Overview

This article delineates four essential steps for identifying startups prior to their funding rounds. Understanding the startup landscape is crucial, as it lays the foundation for effective search strategies. Engaging with startup communities further enhances this process, allowing for deeper insights into emerging ventures. Evaluating startups for investment potential is the final step, ensuring that you can discern promising opportunities early on.

Each step is fortified with actionable insights:

- Leverage online platforms for comprehensive research

- Attend industry events to expand your network

- Apply evaluation frameworks to rigorously assess new ventures

By following these strategies, you will significantly enhance your ability to identify lucrative investment opportunities at their inception.

Introduction

Identifying promising startups before they secure funding can be a game-changer for investors and entrepreneurs alike. As the startup landscape evolves rapidly, understanding the nuances of emerging sectors such as fintech, healthtech, and artificial intelligence becomes crucial for spotting the next big opportunity.

But how can one effectively navigate this dynamic environment and uncover hidden gems before they attract significant investment? This article delves into practical strategies and insights that empower readers to find startups on the brink of success, ensuring they stay ahead in the competitive world of venture capital.

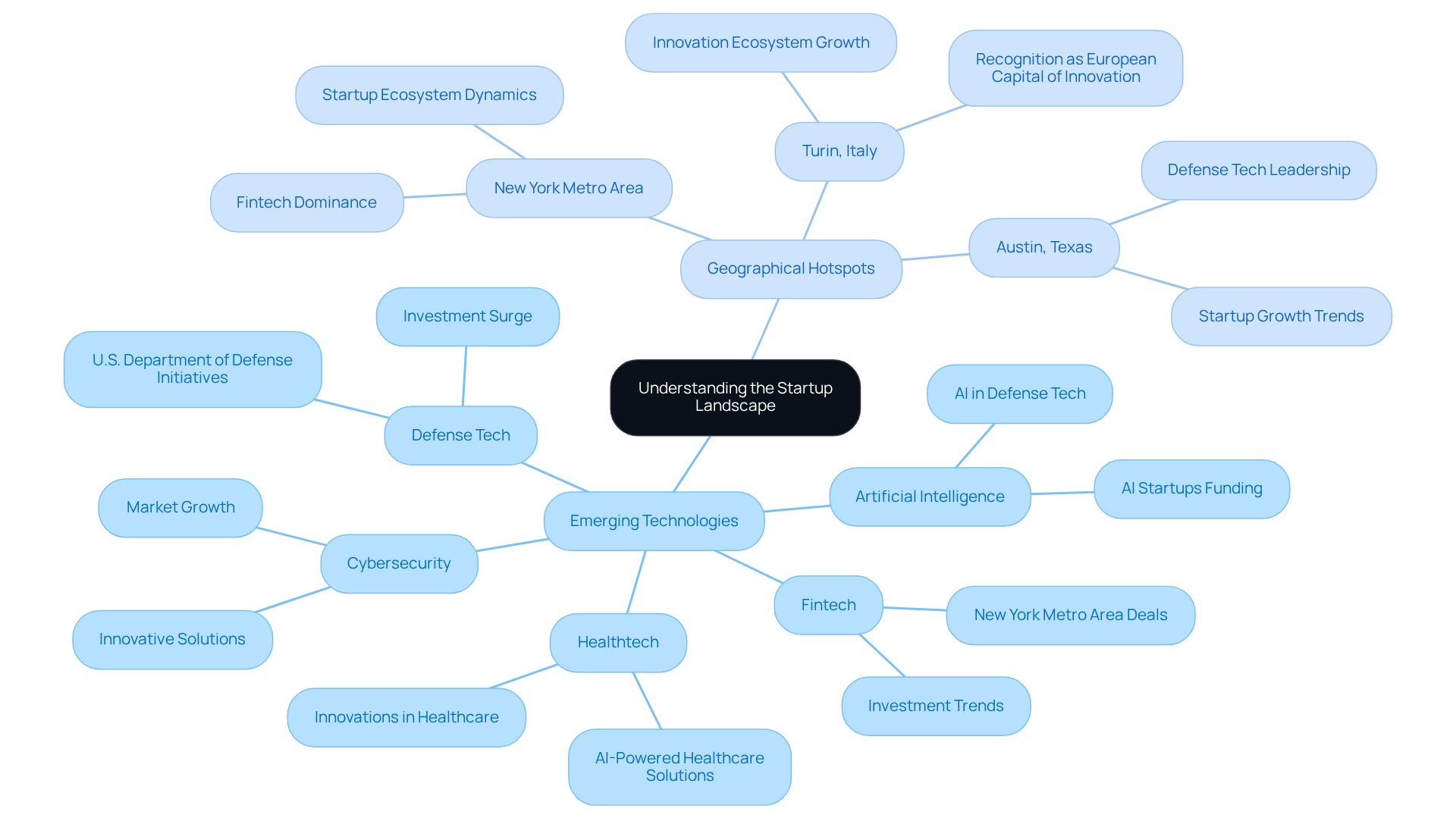

Understand the Startup Landscape

To effectively identify new ventures, it is crucial to understand how to by comprehending the current entrepreneurial landscape. This necessitates extensive research across diverse sectors, with a particular emphasis on emerging technologies like artificial intelligence, fintech, and healthtech—fields that are increasingly drawing early investments. The Global Startup Ecosystem Report 2025 provides critical insights into trends and growth opportunities, underscoring that the logistics sector alone is anticipated to expand from $11.23 trillion in 2025 to $23.14 trillion by 2034, propelled by innovations in supply chain technology and the surging demands of e-commerce.

Moreover, recognizing geographical hotspots is vital, as certain regions showcase more dynamic ecosystems. For example:

- The New York metro area accounts for 30% of U.S. fintech deals, outpacing San Francisco.

- Austin, Texas, boasts a defense tech deal share that is three times the national average.

By grasping these dynamics and leveraging reliable data sources, you position yourself to understand how to find startups before they raise funding, ultimately enhancing your strategic decision-making in the investment landscape.

