Overview

This article offers a comprehensive comparison of five venture capital talent analytics software solutions, emphasizing their functionalities, advantages, and disadvantages. Selecting the right software is crucial; it hinges on key criteria such as functionality, user experience, integration capabilities, and cost. Statistics and expert opinions underscore the increasing importance of data-driven decision-making in the venture capital industry. As professionals navigate this landscape, understanding these elements can significantly influence their success.

Introduction

The landscape of venture capital is undergoing a significant transformation, fueled by an increasing reliance on data analytics to shape recruitment and talent management strategies. As firms seek to secure a competitive advantage, the integration of specialized talent analytics software has become essential, providing insights that enhance decision-making and boost operational efficiency.

Yet, with a myriad of options at their disposal, how can organizations determine which software aligns best with their specific needs and objectives? This article embarks on a comparative analysis of five leading venture capital talent analytics solutions, examining their features, benefits, and potential drawbacks to empower firms in making informed choices for their future workforce strategies.

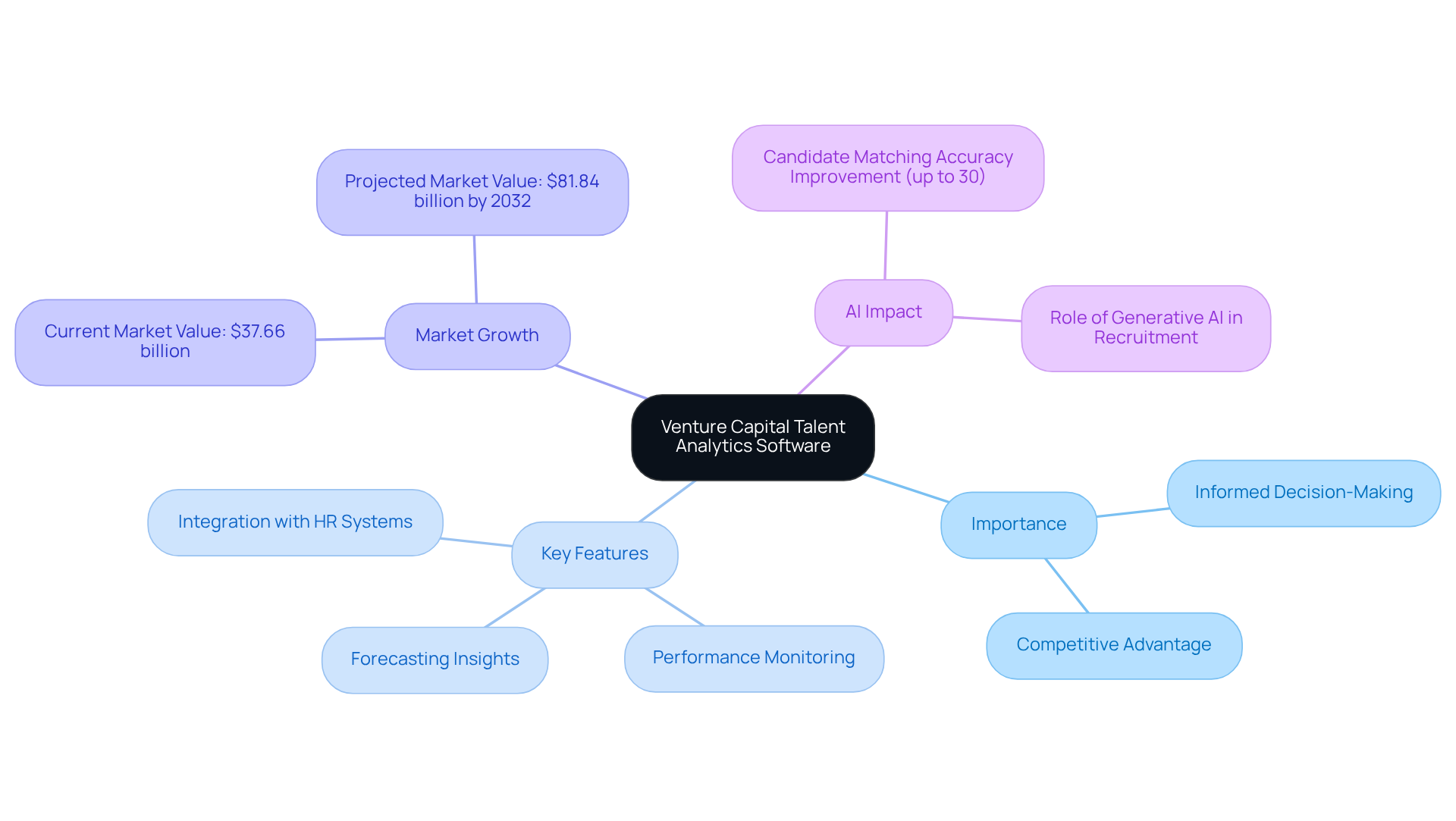

Overview of Venture Capital Talent Analytics Software

Venture capital is essential for firms aiming to make informed, data-driven decisions about workforce acquisition, management, and performance evaluation. These advanced tools leverage data analysis to deliver insights into candidate sourcing, employee performance, and current market trends. By utilizing algorithms and machine learning, they empower firms to identify high-potential candidates, streamline recruitment processes, and enhance overall workforce productivity. Key features typically include:

- Forecasting insights

- Performance monitoring

- Seamless integration with existing HR systems

This allows companies to optimize their personnel strategies effectively.

The significance of workforce analysis in recruitment is underscored by the expanding HR technology market, valued at approximately $37.66 billion in 2023, projected to reach $81.84 billion by 2032. This growth reflects a growing recognition of the importance of data-driven decision-making in workforce acquisition. Organizations utilizing AI-powered analytics can refine their hiring processes; studies show that AI-driven recruitment strategies can enhance candidate matching accuracy by up to 30%. Moreover, generative AI is transforming recruitment by crafting human-like text for job descriptions, fostering more engaging and effective candidate interactions.

Expert opinions consistently emphasize that the future of workforce acquisition lies in the strategic integration of AI technologies. Industry leaders assert that AI serves as a force multiplier, improving decision-making and operational efficiency throughout the investment lifecycle. By embracing venture capital talent analytics software, venture capital firms can enhance their recruitment efforts and secure a competitive advantage in identifying and nurturing the next generation of transformative companies.

