Overview

This article presents five real-time talent monitoring strategies designed to significantly boost investors' success. By leveraging advanced AI-driven tools, investors can make informed hiring and investment decisions. Utilizing these strategies enables investors to gain critical insights into workforce trends, optimize candidate sourcing, and adapt swiftly to market changes. Ultimately, these practices lead to improved investment outcomes, making them essential for any investor looking to enhance their decision-making process.

Introduction

Real-time talent monitoring is swiftly emerging as a cornerstone of investment success, fundamentally transforming how investors identify opportunities and respond to market dynamics. By leveraging advanced AI-driven solutions, stakeholders can obtain immediate insights into workforce trends, empowering them to make data-informed decisions that align with evolving demands. Yet, as the landscape continues to shift, one must ask: how can investors adeptly navigate the complexities of talent acquisition and retention to maximize their portfolio performance?

Websets: AI-Driven Talent Monitoring Solutions for Investors

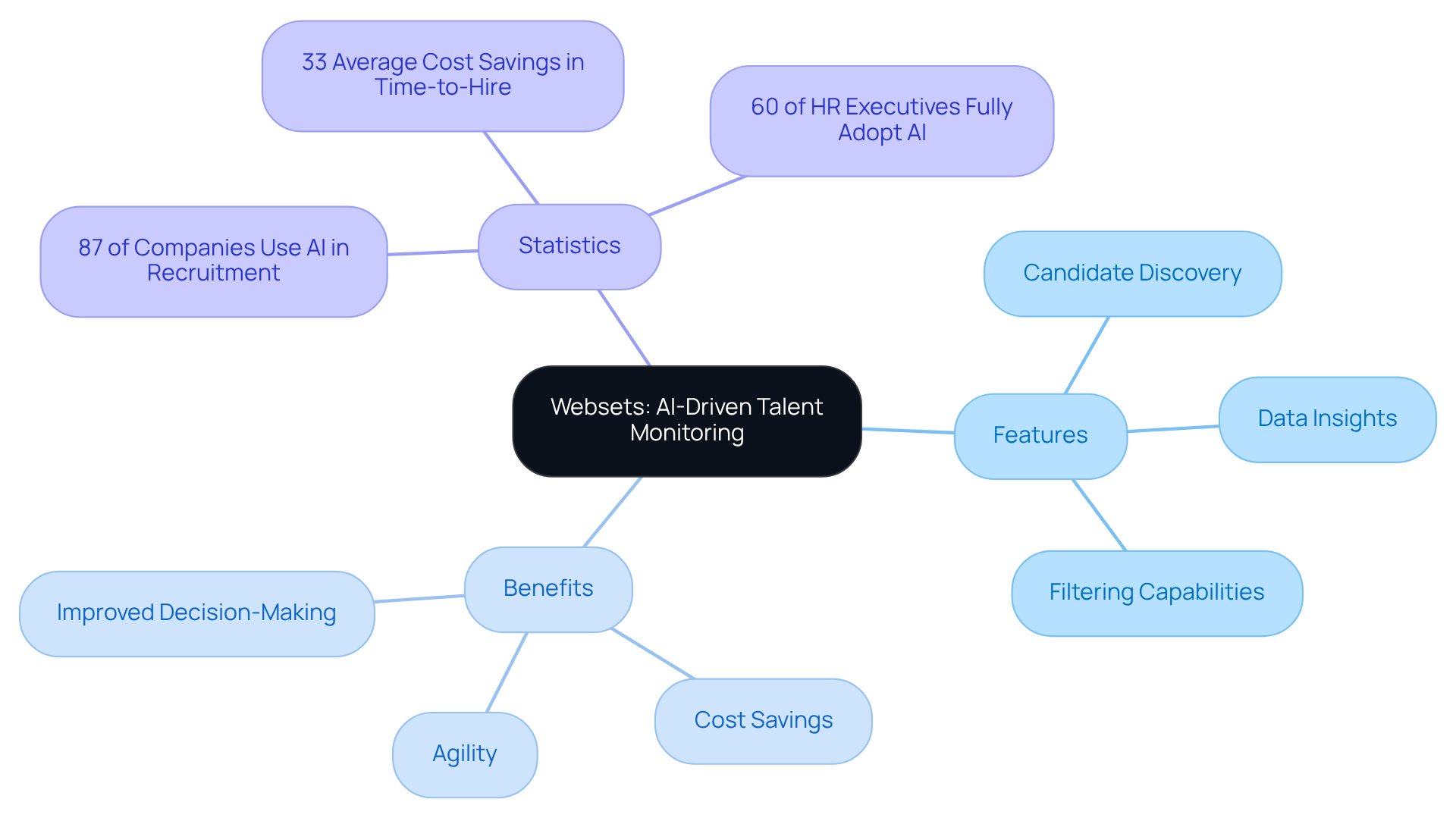

Websets delivers advanced AI-powered solutions that revolutionize real-time talent monitoring for investors and stakeholders. By leveraging sophisticated algorithms and a proprietary search engine designed specifically for large language models (LLMs), the platform facilitates real-time talent monitoring for investors and analysis of workforce trends, ensuring stakeholders have access to the most pertinent information for their strategies. This capability is essential for making informed investment decisions by utilizing real-time talent monitoring for investors, allowing individuals to pinpoint high-potential candidates and accurately assess market dynamics.

With features such as extensive , enhanced data insights, and the ability to filter by skills, experience, and location, Websets is at the forefront of transforming how investors leverage real-time talent monitoring for investors in workforce acquisition and market analysis. The benefits of real-time talent monitoring for investors are significant, including improved decision-making, with organizations reporting average cost savings of 33% in both time-to-hire and cost-per-hire, enhanced candidate sourcing, and the agility to respond swiftly to shifting market conditions, ultimately leading to better investment outcomes.

As Naveen Kumar aptly notes, "AI is no longer optional in recruitment; 87% of companies utilize it, and 60% of HR executives have fully adopted AI in managing personnel." To harness these advantages, stakeholders must consider AI platforms like Websets that offer real-time talent monitoring for investors, along with real-time data analytics and premium support tailored to enterprise needs.

