Overview

Venture capitalists (VCs) actively seek early-stage companies for investment through a strategic blend of:

- Networking

- Industry events

- Accelerators

- Online databases

- Social media engagement

By leveraging their professional networks and utilizing various platforms, VCs discover promising startups. They meticulously assess key investment criteria—such as the founding team, market opportunity, and product viability—to make informed funding decisions. This multifaceted approach not only enhances their ability to identify potential but also ensures that their investments are grounded in solid evaluation metrics.

Introduction

Identifying the next big startup is a formidable challenge in the fast-paced realm of venture capital. As early-stage companies surface, venture capitalists grapple with the task of discerning which ventures merit their investment. This article explores the intricate landscape of early-stage venture capital, unveiling the strategies and resources that VCs leverage to unearth promising startups.

What criteria do they prioritize? How can entrepreneurs effectively position themselves to attract this vital funding? Understanding these dynamics is crucial for anyone aiming to navigate the complex world of startup investment.

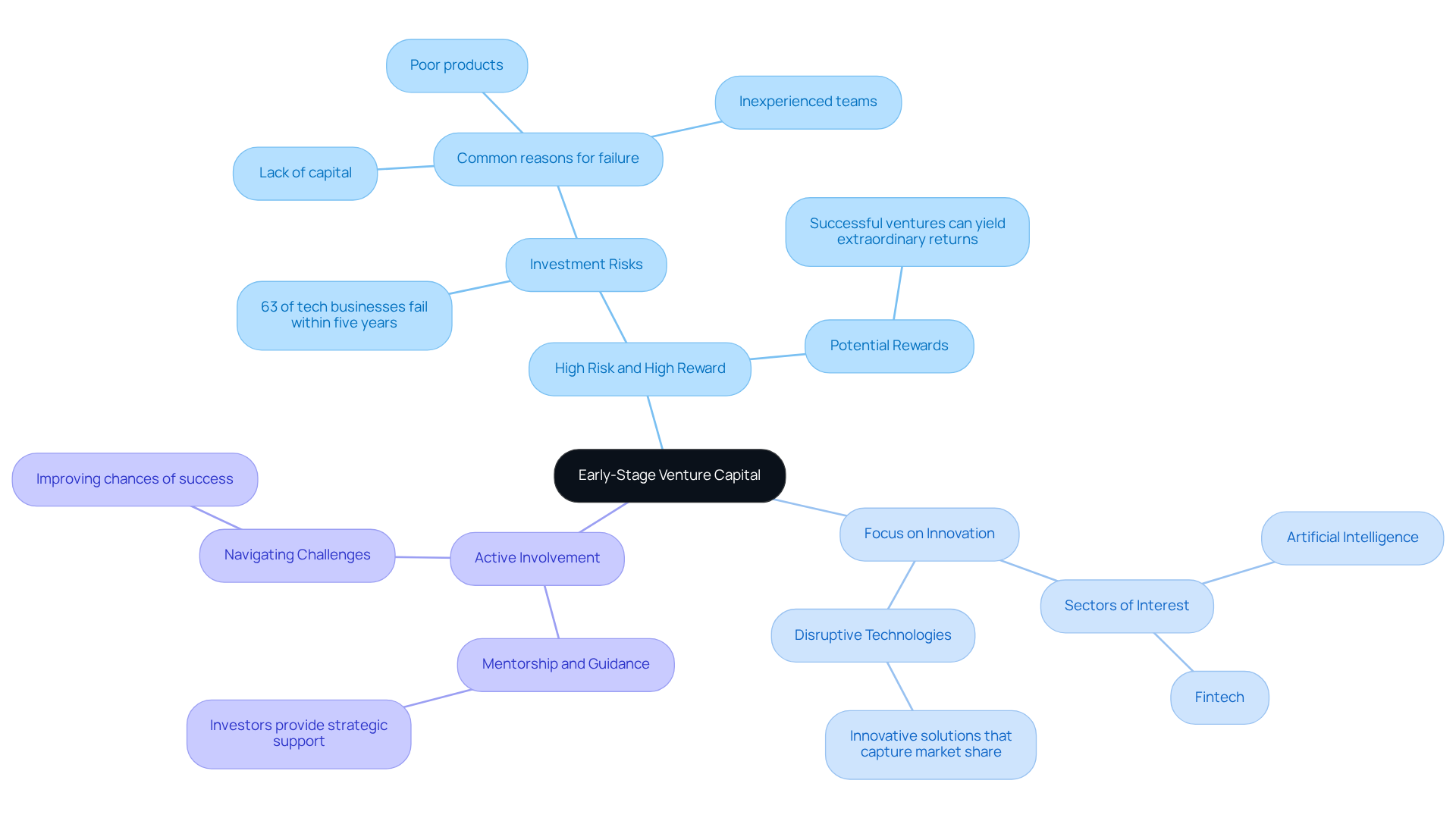

Understand Early-Stage Venture Capital

Initial-stage funding encompasses financial support for emerging companies during their formative phases, typically before they achieve significant market presence or revenue. This stage includes , where investors provide essential capital to facilitate product development, team building, and business model validation. A comprehensive understanding of early-stage capital dynamics is crucial for identifying promising funding opportunities and recognizing the factors that contribute to a company's success.

Key characteristics of early-stage venture capital include:

- High Risk and High Reward: Investments in early-stage companies involve inherent risks, as a substantial percentage of startups face failure. Notably, 63% of tech businesses do not survive beyond five years. Nevertheless, successful ventures can yield extraordinary returns, making the potential rewards appealing for investors. As Roman Axelrod remarked, "Their only path is demonstrating market inevitability."

- Focus on Innovation: Early-stage VCs actively pursue innovative solutions and disruptive technologies that have the potential to capture significant market share. They often prioritize sectors such as artificial intelligence and fintech, which have demonstrated robust growth.

- Active Involvement: Investors typically engage with new ventures beyond mere financial backing, offering mentorship and strategic guidance to help navigate challenges and improve their chances of success.

In 2025, approximately 30% of new ventures are projected to receive seed funding, highlighting the competitive landscape for early-stage investments. Remarkably, securing $100 million has become more straightforward than obtaining $1 million, reflecting a shift in capital dynamics. As venture capitalists navigate this environment, they must balance the risks against the potential for high rewards, making informed decisions based on market trends and the viability of new ventures. By understanding these fundamentals, readers will be better equipped to explore where VCs find early-stage companies and how they evaluate them for investment.

