Overview

This article delves into the effective utilization of the Private Markets Signals API, aimed at enhancing venture capital (VC) success through a structured five-step approach. Understanding private market signals is crucial, as it lays the foundation for selecting the right API. Once the appropriate API is identified, integrating it into VC workflows becomes essential. Analyzing the data for investment insights follows, allowing VCs to make informed decisions. Finally, troubleshooting common issues is vital for refining funding strategies. By mastering these steps, VCs can significantly improve their investment outcomes.

Introduction

Navigating the intricate landscape of venture capital requires more than just intuition; it demands a keen understanding of private market signals that reveal the potential and performance of private companies. Harnessing the power of a Private Markets Signals API enables venture capitalists to unlock invaluable insights, informing their investment strategies and enhancing decision-making.

Yet, with a plethora of APIs available, how can one effectively integrate these tools into their workflow while overcoming common challenges? This guide offers a structured approach to mastering the Private Markets Signals API, equipping VCs with the knowledge to capitalize on emerging opportunities and mitigate risks in a competitive market.

Understand Private Market Signals and Their Importance for VC

Private market signals are critical indicators that provide valuable insights into the performance and potential of private companies. These signals encompass financial metrics, market trends, and . For venture capitalists (VCs), understanding the private markets signals API for VC is essential for identifying high-growth funding opportunities and mitigating risks associated with private market ventures. By analyzing these signals, VCs can make informed decisions that align with their funding strategies and objectives.

