Overview

Mastering human capital signals is crucial for enhancing venture funding success. By providing investors with critical insights into a startup's potential, these signals become vital in decision-making processes. Factors such as:

- Educational background

- Professional experience

- Leadership qualities

- Group dynamics

serve as essential indicators that significantly influence investor choices. Understanding these elements not only improves a venture's chances of securing funding but also positions it favorably in a competitive landscape. Investors are increasingly looking for these indicators to gauge the viability of their investments. Therefore, startups must prioritize showcasing their strengths in these areas to attract the necessary capital.

Introduction

Understanding the intricate dynamics of human capital signals is crucial for unlocking success in venture funding. As investors navigate a landscape that reached a staggering £200 billion in 2022, evaluating a startup's workforce indicators—educational background, professional experience, and leadership qualities—has never been more essential. Yet, with the potential for bias and the evolving nature of teams, how can investors ensure informed decision-making? This article explores the significance of human capital signals in venture funding, offering strategies to leverage these indicators for enhanced investment outcomes while addressing the inherent challenges in the assessment process.

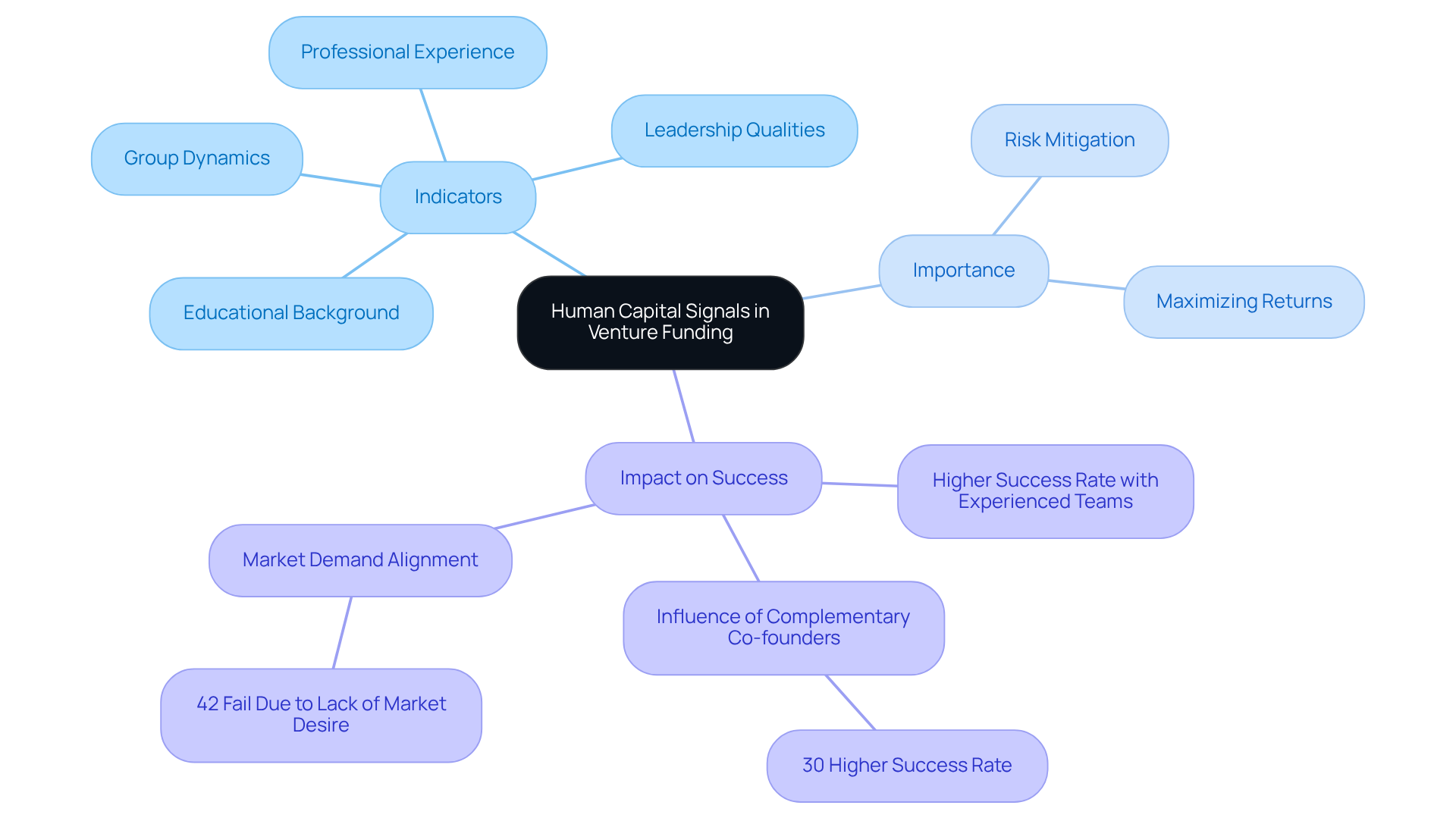

Define Human Capital Signals and Their Importance in Venture Funding

Human resources indicators serve as critical markers that reflect the skills, experience, and abilities of a company's workforce. These indicators encompass elements such as educational background, professional experience, leadership qualities, and group dynamics. In the realm of venture capital, [human capital signals in venture