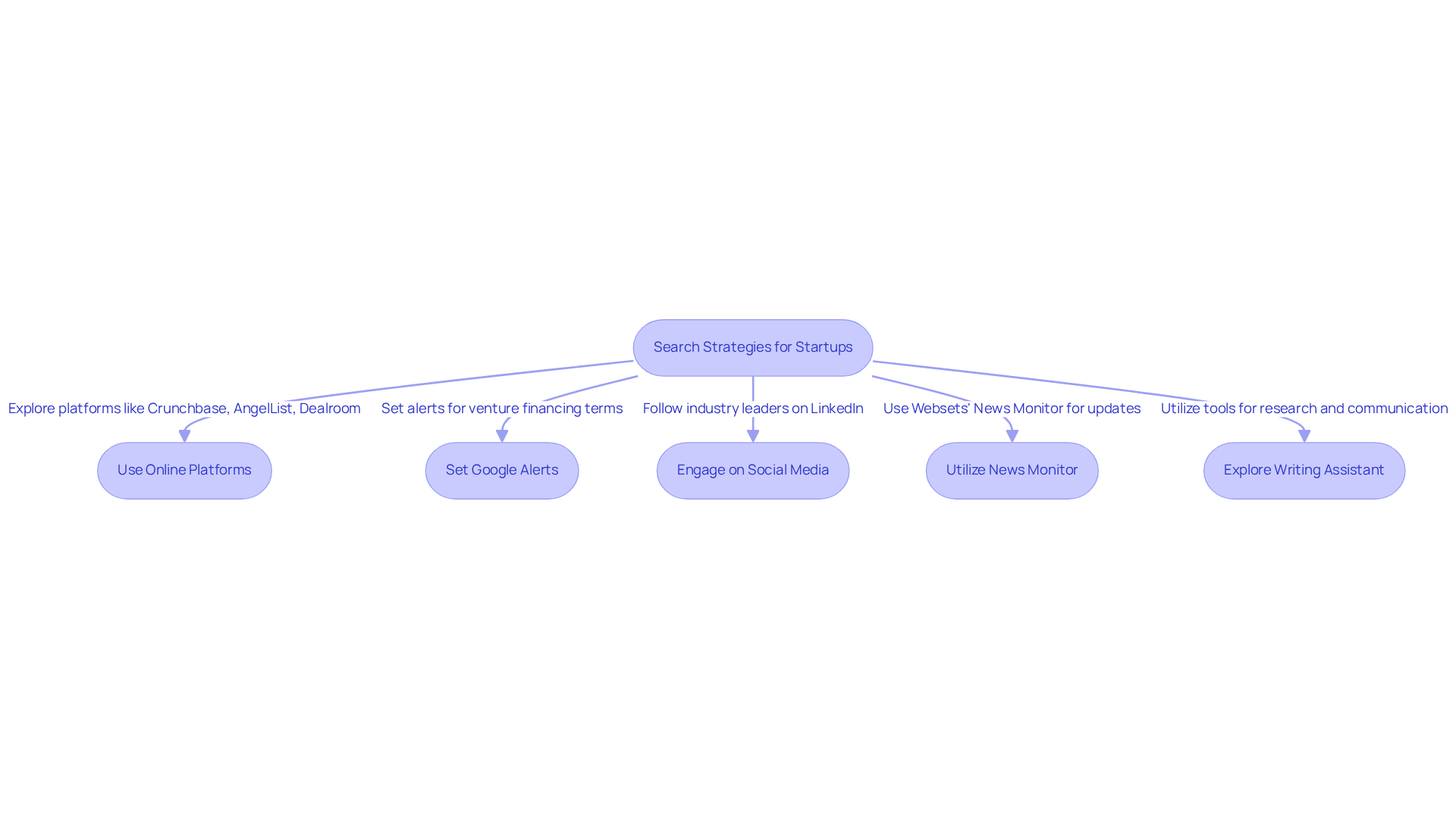

Utilize Effective Search Strategies

Recognizing how to find startups before they raise funding is crucial. Utilize various online platforms and databases such as Crunchbase, , and Dealroom. These resources provide comprehensive insights into new ventures, including their financial backgrounds and key personnel. Notably, AngelList allows users to filter new ventures by financial status, making it easier to identify recently financed firms. Employ advanced search filters to narrow your results by sector, location, and investment stage, ensuring you uncover the most relevant opportunities.

To stay informed, establish Google Alerts for terms related to venture financing and market trends, providing you with timely updates. Engaging on social media platforms like LinkedIn is equally essential; follow industry leaders and participate in relevant groups to remain updated on emerging ventures. Interacting with new business creators is essential for understanding how to find startups before they raise funding, which can prevent you from appearing as an arbitrary salesperson later on.

Consider utilizing Websets' News Monitor for real-time updates on science, politics, finance, and new business investments, which can enhance your lead generation efforts. Additionally, explore Websets' Hallucination Detector and Writing Assistant to streamline your research and communication with potential leads. By implementing these strategies, you can effectively learn how to find startups before they raise funding, especially as early-stage funding approached nearly $30 billion for over 1,700 firms in Q3 2025.

