Overview

This article presents eight strategies essential for achieving success in private equity sourcing, underscoring the critical role of technology—especially AI-driven tools—in enhancing lead generation and decision-making processes. By employing a robust investment thesis and closely monitoring liquidity indicators, firms can significantly improve sourcing efficiency and investment outcomes. Evidence supports the notion that systematic approaches and data precision are vital in navigating a competitive market. Each strategy not only highlights best practices but also provides actionable insights for practitioners seeking to elevate their sourcing capabilities.

Introduction

In the fast-paced world of private equity, sourcing the right deals is paramount to a firm’s success. As the market grows increasingly complex, understanding effective strategies for identifying and securing lucrative investment opportunities becomes critical. This article explores eight innovative tactics that leverage technology, data analysis, and proactive engagement to enhance private equity sourcing. Firms face challenges such as low-quality leads and competitive pressures; thus, the question arises: how can they not only keep pace but also lead the charge in securing the best deals?

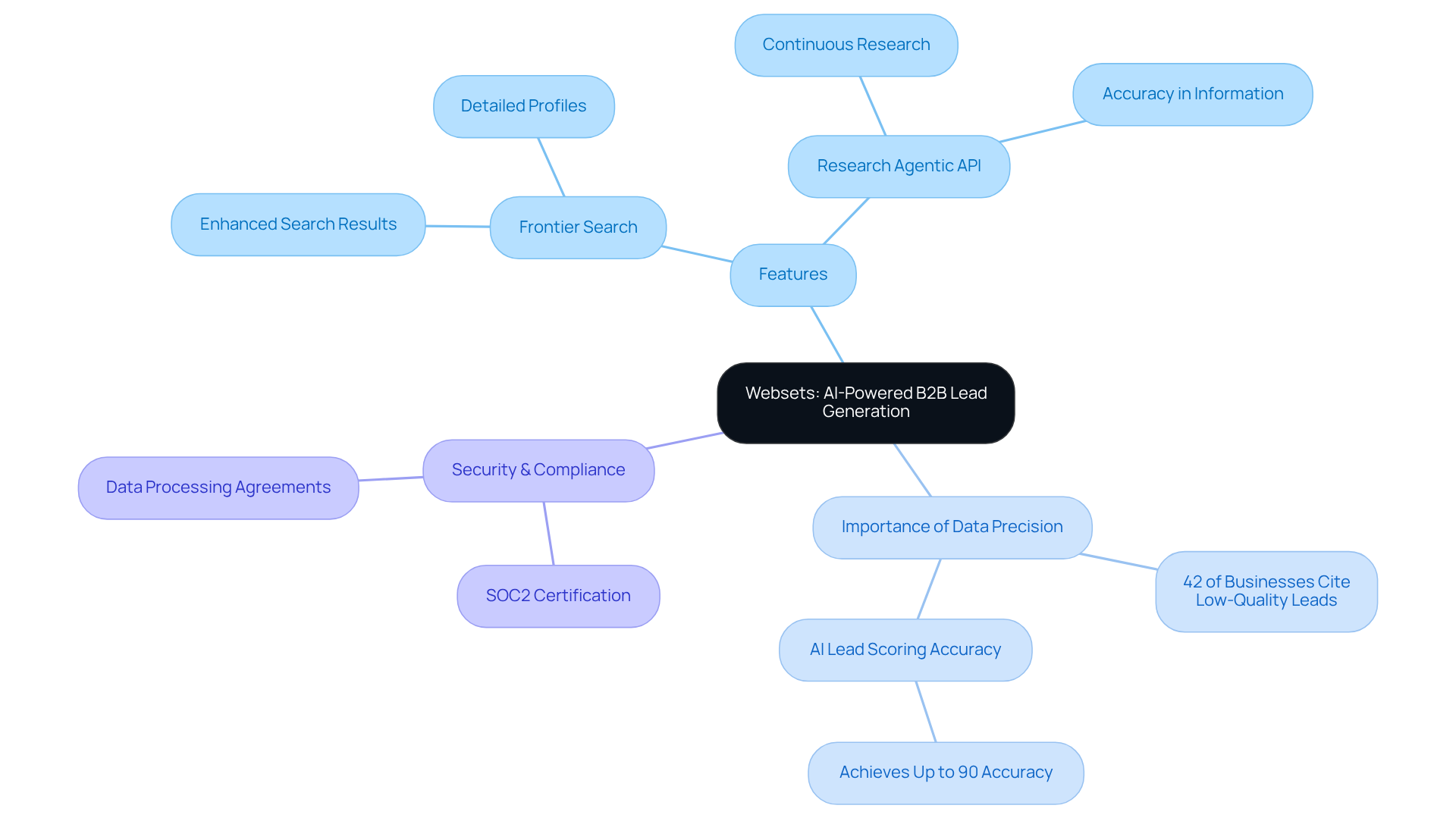

Websets: AI-Powered B2B Lead Generation for Private Equity Sourcing

Websets harnesses advanced AI algorithms to revolutionize , making it an indispensable resource for private equity sourcing. By effectively sifting through extensive datasets, private equity sourcing enables firms to swiftly identify promising funding opportunities and key stakeholders. The platform offers:

- Frontier Search: An in-house developed AI research lab enhances search results with detailed profiles, providing users with comprehensive information that supports informed investment decisions.

- Research Agentic API: This feature continues researching until it outputs the correct answer or report, ensuring accuracy in complex information requests.