funding](https://exa.ai/websets) are indispensable, as they enable investors to evaluate a new business's potential for success. A well-rounded team, equipped with diverse skills and experiences, significantly enhances a venture's likelihood of achieving its objectives. Thus, are vital for investors aiming to mitigate risk and maximize returns.

Consider this: businesses led by founders with a robust industry background often demonstrate a greater potential for success compared to those with less experienced teams. Research reveals that startups featuring complementary co-founders enjoy a 30% higher success rate, underscoring the importance of group composition. This statistic highlights how human capital signals in venture funding directly influence investor decisions, as a strong team can be a decisive factor in securing funding.

Moreover, the venture funding market reached a record £200 billion in 2022, underscoring the escalating significance of effective signaling in obtaining financing. This substantial investment accentuates the necessity for new ventures to showcase strong human capital signals in venture funding in order to attract investors. Furthermore, understanding group dynamics and market demands is crucial; a staggering 42% of new ventures fail due to the creation of products that lack market desire. By aligning their team's capabilities with market needs, new businesses can strategically position themselves for success.

As new ventures confront the complexities of fundraising, showcasing strong human capital signals in venture funding becomes a pivotal element in attracting investment and achieving enduring success. Case studies focusing on early-stage resource acquisition and communication further illustrate the practical implications of these indicators in securing funding. They highlight the imperative for startups to effectively convey their potential, addressing skepticism and obtaining essential resources.