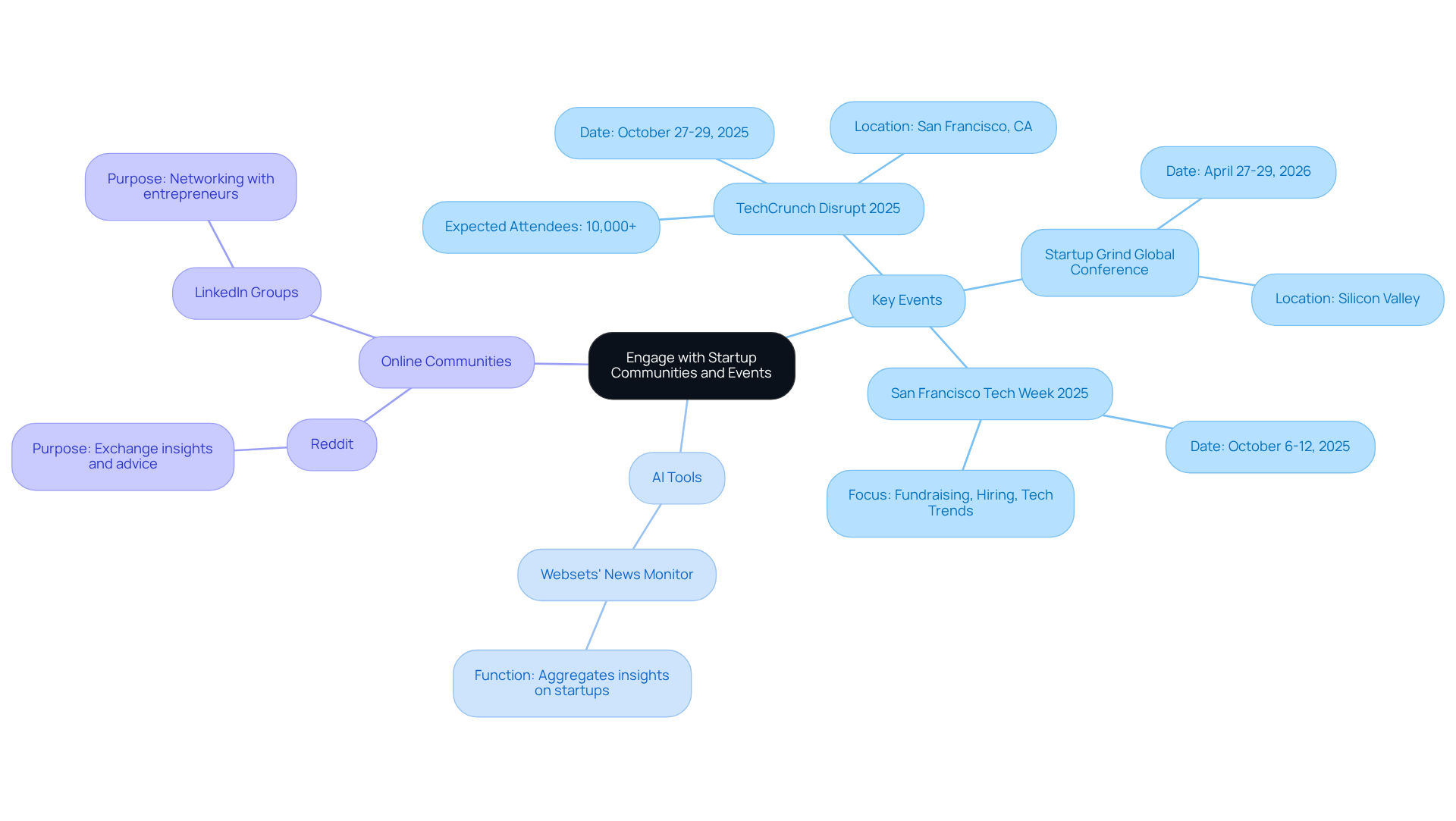

Engage with Startup Communities and Events

To effectively connect with emerging businesses, immerse yourself in dynamic and attend key events. Look for local gatherings, pitch contests, and sector conferences where new businesses showcase their innovations. Significantly, TechCrunch Disrupt 2025, scheduled for October 27-29 in San Francisco, is expected to attract over 10,000 participants, including early-stage companies and prominent venture capitalists. This event presents a prime opportunity to connect with founders and gain insights into their ventures. Similarly, the Startup Grind Global Conference serves as a valuable platform for networking and learning from industry leaders.

Furthermore, consider leveraging Websets' AI-powered tools, such as the News Monitor, which aggregates insights on science, politics, finance, and funding for new ventures. This tool can enhance your lead generation and market research efforts by delivering timely information on emerging businesses. Additionally, joining online communities and forums where entrepreneurs exchange insights and seek advice can be highly beneficial. Platforms like Reddit and LinkedIn groups are invaluable for connecting with entrepreneurs and investors. By actively engaging in these communities and utilizing Websets' tools, you can discover how to find startups before they raise funding and potentially identify investment opportunities. Engaging in these environments not only broadens your network but also positions you to recognize promising ventures early in their development.

