Overview

This article delineates best practices for sourcing candidates for venture capital (VC) positions by leveraging job data. Understanding industry dynamics is paramount; it sets the foundation for identifying the essential skills and experiences required in this competitive field. By utilizing job data effectively, firms can pinpoint candidates who not only possess the necessary qualifications but also align with the goals and culture of VC firms. Furthermore, conducting thorough background checks is crucial to ensure that candidates meet these standards, ultimately fostering a more cohesive and successful team.

Introduction

Navigating the intricate landscape of venture capital demands a keen understanding of emerging trends and effective sourcing strategies. With sectors such as healthcare, AI, and clean technology on the brink of explosive growth, identifying and attracting the right talent has never been more crucial.

But how can investors ensure they are sourcing candidates with the necessary skills while also aligning with their firms' strategic goals? This article explores best practices for leveraging job data to enhance VC sourcing, providing insights that can transform recruitment efforts and drive successful investment outcomes.

Understand the Venture Capital Landscape

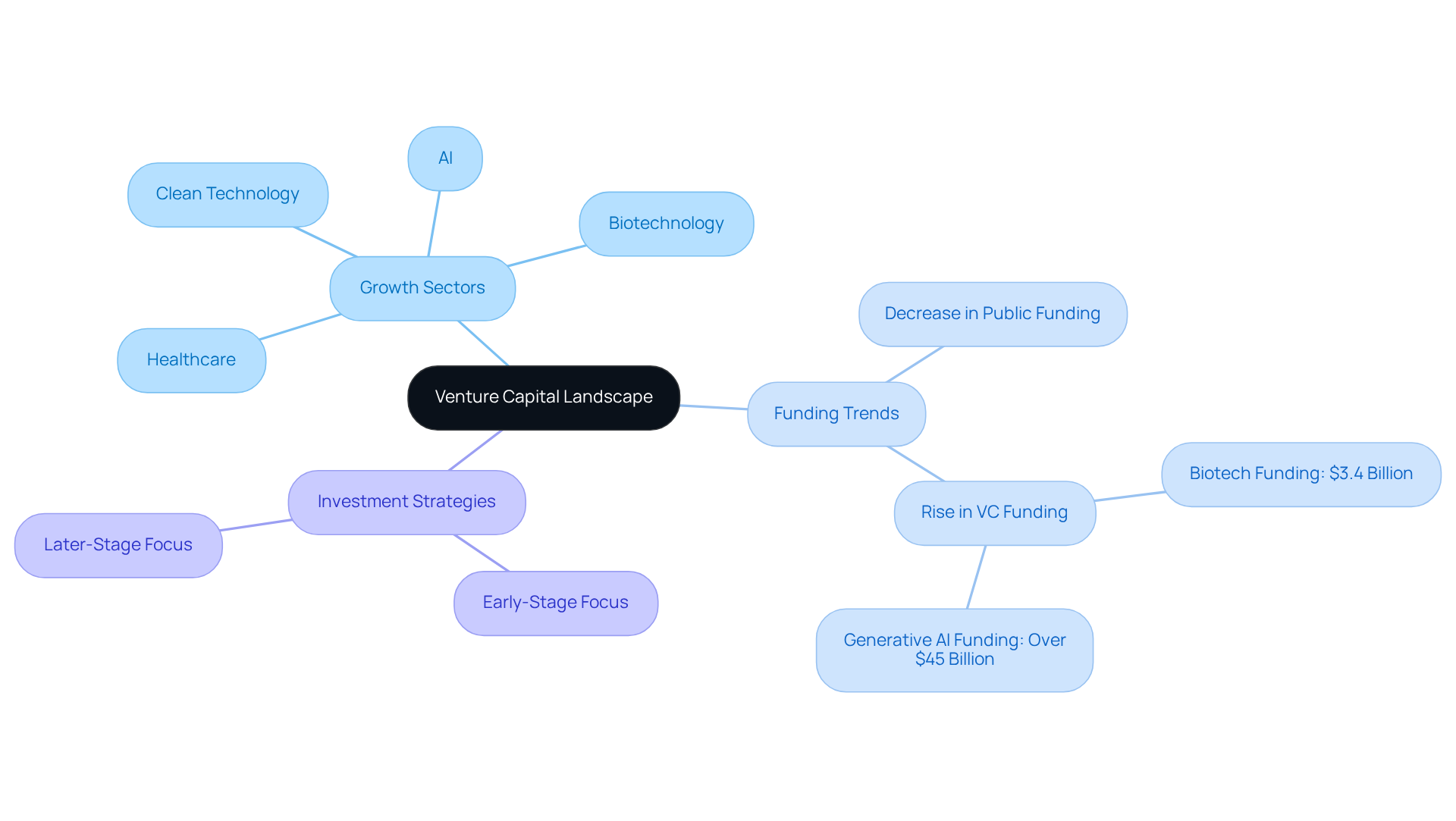

To effectively identify prospects for venture capital positions, grasping the current is crucial. Recognizing the categories of new ventures attracting investment, identifying growth sectors, and understanding the profiles of successful entrepreneurs is essential. In 2025, sectors such as healthcare, biotechnology, AI, and clean technology will experience significant VC interest, driven by their potential for innovation and sustainability. Notably, while public funding for biotechnology has decreased by 56%, VC funding rose to $3.4 billion, marking a 76% year-over-year increase. Familiarizing yourself with these trends will enable you to pinpoint candidates who align with the strategic goals of investors.

Moreover, understanding the investment strategies of various VC firms is essential. Some firms may prioritize early-stage ventures, while others focus on later-stage companies with proven track records. The increase in venture capital funding in generative AI, which exceeded $45 billion worldwide in 2024, demonstrates a distinct inclination for new companies utilizing advanced technologies. As experts widely agree, "2025 will mark a widespread return to IPO and deal activity, following years of low activity." By understanding these nuances, you can improve your sourcing efforts and implement best practices for VC sourcing with jobs data, ensuring that individuals not only fit the roles but also align with the specific needs and preferences of the investors.