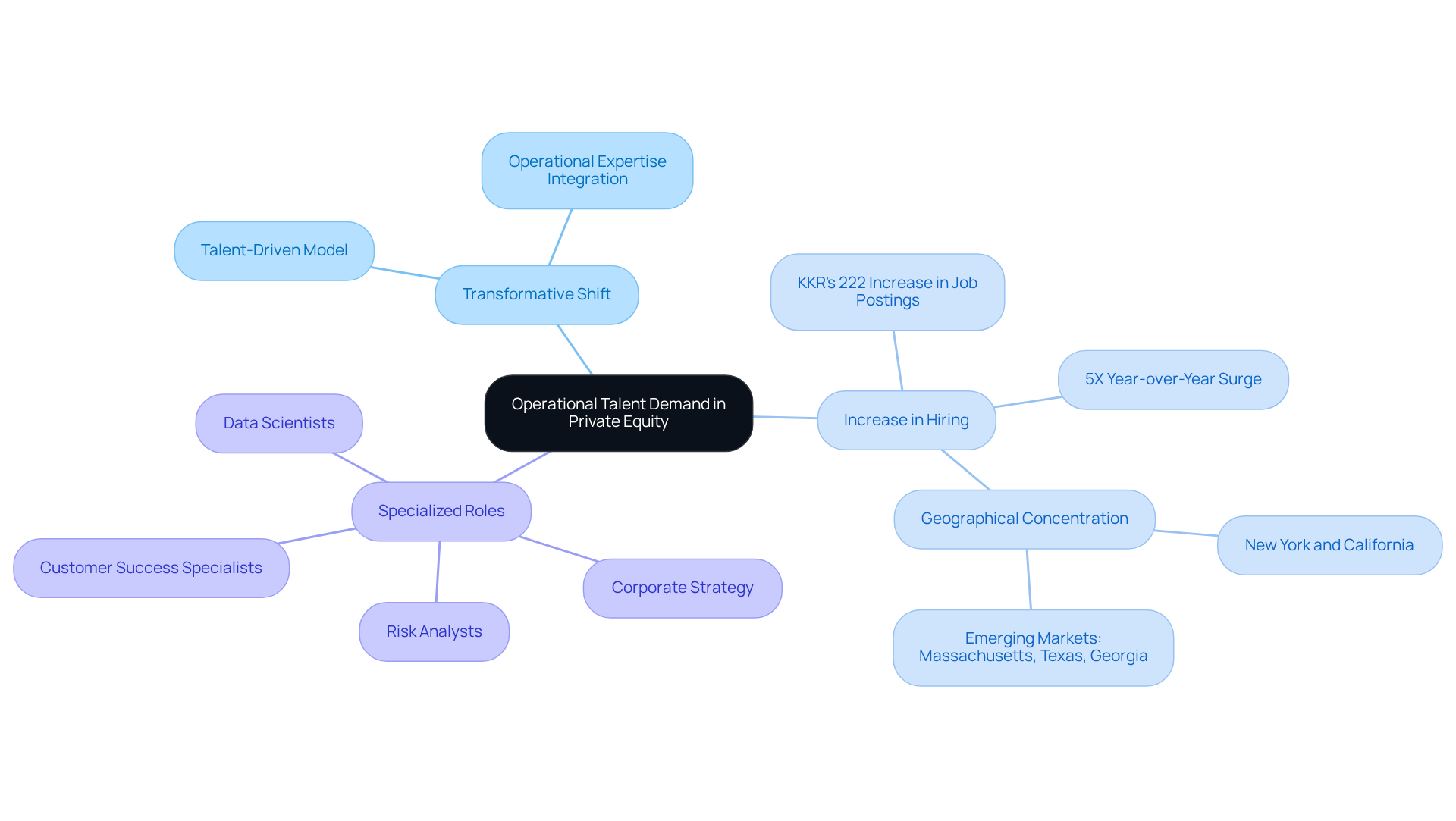

Operational Talent Demand: Understanding the Shift in Private Equity Hiring

The private equity sector is undergoing a transformative shift in its demand for operational expertise, primarily fueled by the increasing necessity for specialized skills and adaptability. As firms transition to a more talent-driven model, the emphasis has moved from traditional hiring practices to a strategic approach that integrates operational expertise within portfolio companies. This evolution is highlighted by an astonishing 5X year-over-year surge in private equity hiring observed in April 2025, underscoring the urgency for firms to adapt to the changing market landscape.

Investors must remain vigilant to these shifts, as they directly influence real-time talent monitoring for investors, hiring practices, and the overall success of their investments. For example, firms like KKR have reported a remarkable 222% increase in job postings, indicative of their expansion into technology and investor services. This trend reflects a growing recognition of the value that contributes to enhancing portfolio performance.

Furthermore, the demand for roles such as:

- Corporate Strategy

- Risk Analysts

- Cross-functional positions like Customer Success Specialists

- Data Scientists

is on the rise, signaling a shift towards embedding specialized skills within teams. As private equity companies increasingly prioritize workforce management, leveraging real-time talent monitoring for investors through online platforms can provide essential insights into the skills currently in demand. AI-driven sales intelligence search enables companies to filter candidates by skills, experience, and location, ensuring that hiring strategies align with the evolving landscape of private equity. As industry experts assert, "Increasingly, today’s workforce leaders are moving beyond traditional hiring responsibilities to serve as strategic HR business partners and trusted advisors to portfolio company CEOs.