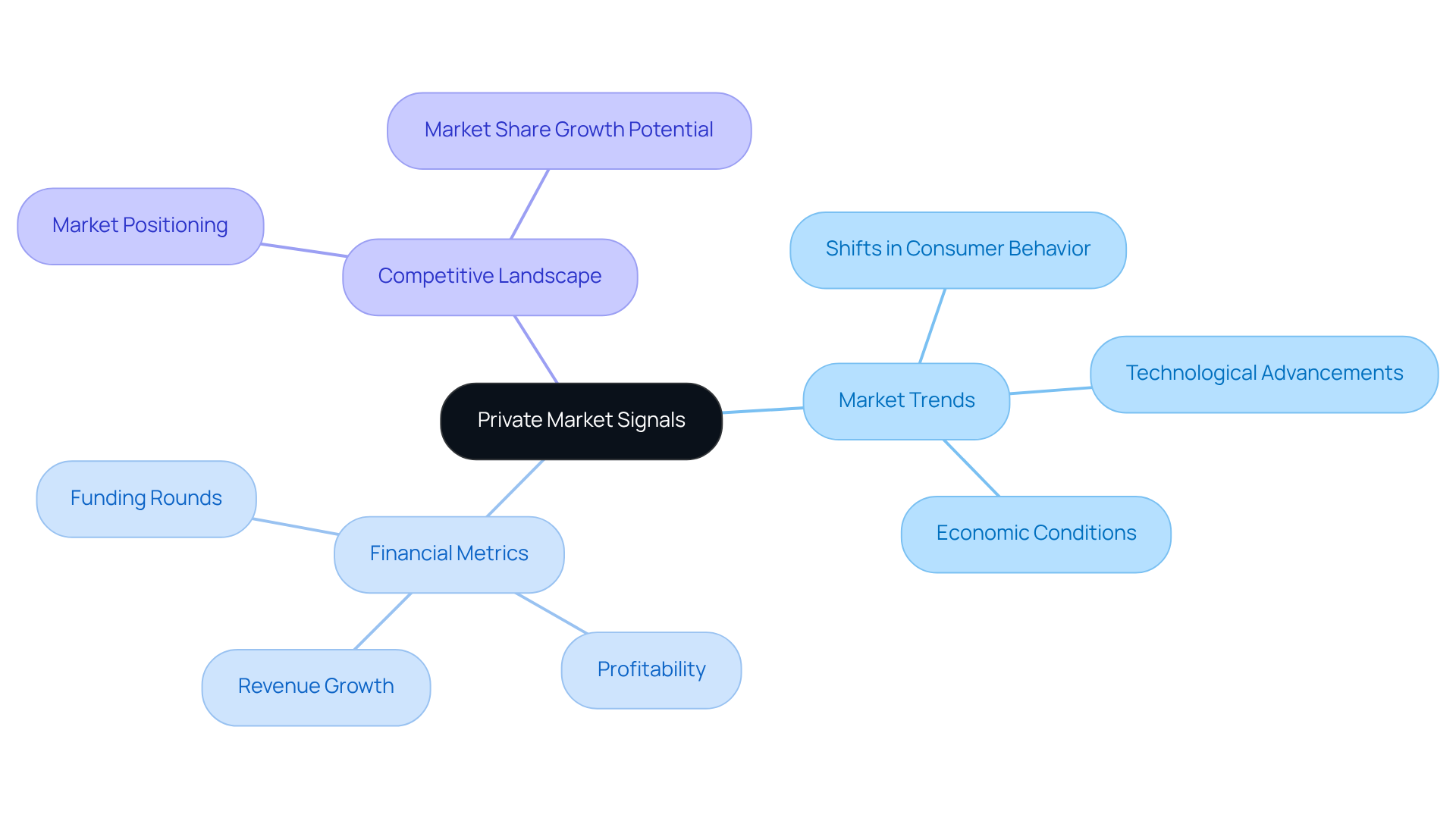

Key aspects to consider include:

- Market Trends: Recognizing shifts in consumer behavior, technological advancements, and economic conditions that may impact private companies is vital.

- Financial Metrics: Evaluating revenue growth, profitability, and funding rounds allows for a thorough assessment of a company's financial health.

- Competitive Landscape: Understanding how a company positions itself against competitors and its potential for market share growth is crucial.

Mastering these signals using a private markets signals API for VC empowers VCs to refine their funding strategies and achieve superior outcomes within their portfolios.