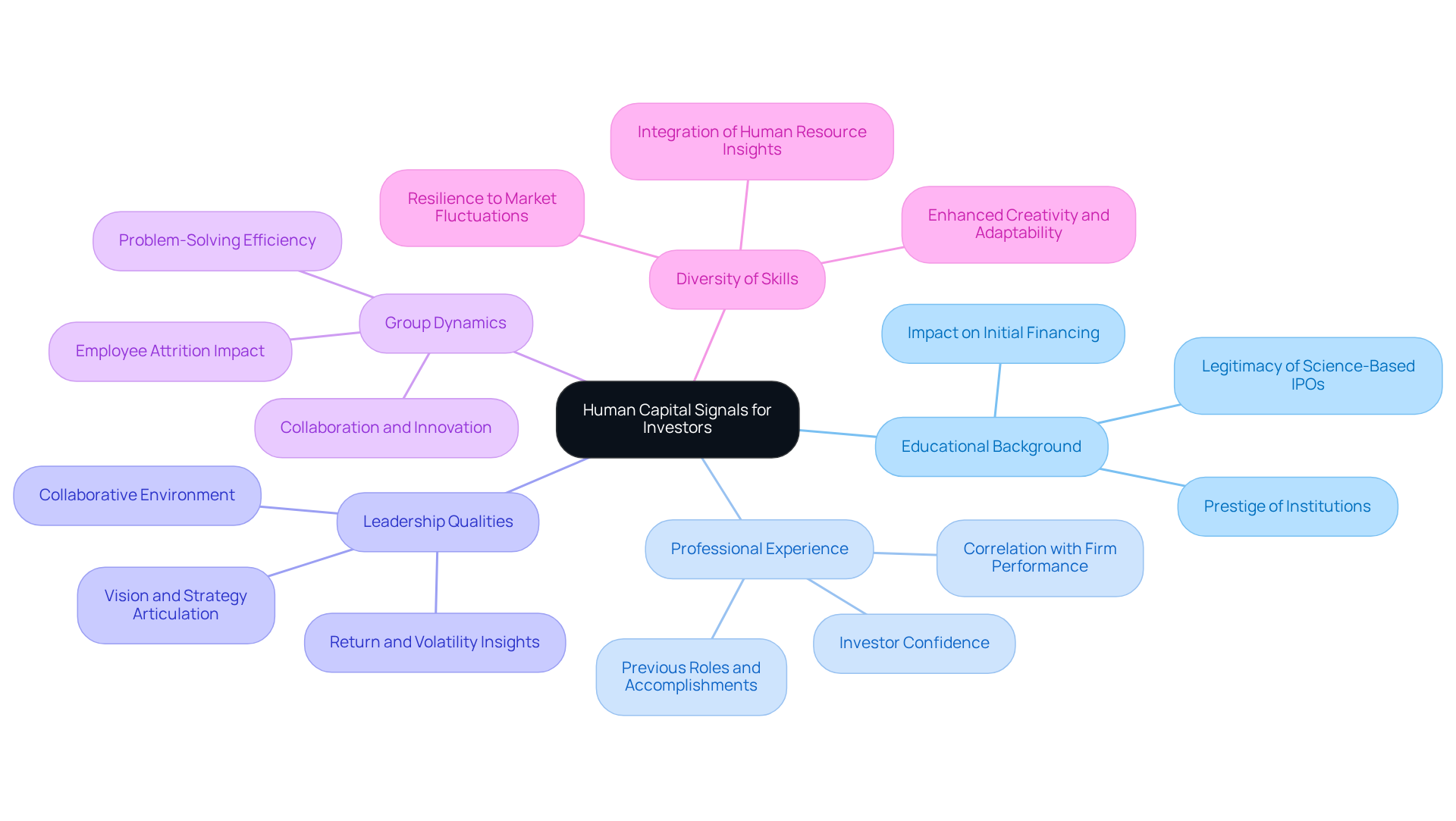

Explore Types of Human Capital Signals Relevant to Investors

Investors must consider several critical types of human capital signals when evaluating startups.

- Educational Background: The educational qualifications and prestige of institutions attended by group members serve as key indicators of their expertise and potential for innovation. Research shows that the educational histories of founders significantly impact their ability to secure initial financing, with education remaining crucial in subsequent funding phases. For example, studies reveal that affiliation with prestigious universities enhances the legitimacy of science-based IPOs.

- Professional Experience: The previous roles and accomplishments of team members in relevant industries signal their capability to navigate challenges effectively. A new business led by individuals with a track record of success in similar projects instills greater confidence among investors. Notably, higher employee turnover correlates with lower future firm performance, underscoring the importance of professional experience in funding decisions.

- Leadership Qualities: Strong leadership is vital for driving a company's vision and culture. Investors seek leaders who can articulate a clear strategy and foster a collaborative environment, as these qualities are essential for long-term success. J.P. Morgan's Quantitative Research highlights that a human capital factor strategy yielded the highest return and lowest volatility among U.S. equity factors, emphasizing the significance of effective leadership.

- Group Dynamics: The ability of a group to collaborate and innovate greatly influences a startup's success. Investors should assess how well group members work together, as efficient collaboration often leads to improved problem-solving and adaptability. For instance, a fund successfully averted disaster by exiting a position after recognizing increasing employee attrition and management issues in a portfolio company, illustrating the critical role of group dynamics.

- Diversity of Skills: A varied skill set within the group enhances creativity and adaptability, making the venture more resilient to market fluctuations. Startups that showcase a range of expertise are typically better equipped to tackle complex challenges and seize new opportunities. The integration of into investment models is increasingly recognized as a valuable tool for investors, evidenced by the growing trend among hedge funds to analyze team structures and manager-to-staff ratios.

By focusing on these human resource indicators, investors can gain a deeper understanding of a startup's potential, enabling them to make more informed funding decisions.

