Overview

This article delves into the mastery of jobs data within the venture capital sector, emphasizing critical metrics, role-specific data, salary benchmarks, and essential analytical tools. By examining employment trends and specific roles, it illustrates how professionals can enhance their career positioning and decision-making capabilities in this competitive landscape. The significance of data in navigating the complexities of venture capital is paramount, underscoring its role in informed strategy and successful outcomes.

Introduction

Understanding the intricate landscape of venture capital jobs data is essential for anyone aiming to excel in this dynamic industry. The demand for specialized roles in VC-backed firms is on the rise, necessitating comprehensive insights into employment trends, salary benchmarks, and the key responsibilities that underpin success in this field. With an abundance of data available, aspiring professionals must navigate this complex terrain effectively to enhance their career prospects and make informed decisions.

How can they achieve this? By leveraging the right insights and strategies, they can position themselves advantageously in this competitive landscape.

Explore the Fundamentals of Venture Capital Jobs Data

The metrics and information critical for understanding the dynamics of the VC industry are included in the jobs data in venture capital. Job Market Trends reveal that analyzing jobs data in venture capital, including employment rates and job openings in VC-backed companies, offers insights into industry growth and the demand for specific roles. Notably, employment at VC-backed firms increases at approximately eight times the pace of non-VC-backed entities, underscoring the sector's resilience during economic downturns. Indeed, annual job growth at VC-backed firms surpassed 4.0% during the Great Recession, demonstrating their capacity to sustain employment even in challenging conditions.

- Role-Specific Data is essential for candidates aiming to tailor their applications effectively. By understanding the skills and qualifications necessary for various positions—such as analysts, associates, and partners—candidates can adopt a targeted approach in a competitive employment landscape where specialized skills are increasingly prized.

- Salary Benchmarks provide crucial guidance for negotiations and career planning. With the median fund size outside traditional hubs being $10 million, grasping can significantly influence career decisions.

- Performance Metrics of Firms play a vital role in guiding hiring choices and investment strategies. Metrics such as revenue growth, employee retention rates, and market expansion are key indicators of success. In fact, approximately 3.8 million jobs data in venture capital-backed companies were mapped in 2020, providing a concrete reference point for understanding employment scale in this sector.

By examining these fundamentals, individuals can enhance their positioning for success in the venture capital sector. Leveraging knowledge from employment dynamics and industry trends allows professionals to navigate their careers effectively. Furthermore, insights from industry specialists like Alyssa Jaffee and Veronica Breckenridge provide valuable perspectives on the evolving employment trends within venture capital.

Identify Key Roles and Responsibilities in Venture Capital

In venture capital, several pivotal roles contribute to the firm's success, each with distinct responsibilities that aspiring professionals must grasp to navigate their career paths effectively.

Venture Capital Analyst: Analysts are tasked with conducting thorough market research, analyzing financial data, and evaluating potential investment opportunities. They play a crucial role in preparing detailed reports and presentations for senior partners, which inform strategic decisions. In 2023, the U.S. venture capital deployment reached $170.6 billion, underscoring the importance of accurate analysis in a competitive landscape. Analysts often utilize their lunch hours for networking and professional development, meeting peers, mentors, and potential investors to enhance project success.

Associate: Working closely with analysts and partners, associates assist in due diligence, deal sourcing, and portfolio management. Typically possessing more experience, they may lead smaller projects and are integral to the investment process. Their ability to source and evaluate deals is critical, as VC associates can expect salaries ranging from $61,000 to $154,000, with bonuses tied to performance. The average work hours for associates typically range between 50 to 60 hours per week, reflecting the demanding nature of the role.

Principal: This mid-level position entails overseeing investment rounds, managing relationships with portfolio firms, and mentoring junior staff. Principals are often on the trajectory to becoming partners, requiring a blend of analytical skills and strategic insight to drive successful investments.

Partner: As senior-level executives, partners make final investment decisions, oversee the firm's overall strategy, and maintain relationships with investors and startups. They are typically seasoned professionals with extensive networks, contributing significantly to the firm's reputation and success.

Operating Partner: Concentrated on assisting portfolio businesses, operating partners utilize their knowledge to foster operational enhancements and expansion. Their role is essential in ensuring that investments yield positive outcomes.