Comparison Criteria for Evaluating Software Solutions

When evaluating venture capital talent analytics software, several key criteria must be prioritized:

- Functionality: A thorough examination of the breadth of features is crucial, including predictive analytics, candidate tracking, and performance management capabilities. A comprehensive toolset is essential for effective talent management. Notably, the global ATS market is projected to reach $4.88 billion by 2030, underscoring the growing importance of robust functionality in these systems.

- User Experience: Assess the application's interface for intuitiveness and accessibility. A user-friendly design can significantly enhance adoption rates among team members. As Alexander Fish states, 'The best VC CRMs provide advanced automation capabilities that remove monotonous manual tasks and maintain information up to date,' emphasizing the necessity for a smooth user experience.

- Integration Capabilities: Investigate how well the software integrates with existing systems, such as HRIS or CRM tools. Smooth integration is essential for preserving workflow efficiency and information consistency. Many organizations are planning to implement AI-driven ATS solutions, indicating a shift towards more integrated systems.

- Data Security: Evaluate the security measures implemented to safeguard sensitive information. Given the essential nature of information in venture capital, strong security protocols are vital. Secure information handling is paramount, as industry experts emphasize the significance of .

- Scalability: Ensure that the application can adapt and grow alongside the firm’s evolving needs. A scalable solution will support long-term operational success, allowing firms to manage increasing data and user demands effectively.

- Cost: Analyze various pricing models to identify a solution that aligns with budget constraints while still meeting essential functionality requirements. Understanding the cost implications is vital, especially as firms look to optimize their technology investments.

- Customer Support: Seek out responsive support options to address any issues that may arise. Effective customer support can significantly influence the overall user experience and application effectiveness. Case studies reveal that platforms providing strong customer support often enjoy higher user satisfaction and retention rates.

By concentrating on these standards, venture capital firms can utilize venture capital talent analytics software to make informed choices that enhance their workforce evaluation abilities and improve overall operational efficiency.

In-Depth Comparison of the Top 5 Talent Analytics Solutions

This comparative analysis presents five leading venture capital talent analytics software solutions:

-

Affinity: Relationship management, automated data entry

- Pros: Excellent for networking, user-friendly; AI-driven automation enhances efficiency