These capabilities optimize the procurement process and significantly enhance data precision, which is essential for private equity sourcing professionals who depend on accurate and actionable insights. As the landscape evolves, companies utilizing AI-driven tools are better equipped to navigate the intricacies of procurement, ultimately enhancing their success in investment strategies. Moreover, with 42% of businesses citing low-quality leads as a significant challenge, accurate data becomes critical. Websets' commitment to security and compliance, including SOC2 certification and extensive data processing agreements, ensures that organizations can trust the integrity of their data. Industry leaders emphasize that data precision is vital in private equity sourcing, making this tool crucial for companies aiming to elevate their efforts.

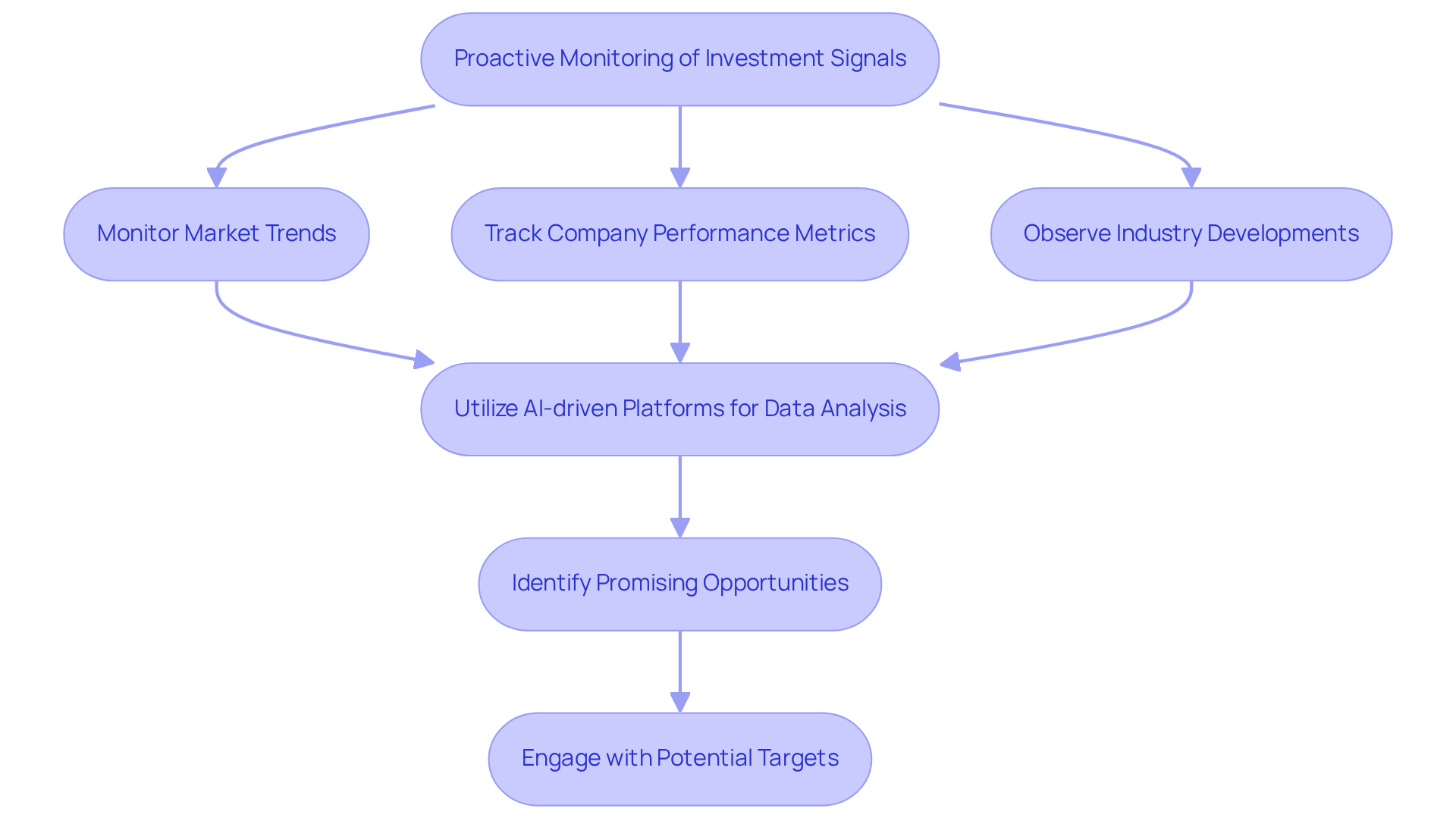

Proactively Monitor Investment Signals for Early Deal Identification

To secure a competitive advantage, private equity firms must actively engage in private equity sourcing by monitoring investment signals—market trends, company performance metrics, and industry developments. Utilizing tools like for real-time monitoring and data analysis can significantly enhance this process. By harnessing Websets' capabilities, firms can improve their private equity sourcing by identifying promising opportunities early and engaging with potential targets before they garner attention from competitors. This proactive strategy not only increases the chances of securing favorable terms but also empowers firms to implement advanced lead generation tactics that resonate with current market dynamics.