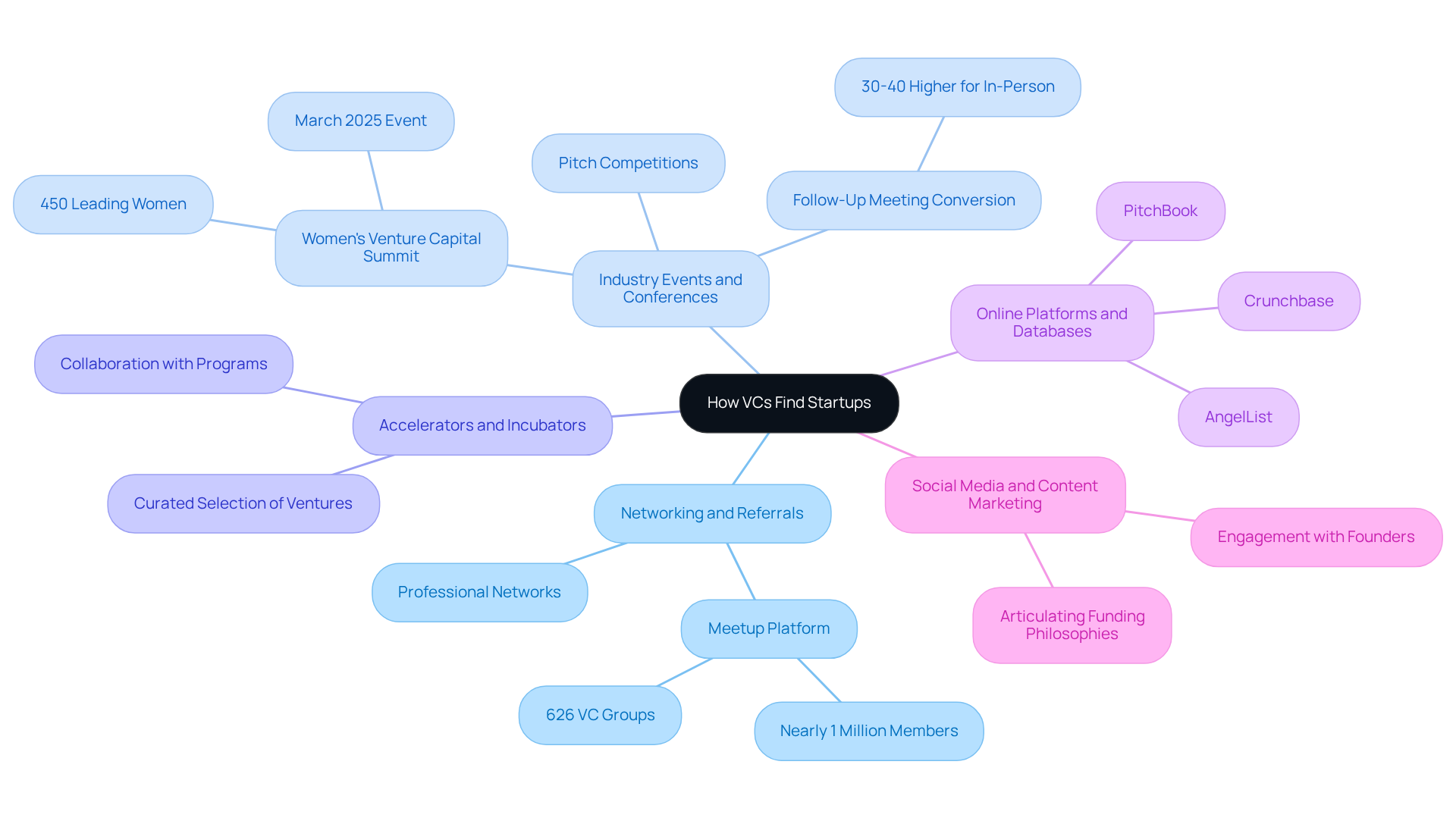

Explore How VCs Find Startups

Venture capitalists utilize a multifaceted approach to identify early-stage companies, particularly in areas where VCs find early-stage companies by seamlessly blending traditional methods with innovative strategies. Here are some key tactics:

- Networking and Referrals: VCs rely heavily on their professional networks, including fellow investors, entrepreneurs, and industry experts, to receive referrals for promising startups. Establishing robust connections within the entrepreneurial ecosystem is crucial for uncovering hidden gems. Notably, the Meetup platform boasts over 626 Venture Capital groups with nearly 1 million members globally, showcasing the vast networking opportunities available.

- Industry Events and Conferences: Engaging in pitch competitions, industry conferences, and demo days allows VCs to connect directly with founders and assess their ideas in real-time. Events like the Women's Venture Capital Summit in March 2025, which brings together 450 leading women in venture capital, serve as fertile grounds for discovering new investment opportunities. Follow-up meeting conversion rates are typically 30-40% higher from in-person connections compared to virtual introductions, underscoring the value of face-to-face interactions.

- Accelerators and Incubators: Many VCs collaborate with company accelerators and incubators that nurture early-stage businesses. By investing in these programs, VCs gain access to a curated selection of new ventures, where VCs find early-stage companies that have already undergone initial vetting, streamlining their discovery process.

- Online Platforms and Databases: Tools like Crunchbase, AngelList, and PitchBook provide venture capitalists with comprehensive databases of emerging businesses, enabling them to filter and search for firms that align with their funding criteria. These platforms are invaluable for monitoring emerging trends and recognizing potential opportunities.

