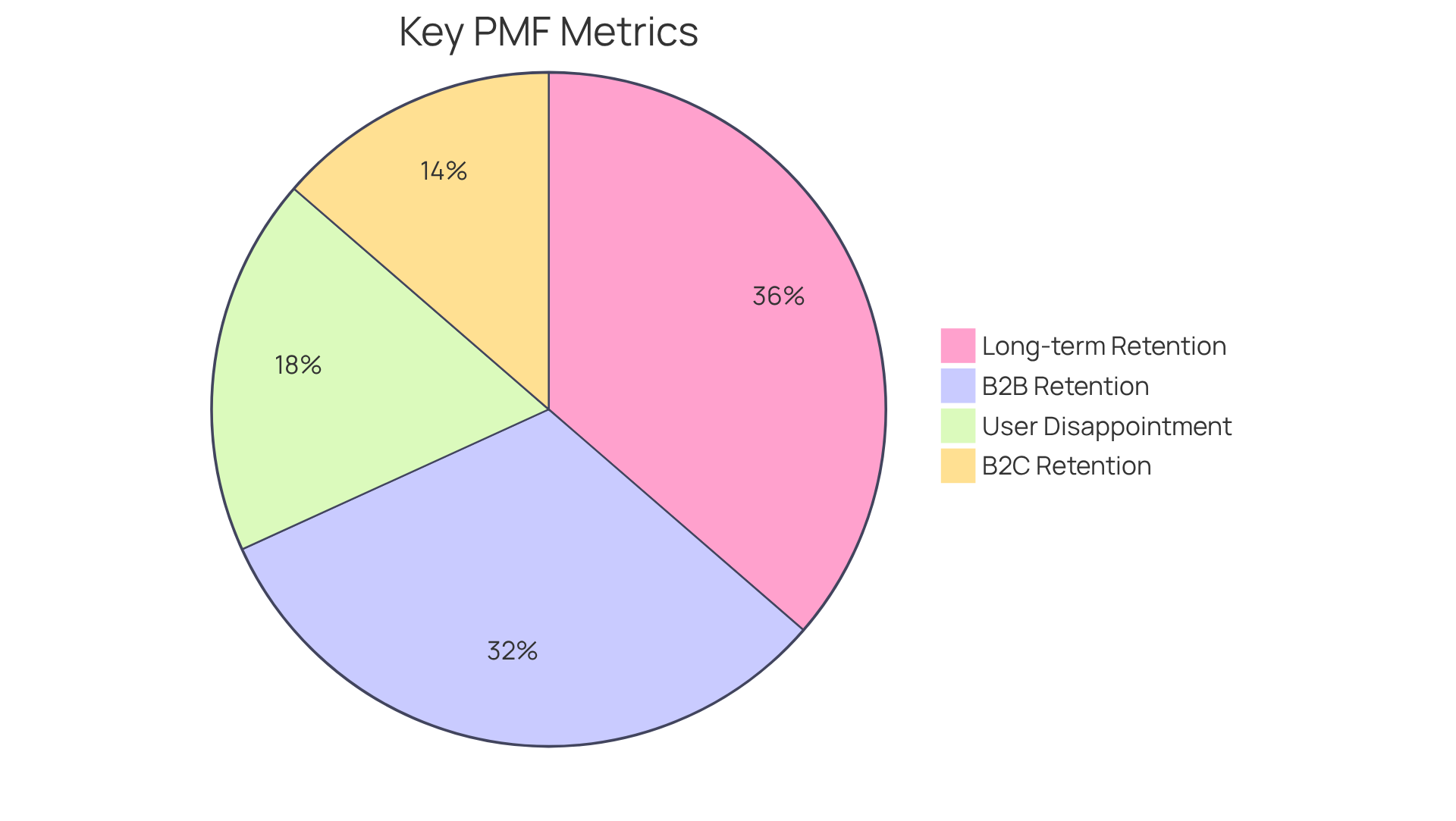

Product-Market Fit: Identifying Alignment for Investment Viability

Recognizing product-market fit is crucial for assessing whether a new venture's offering effectively meets the needs of its target audience. Sales leaders must prioritize clear evidence of customer adoption, retention levels, and positive user feedback. Companies demonstrating high customer satisfaction and low attrition rates often indicate strong product-market alignment, making them more attractive investment opportunities. According to industry insights, a retention percentage exceeding 30% serves as a solid benchmark for B2C products, while B2B products should aim for approximately 70% to ensure long-term sustainability.