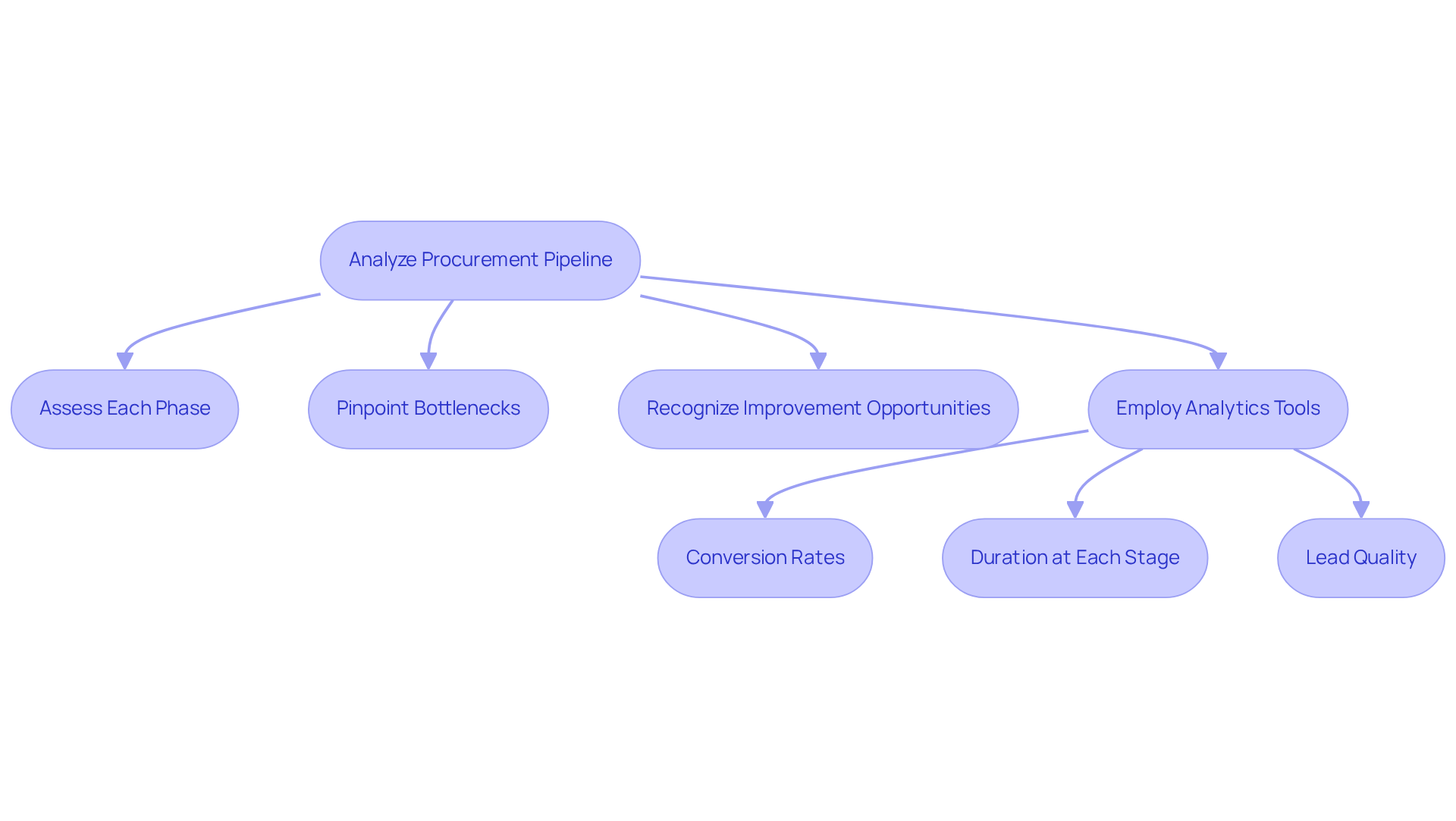

Analyze Your Pipeline to Enhance Sourcing Success

Regular examination of the procurement pipeline is essential for enhancing success rates in private equity sourcing. By systematically assessing each phase of the deal flow, companies can pinpoint bottlenecks and recognize opportunities for improvement. Key metrics to consider include conversion rates, the duration spent at each stage, and the overall quality of leads generated.

Employing sophisticated analytics tools, such as an AI-driven platform, can yield deeper insights into these metrics. This enables companies to and concentrate on high-potential opportunities. For instance, companies that have adopted Websets report enhanced lead quality and quicker deal closures, thanks to accurate lead generation capabilities.

A proactive strategy for deal acquisition, as emphasized by industry experts, can significantly boost conversion rates and streamline the overall process. By focusing on these metrics, private equity firms can improve their private equity sourcing and deal flow analysis, leading to more informed decision-making and ultimately greater investment success. Moreover, with 70% of private equity companies underscoring the importance of brand development, integrating this element into procurement strategies can further elevate effectiveness.

To deepen these insights, companies should establish specific goals for each metric and regularly assess performance against these standards.

Utilize Your Investment Thesis to Direct Sourcing Efforts

A clearly articulated financial strategy is essential for guiding acquisition efforts through private equity sourcing. Leveraging their thesis, companies can effectively filter potential deals, ensuring alignment with strategic objectives. This focused method simplifies the private equity sourcing process and significantly enhances the likelihood of successful funding.

Data indicates that the typical private equity firm engages in private equity sourcing by assessing 80 opportunities before finalizing a single placement, underscoring the importance of a robust thesis in identifying well-suited opportunities.

Industry leader David Rubenstein asserts that in private equity, it’s not merely about buying and selling companies; it’s about improving them. By integrating Websets, an AI-powered platform for B2B lead generation and people search solutions, firms can swiftly identify candidates that meet their funding criteria. This integration streamlines procurement efforts and boosts overall , enabling companies to focus on high-potential investments.