- Social Media and Content Marketing: VCs are increasingly leveraging social media platforms and blogs to articulate their and attract new ventures. Engaging with founders through these channels can lead to fruitful connections, enhancing visibility and fostering relationships.

By understanding these techniques, readers can navigate the capital landscape more effectively, whether they are seeking funding or looking to contribute.

Identify Key Investment Criteria for VCs

Venture capitalists evaluate potential investments based on several key factors that measure a new company's viability and growth potential, which is where VCs find early-stage companies. Entrepreneurs aiming to secure funding must focus on these primary factors:

- Founding Team: A strong and committed founding team with relevant experience and a proven track record is crucial. VCs often view the team's ability to execute the business plan as a key determinant of success, with approximately 70% prioritizing founding team experience in their evaluations. This trend underscores the importance of capable leadership in VC assessments.

- Market Opportunity: Startups must target a large and expanding market. VCs seek ventures that address or needs within a market poised for substantial growth. The increase in unicorns, from 142 in 2015 to over 1,200 by 2024, illustrates a shift in investor behavior towards identifying scalable opportunities.

- Product Viability: The product or service should present a clear value proposition and competitive advantage. VCs look for tangible evidence of product-market fit, which is essential for long-term success.

- Business Model: A scalable and sustainable business model is vital. VCs require clarity on how the new venture plans to generate revenue and achieve profitability, particularly in a landscape where capital efficiency and sustainable practices are increasingly prioritized.

- Traction and Metrics: Early indicators of traction, such as user growth, revenue, and engagement metrics, significantly influence a VC's decision. Showcasing progress and momentum is crucial; startups with robust early metrics are more likely to attract funding.