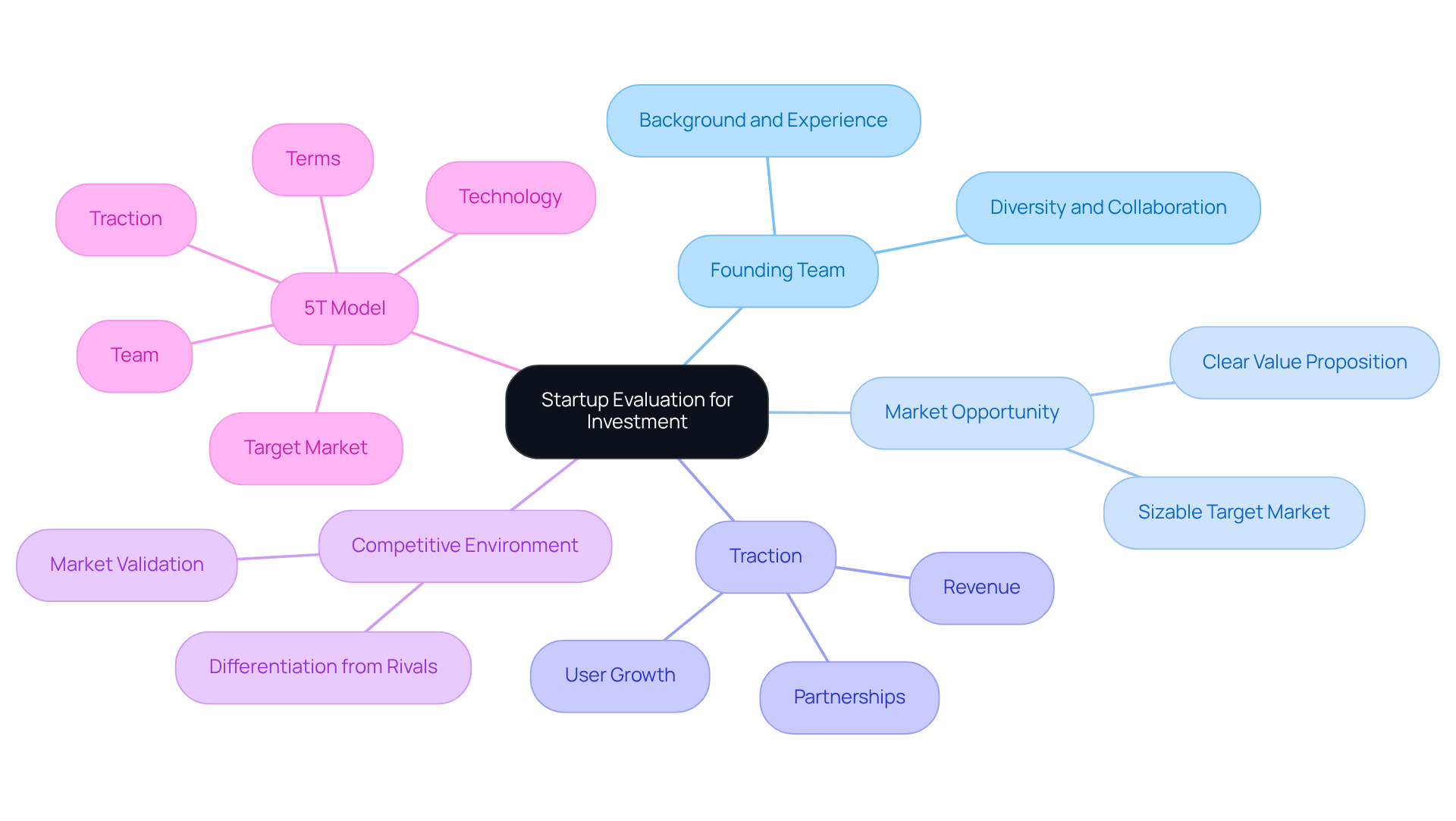

Evaluate Startups for Investment Potential

When assessing new ventures for , it is essential to consider several key factors. Start by evaluating the founding team’s background and experience; a strong team is often a predictor of success. Next, analyze the company's market opportunity—look for a sizable target market and a clear value proposition. Assess the new venture's traction, including user growth, revenue, and partnerships, as these indicators can signal market validation. Furthermore, examine the competitive environment; recognizing how the new venture distinguishes itself from rivals is crucial.

Utilize frameworks such as the 5T model (Team, Target Market, Technology, Traction, and Terms) to systematically evaluate each new venture. By applying these evaluation criteria, you can make informed investment decisions and discover how to find startups before they raise funding, which have high growth potential.

Conclusion

Identifying startups before they secure funding represents a strategic advantage that can profoundly influence investment decisions. By comprehensively understanding the startup landscape and employing effective search strategies, investors can engage with entrepreneurial communities and evaluate potential investments, positioning themselves at the forefront of innovation and growth.

This article outlines critical steps for discovering emerging ventures, emphasizing the importance of researching sectors like fintech and healthtech. Leveraging platforms such as Crunchbase and AngelList, alongside active participation in networking events, enhances visibility into the startup ecosystem while fostering valuable connections with founders and industry leaders.

