Overview

This article presents essential strategies for sales team leaders aiming to master capital sourcing. By establishing a strategic framework, identifying potential funding sources, and leveraging technology, leaders can significantly enhance their funding efforts. The importance of stakeholder engagement cannot be overstated; thorough market research and the application of advanced analytics and CRM systems are crucial for optimizing resource acquisition. Ultimately, these strategies not only improve decision-making but also empower leaders to navigate the complexities of capital sourcing effectively.

Introduction

In a rapidly evolving business landscape, securing capital is paramount for organizations aiming to thrive and innovate. Sales team leaders are critical in this process, navigating the complex terrain of funding sources to support growth initiatives. This article explores effective strategies for mastering capital sourcing. It offers insights on:

- Creating a robust framework

- Identifying potential funding avenues

- Leveraging technology to enhance acquisition efforts

With numerous options available, how can sales leaders ensure they are making the right choices to fuel their organization’s success?

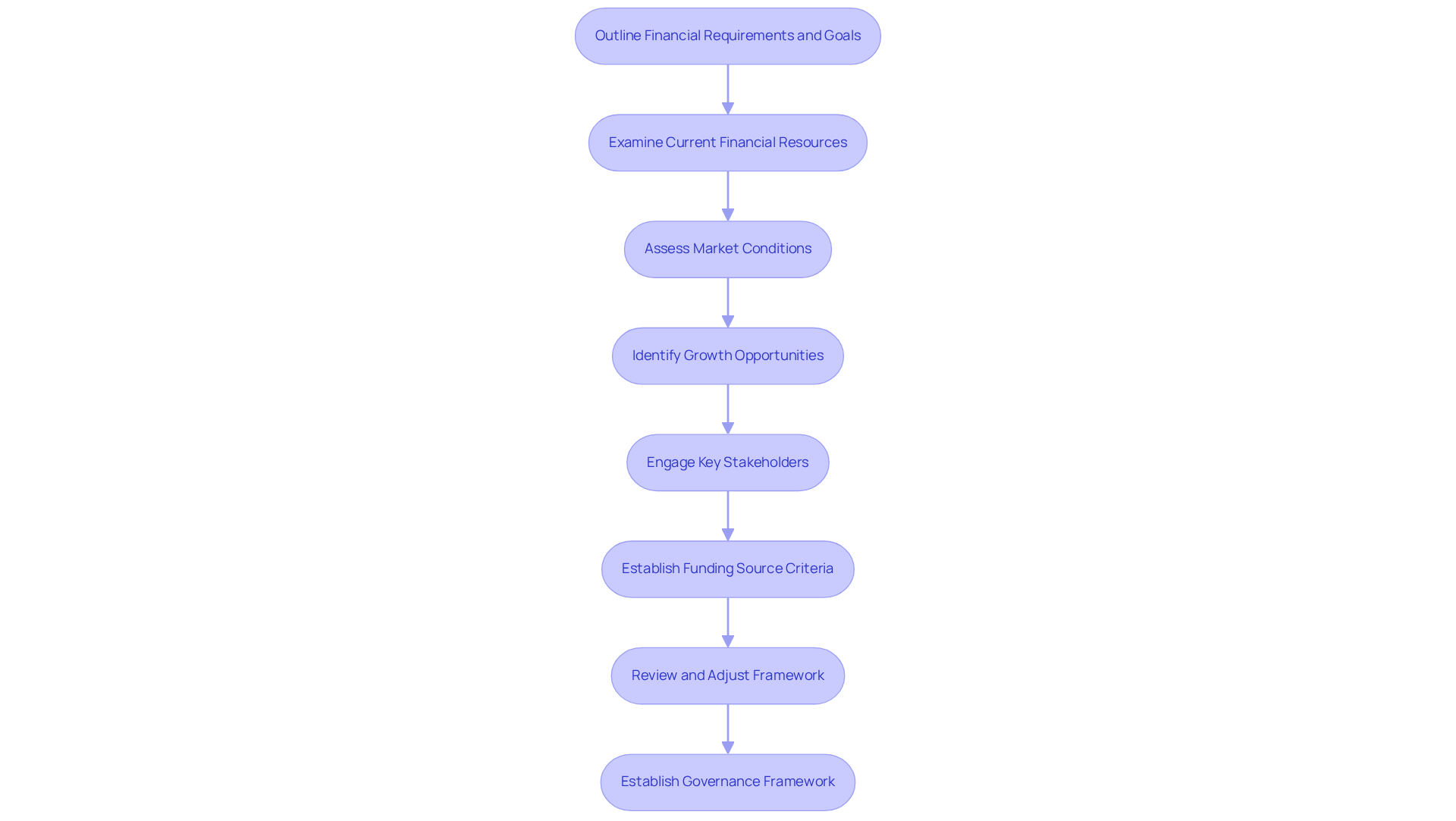

Establish a Strategic Capital Sourcing Framework

To create a strategic funding acquisition framework, begin by clearly outlining your organization's . This essential process requires a thorough examination of current financial resources, market conditions, and potential growth opportunities. Involving key stakeholders is not just beneficial; it is crucial. Their insights ensure alignment across departments and foster a collaborative approach to funding. Companies that actively engage with stakeholders are 30% more likely to succeed with new products, underscoring the critical role of stakeholder involvement.

Next, establish a set of criteria for assessing potential funding sources. Consider factors such as cost, risk, and alignment with strategic goals. For instance, a tech startup may prioritize venture funding during its growth phase, while a mature organization might focus on debt financing to enhance its financial structure. Regularly reviewing and adjusting this framework is vital to adapt to evolving market dynamics and organizational priorities. According to the Project Management Institute, projects with actively engaged stakeholders are up to 70% more likely to meet their original goals, highlighting the importance of stakeholder engagement in achieving successful outcomes.

Furthermore, establishing a governance framework that incorporates regular evaluations of funding strategies and results will enhance accountability and ensure the system remains efficient over time. This proactive strategy simplifies capital sourcing and enhances stakeholder involvement—both essential for successful resource acquisition and long-term organizational success.