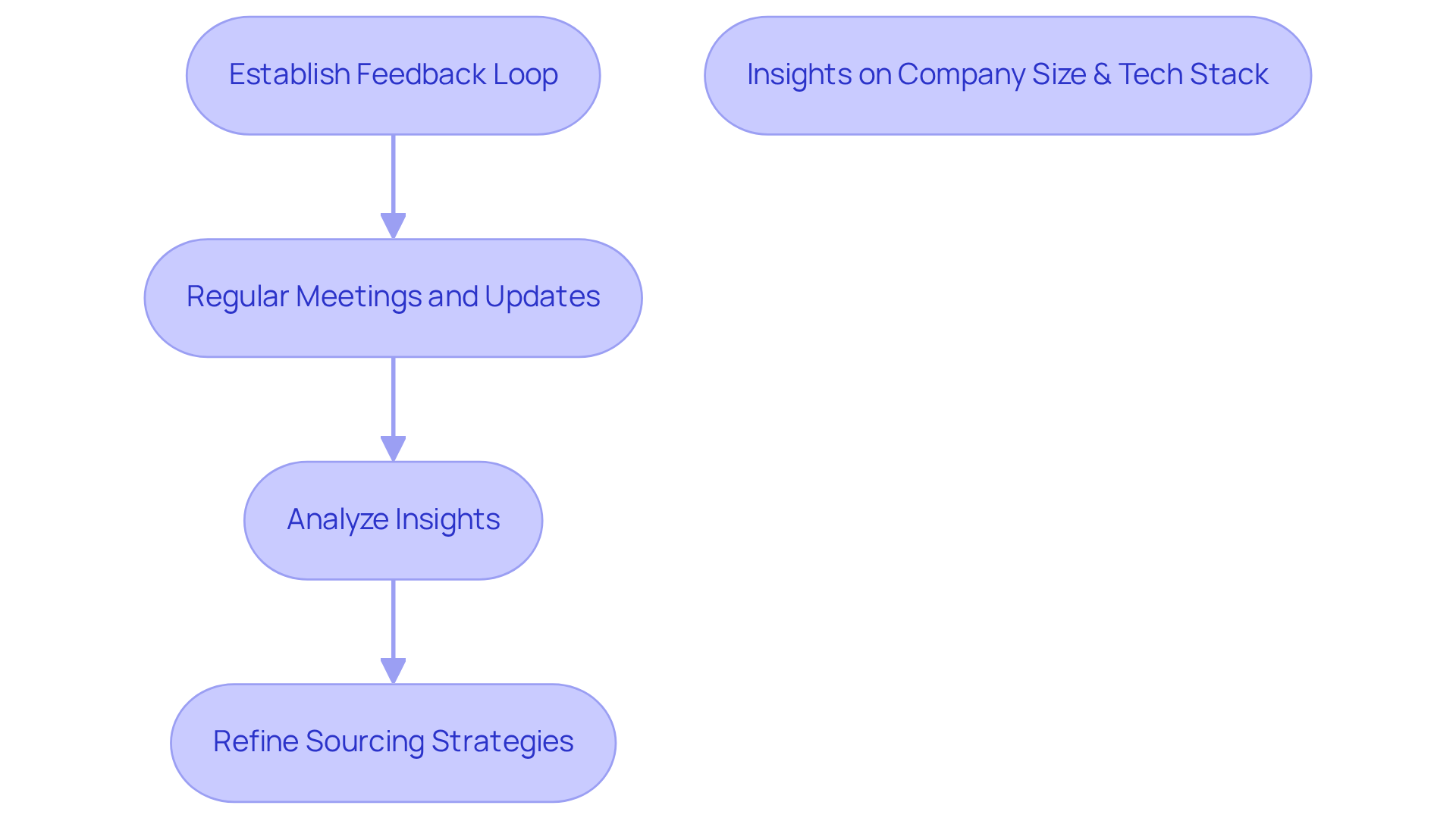

Establish a Feedback Loop Between Portfolio Teams and Deal Sourcing

Establishing a feedback loop between portfolio teams and deal acquisition is crucial for continuous enhancement. Portfolio teams provide valuable insights into the types of deals that succeed or fail, guiding future acquisition strategies. Regular meetings and updates facilitate this information exchange, ensuring procurement efforts align with portfolio performance realities.

By leveraging tools to track and analyze feedback—such as insights on company size and tech stack—firms can refine their sourcing processes and improve effectiveness. The platform's capabilities in identifying notable companies, relevant articles, and tech insights empower teams to make , particularly when targeting Series A funded companies that are expanding their engineering teams and implementing CI/CD practices.

Build a Strong Brand Presence to Attract Quality Deals

Establishing a robust brand presence is essential for attracting high-quality deals in the competitive landscape of private equity. Firms must prioritize investment in marketing and public relations to elevate their visibility and reputation. This strategy encompasses the showcasing of successful investments, thought leadership, and industry expertise. A well-regarded brand not only opens doors to exclusive deals but also facilitates partnerships, streamlining the private equity sourcing of premium opportunities.

Furthermore, leveraging Websets' AI-driven tools can significantly enhance the identification of key influencers and stakeholders. This, in turn, bolsters , further solidifying brand presence.