- Exit Potential: VCs evaluate the potential for a profitable exit, whether through acquisition or an IPO. Understanding the timeline and strategy for achieving a return is essential for securing funding.

- Warm Introductions: Establishing connections through warm introductions from trusted sources can greatly enhance the chances of securing meetings with VCs. This networking credibility is becoming increasingly vital in the current financial environment.

By aligning their business strategies with these criteria, entrepreneurs can significantly improve their chances of attracting investment funding, particularly in environments where VCs find early-stage companies.

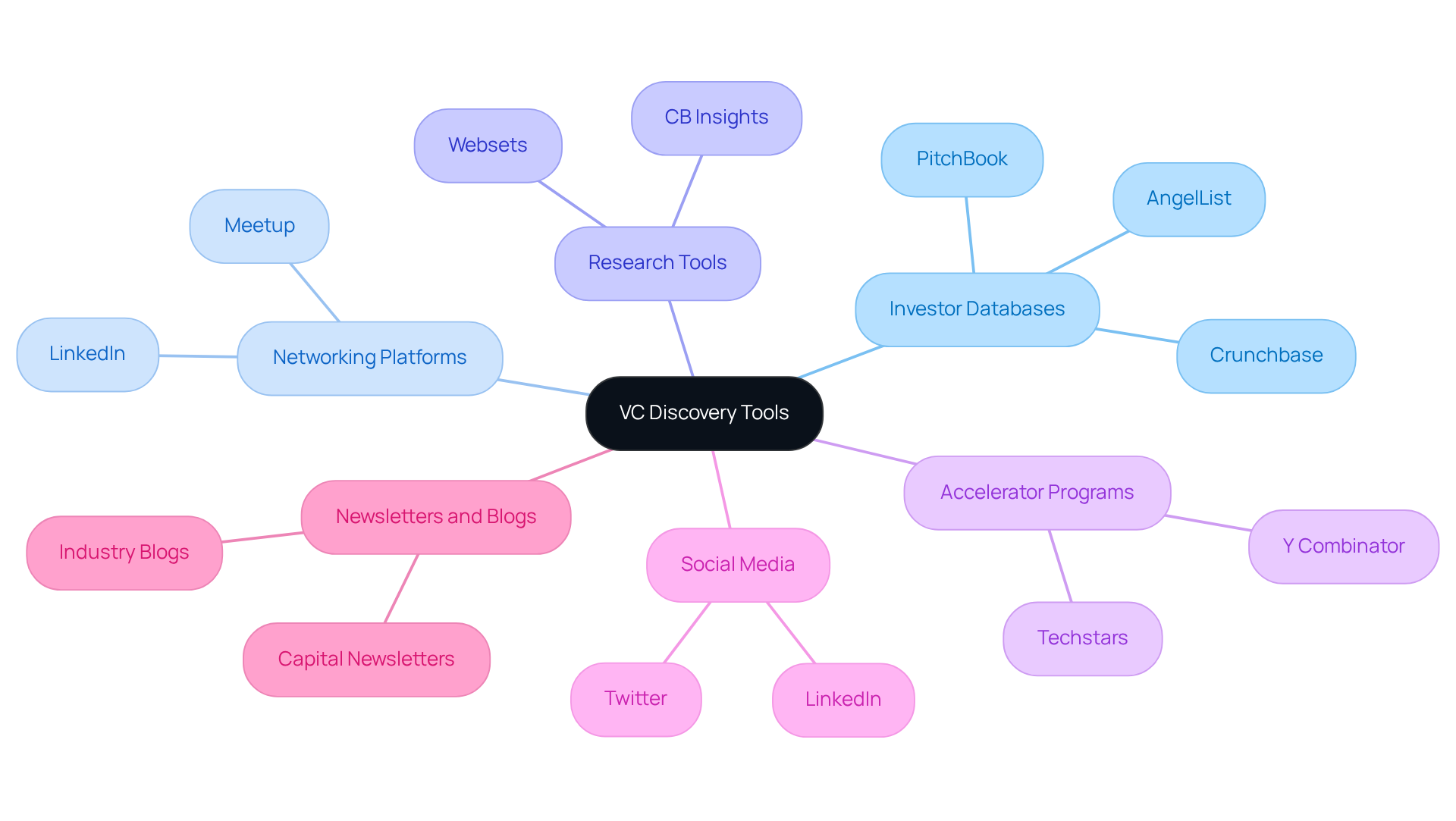

Utilize Tools and Resources for VC Discovery

To effectively identify early-stage companies for funding, venture capitalists and entrepreneurs can leverage a range of tools and resources where VCs find early-stage companies to significantly enhance their search capabilities. Here are some essential options:

- Investor Databases: Platforms such as Crunchbase, PitchBook, and AngelList provide extensive databases of startups, funding rounds, and investor profiles. These tools empower users to filter searches based on specific criteria, greatly increasing the likelihood of uncovering relevant opportunities. For example, Crunchbase excels in top-of-funnel discovery and ecosystem mapping, enabling VCs to swiftly pinpoint high-potential startups.