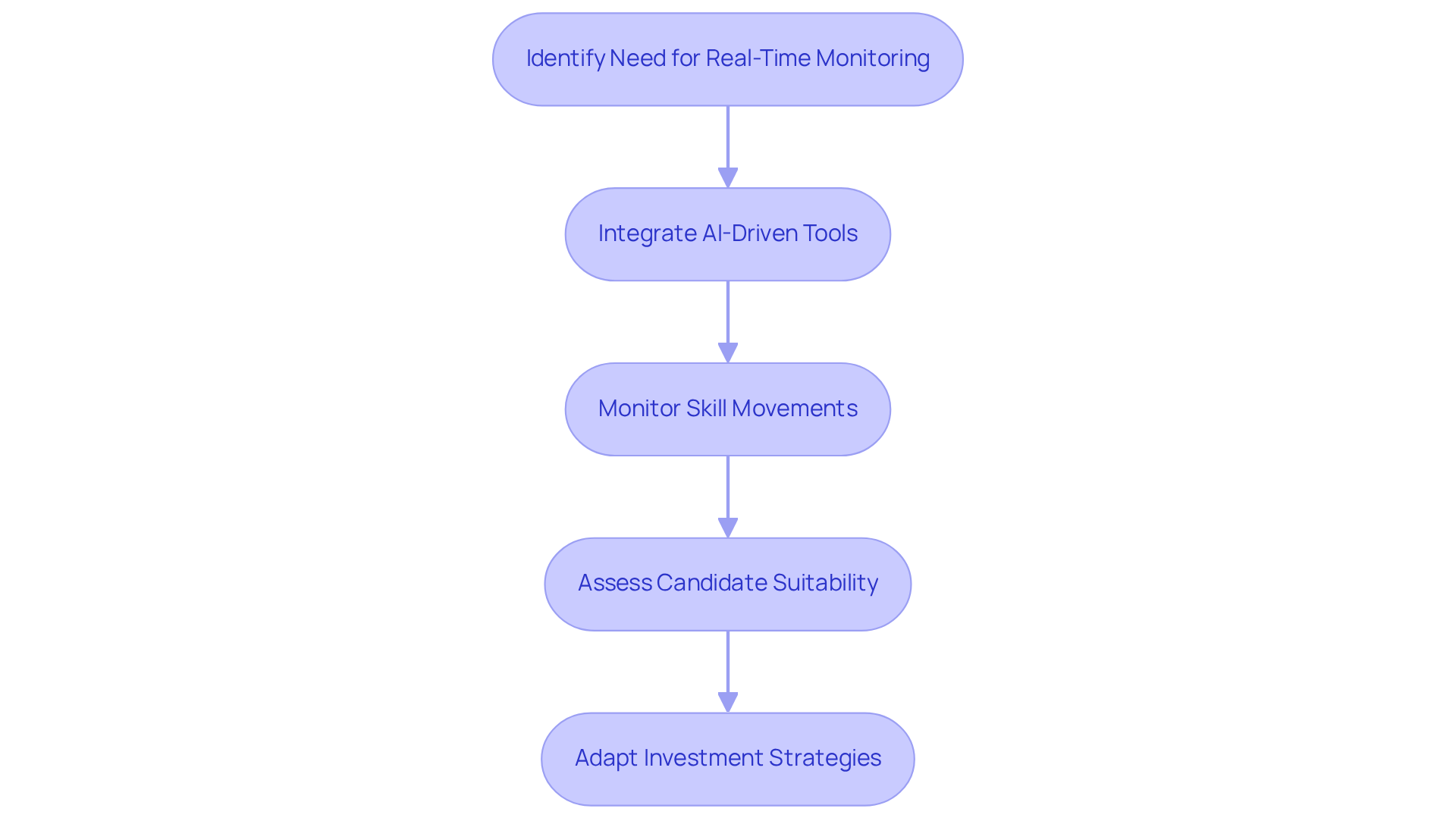

Real-Time Talent Monitoring: A Game Changer for Investment Strategies

Investment strategies are being fundamentally transformed by real-time talent monitoring for investors, which equips them with instant access to crucial information through advanced AI-driven search solutions like those offered by Websets. This capability enables them to monitor skill movements, assess candidate suitability, and swiftly adapt to market fluctuations. By integrating real-time talent monitoring for investors into their investment frameworks, professionals can significantly enhance their competitive advantage and make more informed decisions.

Statistics indicate that 70% of enterprises are anticipated to employ synthetic information for AI and analytics by 2025, underscoring the essential role of real-time information in shaping investment strategies. Experts assert that real-time talent monitoring for investors is no longer optional; it has become a strategic necessity in today’s fast-paced private capital markets. For instance, investment professionals utilizing Websets' Fast API and Research Agentic API can identify high-potential opportunities more rapidly, facilitating prompt evaluations of skills that align with evolving market demands.

Moreover, the integration of real-time data access through real-time talent monitoring for investors fundamentally alters investment strategies. With real-time talent monitoring for investors, they can now make that reflect current market conditions, enhancing due diligence accuracy and optimizing portfolio management. This shift is exemplified by firms leveraging advanced analytics to monitor talent trends, ensuring they stay ahead of the competition in identifying and securing top candidates. As the landscape continues to evolve, the ability to harness real-time insights through tools like Web solutions will be vital for individuals striving to succeed in a dynamic environment.