Utilizing and engagement metrics provides sales teams with invaluable insights into a company's alignment with market demands. Notably, when 40% of users express that they would be 'very disappointed' if they could no longer access a product, it serves as a compelling indicator of product-market fit. This metric, alongside retention rates, can significantly guide funding decisions by serving as venture capital early indicators, highlighting companies that not only attract users but also retain them effectively.

Successful ventures typically emerge from new businesses that possess a clear understanding of their clients' needs and can adapt their products accordingly. For instance, companies such as Airtable and Slack took over four years to achieve product-market fit, underscoring the importance of patience and continuous iteration in the process. Furthermore, many exceptional B2B products boast over 80% long-term retention, emphasizing the critical nature of sustained user engagement. By focusing on these metrics, sales leaders can more effectively evaluate the viability of new businesses and identify venture capital early indicators to make informed funding decisions.

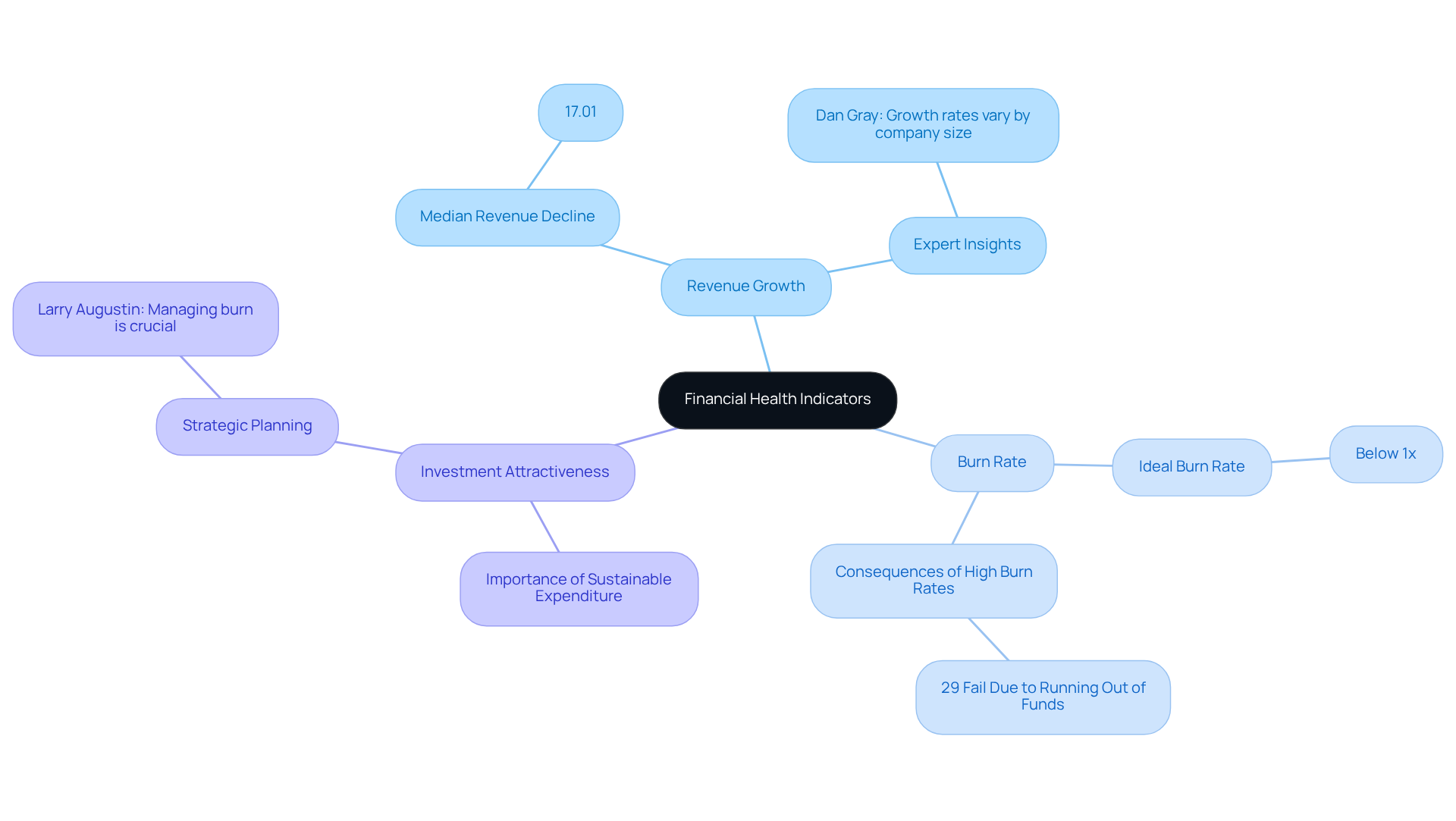

Financial Health: Evaluating Revenue and Burn Rate as Investment Indicators

Evaluating a new business's financial well-being is crucial for making informed investment decisions, particularly in relation to venture capital early indicators like revenue expansion, burn rate, and cash runway. A sustainable expenditure level serves as a key indicator of effective capital management; new ventures that maintain a burn rate below 1x are often seen as venture capital early indicators of prudent expense management. For instance, new businesses with a burn rate aligned with their revenue growth demonstrate a balanced approach to scaling operations.