Understanding these roles equips individuals with the knowledge to and engage effectively with VC firms, particularly in a dynamic environment where jobs data in venture capital and continuous learning and networking are vital for success. The distinction between venture capital and private equity is also crucial, as VC firms focus on startups and smaller companies, while private equity firms invest in established companies. Ongoing education and personal growth are highlighted in this area, as professionals need to remain aware of industry trends and investment strategies.

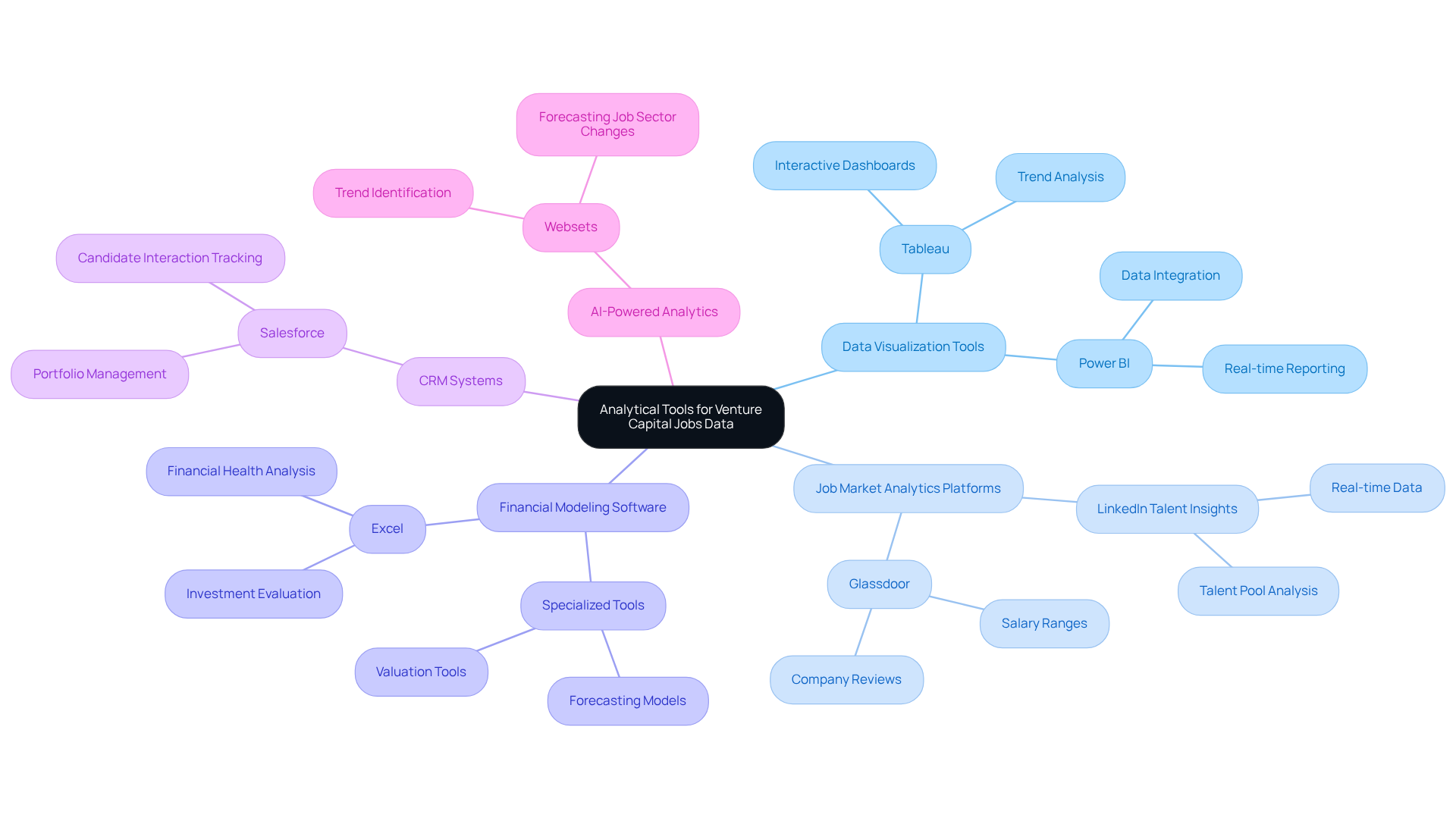

Utilize Analytical Tools for Venture Capital Jobs Data

To analyze venture capital jobs data effectively, a diverse array of analytical tools is essential:

- Data Visualization Tools: Platforms like Tableau and Power BI empower users to craft interactive dashboards that showcase job market trends, salary benchmarks, and role-specific data. This visualization is crucial for identifying patterns and making informed decisions.