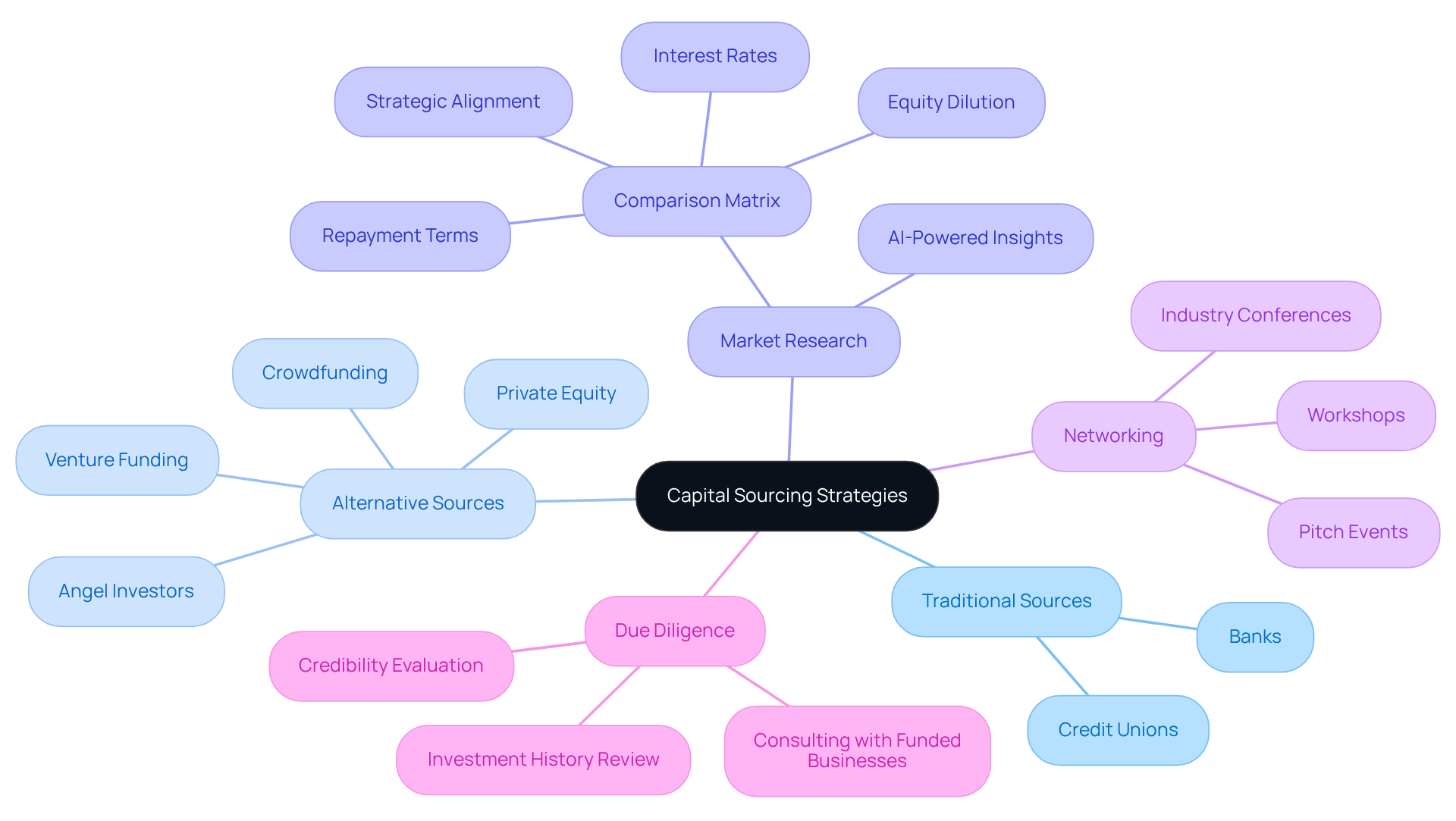

Identify and Evaluate Potential Capital Sources

To effectively recognize and assess potential financial sources, begin with comprehensive market research to understand the spectrum of available capital sourcing options. This includes traditional sources such as banks and credit unions, as well as like venture funding, private equity, crowdfunding, and angel investors. Leveraging Websets' AI-powered platform can significantly enhance this research process, providing deep insights into companies and industries. This enables sales team leaders to analyze market trends and competitor landscapes thoroughly. Construct a comparison matrix that highlights key criteria, including interest rates, repayment terms, equity dilution, and strategic alignment with your organization.

Networking is essential for fostering relationships with potential investors to support capital sourcing and engage with funding partners. Engage in industry conferences, workshops, and networking events to connect with capital sourcing that aligns with your business model. For instance, startups seeking growth capital can gain substantial advantages through capital sourcing by participating in pitch events where venture capitalists are actively scouting for new opportunities. Furthermore, utilize Websets to link enterprises with investors, offering comprehensive information about prospective partners, including their investment history and strategic alignment.

Once potential sources for capital sourcing are identified, conduct a rigorous due diligence process to evaluate their credibility, track record, and compatibility with your organization's values and goals. This may involve reviewing their investment history, consulting with other businesses they have funded, and analyzing their financial stability. Notably, 23% of startups fail due to insufficient resources, underscoring the importance of effective capital sourcing strategies. Additionally, alternative lenders may impose higher interest rates or fees to mitigate greater risks, which should be considered when evaluating financing options. By implementing these strategies and leveraging Websets' features, sales team leaders can enhance their resource acquisition efforts and secure the essential support needed to drive growth.