Leverage Job Data for Effective Sourcing

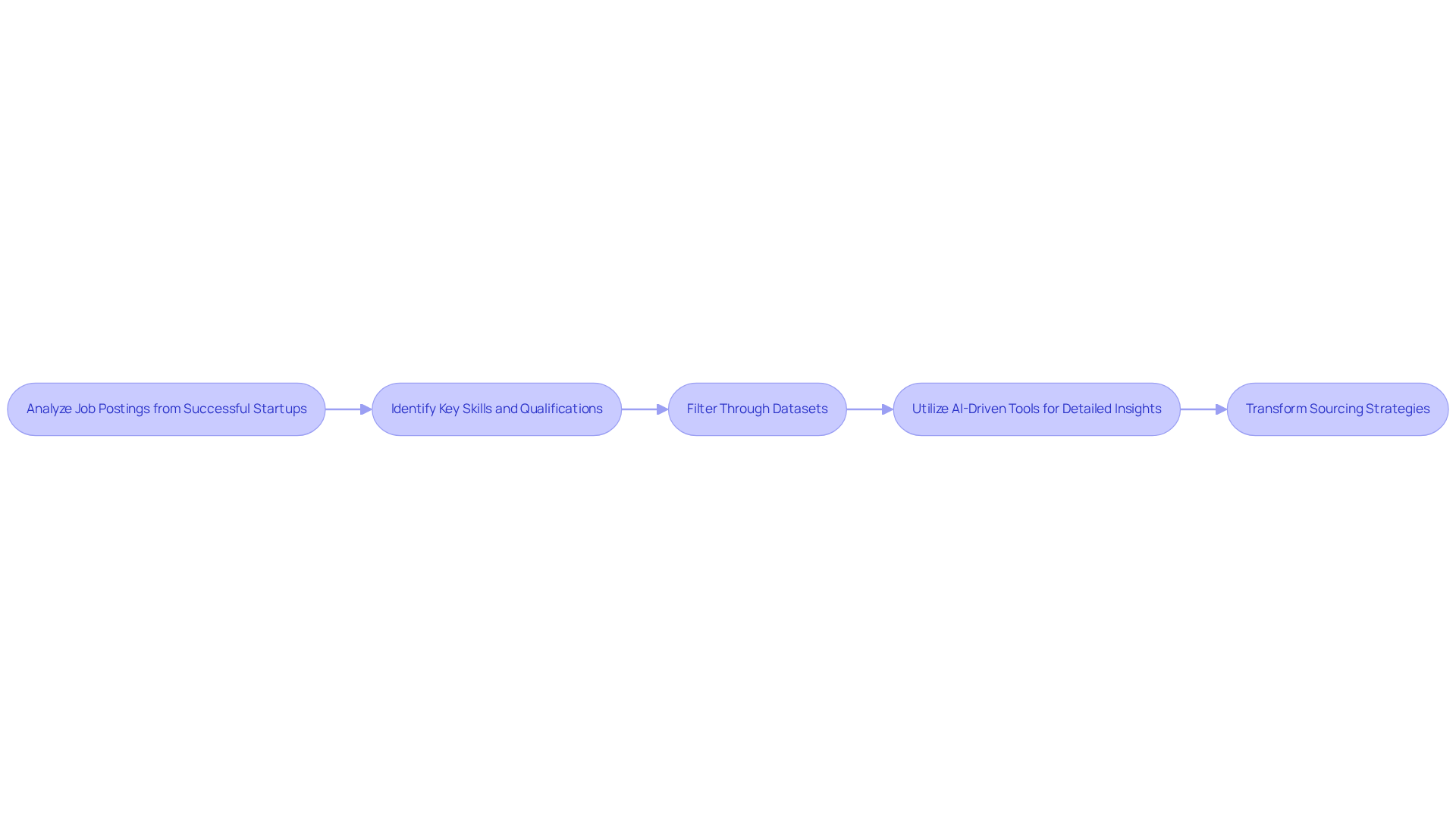

Effectively utilizing job data can significantly enhance your best practices for vc sourcing with jobs data. Start by analyzing job postings from successful startups and venture-backed companies to uncover the best practices for vc sourcing with jobs data that highlight the common skills and qualifications increasingly sought after. As the tech sector evolves, individuals demonstrating proficiency in AI, data analytics, and growth metrics are becoming essential. Platforms like Websets provide valuable insights into applicant profiles, showcasing their previous roles, skills, and achievements. By filtering through extensive datasets, you can identify individuals who not only fulfill the technical requirements but also possess a proven track record in similar environments.

Moreover, leveraging AI-driven tools can enhance your search results with detailed information, such as LinkedIn profiles and comprehensive work histories, offering a complete perspective of potential applicants. This method not only simplifies the sourcing process but also adheres to with jobs data, ensuring that you are reaching the right talent for your capital requirements. Are you ready to transform your sourcing strategies and secure the talent that will drive your success?

Highlight Relevant Experience and Skills

When seeking individuals for venture capital positions, it is crucial to articulate the relevant experience and skills necessary for success. Candidates with backgrounds in finance, entrepreneurship, or technology are often indispensable in the VC landscape. Specific experiences, such as:

- Previous roles in startups

- Involvement in fundraising

- Expertise in market analysis

should be highlighted. Moreover, soft skills like:

- Strategic thinking

- Communication

- Adaptability

are vital for navigating the dynamic world of venture capital.

The allure of serves as a significant incentive for applicants. Networking and leveraging existing connections are essential for enhancing sourcing efforts. Candidates must possess a profound understanding of the market and demonstrate a genuine passion for startups—critical factors in the VC hiring process. By clearly defining these criteria in your job descriptions and sourcing strategies, you can apply the best practices for VC sourcing with jobs data to attract applicants who are not only qualified but also aligned with the culture and objectives of VC firms.