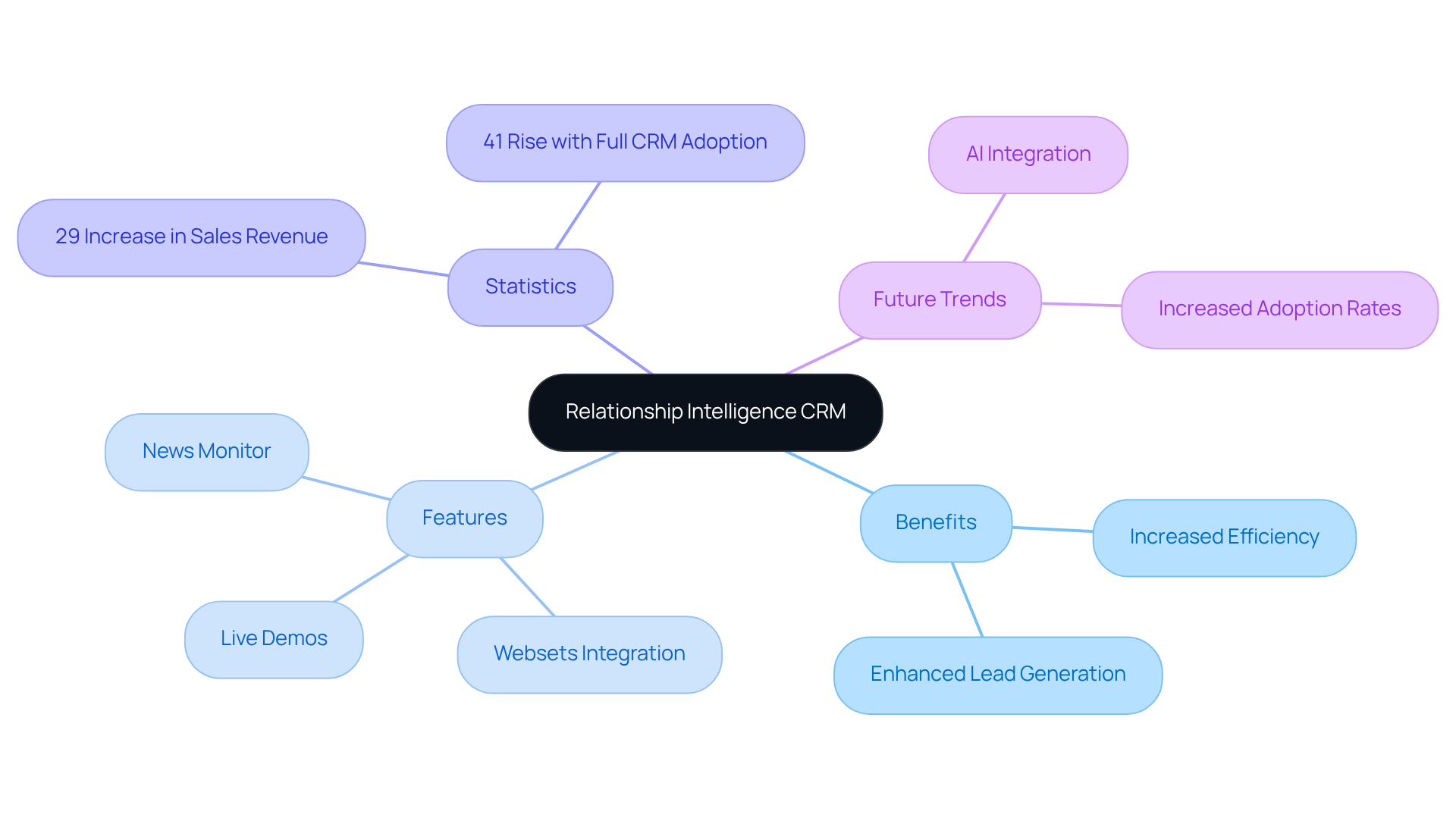

Leverage a Relationship Intelligence CRM for Efficient Deal Sourcing

Utilizing a Relationship Intelligence CRM can dramatically enhance private equity sourcing efficiency for private equity companies. This technology enables firms to systematically manage their connections and interactions with potential investment targets. By monitoring communications and follow-ups, companies can ensure that no opportunity is overlooked. Furthermore, integrating Websets with a CRM amplifies this process by providing enriched data on contacts and employing tools like Exa's Link Similarity and Keyword Search, alongside features such as Live Demos and News Monitor. These capabilities facilitate more informed outreach efforts, empowering businesses to conduct deeper company research and generate high-quality leads.

Statistics reveal that companies leveraging CRM systems can experience a sales revenue increase of up to 29%. Those that fully embrace CRM have noted a remarkable , underscoring the potential impact of effective CRM integration on deal acquisition efficiency. Industry leaders stress the necessity of managing connections effectively, as 61% of companies report that CRM significantly aids in lead generation and nurturing. Moreover, 61% plan to incorporate AI into their CRM within the next three years.

By evaluating their existing CRM systems for integration potential with tools such as Webtools, private equity firms can refine their private equity sourcing strategies and achieve enhanced financial results. To maximize these benefits, firms should regularly assess their CRM functionalities and explore new features that can elevate their investment strategies.