- Job Market Analytics Platforms: Tools such as LinkedIn Talent Insights and Glassdoor offer invaluable insights into job openings, salary ranges, and organizational reviews, enabling users to assess the competitive landscape adeptly. Notably, LinkedIn Talent Insights delivers real-time data on talent pools and engagement metrics, which are vital for understanding market dynamics.

- Financial Modeling Software: Excel, along with specialized financial modeling tools, is indispensable for analyzing the financial health of VC-backed firms, assisting in the evaluation of potential investment opportunities.

- CRM Systems: Customer Relationship Management tools like Salesforce facilitate the monitoring of interactions with potential candidates and portfolio businesses, thereby enhancing recruitment and management processes.

- AI-Powered Analytics: Leveraging AI tools, such as those from Websets, significantly enhances data analysis by identifying trends and forecasting future job sector changes based on historical data. Websets' advanced recruitment strategies can source candidates with unique qualities, while its support comprehensive industry research, pinpointing notable companies and relevant sector information. These services augment the other analytical tools by providing deeper insights and improving overall decision-making processes.

By harnessing these analytical tools, including Websets' innovative solutions, individuals can gain profound insights into jobs data in venture capital, ultimately improving their decision-making capabilities.

Conclusion

Understanding jobs data in venture capital is crucial for navigating the complexities of this dynamic industry. Mastering the various metrics and insights related to employment trends, salary benchmarks, and specific roles within VC firms enables professionals to strategically position themselves for success in a competitive job market.

Key aspects include:

- The rapid growth of employment in VC-backed companies

- The importance of role-specific data for job seekers

Analytical tools are available for effective data analysis, emphasizing the necessity for candidates to be well-versed in the responsibilities of roles like analysts, associates, and partners. Leveraging data visualization and market analytics is invaluable for informing career decisions.

Ultimately, the ability to analyze and interpret venture capital jobs data enhances individual career prospects and contributes to the overall resilience and growth of the venture capital sector. As the landscape continues to evolve, staying informed about current trends and employing the right analytical tools will empower professionals to make informed choices, fostering a thriving environment for innovation and investment.

Frequently Asked Questions

What is the significance of jobs data in venture capital?

Jobs data in venture capital provides critical metrics and information that help understand the dynamics of the VC industry, including employment rates and job openings in VC-backed companies, which indicate industry growth and demand for specific roles.

How does employment growth in VC-backed firms compare to non-VC-backed firms?

Employment at VC-backed firms increases at approximately eight times the pace of non-VC-backed entities, highlighting the sector's resilience during economic downturns.

What was the annual job growth rate for VC-backed firms during the Great Recession?

The annual job growth rate for VC-backed firms surpassed 4.0% during the Great Recession, showcasing their ability to sustain employment even in difficult economic conditions.

Why is role-specific data important for candidates in venture capital?

Role-specific data is essential for candidates as it helps them understand the skills and qualifications necessary for various positions, allowing them to tailor their applications effectively in a competitive job market.

What are some key positions in venture capital, and why is understanding their requirements important?

Key positions in venture capital include analysts, associates, and partners. Understanding the requirements for these roles is important for candidates to adopt a targeted approach in their job applications.

How do salary benchmarks influence career decisions in venture capital?

Salary benchmarks provide crucial guidance for negotiations and career planning, helping individuals understand salary expectations in different regions, which can significantly influence their career choices.

What performance metrics are important for firms in the venture capital sector?

Important performance metrics for firms include revenue growth, employee retention rates, and market expansion, which are key indicators of success and can guide hiring choices and investment strategies.

How many jobs data in venture capital-backed companies were mapped in 2020?

Approximately 3.8 million jobs data in venture capital-backed companies were mapped in 2020, providing a concrete reference point for understanding employment scale in this sector.

How can individuals enhance their positioning for success in the venture capital sector?

Individuals can enhance their positioning by leveraging knowledge from employment dynamics and industry trends, which allows them to navigate their careers effectively.

Who are some industry specialists that provide insights into employment trends in venture capital?

Industry specialists like Alyssa Jaffee and Veronica Breckenridge offer valuable perspectives on the evolving employment trends within the venture capital sector.