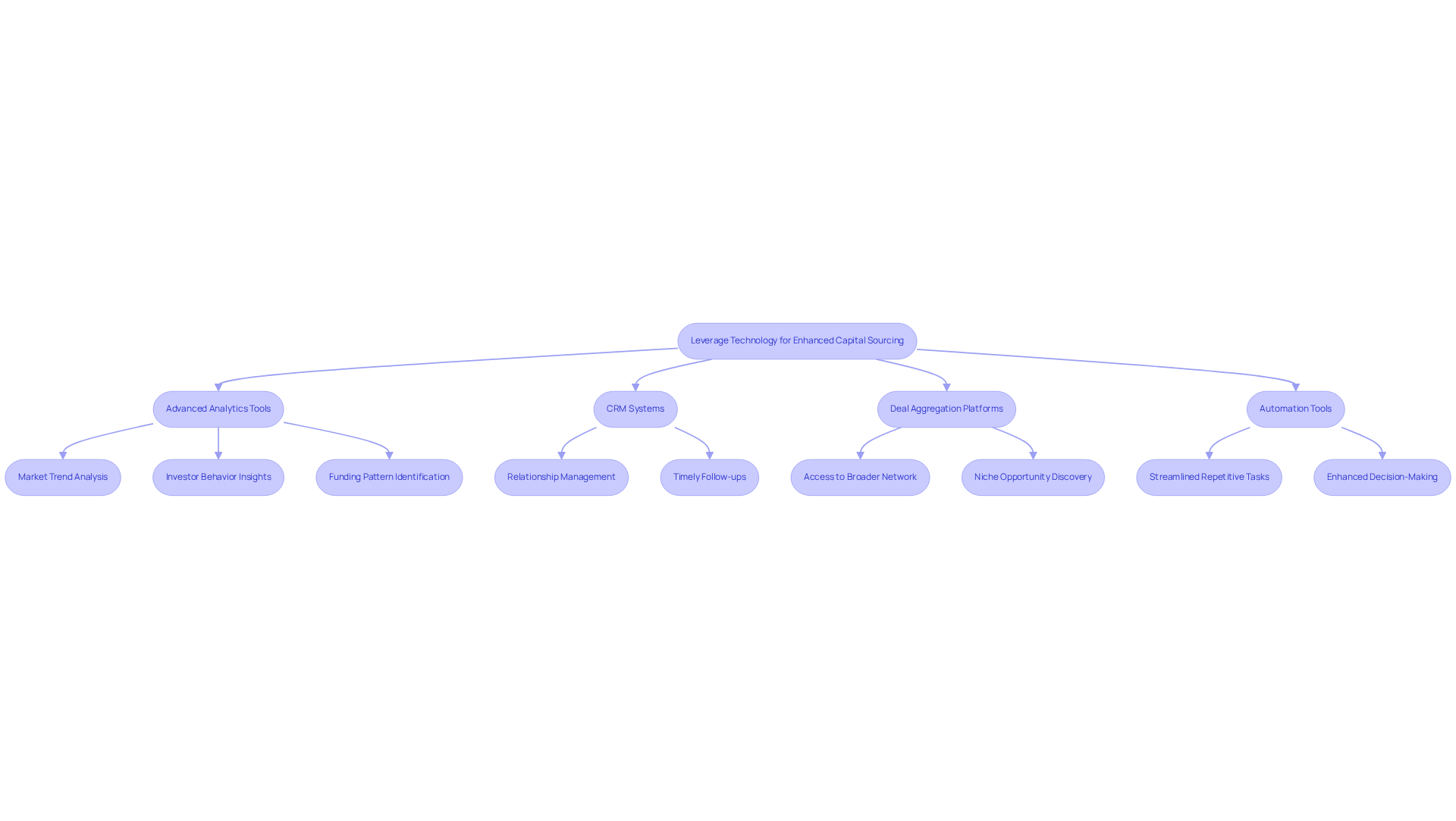

Leverage Technology for Enhanced Capital Sourcing

In today's digital landscape, leveraging technology is crucial for optimizing capital sourcing efforts. Start by implementing advanced analytics tools, such as those provided by Websets. These enterprise-grade, AI-driven web search solutions dissect market trends, investor behaviors, and funding patterns. By offering essential insights into which funding sources align with your organization's objectives, these tools generate well-cited summaries that significantly enhance decision-making.