Burn benchmarks significantly impact the identification of attractive investment opportunities. In 2025, the median revenue decline percentage for new businesses was reported at 17.01%, with the 25th percentile at 6.07%. These figures underscore the importance of monitoring both revenue growth and expenditures to evaluate a new venture's potential for long-term success. Financial analysts emphasize that a sustainable expenditure level, combined with robust revenue growth, enhances a new venture's appeal to investors, which are considered venture capital early indicators. Notably, 29% of new businesses fail due to running out of funds, highlighting the critical need for diligent expenditure tracking.

Successful investment strategies often rely on a comprehensive analysis of these metrics. For example, new ventures demonstrating consistent revenue growth alongside controlled expenditures are more likely to secure financing. As industry experts assert, "Managing burn is what it’s all about. People get into trouble because they plan for what they’ll do with the next funding round rather than plan based on the funding they already have." This statement emphasizes the necessity for regarding burn levels.

In conclusion, a thorough assessment of burn rates not only aids in evaluating a startup's financial health but also serves as a vital component in gauging venture capital early indicators of its attractiveness to investors. By leveraging these insights, sales leaders can make more informed decisions when engaging with potential funding opportunities. Furthermore, the median sales and marketing multiple for 2025, approximately 3x, provides additional context on investment attractiveness and financial metrics.