Explore Available Private Markets Signals APIs

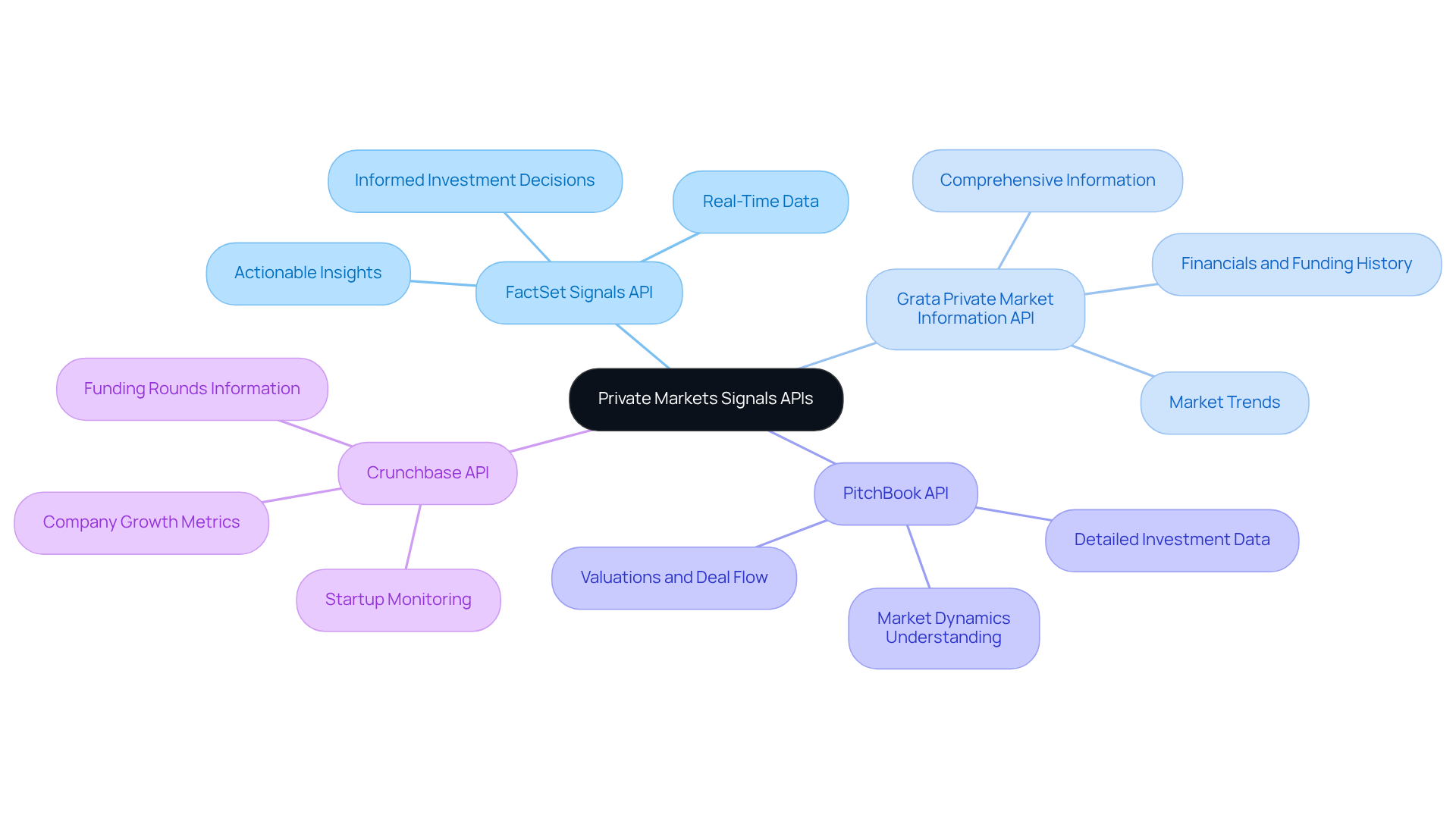

Access to multiple APIs is crucial for gaining insights into the private markets signals API for VC, which enables venture capitalists to efficiently gather and assess vital information. Consider the following noteworthy options:

- FactSet Signals API: This API provides actionable insights derived from extensive datasets, empowering VCs to make informed investment decisions based on real-time data. With to approach nearly $440B by 2025, leveraging such knowledge is essential for navigating the evolving market landscape.

- Grata Private Market Information API: Known for its comprehensive information on private firms, Grata offers insights into financials, funding history, and market trends, making it a valuable resource for financial analysis. Notably, the median deal size reached a new peak of $3.5M in 2025 YTD, underscoring the importance of precise information in securing competitive funding.

- PitchBook API: This API delivers detailed information on private equity and venture capital investments, including valuations and deal flow, which are critical for understanding market dynamics. As the venture market experiences a decline in deal count, access to accurate data becomes increasingly vital.

- Crunchbase API: A key resource for monitoring startup activity, this API provides information on funding rounds and company growth metrics, assisting investors in staying informed about emerging opportunities. Industry leaders stress the necessity of utilizing such tools to enhance financial strategies.

When selecting an API, it is essential to consider factors such as coverage, ease of integration, and the specific insights required for your financial strategy. Testing multiple APIs can help identify the best fit for your workflow, ensuring you utilize the most effective tools for your venture capital pursuits. As Mira Murati, former OpenAI CTO, highlighted, collaborating with innovative leaders can significantly impact financial outcomes in this rapidly evolving landscape.