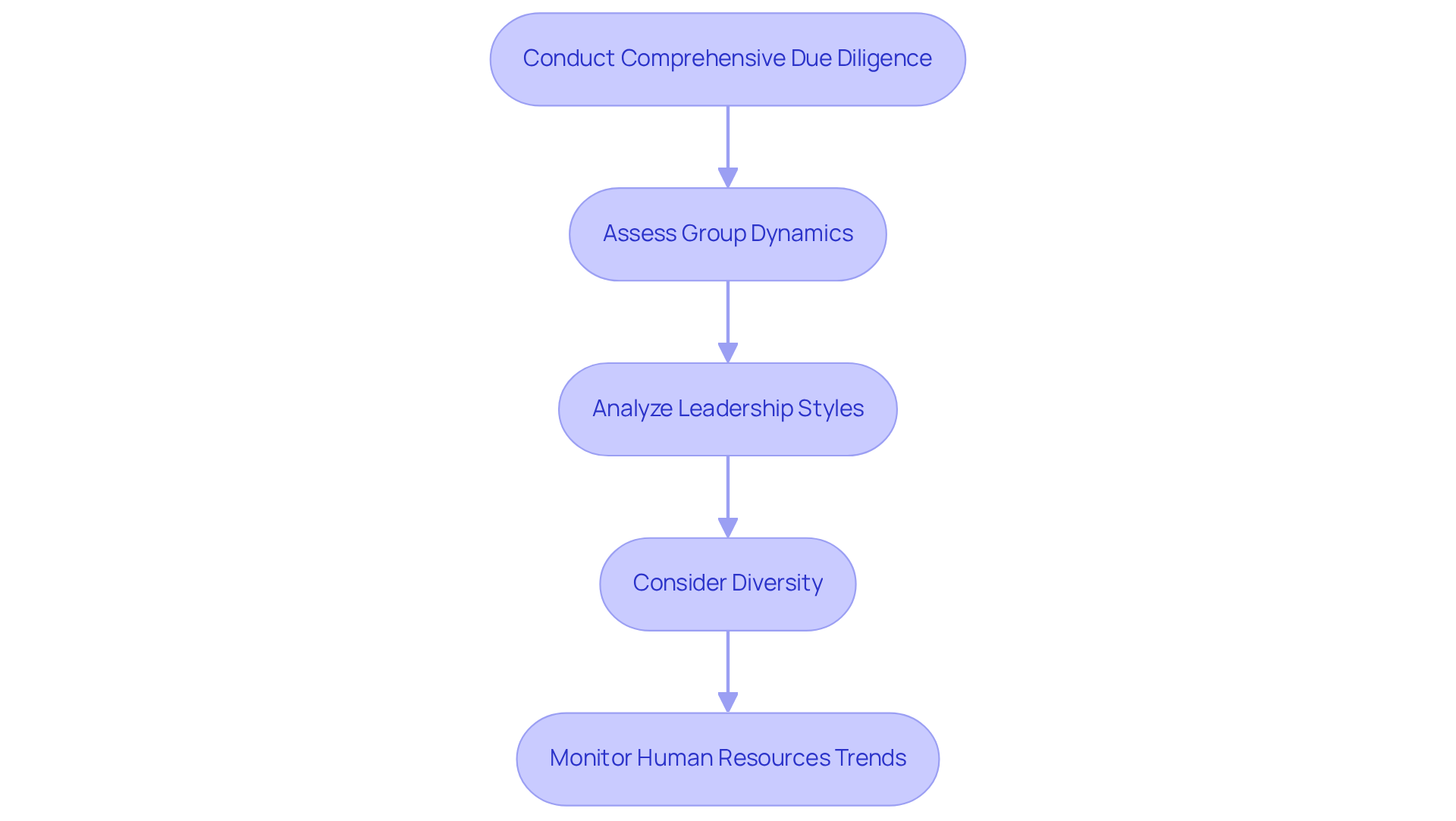

Apply Human Capital Signals in Venture Funding Strategies

To effectively leverage in venture funding, investors must embrace best practices that enhance their decision-making process.

- Conduct Comprehensive Due Diligence: Investors should meticulously scrutinize the educational and professional backgrounds of the founding group and key employees. Relevant experience and a proven track record are critical indicators of potential. Research indicates that new ventures with diverse teams and strong leadership are more likely to succeed, with effective group dynamics playing a pivotal role in their performance.

- Assess Group Dynamics: Observing group interactions during meetings or presentations is essential. Strong collaboration often signifies a healthy work environment that nurtures innovation and resilience. As Brian Christiansen, Executive Managing Director at Sands Capital, highlights, "the significance of candor, collaboration, and entrepreneurialism in creating a culture that promotes long-term thinking" is vital for the success of new ventures.