Ultimately, the ability to find startups before they raise funding transcends mere early access; it revolves around making informed decisions that can lead to successful investments. By employing the insights and tools discussed, investors can adeptly navigate the evolving startup landscape and seize opportunities that align with their strategic goals. Engaging proactively with this dynamic environment can yield significant rewards, making it essential for those aspiring to thrive in the competitive realm of early-stage investments.

Frequently Asked Questions

Why is it important to understand the startup landscape?

Understanding the startup landscape is crucial for effectively identifying new ventures before they raise funding, which involves extensive research across diverse sectors, particularly in emerging technologies.

What sectors are emphasized when researching startups?

The article emphasizes emerging technologies such as artificial intelligence, fintech, and healthtech as key sectors attracting early investments.

What insights does the Global Startup Ecosystem Report 2025 provide?

The report offers critical insights into trends and growth opportunities, highlighting that the logistics sector is expected to grow significantly, from $11.23 trillion in 2025 to $23.14 trillion by 2034, driven by innovations in supply chain technology and increasing e-commerce demands.

Why is recognizing geographical hotspots important in the startup ecosystem?

Recognizing geographical hotspots is important because certain regions exhibit more dynamic ecosystems, which can influence investment opportunities and strategic decision-making.

Can you provide examples of geographical hotspots for startups?

Yes, the New York metro area accounts for 30% of U.S. fintech deals, surpassing San Francisco, while Austin, Texas, has a defense tech deal share that is three times the national average.

How can leveraging reliable data sources benefit investors?

By leveraging reliable data sources, investors can better understand the startup landscape and make informed strategic decisions regarding investments before startups raise funding.