Integrate the API into Your VC Workflow

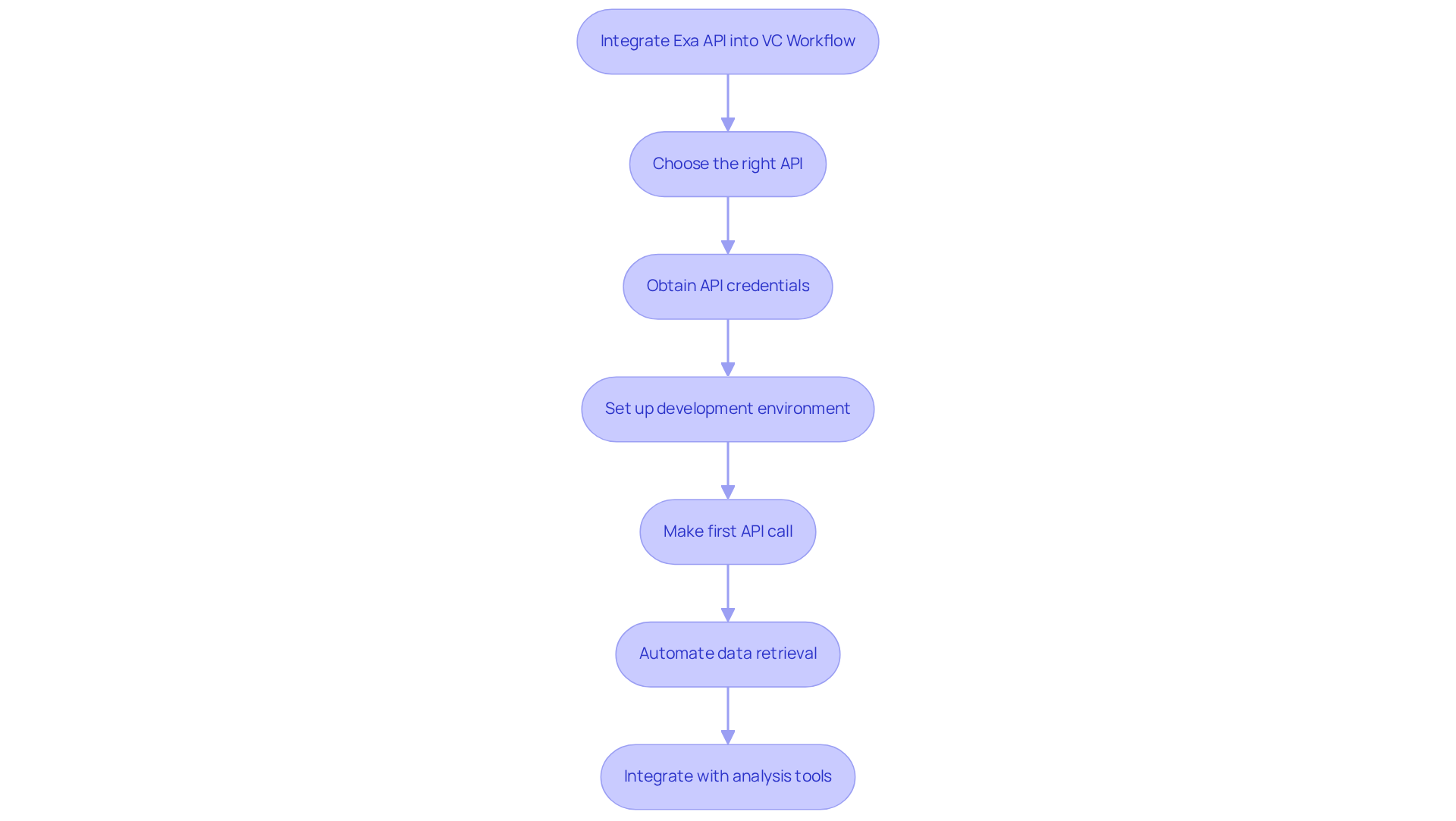

Integrating the Exa API into your VC workflow is essential for optimizing your investment strategy. Start by choosing the right API; the Exa API stands out with its advanced search capabilities and vital information tailored to your needs. Next, obtain your API credentials by signing up for the Exa API service and securing your unique API key for authentication.

Setting up your development environment is crucial. Ensure you have the necessary tools and libraries installed to facilitate API calls, such as Python or Postman. Once ready, make your first API call. Consult the Exa API documentation to familiarize yourself with the endpoints and parameters, beginning with a straightforward GET request to gather information.

To enhance efficiency, . Write scripts that ensure your datasets are regularly updated with the latest details from Exa. Finally, integrate this API information with your analysis tools, like Excel or Tableau, to visualize data and deepen your understanding.

By adhering to these steps, you will streamline your information-gathering process, allowing you to focus on evaluating the findings that matter most to your financial approach.