- Analyze Leadership Styles: Investigating the leadership qualities of the founders is crucial. Effective leaders inspire confidence and guide their teams toward achieving strategic goals, which is indispensable for startup success.

- Consider Diversity: Evaluating the variety of skills and backgrounds within the group is imperative. A diverse team brings varied perspectives and innovative solutions to challenges, enhancing problem-solving capabilities. Notably, only 16% of executives feel they possess adequate technology talent to drive digital transformations, underscoring the necessity for diverse teams to achieve success.

- Monitor Human Resources Trends: Staying updated on trends in human resources management and their implications for startup performance is essential. For instance, VC investment in deep tech in Africa exceeded $3 billion from 2013 to mid-2023, highlighting the increasing importance of human resources in emerging markets.

By integrating these strategies, investors can significantly enhance their ability to identify promising ventures and make informed funding decisions. This approach not only boosts the likelihood of successful investments but also aligns with the growing emphasis on human capital signals in venture funding as a vital asset within the ecosystem.

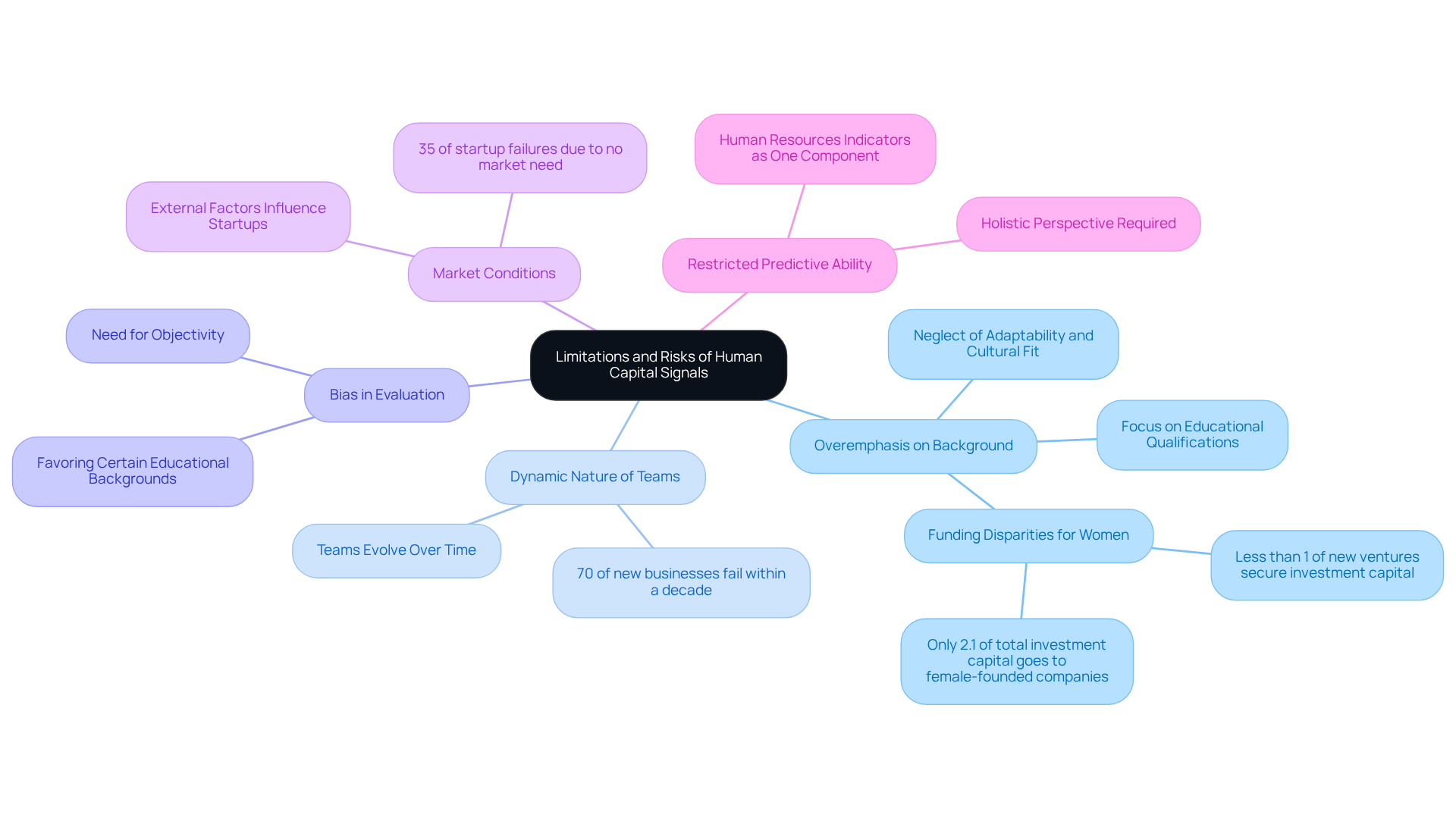

Assess Limitations and Risks of Using Human Capital Signals

Human capital signals provide valuable insights, yet investors must remain aware of their limitations and associated risks.

- Overemphasis on Background: An excessive focus on educational qualifications or prior experiences can obscure essential attributes like adaptability and cultural fit, which are vital for the success of new ventures. Notably, "Less than 1% of new ventures secure investment capital, and a very limited portion of this funding is directed towards companies founded by women," emphasizing the necessity for a broader evaluation approach.

- Dynamic Nature of Teams: Teams are not static; they . Initial indicators may not accurately predict future performance, necessitating ongoing assessment to capture these changes. For instance, statistics reveal that 70% of new businesses fail within a decade, underscoring the importance of adapting evaluations as teams progress.

- Bias in Evaluation: Investors may unconsciously favor certain educational backgrounds or experiences, leading to biased decision-making. It is crucial to maintain objectivity to avoid skewed assessments. As Peter Lynch aptly stated, "Wide diversification is only required when investors do not understand what they are doing," highlighting the need for informed evaluations.

- Market Conditions: External factors, including market trends and economic conditions, can significantly influence a startup's trajectory, often independent of its human resources indicators. A comprehensive understanding of these dynamics is essential for making informed investment decisions.

- Restricted Predictive Ability: Human resources indicators should not be viewed as definitive markers of success; they represent merely one component of a complex assessment. A holistic perspective is vital for informed investment decisions.