Hiring Data as a Market Signal: Insights for Investors

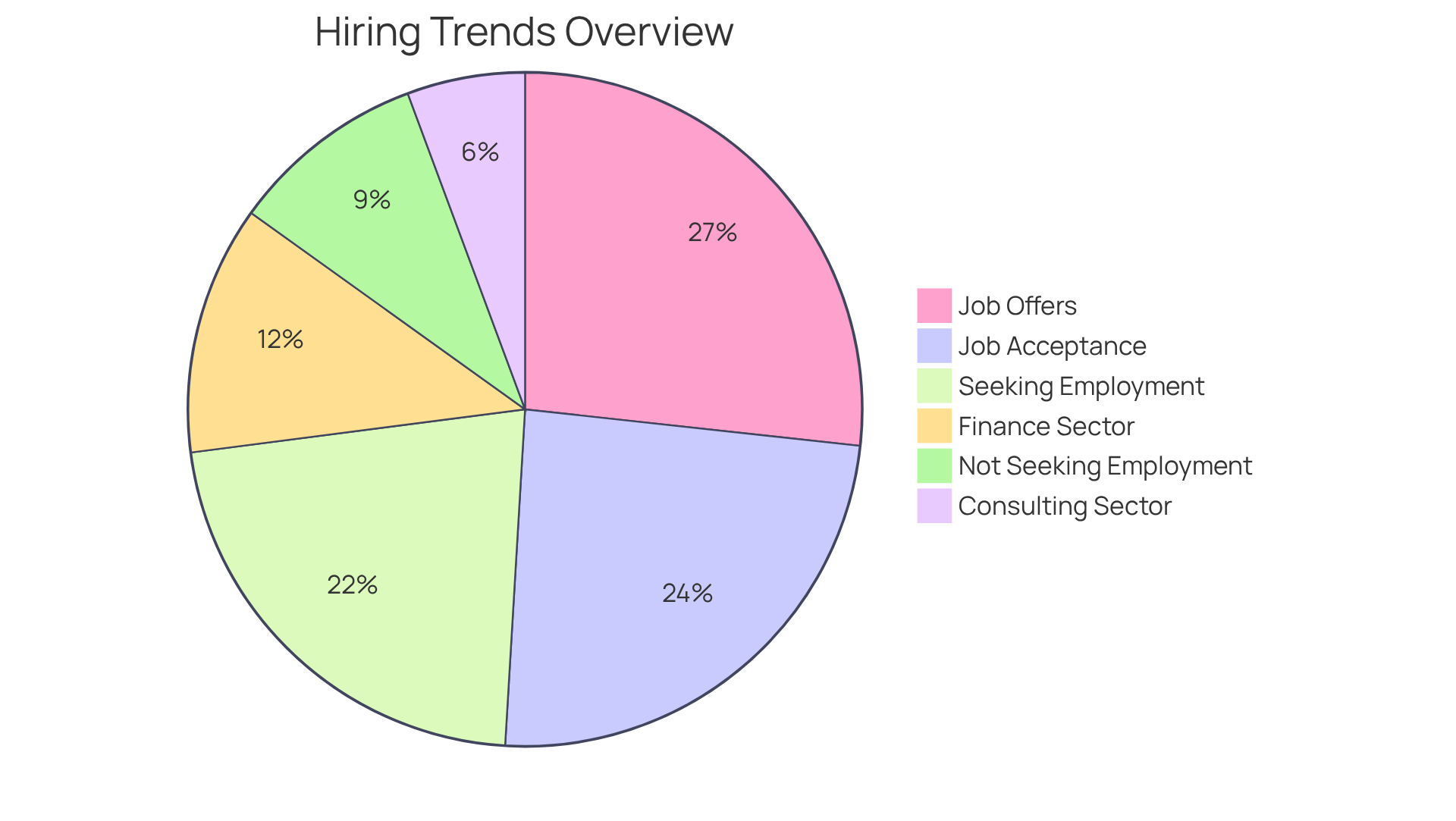

Hiring data serves as a crucial market signal for financiers, offering valuable insights into industry trends and potential growth areas. By analyzing hiring trends through platforms like Websets, stakeholders can pinpoint sectors that are expanding versus those that may be contracting. For instance, while 70% of students from the Class of 2024 actively sought employment, an impressive 85% received job offers, with 77% accepting them. This indicates a robust demand for talent across various sectors. However, it is noteworthy that 30% of graduates did not seek employment, highlighting a significant portion of the market that may not be actively participating. Additionally, the unemployment rate for younger workers has climbed to 10.5%, signaling potential challenges in the job market that could influence investment decisions.

Real-world examples illustrate how individuals leverage hiring data for strategic insights. Sectors such as , which accounts for 38% of functions, and business development consulting, representing 18%, suggest growth potential based on hiring trends. By utilizing real-time talent monitoring for investors, those who track these patterns can adjust their portfolios accordingly, capitalizing on sectors poised for expansion. The AI-driven sales intelligence search can enhance this process by providing comprehensive insights into hiring trends and candidate qualifications, enabling stakeholders to make data-informed choices.

Furthermore, understanding the geographical distribution of job opportunities is essential. With 49% of roles situated in the Northeast, 17% in the West, and 12% being international, stakeholders can tailor their strategies to focus on areas with the greatest growth potential. By incorporating hiring data into their investment evaluations, alongside the thorough insights offered by alternative sources, stakeholders can make well-informed choices that enhance their prospects for success in a dynamic market environment.