Moreover, employing customer relationship management (CRM) systems is vital for managing interactions with potential investors and effectively tracking communications. This practice not only preserves relationships but also ensures timely follow-ups—an essential component for successful funding. Statistics indicate that organizations utilizing CRM systems experience a remarkable increase in engagement and conversion rates, underscoring their importance in funding strategies.

Additionally, consider deal aggregation platforms that compile investment opportunities, granting access to a broader network of investors. While platforms like Affinity and Carta simplify the connection process with potential funding sources, Websets' further enhance this by providing unique search capabilities that uncover niche opportunities often overlooked by other tools.

Automation tools also streamline repetitive tasks, such as data entry and reporting, allowing your team to focus on strategic decision-making. By utilizing AI-driven solutions from Websets, you can significantly enhance the precision of your acquisition efforts. These tools provide predictive analytics that identify the most promising financial opportunities based on historical data and current market conditions. For instance, employing AI algorithms to analyze past investment rounds can forecast which investors are likely to show interest in your business, thereby refining your resource acquisition strategy.

However, it is essential to address challenges related to data quality, as poor data can severely impede the effectiveness of these technologies. Organizations that prioritize data quality experience 2.5 times higher transformation success rates, highlighting the necessity for robust data governance.

In conclusion, leveraging technology in capital sourcing not only enhances efficiency but also positions your organization to capture the most promising funding opportunities, ultimately driving superior outcomes.

Conclusion

Establishing a robust capital sourcing strategy is essential for sales team leaders aiming to secure the necessary funding for growth and innovation. By creating a well-structured framework that incorporates stakeholder engagement, thorough evaluation of potential funding sources, and the integration of technology, organizations can significantly enhance their capital acquisition efforts. This proactive approach aligns financial goals with strategic objectives and fosters collaboration across departments, ensuring all stakeholders are invested in the organization's success.

Key strategies include:

- The importance of market research in identifying diverse funding options.

- The necessity of building strong relationships with potential investors.

- The value of leveraging advanced technology to streamline the sourcing process.

Utilizing tools like CRM systems and AI-driven analytics provides invaluable insights and improves decision-making, ultimately leading to better funding outcomes. Moreover, maintaining data quality is crucial for maximizing the effectiveness of these technologies, as it directly impacts the success of capital sourcing initiatives.

In a competitive landscape, effectively sourcing capital can be a game-changer for organizations. By implementing these best practices and embracing technological advancements, sales team leaders can position their teams for success, ensuring they are well-equipped to navigate the complexities of funding acquisition. The commitment to continuous improvement in capital sourcing strategies fosters growth and empowers organizations to thrive in an ever-evolving market.

Frequently Asked Questions

What is the first step in establishing a strategic capital sourcing framework?

The first step is to clearly outline your organization's financial requirements and goals, which involves examining current financial resources, market conditions, and potential growth opportunities.

Why is stakeholder involvement important in the funding acquisition process?

Stakeholder involvement is crucial because it ensures alignment across departments and fosters a collaborative approach to funding. Companies that engage with stakeholders are 30% more likely to succeed with new products.

What criteria should be established for assessing potential funding sources?

Criteria for assessing potential funding sources should include factors such as cost, risk, and alignment with strategic goals.

How might the funding priorities differ between a tech startup and a mature organization?

A tech startup may prioritize venture funding during its growth phase, while a mature organization might focus on debt financing to enhance its financial structure.

Why is it important to regularly review and adjust the capital sourcing framework?

Regularly reviewing and adjusting the framework is vital to adapt to evolving market dynamics and organizational priorities.

What role does stakeholder engagement play in project success?

Actively engaged stakeholders can make projects up to 70% more likely to meet their original goals, highlighting the importance of engagement in achieving successful outcomes.

What is the benefit of establishing a governance framework in capital sourcing?

A governance framework enhances accountability and ensures the system remains efficient over time, simplifying capital sourcing and enhancing stakeholder involvement.