By recognizing these limitations, investors can critically evaluate human capital signals, fostering a more balanced and informed investment strategy.

Conclusion

Mastering human capital signals is essential for navigating the complex landscape of venture funding and achieving sales success. Understanding and effectively leveraging these signals enables investors to make informed decisions that significantly enhance the likelihood of startup success. Evaluating a team's skills, experience, and dynamics not only aids in risk mitigation but also strategically positions new ventures in a competitive market.

Key insights highlight the importance of various human capital indicators, including:

- Educational background

- Professional experience

- Leadership qualities

- Group dynamics

- Diversity of skills

Each element contributes to a startup's potential for success and can be pivotal in attracting investment. Moreover, understanding the limitations and risks of relying solely on these signals ensures that investors maintain a balanced perspective, allowing for a comprehensive evaluation of potential ventures.

Ultimately, recognizing the significance of human capital signals in venture funding is crucial for both investors and entrepreneurs. This recognition serves as a call to action for startups to cultivate strong teams and communicate their capabilities effectively. By doing so, they enhance their chances of securing funding and align with the evolving demands of the market, paving the way for sustainable growth and success in the future.

Frequently Asked Questions

What are human capital signals in venture funding?

Human capital signals are indicators that reflect the skills, experience, and abilities of a company's workforce, including educational background, professional experience, leadership qualities, and group dynamics.

Why are human capital signals important for investors?

They enable investors to evaluate a new business's potential for success, helping to mitigate risk and maximize returns by identifying well-rounded teams with diverse skills and experiences.

How does the experience of founders affect a startup's success?

Startups led by founders with a robust industry background often demonstrate a greater potential for success compared to those with less experienced teams.

What is the impact of co-founders on startup success rates?

Research shows that startups featuring complementary co-founders enjoy a 30% higher success rate, emphasizing the importance of group composition.

What was the venture funding market size in 2022?

The venture funding market reached a record £200 billion in 2022, highlighting the increasing importance of effective signaling in attracting financing.

What percentage of new ventures fail due to market misalignment?

A staggering 42% of new ventures fail because they create products that lack market desire, underscoring the importance of aligning team capabilities with market needs.

How can startups effectively showcase their human capital signals?

Startups can showcase their human capital signals by effectively communicating their potential, addressing investor skepticism, and demonstrating alignment with market demands to secure essential resources.