- Cons: Limited customization options

- Pricing: Subscription-based

-

PitchBook: Market intelligence, deal tracking

- Pros: Comprehensive data coverage, robust analytics

- Cons: Higher cost

- Pricing: Tiered pricing based on usage

-

4Degrees: Relationship scoring, deal flow management

- Pros: Strong focus on relationship intelligence

- Cons: Steeper learning curve

- Pricing: Monthly subscription

-

Gem: Recruitment analytics, candidate sourcing

- Pros: Great for collaboration, intuitive interface

- Cons: May lack advanced analytics

- Pricing: Pay-per-use model

-

Visible: Portfolio monitoring, reporting tools

- Pros: Strong reporting capabilities, easy to use

- Cons: Limited integrations

- Pricing: Annual subscription

This summary succinctly summarizes the key aspects of each software, enabling firms to identify which solution aligns best with their operational needs. As the venture capital landscape evolves, leveraging venture capital talent analytics software is crucial for optimizing investment strategies and enhancing decision-making processes. The rise of data-driven firms in venture capital, which increased by 20% from 2023 to 2024, underscores the growing significance of these tools. Furthermore, the efficiency benefits of AI in automating data entry are particularly pronounced for solutions like Affinity. As Austen Legler aptly states, "Artificial intelligence is a game-changer in venture capital," emphasizing the transformative potential of these technologies. Additionally, with a projected improvement in liquidity for Limited Partners (LPs) by 2025, decision-makers should consider how these analytical tools can bolster their investment strategies.

Key Takeaways and Recommendations for Choosing Software

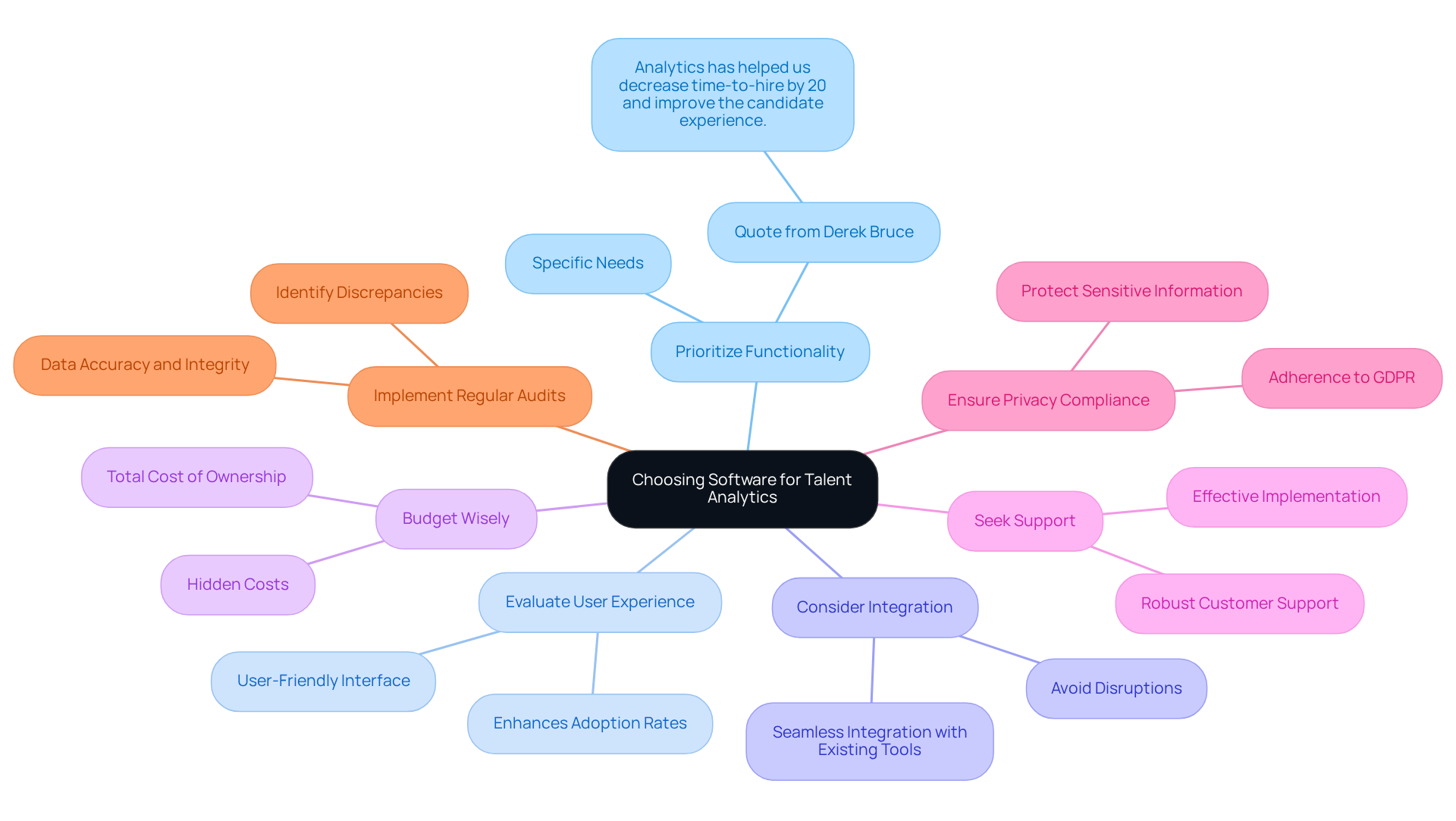

Selecting the right venture capital talent analytics software necessitates a thorough assessment of critical elements to ensure peak performance and user acceptance. Here are key recommendations:

- Prioritize Functionality: Choose software that directly meets your specific needs, whether it involves recruitment analytics, performance tracking, or other vital functionalities. As Derek Bruce, HR Operations Director at First Aid at Work Course, notes, "Analytics has helped us decrease time-to-hire by 20% and improve the candidate experience."

- Evaluate User Experience: A user-friendly interface is essential; it can significantly enhance adoption rates among team members, facilitating smoother transitions and boosting overall productivity.

- Consider Integration: Verify that the application can seamlessly integrate with your existing tools and systems. This capability is crucial to avoid disruptions and .

- Budget Wisely: Conduct a comprehensive analysis of the total cost of ownership, including subscription fees and any potential hidden costs that may arise during implementation and use.

- Seek Support: Opt for solutions that offer robust customer support, which is vital for effective implementation and ongoing usage.

- Ensure Privacy Compliance: It is imperative to select software that adheres to privacy regulations, such as GDPR, to protect sensitive recruitment information and uphold candidate trust.

- Implement Regular Audits: Regular audits and validation checks are necessary to ensure recruitment data accuracy and integrity, enabling organizations to identify discrepancies in data collection.

By following these recommendations, venture capital firms can enhance their talent management strategies through venture capital talent analytics software, ultimately leading to improved investment outcomes.

Conclusion

Venture capital talent analytics software is essential in shaping the future of workforce acquisition and management. By harnessing data, these tools empower firms to make informed decisions that enhance recruitment processes and overall productivity. The strategic integration of AI technologies not only boosts operational efficiency but also enables firms to effectively identify and nurture high-potential candidates.

Key aspects such as functionality, user experience, integration capabilities, data security, scalability, cost, and customer support are critical criteria for evaluating these software solutions. Each of the five leading platforms—Affinity, PitchBook, 4Degrees, Gem, and Visible—offers unique advantages and limitations, allowing firms to find tailored solutions. The growing importance of data-driven decision-making in the venture capital landscape is underscored by the projected growth of the HR technology market, highlighting the necessity for firms to adapt and innovate.

Ultimately, the insights shared emphasize the significance of selecting the right venture capital talent analytics software. By prioritizing critical factors and leveraging advanced analytics, firms can enhance their talent management strategies, optimize investment outcomes, and secure a competitive edge in an ever-evolving market. Embracing these technologies is not merely a trend; it is a strategic imperative that can lead to transformative changes in how venture capital firms operate and succeed in the future.

Frequently Asked Questions

What is venture capital talent analytics software?

Venture capital talent analytics software is a tool that helps firms make data-driven decisions regarding workforce acquisition, management, and performance evaluation by leveraging data analysis for insights into candidate sourcing and employee performance.

What are the key features of venture capital talent analytics software?

Key features typically include forecasting insights, performance monitoring, and seamless integration with existing HR systems, allowing companies to optimize their personnel strategies effectively.

Why is workforce analysis significant in recruitment?

Workforce analysis is significant in recruitment as it reflects a growing recognition of the importance of data-driven decision-making in workforce acquisition, contributing to improved hiring processes and candidate matching accuracy.

How is the HR technology market projected to grow?

The HR technology market is valued at approximately $37.66 billion in 2023 and is projected to reach $81.84 billion by 2032, indicating a significant increase in the importance of data-driven recruitment strategies.

How can AI-powered analytics benefit recruitment processes?

AI-powered analytics can refine hiring processes, enhancing candidate matching accuracy by up to 30% and improving overall recruitment strategies.

What role does generative AI play in recruitment?

Generative AI transforms recruitment by crafting human-like text for job descriptions, which fosters more engaging and effective interactions with candidates.

What do industry experts say about the future of workforce acquisition?

Industry experts emphasize that the future of workforce acquisition lies in the strategic integration of AI technologies, which serve as a force multiplier to improve decision-making and operational efficiency throughout the investment lifecycle.

How can venture capital firms benefit from using talent analytics software?

By embracing venture capital talent analytics software, firms can enhance their recruitment efforts and secure a competitive advantage in identifying and nurturing high-potential candidates.