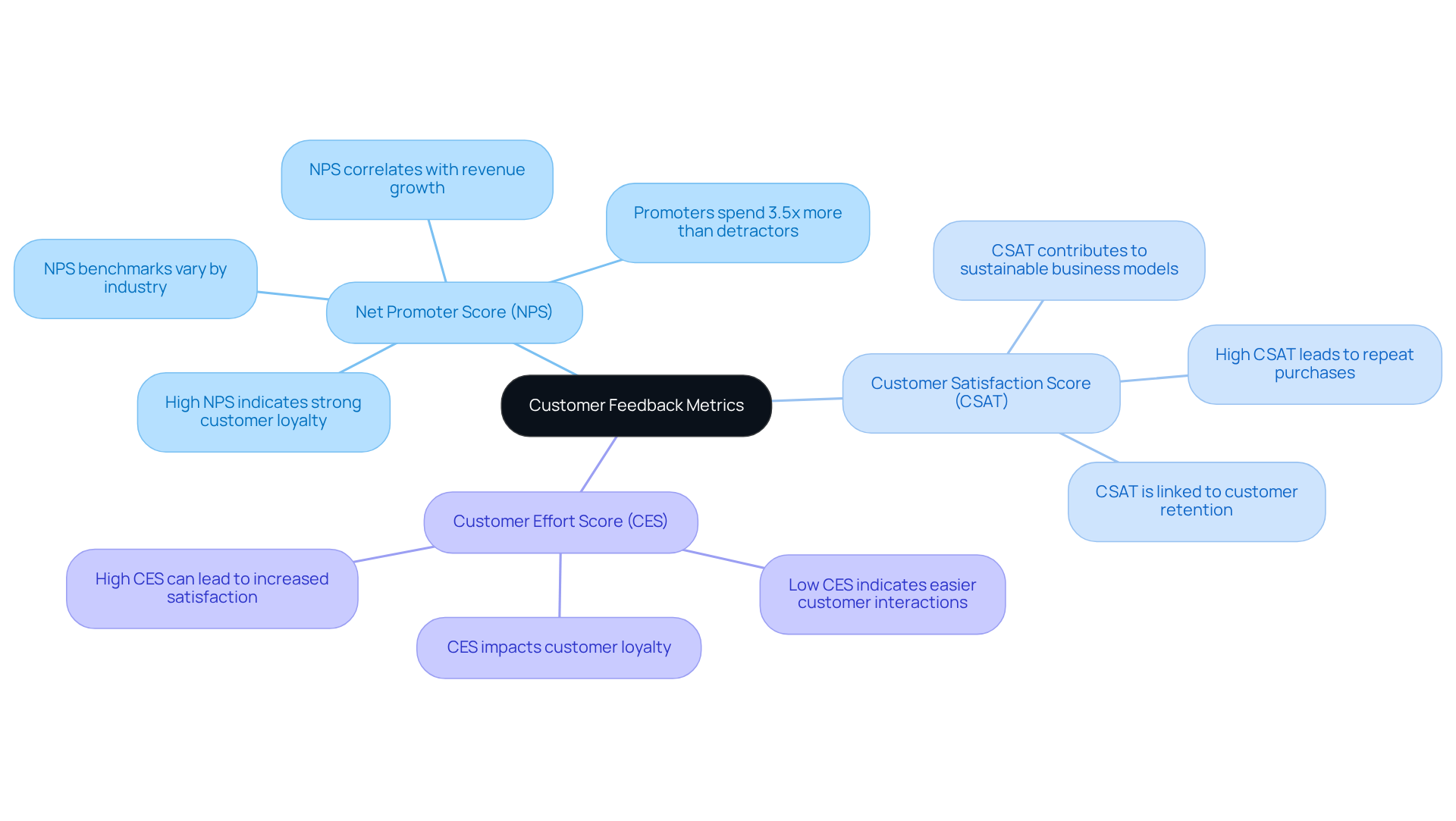

Customer Feedback: Leveraging Engagement Metrics for Investment Insights

Examining customer feedback is paramount for assessing new ventures, particularly through engagement metrics that serve as venture capital early indicators, such as Net Promoter Score (NPS), customer satisfaction scores, and retention rates.

Sales leaders must focus on new ventures that exhibit robust customer loyalty and favorable feedback, as these venture capital early indicators often signify a sustainable business model. For instance, new businesses boasting a high NPS typically enjoy a solid customer base, which can significantly bolster future growth.

In 2025, the average NPS for high-growth companies is projected to hover around 62, reflecting healthy satisfaction levels. Companies achieving an NPS score exceeding 62 exemplify exceptional customer satisfaction.

By leveraging tools that aggregate customer feedback, sales teams can extract actionable insights into a new business's market performance, thus providing venture capital early indicators to facilitate informed funding decisions.

Furthermore, successful financial contributions are often linked to new businesses that prioritize customer engagement metrics, which serve as venture capital early indicators, showcasing their commitment to understanding and meeting customer needs.

As Sobot aptly notes, 'Customer feedback is a goldmine for actionable insights.' This strategic approach not only amplifies the chances of identifying promising ventures but also aligns with the increasing focus on in today's competitive landscape.

Moreover, combining NPS with additional metrics like Customer Satisfaction Score (CSAT) and Customer Effort Score (CES) offers a comprehensive view of customer engagement, further informing investment strategies.