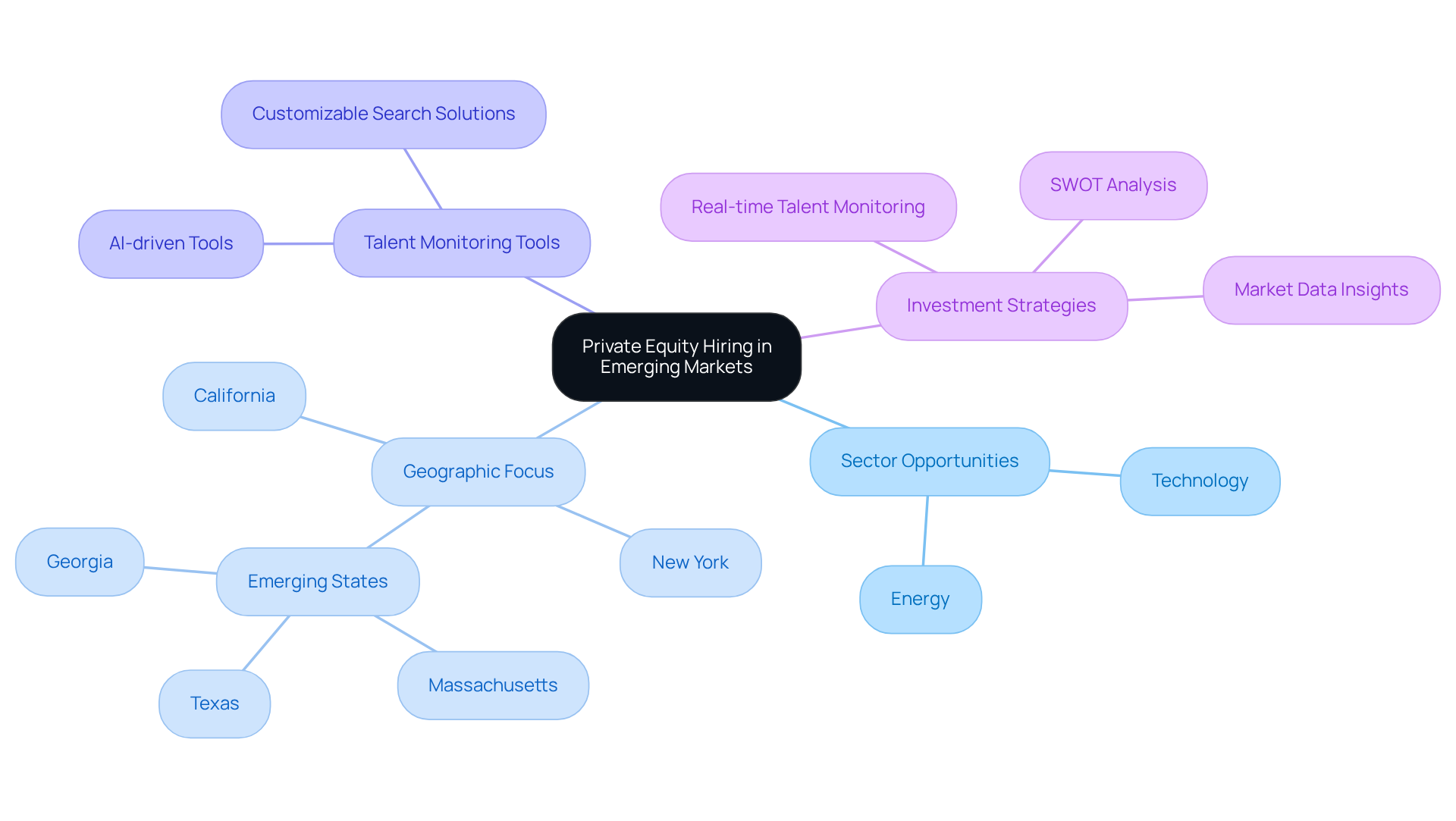

Emerging Markets: Identifying Areas of Private Equity Hiring Surge

Emerging markets present significant opportunities for private equity stakeholders, particularly in sectors experiencing notable hiring increases. By leveraging Websets' AI-driven tools and customizable search solutions, investors can engage in real-time talent monitoring for investors, enabling them to acquire data-driven insights that facilitate early identification of these markets and position themselves advantageously. Recognizing where skills are being sought through real-time talent monitoring for investors can lead to informed investment decisions that align with growth trajectories.

In April 2025, private equity hiring surged nearly fivefold year-over-year, underscoring the robust demand for talent within this sector. The technology and energy sectors stand out, with hiring concentrated in key hubs such as New York and California, which dominate private equity job postings. This trend underscores the importance of utilizing and recruitment, which supports real-time talent monitoring for investors to navigate competitive environments effectively.

By staying attuned to these dynamics and leveraging insights—such as case studies that showcase successful applications—investors can enhance their portfolios and foster sustainable growth. Are you ready to seize the opportunities that emerging markets offer? The time to act is now.

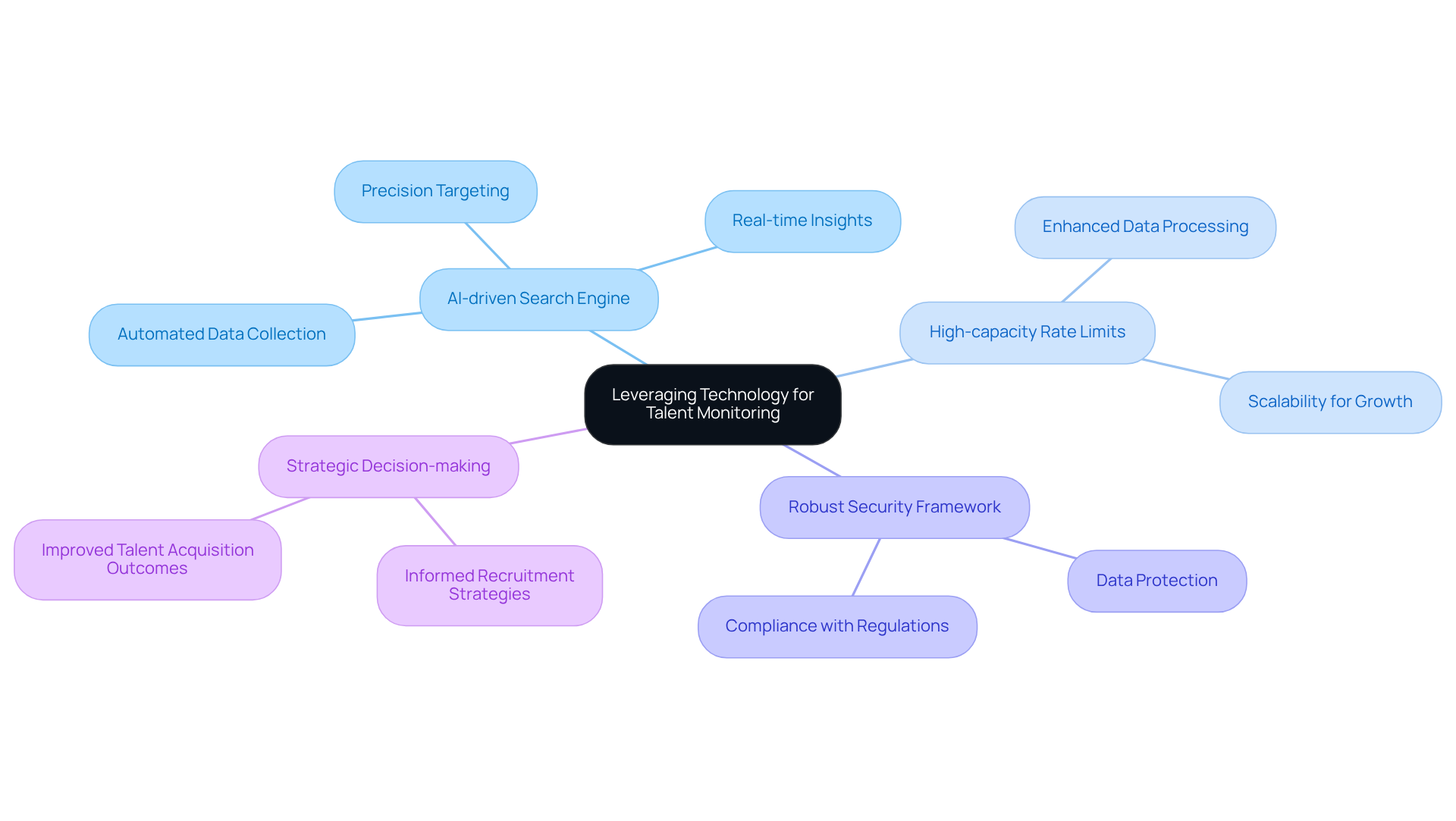

Leveraging Technology: Enhancing Talent Monitoring for Investors

Harnessing technology is essential for enhancing skill monitoring capabilities. Investors can leverage platforms like Websets, which features an advanced AI-driven search engine tailored for complex queries, to automate the collection and analysis of information. This leads to more effective real-time talent monitoring for investors, providing enhanced insights for targeted outcomes.