Test and Validate Candidate Backgrounds

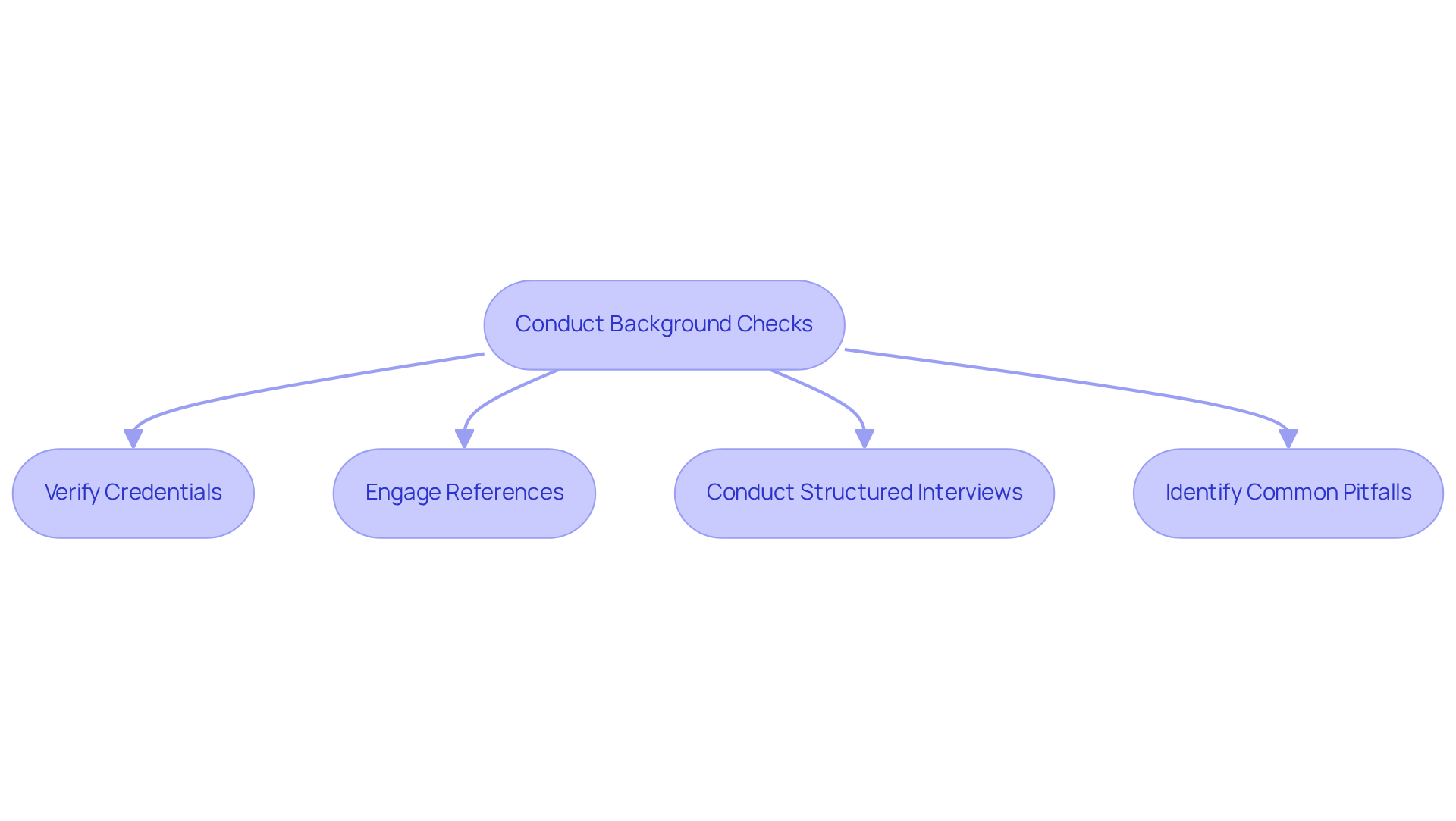

Conducting thorough background checks is imperative to follow best practices for vc sourcing with jobs data when sourcing the right individuals for venture capital roles. Begin by verifying educational qualifications and previous employment. Leverage platforms like Websets to access enriched data that offers insights into an applicant's work history and professional achievements, following the best practices for vc sourcing with jobs data. Consider these actionable steps:

- Verify Credentials: Utilize Websets to cross-check educational qualifications and employment history.

- Engage References: Reach out to references provided by the applicant to gain insights into their past performance.

- Conduct Structured Interviews: Focus interviews on the individual's contributions in previous roles and their work ethic.

- Identify Common Pitfalls: Be vigilant for potential red flags, such as gaps in employment or inconsistent information across sources.

This method not only validates the candidate's background but also sheds light on their work ethic and cultural fit within the VC firm. With a 26% year-over-year increase in from VCs, it is essential to follow best practices for vc sourcing with jobs data to mitigate risks and enhance the quality of your hiring decisions. As Michael Karran aptly notes, "you’re not so much investing in a startup as you are investing in the leadership, judgment, and integrity of its management." This statement underscores the critical nature of thorough vetting in safeguarding your firm's reputation and ensuring sound investment decisions.

Conclusion

Understanding the nuances of the venture capital landscape and effectively utilizing job data are critical components for successful VC sourcing. Grasping current trends—such as the increasing interest in healthcare and AI—and the unique investment strategies of various firms enables better identification of candidates who not only meet technical requirements but also align with the strategic goals of investors.

The importance of leveraging job data cannot be overstated. It uncovers essential skills and experiences sought by VC firms. Highlighting relevant backgrounds, including startup involvement and expertise in market analysis, along with soft skills such as strategic thinking and adaptability, is vital for attracting the right talent. Furthermore, thorough background checks ensure that candidates possess the integrity and judgment essential for success in venture capital roles.