Analyze and Interpret Data from the API for Investment Insights

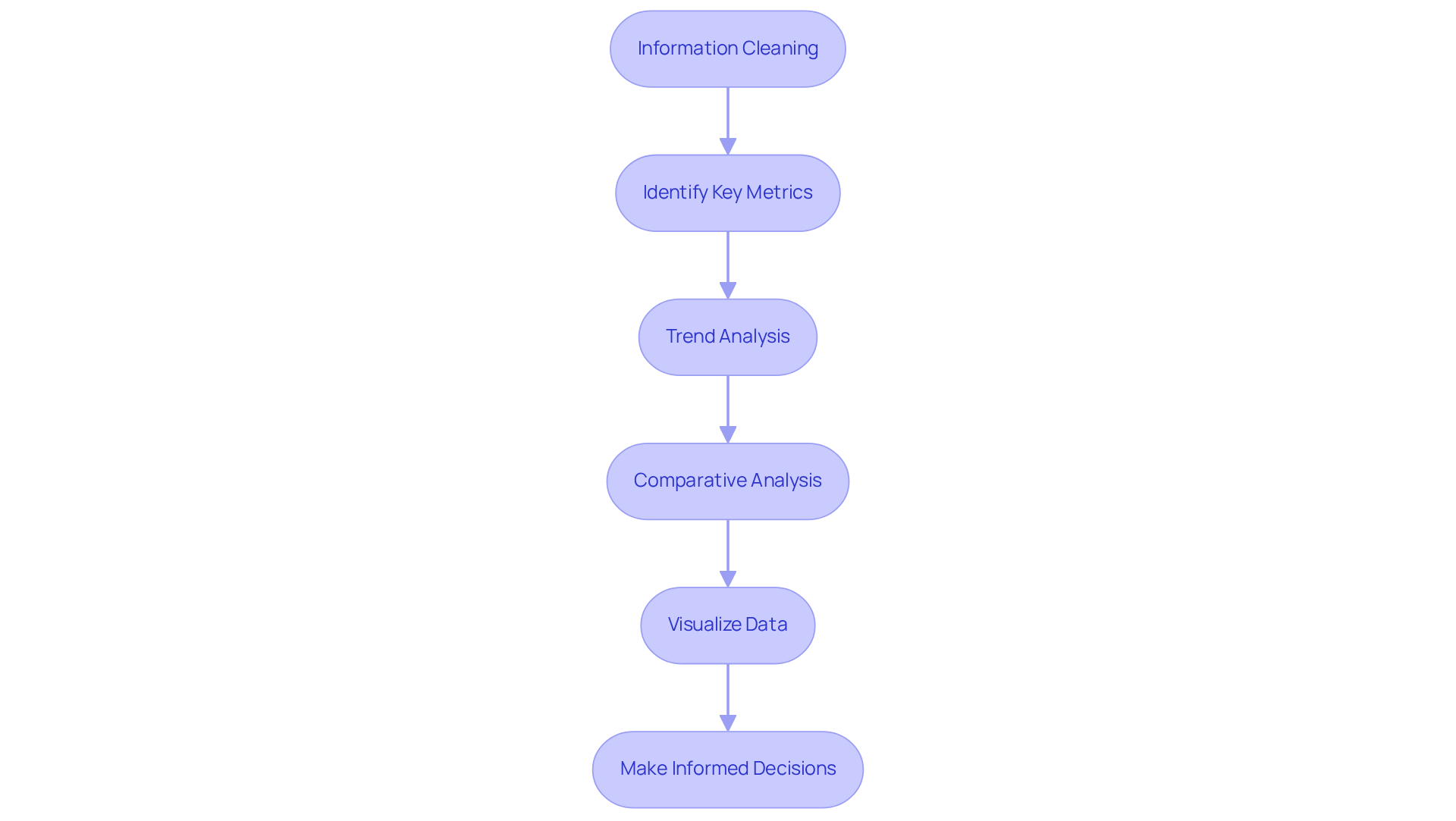

Once the API is integrated and information is gathered, the next critical step is to analyze and interpret this content for valuable investment insights. Here’s a structured approach:

- Information Cleaning: Begin by ensuring the information is tidy and devoid of errors. This includes eliminating duplicates and irrelevant entries to maintain information integrity.

- Identify Key Metrics: Focus on metrics that align with your funding strategy, such as revenue growth, customer acquisition cost, and market share. These are essential for evaluating potential opportunities.

- Trend Analysis: Utilize statistical methods to uncover trends over time. Seek patterns that indicate growth potential or shifts in the market landscape, as these can reveal lucrative opportunities.