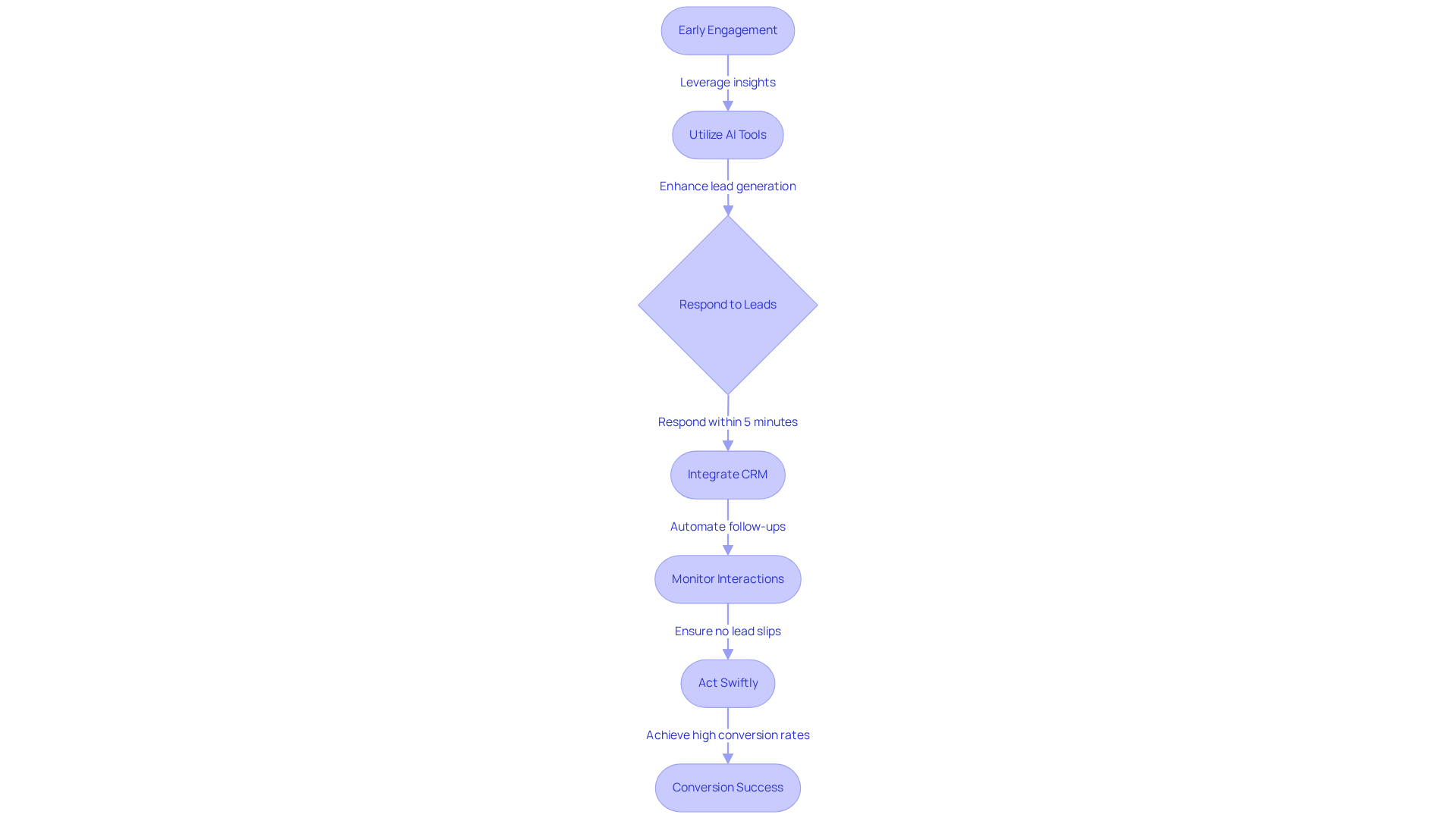

Engage Early and Act Quickly to Secure Competitive Deals

In the dynamic landscape of private equity sourcing, early engagement with potential targets is not just beneficial; it is essential. Companies must prioritize rapid engagement to capitalize on identified opportunities, leveraging insights from platforms to tailor their strategies effectively.

Websets provides AI-driven tools that enhance B2B lead generation and data analysis, enabling sales teams to utilize Exa's link similarity and keyword search for more effective company research. Research indicates that responding to leads within the initial five minutes can significantly improve conversion rates, underscoring speed as a critical factor in successful deal acquisition. In fact, sales teams that respond within the first minute can experience an astonishing 391% increase in conversions.

By integrating CRM platforms like Salesforce or HubSpot, companies can meticulously monitor interactions and automate follow-ups, ensuring that no lead slips through the cracks. With innovative Livecrawl options and default settings designed for and data exploration, Websets empowers organizations to act swiftly and maintain flexibility in their strategies.

This agility in private equity sourcing allows them to navigate the competitive environment more effectively, ensuring they are among the first to negotiate advantageous terms before opportunities become saturated.