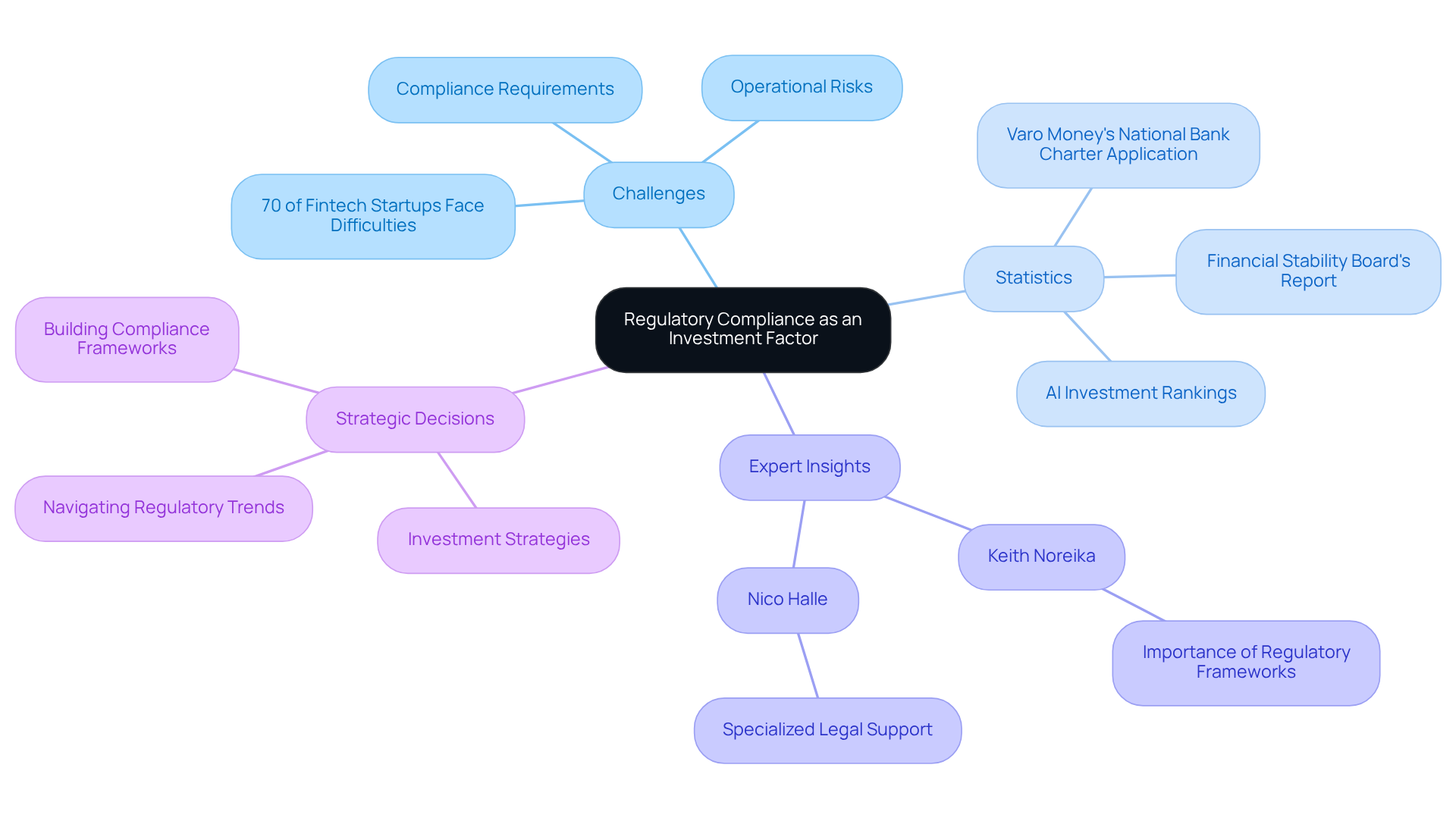

Regulatory Environment: Understanding Compliance as an Investment Factor

Navigating the regulatory landscape is essential for evaluating a new business's compliance obligations, especially in sectors such as fintech and healthcare, where regulations are particularly stringent. Sales leaders must recognize that regulatory changes can profoundly influence a new business's operational capabilities and growth trajectory. For instance, compliance challenges are prevalent in fintech, with a staggering 70% of new companies reporting difficulties in meeting regulatory requirements, which can significantly hinder their attractiveness to investors. The Financial Stability Board has identified ten that demand the attention of authorities, underscoring the challenges faced by these new ventures.