With flexible high-capacity rate limits and a designed for enterprise needs, this platform enables stakeholders to focus on strategic decision-making, free from the constraints of manual data processing. Furthermore, Websets excels in uncovering niche outcomes that other tools may overlook, ensuring that real-time talent monitoring for investors provides access to unique insights that can inform their strategies.

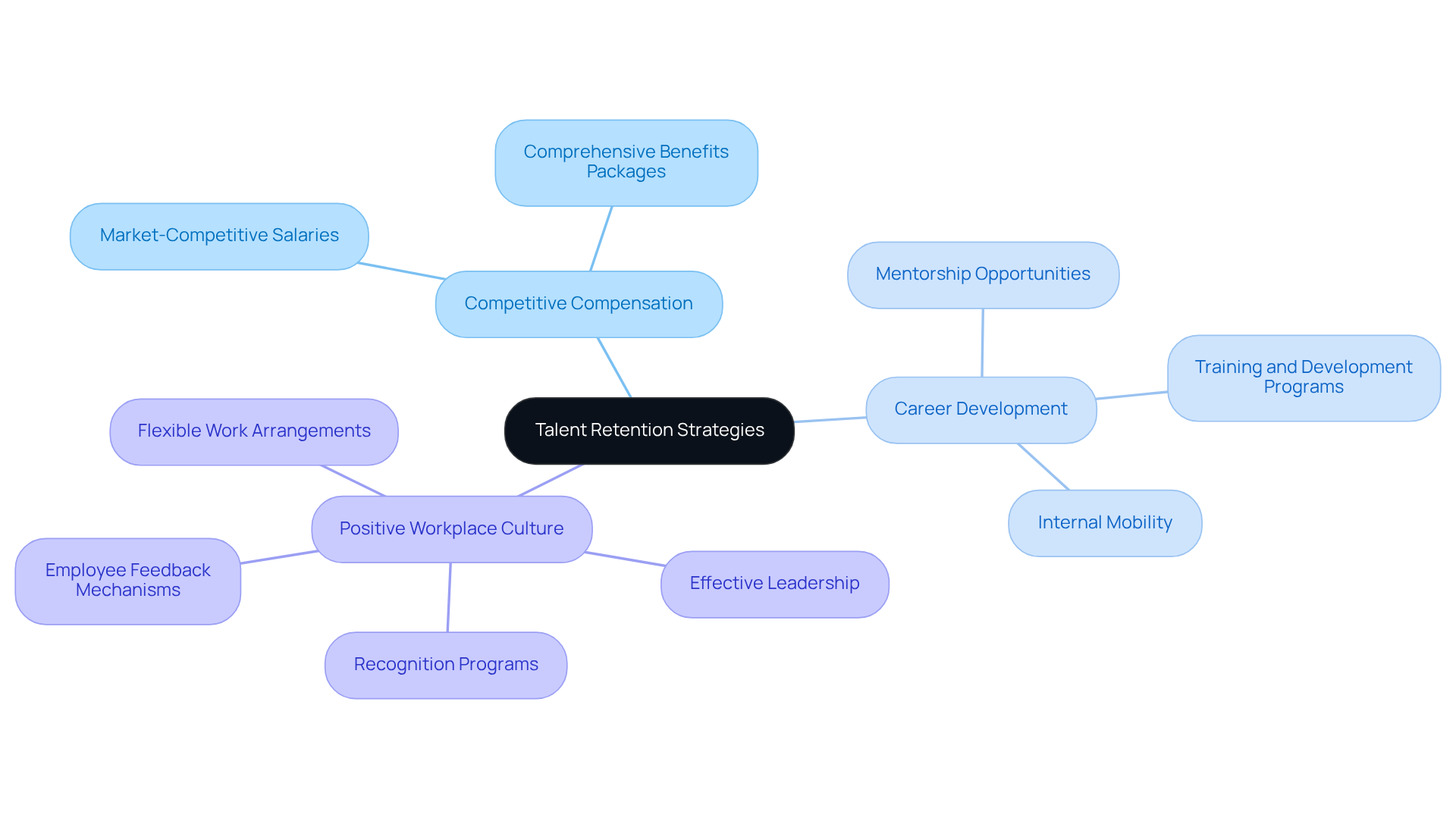

Talent Retention Strategies: Key Considerations for Investors

Talent retention stands as a pivotal concern for stakeholders, given that high turnover rates can significantly hinder the performance of portfolio companies. Engaged employees are 87% more likely to stay with their organizations, clearly illustrating the essential connection between employee satisfaction and retention. Investors must champion strategies that cultivate employee engagement, including:

- Competitive compensation packages

- Comprehensive career development opportunities

- A positive workplace culture

Notably, companies investing in career development express 67% greater confidence in retaining skilled individuals, showcasing the tangible advantages of such initiatives.

Furthermore, effective employee engagement strategies—such as flexible work arrangements and recognition programs—have demonstrated success in boosting retention rates. A Nectar survey highlights that 71% of employees would be less inclined to leave their organization if they received more frequent recognition. Additionally, ineffective leadership is responsible for 50% of resignations, underscoring the critical role of strong leadership in retention strategies.

By prioritizing these initiatives, including soliciting employee feedback to identify motivators and exploring internal mobility—which can enhance retention likelihood by 75%—investors can utilize real-time talent monitoring for investors to elevate employee morale and improve overall company performance. This approach and drives superior outcomes for their portfolios.