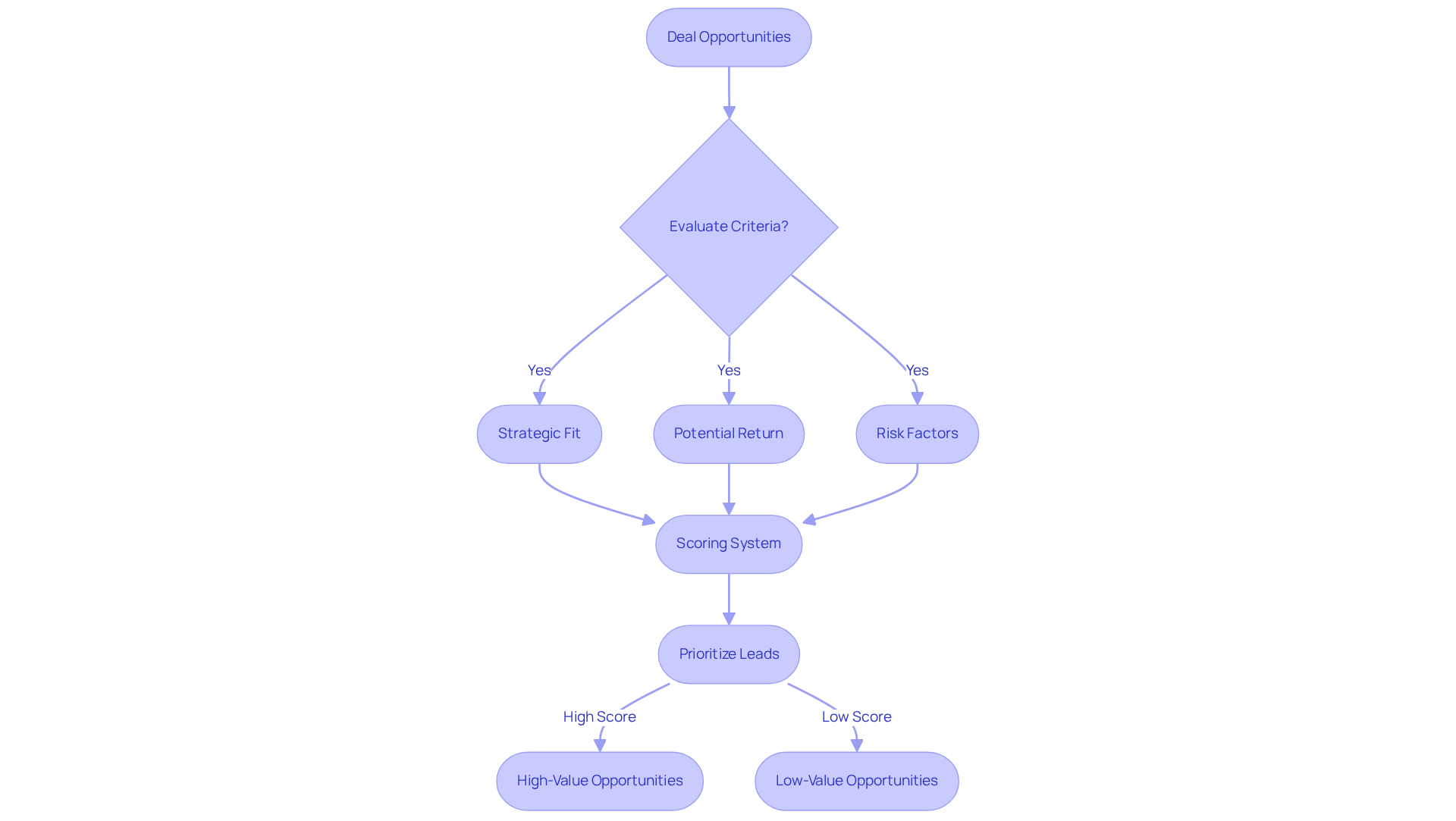

Assign Scores to Opportunities for Prioritized Deal Sourcing

Implementing a scoring system for deal opportunities significantly enhances private equity sourcing efficiency. By assigning scores based on criteria such as strategic fit, potential return, and associated risk factors, firms can effectively prioritize their efforts on the most promising leads. This structured methodology not only optimizes resource allocation but also ensures that teams concentrate on high-value opportunities. Leveraging Websets' AI-powered solutions to gather and analyze data for scoring further enhances this process, leading to more informed decision-making.

Moreover, employing a 'traffic light' approach for segmentation aids in visualizing customer health scores, allowing teams to quickly identify which leads require urgent attention. This strategy aligns with industry insights, where is essential for maximizing financial success. In today's fast-paced environment, adopting such methodologies is not just advantageous; it is imperative for sustained growth and competitive advantage.