- Networking Platforms: Tools like LinkedIn and Meetup are indispensable for connecting with industry professionals, investors, and entrepreneurs. Engaging in relevant groups and discussions can cultivate valuable relationships that may lead to funding opportunities. Successful networking strategies often involve reaching out to founders and mentors, which can significantly enhance response rates.

- Research Tools: Websites such as CB Insights and PitchBook offer market research and analytics, assisting VCs in identifying trends and evaluating potential investments through data-driven insights. Furthermore, utilizing Websets' market research services can refine this process by spotlighting notable companies, articles, and technological insights pertinent to Series A funding. Websets' enable users to pinpoint companies based on size, technology stack, and other critical factors, simplifying the discovery of promising new ventures. This aligns with the trend where AI tools are revolutionizing VC workflows in 2025, affecting deal sourcing and portfolio analysis.

- Accelerator Programs: Engaging in or monitoring accelerator programs can provide access to a pipeline of vetted new ventures. Programs like Y Combinator and Techstars regularly showcase their cohorts, making it easier for VCs to discover promising companies before they enter the broader market.

- Social Media: Platforms such as Twitter and LinkedIn are increasingly utilized by VCs to share insights, connect with startups, and stay abreast of industry trends. Following prominent figures in the capital sector can yield valuable insights and potential funding opportunities.

- Newsletters and Blogs: Subscribing to capital newsletters and blogs keeps readers informed about the latest trends, funding opportunities, and insights from industry experts. These resources can provide a competitive edge by highlighting emerging startups and market shifts.

By adeptly utilizing these tools and resources, including Websets for comprehensive market research, venture capitalists and entrepreneurs can enhance their capacity to discover and connect with early-stage companies, a crucial process where VCs find early-stage companies, whether they are seeking investment or aiming to attract funding.

Conclusion

Identifying where venture capitalists discover early-stage companies is crucial for investors and entrepreneurs navigating the intricate funding landscape. Early-stage venture capital marks a pivotal phase in a startup's journey, characterized by high risks and the potential for substantial rewards. Grasping the dynamics of this funding stage empowers stakeholders to make informed decisions that can significantly influence their success.

The article explores various strategies that VCs employ to uncover promising startups. These strategies include:

- Leveraging professional networks

- Participating in industry events

- Collaborating with accelerators

- Utilizing online databases

- Engaging through social media

Furthermore, key investment criteria such as the strength of the founding team, market opportunity, product viability, and traction metrics are highlighted as essential factors that shape funding decisions.

Ultimately, these insights serve as a call to action for entrepreneurs seeking investment and for VCs aiming to refine their discovery processes. By embracing these strategies and understanding the underlying investment criteria, both parties can enhance their chances of success in a competitive environment. As the venture capital landscape continues to evolve, staying informed and adaptable will be crucial for unlocking new opportunities and fostering innovation.

Frequently Asked Questions

What is early-stage venture capital?

Early-stage venture capital refers to financial support provided to emerging companies during their formative phases, typically before they achieve significant market presence or revenue. This includes seed funding and Series A rounds aimed at facilitating product development, team building, and business model validation.

What are the key characteristics of early-stage venture capital?

Key characteristics include high risk and high reward, a focus on innovation, and active involvement from investors. Early-stage investments are risky, with a significant percentage of startups failing, but successful ventures can yield extraordinary returns. Investors seek innovative solutions and disruptive technologies, often providing mentorship and strategic guidance.

What percentage of new ventures is projected to receive seed funding in 2025?

In 2025, approximately 30% of new ventures are projected to receive seed funding, indicating a competitive landscape for early-stage investments.

How has the process of securing funding changed in recent years?

Securing $100 million has become more straightforward than obtaining $1 million, reflecting a shift in capital dynamics within the venture capital landscape.

Why is understanding early-stage capital dynamics important?

A comprehensive understanding of early-stage capital dynamics is crucial for identifying promising funding opportunities and recognizing the factors that contribute to a company's success, helping investors make informed decisions based on market trends and the viability of new ventures.