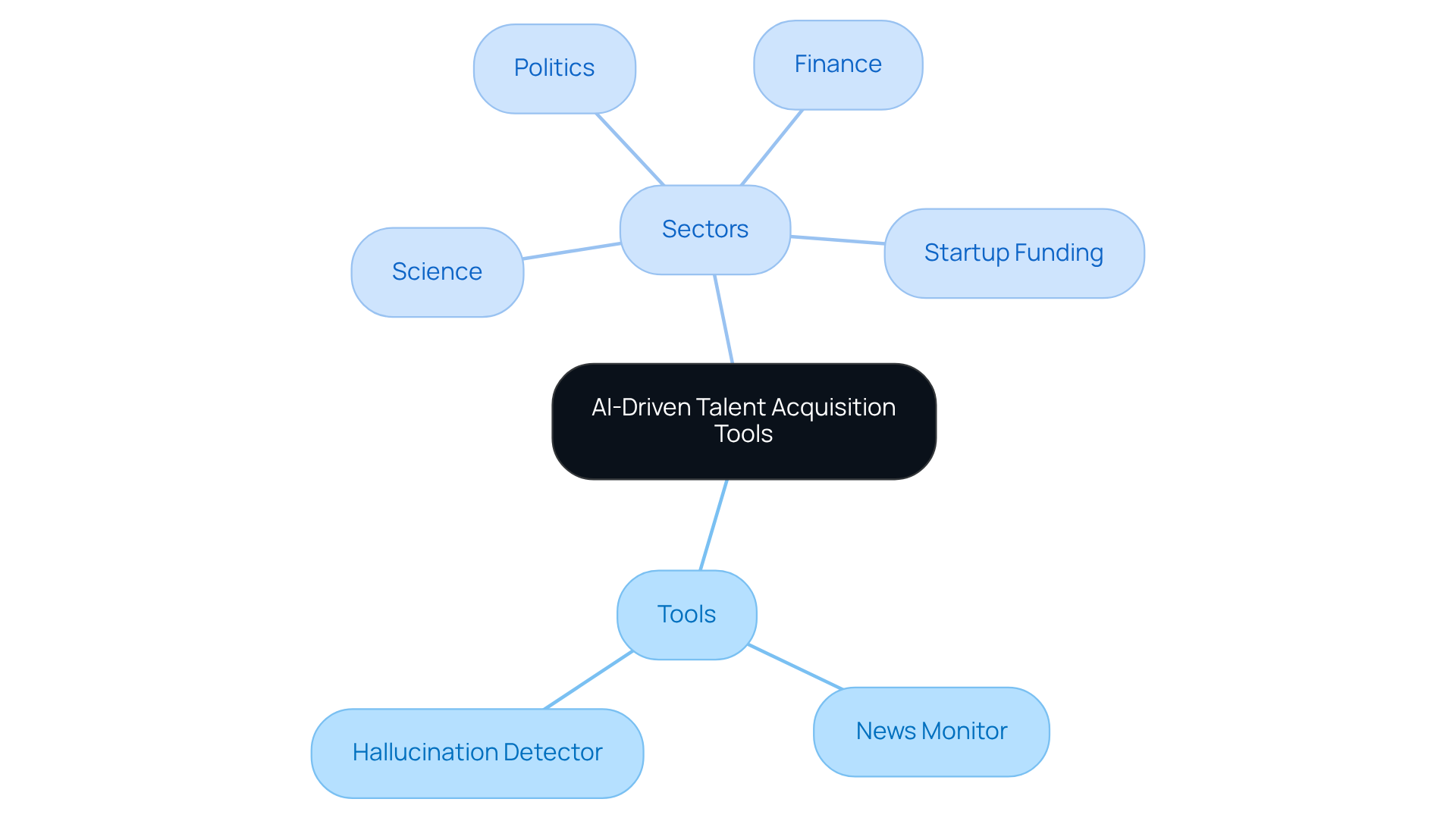

Competitive Landscape: Navigating Talent Acquisition Risks and Opportunities

Navigating the competitive landscape of talent acquisition is crucial for individuals aiming to enhance their portfolios. By leveraging AI-driven tools such as the News Monitor and Hallucination Detector, stakeholders can facilitate real-time talent monitoring for investors, gaining invaluable insights into competitor hiring practices and emerging market trends.

These tools aggregate information across diverse sectors, including:

- Science

- Politics

- Finance

- Startup funding

Empowering stakeholders through real-time talent monitoring for investors to identify unique opportunities and potential risks within the hiring domain. Utilizing online platforms equips stakeholders to make , thereby refining their recruitment strategies and enriching their overall sales insights.

AI Integration: Transforming Talent Monitoring for Better Investment Decisions

The incorporation of AI is revolutionizing workforce monitoring by enabling real-time talent monitoring for investors, equipping stakeholders with enhanced information precision and predictive analysis. Such platforms empower stakeholders to uncover deeper insights into talent trends, which supports real-time talent monitoring for investors and facilitates more informed decision-making. Websets' advanced is specifically designed for complex inquiries, allowing users to efficiently discover and refine information. This technological shift promotes a proactive investment strategy, ultimately leading to superior outcomes.

For instance, predictive analytics can pinpoint skills gaps and anticipate future hiring needs, which is essential for real-time talent monitoring for investors to align their strategies with market demands. Companies that harness these insights have reported remarkable enhancements in recruitment efficiency, with AI-driven methods boosting recruiter capacity by an average of 54%. The platform streamlines this process by delivering accurate lead generation and candidate identification, enriching information with essential details such as skills, experience, and company specifics.

Moreover, the organization prioritizes security and compliance, ensuring that all data processing adheres to industry standards. As the landscape evolves, investors who utilize real-time talent monitoring for investors along with other sophisticated tools, including customizable search solutions, will secure a competitive edge in navigating the complexities of workforce management.