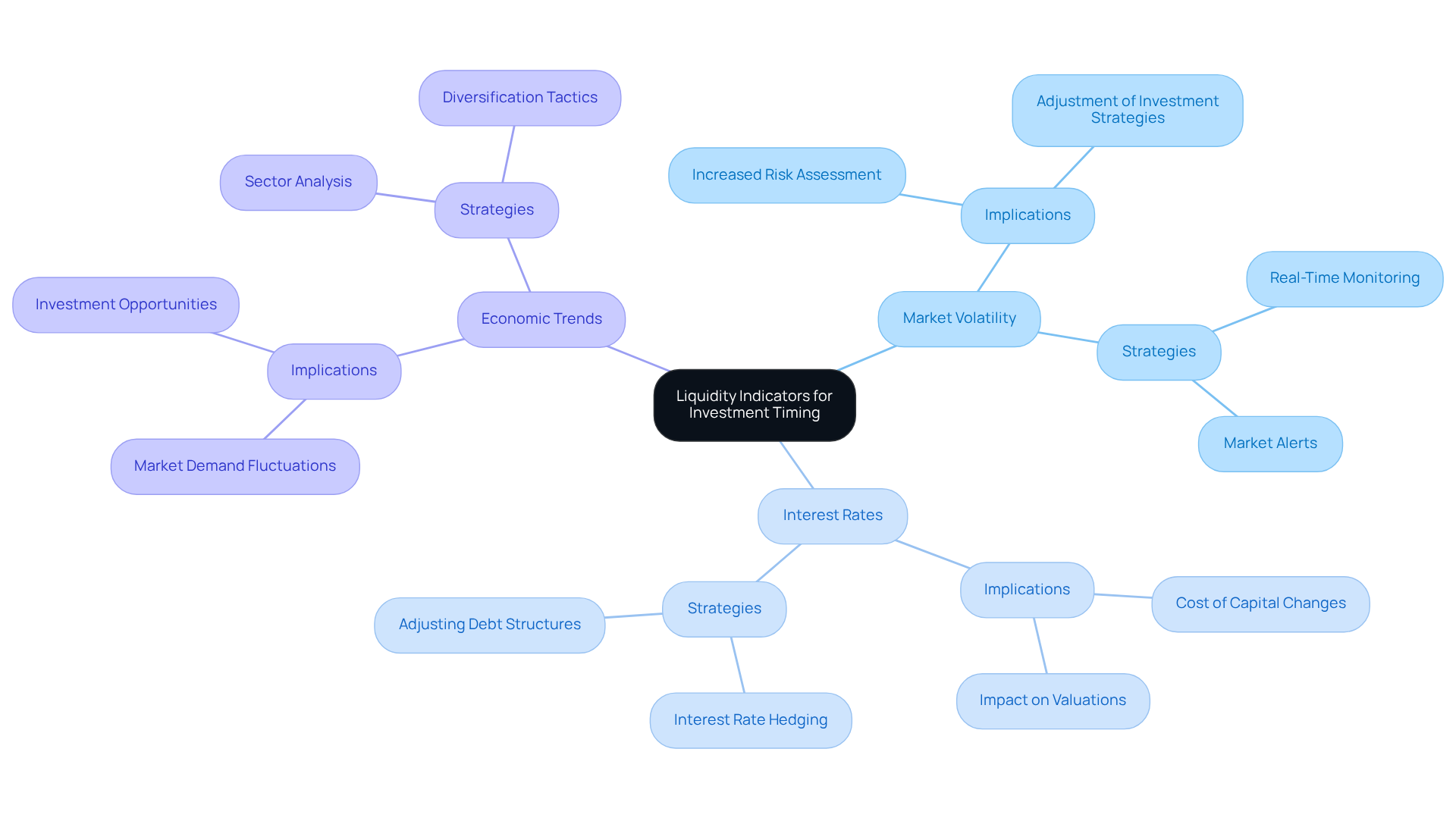

Monitor Liquidity Indicators to Optimize Investment Timing

To enhance capital timing, private equity firms must diligently such as market volatility, interest rates, and broader economic trends. These factors are crucial for making informed decisions about entry and exit points in financial ventures. For example, global interest rates surged by over 500 basis points from 2022 to 2023; understanding the implications of such shifts is imperative. Moreover, total global private equity assets under management (AUM) declined by 1.4 percent from the end of 2023 through the first half of 2024, underscoring the urgency of tracking these indicators.

Geopolitical instability and changes in trade policy present critical challenges for private market managers and investors, making vigilance essential. By employing platforms that monitor these indicators in real-time, firms can enhance their adaptability to market changes and seize favorable opportunities. This proactive approach not only improves investment outcomes but also enables firms to navigate the complexities of a dynamic market landscape effectively.

As a practical strategy, firms should consider setting up alerts within Websets for significant changes in liquidity indicators. This will ensure timely decision-making and empower them to act swiftly in response to evolving market conditions.

Conclusion

In the competitive realm of private equity, effective sourcing strategies are paramount for success. Leveraging advanced tools and methodologies enhances firms' abilities to identify and secure high-quality investment opportunities. The integration of AI-powered platforms, such as Websets, streamlines processes, improves data accuracy, and enables proactive engagement with potential targets.

This article outlines several key strategies for successful private equity sourcing.

- Monitoring investment signals

- Analyzing the procurement pipeline

- Establishing feedback loops between portfolio teams and deal sourcing

These are critical components. Moreover, building a strong brand presence and utilizing a Relationship Intelligence CRM significantly enhance lead generation and facilitate timely engagement with prospects. By assigning scores to opportunities and monitoring liquidity indicators, firms can prioritize efforts and optimize investment timing, ultimately leading to more favorable outcomes.

As the landscape of private equity continues to evolve, adopting these strategies will improve sourcing efficiency and empower firms to navigate challenges with agility. Embracing innovative technologies and fostering collaboration within teams positions private equity firms for sustained success in identifying and capitalizing on lucrative investment opportunities.

Frequently Asked Questions

What is Websets and how does it assist in B2B lead generation for private equity sourcing?

Websets is an AI-powered platform that revolutionizes B2B lead generation by sifting through extensive datasets to help private equity firms identify promising funding opportunities and key stakeholders swiftly.

What features does Websets offer to enhance its lead generation capabilities?

Websets offers features such as Frontier Search, which provides detailed profiles to support informed investment decisions, and a Research Agentic API that continues researching until it outputs accurate answers or reports.

Why is data precision important in private equity sourcing?

Data precision is vital in private equity sourcing because accurate and actionable insights are essential for making informed investment decisions. Low-quality leads are a significant challenge for 42% of businesses, making precise data critical.

How can private equity firms proactively monitor investment signals?

Private equity firms can proactively monitor investment signals such as market trends, company performance metrics, and industry developments by utilizing AI-driven platforms for real-time monitoring and data analysis.

What benefits do firms gain from early identification of promising opportunities?

Early identification of promising opportunities allows firms to engage with potential targets before they attract attention from competitors, increasing the chances of securing favorable terms and enhancing lead generation tactics.

How can analyzing the procurement pipeline improve sourcing success?

Regular examination of the procurement pipeline helps identify bottlenecks and opportunities for improvement by assessing key metrics like conversion rates and lead quality, ultimately refining procurement strategies.

What impact does Websets have on lead quality and deal closures?

Companies using Websets report enhanced lead quality and quicker deal closures due to its accurate lead generation capabilities, which contribute to more informed decision-making.

What role does brand development play in private equity sourcing?

Brand development is emphasized by 70% of private equity companies as important for enhancing procurement strategies, leading to greater effectiveness in deal acquisition.

How should companies assess their performance in private equity sourcing?

Companies should establish specific goals for key metrics and regularly assess their performance against these standards to deepen insights and improve their sourcing strategies.