- Comparative Analysis: Perform a comparative analysis of data from various companies within the same sector. This process aids in identifying industry leaders and laggards, providing context for .

- Visualize Data: Implement charts and graphs to illustrate trends and observations. Effective data visualization simplifies complex concepts, facilitating clearer communication of findings to stakeholders.

- Make Informed Decisions: Leverage the insights garnered from your analysis to steer financial choices, concentrating on opportunities that resonate with your strategic goals.

By mastering information analysis with a private markets signals api for vc, venture capitalists can significantly enhance their ability to make informed investment decisions that drive success in a competitive environment.

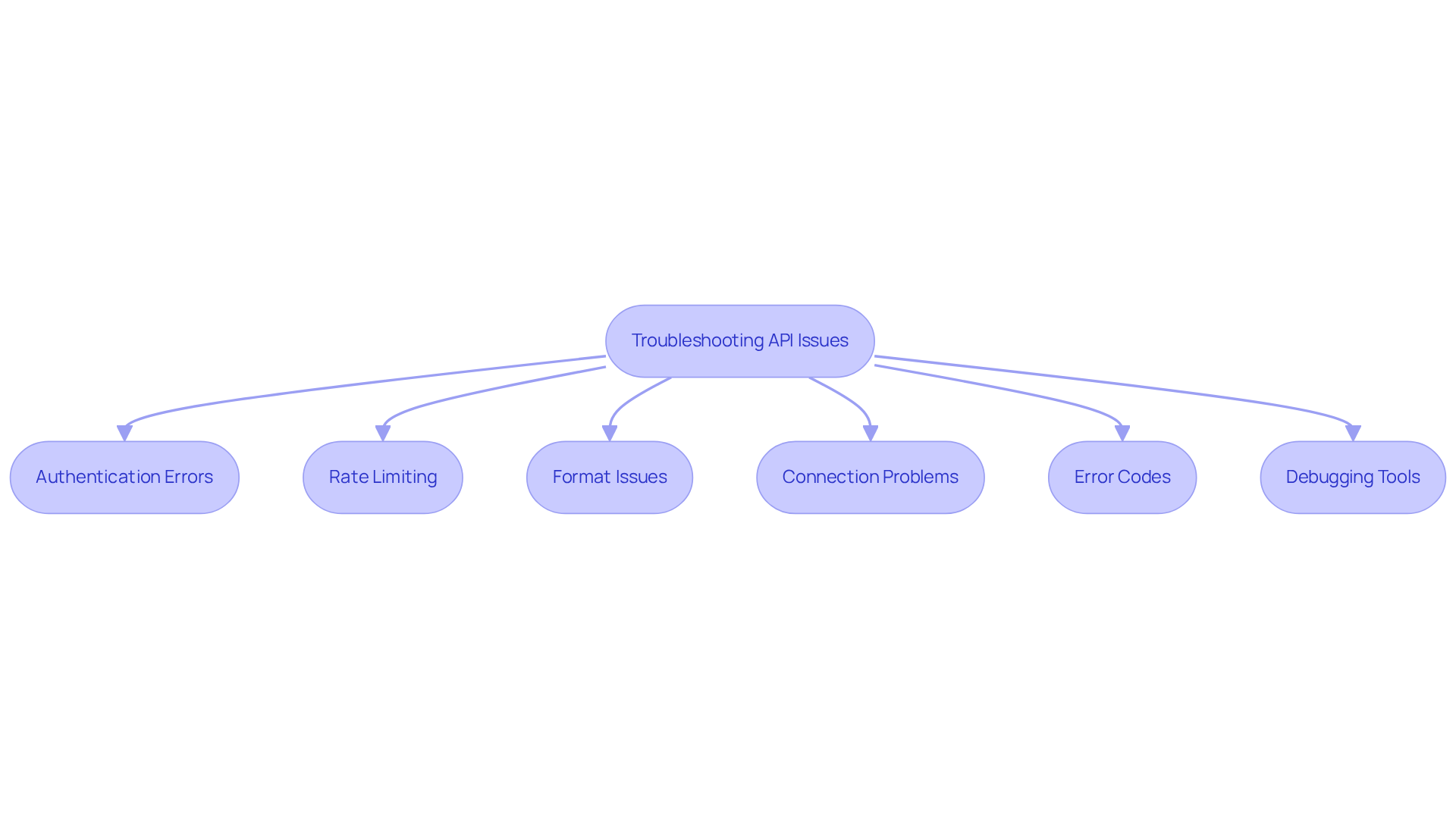

Troubleshoot Common Issues with Private Markets Signals API

When working with APIs, encountering common issues can disrupt your workflow. Here are essential troubleshooting tips to keep your processes efficient:

- Authentication Errors: Verify that your API key is correct and possesses the necessary permissions. Look out for typos or expired keys that could hinder access.

- Rate Limiting: Understand the API's rate limits. Exceeding the allowed number of requests may lead to errors. Implement exponential backoff strategies to manage your request rates effectively.

- Format Issues: Ensure the information returned by the API is in the expected format, such as JSON or XML. If discrepancies arise, consult the API documentation for the correct response structure.

- Connection Problems: Should you experience connectivity issues, check your internet connection and confirm that the API service is operational.

- Error Codes: Familiarize yourself with common error codes returned by the API. Refer to the API documentation for detailed explanations and solutions.

- Debugging Tools: Utilize tools like Postman or curl to test API calls independently. This will help you identify issues without the added complexity of your application.

By proactively addressing these common issues, you can maintain a seamless workflow and ensure that your data retrieval processes remain efficient.

Conclusion

Mastering the Private Markets Signals API is crucial for venture capitalists aiming to elevate their investment strategies. By harnessing the insights these signals provide, VCs can adeptly navigate the complexities of private markets, pinpointing lucrative opportunities while effectively managing risks. This mastery not only fosters informed decision-making but also aligns investment choices with overarching financial objectives.

Key elements highlighted throughout this article include:

- Understanding the significance of private market signals

- Exploring various APIs

- Integrating them into workflows

- Analyzing the resulting data

Insights into market trends, financial metrics, and competitive landscapes underscore the necessity of a data-driven approach in venture capital. Additionally, practical steps for troubleshooting common issues ensure a seamless experience when utilizing these powerful tools.

Given the dynamic nature of the venture capital landscape, embracing the Private Markets Signals API is not just advantageous; it is essential. By actively engaging with these resources and implementing best practices, venture capitalists can position themselves at the forefront of investment success. The call to action is clear: invest time in mastering these signals and tools to unlock greater potential within private markets, ultimately driving impactful outcomes for both investors and the companies they support.

Frequently Asked Questions

What are private market signals and why are they important for venture capitalists (VCs)?

Private market signals are critical indicators that provide insights into the performance and potential of private companies. They include financial metrics, market trends, and competitive analysis, which help VCs identify high-growth funding opportunities and mitigate risks in private market ventures.

What key aspects should VCs consider when analyzing private market signals?

VCs should consider market trends, financial metrics, and the competitive landscape. This involves recognizing shifts in consumer behavior, evaluating revenue growth and profitability, and understanding how a company positions itself against competitors.

What is the role of private markets signals APIs for VCs?

Private markets signals APIs enable VCs to efficiently gather and assess vital information, helping them make informed investment decisions that align with their funding strategies and objectives.

What are some notable private markets signals APIs available for VCs?

Notable APIs include: - FactSet Signals API: Provides actionable insights from extensive datasets for informed investment decisions. - Grata Private Market Information API: Offers comprehensive information on private firms, including financials and funding history. - PitchBook API: Delivers detailed information on private equity and venture capital investments, including valuations and deal flow. - Crunchbase API: Monitors startup activity, providing information on funding rounds and company growth metrics.

What factors should be considered when selecting a private markets signals API?

Factors to consider include coverage, ease of integration, and the specific insights required for your financial strategy. Testing multiple APIs can help identify the best fit for your workflow.

How significant is the projected funding landscape for VCs?

The yearly funding in private markets is projected to approach nearly $440 billion by 2025, highlighting the importance of leveraging accurate data to navigate the evolving market landscape.

Why is it important for VCs to collaborate with innovative leaders?

Collaborating with innovative leaders can significantly impact financial outcomes in the rapidly evolving landscape of venture capital.