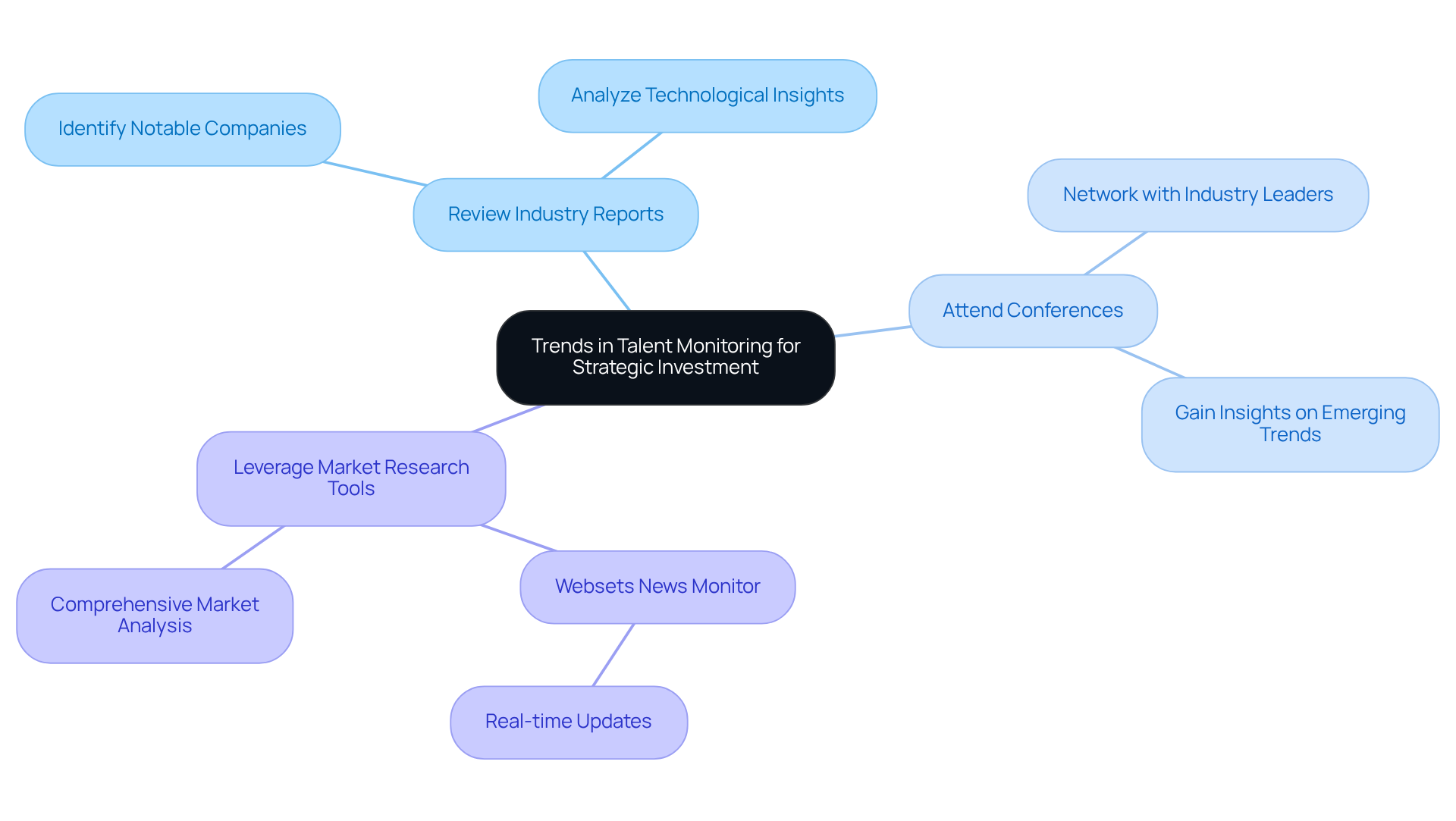

Staying Informed: Trends in Talent Monitoring for Strategic Investment

Staying informed about trends in real-time talent monitoring for investors is essential for strategic investment. Investors must regularly review industry reports, attend pertinent conferences, and leverage platforms that offer comprehensive market research tools. This proactive approach enables the identification of notable companies, articles, and technological insights.

By utilizing Websets' features, including real-time updates via the Websets News Monitor, stakeholders can remain abreast of the latest advancements in Series A funding and engineering growth. Understanding these enables real-time talent monitoring for investors, empowering them to adapt their strategies and maintain a competitive edge in the market.

Conclusion

Real-time talent monitoring has emerged as a pivotal strategy for investors aiming to elevate their decision-making processes and optimize investment outcomes. By integrating advanced AI-driven platforms like Websets, investors gain access to crucial insights into workforce trends, candidate suitability, and market dynamics, fundamentally transforming their approach to talent acquisition and management.

Key strategies have been highlighted throughout this discussion, emphasizing the necessity of:

- Understanding operational talent demand within private equity

- Leveraging hiring data as a market signal

- Utilizing technology to refine talent monitoring efforts

The notable rise in private equity hiring, particularly in specialized roles, underscores the imperative for investors to adapt their strategies to align with evolving market conditions and skill requirements.

As the investment landscape continues to shift, staying informed about trends in real-time talent monitoring is essential. Investors are urged to embrace AI technologies and data analytics to navigate the complexities of talent acquisition effectively. By prioritizing these strategies, stakeholders can enhance their competitive edge and position themselves for sustained success in a dynamic investment environment. The time to act is now—harness the power of real-time insights and drive informed investment decisions that will shape the future of your portfolio.

Frequently Asked Questions

What is Websets and what does it offer?

Websets is an AI-driven platform that provides advanced solutions for real-time talent monitoring for investors and stakeholders. It uses sophisticated algorithms and a proprietary search engine designed for large language models to analyze workforce trends and facilitate informed investment decisions.

How does real-time talent monitoring benefit investors?

Real-time talent monitoring helps investors improve decision-making, enhance candidate sourcing, and respond quickly to market changes. Organizations using this approach report average cost savings of 33% in both time-to-hire and cost-per-hire, ultimately leading to better investment outcomes.

What are some key features of Websets?

Key features of Websets include extensive candidate discovery, enhanced data insights, and filtering capabilities by skills, experience, and location. These features help investors leverage real-time talent monitoring effectively in workforce acquisition and market analysis.

What trends are influencing private equity hiring practices?

The private equity sector is experiencing a shift towards a talent-driven model, emphasizing operational expertise and specialized skills. There has been a significant increase in private equity hiring, with firms like KKR reporting a 222% increase in job postings, indicating a focus on technology and investor services.

What roles are increasingly in demand within private equity?

There is a rising demand for roles such as Corporate Strategy, Risk Analysts, Customer Success Specialists, and Data Scientists. This trend reflects the need for specialized skills within teams to enhance portfolio performance.

How does real-time talent monitoring change investment strategies?

Real-time talent monitoring transforms investment strategies by providing instant access to crucial information, enabling monitoring of skill movements, and assessing candidate suitability. This integration allows investment professionals to make data-driven decisions that align with current market conditions.

What is the anticipated future of AI in investment and talent monitoring?

By 2025, it is expected that 70% of enterprises will employ synthetic information for AI and analytics, highlighting the growing importance of real-time information in shaping investment strategies. Real-time talent monitoring has become a strategic necessity in fast-paced private capital markets.