Implementing these best practices transcends mere position filling; it is about building a robust team capable of driving innovation and success in the competitive venture capital arena. By adopting a data-driven approach and focusing on the right qualifications, firms can enhance their sourcing strategies and secure the talent needed to thrive in a rapidly evolving market. Embracing these insights paves the way for informed hiring decisions that align with the future of venture capital.

Frequently Asked Questions

What is the importance of understanding the venture capital landscape?

Understanding the venture capital landscape is crucial for identifying prospects for venture capital positions. It involves recognizing the categories of new ventures attracting investment, identifying growth sectors, and understanding the profiles of successful entrepreneurs.

Which sectors are expected to attract significant venture capital interest in 2025?

In 2025, sectors such as healthcare, biotechnology, AI, and clean technology are expected to attract significant venture capital interest due to their potential for innovation and sustainability.

How has public funding for biotechnology changed recently?

Public funding for biotechnology has decreased by 56%, while venture capital funding in the sector rose to $3.4 billion, marking a 76% year-over-year increase.

What types of investment strategies do venture capital firms employ?

Venture capital firms may prioritize different investment strategies; some focus on early-stage ventures, while others concentrate on later-stage companies with proven track records.

What trend was observed in venture capital funding for generative AI in 2024?

In 2024, venture capital funding for generative AI exceeded $45 billion worldwide, indicating a strong inclination towards new companies utilizing advanced technologies.

What is expected for IPO and deal activity in 2025?

Experts widely agree that 2025 will mark a widespread return to IPO and deal activity, following years of low activity.

How can understanding venture capital trends improve sourcing efforts?

By understanding the nuances of venture capital trends, one can enhance sourcing efforts and implement best practices for VC sourcing, ensuring candidates fit roles and align with the specific needs and preferences of investors.