Experts emphasize that a robust compliance framework not only mitigates risks but also enhances a new company's credibility with investors. As Keith Noreika, acting Comptroller of the Currency, noted, careful consideration of regulatory frameworks is vital for fostering innovation while ensuring consumer protection. Nico Halle, an expert in fintech regulatory compliance, further asserts that specialized legal support is crucial for assisting companies in navigating these complex challenges.

By staying informed about regulatory trends and compliance mandates, sales teams can make more strategic investment decisions, ultimately pinpointing startups that are well-positioned to thrive in a complex regulatory environment.

Conclusion

Understanding the early indicators of venture capital is essential for sales leaders aiming to identify and capitalize on lucrative investment opportunities. By focusing on key metrics—market trends, startup traction, founding team experience, and financial health—sales leaders can enhance their strategic decision-making and improve their chances of securing funding for promising ventures.

Several critical factors influence investment decisions. Leveraging AI-powered tools like Websets for lead generation is paramount. Additionally, analyzing market shifts for emerging sectors and evaluating customer feedback as a vital investment signal are crucial. Each of these elements serves as an early indicator of venture capital, providing insights that can guide sales strategies and investment planning.

In a rapidly evolving landscape, staying informed about these indicators is not just beneficial—it's imperative. Sales leaders must embrace these strategies and tools to refine their approach, ensuring they are well-positioned to navigate the complexities of venture capital investment. By doing so, they can enhance their own success and contribute to the growth of innovative startups poised to shape the future.

Frequently Asked Questions

What is Websets and how does it enhance lead generation?

Websets is an AI-powered platform that transforms B2B lead generation by using advanced algorithms to help sales leaders identify profitable opportunities with high precision. It enables users to navigate extensive datasets to find professionals or organizations that align with their funding standards, enhancing accuracy and significantly reducing the time spent on lead qualification.

How does Websets support decision-making for sales teams?

Websets provides enhanced data, including LinkedIn profiles, emails, and comprehensive work histories, which supports informed decision-making regarding potential investment opportunities. This enables sales teams to focus on high-potential prospects.

What are the current trends in AI adoption for lead generation?

Currently, 75% of businesses are using or planning to use AI tools for lead generation. Companies that utilize AI for lead scoring have seen a 51% increase in lead-to-deal conversion rates, highlighting the effectiveness of AI in improving lead generation strategies.

How can sales leaders identify early indicators of investment opportunities?

Sales leaders can identify early indicators of investment opportunities by closely observing market trends, particularly shifts towards sustainable technologies or AI-driven solutions. Using Websets' AI-powered sales intelligence, they can analyze detailed company profiles and market trends to discern patterns indicating where venture capital is flowing.

What role does Websets News Monitor play in investment analysis?

Websets News Monitor provides real-time updates on relevant sectors, enhancing the ability of sales teams to detect venture capital early indicators in the market landscape. This proactive approach helps align strategies with market demands.

What growth metrics should sales leaders evaluate for new ventures?

Sales leaders should evaluate essential growth metrics such as Monthly Recurring Revenue (MRR), customer acquisition costs (CAC), and user engagement rates. Consistent growth patterns in these metrics are strong indicators of a venture's potential success.

What is the average customer acquisition cost (CAC) for B2B SaaS firms?

The average CAC for B2B SaaS firms is approximately $656, while new businesses in 2025 have an average CAC of $225 per customer. Understanding these benchmarks is crucial for evaluating a venture's performance.

How does Websets assist in analyzing customer acquisition costs and user engagement metrics?

Websets provides AI-driven tools for B2B lead generation and data analysis, allowing sales teams to access real-time data to evaluate customer acquisition costs and user engagement metrics effectively. This access enables informed decision-making and strategic planning.